Abstract

The aim of this chapter is made to test the validity of purchasing power parity (PPP) between the Slovak Republic vis-à-vis the member countries of Visegrad Group using Augmented Dickey-Fuller (ADF) test for unit root and various techniques inspecting the presence of cointegration (i.e. the Durbin-Watson, the Engle-Granger and the Johansen procedures). Applying both the Engle-Granger and the Johansen methods, we found evidence of PPP between the Slovak Republic and Hungary and between the Slovak Republic and Poland, which is consistent with the economic theory. The existence of the long-run relationship was confirmed by the vector error correction model (VECM). However, we have not found any cointegrating vector in the case of the Slovak Republic and the Czech Republic, which rejects the existence of a persistent long-run equilibrium between exchange rate, domestic prices (i.e. in the Slovak Republic) and foreign prices (i.e., in the Czech Republic)

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The Slovak Republic accepted euro as a domestic currency on January 01, 2009, and became a member country of Economic and Monetary Union (EMU). The process of monetary integration was not easy and the country had to meet a number of conditions for joining the union. The Slovak Republic joined the European Union (EU) in May 2004 and has already become a member of the Exchange Rate Mechanism II (ERM II) to prepare for the adoption of the euro. The main reason for the Slovak Republic’s desire to join the monetary union was the creation of closer economic cooperation with the countries of the European Union. Such a close relation meant new economic opportunities, in particular in international trade. For a small open economy like the Slovak Republic, the open markets and reduction of trade barriers are essential for sustainable economic growth. Other countries have seen these benefits too and have also tried to join the EMU. These countries were obliged to meet a set of constraints and convergence criteria in order to adopt the euro. One of the key criteria was price stability measured by the rate of inflation. The economic theory linking the relationship between the exchange rate and the country’s price level is known as purchasing power parity (PPP) theory.

The concept of PPP was introduced by Cassel (1923), who formulated the synthesis of earlier economists. Purchasing power parity has become a key concept in the international economy. The theory is used as a long-term equilibrium condition for open macroeconomic regimes. PPP compares currencies of different countries through the “basket of goods” approach. According to this theory, the two currencies are in the long-term equilibrium (or at par) when a basket of goods is priced (based on the exchange rate) the same in both countries. PPP assumes that the long-term exchange rate between the two currencies is equal to the ratio of their relative price levels. The advent of a flexible exchange rate has made purchasing power parity popular, which has motivated economists to test whether the concept holds in reality. To achieve this, several testing procedures have been developed consisting of different steps. The PPP analysis has become particularly interesting for countries that intend to adopt the euro.

The Slovak Republic has successfully implemented a new currency and nowadays it is a stable member of the EMU. The country is fully integrated into the European Economic Area (EEA).

Although the country is part of the EMU and most of its trading partners use the same currency, the Slovak Republic also trades with countries that do not use the euro as their domestic currency. Similarly, the European Union consists of countries that are not part of the common monetary union and use their own domestic currencies. For example, within the Visegrad Group (V4), the Slovak Republic is a pioneer in using the euro. The V3 countries (i.e., the Czech Republic, Poland, and Hungary) are key partners for the Slovak economy in terms of trade balance. According to Trademap (2018), up to 25.4% of total exports in 2017 went to V3 countries and up to 29.1% of total imports from Slovakia were from V3 countries (see Fig. 1). In particular, in recent years, doubts have been raised as to whether the common European currency is sustainable. It is increasingly claimed that the newer Member States, in particular, will sooner or later encounter the problem of keeping the euro. Some economists and politicians argue that these countries will be forced to return to their previous domestic currency. For instance, Stiglitz (2016) criticized the euro as a common currency. Some official representatives of some EU Member States (e.g., the Czech Republic and Hungary) also criticize the euro as a common currency. The other countries do not criticize the common currency, but have decided to keep their domestic currency (e.g., Sweden, Denmark, or the United Kingdom). The main argument of all critics is that by adopting the euro, a country will automatically renounce its monetary sovereignty and its ability to respond flexibly to economic shocks. Even the current geopolitical situation is not unambiguously in favor of the vision of a positive future for the euro. The decision of the United Kingdom’s referendum to leave the European Union in July 2016 and the growing pressure from US protectionism raise serious concerns about the existence of the euro. Moreover, the increasing popularity of cryptocurrencies and blockchain technologies raises doubts about standard cash currencies. In this respect, there arises a valid question regarding the sustainability of the euro. In the event of a euro collapse, all EMU countries would face the risk of transfer to national currencies, and the analysis of PPPs would be an important issue for them.

