Abstract

This paper examines the outlook for the supply and demand of mineral raw materials, as related to strong growth in the introduction of electric vehicles (EVs) in the near future. Given the nature of the topic to be addressed, this analysis will be global in scope. It will also focus on batteries, as the fundamental element differentiating EVs from internal combustion vehicles. An analysis of the readiness of the supply side to respond to a major increase in demand for the various raw materials involved shows very substantial differences between the different supply chains, including those of substances classified as critical. No less important are the geopolitical consequences that might threaten some aspects of the market.

This paper is an updated and revised version of the article ‘Protagonismo de las materias primas minerales en el desarrollo del vehículo eléctrico’ by Luis de la Torre Palacios, Eloy Álvarez Pelegry and Jose Antonio Espí Rodríguez, published in Economía Industrial No. 411.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction to Electric Vehicles

Before assessing and discussing possible future problems with the availability or price of mineral raw materials as a result of the growing penetration of electric vehicles (EVs), we first need to specify which types of EV we are talking about. Secondly, we need to identify in which part of the vehicle the mineral raw materials are located. And thirdly, it is essential to estimate the number of EVs that will be operating in a given timescale.

In Spain, the National Policy Framework (Marco de Acción Nacional) defines EVs as vehicles that are fully or partially driven by an electric motor using chemical energy stored in one or more batteries charged from an external power source. The NPF’s definition includes Battery Electric Vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs) and range-extended electric vehicles (REEVs).

This study narrows the scope of BEVs and PHEVs. It does not cover non-rechargeable conventional hybrids, fuel cell electric vehicles1 (FCEVs)—which use hydrogen—or REEVs, due to their low rate of market penetration in recent years.

It is also important to distinguish between different usage segments. The first of these—and the most important in terms of number of units currently on the road and anticipated growth—is passenger light-duty vehicles (PLDVs) and light commercial vehicles (LCVs). Two- and three-wheeled vehicles, such as electric bicycles, are also important. The final segment comprises buses and trucks.

By 2017, the world’s total stock of EVs numbered three million units, with China accounting for 40% of the total. Global sales in 2017 exceeded one million units. In addition, 100,000 buses and 30 million two-wheeled electric vehicles were sold that year; again the majority in both cases were sold in China [9].

2 An Introduction to EV Components

One way of viewing the future impact of EV penetration on materials is to compare an electric vehicle with one with an internal combustion engine. This is the approach taken by UBS in its 2018 study (UBS 2018), which compares a Chevrolet Bolt to a VW Golf.

The total weight of the raw materials in the two vehicles comes to around 1600 kg in the case of the Bolt and 1300 kg in the case of the Golf. The Bolt is 22% heavier than the Golf, primarily because of the battery weight. The Bolt contains 70% more aluminium; 80% more copper; 75% less steel; 60% less iron and 100% less platinum-group metals (PGMs).

At the same time, the Chevrolet Bolt has 140 kg of ‘active’ materials in its batteries (nickel, cobalt, lithium, manganese and graphite) and one kilogram of rare earth elements in the electric motor, particularly neodymium and dysprosium.

In the Chevy Bolt, according to the same source, steel accounts for around 39% of the total weight, iron 2%, aluminium 9%, copper 5%, rubber 1%, graphite 3%, manganese 2%, cobalt 1%, nickel 2%, lithium 0.6%, while rare earth elements and other components make up a considerable 31%.

The UBS report uses these figures to project a world where 100% of vehicles are electric. In such a scenario, there would be an increase in global demand of 2,511% for lithium, 1.2% for cobalt, 26% for graphite, 11% for nickel, 100% for rare earth elements, 21% for copper, 135% for manganese and 12% for aluminium. Demand for steel would fall by 1% and for PGMs by 53%. In economic terms, the value of the semiconductors in the Bolt is estimated at about USD 580, 6–10 times as much as the Golf.

This approach, which seeks to assess the impact of transport electrification on the demand for mineral raw materials, is founded on the basic assumption that demand for raw materials is driven by battery materials.

Any analysis of the demand for raw materials needs to take into account not only increased battery production, but also demand related to power generation and storage, power grids, charging infrastructures and, naturally, demand from the EVs themselves [8].

2.1 Batteries

There is broad consensus today that in the medium-term future at least, ion-lithium batteries will continue to form the bedrock of EV battery development.

This prediction is partly based on the development of ion-lithium batteries in consumer electronics, which has led to the accumulation of extensive experience and an important reduction in unit costs.

EV batteries contain a number of chemicals which are significant because of their influence on the demand for materials. For example, the cathode or positive electrode contains lithium-nickel-manganese-cobalt (NMC); lithium-nickel-cobalt-aluminium oxide (NCA); lithium-manganese oxide (LMO) and lithium ferrophosphate (LFP). In most current designs, the anode is made of graphite, but lithium-titanate (LTO) is also used, especially for heavy vehicles Warner [16] in IEA [9].

The IEA [9] has previously highlighted the importance of developments in transport electrification on demand for materials. The agency points to three major changes, namely: an increase in the use of copper, the rare earth elements contained in electric motors and scarce metals.

It is important to examine the intensity of what the European Union defines as strategic—or in some cases critical—materials (critical raw materials, or CRMs are defined as combining raw materials of high importance to the EU economy and of high risk associated with their supply). These are lithium (Li), nickel (Ni), cobalt (Co) and manganese (Mn).

The IEA identifies the intensity of different battery chemicals in kg/kWh (see Table 1).

