Abstract

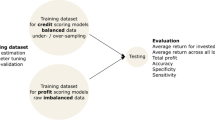

Predicting loan default in peer-to-peer (P2P) lending has been a widely researched topic in recent years. While one can identify a large number of contributions predicting loan default on primary market of P2P platforms, there is a lack of research regarding the assessment of analytical methods on secondary market transactions. Reselling investments offers a valuable alternative to investors in P2P market to increase their profit and to diversify. In this article, we apply machine learning algorithms to build classification models that can predict the success of secondary market offers. Using data from a leading European P2P platform, we found that random forests offer the best classification performance. The empirical analysis revealed that in particular two variables have significant impact on success in the secondary market: (i) discount rate and (ii) the number of days the loan had been in debt when it was put on the secondary market.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Bachmann, A., Becker, A., Buerckner, D., Hilker, M., Kock, F., Lehmann, M., Tiburtius, P., Funk, B.: Online peer-to-peer lending-a literature review. J. Internet Bank. Commer. 16(2), 1 (2011)

Kumar, V., Natarajan, S., Keerthana, S., Chinmayi, KM., Lakshmi, N.: Credit risk analysis in peer-to-peer lending system. In: 2016 IEEE International Conference on Knowledge Engineering and Applications (ICKEA), pp. 193-196 (2016)

Caglayan, M., Pham, T., Talavera, O., Xiong, X.: Asset mispricing in loan secondary market. Technical Report Discussion Papers 19-07. Department of Economics, University of Birmingham (2019)

Byanjankar, A., Heikkilä, M., Mezei, J.: Predicting credit risk in peer-to-peer lending: a neural network approach. In: 2015 IEEE Symposium Series on Computational Intelligence, pp. 719-725 (2015)

Guo, W.: Credit scoring in peer-to-peer lending with macro variables and machine learning as feature selection methods. In: 2019 Americas Conference on Information Systems(2019)

Emekter, R., Tu, Y., Jirasakuldech, B., Lu, M.: Evaluating credit risk and loan performance in online Peer-to-Peer (P2P) lending. Appl. Econ. 47(1), 54–70 (2015)

Malekipirbazari, M., Aksakalli, V.: Risk assessment in social lending via random forests. Expert Syst. Appl. 42(10), 4621–4631 (2015)

Xia, Y., Liu, C., Liu, N.: Cost-sensitive boosted tree for loan evaluation in peer-to-peer lending. Electron. Commer. Res. Appl. 24, 30–49 (2017)

Jiang, C., Wang, Z., Wang, R., Ding, Y.: Loan default prediction by combining soft information extracted from descriptive text in online peer-to-peer lending. Ann. Oper. Res. 266(12), 511–529 (2018)

Yin, H.: P2P lending industry in China. Int. J. Ind. Bus. Manage. 1(4), 0001–0013 (2017)

Harvey, S.: Lending Club’s Note Trading Platform Facade: An Examination of Peer-to-Peer (P2P) Lending Secondary Market Inefficiency. University of Dayton Honors Thesis (2018)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Byanjankar, A., Mezei, J., Wang, X. (2020). Analyzing Peer-to-Peer Lending Secondary Market: What Determines the Successful Trade of a Loan Note?. In: Rocha, Á., Adeli, H., Reis, L., Costanzo, S., Orovic, I., Moreira, F. (eds) Trends and Innovations in Information Systems and Technologies. WorldCIST 2020. Advances in Intelligent Systems and Computing, vol 1160. Springer, Cham. https://doi.org/10.1007/978-3-030-45691-7_44

Download citation

DOI: https://doi.org/10.1007/978-3-030-45691-7_44

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-45690-0

Online ISBN: 978-3-030-45691-7

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)