Trade of the Slovak Republic in 2017 (in thousands of Euro). Note: SK the Slovak Republic, CZ the Czech Republic, HU Hungary, PL Poland. Source: Own prepared based on Trademap (2018)

The Slovak Republic is also a member of the Visegrad Group, within which it is the only country using the euro. As other countries (the Czech Republic, Hungary, and Poland) are important trading partners of the Slovak Republic, it is important to analyze purchasing power parity. The main aim of this chapter is therefore to analyze the validity of purchasing power parity in countries that are members of the Visegrad Group. The chapter aims to verify the long-term relationship between the euro (as the domestic currency in the Slovak Republic) and the Czech Crown (CZK), Polski Zloty (PLN), and the Hungarian Forint (HUF) using various cointegration techniques (the Durbin-Watson approach, the Engle-Granger method, and the Johansen procedure). The analysis is performed on monthly exchange rate and inflation data for the period 2005–2018.

The remainder of the chapter is organized as follows. Data characteristics supplemented by the formulation of the long-term PPP theory and methodological issues of cointegration techniques are outlined in Sect. 2. In Sect. 3, empirical results are presented, and Sect. 4 concludes.

2 Data and Methodology

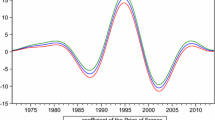

The entire dataset consists of monthly CZK/EUR, HUF/EUR, and PLN/EUR exchange rates retrieved from Eurostat (2018a), where EUR represents domestic currency and the rest represents foreign currency. The rate of inflation is approximated by the harmonized index of consumer prices (HICP) for the Slovak Republic, the Czech Republic, Hungary, and Poland retrieved from Eurostat (2018b). All data are collected on monthly basis covering the period from January 2005 to April 2018, resulting in 160 observations for each variable. The euro is used as the domestic currency for the Slovak Republic and the inspection period takes into account the period before the euro adoption. Although the Slovak Republic started to use the euro since January 2009, the country was part of ERM II since May 2004 when it became an EU member state. It is therefore more appropriate to include also this period before the adoption of the euro. Time series for all variables were obtained from Eurostat. The data included are shown in Fig. 2.

2.1 Definition of Purchasing Power Parity

Purchasing power parity states that prices of goods and services should equalize between countries over time. This simplest definition can be formally written as follows:

where St denotes the nominal exchange rate defined as the domestic price of the foreign currency at time t; Pt represents the price level in the domestic currency at time t and \( {P}_t^{\ast } \) is the price level in the foreign currency at time t. According to the law of one price, which is the core idea of PPP, the price level in all countries should be the same when measured in the same currency. This can be easily expressed by a simple mathematical modification of Eq. (1):

If we denote the domestic value of the foreign price level as Ft, then:

PPP defined by Eq. (2) can be, after rearranging, written as follows:

It is more convenient to express this simple theory in terms of the real exchange rate Gt. The theory of purchasing power parity suggests that the real exchange rate should be equal to 1 when PPP holds:

The standard approach to the analysis of PPP assumes the logarithmic transformation (see Eqs. 6, 7, and 8) of all variables in the above equations. The logarithmic transformation is indicated by lowercase variables. More convenient forms of Eqs. (1, 4, and 5) are as follows:

and

where st denotes the natural logarithm of the exchange rate St; pt and \( {p}_t^{\ast } \) represent the natural logarithms of the price level in domestic country (Pt) and in foreign country (\( {P}_t^{\ast } \)) respectively; ft denotes the natural logarithm of the foreign price level expressed in domestic value and gt is the logarithmic transformation of the real exchange rate Gt. The coefficients β0, β1, φ0, and φ1 are estimated parameters from a particular regression; ζt and εt are error terms representing any short-run deviations from the long-run equilibrium created by random shocks. A key assumption for the validity of the PPP theory is that the variables in Eqs. (6 and 7) are cointegrated (i.e., there is a long-run equilibrium) and the estimated parameters β1 and φ1 must be equal to 1.

