Abstract

This chapter investigates how cohesion funds were spent and how these funds impacted economic developments in the Visegrád countries (Czechia, Hungary, Poland, Slovakia) on short, medium and long terms. Czechia has been the most developed country in the region, Poland and Slovakia were dynamically converging to the European average while the latter also joined the euro-zone and Hungary has significantly improved its external and internal imbalances.

The analysis shows that the sizable spending from cohesion funds had a major impact on growth, investment, external and fiscal conditions. Cohesion funds generally have their primary economic impact throughout investments (both public and private). Funds aim to increase the country’s growth potential in the long run. Spending on competitiveness (R&D, education, health, etc.) might have smaller impact on short term but can have significant long-term effect because it provides more attractive conditions for private investments. While on the other hand, financing private projects can generate significant impact on the short term but the additional impact dissipates quickly. The increased growth potential can generate additional tax revenues in the long term.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

JEL Classification

1 Introduction

Following the fall of the Berlin Wall, people in the Visegrád countries (V4)Footnote 1 enthusiastically embraced freedom and regained national sovereignty, but they had to face a deep economic downturn during the political transition in 1989–1993. GDP declined sharply (by 15–25%), creating massive unemployment (above 10%). The pre-transition economic system of these countries was simply not competitive in the new liberalized environment, and the pace of economic and social transition was not fast enough to counterbalance this by creating new institutions and competitive firms. As a result, a decade into economic transformation, per capita GDP was still below the level people in these countries had in 1989 (Table 4.1). The only exception was Poland, albeit from a significantly lower level than the others because the introduction of Martial law in 1981 depressed the economy for the rest of the decade.

Societies in these countries looked at EU membership as a way to catch up quickly with Western living standards and to create a political and social system that matches those in the West. Hence, public support for joining the EU as early as possible was strong. The EU, however, was keen to ensure that every country that joined the EU met the institutional, legal and operational criteria set out in the ‘Acquis Communautaire’. Thus, the first wave of the eastern enlargement of the EU took place only on 1st May 2004. Expectations on both sides were high, also because Europe and the world economy enjoyed a strong economic boom. This period of high hopes and enthusiasm was however brought to an abrupt end just three years later when the developed world was hit by a financial crisis, the biggest one in the history of the EU. The EU, including the V4 countries, experienced a major economic downturn. The crisis brought to the surface the unresolved structural problems of the V4 economies further amplifying the negative effects of the crisis. Policy makers in the V4 countries and in the EU had to respond quickly and decisively, and EU funds played a major role in their response.

V4 countries were among the EU member states that managed to absorb fully the financial resources allocated to them in the EU budget. Regarding the V4 countries, the highest amount of EU money both in per capita terms and as per cent of GDP was allocated to Hungary. Funds enabling the implementation of cohesion and agricultural policy objectives came from the European Regional Development Fund (ERDF), the European Social Fund (ESF), the Cohesion Fund (CF), the European Agricultural Fund for Rural Development (EAFRD) and the European Guidance and Guarantee Fund (EGGD). The disbursement of EU funds that amounted to financial transfers from high-income countries to low-income member states was seen as policy tool to speed up income convergence. EU money had in fact a significant economic and social impact on the region: investment, GDP, consumption and employment increased, and external and internal stability strengthened.

We analyse the role EU funds played in the economic development of the Visegrád countries. This chapter investigates how cohesion funds were spent and how these funds impacted private and public investments in the short, medium and long terms. We also aim to clarify how EU funds provided fiscal support and stimulus in the region during the recovery after the recent crisis. Our study estimates the role of EU funds in eliminating internal (budget) imbalances and reaching macroeconomic stability in Visegrád countries with a dynamic stochastic general equilibrium (DSGE) model framework.

At the time of joining the EU, V4 countries had no apparent fundamental macroeconomic economic issues, except Hungary, which faced major budgetary issues (see Vértes 2014; Vértes 2015). However, after joining the EU, some serious imbalances emerged across the region. In this chapter, we shall analyse how the spending structure of EU funds affected these economies during the crisis and in the recovery following the crisis, and what the economic policy reaction to the economic crisis and different external shocks was. The focus of our study is to analyse how the EU funds helped the recovery of the V4 countries after the crisis. As the crisis lasted for an extended period, it had a significant and lasting impact on potential growth in the region.

