Abstract

As a response to higher customer demand and increased competition, innovations in port operations is of concern for port customers and port operators. The growth in world trade is doubling every 5–7 years with a corresponding increase in cargo container movements, most of which are handled by seaports. Moving more traffic through the limited area of a seaport can only be achieved by an increase in port performance. Shipowners, terminal operators and forwarding agents each have optimized their performance guided by values collected on key performance indicators. The purpose of this chapter is to contribute to the understanding of the use of key performance indicators as a mean to drive port innovations. We argue that the use of standard key performance indicators leaves ports in the region of incremental innovations with a diminishing rate of return of investments, missing out on the potential efficiency growth by breakthrough innovations. Our results from a case study at Oslo port shows that operations suffer from a lack of information sharing resulting in an unused potential, not captured by the current performance indicators. We propose a new Information Sharing Indicator to motivate and guide ports in adopting breakthrough innovations for information sharing.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Generally, performance measurements are crucial for all types of organizations, including privately owned corporations, state-owned corporations and non-profits organizations because they illustrate the extent to which these organizations have achieved their targets. Port actors experience the ongoing digitalization of society. Assets within a port, like cargo containers, trucks, cranes, and employees, are increasingly being attached to digital devices that connect the asset with management systems over the Internet through wireless technologies (Wi-Fi, RFID) and associated management software. Examples are the Electronic Product Code Information System (EPCIS) and various dashboard management systems. The goals are to improve resource management, traffic flow, and management of infrastructure and environment, using real-time data and analytics (SmartPort 2014). This digitalization contributes to the transformation of port management from managing physical assets only, towards an increased need to manage the information used to plan and operate the port. In parallel with the digitalization, the growth of cities, as well as the growth of world trade, lead to an increasing amount of goods being handled by ports (Duranton and Turner 2012). Since ports and cities are naturally co-located, its land area is of premium value with few or no possibility for growth. Thus, an increasing amount of goods must be handled using the same or less land area. This challenge can only be met by improving the performance of ports. However, many ports struggle to improve their performance (Lin 2013). We postulate that a specific reason for this is the lack of performance metric that captures the ongoing digitalization, and thus can guide their efforts for improvements. The industry-wide port performance frameworks used consists of a set of key performance indicators (KPIs). Generally, the performance of a port is characterized by its ability to handle the movement of goods between the sea-side transporters and the land-side transporters. The most important measure for this service is the volume of goods handled per unit of time expressed as Container Throughput since the cargo container is the predominant transportation unit (SmartPort 2014; Cullinane and Wang 2010). Improving port performance by increasing the Container Throughput is a common goal of ports since it in turn gives lower ship-turnaround-time, as well as lower truck-turnaround-time of port customers. A previous study generalized the resources needed for port operations as land, labour and capital (SmartPort 2014). Capital includes port assets like cranes, ship-shore container gantry, straddle carriers and various container-handling trucks. These resources constitute the indicators in the KPIs. We show in this chapter that the KPIs used include performance indicators for physical capital, but they lack an indicator capturing the performance of the digitalization process. We identify information sharing between port actors and terminal operators as an important Key Performance Indicator (KPI). Information sharing is often discussed in conjunction with visibility. In this chapter, information sharing refer to an activity that leads to visibility of relevant events, objects and plans across company borders to support performance-related decisions. We motivate the need for an Information Sharing Indicator by conducting a case study of the main container terminal in Norway, the Oslo port. Oslo port handles most of Norway’s import and export of merchandises. We describe the Information Sharing Indicator and propose how to incorporate it within the contemporary frameworks used by the industry for port performance measurements. The remaining of this chapter consist of a review of related literature in Sect. 2, a case study of the performance of Oslo port in Sect. 3, our proposal for Information Sharing as a new performance indicator in Sect. 4 followed by conclusions in Sect. 5.

2 Related Literature

A number of research papers show that information sharing is important for improving supply chain performance in general (Koçoğlu et al. 2011; Prajogo and Olhager 2012; Ye and Wang 2013), and in particular to counter the bullwhip effect, i.e. the demand variability amplification along a supply chain. It has proven to provide significant inventory reduction and cost savings (Lee et al. 2000). However, when it comes to performance measurement frameworks used by ports, information sharing is not included, and consequently not used. Some papers recognize the importance of information sharing on port performance. Olesen et al. describe the importance of how to enable information sharing in complex environments such as ports (Olesen et al. 2012, 2014). We find that several indicators like crane efficiency and area efficiency in previous frameworks are directly positively affected by information sharing, although it is not stated in an explicit manner. We investigate previous research on KPIs for port performance by focusing on the indicators identified by listing their input and output variables. Technology and automation have the potential to enhance port efficiency radically. Thus, we look at the theory of innovations to separate incremental innovations from breakthrough and disruptive innovations.

2.1 Input and Output Selection Using Data Envelopment Analysis

Commonly, Data Envelopment Analysis (DEA) is being used to benchmark the port performance of various ports. In our research, we do not use DEA since it requires more input data than what is currently available. However, since previous studies involving DEA give valuable insights regarding the input and output variables used. We identify KPI variables used by earlier researchers in Table 1.

As can be seen from Table 1, all of these papers use input and output variables related to physical aspects.