The long-run equilibrium can be verified using cointegration methods. The test for cointegration can be used as direct evidence of long-run relationship between two variables—see Enders (2010) or Gujarati and Porter (2009). The long-run purchasing power parity holds if the real exchange rate gt defined by Eq. (8) is stationary. Standard method how to test stationarity is Augmented Dickey-Fuller (ADF) test for unit root—see, e.g., Enders (2010), Patterson (2000), Dickey and Fuller (1981). There are various tests for cointegration used for the PPP analysis—see, for instance, Baillie and Bollerslev (1994) or Kouretas and Zarangas (1998) or Bohdalová and Greguš (2014). The most common testing procedures for cointegration are the Durbin-Watson approach, the Engle-Granger method, and the Johansen procedure—see, e.g., Weliwita (1998), Lothian and Taylor (2000), Christev and Noorbakhsh (2000), Rublíková (2003), Koukouritakis (2009), Chocholatá (2007, 2009), Sideris (2005).

2.2 The Augmented Dickey-Fuller Test for Stationarity

The vast majority of economic data is nonstationary, which disqualifies the interpretation of standard t-statistics when deciding on statistical significance. It is, therefore, necessary to first test whether the examined variables are stationary and to deal with this issue accordingly. The essence of the cointegration analysis is therefore based on the analysis of whether the linear combination of nonstationary time series is stationary. A common method to test whether time series is stationary is multivariate Augmented Dickey-Fuller (ADF) test for unit root. The procedure consists of several steps testing for the unit root in a particular variable, taking into account constant and trend, constant without trend, and no trend neither constant. The null hypothesis that γ = 0 (i.e., time series has a unit root and data are nonstationary) is tested against the alternative that γ < 0 (i.e., time series has no unit root and data are stationary). The generally accepted method of tackling the nonstationarity is data transformation in the first difference. Based on the ADF test, it is possible to decide on the order of integration in the given time series. Identifying the order of integration is an essential part of cointegration analysis, since only variables integrated at the same order can be cointegrated. There can be distinguished three cases, which will either suggest stopping the cointegration testing procedure or lead us to the next steps—see Enders (2010):

-

(a)

Both variables are stationary (i.e., I(0)), which means that standard regression analysis can be used.

-

(b)

Both variables are integrated of the same order (and nonstationary), which indicates that cointegration analysis is necessary and we can proceed further with cointegration analysis.

-

(c)

Variables are integrated of a different order and we can conclude that variables are not cointegrated.

After deciding that the examined variables (i.e., ft and pt) are integrated of the same order, it is possible to proceed with one of the techniques for identifying cointegration.

2.3 The Durbin-Watson Method

The simplest cointegration test is the use of Durbin-Watson (DW) statistics from the regression defined by Eq. (7). The Durbin-Watson method tests whether the residuals εt are generated by the unit root process. The hypothesis can be specified as follows—see Enders (2010):

-

H0: εt ∼ I(1) corresponding to ρ = 1 or DW = 0 (i.e., time series are not cointegrated).

-

H1: εt ∼ I(0) corresponding to ρ < 1 or DW > 0 (i.e., time series are cointegrated).

The model has several drawbacks. First, it is necessary to determine the critical values for deciding on the statistical significance of Durbin-Watson statistics, because critical values are given by empirical distribution. Second, a more serious drawback is that the model is valid only if the residuals εt are generated by the AR1 process. The AR1 process can be identified by analyzing the partial autocorrelation of the residuals from the correlogram. If residues are generated by the AR1 process, the conclusions on cointegration can be considered valid. Otherwise, the conclusions are not valid and it is not possible to conclude whether the variables are cointegrated.

