Abstract

Digitalization is one of the most frequently discussed topics in industry. New technologies, platform concepts and integrated data models do enable disruptive business models and drive changes in organization, processes, and tools. The goal is to make a company more efficient, productive and ultimately profitable. However, many companies are facing the challenge of how to approach digital transformation in a structured way and to realize these potential benefits. What they realize is that Product Lifecycle Management plays a key role in digitalization intends, as object, structure and process management along the life cycle is a foundation for many digitalization use cases. The introduced maturity model for assessing a firm’s capabilities along the product lifecycle has been used almost two hundred times. It allows a company to compare its performance with an industry specific benchmark to reveal individual strengths and weaknesses. Furthermore, an empirical study produced multidimensional correlation coefficients, which identify dependencies between business model characteristics and the maturity level of capabilities.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

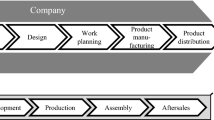

The product lifecycle refers to the processes of planning, designing, verifying, manufacturing and maintaining of products. In order to systematically manage all accruing product related information and to support engineering processes throughout the product lifecycle, the concept of product lifecycle management (PLM) raised [1].

The increasing demand for smart products and factories is forcing companies to re-think their product development process and thus also to adapt their PLM strategy. PLM plays a key role in the intended digitalization and represents an opportunity to make a company more efficient, productive and profitable. Maturity models have proven to be a valuable method for defining a future strategy, as they provide transparency on the strengths and weaknesses of a company. The goal of the model presented here is to create a standardized framework. The capabilities considered in the model cover both PLM core competencies as well as extended building blocks related to the use of new technologies (e.g. predictive maintenance through the Industrial Internet of Things). We will investigate and evaluate existing maturity models, introduce a novel holistic model and analyze the panel data in an empirical study.

2 State of the Art

Holistic maturity assessment approaches include elements of strategic guidance and roadmaps as those provided by Acatech [2] and Issa et al. [3]. They propose guidelines for assessing Industry 4.0 maturity not only in the context of product lifecycle management. They rather emphasize the complete value creation process including horizontal and vertical integration. Most of the holistic maturity models focus on manufacturing and do not address product lifecycle management in detail.

Schumacher et al. [4] presented an Industry 4.0 realization model targeting industrial manufacturing companies. According to Schumacher et al. [5], their model accounts for 65 assessment items included in 8 maturity dimensions: Technology, Products, Customers and Partners, Value Creation Processes, Data & Information, Corporate Standards, Employees and Strategy & Leadership.

Besides holistic Industry 4.0 approaches, more specific maturity models are prevalent. Weber et al. [6] developed a maturity model for data-driven manufacturing, which helps companies to assess maturity of their IT regarding the requirements of vertical- and horizontal system integration.

Batenburg et al. [7, 8] worked on Product Lifecycle Management ‘s alignment and maturity using five business dimensions: 1) SP- strategy & policy, 2) OP - organization & processes, 3) MC - monitoring & control, 4) PC - people & culture, and 5) IT - information technology. Originally used for aligning CRM, these dimensions help visualize both the average PLM maturity and alignment using a radar plot.

Batenburg et al. [7] developed a PLM framework based on metrics. Batenburg et al. [8] showed how the PLM framework could be used by individual organizations to assess their current PLM maturity and alignment and use that as a starting point for defining their PLM Roadmap. Their findings suggest that PLM needs to be culturally embedded as an enterprise-wide system and concept.

Kärkkaeinen et al. investigated Batenburg et al.’s approach [9]. They claim that PLM implementation changes partners’ processes. Savino et al. [10] presented a PLM Maturity model based on an Analytical Hierarchy Process (AHP), a multi-criteria approach, which approach aims at helping companies analyze their requirements and identify the right PLM tools.

Bensiek and Kühn [11] introduced an approach for maturity-based process improvement that is suitable for SMEs (Small and Mid-sized Enterprise) and focused on virtual engineering. These components are maturity dimensions originally considered by Batenburg et al.’s model [7], Sääksvuori & Immonen’s model [12] and Bensiek & Kühn‘s model [11].

