Abstract

We analyze the multistage model of a duopoly in which firms decide on the level of product differentiation, R&D investment and production. The decision of differentiation is strongly related to the cost-reducing technology spillover. We find that there is a positive relationship between the level of substitution and R&D investment, which transfers into higher production and lower market price. The critical aspect of the paper is the welfare analysis of the cartelization in the market. We show that cooperation in R&D investment coordinates high investment with closer substitution, and it increases both firms profits and consumer welfare. Moreover, from the consumers’ perspective, the total monopolization of the market is more efficient scenario than a fully competitive one. Hence, the gains from coordinated joint research far outlast the possible loss from monopolization of the market.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

13.1 Introduction

The impact of research and development on the economic progress of an enterprise is a non-debatable issue in the current economic world. Nowadays, there are even several examples of firms in which R&D investment highly exceeds their financial possibilities. Thus, some form of joint activity among the firms is required to achieve an economically reasonable level of investment and production, cf. (Kaiser 2002).

The impact of antitrust policies and joint R&D procedures is a constant topic of the debate in economic and policy forums. Since 1980, the three centers of economic regulation (European Commission, FTC and MITI) changed their courses on actively banning such form of cooperation, seeing the benefits that lie from having a joint research center between firms, cf. (Horváth 2002). A joint research center is an alternative form to a merger of companies, cf. (Davidson & Deneckere 1984). However, this form is deemed by the antitrust agencies as providing a significantly harmful effect for consumers, due to market monopolization, cf. (van Wegberg 1995).

In this paper, we investigate the effects of horizontal R&D cooperation on the heterogeneous market. The horizontal cooperation is a way of know-how sharing by two equal (in terms of size or capacities) firms operating on the same market while remaining competition, cf. (Kamien et al. 1992; Belderbos et al. 2004). The idea of such an agreement being beneficial for the firms is that R&D activity is associated with increasing marginal cost, thus making it efficient to split tasks between two or more units, cf. (Camagni 1993; Becker & Dietz 2004).

The purpose of the research is to examine how R&D cooperation impacts a market in which goods are horizontally diversified. Therefore, we will be able to compare the situation of the cooperation in R&D with a fully competitive scenario as well as a monopolized market. The existing literature finds that for a significant amount of technological spillover between firms, the cooperation in R&D provides a better situation for consumers as well as firms, cf. (d’Aspremont & Jacquemin 1988; De Bondt & Veugelers 1991; Kamien et al. 1992). However, for a limited spillover of technologies, the R&D cooperation makes the consumers worse off than in the case when firms choose their investment decision non-cooperatively. The research also revealed a positive relation between spillover ratio and firms’ profits as well as consumer surplus.

We propose an extension to the model of (d’Aspremont & Jacquemin 1988) later developed by Kamien et al. (1992) by adding a heterogeneity of the product. Thus, we analyze a Cournot duopoly in which firms decide first how close they are from each other in terms of substitutability, then they made simultaneous decisions concerning their level of R&D investment and then production. The addition of a decision concerning the scale of product heterogeneity allows us to study the effect of cooperation on horizontal differentiation of goods as well as its impact on the consumers. Hence, we add a new stage to the game: before other strategic decisions are being made, firms decide on how apart from each other their products are, as in the horizontal differentiation way that can be related to the Hotelling model, cf. (Hotelling 1990). We assume that this decision maximizes their joint profit – this can be associated with a simplified form of obtaining Hotelling competition result of profit-maximizing differentiation.

We set a trade-off between a decision of product differentiation and spillover ratio. Thus, we assume that if the products are close substitutes, they can generate a significant cost reduction from each other’s investment in R&D. Hence, the decision of differentiation can be modeled as a decision of choosing an optimal level of spillover.Footnote 1 The goods horizontal differentiation and spillover ratio are linked by a continuous function h with parameter \(\alpha \) that allows to modify the easiness of differentiation for a given level of closeness of technologies.

We find that the optimal level of spillover ratio from the firms’ perspective, contrary to original research, is below the perfect spillover level. If differentiating between each other’s products is very limited, the optimal strategy is to disregard the gains from spillovers and operate on two separate markets. For some easiness of differentiation, there can be an equilibrium when firms decide on the positive but not complete level of substitutability of the offered products. Moreover, the easier it is to differentiate from one another, the higher the level of spillover is set by the firms.