2.4 The Engle-Granger Method

An alternative test for cointegration is the Engle-Granger method, assuming that the two time series (i.e., ft and pt) are integrated of the same order d. According to Engle and Granger (1987), the long-run PPP defined by Eq. (7) can be estimated by the standard regression method. If the variables are cointegrated, the residuals obtained from this equation must be integrated into the order less than d. The residual sequence from Eq. (7) can be denoted as \( {\hat{\varepsilon}}_t \). The ADF test can then be performed taking into account that this residual sequence \( {\hat{\varepsilon}}_t \) comes from a regression equation. Intercept neither time trend does not need to be therefore included. The test for a unit root in the estimated residuals using the standard Dickey-Fuller specification can be defined as follows:

where γ1 and α1 represent estimated parameters and ωt is an error term in a given specification.

The hypothesis can be specified as follows—see Enders (2010):

-

H0: γ = 0 → residuals contain unit root (i.e., variables ft and pt are not cointegrated).

-

H1: γ < 0 → residuals have no unit roots (i.e., variables ft and pt are cointegrated).

The drawback of the Engle-Granger method is that the standard critical values are not adequate and appropriate critical values should be derived from MacKinnon (1991) empirical distribution.

2.5 The Johansen Method

A more sophisticated method for testing cointegration has been proposed by Johansen (1988) and Johansen and Juselius (1990). While the Engle-Granger method is suitable for a bivariate system consisting of one cointegrating vector, the Johansen method is adequate for more than two variables—see Asteriou and Hall (2007). The Johansen method is based on maximum likelihood estimation, which enables to capture the feedback effects between variables. The Johansen method begins with the following vector autoregressive (VAR) specification of a vector of N stationary variables:

where Xt is a column of all endogenous variables; Dt contains a set of conditioning variables, ϕ is an estimated parameter; the stochastic terms v1,…, vT are drawn from N-dimensional identically and independently normally distributed covariance matrix. In our case the vector Xt is a vector of dimension N = 2 because it consists of two endogenous variables ft and pt specified by Eq. (7).

Since most economic time series are nonstationary, the VAR models defined by Eq. (10) are generally estimated in the form of their first differences. Equation (10) can be rewritten in the form of the first differences as follows:

where

and

Equation (11) differs from a standard first difference specification of the VAR model only by the presence of ΠXt − 1 term in it. This term contains information about the long-run equilibrium relationship between the variables in Xt. If the rank of Π matrix r is 0 < r < N, then there can be defined two matrices α and β, both with dimension N × r such that αβ´ = Π where α is a matrix of error correction parameters measuring the speed of adjustment coefficients and β is the long-run matrix of coefficients corresponding to the set of cointegrating vectors.

In the first step of the Johansen method, it is necessary to control for the order of integration of the examined variables, similar to the other methods. In the next step, it is necessary to identify the appropriate lag length of the VAR model using either Akaike information criterion (AIC) or Schwarz information criterion (SIC). Since vast literature recommends the use of SIC for larger and more robust models, we will also use this indicator—e.g., Patterson (2000).

In addition to determining the optimal lag length, it is important to decide whether to include the intercept and/or the trend in either short-run model (i.e., the VAR model) or the long-run model (i.e., the cointegrating equation—CE). As selection criteria can be used the so-called Pantula principle, which is based on testing the joint hypothesis of both the rank order and deterministic components. There are five possible model specifications—see Patterson (2000) Asteriou and Hall (2007):

-

Model 1: No intercept neither trend in CE or test VAR.

-

Model 2: Intercept (no trend) in CE—no intercept in VAR.

-

Model 3: Intercept (no trend) in CE and test VAR.

-

Model 4: Intercept and trend in CE—no intercept in VAR.

-

Model 5: Intercept and trend in CE—intercept in VAR.

The testing procedures determining the number of cointegrating relationships are based on two likelihood test statistics known as the trace statistic (λtrace) and the maximal eigenvalue statistic (λmax), which are specified by the following equations:

and

where T is the total number of observations.