2.2 Demand for Electric Vehicles and Batteries

2.2.1 Demand for Batteries and Related Materials

There will be two essential consequences of the large-scale roll-out of EVs: an increased demand for electricity and an increased demand for batteries. In the case of power demand, consumption hypotheses range between 18 and 27 kWh/100 km. The IEA [9] estimates 20–27 and 18 kWh/100 km [1].

We also need to consider the figure for yearly mileage figure, where the estimates of the two sources cited in Table 2 range from 8,500 to 20,000 km per year.

Using forecast vehicle figures for 2030, with the highest and lowest estimated consumption per kilometre and annual mileage, gives us a very wide range of estimates for global electricity demand in 2030, ranging from 168 to 594 TWh for 110 million vehicles, to 348–1,231 TWh for 228 million vehicles in the EVI30@30s ‘ambition’ target. (The EV30@30 campaign, launched in 2017, sets a target for members of the Electric Vehicles Initiative (EVI) of reaching a 30% sales share for EVs by 2030).

We also need to consider power consumption by two- and three-wheeled vehicles, as well as trucks and buses. The IEA [9] gives a figure of 404 TWh and 928 TWh for 2030 in the NPS and EVI scenarios cited above.

Any increase in the number of EVs and electricity demand will be linked to an increase in battery capacity and production.

By 2030, the battery range of EVs is expected to increase, translating into an increase in battery capacity of around 70–80 kWh (as compared to the current figure of 20 kWh in China and 60 kWh in the United States according to the IEA [9]; this would mean a rise in annual battery capacity from 68 GWh in 2017 to 775–2250 GWh in 2030 depending on the scenario.

Other sources cite figures of 450 TWh of power demand in 2030, with 8,000 GWh of batteries in operation in light vehicles worldwide [11]. Based on EV fleet and sales figures, this would entail a production capacity of roughly 2,000 GWh in that year.

In order not to exhaust readers with any further digressions, we shall base our estimate for demand for battery materials in the two scenarios on assumed figures of 775 GWh and 2000 GWh.

Using these figures, Table 2 shows estimated demand for lithium, nickel, cobalt, and manganese in thousand tonnes for 2030, depending on the type of battery.

The IEA [9] gives a central 2030 estimate of relative content of battery chemicals of 50% NMC 811, 40% NMC 622 and 10% NCA. Based on this estimate, in the New Policy Scenario (NPS), demand would come to 101,000 tonnes for cobalt and 91,000 tonnes for lithium; naturally, these figures are far higher in the EV30@30 scenario, with figures of around 291,000 and 263,000 tonnes, respectively.

Taking sales of 10 million and 30 million EV units in 2025 and 2030 respectively, demand for nickel would come to 299,000 and 985,000 tonnes and for cobalt 80,000 and 259,000 tonnes respectively [8]. Glencore also estimates increases in copper demand in the two timeframes of 1 and 2 million tonnes, respectively.

Using the figures in the Table 2, we can position these estimates in relation to vehicle demand and battery chemicals. For example, changes in the chemical make-up of the cathode will have a greater effect on demand for Co and Li, primarily.

2.3 Supply of Metals Used in EV Power Accumulators

2.3.1 The Materials that Make Up the Electric Vehicle

On the supply side, this section addresses the problem of the availability of the raw materials used in the fundamental parts of EVs.

We divide these materials into two groups: those that make up the structure of the vehicle, and those that are part of the electrical accumulation systems and electric motors. The former involve demand-flexible production chains, while in the case of the latter, major efforts will be required to adapt the industries involved in their production. They will also need continuous transformation, in order to respond adequately to greater-than-trend demand.

The second group includes some minerals and metals that are relatively scarce (cobalt and rare earths) and others that are less so (graphite, lithium, nickel and manganese), but for which a rise in demand is anticipated (although the exact size of this increase is disputed). We shall further discuss the source and supply problems of the natural materials used in electric batteries.

This section address general features related to their emergence on the market, from their initial emergence to their decline or disappearance, as well as the specific characteristics of their supply chains.

2.3.2 Graphite

Part played by graphite in EVs. This is the most common component in many electric car batteries, particularly in lithium-ion batteries.

Conditions of natural reserves. Natural graphite is the product of metamorphic recrystallization of organic matter contained in rocks. When this process occurs in layers of coal, or in rocks that contain liquid hydrocarbons, deposits of graphite are generated. However, deposits of this ore can also be volcanic or hydrothermal in origin. Natural graphite is relatively abundant in nature and consists mostly (80–90%) of carbon, with inorganic impurities of different kinds. In the concentration process, these impurities are eliminated using selective flotation systems or chemical treatments. The properties and composition of the graphite are determined by its geological location. It is hardly surprising, therefore, that a priori graphite resources seem immense.

There are three different types of natural graphite produced in different types of mineral deposits:

-

a.

Flake graphite. This is the least common form of graphite. Its costs about 4 times more than amorphous graphite and is used in many traditional applications. In addition, it is highly sought-after for graphite applications such as the anode material of lithium-ion batteries.

-

b.

Amorphous graphite. This is the most abundant form of graphite. It has a comparatively low (70–80%) carbon content. It has no visible crystallinity and is the least pure of the three types. It is not of sufficient quality for use in most electrical accumulation applications.

-

c.

High crystalline graphite (crystalline vein). This form of graphite is extracted only in Sri Lanka. It has a carbon content of 90–99%. Its scarcity and high cost limit its viability for most applications.