2.2 The Smart Port Project

The smart-port project is a comprehensive study of key factors for competitiveness for Mediterranean ports. The project has taken into account previous EU initiatives to compile all relevant information for making a holistic definition of the smart-port concept (SmartPort 2014). The scope of the project covers different categories of port competitiveness, including operational, energy, and environmental aspects resulting in 68 KPIs in total for the three categories. Our focus is on the operational issues; thus, we consider this part of the Smart Port project. The nine groups of KPIs for the operational category are:

-

Berth productivity: Annual throughput (Twenty-foot Equivalent Unit (TEU)/meter of container quay).

-

Infrastructure productivity: Annual TEUs/Total terminal area, Annual TEUs/Total storage or yard area, Annual TEUs/(Total storage or yard area + Total hinterland storage areas), Annual TEUs/ Number of containers terminals, Annual TEUs reefers/Total number of electrical outlets for reefers (static capacity).

-

Capacity for receiving large vessels: Length of quay with +14 m depth (m)/ Total quay length (meters) – only container quay.

-

Size and use of the maximum capacity: Annual TEUs/capacity of the containers terminals (static capacity), Average annual number of hours (containers terminals are working), Annual TEUs/Average annual number of hours (containers terminals are working).

-

Technologic level: Number of Information and Communication Technologies (ICTs) that the port and terminals operators offer to the port community: Wireless communications (Private Mobile Radio for voice, Wi-Fi for data, etc.), Wireline communications (Private Automated Branch Exchange, Fiber Optical network, etc.), Radio-frequency identification (container identification, container security, entrance system, etc.), Optical Character Recognition, Closed-Circuit Television (Container/Truck identification, security, etc.), Global Navigation Satellite System, Differential Global Navigation Satellite System (Crain guidance, container/truck positioning, etc.), Technology Operations Services (Command and control integration, logistic support), Port Community System, Logistics Collaborative Systems, Business-to-Business systems.

-

Level of automation: Annual throughput in TEU per number of quayside cranes, Percentage of automatized quayside cranes, Annual throughput in TEU per number of yard gantries, Percentage of automatized yard gantries, Annual throughput in TEU per number of equipment for internal movements (trucks, shuttle, etc.), Percentage of automatized equipment for internal movements (trucks, shuttle, etc.), Total percentage of automatized quayside cranes, yard gantries and equipment for internal movements.

-

Level of Intermodality: Magnitude of the rail infrastructure (Total sidings in port area (Km)/Total terminal area), Use of the intermodality-railway option (Total TEUs transported by rail/Total TEUs), Use of the intermodality-road option (Total TEUs transported by road/Total TEUs).

-

Lines calling at the port: Total number of TEUs/Number of carriers (only carriers of maritime transport), Number of main lines (large intercontinental and inter-oceanic lines with large ships and tonnage arriving in port and with a large volume of goods) /Total number of lines, Total TEUs per number of vessels that stops in the port.

-

Quality, safety and security: Number of safety and security arrangements and certificates, Number of quality certificates or arrangements according any standard that can contribute to improve or ensure the operations’ efficiency, Scope of the quality certificates or arrangements (Port activities covered by quality management systems), Scope of the safety and security arrangements and certificates (Port activities covered by the safety and security management systems).

Group 1–4 covers berth area, container throughput, capacity for large vessels, while group 5 focus on the technology available in terms of hardware and software. In group 6, the level of automation is expressed as container throughput per automated equipment. The Level of Intermodality in group 7, followed by the number of throughput per Lines calling at the port in group 8 and Quality and safety KPIs in group 9. This set of operational KPIs covers physical assets as well as software and security and quality. We note that the vital aspect of information sharing is not covered.

2.3 Woo, Pettit and Beresford (2011)

In respect to seaport performance, the most recent framework presented by Woo et al. (2011) is one of the most comprehensive frameworks in use. It is created based on the interests of all stakeholders of a port and it represents the latest development in this field. Woo et al. created this framework in 2008 and modified it in 2011. Woo et al. believe different interest groups in ports have their own preference on performance indicators and their preference may differ from one to another. Therefore, they selected four groups to conduct a survey, including port-operating companies, shipping companies, public sector organizations (i.e., government and port authority) and academics. Although academics are not stakeholders of a port, they believe academics have knowledge on logistics and port industry and may have a broader perspective of future issues. One hundred questionnaires were sent by email during their survey and 72 responses were received (Woo et al. 2008). They generated an initial port performance measurement framework based on the 72 responses in the survey resulting in 7 indicator categories with a total of 16 performance indicators. Three years later, they published a follow up of their study. Their new framework was validated by 100 questionnaires sent to the same four groups, namely, port operating companies, shipping companies, public sector organizations and Academics. Most importantly for our case, they identified the importance of cooperation among stakeholders from the survey responds, and they acknowledged this by including the category “Port cooperation and networking”. However, as can be seen in Fig. 1, they were not able to identify any performance indicators for this category. In addition, the port cooperation and networking category were identified by reference to the development of strategic relationships with overseas ports, between neighbouring ports and at inland ports. Previously, others like e.g. Notteboom and Winkelmans (2001) had suggested that even simple forms of coordination could help to counterbalance carrier power, especially when container flows towards the shared local hinterland of the neighbouring ports are involved. Thus, including the port cooperation and networking category was appropriate even if how to operationalize it in terms of performance indicators was not done. Since indicators for information sharing are missing (Fig. 1), we suggest adding it both for the Oslo port authority based on our case study and to the general framework (Fig. 5).

