Abstract

The “spokes model” takes the name from its graphical visualisation that resembles the spokes of a bike’s wheel. It describes a market as a collection of spokes, joining at a common centre, where consumers are located. Firms may be situated at the extreme of these spokes, at the interior of the market structure or even outside of the spokes structure. The model has been introduced relatively recently (Chen and Riordan, Econ J 117(522):897–921, 2007a) and it is a useful tool to model product differentiation. An important characteristic is that competition between firms is spatial, that is, the distance between consumers and firms is crucial for the outcomes, but non-localised, as a firm competes directly with all others and not only with the neighbours. This chapter (1) introduces a benchmark version of the spokes model, (2) clarifies important characteristics that distinguish it from other approaches existing in the literature, and (3) highlights its suitability for applications, by reviewing the flourishing literature that has been adopting this approach. Applications are presented by reviewing the role of non-localised competition on (1) pricing decisions, (2) location choices, and (3) variety provision.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Background

The spokes model is a model of spatial non-localised competition. The model was introduced almost at the same time by Chen and Riordan (2007a,b) and Caminal and Claici (2007). The model represents the market as a collection of spokes and it visually looks like the internal part of a bike’s wheel. Consumers are located all over the spokes that compose the market. They have a preference for the good supplied by a firm on their own spoke. Firms, however, may or may not be present on all spokes. The model is represented graphically in Fig. 6.1.

In the example in Fig. 6.1, the market is constituted of N = 5 spokes and n = 3 firms. The firms are identified by the black dots. All firms are located at the extreme of their spoke, a location which we can denote by y i = 0, with i = 1, …, N. All the spokes join in the common centre, x = 1∕2. Given that the firms are located at the extremes of their respective spokes, a consumer located in the centre of the spokes structure is completely indifferent between any of the products supplied on the market. The absence of black dots on spokes 3 and 5 implies that no firm is located there.

The model is spatial as the preference for the good can be measured by the distance between a consumer and a firm. Such a distance can be interpreted in a geographical sense, as, for example, the meters separating a consumer from a shop, or in terms of product characteristics, as, for example, how different is a product from a consumer ideal specification. In the latter interpretation, the spokes model is suited to capture horizontal differentiation between firms or brands: whereas all products satisfy the same need or have the same quality, consumers have heterogeneous preferences for each. In this sense, it is an addition to the economist’s toolkit, as a possible alternative to the Hotelling (1929) model, that represents the market as a linear city with sellers and consumer located over it, and the Salop (1979) model that extends the previous to a circle.

One distinguishing characteristic of the spokes model, also compared to the two recalled alternatives (Hotelling 1929; Salop 1979), is worth remarking. Each consumer has a favourite product in the one supplied by the firm or brand on its own spoke; however, there is no inner ranking between any of the other options available on the market. This is because the consumer would have to travel through the centre and then walk the exact same distance to reach any of the remaining firms, as they are all located at the extremes of their spoke. In this sense competition in the spokes model is non-localised, as it is not limited to a subset of neighbouring firms but it involves all the market actors.

The spokes model has been introduced relatively recently, but it has proved to be a valuable addition to an economist’s toolkit. In the rest of the chapter, I will provide motivating examples and contexts where the model can be productively employed (Sect. 6.2). Then, I will describe the original version of the model in some more details (Sect. 6.3). The remaining sections will be dedicated to showcase some interesting research questions that have been posed in the context of the model. These include pricing (Sect. 6.4), location choices (Sect. 6.5), and market entry (Sect. 6.6). Section 6.7 briefly reviews further economic applications of the model. Section 6.8 concludes.

2 Motivating Examples

It is a familiar experience to many, unfortunately, that while driving in a different city or region a red led starts flashing on the dashboard. Depending on the intensity of the problem, you may find yourself browsing the internet for car repair garages in the vicinity.

This unpleasant situation is one for which the spokes model may well capture the choice set of the car driver. In fact, the driver’s main need is to repair the car, and most likely all the available garages would be able to do a fair work. In terms of the model, the garages represent the firms on each spoke. For a number of reasons, though, one is likely to have a preference for a garage that specialises or that, at least, declares specialisation in the brand of one’s car. Hence, the driver is located on a specific spoke and has a more or less strong preference for the specialised repair.

Such a specialised garage, however, may not be locally available. In that case, a generic repair shop may exist, corresponding to a firm locating in the centre of the spokes structure. Otherwise, the car’s owner might be somewhat indifferent between all other available shops, specialising in the repair of different car brands.

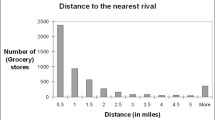

This example is what motivates the study of competition and product service variety in the Dutch car repair market in Lijesen and Reggiani (2020). They employ the address dataset by BOVAG, the Dutch industry association for car repair firms. The association covers 86% of the car repair market in terms of firms and a much higher percentage in terms of turnover. The dataset provides information about the brand that a firm specialises in, if any. About half of all car repair firms in the sample are specialised in repairing one brand of car. The other half of the car repair shops is either generic or specialised in specific repair types (e.g., tyres).

The market has, indeed, characteristics that are in line with the spokes model. In fact, whereas there are on average 12 shops per local market, at the national level, there are specialised repairs for 16 brands. In line with the idea of “empty spokes”, then, not all national brands are available in each local market. Moreover, the authors document how in most local markets, 60% of the total, both specialised and generic repair shops co-exist. However, 20% of the local markets feature only generic garages and 5% only specialised, whereas, in the remaining 15% mostly rural regions, no garage is available at all.

In this context, it is then worth asking what is the relation between the variety offered by the market, measured by the share of specialised garages, and the number of firms active locally. This is a question for which the spokes model is well suited, whereas other models in the traditional economist’s toolkit fall short.

As shown in Fig. 6.2, Lijesen and Reggiani (2020) find that the probability of a repair being specialised increases with the number of competitors in a local market. The result is obtained controlling for a number of shifters as the number of households, the average household income, and the dummies for the level of urbanisation. The relation tends to flatten as the number of firms increases, but that happens for a high number of local competitors, even higher than the number of national level brands. This probably indicates that garages try to avoid local level competition with firms specialising in the same car brand.

Predicted probability of a garage being specialised in a local market. Source: Lijesen and Reggiani (2020)

Whereas the car repair example is particularly fitting, the model is also well suited to analyse most secondary and ancillary goods, as for instance appliances’ parts, ink cartridges, phone covers, insurance policies, and so on. Moreover, the model can be employed to think productively of competition in situations with the following characteristics.

First, consumers may not have immediate neighbouring substitutes for the good in question. This can be the case of, say, sport shoes and equipment. A field hockey player, for example, needs very specific shoes. If those are not available, the player may need to settle for either generic trainers or indoor football boots; however, different players may differ in their ranking of the second best alternative. Similarly, whereas many when buying a soft drink may find Pepsi the obvious alternative to Coca-Cola, others may instead consider Fanta or Irn-Bru. A similar logic may apply for goods like whiskey, fashion brands, and so on. Second, national brands are not necessarily always present at the local level. Indeed, not all retailers or supermarkets stock all the available brands. Finally, some sellers may be more or less prominent than others and occupy a “central” position in the network of sellers. This point has been made by Firgo et al. (2015) to study the price implications of centrality on pricing by the 273 gas stations of Vienna. Their results confirm that firms characterised by a more central position in a spatial network are more powerful in terms of having a stronger impact on their competitors’ prices.