Additionally, there is also synthetic graphite, manufactured using high-temperature treatment of amorphous carbon materials. The raw material used in the process is calcined petroleum coke and coal tar, making it very expensive to produce—up to 10 times the cost of natural graphite.

Concentration of production. In 2018, China was the world’s largest source, producing 630,000 tonnes of ore, according to the US Geological Survey, February 2019 (Table 3), which calculates the country’s share at 68% of total world extraction and 35% of consumption. Despite China’s absolute dominance of the graphite market, however, this position is not expected to continue indefinitely. Brazil is the world’s second-largest source, producing 95,000 tonnes of graphite. In third place comes India, at 35,000 tonnes. Today, there is a clear concentration of production (quantified in Table 3). Above all, the Chinese predominance should be a cause for concern.

Possible substitutes. New uses of technology in fuel cells, batteries and applications, such as high strength lightweight composites may substantially increase the global demand for graphite, as there are currently no substitutes.

New resources. Despite its great abundance in nature, graphite (particularly its higher-value qualities) is under-researched. The figure of 800 million tonnes inferred by the USGS [14] is considerably lower than other estimates of close to one billion tonnes. Large-scale flake varieties are in great demand for applications in quality products, including the manufacture of graphene. In the short term, prospecting for graphite in as-yet unstudied geological environments is expected to bear fruit. In addition, artificial graphite may always be considered as an alternative in high-end products, although its production cost currently appears prohibitive.

2.3.3 Lithium

Part played by lithium in EVs. The newly created lithium-ion batteries are formed by a lithium salt electrolyte and graphite electrodes and cobalt oxide. The use of new materials such as lithium has made it possible to achieve high specific energies, high efficiency, elimination of the memory effect and a lack of maintenance. In addition, they have twice the energy density of nickel-cadmium batteries and are around one-third smaller. However, they also have disadvantages, the main one being their high production cost, although this is gradually being reduced. They are fragile and can explode if overheated and must be stored very carefully.

Conditions of natural reserves. Lithium is a relatively rare element, although due to its abundance in the earth’s crust, it is listed as the 27th most common element. Despite being found in many rocks and some brines, its concentration is usually very low. High-concentration lithium brines come from both geothermal waters and surface leaching from volcanic ashes, clays or other rocks. The brines may be geothermal (long exploited), from oil fields (with enormous possibilities and relatively well-studied) and from heterolytic clays (a very abundant and promising source for the future). Approximately half of all lithium currently produced comes from conventional hard rock deposits, while the other half comes from the extraction of lithium dissolved in brines.

The US Geological Survey [15] estimates global reserves of lithium (mineral resources that can be economically exploited) from solid lithium minerals, brines and minerals in clays (heterolytic) at 55 million tonnes.

Concentration of production. The leading producers of lithium (see Table 4) are Australia, Chile, China, Argentina and Zimbabwe. Lithium in very large quantities has also been identified in the brines of Bolivia, China and Israel. It is estimated that China and Europe are the world’s largest consumers of lithium, accounting for 29% and 28% of the total, respectively. Until now, lithium production sources and demand have been relatively well-balanced. However, over the last year supply has exceeded demand, causing a—possibly transitory—surplus. Nevertheless, a deficit in the supply of lithium is coming, with new countries joining the demand.

In reality, there are no major differences in the production potentials of supplier countries. Moreover, in the near future, sources of lithium supply will be further diversified, with the inclusion of lithium from brines from oil wells, anomalous clays in lithium and others. In addition, there are only small differences in production costs between hard ore mined using conventional methods and lithium extracted by pumping from brines

New resources. As demand for lithium increases, new players are expected to join the supply side. Strategic investors are already taking positions in lithium source types not previously exploited, such as heterolytic clays and brines from oil fields, both of which would have a greater yield than pegmatites with spodumene and other lithium minerals.

2.3.4 Cobalt

Part played by cobalt in EVs. In a lithium-ion battery, the different cathode chemicals have an impact on the demand for the component raw materials. For example, by weight, LCO (lithium-cobalt oxide) batteries contain only 7% cobalt and 60% lithium, while an NMC (nickel-manganese-cobalt) battery has approximately 7% lithium, 20% nickel, 19% manganese and 22% cobalt in relation to total weight. An indicative figure (depending on battery type) shows that each battery contains approximately 15 kg of cobalt chemicals. Lately there has been a growing awareness that different cathode technologies in lithium-ion batteries may allow progress to be made towards reducing cobalt and replacing it with nickel.

Conditions of natural reserves. Both in its free and combined state, metal cobalt resembles iron and nickel. It is widely distributed in nature and makes up approximately 0.001% of the total igneous rocks in the earth’s crust, as compared to 0.02% for nickel. Cobalt and its alloys are resistant to wear and corrosion, even at very high temperatures. It is important to bear in mind that lithium-ion batteries actually contain no cobalt metal. Rather, they contain cobalt chemicals, with cobalt sulphate being one of the raw materials preferred by cathode manufacturers.

In nature, cobalt is part of a series of mineral deposits, whose main features are as follows:

-

There are no clear concentrations. Moreover, although taken as a whole there are extensive deposits, no more than five types are of economic interest.

-

Sediment Hosted (SH) copper deposits specifically included in strata or sedimentary episodes, are the model of greatest generic interest, accounting for over half of the world’s production.

-

It is therefore unsurprising that cobalt production is geographically concentrated, with a concentration in the African interior. In other cases, production is associated with other metals and depends on whether they are economical to mine.