Multi-dimensional port performance measurement framework (Woo et al. 2011)

2.4 Incremental Versus Breakthrough Innovations

The etymology of innovation is from the Latin “innovare” that means to renew or change. We use the term innovation to address change from two perspectives; incremental and breakthrough innovations. Incremental innovations describe modest changes to existing products or services. These improvements keep a business competitive, by e.g. adding new product features and service enhancements. The incremental development of technologies is commonly characterized by a logistic function, denoted the S-curve since it follows an S-shaped growth path (Andersen 1999). It has an initial growth, followed by exponential growth, then a period in which the growth slows and then levels off, approaching—but never attaining—a maximum upper limit. The inflection point separating the S-curve into two equal regions of opposite concavity is called the point of diminishing performance (returns). For technologies, this means that, at some point, further investments in existing technologies will only give marginally increased performance. This is illustrated by the S-curve at the left in (Fig. 2). A breakthrough innovation refer to large technological improvements that propel an existing product or service ahead of competitors. Breakthrough innovations promise significant gains in performance compared with current products (Kalbach 2015; To 2006). A breakthrough innovation implies entering the incubation region of a new S-curve, possibly at a lower level, intersecting the first curve at some point in time as illustrated in Fig. 2.

We argue that a new S-curve requires new performance indicators representing the driving element of the innovation. In our case, information sharing. The new “Information Sharing” KPI guide ports towards utilizing intelligent port systems enabling them to adapt to the breakthrough innovation. Without a new indicator, the indicators of the previous S-curve will guide companies, slowing down a move towards utilizing new technology of the next S-curve. We note that a breakthrough innovation differs from a disruptive innovation as defined by Clayton Christensen et al. (2015). Disruptive innovations result in worse product performance in the near term by bringing to market a very different value proposition of lower initial performance than had been available previously.

In summary, there is a gap in the existing literature on KPIs. The current literature mostly focuses on indicators related to the old S-curve; the physical movement or storage of goods. To enter the new S-curve one need to focus on information sharing to coordinate activities among actors in modern smart ports. This chapter aims at reducing this gap by introducing Information Sharing as a new KPI for container port operations.

3 Case Study: Performance of Oslo Port

In this section, we introduce the performance indicators currently used by Oslo port authority and we identify enablers for improving overall performance including a suggested performance indicator for information sharing.

3.1 Oslo Port

The port of Oslo is the major Norwegian port designated to passengers and freight. As is common for public ports, Oslo port is a municipally-owned company, non-profit / self-financing organization, reporting to the City of Oslo’s department for transport and environment. Oslo port handles passengers and all kinds of commodities, including dry bulk, wet bulk, containers, Ro-Ro and parcels. In terms of this research, the performance of container terminals is our focus. There are two container terminals at the Oslo port: Oslo Container Terminal is the operator at Ormsundkaia, while Sjursøya Container Terminal works at Søndre Sjursøykai (Lin 2013). In container terminals in, or close to, city centres, the limited area is one of the main challenges as is also the case for Oslo port (Lin 2013). Oslo port has already lost certain customers and market share due to its limited storage area. To address this problem, the Oslo port authority wants to convert its container terminals into the most area-efficient terminals in Europe. They have made two efforts to improve area productivity during the last 10 years. Firstly, they purchased four Rubber Tired Gantry (RTG) cranes to replace reach stacker (RS) vehicles. RTGs are more efficient than reach stackers because the former requires less space for operation and they allow greater density in the stacking area than the RSs. Also, it is commonly known that RTGs have a higher automation potential (Kalmar Container Handling Systems 2015). Secondly, the Oslo port authority improved their terminal operating system (TOS) that also can contribute to increase the area efficiency by bettering housekeeping. Remarshaling is one of the main reasons for conducting housekeeping. The remarshaling operation is a way in Oslo port (it is also a common practice in a normal port) to speed up loading operation of export containers onto a ship. Because export containers normally are scattered around a block, containers on the storage area should be rearranged to mirror their final positions on the container ship. An advanced information system can provide a feasible working plan to convert the current layout of the storage area into the desired layout with the minimum number of container moves and travel distance. Since each movement of container requiring space, a better terminal operating system can improve the container flow, thereby increasing area efficiency.

3.2 Performance Measurement by Oslo Port Authority

The four performance indicators used by Oslo port authority to measure the performance of Oslo Container Terminal and Sjursøya Container Terminal were Container Throughput, Area Efficiency, Crane Efficiency and Gate-to-Gate time. These performance indicators are included in the framework created by Woo et al. (2011) who use other terms to interpret these indicators. We show the mapping in Table 2.

These performance indicators are the most frequently used ones by not only port authorities but also their stakeholders, including terminal operators, forwarding agents, shipping lines, etc. More specifically, terminal operators use them to assess their own performance; port authorities need to measure their services providers’ performance and port users (i.e., forwarding agents, shipping lines, etc.) use these indicators (especially, crane efficiency and gate-to-gate time) to compare service quality between different ports.

3.2.1 Container Throughput

Container throughput of Oslo port is 208,799 and 202,790 in terms of Twenty-foot Equivalent Unit (TEU) and 1346 and 1278 in terms of thousand tons in 2011 and 2012 respectively (Lin 2013). For more information, please see Tables 3 and 4. It is the most frequently used indicator and should be adopted by all container terminals worldwide.