3 The Spokes Model

The spokes model, illustrated in the example of Fig. 6.1, can be described as follows. The market is constituted of N spokes. At most one of the n ≤ N firms can locate in each of the spokes. All spokes are identical: they have an origin (x = 0), a constant length normalised to 1∕2, and they all join at the centre of the market (x = 1∕2). Consistently with most of the literature, the technology structure can be described by the following cost function:

where the marginal cost c is constant and f is a fixed cost of entry. In the original version, which we follow closely, each firm charges a uniform price p i (Chen and Riordan 2007a).

Consumers are assumed to be uniformly distributed on the N spokes, and each has a unit demand for the good supplied in the market. The uniform assumption is often analytically convenient, but, in many cases, the model works well even under a more general atomless distribution f s(x), as long as there is symmetry between the spokes. The valuation of the good v is identical for all consumers. Each of them also suffers a unit mismatch cost, t, if the exactly preferred variety is not available or, in the geographical interpretation, a unit transport cost. The overall mismatch is a function of the distance, d(x i, y j), between a consumer located at x i on spoke i and a firm located at y j on spoke j.

A distinguishing feature of the model is that the distance between the consumer and the firm is spoke dependent: the distance between a consumer located at x = 0.4 and a firm in y = 0.2 depends on whether both are on the same spoke or on different ones. In the former case, the distance is 0.4 − 0.2 = 0.2, in the latter (0.5 − 0.4) + (0.5 − 0.2) = 0.4, as the consumer needs to travel through the centre to reach the firm on a different spoke.

As a result of the previous assumptions, the utility function of a customer located in x i considering to buy the product of the firm located at y j is

The utility function allows specifying the demand of each firm and closes the model. This last step is not straightforward, as it depends on the parameters of the model and an important assumption on consumer preferences. This is further discussed in Sect. 6.3.1. Given the stated framework, however, the game played by the n firms can be thought of being potentially constituted of at least the following three stages, which correspond to the broad categories of research questions to be addressed in the rest of this chapter:

-

1.

Entry decision: firm i decides whether to enter the market or not, i = 1, …, n ≤ N;

-

2.

Location decision: firm i chooses its location y i on spokes i;

-

3.

Pricing decision: firms simultaneously compete in prices and each chooses p i.

3.1 Demand Specification

As recalled above, the definition of demand is crucial for the analysis of the model. In most spatial models, the key step to specify the demand and payoff functions is the identification of the set of indifferent consumers. To this end, there are two possibilities.

First, following Chen and Riordan (2007a) and Caminal and Claici (2007), we can assume that each consumer has preferences only for a finite number brands/spokes, for simplicity say two. No matter whether a brand is available on the market or not, the consumer likes it. The implication is that a consumer located, for example, on spoke 1 in Fig. 6.1 surely likes the product of firm 1. As a second favourite brand, he may like the product of firms 2 or 4, whose products are also available, or any of the other brands that are not supplied in the market, like 3 and 5. Hence, there are three types of consumers: (1) consumers with preference for two existing brands, (2) consumers for which only one of the favourite brands is available, and (3) consumers that like two brands that are not supplied. Firms compete for the first type of consumers, while the second type are captive to one of them. The third type of consumers is not served, so the market is not covered. Overall, this scenario can be identified as one of the captive consumers and we mostly focus on it in what follows.

The second scenario allows consumers to consider in their choice set all alternative suppliers that are available. As a result, consumers located on the empty spokes are not captive to any of the firms. We can refer to this scenario as all-out competition and we will mainly focus on it in Sect. 6.5.

Moving back to the captive consumers scenario, a consumer located on a given spoke, say 1, also has a second preferred brand, which is any of the remaining four brands in our example of Fig. 6.1, chosen randomly with probability 1∕N − 1. More generally, for a consumer on spoke i, if the second brand j is available, then the indifferent consumer \(x_{ij}^*\) is found by solving:

The captive indifferent consumer \(x^{\prime }_{ij}\), instead, is identified by:

In trying to solve (6.3)–(6.4), there is a second issue to tackle. To simplify matters, we will start by assuming that the firms are all located at the extreme of their spoke, that is, y i = 0, and the disutility d(x i, y j) is just the distance (i.e., it is linear). Depending on the parameters of the model and the firms’ prices, the indifferent consumers (\(x_{ij}^*\) and \(x^{\prime }_{ij}\)), which represent a location on the spoke, can be any number. In other words, there can be corner solutions. For example, if the good valuation is low compared to the price, both types of consumers may not purchase at all (\(x_{ij}^*,\,x^{\prime }_{ij}\leq 0\)); if, instead, the valuation is high, all captive may purchase (\(x^{\prime }_{ij}\geq 1\)).

Solving (6.3)–(6.4) gives, respectively:

so that, assuming the prices are not too different and v is not extremely low, the demand function is derived by Chen and Riordan (2007a) as:

The first line of (6.5) corresponds to the case where some captive consumers with a bad match with firm i are not served, whereas the second line is when all captives purchase. In the equations, 2∕N is the density of consumers on each spoke and, as recalled, 1∕N − 1 represents the probability of each spokes to be a given consumer’s second favourite brand.

Given the intricate procedure to define demand in the spokes model, it is worth noting the close relation with the workhorse of spatial competition, the Hotelling (1929) linear city model. The latter is, indeed, a special case of the spokes model when setting n = N = 2. Hence, the spokes model extends Hotelling (1929) competition to n firms and also allows addressing cases when not all brands are available to consumers (n < N).

4 Pricing

The properties of pricing in the spokes model can be analysed following Chen and Riordan (2007a). Before doing that, it is worth recalling some assumptions that ease the presentation of the results. First, we keep assuming that firms’ location is fixed at the extreme of each spoke, y i = 0. Second, for simplicity we normalise the marginal cost c to zero and the unit mismatch cost t to one. Finally, the mismatch disutility is linear in the distance, d(x i, y j), separating the consumer from the firm. As a result, the firms’ profit function is, simply, πi = p iqi, and qi is specified by (6.5).

The first-order condition for a symmetric equilibrium looks familiar:

and it highlights the usual trade-off between the marginal demand gains and the infra-marginal losses of lowering the price, p i. Under the symmetry assumption, the demand function (6.5) simplifies to:

from which it is also easy to compute \(D^{\prime }_i(p_i,p^*)\).

The pricing equilibrium of the spokes model can then be characterised as follows:Footnote 1

Proposition 6.1 (Chen and Riordan 2007a)

The spokes model has a unique symmetric equilibrium. The equilibrium price is:

with \(\overline {v}(n,N)=2 \frac {N-1}{n-1}+\frac {1}{2} \frac {2N-n-1}{N-n}\).

Note first that the equilibrium price depends crucially on the consumers’ intrinsic product valuation, v. This is also illustrated in Fig. 6.3. There are boundaries on the values of v for which a unique pure-strategy symmetric equilibrium exists. Indeed, if v < 1, then firms are effectively independent monopolists; if, instead, \(v > \overline {v}(n,N)\), then a profitable deviation from the candidate equilibrium price exists. From a technical point of view, it is also worth remarking that the prices in Regions I and III are interior solutions, obtained from solving the first-order conditions; Regions II and IV are corner solutions, corresponding to kinks in the demand curve.