As in the original papers, we analyze the welfare implications of cooperation in the R&D investment and full market monopolization.Footnote 2 Similarly to the result of the homogeneous market, we find that R&D cooperation is beneficial both to firms and to the consumers. However, contrary to (d’Aspremont & Jacquemin 1988), we find that the cooperation in R&D is beneficial to both market parties for any tested parametrization. It is because firms want to coordinate high investment with a high level of spillover which significantly lowers the market price.

Another critical point of our findings is that full monopolization, in any analyzed scenario, is a better alternative than a fully competitive one regarding the total welfare. Moreover, it is only slightly worse than the R&D cooperation from the perspective of consumers and total welfare. This result comes from the fact that monopolization stimulates more R&D investment and increases its efficiency from the cost-reduction perspective and thus allows firms to lower the market price while remaining a positive margin.

The relationship between product differentiation and R&D research has been examined in economic literature. Dixit (1979), Singh et al. (1984), Lin & Saggi (2002), Cefis et al. (2009) are just some prominent examples of the contemporary theoretical and empirical investigation of this relation. The analysis focused mainly on finding the interrelationship of product differentiation, R&D investment in a competitive scenario. The emphasis in the research was mainly placed on differentiation strategies and entry barriers in an innovative market. Symeonidis (2003) compares Bertrand and Cournot competition for different levels of exogenous technology spillover and horizontal market differentiation. Harter (1993) looks at the horizontal location model in a context of R&D investment and looks for entry barriers. Park (2001) analyzes a vertical market differentiation with R&D investment and examines the impact of subsidies on the market. The first notion of heterogeneous products and R&D investment was examined by Piga & Poyago-Theotoky (2005). They propose a three-stage game with the location, R&D investment and price stage. They find that, for the high cost of differentiation, there is a perfect differentiation equilibrium. They also find a positive relationship between product differentiation and R&D activity.

The remaining unsolved issue is the examination of the impact of cartelization on the industry with R&D spillover in which products are differentiated. It is an especially important research question concerning antitrust policies in the aspect of innovative industries. Prokop et al. (2018) analyzes the Stackelberg model with technology spillover and exogenous differentiation. Thus, the link between the decision of horizontal differentiation and R&D investment in cooperative scenarios has not been researched. The paper is trying to fill the gap in this area.

The article is structured as follows. Section 13.2 describes the basic model of Cournot duopoly with endogenous differentiation and R&D investment. The model is then solved for a given parametrization. In Sect. 13.3, we analyze two cooperative scenarios: the R&D investment cooperation and full market monopolization in terms of welfare comparisons. Section 13.4 concludes.

13.2 The Model of Duopoly

We examine a model of a two-firm, Cournot-type competition, in which firms compete by producing each a single heterogeneous good. The goods are horizontally differentiated; hence, they remain substitutes for each other. Therefore, the inverse demand function of a firm 1 is

where a is a demand function parameter, \(q_1\) and \(q_2\) are the produced quantities of firms 1 and 2 and \(h: [0, 1]\rightarrow [0, 1]\) is a function of substitutability between the goods. Its argument \(\beta \in [0,1]\) is the technology spillover parameter between the firms, which is described below. The function h links the technology spillover into the substitution of the goods from the perspective of a consumer. We assume that firms are identical in the sense of production technology and demand, to the extent of their heterogeneity in the offered product. Thus, the inverse demand function of firm 2 is symmetrical to the one in the formula 13.1.

Firms incur a linear cost of production \(c < a\), which can be lowered by R&D investment. We denote by \(x_i\) the investment in R&D of firm i, which is described in monetary terms. Moreover, the investment of the firms can impact the production cost of each other due to technology spillover. This phenomenon is captured by the parameter \(\beta \in [0, 1]\) which states what proportion of one firm investment can be transferred to its competitor. The cost of R&D investment is quadratic with parameter \(\gamma > 0\). The cost function of firm 1 is then (with symmetrical one for firm 2):

Hence, the firm 1 profit is then given by the following formula

with an analogous one for firm 2.

The game has the following dynamics:

-

1.