In Oslo container terminal, throughput is constrained by the size of stacking storage area to a large extent, since both import and export containers need to stay at the terminal waiting for vehicles or container ships coming and collecting them. Export containers through Oslo port are given 7 days free time of storage. Containers can be delivered to the terminal and stay there for 7 days without cost for the shipper. In terms of import containers, there are 2 days free time. If a container stays at terminal longer than these limitations, the owner of this container will be charged a demurrage, which is costly. Hence, storing containers in a terminal beyond the days included is not an attractive option. Oslo port has already lost certain customers and market share due to its limited storage area (no more area to store unloaded containers of new customers). It happened when they shortened the free storage period for import container to 2 days. 5–7 days are more common in Norwegian ports (Berg 2013).

3.2.2 Area Efficiency

Oslo port authority wants to convert its container terminals into the most area efficient terminals in Europe. Therefore, area efficiency is adopted as a performance metric by Oslo port authority. It is calculated by the ratio of container throughput and terminal area. It is also worth to mention that the port authority regards container throughput in tons as output factor rather than number of TEU. Table 5 illustrates area efficiency in 2011 and 2012 provided by Oslo port authority.

3.2.3 Crane Efficiency

Currently, the gross crane efficiency is 20 lifts per crane hour and net one is 27 lifts per crane hour in Oslo container terminals (Hatteland 2013). The target of gross crane efficiency is 20 lifts per crane hour currently, thus Oslo Port has already met the target. Therefore, the port plans to increase this target to 27 lifts per crane hour. This new target is determined based on the analyses of terminal layout and certain simulations of crane efficiency, which testify this new target is technically achievable. An important measure in this regard will be to coordinate the stevedore’s breaks with the remaining port actors. Since crane efficiency is the key determinant of ship working time and ship turnaround time, it has been a target for automation. We illustrate this trend by referring to the automation at Sydney’s Patrick terminal (Saulwick 2015). Alistair Field, the managing director of Patrick Terminals and Logistics, commenting on the level of automation into its stevedoring operation: “This is fully automated, there are no human beings, literally from the moment this truck driver stepped out of his cabin from then onwards this AutoStrad will take it right through the quay line without any humans interfacing at all”. They estimate that in total, the new system allows the stevedoring operation to take place with staff about half the previous size while also generating other advantages like safer operations, 24/7 operation without the need for expensive overhead lighting since the automated system navigate without the need for light, they use 20% less fuel, they incur lower maintenance costs, and when there is a rush the information system redirects workers from other tasks to focus on the most pressing job (Saulwick 2015). In the port of Oslo, the stevedores’ break is one of the main obstacles of improving crane efficiency. If there is no stevedores’ break, the ship turnaround time can be decreased by 25% (Hatteland 2013). One way to achieve this is by using four stevedores a team instead of three stevedores a team. The trade-off would be made between decreasing ship turnaround time by 25% and increasing manpower cost by 33%. However, in practice, most of shipping lines are not willing to pay for this service (Hatteland 2013), leading to further pressure for automation.

Ship design is another important external factor influencing crane productivity. Normally, after a container is moved to the quay side by port chassis, Ship-to-Shore Gantry (SSG) cranes attach to the container and lift it at waist-high. At this time, stevedores take proper container fittings and attach them to the container corners before the crane moves the container to the correct position on the ship with hatch covers. Fully automatic twist locks (which can automatically lock and unlock) can make the loading/unloading process more efficient then semi-automatic twist locks (which can automatically lock and should be manually unlocked) (Hatteland 2013).

In terms of a container ship with no hatch covers, the containers can be loaded directly into the cell guides and no fitting is called for. Loading and unloading process for a container ship like this is faster and more cost-efficient because cell guides in this ship are fixed structures that can keep containers without any other equipment, such as twist locks mentioned above. This type of container ship can dramatically reduce labour cost and fitting installing time (Pacificmarine 2013). Such measures depend upon coordinated operations and information exchange between the stakeholders.

3.2.4 Gate-to-Gate Time

Gate-to-gate time means the total time used by a vehicle from getting in to getting out of a container terminal. This indicator includes measures of issue like the traffic congestions in the terminal and time used to identify the right container. This indicator has high variability in practice. Generally speaking, if there is no traffic congestion in the terminal, 15 min should be taken from getting in to getting out (Hatteland 2013). However, when there is much traffic combined with internal and external vehicles, productivity will slow down dramatically. For instance, when the terminal is handling a container ship, at the same time, there is a big pressure on collecting containers from external actors (landside service) (Hatteland 2013). The Oslo port authority set a target for this indicator for 15 min. That is to say; if there is no high pressure on internal traffic, the port can meet this target. Oslo port set this target according to the capacity of the terminal and their experience (Hatteland 2013).

3.3 Potential to Improve the Overall Performance

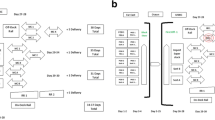

In the storage area of Oslo container port, containers are unloaded from port chassis and stacked (or unstacked and loaded to port chassis) by RTGs and reach stackers. More specifically, arriving containers (imported) will be unloaded by SSGs from vessels, placed on port chassis, hauled to stacking area and stacked by RTGs. Normally, 2 days later, external trucks will come in and drive under the RTG crane to collect these containers. By contrast, exported containers are unstacked from the storage area, placed on port chassis, hauled to port’s apron and loaded to ships by SSGs (see Fig. 3).