2 Literature Review

Various studies examine the role of EU funds in the recipient economies. These studies, which usually analyse the ex-post impacts of EU funds, provide important evidence to support future policy making. There are two main types of the applied methodologies: (i) micro-based counterfactual analysis and (ii) model simulations using macroeconomic or macroeconometric (estimated) models. The latter can be interpreted as an analysis of the ex-ante impact of the funds: What would be the expected effect at the macro level if the financed projects were implemented effectively and optimally? Econometric or micro-based assessment is closer to an actual, ex-post assessment of the EU funds than simulation-based macroeconomic valuations.

The micro-based counterfactual analyses have very strict assumptions and the methodological framework is described by the European Commission’s Evaluation Sourcebook: ‘The counterfactual situation is purely hypothetical, thus can never be directly observed. For the same reason, an effect can never be directly observed, nor can an impact (impact indicators notwithstanding). By contrast, effects and impacts can be inferred, as long as the available data allow a credible way to approximate the counterfactual. There are two basic ways to approximate the counterfactual: (i) using the outcome observed for non-beneficiaries; or (ii) using the outcome observed for beneficiaries before they are exposed to the intervention. However, caution must be used in interpreting these differences as the “effect” of the intervention. By far the most common strategy to estimate the causal effect of an intervention is to exploit the fact that some “units” have been exposed to the intervention and some other have not, according to some selection mechanism or rule’ (European Commission 2013, p. 78).

Allard et al. (2008) examined how EU funds in the new member states were expected to affect economic growth. The study analysed the expected impact and not the actual one due to the small number of actual observations. In the study, the IMF’s dynamic stochastic general equilibrium model, the so-called GIMF (Global Integrated Monetary and Fiscal model) was applied to analyse the impact of the transfers. GIMF is a large-scale open-economy macroeconomic model with microeconomic foundations based on optimizing forward-looking economic actors with various nominal and real rigidities. They concluded four lessons: (i) EU transfers are expected to be more effective if they were spent on public infrastructure investment rather than on income support; (ii) contribution to household welfare is highest when the funds are invested; (iii) there are just minor differences in effects under different exchange rate regimes; (iv) counter-cyclical fiscal policy is recommended from countries that receive EU funds.

Pereira and Gaspar (1999) used an individual country macroeconomic model to analyse the impact of cohesion spending. They examined the EU funds given to Portugal which was around 3.5% of GDP between 1989 and 1993. The European Union fiscal support increased GDP growth by 0.5 percentage points in the short and long run. Furthermore, the authors suggested that GDP growth was maximized when cohesion funds were spent on infrastructure. However, the impact of transfers on the current account and real exchange rate has adverse effects on long-term convergence.

Varga and in ’t Veld (2011) studied the potential macroeconomic impacts of the Cohesion Policy’s fiscal transfers. They applied a DSGE model (QUEST III endogenous R&D) with semi-endogenous growth and endogenous human capital accumulation. The result of the study was that structural funds caused significant output gains in the long run because of induced productivity improvements.

In ’t Veld (2013) used the same QUEST model family to examine the EU fiscal consolidation assistance between 2011 and 2013 in the eurozone’s core and periphery. The impact of the funds on GDP depended on two factors: how quickly the expectations were influenced and on the composition of the subsidies. Expenditure-based assistance was found to have a higher impact multiplier than revenue-based subsidies.

Banai et al. (2017) analysed the effect of EU funds on the Hungarian small and medium enterprises with micro-based counterfactual methods. In their paper, pairing was based on the propensity score and the impact was quantified through a fixed effect panel regression. The method applied in this chapter included two steps: (1) estimation of getting the subsidies for each company in the sample (2) pairing a non-subsidized company to each subsidized company. The funds of 2007–2013 had significant positive impact on employment, revenue, gross added value but no significant impact was found on productivity (proxied as revenue per employee).