Firms decide upon the spillover ratio \(\beta \) which corresponds to product differentiation \(h(\beta )\);

-

2.

Firms choose their level of R&D investment \(x_i\);

-

3.

Firms choose their level of production \(q_i\);

-

4.

The market prices are obtained, and firms receive their profits.

Each firm is informed about the action of its opponent after each stage. At stages 2–3, firms decide simultaneously about the level of R&D investment and the quantity produced. At stage 1, the decision is mutual: firms decide on the level of substitution to maximize their joint profit.

The function h transforms the decision of how much the products should differ from the technological perspective into their substitutability from the consumers’ perspective. While firms would like to obtain a monopoly power and the products not to be easily substituted for one another, there is a trade-off of technological advantage from closely related goods that come from cost-reducing spillover. Thus, for \(\beta = 0\), there is no spillover effect, but firms can perfectly distinct their products and become monopolists. On the other hand, if \(\beta = 1\), the game transforms into a classic Cournot homogeneous competition from the standpoint of market demand with complete spillover, representing a situation of two firms supplying a homogeneous good and having a joint research unit. The choice of \(\beta \) does not bear any cost or restraints. Hence, function h provides a limit of possible product differentiation for a given level of technological closeness.Footnote 3

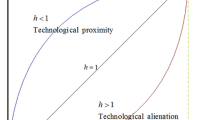

Mathematically, h should be a monotonic function transforming the interval [0, 1] into itself. In the following analysis, we will use the function \(h(\beta ) = \beta ^ \alpha \) as an example of such a function. While satisfying the above requirements, it has relatively simple form that can trace whether high differentiation, so low level of \(h(\beta )\), is achieved for relatively close technologies (that happens if \(\alpha > 1\), we will denote the possibility of differentiation as “easy”) or whether firms cannot differentiate their product from the opponents without losing a substantial part of the spillover effect (so when \(\alpha < 1\), the differentiation is “difficult”).

The game is solved using backward induction. The resulted solution is a subgame perfect Nash equilibrium. The equilibrium then takes the form of a tuple including decision about the optimal spillover level \(\beta \), the R&D investment amount \(x_i\) for given \(\beta \) and the amount of the good produced given \(x_i\) and \(\beta \) for \(i = 1, 2\). As the game is symmetric, we focus only on a symmetric equilibrium of the game. Moreover, we only allow for pure strategies to be played.

13.2.1 Optimal Production Level

Going through backward induction, we start solving the model by finding the optimal levels of production, given a level of spillover \(\beta \) and R&D investment levels \(x_1, x_2\). We find that by separately optimizing the firms’ profits with respect to their amount of production. The optimal production is then:

where \(i = 1, 2\) and subscript \(-i\) refers to the opponent of i. We can see that the level of firm’s optimal production increases with the R&D investment, both its own as well as its opponent’s. Moreover, as it is the case in the (d’Aspremont & Jacquemin 1988) and in the standard Cournot model, the levels of production are strategic substitutes.

An increase in the spillover effect level \(\beta \) does not constitute a straightforward response in the equilibrium production. For identical levels of firms’ R&D investment, if the diversification is easy, the production lowers with the level of the spillover. It means that the substitution effect, generated by \(h(\beta )\), dominates the cost-lowering one that comes from the technology spillover.

13.2.2 Optimal R&D Investment Level

Knowing the equilibrium production function \(q_i^*(x_i, x_{-i}, \beta )\) from the formula 13.4, firms decide separately on the optimal level of R&D investment. Their equilibrium decision, \(x^*_i\) for firm \(i = 1, 2\), is then a function of \(\beta \) and model parameters:

For \(\alpha \ge 1\) (so when differentiation is easy), the R&D investments are, contrary to production levels, strategic complements. However, if the differentiation is difficult, the increase in opponent’s investment may not cause a positive reaction in that area. For a given \(\alpha < 1\) and for low levels of \(\beta \), it might be possible that the investment levels are strategic substitutes. This relation comes from the fact that the increase of opponent’s investment forces firms to raise their production in a linear way, which leads to a lower market price. Moreover, the increase of opponent’s investment, due to the spillover effect, already lowers the firm’s production cost. As the investment cost is quadratic, it might be more profitable to decrease the level of investment as a response to opponent’s increase in R&D spending. It is especially true for the case of high product differentiation, where the price effect, as well as spillover, is small.