3.3.1 Traffic Congestion

According to the primary information obtained from interviews with informants, internal traffic congestion is the main obstacle of improving the performance on gate-to-gate time. Internal traffic congestion is mainly generated when handling ships and trucks at the same time. Making a balance between internal vehicles and external vehicles can improve the performance of gate-to-gate time. More specifically, after an external vehicle comes in and drives under the RTG crane, the RTG crane needs to lift a maximum of four containers normally to get the right container which should be loaded onto the truck. If at the same time, an internal vehicle comes from the ship, it should wait in a queue behind the external truck. That is to say, the internal vehicle will fail to go back with container on time and the SSG must wait. The consequence is that not only the crane efficiency of SSG is decreased, but also the gate-to-gate time and ship turnaround time are increased (Madland 2013). Although the containers that come from ships may very well be collected before one that is already in stack and the internal vehicle should be given higher priority than external vehicles, the problem is that terminal does not know when a truck will come to collect an import container. When internal vehicles are driving between SSG and RTG with import containers, external vehicles may arrive and mix the traffic, hence causing queuing and waiting times. Consequently, the lack of information sharing among the stakeholders gives rise to the internal traffic congestion (Madland 2013).

The terminal operator does not have information on when, and in what sequence the containers are collected by external actors such as, forwarding agents. Therefore, the port operator fails to prepare in advance (Hatteland 2013). More specifically, when trucks come, truck drivers might ask for their container that could be positioned in the bottom of a stack, which generates many extra unnecessary lifts in order to get these containers (Madland 2013). Since each move of a container requires space, better information sharing between terminal operators and terminal users can reduce the number of lifts thereby improving the container flow and area efficiency. If the terminal operator had known this information in advance, it would be easier to move the containers what the truck drivers wanted to the top of the stack before they arrive, thereby dramatically reducing the gate-to-gate time. This situation of missing information gives rise to the main obstacle of improving gate-to-gate time. Currently, forwarding agents send orders to truck drivers asking them to pick up containers at terminal. When they arrive at the port and ask for their containers, the information goes to the crane driver. The truck driver has a booking reference that is connected to a container number. The container number is connected to an area reference and position in the stack. The booking is also connected to a ship operator. The terminal operator usually put different ship operators’ containers in different stacks. For instance, Maersk’s containers are put in Maersk Stack, etc. It is the Forman that has control on where each container is mainly by routine with no written records. Even if they are good at memorizing, as pointed out in the interview with Madland (2013), an information system promoting the sharing of information among stakeholders and a joint planning system will improve operational efficiency.

3.3.2 Container Sequence

It is possible for the terminal to get more or less full overview of information regarding ship handling by exchanging information with the ship owners. By contrast, the terminal knows nothing about in which sequence containers are collected by trucks until truck drivers come. Although loading information is available for ship handling in advance, in Oslo Container Terminal, there is no buffer area in front of the berth that can be used to temporarily store containers to be loaded onto a ship. This makes remarshaling in front of a berth impossible. As a consequence, terminal tractors move containers between ship and stacking area back and forth. SSG should wait for terminal tractors to load and unload containers to and from the ship. In Sjursøya Container Terminal, there is a very limited area for storage when using straddle carrier (2–3 containers per crane). This limited area also enables SSGs to put containers on the ground under crane without the need of waiting for internal vehicles’ to come back. Hence, it makes flexibility but it is also impossible for operations of remarshaling in front of a berth, which hinder the improvement of performance (Madland 2013).

3.3.3 Discussion

To sum up, information missing (the lack of information sharing between terminal operators and forwarding agents) is the cause hindering the improvements of overall performance in container terminals of Oslo port, including area efficiency, crane efficiency, throughput and gate-to-gate time. See Fig. 4.

Information can improve the container flow, thereby increasing area efficiency. Because the size of the stacking storage area is the constraint of container throughput in Oslo container terminals, increased area efficiency leads to increased container throughput. In addition, the information provided by forwarding agents enables terminal operator to prepare containers before trucks come, which can dramatically reduce gate-to-gate time. Reduced gate-to-gate time leads to shorter queue in the stacking area which increases the possibility that port chassis coming from a ship can go back on time, thereby increasing SSG crane efficiency. However, since information sharing is not measured in any way by current performance metrics, the port and the related actors focus on the traditional metrics. Sharing of information is not measured, and thus, not managed well. A metric capturing the level of information sharing would make the importance of information sharing clear to all parties.

3.3.4 Further Evidence of the Importance of Information Sharing

3.3.4.1 The Port-Ship Coordinated Planning (PoShCoP) Project

Enhancing information sharing of port planning information across actors is also important for projects like The Port-Ship Coordinated Planning Project (PoShCoP 2015) where the central issue is the coordinated planning of ship-owners plans with the plans of ports. The planning of port movements of ships, and their associated approaching and departing phases, are often found to be poorly coordinated. A typical reason is that a plan might be good at an early stage, but as times passes, external events may happen that invalidates the plan, or makes it difficult to fulfil. This might be the delay of a ship due to bad weather, causing later congestion in the harbour, or the early arrival of a ship at a port when the ship could have slow-steamed instead, if it had known its slot time at the port. Slow steaming refers to the practice of operating container ships at significantly less than their maximum speed to save fuel and to smooth operations in ports. The PoShCoP project develops a cooperating operational planning system for combined port and ship planning from various levels. The simplest is that one actor is granted access to relevant plans of another actor during planning and re-planning, while the most advanced is to let the solvers (planning software) of each actor cooperate in order to find a solution that would benefit all actors involved. The methods developed in the PoShCoP project are within discrete optimization focusing on the core issues of route planning (and related planning problems like area utilization in the port). However, to be able to solve the planning problems by discrete optimization methods, the information must first be shared between ship-owners and port operators.