For Hungary, GKI Economic Research and KPMG (2016)Footnote 2 produced a comprehensive analysis of the results of the EU programming period 2007–2013.Footnote 3 The objective of the report was to elaborate an impact analysis covering all EU financial sources and adjacent domestic investment projects according to intervention areas for the given budgetary period. Hungary was one of the EU member states that succeeded in absorbing completely the financial resources allocated to it in the common budget. Funds paid to beneficiaries had a significant economic and social impact in Hungary: GDP, consumption, investments and employment increased, and Hungary’s external and internal stability improved. In the time frame analysed, Hungary’s GDP would have decreased without EU funds and the excessive deficit procedure against Hungary could not have been terminated. Nevertheless, Hungary’s competitiveness deteriorated over this time period. In spite of the rather high level of funds in per capita terms by international standards, Hungary could not keep pace with the countries of the Central and Eastern European region.

Overall, there is no consensus regarding the actual impact of the funds. The effects of EU funds are controversial as some other papers find evidence for positive impacts (e.g. Fayolle and Lecuyer 2000), some papers find positive impacts only for open economies (e.g. Everdeen et al. 2003) and some find no evidence for assisting convergence (e.g. Cappelen et al. 2013).

3 Scope of the Research: Countries and Data

3.1 Visegrád Countries Versus Other EU Member States

V4 countries have largely followed the same strategy to transform their economies since transition started in 1989. Hence, they have similar economic structures, they are all small, open economies, which also show strong openness of financial markets (Czelleng 2019). However, domestic economic policy decisions, especially during the time-period under investigation in this chapter, were rather different.

Since 2004, when V4 countries joined the EU, the world economy was hit by a global financial crisis and the EU was hit by the euro crisis. Hungary was among the few countries that were unable after 2004 to increase its aggregate productivity level (proxied by GDP per person employed; see Fig. 4.1). Czechia could increase its productivity level by 30%, an increase that is three times higher than the EU average. Poland and Slovakia could increase their productivity levels by more than 50%. Czechia and Poland managed to do so without increasing their public debt to GDP ratios. Hungary and Slovakia slightly increased their public debt ratios but less than the EU average. All V4 countries have public debt ratio increases between 0 and 20 percentage points but very different productivity increases. As their experience shows, with appropriate domestic policies productivity can be enhanced without significantly increasing public indebtedness even during a crisis. Domestic policies mattered a lot in this regard.

EU members’ public debt change in percentage points (vertical axis) and productivity changes in percentage points (horizontal axis); 2004–2017. The decline in Hungarian productivity is because during the analysed period no significant growth was measured while, due to the so-called Public Working Scheme, the Hungarian employment statistics were boosted (mainly with low skilled employees). (Source: Eurostat)

EU funds have various effects on an economy. In the first phase, EU funds induce real economic transactions (consumption, investment). Then, it is pre-financed by the government and only months (in some cases years) later financing is covered by the European Commission. Every phase has different impact on the economy. The direct real economic effects are in the first phase when the selected investments are activated. It has a budgetary and financing impact as the government settles (pre-pays) the cost (government expenditure). There is government revenue impact in the second phase due to the balance of transfers as the EU provides the funds. Due to the administration of the funds, EU might transfer the funds two years after the end of financial framework. Due to data discrepancies, the fluctuation in the spending in different main areas (Tables 4.2, 4.3, 4.4 and 4.5) is estimated during the financial framework period (2007–2013), while the real economic effects are counted up to the end of the budgetary period (until 2015).

During the financial framework of 2007–2013, €26.7 billion was allocated to Czechia which means 2.4% of the country’s GDP per annum on average; €12 billion or 2.2% of GDP per annum on average to Slovakia, €25.8 billion or 3.6% of GDP per annum on average to Hungary; and €66.5 billion or 2.6% of GDP per annum on average to Poland. The funds helped to implement different programmes. In this chapter, we aggregated them into main categories. These are E-Administration, Employee skills development, Energy efficiency, Environment, ICT, Infrastructure, R&D, SMEs, Transport.

Based on the fluctuation of total EU funds, we estimated the yearly spending on different programmes as only aggregated numbers are published. Using these estimates, we applied the following spending structure in our model.