Paavel et al. [13, 14] combined the approach of Batenburg et al. [7] with the fuzzy logic method proposed by Zhang et al. [15]. Paavel et al.’s [13] model shows how these elements are combined for a PLM maturity model. Based on an assessment of benefits, the expert group evaluated readiness for different business dimensions. Paavel et al.’s PLM maturity model groups all PLM components into a TIFOS framework based on PLM functionalities, and proposes a PCMA maturity model to evaluate PLM components’ strengths and weaknesses.

To provide companies an effective framework for identifying potential benefits along the entire product lifecycle, we believe that following requirements should be met by a maturity model.

-

a) Holistic view on the product lifecycle (planning phase, definition phase, verification phase, production phase, service/operating phase)

-

b) Reference data/benchmark of comparable companies

-

c) Consideration of several dimensions (process, IT systems, employees, etc.)

-

d) Clearly defined process for implementing the model

-

e) Possibility to identify relevant topics – “Next Step”

-

f) Clearly defined criteria behind the maturity levels

-

g) Consideration of company characteristics (size, branch, strategy, etc.)

-

h) Possibility to prioritize individual capabilities

-

i) Graphical representation of the maturity levels

These criteria also build the foundation for our state-of-the-art review. Therefore, the already introduced models have been considered and evaluated, as depicted in Table 1.

As Table 1 displays, there are various maturity models available. However, none of them fits holistically to the introduced criteria. This circumstance encouraged us to define a maturity model addressing a company’s capabilities along the entire product lifecycle. As already stated, the model does include core PLM capabilities, but also address other areas relevant from a digitalization perspective such as e.g. manufacturing planning, engineering and execution.

3 Maturity Model Description

3.1 Underlying Research Questions

The maturity model discussed was developed as part of research work that did focus on the following questions.

-

Are there characteristics of strong PLM architectures that represent a Strategic Excellence Position for a company [17]?

-

Does a company that aligns its PLM architecture with the company’s business strategy achieve a competitive advantage?

-

Can patterns be derived from the entrepreneurial or strategic characteristics of a company that require a specific PLM architecture?

A PLM Architecture in context of this work was understood as a firm’s specific realization of Product Lifecyle Management within given boundary condition: Industry; industry segment; company characteristics such as business strategy (e.g. operational excellence); company size; structural and procedural organization; enterprise role (e.g. contract manufacturer, tier 1, etc.); value chain and process design; order category (e.g. make-to stock, engineer to order, etc.); production type (e.g. one-off, serial or mass production); network of engineering, manufacturing and service locations; data/content managed; IT systems used; technology leveraged; etc.

Empirical investigation of these questions required a descriptive model. Creating that model, we built on proven techniques, methods or frameworks and used available practices wherever possible (see Sect. 3.2). The work finally led to the Maturity Model introduced in this paper.

3.2 Utilized Methods and Frameworks

Strategy Maps

Robert S. Kaplan’s and David P. Norton’s [18,19,20] framework of Strategy Maps [19] (based on the Balanced Scorecard (BSC) concept [18]) was identified as an appropriate approach to link PLM architectures to business strategies planning. The Strategy Map is based on the four perspectives known from the BSC, arranged in a cause-and-effect relationship: Learning and Growth, Business Process, Customer and Financial.

Kaplan and Norton [18,19,20] see the intangible assets of an organization anchored at the Learning and Growth level of the BSC. They are concerned with recognizing the value they add to the implementation of the corporate strategy. They differentiate between three aspects: human, information and organizational capital.

The Strategy Maps are a valuable advancement to the classic Balanced Scorecard because they show us how entrepreneurial success arises from intangible resources. The possibilities offered by PLM architectures allow companies to sharpen or develop comprehensive skills that address all three aspects of the Learning and Growth perspective. The maturity model focuses on selected operational capabilities, which are mapped by the interactions of the various information systems (Product Lifecycle Management, Enterprise Resource Planning, Supply Chain Management, Manufacturing Execution, etc.). The BABOK [23] explains the term Capability and Capability Analysis as follows.

Capability

-

Capabilities are the abilities of an enterprise to perform or transform something that helps achieve a business goal or objective. Each capability is found only once on a capability map, even if it is possessed by multiple business units.