3.3.4.2 Workload Variance

The characteristic of the workload distribution of a typical day and a typical week was studied for Oslo port. Based on communication with the management at Oslo Port and the Sitma Port Consultancy (Lin 2013), two trends regarding the workload distribution of both the landside service and the quayside service were found. Typically, over a week, Monday, Tuesday and Thursday are the busiest days. Ships normally depart from ports located in central Europe on Friday, arriving at Oslo in the morning on Monday. Over a day, the workloads typically peak between 0900 and 1200 (Lin 2013). Although the ship owners’ plans can be hardly changed by the Oslo port authority, port operators can make certain preparations before port users arrives. For example, lift the to-be-collected containers to the highest tier to reduce the workload when forwarding agents arrive. Certain preparations in advance can make the workload curve more smoothly and reduce the possibility that workload exceeds their capacity leading to congestion. Also, as for the PoShCoP project, delays of ships due to external factors like bad weather can cause congestion in the harbor which could be avoided by re-planning or by slow-steaming saving costs for all actors. Information sharing between port users and port operators are called for to make the worklist for preparation.

3.3.5 Relations Between Supply Chain Actors and Information Sharing

As discussed above, the information sharing between all actors is of importance for the efficiency of a port. However, information sharing among all actors may not be easy to achieve. A strong major actor and/or concerted efforts among all actors are typically needed.

Port operator as a strong actor

A strong actor, to some extent, can control all activities in a port and set the “rules of the game”. This strong actor may have the ability to require all other actors to share information. The port operator seems the one who very likely has the potential to be in such a controlling position in a port and ask for data sharing to increase their efficiency.

Government as a strong actor

If even the port operator does not have the governance power to facilitate the information-sharing activities, it will be very difficult to see that any other individual LSPs playing in a port could be in a position to make data-sharing activities mandatory for all actors. In this situation, the government may trigger information sharing by making laws and regulations due to security or financial control reasons.

Port operator as an information buyer

Under the situation where the strong actor is absent, the port operator may also take such a responsibility to facilitate the information sharing among actors. More specifically, they can buy information from other actors, like buying other services, thereby enhancing their efficiency, but unless the benefits for the port operator outweigh their costs.

Concerted efforts among actors

Certain actors may see their benefits if a port can enhance efficiency. As discussed above, forwarding agents may benefit from the increased efficiency in the back yard of a port. Information provided by forwarding agents enables the terminal operator to prepare containers before trucks come. Reduced gate-to-gate time can also reduce the cost of forwarding agents. To this end, forwarding agents and other actors may be willing to share their information to increase the efficiency of a port and reduce their costs. However, the port operator cannot force those who are reluctant to share information and can accept the current port efficiency.

To sum up, information sharing can be achieved by a strong major actor and/or concerted efforts among all actors. A KPI of information sharing let actors to see the absence of information sharing and the related inefficiency in port operation and motivate port actors to share their information.

4 Information Sharing as a New Performance Indicator

Due to the importance of information sharing, it should be considered as a new performance indicator. Such an indicator will expose information sharing issues in an explicit manner, helping the actors to give information sharing a higher priority to improve performance. We argue for this first by an example for the port of Oslo, then we suggest generalizing it by including it in the performance measurement framework by Woo et al. (2011).

The following metrics are referred to as the “Information Sharing Indicator”. It represents a novel approach to measuring the port operational performance in terms of information. The indicator is composed of two primary metrics. The first metric of the Information Sharing Indicator is “shared”. This metric is a sum of zero/one variables showing whether information between two actors is shared (1) or not (0).

The type of information to be shared is information related to the operations of the port, which in this case is scheduling information made by ship owners, port operators and freight forwarders. We define the second part of the Information Sharing Indicator to be a “level” metric reflecting what extent scheduling information is exchanged. Schedules might change, so the freshness of the schedules have higher value the more recent they are. As a first approach to quantify the level of the information exchanged we define three classes (which can easily be extended with more classes). Short term is within a week, and long term is above 1 week. The information at the next level comes in addition to the information shared at the previous levels. The levels are:

1. Sharing of long term schedules and plans

2. Sharing of short term schedules and plans

3. Real-time sharing of deviations

The Information Sharing Indicator (ISI) is defined as the ratio of the actual value to the maximum value of the shared and level metrics:

Where N is the total number of interactions between ship owners, port operators and freight forwarders on the landside. If each actor needs to communicate with all other actors the total number of interactions will be n(n – 1)/2 (assuming bidirectional information exchange). The complexity involved in multi-party networks for container handling is further described in (Jager and Hjelle 2015). Si is one if information is exchanged and zero otherwise. Li is the value of information exchanged. Lmax is 3 in our case with 3 as the highest-level metric.