-

Marine nodules, although not constituting a resource for immediate use, will play an important role in the future.

Concentration of production. Cobalt deposits are found worldwide but are most prevalent in the African copper belt (the Democratic Republic of the Congo and Zambia), with more than 64% of the world’s cobalt production concentrated in a single country (Table 5).

In 2016, approximately 60% of the cobalt extracted was a by-product of copper, 38% a by-product of nickel and the remaining 2% came from primary cobalt mines. Thus, changes in the global production of copper and nickel are the main determinants of changes in cobalt production.

New resources. Cobalt from abyssal marine nodules can only be considered as an alternative to traditional deposits. Cobalt reserves are estimated at 7.2 million tonnes with total resources of 25 million tonnes. However, about 120 million tonnes of cobalt are in the form of manganese nodules in abyssal bottoms in the Atlantic, Indian and Pacific oceans. Nonetheless, any real exploitation of these resources still faces legal and environmental barriers, as well as technological difficulties.

2.3.5 Nickel

Part played by nickel in EVs. The original lithium-ion batteries introduced by Sony in 1991 used a lithium-cobalt or LCO cathode powder, which was approximately 60% cobalt by weight. Although LCO has remained the chemical of choice for personal electronic products for almost 30 years, it has never been seen as an enabling chemical for electric vehicles, since it is scarce and expensive and LCO cells have a spectacular safety record.

In 1999, two nickel-rich cathode chemical compounds were introduced. The first of these is nickel-cobalt-manganese, or NCM/NMC, which uses equal proportions of nickel, cobalt and manganese to reduce the cobalt content from 60 to 20%. In addition, nickel-cobalt-aluminium (NCA) chemistry mainly uses nickel with small amounts of cobalt and aluminium to reduce the cobalt content from 60 to 9%. Since 1999, battery manufacturers have continued their efforts to reduce cobalt content, but the pace of progress has been very modest.

Conditions of the natural stock. Nickel is a metallic element of natural origin, lustrous and silvery white. It is the fifth most common element on earth and appears extensively in the earth’s crust. However, most of the nickel is found in the centre of the earth and is therefore inaccessible. The key features of nickel metal are high melting point, resists corrosion and oxidation, very ductile, easily alloyed, magnetic at room temperature, can be deposited by electroplating and has catalytic properties.

Due to these characteristics, nickel is extensively used in over 300,000 products for consumer, industrial, military, transportation, aerospace, marine and architectural applications. Its greatest use (about 65%) is in alloys, especially with chromium and other metals to produce stainless and heat-resistant steels. In many of these applications, there is no substitute for nickel that does not reduce performance or increase costs.

Nickel mineral resources consist of primary sulphide minerals (45%) with an average Ni content of 0.58%, and laterite ores (55%) with an average Ni content of 1.32%. Only 42% of world production comes from laterite type minerals, while the remaining 58% comes from sulphide minerals. It is estimated that 72% of the world’s mineral resources are included in lateritic minerals, while 28% of all global mineral resources are in sulphide minerals.

Concentration of production. The five main nickel producing countries in 2018, according to the latest figures from the US Geological Survey (Table 6) are: Indonesia, the Philippines, Russia, New Caledonia and Australia.

According to the Herfindahl–Hirschman Index, there is no concentration in production, although some countries—such as Indonesia, Philippines, Russia and New Caledonia—have retained a prominent position for many years.

New resources. Over the past two decades, lithium-ion battery manufacturers have eagerly sought advanced cathode formulations that would partially replace expensive cobalt through the use of much cheaper nickel. In general, increasing the nickel content in a cathode formulation improves the energy density of the battery, but reduces stability, meaning that there is a trade-off between cost and safety.

Nickel has been widely explored throughout the world for many years, due to the value of its concentrates. As a result, good information is available on its production potential and economic outlook. Identified land-based resources averaging 1% nickel or greater contain at least 130 million tonnes of nickel, with about 60% in laterites and 40% in sulphide deposits [14]. Nickel, together with cobalt and copper, forms part of the composition of marine nodules, which in the future could be an alternative to current resources.

2.3.6 Manganese

Part played by manganese in EVs. Manganese is an essential element for modern industry. Its main use is in the manufacture of steel. Although the amount of manganese consumed to make a tonne of steel is small (0.6–0.9%) it is an irreplaceable component in its production.

Conditions of the natural stock. Manganese is the twelfth most abundant in the earth’s crust, accounting—although estimates vary—for about 0.15%. The highest quality manganese minerals contain 40–45% manganese. The predominant processes in the formation of the world’s main deposits take place in marine environments.

Concentration of production. There should in principle be no global shortage of manganese mineral resources, albeit a number of strictly economic factors limit production. For example, widespread use in steel for construction has led to intense demand (around 18 million tonnes) (Table 7) and it is in this large-scale production that the metal might become scarce. Production concentration is a consequence of the need to achieve large-output mining projects.

According to the US Geological Survey [5], the Kalahari manganese district in South Africa contains 70% of the world’s identified resources and about 25% of its reserves.

2.4 Considerations on Production Concentration: The Herfindahl–Hirschman Index (I)

The Herfindahl–Hirschman Index (I) is used in economics to measure market economic concentration. A high I score denotes a highly concentrated and uncompetitive market. The index is calculated by squaring the market share owned by each country and totalling these amounts. Thus, a perfect monopoly, in the case of producing countries, would give an I score of 10,000.

To homogenize the results as much as possible, the same source of information has been used to calculate all five substances, viz. the statistics provided by the USGS for 2017 (Table 8).