Prices as a function of the value of the good. Source: Chen and Riordan (2007a)

The intuition for the results is the following. Usual oligopoly competition takes place in Region I: all consumers whose both desired brands are available benefit from price competition between firms. Unlike other regions, the equilibrium price depends on the number of active firms, the total number of possible brands but not on the relatively high valuation for the good. In Region II, instead, firms exploit captive consumers, who only find one brand available on the market. The price is set such that the marginal consumer is indifferent between purchasing the least favourite brand and nothing at all. This is exactly where the kink in the demand takes place and price increases one to one with the good valuation.

In Region III, firms sell to both consumers who have a choice and captive ones. The marginal consumer in the competitive segment is indifferent between the two available brands, while the marginal captive consumer is indifferent between purchasing the second preferred variety and staying out of the market. The equilibrium price depends on all three parameters, v, n, and N. Region IV is characterised by a different kink in the demand, where only consumers whose first preferred brand is available do purchase the product, and the marginal consumer is indifferent between purchasing and not. Also for this kink, the equilibrium price only depends on the valuation.

Pricing in the spokes model has interesting comparative statics properties. Proposition 6.2 highlights the effect of an increase in the number of firms on the equilibrium prices.

Proposition 6.2 (Chen and Riordan 2007a)

The equilibrium price does not respond to changes in the number of firms in the kinked demand equilibria of Regions II and IV. Dargaud and Reggiani (2015) relate this feature of the equilibria to ex-post evidence on the price effects of horizontal mergers. In fact, existing studies suggest that the undesirable effects on prices and consumer surplus, usually under the scrutiny of antitrust authorities, do not always take place and even relevant consolidations may end up having negligible price effects. A corollary of the above finding, in fact, is that mergers in the context of non-localised spatial competition may have zero price effects when firms target specific kinks of the demand function. In Region I, instead, the usual comparative statics is in place: prices decrease following an increase in the number of competitors in the market. The intuition relates to the higher relevance, ceteris paribus, of the duopoly competition segments vis à vis the captive ones.

More unusual, however, is the result for Region III: an increase in the number of competitors leads firms to increase their prices. Unlike other oligopoly models of price-increasing competition, Chen and Riordan (2007a) obtain such result under complete information and pure strategies. The region is characterised by a more elastic demand for the captive segment than for the competitive one. The property is due to the fact that, as the firm lowers its price, the marginal consumer in the monopoly segment always has zero surplus from its outside option (infinite elasticity), while the marginal consumer in the competitive segment becomes increasingly attracted by the alternative competing brand (finite). As the number of firms becomes higher, the captive segment shrinks and the competitive segment expands, reducing the overall average demand elasticity, ultimately leading to a higher equilibrium price. Chen and Riordan (2008) extend the latter result, by employing a more general discrete choice duopoly model of product differentiation, in which consumers’ values for substitute products have an arbitrary symmetric joint distribution.

5 Location Choice

The original version of the spokes model assumes that firms are exogenously located at the end of their spoke. However, it is possible to allow firms to choose any location, either on the spokes or even outside of the area where consumers are located. In terms of the model notation, the location of firm i on that spoke, y i, is not restricted to lie between 0 and 1∕2, but it can take negative values too. An example is provided in Fig. 6.4.

A market with n = 2 firms and N = 5 spokes. Firm 1 is located within the spokes structure, y 1 ∈ [0, 1∕2], whereas firm 2 is located outside, y 1 ∈ ] −∞, 0] Source: Lijesen and Reggiani (2019)

5.1 Location as Specialisation

Allowing for endogenous location, as by stage 2 of the timing presented in Sect. 6.3, enables to address further interesting research questions. For example, Lijesen and Reggiani (2019) observe that the choice of specialisation affects firms’ brand perception by consumers and it is of crucial importance for their profitability in competitive markets. Specialisation is one of the keys to achieve strategic product differentiation and avoid fierce direct competition; a notion is present in economics models (e.g., Hotelling 1929) as well as in the strategy literature (Porter 1980).

The authors show that the spokes model, in its product characteristics interpretation, can be productively used to study the choice of specialisation. In the spokes model, in fact, only the potential level of variety, N, is exogenously fixed, and firms can choose freely where to locate in the product space, that is, specialise. In terms of the example in Fig. 6.4, one can say that firm 2 is more specialised than firm 1, as the latter supplies an almost generic product, appealing to a wider market. In that context, they ask the following. What drives a firm to choose a generic design vis à vis a specialised one? If a firm chooses to specialise, how much specialisation is optimal? Under which circumstances do specialised firms co-exist with generic ones? How does competition affect these choices?

It has to be noted that the traditional economics toolkit does not seem to provide a similarly suitable approach to address the previous questions. For example, most models of spatial competition (e.g., Hotelling 1929; Anderson et al. 1992) treat product differentiation as endogenous but predefine a constant product space. This clearly implies that, by construction, the level of specialisation decreases as the number of suppliers increases. On the other hand, in textbook approaches to monopolistic competition (e.g., Dixit and Stiglitz 1977), each firm is assumed to deliver one variety, and hence the market variety is positively related to the number of suppliers.

In order to tackle endogenous location, Lijesen and Reggiani (2019) need to assume that the transport costs d(x i, y j) are proportional to the square of the distance separating consumers from the firm. It is well known, in fact, that a pure-strategy Nash equilibrium of the location subgame does not exist if transport costs are linear in distance. Sufficiently convex transport costs, instead, warrant pure-strategy existence (d’Aspremont et al. 1979; Economides 1986). This implies:

Finally but importantly, as discussed in Sect. 6.3.1, the analysis allows for firms to compete for all consumers (all-out competition), and the preferences of consumers are not restricted to only a subset of brands as in the benchmark version of the model.

Under these assumptions, the authors provide a general characterisation of the optimal pricing choices (stage 3 of the timing in Sect. 6.3) in the spokes model with endogenous location and all-out competition. The procedure is very similar to the benchmark case and relies on identifying indifferent consumers. Assuming that y i ≥ y j, j ≠ i, these are now identified by the two following expressions:

where A ij = 1 − yi − yj and k are the unoccupied spokes. The difference is that there are now no captive segments of demand and, hence, profits:

are characterised by different demand functions. These are given by:

The first terms in (6.6) and (6.7) represent the demand accruing from the occupied spokes, the second term is the demand (if any) from the empty ones. The latter assume values 1∕2 and 0 in (6.6) and (6.7), respectively, when n > 2 if \(N \leq \frac {5}{2}(n-1)\). This is an interesting property of the spokes model with quadratic transport cost and all-out competition. The convexity of the costs implies that firms may share even the empty spokes, contradicting the intuition by which the closer/less specialised firm must attract them all. However, as long as there are not too many empty segments of the market (i.e., if n > 2 and \(N \leq \frac {5}{2}(n-1)\)), it is optimal for the more specialised firms to focus on their own spokes. Note that such assumption always holds if there are no empty spokes (n = N). If empty segments are too important, then all firms would compete for them and the demand would be split.

Pricing in the spokes model with endogenous location and all-out competition can then be characterised in terms of the best response functions and, if symmetry between firms is assumed, even explicitly. As the number of spokes increases, the equilibrium price of all firms increases. Intuitively, the larger the number of empty segments in the market, the larger the proportion of consumers that the firm closer to the centre, firm i, serves: this leads to a higher equilibrium price, p i. As prices are strategic complements, all other firms optimally raise their prices p j too.

The main result, however, is about specialisation. Using the pricing results, it is in fact possible to address firms’ choices in both a duopoly and a triopoly.