4.1 Example of Usage in Oslo Port

The three actors having the greatest effect on the performance are ship owners, port operators and freight forwarders. In the port of Oslo there is one port authority, an estimated 20 ship owners and an estimated 20 forwarding agents resulting in n = 41 actors. The total number of interactions, N, is n(n – 1)/2 = 41(41 – 1)/2 = 820. Fortunately, for the Oslo Port case the number of interactions is much lower. The port operator can be seen to act as a hub with which all ship owners communicate, and also the freight forwarders communicate with the port operator. In the general most advanced case one could envision that all actors cooperate in order to find a solution that would benefit all actors involved. For now we focus on starting sharing information among the central actors via a hub in which the number of interactions is proportional to n (Jager and Hjelle 2015). If the port operator shares information with each of the ship owners and each of the forwarding agents we get a maximum of N = 40 interactions. The Oslo port shares long-term schedules with most ship owners, and short-term schedules are exchanged with just a few, estimated to 15 out of 20 of which 4 of the 15 exchange short-term schedules. As for the freight forwarding agents on the landside this number is even lower. It is estimated to be 5 of the 20 agents that share long term schedules (Hatteland 2013). The maximum value is N + N × Lmax = 40 + 40 × 3 = 160. Using the formula, the actual value of the shared and level metrics becomes 44 giving ISI = 44/160 = 0.275. Thus, by our estimates, the Port of Oslo can be seen to use information only 27.5% of the potential for information sharing.

In this manner, an Information Sharing Indicator would expose the level of information sharing to all the actors involved and to the relevant authorities. This calculation method is a first approach. We propose to refine it through an iterative process of applying it to a port case, refining, repeating the cycle until the model becomes stable. A calculation of the value of the Information Sharing Indicator together with other KPI’s to form a combined indicator require substantial computing efforts due to its complexity, see e.g. Linn et al. (2007). We advocate using a qualitative approach to evaluate the combination of several KPIs, since a numerical weighting among indicators is hard to implement in practice.

4.2 Including the Information Sharing Indicator in the Performance Measurement Framework

We suggest adding information sharing between port users and port operators as an explicit parameter in the performance measurement framework developed by Woo et al. (2011) as shown in Fig. 5. The Information Sharing Indicator is added under the Port cooperation and networking category thereby completing the framework by having an operational indicator for all categories. One might argue that measuring information sharing is an input that influences the performance rather than a performance indicator. Similar reasoning on one of the traditional KPIs would be: is the number of cranes an input that influences the performance rather than a performance indicator? Since, in our case, the goal of using the KPIs is to guide managers towards increasing the performance of the port, we maintain that in the light of the breakthrough innovation (the digitized automated port), managers need the new indicator to guide them in making decisions. If using existing KPI’s only, the managers will have a hard time to figure out how to improve performance. Arguably, the most important indicator to make decisions in the emerging smart port environment is the Information Sharing Indicator since it captures the most important indicator for enhanced performance. It reflects the direct relationship: little information sharing, means low performance, and vice versa.

5 Conclusion

According to the analysis in this chapter, we discussed the problem of information sharing between terminal operators and forwarding agents and we argued for that a lack of sharing is a major cause hindering performance improvements of container terminals at Oslo port, including area efficiency, crane efficiency, throughput and gate-to-gate time. Although crane efficiency can be influenced by external factors to some extent, information sharing can also dramatically increase the terminals’ performance by this indicator. That is to say, the enhanced information sharing between terminal operators and forwarding agents can improve the performance of container terminals in Oslo port. More specifically, information sharing can improve the container flow across the entire supply chain, thereby increasing area efficiency. Because the size of the stacking storage area is the constraint of container throughput in Oslo container terminals, increased area efficiency leads to increased container throughput. In addition, information provided by forwarding agents enables terminal operator to prepare containers before trucks come, which can dramatically reduce gate-to-gate time. Reduced gate-to-gate time leads to shorter queue in the stacking area which increases the possibility that port chassis coming from a ship can go back on time, thereby increasing SSG crane efficiency.

Due to the importance of information sharing shown in the case of container terminals of Oslo port, we suggest adding it as a new performance indicator in the performance measurement framework used by Oslo port authority and also include it in port performance measurement frameworks as shown for the framework by Woo et al. (2011). We have argued that standard key performance indicators leave ports in the region of maturity with only small incremental innovations in the maturity region of the technology diffusion model. Ports in this region receive a diminishing rate of return of investments, being stuck in the maturity region. We have proposed a new Information Sharing Indicator (ISI) that motivates ports to adopt breakthrough technological innovations that will lead ports towards a new rapid growth period.

References

Al-Eraqi, A. S., Mustafa, A., Khader, A. T., & Barros, C. P. (2008). Efficiency of Middle Eastern and East African seaports: application of DEA using window analysis. European Journal of Scientific Research, 23(4), 597–612.

Andersen, B. (1999). The hunt for S-shaped growth paths in technological innovation: a patent study. Journal of Evolutionary Economics, 9(4), 487–526.

Barros, C. P. (2012). Productivity assessment of African seaports. African Development Review, 24(1), 67–78.

Barros, C. P., Felício, J. A., & Fernandes, R. L. (2012). Productivity analysis of Brazilian seaports. Maritime Policy & Management, 39(5), 503–523.

Berg, G. (2013). Face to face interview with Geir Berg. In N. Lin (Ed).

Christensen, C. M., Raynor, M., & McDonald, R. (2015, December). What is disruptive innovations? Harvard Business Review.

Cullinane, K., & Wang, T. (2010). The efficiency analysis of container port production using DEA panel data approaches. OR Spectrum, 32(3), 717–738.

Cullinane, K., Song, D. -W., Ji, P., & Wang, T. -F. (2004). An application of DEA windows analysis to container port production efficiency. Review of Network Economics, 3(2).