Table 9 shows the Herfindahl–Hirschman Index for different minerals. Rare earths occupy a prominent first place, although there has been an important decline in the score compared to previous years, when it constituted an almost perfect monopoly. An important concentration can also be seen in the production of graphite, reflecting the strong Chinese presence on the market. However, in this case, the situation is not as dramatic as with rare earths, since all analysts recognize that there are opportunities in other countries. It is also striking to note the similar position in the scores for lithium and cobalt, which are both undergoing a dramatic process of adjustment to future demand, which will leave cobalt in a more isolated position, since the geographical distribution of new production opportunities will not result in any change in its score. Manganese and nickel are in the last position, as explained by the maturity of their production—the result of extensive demand from the metallurgical industry.

2.5 The Formation of Supply Chains and the Problems of Secure Supply

2.5.1 Concepts

The structure of the material supply chain needed by an industrial sector is often quite complex and very specific to that industry. If we consider the initial part of an industrial product’s life cycle, it starts with the supplier’s relationship with the natural environment in which the raw materials are obtained—in this case, the minerals. The problems begin when a mineral good is produced in excessive volumes and with temporary demand. Knowledge of the natural stock of raw materials is always complex and full of uncertainties and it is therefore crucial to begin new supplies to cater to sudden variations in demand.

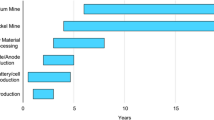

It is well understood that metal concentrations need time to be discovered in nature and put into production. Project maturity periods of over 12 years are not unusual and a figure of around 8 years is very common. Depletions in mineral concentrations should result in their efficient substitution and, when this occurs, technology must come to their aid. To facilitate an understanding of these phenomena, a very simple diagram of the value chain (production cycle) is shown in Fig. 1.

The ‘value chain’ of the mineral raw material production process begins in Stage 1 of the life cycle of each metal. This phase involves exploration for new resources using selectivity criteria based on the desired qualities. Selection of these resources is related to market demand or, in any case, economies of production. Stage 2 involves mining the mineral raw material. The dimensions and grades are related, both by the qualities and quantities of the deposit and by the demand. Selectivity in exploitation is determined by grade limits, which are based on demand and production costs.

In Stage 3, the extracted ore is concentrated and prepared at the place of mining; this process often requires a greater technological effort and operating costs. In this operation, the grains of ore must be released for concentrating, in order to produce products of the highest possible grade. They are then transported from the exploitation site to the metallurgy or refining process.

In Stage 4, a complex industrial process is required to extract the metal from the containing mineral. This operation is carried out in different locations away from the mine and consumes large amounts of energy. In some cases, it may be considered to form part of Stage 3, since an impure metal can be produced in the hydrometallurgical process associated with this stage.

Finally, Stage 5 includes a number of secondary processing operations which, in the case of metals, turn the raw material into ingots or plates. In some cases, these products are used in further industrial processing, as part of the final chain in making more complex components. In other cases, as with lithium or graphite, these operations do not produce metals but entail a chemical transformation to create the final component.

2.5.2 Application to the Components of Electric Batteries

Table 10 shows the metals and minerals used in electric vehicles whose value (supply) chains face uncertainty due to a foreseeable extraordinary demand. Two levels of criticality are identified in the table in light and dark grey. The table also shows the most frequent metal concentrations at each stage of the life and supply cycle.

2.5.3 Explanation and Comments

2.5.3.1 Graphite

In the case of graphite, the supply chain is not directed towards the production of a pure component, but rather its physical preparation for incorporation into the manufacturing stages of the battery components. For this reason, the quality of the deposit (Stage 1) is fundamental, since higher mineral qualities allow for more demanding final products, as is the case with new batteries. Graphite is very abundant in nature, with some agencies estimating up to 900 million tonnes of recognized resources; however, the best quality deposits are very scarce.

2.5.3.2 Lithium

Like graphite, lithium is not used in elemental or isolated form, but chemically in the final stages of the supply chain. Lithium can come from host solid minerals (spodumene, petalite and others), in relatively low concentrations (generally no more than 4% Li2O) in Stage 1 or 2, while in the concentration process (Stage 3) it can reach about 10% Li2O. Stage 4 involves chemical processing, to obtain the lithium carbonate product that is marketed for the first phases of incorporation into lithium-ion batteries.

For some years, underground or surface brines (the Andean salt flats) have offered an alternative source to solid minerals, and today, the global lithium supply is distributed fairly equally between the two sources. The operating advantage of this method is that the lithium is dissolved and Stage 1 or 2 of the value-supply chain almost overlaps with Stage 3 (concentration). The rest of the cycle is largely similar.

Lithium metal is very abundant in nature and Stage 1 of the supply chain is constantly being enriched with the discovery of new potential occurrences (new sources of supply) and any scarcity of the mineral is therefore highly unlikely. Nonetheless, from an economic perspective, when working with very low metal concentrations, not all sources and qualities are admissible for Stage 3. These conditions may vary according to price, but battery economics may also suffer due to the current high prices of this metal. Stage 5 also requires proper analysis, because around 60% of manufacture of the final product is concentrated in China.

2.5.3.3 Cobalt

One of the most notable characteristics of cobalt production is the concentration of producers in Stage 1. In addition, production is shared with copper and nickel. Stage 3 (the concentration process) is very similar to that of other metals and does not entail any specific problems, except for the difficulties of expanding the size of existing facilities to adapt production to demand. There are no large cobalt deposits in the world (Stage 1) and the alternative exploitation of marine nodules is still at an experimental phase. China also has a strong role in Stage 4 of the cobalt supply chain.