-

Capabilities can identify explicit performance expectations. When a capability is targeted for improvement, a performance gap can be identified - the difference between the current performance and the desired performance, given the business strategy.

-

At the strategic level, capabilities should support an enterprise in establishing and maintaining a sustainable competitive advantage and a distinct value proposition.

Business Capability Analysis

Identifying performance gaps helps prioritize investments. This analysis helps launch clearly focused initiatives that are coordinated with the various stakeholders. It creates a common understanding of the strategy adopted and the expected results. Analysis especially benefits I4.0 projects, which address the ability of the organization to either offer new products and services or improve operational excellence. This instrument promotes concerted cooperation across organizational boundaries. Capability analysis in a Maturity Assessment involves two challenges; company acceptance and acquiring a network of experts to apply this broad and cross-functional framework. We shall call Grading Models the listing of the capabilities to be analyzed and the development of the underlying assessment models. Siemens provided a good opportunity to apply the model because this company has a global network of subject matter experts and its portfolio covers almost all aspects of the product lifecycle.

3.3 The Maturity Model

The maturity model was designed in such a way that a comprehensive capability analysis is possible in its application. It addresses the essential phases of the product life cycle: planning, development, production planning, production, and operational and service tasks.

As depicted in Fig. 1, at the heart of the model, we find a set of fifty recurring capabilities of companies designing and manufacturing products in various industries.

Any maturity model will cover only some aspects and will be subject to changes as new technologies push the boundaries of what is possible. Still, we found this model generic and stable enough to collect data, gain new insights, and draw conclusions. To enable benchmarks based on the model, it is necessary to maintain a time-stamp with every data point recorded. In this way, we ensure consideration of continuous improvements in the market by just comparing with other companies assessed within e.g. the last three years.

Description of Capability

A definition of terms is provided for each capability presented in the model in order to establish a common understanding or, where necessary, to define delimitations. Furthermore, business benefits, objectives, application examples and solutions are outlined.

Business Characteristics

In order for the model and the collected market data to be used for benchmarks, each company under consideration must be classified. A set of standard characteristics (e.g. industry, business strategy [25], size, target markets, etc.) allows taking a fingerprint of business characteristics. This data is relevant, when it comes to selecting datapoints for comparison with e.g. the Industry, firms of a similar size, firms within the same business strategy etc.

Five Knowledge Domains

The set of fifty capabilities has been clustered in five Knowledge Domains (see Fig. 2), which would typically see different roles or personas in the organization dealing with the topics. For example, skills in the areas of visualization, simulation and testing are summarized in the “Verify” section. This structure has proven valuable in planning and executing capability assessment workshops.

Five Maturity Levels

Maturity levels are based on the Gartner approach for Product Lifecycle Management presented by Dr. Marc Halpern [22] (Research VP, Engineering and Design Technologies, Gartner) at the Product Innovation Conference Munich (2016). This approach aligns in many aspects with the VDMA [23]. We use a five-step maturity model, as illustrated in Fig. 3.

Five-step maturity model based on Gartner Research; according to [22]

The individual stages build on one another. They represent a possible development path for the company. Reaching a higher level involves one-off (change project, IT costs) and recurring expenses (quality assurance, maintenance, administration). A company will therefore always strive to achieve the level of maturity that matches the operational requirements and makes a positive contribution to value. The necessary skills correspond to the fundamental tasks of product data management (PDM) up to expansion level two (“repeatable”). Upon reaching the “integrated” level, a company uses a cross-location or cross-product line PLM architecture. The necessary data models are harmonized, and working methods are based on standardized procedures [23]. Levels one to three have a strong technology orientation. At expansion stages four and five, a company has internalized the basic PLM principles as part of the corporate culture and is looking away from technical formalisms towards business benefits. A firm asks questions like. How can we optimize our processes in terms of vertical and horizontal integration? Where can we exploit further optimization potential using new technology?