13.2.3 Optimal Level of Product Differentiation

At the beginning of the game, firms decide cooperatively on the level of product differentiation. That is, they determine the level of \(\beta \) in a way that maximizes their joint profit. This decision comes with a trade-off. On the one hand, higher \(\beta \) lowers their production cost for given R&D investment through spillover effects. On the other hand, high \(\beta \) constraints their ability to differentiate the products which are reflected in the offered price.

We were, unfortunately, unable to obtain an exact analytic form of optimal spillover variable for the general specification of the parameters. However, we were able to obtain some general results, summarized, by the following proposition:

Proposition 1

If \(\alpha \le 1\), the optimal level of spillover ratio \(\beta ^*\) is equal to 0.

If \(\alpha > 1\), the optimal level of spillover ratio \(\beta ^*\) is higher than 0.

If it is difficult to differentiate products, then firms would not like to engage in technology exchange through spillovers. Instead, the optimal situation is when they produce maximally differentiated products and obtain monopoly profits. However, if firms can easily make their products distinct from each other, they allow some level of spillover in order to lower their production cost. This comes from the fact that while the increase in \(\beta \) leads to a linear reduction in production cost as well as sublinear (for \(\alpha > 1\)) or superlinear (for \(\alpha < 1\)) price increase. Thus, the intuition is that the optimal level of \(\beta \) should be then weakly increasing with the level of \(\alpha \) (if differentiation is easy), which is in line with the following numerical simulations.

13.2.4 Numerical Results

To obtain exact solution of the model, we assume that the parameters take the following form: \(a = 1\), \(c = 1/2\), \(\gamma = 1/2\).Footnote 4 This parametrization would lead to the monopoly price of 2/3 with monopoly production of 1/3. We gathered the results from numerical simulations into the following statements.

Statement 1

The optimal level of \(\beta ^*\) is weakly increasing in \(\alpha \). If \(\alpha > 1\), \(\beta ^*(\alpha )\) is strictly increasing.

As we can see in Fig. 13.1, for \(\alpha > 1\), the optimal level of spillover ratio \(\beta ^*\) is strictly increasing in \(\alpha \). This increase, apart from the initial level, is marginally decreasing. Thus, as the ability to differentiate for a given level of spillover is higher, firms are more willing to accept the closeness of their products. At the limit, as \(\alpha \rightarrow \infty \), \(\beta ^* \rightarrow 1\).

Statement 2

The level of firm’s R&D investment in the equilibrium \(x_i^*\) is weakly increasing in \(\alpha \) and strictly increasing for \(\alpha > 1\).

The amount of firm’s production in the equilibrium \(q_i^*\) is weakly increasing in \(\alpha \) and strictly increasing for \(\alpha > 1\).

The equilibrium price in the equilibrium is weakly decreasing in \(\alpha \) and strictly decreasing for \(\alpha > 1\).

The other decision variables of firms: R&D investment and production level are also weakly increasing in \(\alpha \). If \(\alpha < 1\), due to no spillover, the optimal levels of \(x^*_i\) and \(q^*_i\) are the same for any value of the parameter. Thus, with higher spillover ratio that comes from higher values of \(\beta ^*\), the firms will commit to higher R&D investment. However, because of lower differentiation of products, they need to engage in a fiercer competition by increasing their production over the monopoly level.

It shall be noted that for the given parametrization, the increase in R&D investment and quantity produced due to increase in \(\alpha \) (if the differentiation is easy) has a steady, linear property as we can see in Fig. 13.2. The rates of increase of these variables are not very significant, in comparison with the reaction of the optimal level of spillover. As \(\alpha \) increases from 1 to 10, the optimal level of R&D spending and production amount increase for about 25.1% and 26.4%, respectively in an almost linear fashion. The linearity comes from the fact that, while higher \(\alpha \) (and thus, a higher level of spillover) lowers the production cost linearly, it also lowers the price in a sublinear fashion (for \(\alpha > 1\)). Hence, the product of these two forces leads to a modest increase in decision variables due to an increase of \(\alpha \).