Proposition 6.3 (Lijesen and Reggiani 2019)

In the specialisation/location subgame of the spokes model with all-out competition:

-

(i)

if n = 2 < N firms, the subgame perfect Nash equilibria are:

$$\displaystyle \begin{aligned} y_{i}^{\ast}=\frac{1}{2},y_{j}^{\ast}=\frac{N-5}{6(N-1)},\quad i,j=1,2.{} \end{aligned} $$(6.8) -

(ii)

if n = N = 3, the game has two subgame perfect Nash equilibrium configurations. The equilibrium specialisations/locations are:

$$\displaystyle \begin{aligned} \begin{array}{rcl} \mathit{\mbox{(1)}} y_{i}^{\ast} &\displaystyle =&\displaystyle \frac{5}{16},\quad i=1,2,3; {} \end{array} \end{aligned} $$(6.9)$$\displaystyle \begin{aligned} \begin{array}{rcl} \mathit{\mbox{(2)}} y_{i}^{\ast} &\displaystyle =&\displaystyle \frac{1}{2},\quad y_{j}^{\ast} =\frac{1}{8}\quad i\neq j; {} \end{array} \end{aligned} $$(6.10) -

(iii)

if n = 3 < N = 4, one subgame perfect Nash equilibrium of the game is characterised by specialisation/location:

$$\displaystyle \begin{aligned} y_{i}^{\ast }=\frac{1}{2},\mathit{}y_{j}^{\ast }=\frac{1}{8}\mathit{\ }i\neq j. {} \end{aligned} $$(6.11)

The results in Proposition 6.3 provide several insights. First and above all, market equilibria are characterised by the co-existence of specialised and generic firms. This is a theoretical prediction very much in line with our everyday experience. Local markets, in fact, feature specialised and generic firms and very often both of them. Restaurants catering a single cuisine (ethnic or regional, vegetarian, steak houses, and many more) can be found close to restaurants with a more generic menu. Stores for sports gear focused on a single brand or a single sport exist alongside firms that cater to many sports. General interest book stores partly serve the same markets as children’s book stores and travel book stores. General hospitals can be found in the same local market as specialised hospitals and clinics.

This feature arises naturally in Lijesen and Reggiani (2019): as firms compete for all consumers in the market (all-out competition), one of them chooses a generic design to appeal to all market segments. Other firms, instead, specialise and focus on their own “niches”. Despite all the real-life examples of markets that combine generic and specialised firms, the only model that does not predict either extreme specialisation or clustering is the sequential location choice version of the Hotelling’s linear city model (Tabuchi and Thisse 1995). The spokes model delivers the result even in presence of simultaneous move and fully symmetric firms.

The above result applies to both duopoly and triopoly. The fact that the spokes model allows for an explicit solution with endogenous location for more than two players is noticeable in itself. In the related context of price and location choices in the Hotelling model, the only extension to a number of firms higher than two (Brenner 2005) relies on computational solutions rather than analytical ones.

Other noticeable features are the following. First, the specialisation of the non-generic firm j decreases in a duopoly, as the share of consumers on empty spokes increases. Intuitively, as N increases, the benefit of a more specialised design to soften competition is proportionally less relevant. Specialisation, instead, is unaffected by the unoccupied segments of the market when three firms compete in the market. Second, Lijesen and Reggiani (2019) also provide a version of the model with dichotomous specialisation. In that setting, the co-existence of generic and specialised firms holds more generally for any number of competitors, provided that the above restriction that empty spokes are not too relevant for firms holds. Third, in the triopoly case, it is also interesting to notice that both symmetric specialisation and the asymmetric generic-specialised co-existence are possible outcomes when there are no unoccupied segments of the market. Finally, the authors also solve the model under the usual assumption of captive consumers (Chen and Riordan 2007a; Caminal and Claici 2007) and show that the results are not robust: in that case, the standard outcome of full specialisation, and no generic firms, is obtained.

5.2 Location and Product Line Design

Reggiani (2014) also studies endogenous location in the spokes model. In the model, however, firms are allowed to price discriminate using location-contingent pricing. The fact that firms know consumers’ locations, and can adjust pricing accordingly, has a large influence on both pricing and optimal location. First, the analysis can be performed for both linear and quadratic transport costs. Second, once again the assumption of captive consumers does not need to be invoked, and all-out competition takes place. Third, firms bear transport costs and deliver the product to consumers’ address, xs.

In that context, as firms make personalised offers to consumers, they are basically engaging in Bertrand competition, with heterogeneous costs for serving each location. The cost heterogeneity reflects the distance from consumers, whose delivery cost is borne by the competing suppliers. There are, then, two segments of the demand faced by a firm i: the consumers for which it is the lowest cost provider, D i, and those for which there is a tie in costs D s. The latter segment is then divided between firms according to a sharing rule r: for example, each firm gets an equal proportion of these consumers. The profit function of a firm can then be written as:

As in heterogeneous cost Bertrand competition, price competition under spatial price discrimination leads then the closest firm to get the consumer x s and charge the price corresponding to the cost of delivery of the second most efficient firm. More formally, given the set of locations y = (y 1, …, y i, …, y n), the unique equilibrium of the pricing stage is:

and the profit function simplifies to:

An established result in the literature on spatial price discrimination is that the equilibrium location pattern is consistent with social cost minimisation. This was proven under rather general conditions by Lederer and Hurter (1986). If there are no unoccupied segments of the market (n = N), the result also holds for the spokes model. This is quite easily seen. The socially optimal location configuration is defined as the one that minimises the total transport costs, that is, a vector of locations y = (y 1, …, y n) that minimises over the spokes structure X:

There is then a very close relation between the social cost function and the profits of a firm, as the following decomposition shows:

It then follows immediately that the vector of locations \(y^*=(y_{1}^*,\ldots ,y_{n}^*)\) that maximises profits is also minimising the social cost. The competitive pressure between firms drives prices down to cost; in case of a price tie, the most efficient firm “wins” the consumer as prescribed by the sharing rule. As the cost of the second most efficient firm is not affected by the firm’s location, all that matters to the choice of location is to minimise cost over the firm’s own turf; this implies that the incentives in choosing location are in line with minimising the social cost function.

The full characterisation of the equilibrium locations is also provided.

Proposition 6.4 (Reggiani 2014)

In the spokes model with n = N firms and spatial price discrimination, the equilibrium locations are characterised by the following vectors:

-

(i)

\(y_{i}^{\ast }=\frac {1}{4},\) ∀i = 1, …, n, for n = 2, 3;

-

(ii)

\(y_{i}^{\ast }=\frac {1}{4},\) ∀i = 1, …, n and \(y_{i}^{\ast }=\frac {1}{2},\) \(y_{j}^{\ast }=\frac {1}{6}\) ∀j ≠ i, for n = 4, 5;

-

(iii)

\(y_{i}^{\ast }=\frac {1}{2},\) \(y_{j}^{\ast }=\frac {1}{6}\) ∀j ≠ i, for n ≥ 6.

A highly asymmetric location pattern is one outcome if the number of firms is sufficiently high: in that case, one firm supplies a generally appealing product, whereas others focus on a specific niche.

The most important result, however, is that unlike in Lederer and Hurter (1986), social cost minimisation is not always achieved. For an intermediate number of competitors (n = 3 or n = 4), in fact, multiple equilibrium vectors are obtained: in this case, only asymmetric location configurations globally minimise the sum of transport costs.