The hypothesis in the case of the trace test can be specified as follows—see Patterson (2000) or Asteriou and Hall (2007):

-

H0: Π ≤ r → variables ft and pt are not cointegrated.

-

H1: Π > r → variables ft and pt are cointegrated.

The maximal eigenvalue is tested by the following hypothesis—see Patterson (2000) or Asteriou and Hall (2007):

-

H0: Π = r → variables ft and pt are not cointegrated.

-

H1: Π = r + 1 → variables ft and pt are cointegrated.

Both statistics are distributed as χ2 with N − r degrees of freedom, where N is the number of endogenous variables and r represents the value of the rank under the null hypothesis.

2.6 The Vector Error Correction Model

If the variables ft and pt are identified as cointegrated, following the above-mentioned techniques, the residuals from the equilibrium regression defined by Eq. (7) can be used to estimate error-correction (ECM) term expressing the dynamics of the equilibrium relationship between the two variables. The ECM specification combines the short- and long-run effects of the variables and it can be noted as follows:

where ft and pt are nonstationary (and cointegrated) variables integrated of I(1) order; εt − 1 is the stationary lagged residual representing the short-run deviations from the long-run equilibrium stated in Eq. (7); μ, ψ1, …, ψp, ω0, …, ωq are unknown parameters of the ECM model; γ represents the speed of adjustment parameter and ut is a white noise term.

Finally, the residuals of this vector error correction model (VECM) defined by Eq. (16) should be tested using Jarque-Bera or Cramer-von Mises normality tests.

3 Results

In this section we present our results from the analyses outlined in the previous part. First, we present the results of the test for stationarity using the ADF test for unit roots and then we show the results for cointegration analysis using the Durbin-Watson, the Engle-Granger, and the Johansen methods. If we find evidence supporting cointegration, we can proceed with the VECM model to investigate the short-run relationship.

3.1 Stationarity

In the first step in the cointegration analysis, it is necessary to decide whether our variables ft and pt are stationary or not. Subsequently, it is crucial to identify the order of integration for the variables. For this purpose, we have performed the Augmented Dickey-Fuller (ADF) test for unit root. The results are shown in Table 1.

The results of the ADF test presented in Table 1 indicate that all examined have one unit root. Thus, all variables are nonstationary and they are integrated of order of one, I(1). Since the data are integrated of the same order, it is possible to proceed further with the cointegration analysis.

3.2 The Results of the Durbin-Watson Method

Because the variables ft and pt are integrated of the same order, we can perform the first test of cointegration. Table 2 captures the results of cointegration test using the Durbin-Watson method.

At the first look, it seems that in all three specifications we would not reject null hypothesis claiming that time series are not cointegrated and we would conclude that the variables are not cointegrated. It is worthy to point out that for Hungary and Poland the value is very close to the critical value threshold. However, based on a deeper analysis of residuals, we conclude that residuals εt are in all three specifications generated by the AR2 process instead of the AR1 process. Our final conclusion is therefore that the models are not valid and we cannot decide whether the variables ft and pt are cointegrated or not.

3.3 The Results of the Engle-Granger Method

An alternative testing procedure for identifying cointegration is the Engle-Granger method. Similar to the Durbin-Watson method, it is also required that the variables ft and pt are integrated of the same order. The model is based on t-statistics estimated by the ADF model for unit root. The results supplemented by calculated critical values and concluding statements are summarized in Table 3.

Table 3 shows that in the case of the Czech Republic, the variables ft and pt are not cointegrated, which means that there are no long-run equilibrium between exchange rate, domestic and foreign prices and as a consequence PPP does not hold. However, for the other two specifications, we can conclude that the variables ft and pt are cointegrated and PPP between the Slovak Republic and Hungary and between the Slovak Republic and Poland is confirmed.