2.5.3.4 Nickel

The nickel used in Stage 1 comes from two very clearly defined sources. Approximately half of all production comes from sulphide deposits with a relatively high concentration of nickel. The remainder is found in oxidized form, with very low metal grades. In the future, however, oxidized nickel deposits will be the chief sources of supply, as it is here that there is greatest potential for an increase in production. Stage 3 is quite dissimilar in the two cases with a difference in electrical consumption per unit of metal produced. In the metallurgical stage (Stage 4), there is an even greater difference, and work is ongoing to reduce the electrical consumption of oxidized and lateritic minerals.

2.5.3.5 Manganese

Manganese is a relatively abundant metal in nature and forms mineral deposits of all categories (Stage 1). Its extraction and processing do not involve different processes to other minerals, apart from some cases in which hydrometallurgical or chemical processes are used (Stages 3 and 4). The final product of the mining and beginning of the metallurgical process (Stage 5), for supply to the accumulator industry, may entail rigidities due to a strong demand for chemical products, a phenomenon which is reflected in current prices.

2.5.4 Consequences for Secure Supply of Mineral Raw Materials for Electric Vehicle Batteries

Based on current supply conditions and medium-term forecasts for EV mineral components (or their constituent metals) and the circumstances that may affect secure supply of the electric battery industry, the following considerations should be taken into account for each of the components:

2.5.4.1 Graphite

-

Existence of an adequate value-supply chain.

In today’s world, graphite is considered a key strategic material in the economics of green technology, which includes advances in energy storage, electric vehicles, photovoltaic energy and electronics. Graphite is also the source of graphene. As the green tech economy grows over the next decade, demand for graphite is expected to outstrip supply. It is thought that, in the EV market alone, the estimated demand for 2020 would require more than today’s total production. With the demand for large-scale graphite production growing, it is estimated that 25 new graphite projects will be needed to meet the world’s needs in 2021.

Emerging markets such as India and China, where the pace of industrialization has far exceeded world averages, have led to a slowdown in the supply of graphite for domestic consumption. China still controls more than 65% of global graphite production, although recently there has been a fall in output, and some older and smaller mines have been closed due to environmental violations. China is also consuming more graphite itself, withdrawing a small amount from international market in order to export the finished products.

At the same time, it is believed that the world’s recognized graphite resources may be in excess of 900 million tonnes. In other words, the gap between supply and demand cannot be blamed on the research effort, but rather on a lack of adaptation for many causes, with China at the centre of the controversy. In the short term, however, adapting the supply chain to the avalanche of demand for quality products motivated by new energy technologies should not be an insurmountable problem, especially in view of the possibility of manufacturing artificial graphite.

-

Political factors.

Asia-Pacific countries, driven mainly by China and India, constitute the fastest-growing market for graphite. Factors such as low labour costs and natural graphite resources are leading to sustainable market growth (especially in China), even in low demand conditions. With a solid position on the graphite market, China is expected to see sustained growth, backed by its overseas investments; however, it also recently began to protect its internal needs and to control its exports.

2.5.4.2 Lithium

-

Existence of an adequate value-supply chain.

According to Goldman Sachs, global demand for lithium increased by 39% in 2018. Given that the metal is used not only in batteries for electric vehicles and mobile devices, but also for the manufacture of lubricating greases and other uses, one must ask whether there will be enough lithium to go around in the coming decades. With 40 million tonnes of currently recognized resources, the availability of this element is not currently a factor that limits large-scale production of electric cars. What might slow the rate of battery manufacture, however, are bottlenecks in the lithium distribution chain.

There are also some question marks over the potential for rapid adaptation of world lithium production to strong demand. There is concern that supply is slowing down due to the complexity of building evaporation ponds in Andean regions of South America which, as well as matters of cost, also pose problems related to water supply and other environmental issues.

Demand rose in 2018 by over 27% and is expected to grow at over 20% in 2019. According to Ricardo Ramos (CEO SQM) beyond 2019, the prospect for growth in demand continues to look extremely healthy, leading us to believe that the landmark of a 1 million ton per year lithium market may be reached sooner than originally anticipated [10].

Many analysts believe that there is enough lithium metal in the Earth’s crust to support the manufacture of electric vehicles in the required volumes, based solely on the needs of lithium batteries. Although assessments are far from being precise, it is thought that there are very abundant available resources of lithium.

Twenty-six battery plants are expected to begin production or expand capacity by 2022. In 2014, there were only three battery mega factories in process. These plants have a combined planned capacity of 344 GWh. To put this in perspective, total demand for lithium-ion batteries in 2017 is estimated at 100 GWh, but the industry needs to expand. Indeed, it is estimated that demand for batteries could rise to between 775 GWh and 2000 GWh by 2030 (see estimates in Table 2). This would involve lithium demand levels of between 77,500 and 300,000 tonnes.

Adapting the lithium supply chain to foreseeable demand is likely to involve market dislocation, based on EV production figures from 2050 on (although in this report we base our analysis and assumptions on predictions for 2030), due to the immense production effort required to meet demand. This might appear catastrophic, but the real scenario will not be quite as dramatic. We can readily envisage the first stage of adaptation with an increase in production to 2030, motivated by current high prices and interest by investors in new projects. Subsequent adjustments in price will come as a result of reduction in battery consumption and increased efficiency, as has always been the case.