Intuitively, such highly asymmetric location patterns are the only equilibrium in case some segment of the market is unoccupied by firms (n < N). In that case, in fact, the fierce competition for the consumers in the empty segments leads one firm to choose the centre of the spokes market; all other firms specialise on serving consumers on their own spoke. Such an outcome, with locations \(y_{i}^{\ast }=\frac {1}{2}\,\,y_{j}^{\ast }=\frac {1}{6}\), is also social cost minimising.

Following MacLeod et al. (1988), Reggiani (2014) interprets spatial price discrimination in the characteristics space. In standard spatial models, transportation costs are a measure of consumers’ disutility, and location is a product characteristic. In presence of spatial price discrimination, instead, firms personalise and adapt their product lines to the demand expressed by buyers. Despite in the last decade relationship marketing and one-to-one marketing have become established practices, firms are not yet offering a customised product to every buyer. The customised product interpretation also fits business-to-business contexts: software providers, for example, compete for customers with standardised products that can be adjusted at some cost to the specific needs of the customer. The results provided suggest that in these contexts some firms specialise in providing a range of products to a specific segment, while others may target several segments of the same market with even wider product ranges.

6 Entry and Variety Supply

After pricing and location, another natural question to ask in the context of the spokes model is how many firms do enter the market. In a different interpretation, if every brand supplied by the market is considered a variety, the model can provide further answers to the traditional issue of under or over provision of variety through market competition. Indeed, Chen and Riordan (2007a) themselves provide the first analysis of this issue in the context of the model.

6.1 Under or Over Provision of Variety?

Chen and Riordan (2007a) assume that there are many identical potential firms that can enter and supply a brand by incurring a fixed entry cost f > 0, as by Eq. (6.1). Unlike Sect. 6.5, the assumption of exogenous location, at the extreme of each spoke (y i = 0), holds again. Entry takes place up to the point where the profits earned by firms are just sufficient to cover the fixed cost. In other words, n∗ is found by ensuring that π(n∗) − f > 0 and π(n∗ + 1) − f < 0. The equilibrium profits correspond to the equilibria obtained in Sect. 6.4, Proposition 6.1. Profit-based entry is then compared with the socially optimal level. The latter is defined as the number of firms needed on the market to maximise social welfare.

The relationship between the nature of competition and entry is not straightforward. In the spokes model of non-localised competition, both under and over provision of product varieties are possible and multiple equilibria can occur. Two polar cases are considered. First, if the valuation is sufficiently high, prices do not play a role and social surplus simply corresponds to the surplus generated by matching consumers to their favourite brand. In that case, for a given number of spokes, free entry can lead to either under or over provision of variety. In particular, free entry tends to be excessive when the fixed cost is relatively low. In fact, the entry of an additional firm has a negative externality on incumbent firms, as it reduces profits. However, there is also a positive impact, linked to both market expansion and improved matching effects. The first, negative, effect dominates if the fixed cost is low and makes entry excessive. The latter positive effects, instead, become more prominent if the fixed cost is large and entry becomes insufficient.

Second, the authors consider the case of relatively low valuation of the good. The analysis is further complicated by two elements: first, there can be multiple equilibria and, second, prices are not socially optimal. Hence, the authors consider both a regulator that also sets optimal prices and one that only affects variety supply for given prices to guarantee an optimal match. The results are qualitatively similar to the previous case but depend on one further effect, in addition to the ones previously discussed: the business-stealing effect associated with entry. The balance of these complicated effects is studied further by Caminal and Granero (2012) a series of follow-up articles that build on their methodology.

6.2 Variety Provision and Market Structure

Caminal and Granero (2012) focus their attention on the role of multi-product firms in the provision of product variety in the spokes model. In the presence of economies of scope, there may be a small number of multi-product firms that use their product range strategically in order to affect rivals’ prices. Whereas, as in Chen and Riordan (2007a), variety can be both insufficient and excessive, the authors highlight that under some conditions, firms can drastically restrict their product range in order to soften price competition. This strategic effect leads to a substantial under provision of variety.

In doing so, a nice methodological innovation is introduced. The authors assume that the number of varieties is sufficiently large and formulate a continuous approximation by which the product range of a multi-product firm can be treated as a share, that is, a continuous variable. In particular, they consider the limiting case in which the number of possible varieties N tends to infinity, keeping the mass of consumers per variety equal to 1∕2. As a result, the fraction of active varieties can be denoted as γ ∈ (0, 1) and consumers can be classified into three different groups. Fraction γ 2 has access to both desired varieties, fraction 2γ(1 − γ) can purchase only one of them, and fraction (1 − γ)2 can access none and is therefore excluded from the market. There is also a fixed cost of entry per variety, such that the overall entry cost is γf.

Their formulation is so flexible that allows to address and compare provision of variety under many market forms: (1) the social optimal as chosen by a planner, γ ∗, (2) a monopoly controlling all γ M varieties, (3) monopolistic competition where each firm supplies one variety, γMC, and (4) multi-product oligopoly, where n firms hold a share of varieties and total provision is γO.

The presence of multi-product firms influences the overall provision of product variety through the following three main channels as described by Caminal and Granero (2012). (1) Cannibalisation: a multi-product firm internalises the impact of a new variety on the demand for the other varieties that it produces. This effect tends to reduce product diversity. (2) Appropriability: the presence of a small number of large multi-product firms is associated with prices that are higher than those set by single-product firms. This effect tends to expand product variety. (3) Strategic price effect: an oligopolistic firm anticipates that its product range influences the rivals’ prices, and the sign of such effect is ambiguous. The way these effects play out in equilibrium is illustrated through an example in Fig. 6.5.

Variety provision and entry cost: multi-product oligopoly compared with social planner (left) and monopolistic competition (right). Source: Caminal and Granero (2012)

The neat methodology of Caminal and Granero (2012) has found other interesting applications around the themes of entry and variety supply. For example, Caminal (2010) focuses on content provision and language diversity. As cultural goods and media products can make content available to their audiences and readerships only through a particular language, the choice of language is a non-trivial decision in markets with bilingual or multilingual consumers. The article shows that the existence of bilingual consumers may seriously bias market outcomes against minority languages. In particular, the level of linguistic diversity determined by profit maximising firms tends to be inefficiently low, except when and where the cost of producing a second linguistic version becomes sufficiently low. The author concludes that the model provides an efficiency argument supporting government intervention to protect minority languages on the market.

Using a similar approach, Granero (2013) studies the price and variety effects of most-favoured-customer clauses in the case of a multi-product duopoly. As discussed, for example, in Cooper (1986), Baker (1995), Besanko and Lyon (1993), and Chen and Liu (2011), most-favoured-customer clauses are usually seen as anti-competitive coordination devices that firms adopt for the purpose of sustaining higher prices. The article examines the welfare impact of such clauses under endogenous product variety. Product variety is relevant because prospective higher prices from most-favoured-customer clauses can be anticipated by multi-product firms in designing product lines. Under such circumstances, it is not always the case that the clauses are harmful to consumers. In fact, most-favoured-customer clauses tend to be socially neutral for relatively large fixed costs of product line assortment, harmful for intermediate costs, and even beneficial for relatively small entry costs.