3.4 The Results of the Johansen Method

In this section, we control for the cointegration between the variables ft and pt using the Johansen estimation procedure. Johansen method is considered a more sophisticated technique, which can be used as robustness check of our previous results. After identification of the same order of integration of the analyzed variables in all four countries, it follows the determination of the optimal lag length of the unrestricted VAR model. As it was already mentioned, we use Schwarz information criteria (SIC) to identify the optimal lag length (since we use 160 monthly observations, the maximal lag length is set as 12). For all three specifications the SIC criterion selected 4 lags as optimal. We, therefore, include 4 lags into the VAR in all our models. The results of the Pantula principle test for the trace statistics and the maximal eigenvalue statistics are captured in Table 4.

From the results shown in Table 4, we can clearly observe that there was found no evidence to support the presence of cointegration between the variables ft and pt in the case of the Czech Republic. The trace statistics yield the same conclusion as the maximal eigenvalue statistics. All model specifications (except for model 1 in the case of trace statistic) suggest that the variables are not cointegrated. However, model 1 is the most restrictive model and is considered the least likely in the literature—see, e.g., Petitjean and Giot (2004) or Asteriou and Hall (2007). As a matter of fact, we can conclude that the PPP was not confirmed in this case. The results are different in the case of Hungary and Poland. Most model specifications indicate that the variables are cointegrated. Particularly, in the case of Poland we have found clear evidence that PPP is valid. In the case of Hungary, some models reject cointegration, but in both trace and maximal eigenvalue statistics, we have at least three models, which speak for cointegration between variables ft and pt. Based on the Johansen test, we can say that there is a long-run equilibrium between Hungary and Poland (in relation to the Slovak Republic as a domestic country) in terms of exchange rates, domestic and foreign prices, but this was not the case for the Czech Republic.

3.5 VECM Specification

As we have rejected the cointegrating relationship for the Czech Republic, there is no need to estimate a VECM model to determine the deviation from the long-term equilibrium. In the case of Hungary and Poland, however, this deviation should be determined using the VECM model for each country separately. The estimated VECM based on model 3 from Pantula principle for Hungary considering one cointegrating vector and 4 lags has the following form:

where Δft represents a change in the foreign price level (in Hungary) and Δpt is a change in domestic price level (in the Slovak Republic). The VECM enables us to combine the short-run dynamics and the long-run equilibrium. The long-run information in the above equations are captured in parenthesis and the remaining terms represent the short-run dynamics. The speeds of adjustments (representing the stability of the systems) are given by the coefficients −0.1161 and 0.0108. Since the absolute value of both coefficients is less than one, both systems are stable. The speed of adjustment is very small and indicates that only 11.161% and 1.08%, respectively, of any deviation from the long-run equilibrium is corrected within a month.

The estimated VECM for Poland (based on model 3) considering one cointegrating vector and 4 lags is as follows:

The results are similar to the results for Hungary. The speeds of adjustments are again less than 1 in absolute value.

Finally, it is necessary to verify whether the residuals of this VECM defined by Eq. (16) are normally distributed. For this purpose, we used Jarque-Bera and Cramer-von Mises tests of normality. Based on both tests, the hypothesis that the residuals from VECM equations are normally distributed can be rejected on the level of 0.5 for both cases. These findings do not compromise the results of the VECM model.

Finding the existence of cointegration between the Slovak Republic and Hungary and between the Slovak Republic and Poland confirms the validity of PPP. In addition, it is important to estimate parameter φ1 from Eq. 7. If the PPP holds, φ1 should be equal to 1. Estimated parameter φ1 can be found in the VECM specifications. In the case of Hungary φ1 is 0.9142 and in the case of Poland 0.8584. Both estimated values are close to one. We can, therefore, conclude that the PPP theory is confirmed for Hungary and for Poland.

4 Conclusion

The discussion of PPP has never been ceased since Cassel (1923) introduced this theory. There have been carried out various research papers attempting to either confirm or reject the validity of this theory. The aim of this chapter is to investigate whether PPP holds between the countries of Visegrad group using cointegration techniques for searching a long-run relationship between exchange rate, domestic prices (i.e., in the Slovak Republic) and foreign prices. We found evidence supporting PPP between the Slovak Republic and Hungary and between the Slovak Republic and Poland applying both the Engle-Granger and the Johansen procedures. In addition to the finding of one cointegrating vector (i.e., indicating the existence of the long-term equilibrium), the validity of the PPP was confirmed by the VECM model as the φ1 coefficient for both countries was close to one. In case of the Czech Republic, however, the conclusion is opposite. Compared to Hungary and Poland, a presence of cointegration with the Czech Republic was not found, which rejects the existence of a long-run equilibrium and compromises PPP. Our findings proved to be robust for a given dataset under various specifications.