The equilibrium price, as it is depicted in Fig. 13.4, is strictly decreasing in \(\alpha \) if the differentiation is easy for firms. The decrease is stronger than the increase in production from Fig. 13.3. It follows from the fact that the price of firm’s i product depends linearly on the quantity of it produced but also for higher values of \(\alpha \), the optimal level of spillover increases, which makes the goods closer substitutes. Thus, the higher impact of the quantity increase of the opponent makes, by joint force, the market price fall more rapidly than the increase in the quantity of the product itself.

Although the increase in \(\alpha \) lowers the price for the firm’s i product, the single firm’s profit is increasing with the value of the parameter, as it is shown in Fig. 13.5. It is due to the higher quantity produced (the total revenue is increasing with \(\alpha \)) as well as cost reduction as a result of a higher technology spillover.

From the welfare perspective, it might be interesting to see how differentiation constraint affects consumers. We define the consumer surplus CS as follows:

The consumer surplus is taken from the standard formula of single-good demand–supply analysis. Hence, it does not consider any effect of a multiproduct market, particularly the benefit of having a broad area of products. Thus, the only variable that affects the consumer surplus is the price. The definition was chosen for its simplicity but also because the market price for a single good captures the spillover and differentiation effects into a single number. Also, the price is decreasing with \(\alpha \), which makes consumer surplus positively related to the market homogeneity. Thus, including the fact of a wider variety of product due to product differentiation would not change this relation.

The total welfare, being the sum of consumer surplus and firms’ profits, is also increasing with the easiness of differentiation as it is shown in Fig. 13.6. Therefore, it is in both firms’ and consumers’ interest to allow firms to differentiate their product. It allows for higher spillover, lowering the production cost, which translates into a higher supply of product and thus lower prices.

The effects of differentiation constraint \(\alpha \) on firms’ profits, consumer surplus and total welfare are summarized in the following statement.

Statement 3

The single firm profit in equilibrium is weakly increasing in \(\alpha \). If \(\alpha > 1\), the profit is strictly increasing.

The consumer welfare is weakly increasing in \(\alpha \). If \(\alpha > 1\), the consumer welfare is strictly increasing.

The total welfare is weakly increasing in \(\alpha \). If \(\alpha > 1\), the total welfare is strictly increasing.

13.3 Market Cartelization

We now investigate the impact of a partial or total cartelization of the markets in the presented setting. As in (d’Aspremont & Jacquemin 1988), we will consider two types of cartelization: the collective decision in R&D investment (leaving the competition in the production stage) and full monopolization (in R&D investment and production). Since the differentiation decision is already assumed a cooperative one, we do not impose any changes on that from the baseline analysis standpoint. Hence, we can investigate how the market equilibrium changes in response to making competition less fierce in such a market structure and how will it affect consumers and total welfare. For language simplicity, we will denote the base model as a fully competitive one, although it shall be noted that the optimal level of spillover is not decided upon competitively.

13.3.1 Cooperation in the R&D Investment

We now allow firms to choose the level of R&D investment at period 2 in a cooperative manner, that is, in such a way that maximizes their joint profits. Thus, knowing the optimal production function from the formula 13.4, they choose \(x_1\) and \(x_2\) to maximize the sum of their profits for a given value of \(\beta \). The optimal investment \(x^{CX}_i\) is then

The comparison between the optimal level of R&D investment in the base model, given by Eq. 13.5 and the one with the cartel at the investment stage is given by the following proposition.

Proposition 2

If the differentiation is easy (so \(\alpha > 1\)), the optimal level of investment is higher in the game with R&D investment cooperation than in competitive scenario for any value of spillover ratio \(\beta \).

If it is easy to differentiate, allowing firms to decide on R&D investment jointly will lead to higher spending in that area. For \(\alpha < 1\), so when it is difficult to differentiate, the difference is ambiguous. It shall be noted that from the Proposition 1, at least in the base model, there is no spillover if \(\alpha \) is not higher than 1. Thus, in that case, firms act as monopolists on the separate market and have no economic interaction. Therefore, if firms can coordinate their actions on R&D, they can boost each others decision in that regard. In comparison with (d’Aspremont & Jacquemin 1988), this relation is independent from the value of \(\beta \).