4 Methodology

The applied model is a dynamic stochastic general equilibrium model augmented with various frictions. The model is calibrated on the countries in the region which allows us to analyse the impact within the same model framework. These types of models assume dynamic optimization of economic actors, that is, agents take the expected future factors into consideration when they make their decisions in the current period. The model used here is based on the Baksa-Czelleng (2019) model with minor adjustments. The applied new Keynesian dynamic stochastic general equilibrium model includes six economic actors and they can be subdivided into further subgroups. The model includes OLG (OverLapping Generations) households (also liquidity constrained households), corporates (three different types of actors in the production sector), financial sector,Footnote 4 government, monetary authority and foreign market. The detailed description can be found in the appendix.

Applied frictions and main assumptions in the model are as follows:

-

Consumers’ habits play an important role besides optimizing their utility.

-

Production can only gradually adapt to changing circumstances. The adjustment in production and enhancement in capacities are costly.

-

Investment decisions are not only based on the current cost of capital but also on expected future profitability and expected future cost of capital.

-

Prices and wages are rigid. Indexation is costless for economic actors.

-

We assume hybrid inflation expectations (i.e. a combination of rational and adaptive expectations).

-

Economic actors are aware of the fact that the economy will receive EU funds regarding amounts and timing.

Based on the spending we can distinguish various shocks in the model. Cohesion policy interventions are simulated through shocks given to corresponding variables in the model. Table 4.6 summarizes the cohesion policy intervention and the corresponding model variable.

5 Model Results

It is important to emphasize that, in spite of the fact that the evaluation is for a period in the past, the results should be interpreted as estimated ex-ante assessments based on the assumptions made in the model. The latter does not capture the efficiency of subsidized project selection and additionality. Corruption is not analysed by the paper either. In order to change these assumptions, one would need to conduct a micro-based analysis. This is not done here but can be the subject of future research.

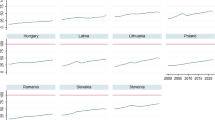

The impact of cohesion funds between 2007 and 2013 for the Visegrád group is shown in Figure 4.2.

According to our estimation, the level of real GDP in Czechia was more than 2.5% higher in 2013 due to the positive impact of cohesion funds between 2007 and 2013. Czechia was massively hit by the crisis. The share of research and development and employee development spending in GDP were the highest among the V4 countries. These spending targets aim to improve productivity and thus competitiveness for a small, open economy. As a result, the long-term economic impact of the cohesion funds disbursed during the Multiannual Financial Framework (MFF) between 2007 and 2013 is estimated to be rather persistent and expected to generate 1% additional real GDP even in 2030.

Our estimates show that Slovakia’s GDP was more than 3.8% higher in 2013 due to the cohesion fund spending between 2007 and 2013. Slovakia’s real GDP returned to the pre-crisis level in 2011. The government took advantage of the cohesion funds as it tried to develop mainly real and IT infrastructure. The share of public investments was the highest among the V4 countries. The economic impact of the cohesion funds for the MFF between 2007 and 2013 in 2030 is expected to surpass 2%.

Based on the model results, Poland’s GDP was more than 4.7% higher in 2013 due to the cohesion funds between 2007 and 2013. Poland spent the lowest portion on direct corporate financing among the V4 countries. This was mainly because Poland was the only country that could avert a recession in the EU after 2008. Private investments were not hit during the crisis as the credit market and profit outlook remained high. Therefore EU funds could be spent on infrastructure and competitiveness which could support private investments further in the long term. As a result, the long-term economic impact of the disbursement of cohesion funds from the MFF between 2007 and 2013 on GDP in 2030 would be greater than 3%, the highest among V4 countries.

As per our results, Hungary’s GDP was more than 4.4% higher in 2013 due to the cohesion funds between 2007 and 2013. Hungary was hit hard by the crisis and the GDP returned to the pre-crisis level only in 2014. The proportion of corporate financing (especially SMEs) was the highest among V4 countries. The economic impact of the cohesion funds for the MFF between 2007 and 2013 in 2030 is expected to surpass 2%. Projects financed from the cohesion funds lead to long-term economic benefits in Hungary as well, but the positive effect is expected to be considerably less persistent than in other countries. Overall, EU funds had significant impact in the short term, but their impact seems to have evaporated quicker than in other countries. This is because Hungary spent more on corporate financing than other V4 countries to tackle insufficient market financing during the crisis. This strategy aimed to support the economy and was successful in avoiding an even larger drop in GDP, but it did not help generate additional growth in the long term.