Finally, Granero (2019) adds to the analysis of variety supply the element of quality investment. Focusing on a multi-product duopoly, the article examines the linkages between strategic product assortment, quality choice, and pricing. The continuous approximation of the number of active varieties in the spokes model is adopted to derive the symmetric equilibria of a three-stage game. First, firms i = 1, 2 simultaneously choose the fraction of potential varieties they wish to supply, γ i, and the resulting duopoly total fraction of active varieties is γ D. Second, after observing such fractions, firms choose their product qualities, qi. Third, firms compete in prices p i. The model is solved and a symmetric equilibrium is studied under two configurations: first, social welfare maximisation and, second, the multi-variety duopoly profit maximisation.

The two configurations have in common that the equilibrium number of varieties weakly decreases and the quality supplied weakly increases, as the fixed cost of a variety increases. However, the duopoly quality supplied can be either too low or too high. Even in this case, the results depend on which of several effects dominates: (1) the impossibility to discriminate segments of consumers and price competition, both of which decrease the incentives to invest in quality; (2) business stealing from competitors, which encourages quality investment; and, finally, (3) a cannibalisation effect on a firm’s own brands.

The balance of these effects, represented through an example in Fig. 6.6, is complicated but the author proposes the following interpretation. First, relatively high expected prices induce firms to expand their product range and, thus, to alter quality. On the other hand, however, a strategic multi-product firm anticipates that its product range affects price competition. This strategic price effect can also affect product variety and quality. In particular, when the strategic price effect dominates, for relatively high values of the fixed cost, the two firms have incentives to refrain from expanding their product range and relax price competition. In this case, product variety becomes insufficient and quality investment excessive. In contrast, when business stealing dominates, for relatively low levels of the fixed cost, each multi-product firm produces an excessive number of brands and chooses an insufficient level of quality. Below those levels of the entry cost, firms restrict product assortment considerably in order to avoid fierce price competition, and this can lead to a sizable over provision of quality.

Quality provision, entry, and fixed cost: over provision for low and relatively high levels of the fixed cost and under provision for relatively low and high levels. Source: Granero (2019)

6.3 Limiting Properties of the Spokes Model

Last but not least, perhaps the most important result of Chen and Riordan (2007a)’s work is to show the limiting properties of the spokes model. In fact, they establish that as the number of firms grows to infinity, the spokes model tends to monopolistic competition à la Chamberlin. The “trick” is to observe that as n becomes large, also N must be large and assume further, following Hart (1985), that the relation between the number of firms and spokes is constant: n = kN where k ∈ ]0, 1]. In other words, as the number of possible varieties increases, the fixed cost declines appropriately to keep the number of entering firms constant. They then reach this important conclusion.

Proposition 6.5 (Chen and Riordan 2007a)

If n = kN and N →∞, then:

In the limit, as the market becomes less and less concentrated, price in the spokes model remains bound above the marginal cost. The spokes model provides a spatial representation of monopolistic competition, according to the general definition of Hart (1985), of which the model is a special case.

7 Further Applications of the Spokes Model

The previous discussion has illustrated how the spokes model, in its several variations, can be a useful modelling tool in situations where horizontal differentiation and competition between firms are important to understand the market outcomes. This observation helps explain why the spokes model, in spite of having barely reached teenage status, has already found several applications. These applications are particularly focused in industrial organisation, but the model can prove useful in several other fields, including marketing and management. A short review of the existing work based on the model is provided in what follows.

Caminal and Claici (2007), who introduced the model simultaneously to Chen and Riordan (2007a), use it to tackle the issue of loyalty rewards. Examples of these practices are frequent flyer programmes or supermarket point collection schemes. They observe that economists and policy analysts usually believe that such pricing schemes tend to reinforce firms’ market power and, hence, are detrimental to consumers’ welfare.

In order to study such schemes, they use a two-period model in which consumers are uncertain about their future preferences. In particular, following the captive consumers assumption, each consumer derives utility from the same pair of brands in both periods, but the location x s is randomly and independently chosen in each period. In other words, the uncertainty refers to the future relative valuation of the two brands they are interested in. In the second period, firms are able to discriminate between first-time and repeat buyers, who can prove previous transaction with the same supplier and be rewarded.

The model generates loyalty rewarding schemes as, in equilibrium, the prices charged to repeat consumers are lower than those paid by switchers. However, in line with results from the customers’ poaching literature (Fudenberg and Tirole 2000), the programmes are business-stealing devices that tend to enhance competition and lead to lower average transaction prices. The conclusion is robust to both full and partial price commitments.

Chen and Riordan (2007b), inspired by the cement and concrete market, focus on the connection between exclusive contracts and vertical organisation. A vertically integrated firm can use exclusive dealing to foreclose an equally efficient upstream competitor and to “cartelise” the downstream industry. Neither vertical integration nor exclusive dealing alone would lead to such anti-competitive effect. The extent of cartelisation depends, between other elements, on downstream market concentration and on the degree to which downstream competition is localised.

To illustrate the latter point, the authors use a version of the model with n downstream firms that incur transportation costs to deliver the intermediate good to a consumer at a particular location. As a result, as in Reggiani (2014), a firm located at the terminal node of a customer’s spoke has a cost advantage over other competitors. Upstream firms use two-part prices. The main conclusion on the joint effect of exclusive dealing and integration is robust to this extension. Similar results do not apply if competition is localised (Salop 1979) and the number of downstream firms is sufficiently high.

Chen and Schwartz (2016) focus on an important question in the analysis of horizontal mergers. Policymakers are usually interested in what share of a firm’s lost output from a unilateral price increase diverts to the merging partner. Such “diversion ratio” is often estimated using data on customer switching from a firm to its rivals, also known as “churn”. The authors use a three-firm version of the spokes model to investigate the potential biases of such estimates.

Unlike what the often employed stylised models suggest, the conclusions crucially depend on what caused the churn. This can be either (1) shifts in quality or changes in the marginal cost of the firm or of a rival or (2) demand-side shifts due to changed circumstances or learning about product attributes. Perhaps less intuitively, churn can be greater between more distant competitors in the presence of demand-side shifts. Unfortunately, policymakers are often unable to observe what caused such shifts, and the identified biases can affect decisions. As a result, Chen and Schwartz (2016) conclude that when little is known about the reason for switching, raw churn data deserves less weight, especially when the patterns conflict with information from other sources about relative competitive closeness.

Chen and Hua (2017) study how a firm’s incentive to invest in product safety is affected by both the market environment and product liability. They embed the spokes model into a simple two-period dynamic game with safety investment and product liability. Specifically, each firm’s product may cause consumer harm with some probability. In Period 1, a firm can invest to produce a high-safety product in both periods at a positive marginal cost. Without investment, the product will have low safety and zero marginal cost. After purchasing a product, a consumer can take precaution effort. Without such effort, if a consumer is harmed, the damage is relatively small if the product is of high safety but large if the product is low safety. Then, if the fixed cost of safety investment is sufficiently small, it is efficient for firms to produce and sell the high-safety product. If a consumer is harmed, the firm is required to compensate the consumer a fraction of the damage according to its product liability: partial or full.

The results suggest that partial liability, together with reputation concerns, can motivate firms to invest in safety. Increased competition resulting from less product differentiation diminishes a firm’s gain from maintaining reputation and raises the socially desired product liability. On the other hand, an increase in the number of competitors reduces the benefit of maintaining reputation, but the effect on the potential gain from cutting back safety investment is less clear. In particular, the optimal liability may vary non-monotonically with the number of firms. Therefore, the relationship between competition and product liability is subtle.