The optimal level of spillover ratio \(\beta ^{CX}\) for the model with R&D cartel has similar properties as in the fully competitive scenario. This finding is summarized in the following proposition.

Proposition 3

If \(\alpha \le 1\), the optimal level of spillover ratio \(\beta ^{CX}\) in the game with R&D cooperation is equal to 0. If \(\alpha > 1\), the optimal level of spillover ratio \(\beta ^{CX}\) is higher than 0.

Thus, as in the fully competitive scenario, firms will cut any form of market interaction if the differentiation is difficult in exchange for being a monopolist without any technology spillover benefits.

Given the same parametrization as in the base model, we can compare the optimal values of \(\beta \) between scenarios. The following statement provides an impact of cartelization on product differentiation.

Statement 4

If the differentiation is easy (so \(\alpha > 1\)), \(\beta ^{CX} > \beta ^*\).

Hence, if the cooperation in R&D is possible, firms decide on the spillover ratio that is higher than the one in the case of no cooperation. This comes as an implication of higher investment in R&D: if firms coordinate on higher investment, they want to gain cost greater cost reduction by increasing their spillover ratio. Figure 13.7 shows a comparison between the two optimal spillover ratios.

The increase in spillover ratio transfers into higher spending (as stated in Proposition 2) as well as higher production. As the coordination itself makes the investment higher, the increase in spillover ratio uplifts the values of R&D spending to even higher values as it is shown in Fig. 13.8. A very high boost to investment leads consequently to increased production, depicted in Fig. 13.9. Furthermore, the cooperation in R&D makes the values of this decision variables more influenced by the changes in differentiation constraint parameter \(\alpha \).

The following statement summarizes the impact of cooperation in R&D investment on welfare.

Statement 5

If differentiation is easy (so \(\alpha > 1\)):

-

Single firm profit is higher in the case of R&D cooperation than in full competition. Moreover, it is increasing in \(\alpha \).

-

Consumer surplus is higher in the case of R&D cooperation than in full competition. Moreover, it is increasing in \(\alpha \).

-

Total welfare is higher in the case of R&D cooperation than in full competition. Moreover, it is increasing in \(\alpha \).

Intuitively, coordinating on R&D investment makes both firms better off in terms of their profits, as it is shown in Fig. 13.10. The coordinated increase in R&D investment and higher spillover ratio transfers into significant lowering of production cost. The closer substitutability lowers the price for the firm’s product, but higher production compensates for that in terms of revenue. The easier it is for firms to differentiate their product, the higher the profit: while an increase in spillover, as a result of higher \(\alpha \), makes the competition stronger, the cost reduction is significant enough to compensate for that.

Because the market price goes down as a result of an increase in production, as well as in spillover ratio (due to lower differentiation), the consumer surplus rises when firms attempt to coordinate investment levels in R&D as it is depicted in Fig. 13.11. Thus, the total welfare, being the sum of firms’ profits and consumer surplus, is also higher in the case of R&D cooperation than in full competition as it is increasing with the easiness of differentiation between firms.

13.3.2 Full Cartel

Similarly to (d’Aspremont & Jacquemin 1988), we will also examine the scenario in which both R&D investment and production are decided on cooperatively. Therefore, all the strategic variables are chosen as if firms were acting like a monopolist on two linked markets with two production and R&D facilities. Moving through the backward induction, the optimal level of production \(q^{FC}_i\) of a single firm is then:

where x is a R&D spending of a single firmFootnote 5 and \(\beta \) is the chosen beforehand optimal level of spillover. For the given level of \(\beta \) and \(x_1 = x_2 = x\), the quantity produced under full competition is higher than under full cooperation iff \(x(1+\beta ) > a - c\).

The R&D investment in the case of full cooperation is subject to the same rules as in the R&D cooperation scenario. The optimal level of spending \(x^{FC}_i\) of a single firm for a given value of technology spillover ratio is then

For the given value of \(\beta \), the order between \(x^*_i(\beta )\), \(x^{CX}_i(\beta )\) and \(x^{FC}_i(\beta )\) is ambiguous and strongly depends on value of parameters.