Besides economic growth, cohesion funds also helped economies to improve their internal balances, which in turn changed investors risk assessment. The impact on the fiscal balance comes through several channels. Countries pay for being in the EU, which has a negative effect on the budget balance. Spending from EU funds impacts the budget balance in several ways. In principle, because of additionality and co-financing, EU funds should increase total public spending and thus increase the deficit. In reality, however, there was a strong substitution effect, projects funded by EU money replaced projects that had been funded previously from domestic sources. Therefore, easing the pressure on the budget balance. Cohesion funds, through financing public and private investments, research and development projects or developing employees’ skills, generate higher tax revenues through several channels, not just higher economic growth and faster convergence. However, as the fiscal rules in the EU limit the fiscal deficit, these positive effects are not on the budget directly, but manifest themselves as less pressure on other items to adjust to meet the deficit target. A positive effect means more space to reduce taxes or increase expenditure in other areas.

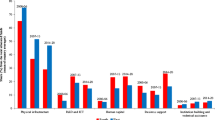

As is the case for every recipient country, cohesion funds also have an economic impact on private sector investments. Spending from these funds aim to improve conditions for private investors which in turn is expected to increase the country’s growth potential in the long run. Private investments are also supported by the substantial amount allocated to improve competitiveness through spending on research and employees’ skills. The largest overall impact on GDP growth has been estimated through the impact on investments, especially on public investments during the MFF. According to our model simulations, public investment was higher by 18.4% in 2013 than it would have been without cohesion fund spending in the Visegrád countries (Fig. 4.3). Private investments are estimated to be almost 5.5% higher in 2013 than they would have been without EU funds. In the case of private investment, there is a long-term effect of EU funds while in the case of public investments the increase generated by the EU funds dissipates quickly (have significant impact only in the short term). However, it is important to emphasize that the nature of private investment seems to determine the extent and duration of the impact. Spending on competitiveness (R&D, education, etc.) might have a smaller impact in the short term but can have a significant long-term effect, just like spending on infrastructure. While on the other hand, financing private projects can generate a significant impact on the short term but the additional impact dissipates quickly. Moreover in the Visegrád countries, a significant share of public investment was spent on infrastructure, which is considered as a key incentive for private investments over a longer time horizon.

Our model calculations suggest that EU funds had the highest positive impact on private and public investments in Hungary. Public investment is estimated to be higher by more than 40% while the impact on private investments was 8.5% in 2018. The reason is that due to budgetary constraints and the high debt level, the Hungarian government could manage development projects only from EU financing. Due to companies’ insufficient access to financing, the impact on private investments was also significant. Private investments were also supported by the substantial amount allocated to improve competitiveness through support for research and employees’ training. Poland had an above average impact on private investments in 2013 with 6.1% as a result of EU funds between 2007 and 2013 while Czechia and Slovakia have been impacted by 3.4% and 3.8% respectively. Regarding public investments, Slovakia had an impact above the average next to Hungary while public investment in Poland and Czechia would have been 14% lower in 2013 without the EU funds.

Our model simulations show significant differences regarding the long-term effects of EU funds in the V4 countries, especially on private investments. In the case of Poland and Slovakia, the impact on private investments even increased further after the end of MFF and it is expected to remain significant in 2030. In spite of a strong impact on investments during the MFF, the long-term impact of EU funds seems less persistent in Hungary due to the above discussed reasons.

In the case of all V4 countries, our estimates suggest that significant additional tax revenue was collected between 2007 and 2018 due to cohesion fund spending related to the 2007–2013 MFF (Fig. 4.4). Furthermore, the spending is expected to have a long-term impact on tax revenues which is generated by the higher level of long-term employment and increased economic performance. The largest additional income is generated by VAT as an individual tax category (between 19% and 34% of the total) but the lion’s share came from taxes related to employment (SSC and PIT together provide 42–50%).