-

Political factors.

China is the world’s largest consumer of lithium, due to its rapid economic development, large population and growing demand for electric vehicles—driven by the search for solutions to air pollution problems, particularly in certain cities. China’s lithium resource depends heavily on imports, with 70% of the spodumene concentrate imported only from Australia. Projected growth in electric vehicle sales will ensure that the country remains dependent on lithium imports and even in China, some commentators are already predicting problems with security of supply.

2019 is a good example of volatility in the lithium market [10]. Despite a double-digit growth in demand, prices continued their downtrend. As a result, lithium miners around the world reacted to the challenging market conditions by scaling back production and cutting costs. China is a key driver because they are the main consumers of lithium raw materials. The change in the electric vehicle subsidy regime in China, combined with a relative weakness in the China economy, has impacted lithium raw material demand, in turn impacting pricing in unexpected ways.

Lithium prices fell consistently throughout 2019, resulting in lithium off-takers and strategic groups being more cautious with their approach. This was further exacerbated by a number of unexpected negative macro factors, including the magnitude of US–China trade tensions and China revoking EV subsidies.

2.5.4.3 Cobalt

-

The existence of an adequate value and supply chain.

In 2020, consumption in batteries is predicted to account for 59% of all cobalt demand, reflecting a 58% increase in demand for batteries compared to 2016 levels [7], which is expected to result from increased demand for electric vehicles.

The rechargeable battery segment has become the largest- and fastest-growing end use of cobalt. Around 97% of global cobalt production is a secondary by-product of copper and nickel extraction, leaving cobalt supplies exposed to fluctuations in the copper and nickel market. If the demand for copper drops, cobalt production could fall with it. The suspension of Glencore’s production in its copper and cobalt mines Katanga and Mopani in the Democratic Republic of the Congo (DRC) and Zambia in 2015 is a good example.

So, although a large proportion of the existing cobalt supply remains uncertain and it is difficult to obtain new capacity due to the shortage of primary cobalt resources, the risk to the lithium-ion battery supply chain remains, and prices are likely to continue rising.

-

Political factors.

China controls most of the world’s refined cobalt and depends on the Democratic Republic of the Congo for more than 90% of its cobalt supply. In the words of specialist Rawles [13] ‘The important thing is to realize that China produced 80% of the world’s cobalt chemicals and that much of its raw material comes from concentrates from the Democratic Republic of the Congo’. Any change in the producing country can have a real impact on the prices of cobalt chemicals.

2.5.4.4 Nickel

-

Existence of an adequate supply chain.

Nickel differs from the other raw materials discussed in having a well-consolidated value/supply chain. Nickel is present in stainless steels that make up an important part of the flow of industrial material, especially in products and applications of quality steels. It is important to consider that total world production of nickel metal comes to 2.3 million tonnes (USGS 2018) and the foreseeable quantities required in EVs have not yet been incorporated. In addition, as already mentioned, the excessive increase in cobalt prices has already aroused interest in replacing it with another very similar metal—for example, nickel. Even in nature, the two metals are found together in some types of mineral deposits.

Nonetheless, the roll-out of electric cars could lead to demand for this metal rising by 2030 to anywhere between 310,000 and over 1.5 million tonnes—very significant figures compared to current production levels.

-

Political factors.

Judging by the values shown in the HHI index in Table 9, nickel is free from the dangers of cartelization, as production is quite diversified. In addition, somewhat unusually among the minerals discussed here, the Chinese presence is not a cause for concern, given its low production levels.

2.5.4.5 Manganese

-

Existence of an adequate supply chain.

In the early stages of the cycle, the mining industry does not differentiate by final destination of the product (steel industry and manufacture of chemical products). However, both its concentrates and, in certain cases, the precipitates from leaching in the manganese plant, are specifically oriented towards the final chemicals. Products derived from them may be used as elements in electric accumulators.

For all these reasons, and also at a global level, supply chains may be able to cope with major increases in demand, especially when price differences arising from that situation are not important.

-

Political factors.

Manganese is a critical metal for the steel industry of some important countries, such as the United States. The fact is that, although more moderate than other strategic metals, manganese production is relatively concentrated. However, we are dealing here with the supply of manganese as chemicals for the manufacture of electric batteries, not the construction steel industry, and for this industry, although the Chinese presence is very important, it seems unlikely that pressure can be exerted on the supply of this metal.

3 Conclusions

An adequate and secure supply of mineral raw materials is crucial for the current and future EV industry, if it is to successfully complete the progressive and intense roll-out of electric vehicles. Based on our understanding of the problems that are expected to arise in the coming years, the viability of efficient and safe supply chains will be of key importance in addressing growth in demand for mineral raw materials to meet the foreseeable global increase in electric vehicles.

Meeting the need for energy storage has been a much sought-after goal for many decades. However, it is now—with the backing of more resolute social opinion and an automotive industry that is beginning to accept the new challenge—that technology must be used comprehensively to achieve that goal competitively, in a way that meets the needs of consumers.

In the problem analysed here of catering to increases in demand for raw materials and metals for EV batteries, three key points need to be highlighted:

-

1.

Uncertainty over demand, with two fundamental aspects not fully defined. The first area of uncertainty is the quantification of demand, with lower and higher values varying greatly from one forecast to another. The second aspect involves the slope or gradient of growth, reflecting the key importance of the speed of change. This could also lead to a lack of synchrony between technical restrictions and their solution, as well as a sharp variation in prices caused by the threat of a presumed shortage.