Rhodes (2011) observes the prevalence of search-related advertising in online markets. An implication is that consumer search is rarely random: sponsored links appear high up on a webpage, and consumers often click on them. Firms bid aggressively for these “prominent” positions at the top of the page. The question, then, is why prominence is valuable in those contexts, given that visiting an additional website is almost costless.

In the framework presented, consumers know their valuations for the products offered in the market, but do not know which retailer sells which product. The spokes model allows to capture the search results proposed by a gatekeeper, like Google or Bing, either in a random order or sorted to give prominence to a specific firm. The main contribution is to show that a prominent retailer earns significantly more profit than other firms, even when the cost of searching websites and comparing products is essentially zero.

The mechanism behind the result relies on consumers learning which retailer sells which product by visiting websites and stop searching once they believe they have found their best match. Consequently, a non-prominent retailer tends to attract consumers who already know that they value its product highly. Each non-prominent retailer exploits this by charging a high price, which deters consumers from searching at all. In equilibrium, the prominent retailer has a lower price, but a much wider market reach and higher equilibrium profits, even in presence of almost zero frictions.

Germano and Meier (2013) have analysed the incentive of media in reporting news. The article highlights the dependence of global newspaper publishing from advertising. In 2010 advertising counted for 80% of these firms’ revenues in the US and 57% in OECD countries. This reliance has a bearing on the choice of news coverage and content. The spokes model is used to allow for an arbitrary number of media firms and outlets. Media content can be free to users, and they get utility from both quality and accuracy of sensitive information. The latter directly affects advertisers.

In this setting, the authors show that topics sensitive to advertisers can be under-reported by all outlets in the market. Under-reporting tends to increase with the concentration, that is, when there are not many news outlets on the market. Interestingly, ownership plays an important role. In fact, adding outlets while keeping the number of owners fixed can further increase the bias.

Amaldoss and He (2010) study firms’ use of finely targeted advertising to inform consumers about their products in presence of horizontal differentiation. In that context, they use the spokes model to show how diversity in consumers tastes, informative advertising, and improvements in advertising technology influence prices.

The model shows that informative advertising can enhance competition if consumer valuations are high. However, for low consumer valuations, advertising is associated with higher prices. Moreover, when consumer valuations are high, price increases with greater diversity in tastes, whereas the opposite holds if consumer valuations are low. Finally, improvements in advertising technology lead to higher levels of advertising only if consumer valuation is sufficiently high.

Amaldoss and He (2013) note that some products are particularly salient, or prototypical, in their categories. When people think of colas, Coca-Cola comes to mind. Research in consumer psychology has long demonstrated that prototypicality influences memory, shapes the composition of the consideration set, and affects purchase decisions. The article studies how prototypicality affects competition between horizontally differentiated firms.

The authors use a variant of the spokes model in which prototypicality influences the probability of the product being included in consumers’ consideration sets, without affecting its valuation. Their analysis shows that when consumer valuations are low, the prototypical product is priced lower than a non-prototypical product and, despite that, it earns more profits. However, when consumer valuations are high, it is the prototypical product to be priced higher but still more profitable. This is consistent with evidence by which some prototypical products are priced lower than other products in their category, whereas in certain other categories they are priced higher.

Mantovani and Ruiz-Aliseda (2016) provide a rationale for the burst in the amount of collaborative activities among firms selling complementary products. They also highlight factors that may result in a lower profitability for such firms overall. To this end, they use a version of the spokes model to capture the supply of two goods by two firms and two complements supplied by two different firms. Products are both horizontally and vertically differentiated, that is, both the consumer fit and objective quality are heterogeneous.

The companies can collaborate with producers of the complementary goods, to enhance the quality of the systems formed by their components. Collaboration makes it cheaper to enhance such quality: hence, building innovation ecosystems results in firms investing more if collaboration were impossible. In markets reaching saturation, however, firms are trapped in a prisoner’s dilemma: the greater investment creates more value but not value capture, because the value created relative to competitors does not change.

Loginova (2019) studies price competition between online retailers when some operate their own branded websites and the others sell their products through an online platform, such as Amazon Marketplace. The spokes model is adopted because it can easily accommodate the two types of firms, owing to its non-localised nature. The firms face a trade-off. Selling through Amazon allows a firm to reach more customers: consumers are normally unaware of alternatives unless they use Amazon that greatly decreases search and comparison costs. On the other hand, starting one’s own website can help the firm to increase the perceived value of its product and build brand reputation. In the long run each firm chooses between Amazon and its own website, whereas in the short run the chosen sale channel cannot be amended. The comparative statics of the resulting equilibria provides some interesting insights. For example, the number of firms that choose Amazon may decrease in response to increased competition. Moreover, a pure-strategy Nash equilibrium not always exists, which is interpreted as price dispersion. Firms are more likely to employ mixed strategies in less concentrated markets and when the increase in the perceived value of the product is relatively small.

Ganuza and Hauk (2006) develop a stylised model of horizontal and vertical competition in tournaments. The sponsor, a benefactor running the tournament to generate ideas, cares not only about the quality of the design but also about the design “location” in the characteristics space. A priori, not even the sponsor knows its preferred design location, which is only discovered once the actual proposals have been seen. The benchmark model with two competitors choosing one design each is then extended to allow for several competing designs using the spokes model.

The authors show that the more efficient competitor is more likely to be conservative when choosing the design location. Also, if some differentiation in design locations is desirable, the cost difference between contestants can be neither too small nor too big. Therefore, if the sponsor mainly cares about the variety of design locations proposed, participation in the tournament by the two lowest-cost contestants cannot be optimal.

Aydogan and Lyon (2004) take on the challenging task of modelling an intangible asset like tacit knowledge. In their framework, knowledge-trading coalitions can transfer tacit knowledge, but this is unverifiable and requires face-to-face contact. This makes spatial proximity important and the use of a simplified version of the spokes model suitable. Their work may help explain the structure and stability of multi-member technology-trading coalitions, of which the Silicon Valley is a prominent example.

The main result is that when there are sufficient “complementarities” in knowledge exchange, successful transfer is facilitated if firms can meet in a central location, thereby economising on travel costs. When complementarities are small, however, a central location may be undesirable because it is more vulnerable to knowledge withholding than a structure involving bilateral travel between firms.

Izmalkov and Sinyashin (2019) present an interesting “twist” in the spokes model, which they refer to as the “rake model”, to study markets in which a general market-wide product co-exists with specific niche products, for example, local producers competing with a large online distributor. As Fig. 6.7 illustrates, the market-wide product is located at the top of the market structure, that is, above the centre where all spokes meet. In other words, there is an additional loss associated with demanding the generic product. Specific products are still located at the extremes of the spokes, which are all occupied. As a result, there are N spokes and N + 1 firms on the market.

The “rake model”. Source: Izmalkov and Sinyashin (2019)

The authors solve for both the monopoly and monopolistic competition equilibria. The results show that the general product can be sold even if it has a high additional cost associated and it is a poor substitute to the niche products. When the products are sufficiently valuable, the general product is overproduced by the monopolist and even more so under monopolistic competition.

Another interesting generalisation of the model is presented in Wang and Wang (2018). The authors analyse the “network-city model”, in which firms compete simultaneously with all other firms setting prices. As Fig. 6.8 makes clear, the city network extends the spokes model by adding links between firms, still located at the extremes of their spokes. The model allows for heterogeneous product differentiation, marginal costs of production, and generic consumer densities, although requiring symmetry of densities between pair of firms. The article shows that the model has a unique and easily computable equilibrium.