6 Concluding Remarks

In this chapter, we analysed the impact of EU funds on economic developments in the Visegrád countries during and after the financial crisis. The study focused on the impact of cohesion funds on growth and the fiscal position and assumes that issues related to efficiency in project selection for EU funds, corruption and additionality of projects do not influence the outcome in a major way. The analysis shows that the sizable spending from cohesion funds had a major impact on investment and growth.

Overall, EU funds had a significant positive impact on fiscal conditions. To a large extent, they substituted for expenditure that would have had to be funded from domestic sources. Moreover, they had a strong additional positive impact on tax revenues. Therefore, spending from the 2007–2013 MFF played an important role in restoring fiscal balances in the region, which in turn helped the overall economic recovery. The fact that the serious imbalances that had emerged after the countries joined the European Union were eliminated also helped improve investors’ sentiment and credit rating. This gave an additional boost to the recovery.

Cohesion funds have their primary economic impact through investments. Countries which were hit massively by the crisis experienced a huge drop in private investments, because companies’ profit expectations deteriorated and because companies had no adequate access to financing. Therefore, such countries spent more on direct corporate financing (through subsidies or loans) in order to complement insufficient market financing. While these actions were unavoidable to shelter countries from serious economic recessions, their long-term impact is lower than that of other forms of spending. As Table 4.7 illustrates, Hungary spent more on subsidizing firms, and thus the long-term impact of EU funds is less persistent.

Our results are in line with the literature; they confirm that the long-term impact of spending from EU funds is maximized if funds are spent on public infrastructure and on productivity-enhancing measures (innovation and employees’ skills). These are the projects that are most conducive to private investment in the long term. The increased growth potential can generate additional tax revenues up to 3.5% of the total government budget in the long term, which helps improve fiscal balances. Overall, the better financing position will moderate the risk premium of countries in the region, which in turn will further improve budgetary conditions.

Overall, our results suggest that EU transfers helped significantly improve the longer-term growth potential of the Visegrád countries. They also helped reduce the macroeconomic imbalances that had been accumulated prior to the crisis, and through this, they helped reduce the risk premium in the region.

Notes

- 1.

The V4 group is a loose alliance of Czechia, Hungary, Poland and Slovakia. It aims to advance military, cultural, economic and energy cooperation within the group. All four countries are also NATO members. The idea of creating such an alliance originates from a summit of political leaders from Czechoslovakia, Hungary and Poland that was held in the Hungarian town of Visegrád in 1991. Visegrád was chosen to establish a historical link with a similar meeting in 1335.

- 2.

The authors of this paper were members of the research team.

- 3.

In fact, because of the n+2 year rule of the EU, the time horizon of the report is 2007–2015.

- 4.

Financial sector is based on Gertler-Karadi (2011).

References

Allard, C., Choueiri, N., Schadler, S., & van Elkan, R. (2008). Macroeconomic Effects of EU Transfers in New Member States (IMF Working paper 08/223).

Baksa, D., & Czelleng, A. (2019). Jegybanki hitelprogramok értékelése Magyarországon egy pénzügyi szektorral bővített DSGE modellben (Working Paper).

Banai, Á., Lang, P., Nagy, G., & Stancsics, M. (2017). Impact Evaluation of EU Subsidies for Economic Development on the Hungarian SME Sector (MNB Working Papers 8).

Cappelen, A., Castellacci, F., Fagerberg, J., & Verspagen, B. (2013). The Impact of EU Regional Support on Growth and Convergence in the European Union. Journal of Common Market Studies, 41(4), 621–644.

Czelleng, A. (2019). A visegrádi országok pénzügyi integrációja: a részvény- és kötvénypiaci hozamok, valamint a volatilitás együttmozgásának vizsgálata wavelet és kopula tesztekkel. Statisztikai Szemle, 97(4), pp. 347–363.

European Commission. (2013). Evaluation Sourcebook – Methods and Techniques. Available: https://ec.europa.eu/regional_policy/sources/docgener/evaluation/guide/evaluation_sourcebook.pdf

Everdeen, S., Gorter, J., & Mooij, R. (2003). Funds and Games. ENEPRI Occasional Paper No. 3.