A similar research to ours was carried out by Chocholatá (2007), who verified PPP in the V4 countries in 2007 when the Slovak Republic was in exchange rate transition period. Using cointegration techniques, the author documented that all analyzed exchange rates were identified to be nonstationary, which means that PPP did not hold. This finding is to some extent identical to our conclusion with respect to the Czech Republic. Chocholatá (2009) performed similar research for the Slovak Republic and Latvia. She was verifying the PPP in the period when both countries were members of ERM II in the process of the euro adoption. Although, she found some indications that the PPP might be valid in the case of Latvia, the conclusions for the Slovak Republic did not identify any long-run equilibrium supporting the purchasing power parity. Koukouritakis (2009) verified PPP between each of the twelve new EU countries in 2009. The results of his study suggest that PPP holds for Bulgaria, Cyprus, Romania, and Slovenia. For the rest of the countries, the long-run PPP was violated, which could be due to the fact that the currencies of these countries have been pegged to the euro and could not reflect the inflation differences. Coakley and Snaith (2004) used the US dollar and Deutsche Mark denominated exchange rate over the period 1977–2001 for 15 European countries to test for the long-run relative PPP applying nonstationary panel regression estimator. They conclude that the long-run relative PPP holds in their European sample.

There are several studies reporting that PPP does not hold. Therefore, it is useful to name the potential causes of this imbalance. Christev and Noorbakhsh (2000) used the cointegration techniques to validate PPP in six central and east European countries (Bulgaria, the Czech Republic, Hungary, Poland, Romania, and the Slovak Republic) in 1990–1998. They identified several reasons for possible deviations from the long-run equilibrium—slower domestic price adjustments to world prices and restrictive monetary policy, productivity shocks, inflexible exchange rate regimes, non-tradeable goods, and services. Similar conclusions made Sideris (2005) who tested PPP for seventeen European countries. He identified productivity shocks, non-tradeable goods and services, and inflexible exchange rate regimes as possible reasons for deviations from the long-run PPP. In respect to our results, the rejection of the PPP between the Czech Republic and the Slovak Republic can be partially explained by expansionary monetary policy represented by the quantitative easing, which is far from equilibrium. Moreover, looking at the long-run evolution of all four currencies (i.e., EUR, CZK, HUF, and PLN), it is obvious that the national currency of the Czech Republic appreciated the most. The invalidity of PPP can be therefore partially explained by the real appreciation of the Czech crown (see Fig. 2) that could in tandem with different monetary policies create inequality in the long-run horizon.

References

Asteriou, D., & Hall, S. G. (2007). Applied econometrics. A modern approach. New York: Palgrave Macmillan.

Baillie, R. T., & Bollerslev, T. (1994). Cointegration, fractional Cointegration, and exchange rate dynamics. The Journal of Finance, 49(2), 737–745.

Bohdalová, M., & Greguš, M. (2014). Cointegration analysis of the foreign exchange rate pairs. Proceedings CBU International Conference on Innovation, Technology Transfer and Education, February 3–5, Prague, pp. 147–153. https://doi.org/10.12955/cbup.v2.497

Cassel, G. (1923). The theory of social economy (Vol. 1). London: T. Fischer Unwin.

Chocholatá, M. (2007). Validity of the purchasing power parity in the V4 countries. International Journal of Pure and Applied, 35(1), 17–29.

Chocholatá, M. (2009). Purchasing power parity and Cointegration: Evidence from Latvia and Slovakia. Journal of Economics, 57(4), 344–358.