The “network city” model. Source: Wang and Wang (2018)

8 Concluding Remarks

The spokes model is a relatively recently introduced model of non-localised spatial competition and it adds to the toolkit of economists when studying situations where product differentiation plays an important role.

The previous discussion has first motivated the use of the model, through real-world examples where its assumptions can fit particularly well. A benchmark version of the framework, broadly following Chen and Riordan (2007a), was then introduced. The analyses of non-localised competition in the spokes model were classified according to the focus on pricing decisions, location choices, or variety supply. Finally, other applications of the model to several relevant economic problems have been reviewed.

Whereas some empirical exercises based on the spokes model exist (Firgo et al. 2015; Lijesen and Reggiani 2020), the empirical literature is still rather scarce. Somaini and Einav (2013) analysis of partial lock-in of consumers to product is perhaps the only full-fledged attempt to a structural implementation of a dynamic model related to the spokes model. Empirical analyses based on the spokes model could be one of the frontiers to be further explored and developed in future research.

Notes

- 1.

The interested reader can find the proof in Chen and Riordan (2007a), pp. 917–919.

References

Amaldoss, W., & He, C. (2010). Product variety, informative advertising, and price competition. Journal of Marketing Research, 47(1), 146–156.

Amaldoss, W., & He, C. (2013). Pricing prototypical products. Marketing Science, 32(5), 733–752.

Anderson, S. P., De Palma, A., & Thisse, J. F. (1992). Discrete choice theory of product differentiation. Cambridge: MIT Press.

Aydogan, N., & Lyon, T. P. (2004). Spatial proximity and complementarities in the trading of tacit knowledge. International Journal of Industrial Organization, 22(8–9), 1115–1135.

Baker, J. B. (1995). Vertical restraints with horizontal consequences: Competitive effects of most-favored-customer clauses. Antitrust LJ, 64, 517.

Besanko, D., & Lyon, T. P. (1993). Equilibrium incentives for most-favored customer clauses in an oligopolistic industry. International Journal of Industrial Organization, 11(3), 347–367.

Brenner, S. (2005). Hotelling games with three, four, and more players. Journal of Regional Science, 45(4), 851–864.

Caminal, R. (2010). Markets and linguistic diversity. Journal of Economic Behavior & Organization, 76(3), 774–790.

Caminal, R., & Claici, A. (2007). Are loyalty-rewarding pricing schemes anti-competitive? International Journal of Industrial Organization, 25(4), 657–674.

Caminal, R., & Granero, L. M. (2012). Multi-product firms and product variety. Economica, 79(314), 303–328.

Chen, J., & Liu, Q. (2011). The effect of Most-Favored Customer clauses on prices. Journal of Industrial Economics, 59(3), 343–371.

Chen, Y., & Hua, X. (2017). Competition, product safety, and product liability. Journal of Law, Economics, & Organization, 33(2), 237–267.

Chen, Y., & Riordan, M. H. (2007a). Price and variety in the spokes model. Economic Journal, 117(522), 897–921.

Chen, Y., & Riordan, M. H. (2007b). Vertical integration, exclusive dealing, and expost cartelization. RAND Journal of Economics, 38(1), 1–21.

Chen, Y., & Riordan, M. H. (2008). Price-increasing competition. RAND Journal of Economics, 39(4), 1042–1058.

Chen, Y., & Schwartz, M. (2016). Churn versus diversion in antitrust: An illustrative model. Economica, 83(332), 564–583.

Cooper, T. E. (1986). Most-favored-customer pricing and tacit collusion. RAND Journal of Economics, 17, 377–388.

Dargaud, E., & Reggiani, C. (2015). On the price effects of horizontal mergers: A theoretical interpretation. Bulletin of Economic Research, 67(3), 236–255.

d’Aspremont, C., Gabszewicz, J. J., & Thisse, J. F. (1979). On Hotelling’s “Stability in competition”. Econometrica, 47(5), 1145–1150.

Dixit, A. K., & Stiglitz, J. E. (1977). Monopolistic competition and optimum product diversity. American Economic Review, 67(3), 297–308.

Economides, N. (1986). Minimal and maximal product differentiation in Hotelling’s duopoly. Economics Letters, 21(1), 67–71.

Firgo, M., Pennerstorfer, D., & Weiss, C. R. (2015). Centrality and pricing in spatially differentiated markets: The case of gasoline. International Journal of Industrial Organization, 40, 81–90.

Fudenberg, D., & Tirole, J. (2000). Customer poaching and brand switching. RAND Journal of Economics, 31, 634–657.

Ganuza, J.-J., & Hauk, E. (2006). Allocating ideas: Horizontal competition in tournaments. Journal of Economics & Management Strategy, 15(3), 763–787.

Germano, F., & Meier, M. (2013). Concentration and self-censorship in commercial media. Journal of Public Economics, 97, 117–130.

Granero, L. M. (2013). Most-favored-customer pricing, product variety, and welfare. Economics Letters, 120(3), 579–582.

Granero, L. M. (2019). Strategic product variety and quality choice. Economics Letters, 182, 10–14.

Hart, O. D. (1985). Monopolistic competition in the spirit of chamberlin: A general model. The Review of Economic Studies, 52(4), 529–546.

Hotelling, H. (1929). Stability in competition. Economic Journal, 39, 41–57.

Izmalkov, S., & Sinyashin, A. (2019). Davids and goliath: Spatial competition of niche and general products. Mimeo.

Lederer, P. J., & Hurter, A. P. (1986). Competition of firms: Discriminatory pricing and location. Econometrica, 54, 623–640.

Lijesen, M. G., & Reggiani, C. (2019). Specialization, generic firms and market competition. Mimeo. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3246996

Lijesen, M. G., & Reggiani, C. (2020). Product variety and market competition in the dutch car repair market. Mimeo.

Loginova, O. (2019). Price competition online: Platforms vs. branded websites. Mimeo.

MacLeod, W. B., Norman, G., & Thisse, J.-F. (1988). Price discrimination and equilibrium in monopolistic competition. International Journal of Industrial Organization, 6(4), 429–446.

Mantovani, A., & Ruiz-Aliseda, F. (2016). Equilibrium innovation ecosystems: The dark side of collaborating with complementors. Management Science, 62(2), 534–549.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competition (Vol. 300, p. 28). New York: Simon and Schuster.

Reggiani, C. (2014). Spatial price discrimination in the spokes model. Journal of Economics & Management Strategy, 23(3), 628–649.

Rhodes, A. (2011). Can prominence matter even in an almost frictionless market? Economic Journal, 121(556), F297–F308.

Salop, S. C. (1979). Monopolistic competition with outside goods. Bell Journal of Economics, 10(1), 141–156.

Somaini, P., & Einav, L. (2013). A model of market power in customer markets. Journal of Industrial Economics, 61(4), 938–986.

Tabuchi, T., & Thisse, J.-F. (1995). Asymmetric equilibria in spatial competition. International Journal of Industrial Organization, 13(2), 213–227.

Wang, T., & Wang, R. (2018). A network-city model of spatial competition. Economics Letters, 170, 168–170.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter

Reggiani, C. (2020). Non-localised Spatial Competition: The “Spokes Model”. In: Colombo, S. (eds) Spatial Economics Volume I. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-40098-9_6

Download citation

DOI: https://doi.org/10.1007/978-3-030-40098-9_6

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-40097-2

Online ISBN: 978-3-030-40098-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)