Fayolle, J., & Lecuyer, A. (2000). Regional Growth, National Membership and European Structural Funds: An Empirical Appraisal. Revue de l’OFCE (73).

Gertler, M., & Karadi, P. (2011). A Model of Unconventional Monetary Policy. Journal of Monetary Economics, 58(2011), 17–34.

GKI-KPMG (2016). A magyarországi európai uniós források felhasználásának és hatásainak elemzése 2007–2013-as programozási időszak vonatkozásában (Working Paper).

In ’t Veld, J. (2013). Fiscal Consolidations and Spillovers in the Euro Area Periphery and Core. European Economic Papers no. 506.

Karsai, G. (2006). Ciklus és trend a magyar gazdaságban 1990–2005. In Közgazdasági Szemle, LIII. évf.

Pereira, A. M., & Gaspar, V. (1999). An Intertemporal Analysis of Development Policies in the EU. Journal of Policy Modeling, 21(7), 799–822.

Varga, J., & in ’t Veld, J. (2011). Cohesion Policy Spending in the New Member States of the EU in an Endogenous Growth Model. Eastern European Economics, 49(5), 29–54.

Vértes, A. (2014). Tíz év az EU-ban, felzárkózás nélkül; In A. Ágh, A. Vértes, & Z. Fleck (Eds.), Tíz év az Európai Unióban – Felzárkózázs vagy lecsúszás. Kossuth kiadó. Budapest, Hungary

Vértes, A. (2015). The Hungarian Economy, On the Wrong Trajectory. In A. Inotai (Ed.), Hungary’s Path Toward an Illiberal System (Vol. 63, p. no. 2). Südost-Europa.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix A: Summary of Model

Appendix A: Summary of Model

Households

Capital producers

Banks

Intermediate firms

Retailer firms j ∈ {C, INv, Gov, X}:

Government

Monetary policy

Foreign trade

Equilibrium conditions

Parameters

-

B∗—Foreign bond

-

Kt—Capital

-

MPCt—Marginal propensity to consume

-

REERt—Real effective exchange rate

-

W—Nominal wage

-

it—Nominal interest rate

-

r∗—Foreign interest rate

-

h—Technical parameter for households’ behaviour (habit parameter)

-

p—Nominal prices

-

B—Domestic bond

-

C—Consumption

-

Debt—Government debt

-

E—Expectations

-

EUFt—EU funds

-

Exp—Expenditures of the government

-

G—Adjustment function

-

GB—Balance for the government budget

-

Inc—Total income for households

-

Inv—Investments

-

L—Labour force

-

M—Import

-

N—Net value

-

Profit—Profit for final producer

-

Q—Tobin’s Q

-

R—Rotemberg’s cost function

-

Rev—Revenues of the government

-

T—Taxes

-

TB—Trade Balance

-

TC—Total cost

-

TR—Transfers

-

X—Export

-

Y—Total output

-

g—Growth rate

-

mct—Marginal cost

-

r—Interest rate

-

ret—Return

-

v—Technical parameter for financial sector

-

α—Technical parameter for production

-

β—Technical parameter for households’ behaviour

-

δ—Amortization rate

-

η—Technical parameter for financial sector

-

θ—Technical parameter for financial sector

-

λ—Technical parameter for financial sector

-

μ—Import share in production (technical parameter)

-

ξ—Yield spread between risk-free (government bond) and risky (corporate bond)

-

π—Inflation

-

τ—Taxation rate

-

φ—Technical parameter for pricing

-

ψ—Technical parameter for households

-

ω—Technical parameter for household

-

ϕ—Technical parameter for monetary policy

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Czelleng, A., Vertes, A. (2021). The Impact of EU Cohesion Funds on Macroeconomic Developments in the Visegrád Countries After the 2008–2009 Financial Crisis. In: Landesmann, M., Székely, I.P. (eds) Does EU Membership Facilitate Convergence? The Experience of the EU's Eastern Enlargement - Volume II. Studies in Economic Transition. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-57702-5_4

Download citation

DOI: https://doi.org/10.1007/978-3-030-57702-5_4

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-57701-8

Online ISBN: 978-3-030-57702-5

eBook Packages: Economics and FinanceEconomics and Finance (R0)