Duranton, G., & Turner, M. A. (2012). Urban growth and transportation. The Review of Economic Studies, 79(4), 1407–1440.

Hatteland, C. J. (2013). Face to face interview with Carl Johan Hatteland. In N. Lin (Ed.).

Hung, S.-W., Lu, W.-M., & Wang, T.-P. (2010). Benchmarking the operating efficiency of Asia container ports. European Journal of Operational Research, 203(3), 706–713.

Jager, B., & Hjelle, H. M. (2015) Handling multi-party complexities in container flows in the upstream oil and gas supply chain: Potential lessons for an application to intercontinental container supply chains. In Transportation information and safety (ICTIS), 2015 international conference on, 2015 (pp. 661–668). IEEE.

Kalbach, J. (2015). Clarifying innovation: Four zones of innovation. Experiencing information [Accessed: 10.1.2017].

Kalmar Container Handling Systems. (2015). Container handling systems brochure. http://www.rrtobe.com/salesmaterial_store_pdf_low_res/CHS_KIOY0309E-17.pdf

Kasypi, M., & Shah, M. (2013). Malmquist productivity index for container terminal. European Journal of Business and Management, 5(2), 58–70.

Koçoğlu, İ., İmamoğlu, S. Z., İnce, H., & Keskin, H. (2011). The effect of supply chain integration on information sharing: Enhancing the supply chain performance. Procedia-Social and Behavioral Sciences, 24, 1630–1649.

Lee, H. L., So, K. C., & Tang, C. S. (2000). The value of information sharing in a two-level supply chain. Management Science, 46(5), 626–643.

Lin, N. (2013). Port performance: Models and metrics supporting performance evaluation.

Linn, R., Liu, J., Wan, Y.-W., & Zhang, C. (2007). Predicting the performance of container terminal operations using artificial neural networks. In K. Bichou, H. M. G. Bell, & A. Evans (Eds.), Risk management in port operations, logistics and supply-chain security (pp. 117–134). London: Informa.

Madland, O. (2013). Unstructured telephone interview with Olav Madland. In N. Lin (Ed.).

Notteboom, T. E., & Winkelmans, W. (2001). Structural changes in logistics: how will port authorities face the challenge? Maritime Policy & Management, 28(1), 71–89.

Olesen, P. B., Hvolby, H.-H., & Dukovska-Popovska, I. (2012). Enabling information sharing in a port. In IFIP international conference on advances in production management systems (pp. 152–159). Springer.

Olesen, P. B., Damgaard, C. M., Hvolby, H. -H., Dukovska-Popovska, I., & Sommer, A. F. (2014). Framework for information sharing in a small-to-medium port system supply chain. In IFIP international conference on advances in production management systems (pp. 257–264). Springer.

Pacificmarine. (2013). How do container ships work? http://www.pacificmarine.net/marine-deck/cargo-securing/how-do-container-ships-work.htm.

PoShCoP. (2015). The port-ship coordinated planning project, supported by the Norwegian Research Council.

Prajogo, D., & Olhager, J. (2012). Supply chain integration and performance: The effects of long-term relationships, information technology and sharing, and logistics integration. International Journal of Production Economics, 135(1), 514–522.

Schøyen, H., & Odeck, J. (2013). The technical efficiency of Norwegian container ports: A comparison to some Nordic and UK container ports using Data Envelopment Analysis (DEA). Maritime Economics & Logistics, 15(2), 197–221.

SmartPort. (2014). Action Plan towards the SMART PORT concept in the Mediterranean Area, EU Project by Andalusian Institute of Technology, University of Cádiz, Institute of Communication and Computer Systems, and Prometni Institut Ljubljana, supported by European Regional Development Fund.

Sydney’s Patrick terminal goes automated, with fewer staff but dancing robots. (2015, June 18). The Sydney Morning Herald.

To, H. (2006, May 16). The next big trend and the “double merit” scenario. SafeHaven.

Woo, S. H., Pettit, S. J., & Beresford, A. K. C. (2008, September). A new port performance measurement framework in a changing logistics environment. In Proceedings of the LRN 2008 annual conference (Vol. 6).

Woo, S. H., Pettit, S., & Beresford, A. K. (2011). Port evolution and performance in changing logistics environments. Maritime Economics & Logistics, 13(3), 250–277.

Wu, Y.-C. J., & Goh, M. (2010). Container port efficiency in emerging and more advanced markets. Transportation Research Part E: Logistics and Transportation Review, 46(6), 1030–1042.

Ye, F., & Wang, Z. (2013). Effects of information technology alignment and information sharing on supply chain operational performance. Computers & Industrial Engineering, 65(3), 370–377.

Yuen, A. C. -l., Zhang, A., & Cheung, W. (2013). Foreign participation and competition: A way to improve the container port efficiency in China? Transportation Research Part A: Policy and Practice, 49, 220–231.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Jager, B., Lin, N. (2021). Utilizing Breakthrough Innovations: The Need for Information Sharing as a New Key Performance Indicator for Container Port Operations. In: Hernández, J.E., Li, D., Jimenez-Sanchez, J.E., Cedillo-Campos, M.G., Wenping, L. (eds) Collaborative Logistics and Intermodality. Springer, Cham. https://doi.org/10.1007/978-3-030-50958-3_8

Download citation

DOI: https://doi.org/10.1007/978-3-030-50958-3_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-50956-9

Online ISBN: 978-3-030-50958-3

eBook Packages: Business and ManagementBusiness and Management (R0)