As regards technical restrictions, of the five phases of the supply chain, the critical phases identified for each material are: graphite, Phase 1 (exploration); lithium, Phase 3 (preparation and concentration); cobalt, practically all phases; nickel, Phase 4 (metallurgy of concentrates); manganese, preparation of concentrates and metallurgy; and neodymium, the first and last phases.

As far as prices are concerned, minerals such as lithium—where there is uncertainty about the possible appearance of short-term bottlenecks in coming years—may be more clearly affected. The price of cobalt, too, has almost quadrupled in three years due to the threat of a market shortage. Thus, prices will be the economic signals for the development of new productions, with physical and logistical capacity requiring periods of adjustment during which prices will be high.

However, in the case of raw materials that are clearly abundant in nature, the supply chain can be relied upon to adapt gradually in the medium term. In the case of resources such as cobalt, for which there is no medium-term guarantee of supply, past experience suggests that the most likely solution will lie with technological advances in the search for substitutes.

The search for substitute goods—such as a higher proportion of nickel to reduce the cobalt content in batteries—will also affect value-supply chains. Therefore, while uncertainties with regard to demand estimates will more clearly affect lithium and cobalt, it is important to note that prices will also play a role as a variable.

-

2.

Time horizons of forecasts. While demand will clearly see very considerable growth to 2030, estimates of the scale of that increase vary greatly and it is practically impossible to make any reasonably reliable estimates for longer-term horizons. This is an extremely important consideration, given the rate of response and transformation of the mining industry. Discovering new mineral resources and developing mining projects inevitably takes time and the accuracy of the models depends precisely on this response time. For some metals, especially cobalt, there is no reasonable response to an acceleration in demand of the order predicted after the 2020s.

-

3.

The danger of geopolitical exploitation of weaknesses in the supply chain. China holds a dominant position at different points in the supply chain of almost all scarce mineral raw materials required for the electric vehicles of the future, a factor which must at least be a cause for concern. It is very striking how the Asian giant has managed to take a preferential position, both in the production of raw materials and in the primary processing of low production and almost always strategic minerals. This is the case for all raw materials currently classed as strategic and sometimes critical (CRM). It should not be forgotten that China is the country with the highest future demand for electric vehicles. Moreover, the concentration of production in very few hands (the highest Herfindahl–Hirschman scores are for rare earths, graphite, lithium and cobalt) and areas of political or social instability (cobalt) is another factor of insecurity often recognized by the markets themselves.

Note

-

1.

In 2017, there were 7,200 units of this type of vehicle on the road. Of these, slightly more than half were in the United States, 2,300 in Japan and 1,200 in Europe, mainly Germany. For more information on the basic techniques and use of hydrogen in transport, see Alvarez Pelegry and Menendez Sanchez [1].

References

Alvarez Pelegry E, Menendez Sanchez J (2017) Energias alternativas para el transporte de pasajeros. El caso de la CAPV: análisis y recomendaciones para un transporte limpio y sostenible. Cuadernos Orkestra

Andrew M (2015) Flake graphite market trends and pricing patterns. Industrial Minerals INATA indmin.com/graphiteanalysis

Barrera P (2019) Lithium forecast 2020: execs expect recovery, bet on long-term fundamentals. Investing news. https://investingnews.com/daily/resource-investing/battery-metals-investing/lithium-investing/lithium-forecast/?mqsc=E4106167

Bloomberg (2018) New energy outlook 2018. https://about.bnef.com/new-energy-outlook

Cannon WF, Kimball BE, Corathers LA (2017) Manganese. Professional Paper 1802-L. U.S. Geological survey. https://pubs.usgs.gov/pp/1802l.pdf

CRU (2018) CRU International Limited. Cobalt analysis. https://crugroup.com/analysis/technology-metals

Darton Commodities Limited (2018) dartoncommodities.co.uk

Glencore (2018) The EV revolution and its impacts on raw materials. https://www.iea.org/media/Workshops/2018/Session3Glencore.pdf

IEA (2018) Global EV outlook 2018: towards cross-modal electrification. www.iea.org

Investing News (2019) The battery metals market in 2019. https://investingnews.com/free-report-online/battery-metals-market-stocks/

IRENA (2018) Electric vehicles technology brief. www.irena.org

Kay A (2018) 10 top manganese-producing countries. Investing Nes Netor. https://investingnews.com/daily/resource-investing/critical.metals-investing/manganese-investing

Rawles C (2018) Cobalt critical to lithium-ion battery chemical mix. Investing News Network

USGS (2018) Mineral commodity summaries. Graphite (Natural). https://minerals.usgs.gov/minerals/pubs/commodity/graphite

U.S. Geological Survey (2019) Mineral commodity summaries. https://prd-wret.s3-us-west-2.amazonaws.com/assets/palladium/production/s3fs-public/atoms/files/mcs-2019-graph.pdf

Warner J (2015) The handbook of lithium-ion battery pack design. Amsterdam, Oxford Woltham. Elsevier Science

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this chapter

Cite this chapter

de la Torre Palacios, L., Pelegry, E.Á., Rodríguez, J.A.E. (2021). The Interest of Mineral Raw Materials in the Development of Electric Vehicles. In: Arcos-Vargas, A. (eds) The Role of the Electric Vehicle in the Energy Transition. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-030-50633-9_8

Download citation

DOI: https://doi.org/10.1007/978-3-030-50633-9_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-50632-2

Online ISBN: 978-3-030-50633-9

eBook Packages: EnergyEnergy (R0)