Six Dimensions of Change

As a global provider of IT consulting and services, the company CSCFootnote 1 developed a comprehensive methodology kit under the title Catalyst. One of the cornerstones of this methodology framework was examination of a business problem and the impact of change from six perspectives, known as the domains of change. These are defined as Process, Organization, Location, Data, Application and Technology.

The Maturity Model did adopt this concept with one enhancement by replacing the Location perspective with Collaboration. This move still did include the CSC idea of understanding where a company was making business, but put more focus on how different sites, subsidiaries, suppliers and customers do interact with each other.

-

Process. The business process dimension focuses on what the company does, how activities are carried out and in what sequence, what rules are followed, and the type of results obtained. Change in the business process domain is often a key driver for change in all the other domains.

-

Organization. The organization dimension focuses on the people and organizations involved in the change: their culture, capabilities, roles, team structures, and organizational units.

-

Collaboration. The collaboration dimension focuses on how stakeholders are interacting with each other and how communication is managed from an internal and external perspective. It may therefore include customer and vendor communication as well as with internal clients.

-

Data. The data dimension focuses on the content, structure, relationships, and business rules for the data used by the business processes, applications, and organization. It also considers the transformations needed to result in information and knowledge that the company can use.

-

Application. The application dimension focuses on the capabilities, structure, and user interface of software applications and application components used to support the change. Applications or components may be specific enterprise applications such as Product Lifecycle Management, Enterprise Resource Planning, Supply Chain Management, Manufacturing Execution, etc. or they may be general in nature, such as a data authoring system or even an electronic spreadsheet.

-

Technology. The technology dimension focuses on the hardware, software, and communications infrastructure used to enable and support solutions and services. Change in the technology domain is often a key driver for change in other domains

3.4 Grading Model

Putting the six domains of change in context with the five levels of maturity results in a matrix as displayed in Fig. 4. This structure served as the basis for the development of what we call Grading Models. In interviews with subject matter experts for each of the capabilities we discussed and documented the characteristics in each field of the matrix. The resulting, standardized framework allows companies to locate their individual skill levels. Grading models should be reviewed, updated and adjusted to market changes at least every three years.

Figure 4 also illustrates generically (arrows) a detailed view on the as-is and target state discussed with firms. The gaps identified along the Dimensions of Change are valuable insights when it comes to planning transformation processes and required organizational change management.

3.5 Prioritization

In addition to assessing the maturity level, MoSCoW analysis is used to prioritize each capability. Following this principle each capability is prioritized via the values “Must”, “Should”, “Could” or “Won’t”. For a better guidance the prioritization system utilizes Porters value chain. If a capability contributes to a core competence of the organization, it shall be qualified as a “must have”. If it contributes to primary activities in the value chain [24], it will be rated as a “should have”. Whatever addresses support activities will be rated as a “could have”. In case a capability is not relevant for a company it can be classified as “won’t”. By overlaying business priority and maturity, the model enables a qualitative view of hidden potential.

3.6 Example of Capabilities and Grading Models

Figure 5 finally gives an example for the capability Logistic Simulation. The generic representation shows how the model presents itself in case of an analysis, presenting description of capabilities, Grading Model along the 5 maturity levels and the possibility to prioritization. The image shows an excerpt of the expert’s observation of how companies are operating today.

4 Empirical Study on Maturity Model Data

Besides capabilities with their priority and maturity levels, the model also utilizes several business characteristics (e.g. industry or country). In this paper we focus on the relations between industries and capabilities. The underlaying data panel consists of 189 companies. Most of them are in Machinery & Heavy Equipment Industry.

We examined the interdependencies between the introduced attributes by applying a correlation analysis. As part of the analysis the application “R” evaluates each classification feature with the corresponding maturity and priority stages. According to Puth et al. the Kendall or Spearman rank correlation are appropriate methods for the ordinate data values in the panel [26]. As the maturity and priority levels show a tied data behavior, which means that priority and maturity ranks can be assigned multiple times, the Kendall model offers a more resilient behavior and has therefore been chosen [26]. The correlation matrix consists of more than 30.000 coefficients, so only relevant dependencies have been evaluated in detail. The correlation coefficients can range from –1 to +1. A strong positive correlation takes a value close to +1, while a strong negative correlation takes a value close to –1. In case that the correlation coefficient shows a value around 0, no dependency between the characteristics exists.