Christev, A., & Noorbakhsh, A. (2000). Long-run purchasing power parity, prices and exchange rate in transition. The case of six central and east European countries. Global Finance Journal, Elsevier, 11(1–2), 87–108.

Coakley, J., & Snaith, S. (2004). Testing for long-run relative purchasing power parity in Europe. Money macro and finance (MMF) research group conference 2004, 34, Money Macro and Finance Research Group.

Dickey, D., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49(4), 1057–1072. https://doi.org/10.2307/1912517

Enders, W. (2010). Applied econometric time series. Hoboken: John Wiley & Sons.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica, 55(2), 251–276. https://www.jstor.org/stable/1913236

Eurostat. (2018a). Exchange rates by countries. [Dataset]. Retrieved May 15, 2018, from http://ec.europa.eu/eurostat/

Eurostat. (2018b). Harmonized index of consumer prices by countries. [Dataset]. Retrieved May 15, 2018, from http://ec.europa.eu/eurostat/

Gujarati, D. N., & Porter, D. C. (2009). Basic econometrics. New York: McGraw Hill Irwin.

Johansen, S. (1988). Statistical analysis of Cointegration vectors. Journal of Economic Dynamics and Control, 12(2–3), 231–254. https://doi.org/10.1016/0165-1889(88)90041-3

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on Cointegration with application to the demand for money. Oxford Bulletin of Economic and Statistics, 52, 169–210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Koukouritakis, M. (2009). Testing the purchasing power parity: Evidence from the new EU countries. Applied Economics Letters, 16(1), 39–44. https://doi.org/10.1080/13504850701735807

Kouretas, G., & Zarangas, L. P. (1998). A cointegration analysis of the official and parallel foreign exchange markets for dollars in Greece. International Journal of Finance and Economics, 3(3), 261–276. https://doi.org/10.1002/(SICI)1099-1158(199807

Lothian, J. R., & Taylor, M. P. (2000). Purchasing power parity over two centuries: Strengthening the case for real exchange rate stability. A Reply to Cuddington and Liang. Journal of International Money and Finance, 19, 759–764.

MacKinnon, J. G. (1991). Critical values for cointegration tests. In R. Engle & C. Granger (Eds.), Long run economic relationships (pp. 267–276). Oxford: Oxford University Press.

MacKinnon, J., Haug, A., & Michelis, L. (1999). Numerical distribution functions of likelihood ratio tests for cointegration. Journal of Applied Econometrics, 14(5), 563–577.

Patterson, K. (2000). An introduction to applied econometrics: A time series approach. London: MacMillan Press.

Petitjean, M., & Giot, P. (2004). Forecasting the bond-equity yield ratio using regime switching and Cointegration models: An international comparison. Computing in economics and finance 2004, 6, Society for Computational Economics.

Rublíková, E. (2003). Purchasing power parity and cointegration. Economics and Informatics, 1, 647–668.

Sideris, D. (2005). Purchasing power parity in economies in transition: Evidence from central and east European countries [working paper]. Ioannina: University of Ioannina. http://www.econ.uoi.gr/working_papers/sideris/sideris2.pdf.

Stiglitz, J. E. (2016). The euro: How a common currency threatens the future of Europe. New York, London: W.W. Norton & Company.

Trademap. (2018). Trade statistics for international business development. [Dataset]. Retrieved May 15, 2018. from https://www.trademap.org/Index.aspx

Weliwita, A. (1998). Cointegration tests and the long-run purchasing power parity: Examination of six currencies in Asia. Journal of Economic Development, 23(1), 103–115.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Pažický, M. (2020). New Empirical Evidence on the Purchasing Power Parity from VISEGRAD Group Countries. In: Bilgin, M.H., Danis, H., Demir, E. (eds) Eurasian Economic Perspectives. Eurasian Studies in Business and Economics, vol 14/1. Springer, Cham. https://doi.org/10.1007/978-3-030-53536-0_9

Download citation

DOI: https://doi.org/10.1007/978-3-030-53536-0_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-53535-3

Online ISBN: 978-3-030-53536-0

eBook Packages: Economics and FinanceEconomics and Finance (R0)