According to Akoglu there are many interpretations of correlation coefficients. As most of the classification models confirm a fair correlation for coefficients larger than 0.3, this threshold has been used to identify relevant correlations [27].

Table 2 shows an excerpt of the calculated Kendall’s rank correlation factor (τ) for different industries. Only four of the seven industries contain a positive correlation to at least one capability. Possibly there are so few because we had less than thirteen data points for the industries Electronics & Semiconductors, Energy & Utilities, and Medical Devices & Pharmaceuticals. In order to draw conclusions for these industries the panel data could be extended via further assessments. Additional to Kendall’s τ the significance has been examined via p-values. At this point it should be mentioned that only correlations have been examined and that causality has not been proved.

Concerning the interpretation of the data, the positive coefficients show whether a capabilities’ priority or maturity is explicitly larger for a specific industry segment compared to the remaining industries. A larger value shows a stronger correlation between the two classification features. Furthermore, some of the correlations display a level of significance under 5%. This indicates that the correlation exhibits a statistically significant behavior. For instance, the industry Automotive & Transportation reveals a correlation coefficient of 0.47 and a p-value under 0.05 for the priority of the capability Logistic Simulation. This potential coherence might be attributable to the often-prevalent mass production and the pursue to optimize the throughput in automotive industry. Another noteworthy correlation origin from the relationship between Aerospace & Defense industry to the capability of Quality Management. The correlation coefficient for the priority is 0.38 and shows that this industry ranks the capability Quality Management higher as the remaining industries. This may be since the industry is forced to follow aerospace and military standards demanding the traceability of manufacturing and quality information.

5 Results and Discussion

The new model allows companies to evaluate their maturity levels along fifty capabilities. It provides a standardized framework for the entire product lifecycle that allows rating, classifying, and comparing companies. The framework assists in defining potential filed of actions for improvement and it can drive the discussion of an appropriate digitalization strategy. The empirical study provides first insights into the current maturity and priority status of capabilities across various industries.

Future research could examine relationships between capabilities and business characteristics other than industry (e.g. strategy, operating processes, size of company or country). Companies could benefit from the development of a methodology to identify a suitable information technology and process architecture based on business characteristics.

Notes

- 1.

The American company Computer Sciences Corporation (CSC) was founded in 1959 and grew a multinational corporation and globally important player in the IT-consulting and services business. In 2017 CSC merged with the HP Enterprise Service Line creating DXC Technology. With nearly 6,000 customers in over 70 countries, the company has an estimated annual turnover of $20 billion in 2020.

References

Eigner, M., Stelzer, R.: Product Lifecycle Management - Ein Leitfaden für Product Development und Life Cycle Management. Springer, Heidelberg (2009). https://doi.org/10.1007/b93672

Schuh, G., Anderl, R., Gausemeier, M.: Acatech Study – Industrie 4.0 Maturity Index: Managing the Digital Transformation of Companies, Herbert Utz Verlag, Munich (2007)

Issa, A., Hatiboglu, B., Bildstein, A., Bauernhansl, T.: Industrie 4.0 roadmap: framework for digital transformation based on the concepts of capability maturity and alignment. Procedia CIRP 72, 973–978 (2018)

Schumacher, A., Erol, S., Sihn, W.: A maturity model for assessing Industry 4.0 readiness and maturity of manufacturing enterprises. Procedia CIRP 52(1), 161–166 (2016)

Schumacher, A., Nemeth, T., Sihn, W.: Roadmapping towards industrial digitalization based on an Industry 4.0 maturity model for manufacturing enterprises. Procedia CIRP 79, 409–414 (2019)

Weber, C., Königsberger, J., Kassner, L., Mitschang, B.: M2DDM–a maturity model for data-driven manufacturing. Procedia CIRP 63, 173–178 (2017)

Batenburg, R., Helms, R.W., Versendaal, J.: PLM roadmap: stepwise PLM implementation based on the concepts of maturity and alignment. Int. J. Product Lifecycle Manage. 1(4), 333–351 (2006)

Batenburg, R.S., Helms, R.W., Versendaal, J.M.: The Maturity of Product Lifecycle Management in Dutch Organizations. A Strategic Perspective (2005)

Kärkkäinen, H., Myllärniemi, J., Okkonen, J., Silventoinen, A.: Assessing maturity requirements for implementing and using product lifecycle management. In: The 9th International Conference on Electronic Business, Macau, pp. 669–678, November 2009

Savino, M.M., Mazza, A., Ouzrout, Y.: PLM maturity model: a multi-criteria assessment in southern Italy companies. Int. J. Oper. Quant. Manage. 18(3), 159–180 (2012)

Bensiek, T., Kuehn, A.: Maturity model for improving virtual engineering in small and medium-sized enterprises. In: Rivest, L., Bouras, A., Louhichi, B. (eds.) PLM 2012. IAICT, vol. 388, pp. 635–645. Springer, Heidelberg (2012). https://doi.org/10.1007/978-3-642-35758-9_57

Saaksvuori, A., Immonen, A.: Product Lifecycle Management. Springer, Heidelberg (2008). https://doi.org/10.1007/978-3-540-78172-1

Paavel, M., Karjust, K., Majak, J.: Development of a product lifecycle management model based on the fuzzy analytic hierarchy process. Proc. Est. Acad. Sci. 66(3) (2017)

Paavel, M.: Product Lifecycle Management Maturity Model Development (2018)

Zhang, H., Bouras, A., Sekhari, A., Ouzrout, Y., Yu, S.: A PLM components monitoring framework for SMEs based on a PLM maturity model and FAHP methodology (2014)

Pels, H.J., Simons, K.: PLM maturity assessment. In: 2008 IEEE International Technology Management Conference (ICE), pp. 1–8. IEEE, June 2008

Puempin, C.: The Essence of Corporate Strategy. Gower Publishing Company Limited, Vermont (1987)

Kaplan, R., Norton, D.: The Balanced Scorecard - Translating Strategy into Action. Harvard Business Review Press, Harvard (1996)

Kaplan, R., Norton, D.: Strategy Maps - Der Weg von immateriellen Werten zum materiellen Erfolg. Schäffer-Poeschel, Stuttgart (2004)

Kaplan, R., Norton, D.: The Execution Premium - Linking Strategy to Operations for Competitive Advantage. Harvard Business Press, Harvard (2008)

International Institute of Business Analysis: BABOK v3. IIBA, Toronto (2015)

Halpern, M.: PLM maturity and usability - the steps to greater product success. In: PI Conference, Munich (2016)

Informatik, V.D.M.A.: Leitfaden zur Erstellung eines unternehmensspezifischen PLM-Konzeptes. VDMA Verlag GmbH, Frankfurt am Main (2008)

Porter, M.: Competitive Advantage: Creating and Sustaining Superior Performance. Simon & Schuster, New York (1998)

Treacy, M., Wiersema, F.: The Discipline of Market Leaders - A Common-Sense Map Toward Market Leadership. Perseus Publishing, Basic Books, New York (1995)

Puth, M.T., Neuhäuser, M., Ruxton, G.D.: Effective use of Spearman’s and Kendall’s correlation coefficients for association between two measured traits. Anim. Behav. 102, 77–84 (2015)

Akoglu, H.: User’s guide to correlation coefficients. Turk. J. Emerg. Med. 18(3), 91–93 (2018)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 IFIP International Federation for Information Processing

About this paper

Cite this paper

Pfenning, P., Eibinger, H.C., Rohleder, C., Eigner, M. (2020). A Comprehensive Maturity Model for Assessing the Product Lifecycle. In: Nyffenegger, F., Ríos, J., Rivest, L., Bouras, A. (eds) Product Lifecycle Management Enabling Smart X. PLM 2020. IFIP Advances in Information and Communication Technology, vol 594. Springer, Cham. https://doi.org/10.1007/978-3-030-62807-9_41

Download citation

DOI: https://doi.org/10.1007/978-3-030-62807-9_41

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-62806-2

Online ISBN: 978-3-030-62807-9

eBook Packages: Computer ScienceComputer Science (R0)