Investigating further the case of full cooperation, we find that, similar to two previous cases, the optimal level of spillover is increasing with the easiness of differentiation as it is stated in the following proposition.

Proposition 4

If \(\alpha \le 1\), the optimal level of spillover ratio \(\beta ^{FC}\) in the game with R&D cartel is equal to 0. If \(\alpha > 1\), the optimal level of spillover ratio \(\beta ^{FC}\) is higher than 0.

For the same parametrization as in the previous scenarios, we find that the optimal level of spillover is highest in this scenario. This finding is summarized in the following statement.

Statement 6

For \(\alpha > 1\), the optimal level of spillover in the full cooperation scenario is higher than in any other two cases, so \(\beta ^{FC}> \beta ^{CX} > \beta ^*\).

In the case of a monopoly operating on two markets with two production and R&D facilities, it chooses to have a very high ratio of spillover. It partially comes from the fact that having control over the production level, firms in full cooperation are not as much troubled by the closeness of their products for consumers. As numerical simulations in Fig. 13.12 show, the optimal level of spillover ratio (and thus the corresponding level of substitutability between their products) is just a bit higher than in the case of cooperation in only R&D investment. As in the case of two previous scenarios, the optimal level of spillover is increasing in \(\alpha \) (if the differentiation is easy) in a marginally decreasing manner. The highest difference between \(\beta ^{FC}\) and \(\beta ^{XC}\) is obtained at \(\alpha = 2.8\).

The optimal values of decision variables in case of full cooperation equilibrium, as our numerical simulations suggest, are very closely related to the values in the case of only R&D cooperation. They also fall under the same relationship with parameter \(\alpha \). The following statement summarizes the relation between decision variables in the three analyzed scenarios.

Statement 7

If \(\alpha > 1\) (so differentiation is easy):

-

The R&D investment is subject to the following relation: \(x^{FC}> x^{CX} > x^*\).

-

The production is subject to the following relation: \(q^{CX}> q^{FC} > q^*\).

Thus, even if the markets are monopolized, due to a high level of R&D investment and thus cost reduction, the production level under full cooperation is higher than under fully competitive scenario. From the equilibrium outcome standpoint, a fully cooperative case does not differ a lot from the case of cooperation in only R&D cooperation—it presents with a bit higher investment in R&D and a little lower production with more spillover effect.

As intuition suggests, the single firm profit is higher if it is part of a full cooperative scenario than in any case when there is competition at any stage of the game. However, the difference obtained by numerical simulations between full cooperation and cooperation in only R&D investment is insignificant—at the highest point with respect to \(\alpha \), it amounted for only 0.16% increase in profits.

The consumer surplus, due to lower production and thus higher price (which is not suppressed by a bit higher differentiation), is lower for full cooperation scenario than in the case when only R&D investment is coordinated. This results in total welfare being highest in the scenario of cooperation in only R&D investment, but the case of full cooperation is a not much worse one from the perspective of total welfare: performed numerical simulations suggest that in the worst case, the total welfare would drop for 1.8% due to cooperation in production (assuming cooperation in R&D investment). The formal statement of the relation of welfare values for the three scenarios is given below.

Statement 8

Given that \(\alpha > 1\):

-

The single firm’s profit is subject to the following relation: \(\pi ^{FC}_i> \pi ^{CX}_i > \pi ^*\).

-

The consumer surplus is subject to the following relation: \(CS^{XC}> CS^{FC} > CS^*\).

-

The total welfare is subject to the following relation: \(TW^{XC}> TW^{FC} > TW^*\).

13.4 Conclusion

The paper examines the impact of R&D cooperation and full monopolization on product differentiation, R&D investment and production levels. In our three-stage game, firms want to differentiate the product in order to gain more monopoly power, while the closer substitutes their products are, the more they can gain from technology spillover. We find a positive relationship between the level of differentiation and R&D investment. Thus, the easier it is for firms to differentiate, the more they will invest in R&D, to reduce the negative impact of differentiation on cost-reducing spillover that transfers into production increase and thus price reduction. The results are consistent with the similar model of horizontal differentiation with R&D investment of (Piga & Poyago-Theotoky 2005).

The key aspect of the paper comes from the investigation of welfare analysis in two cooperation scenarios, R&D cooperation and full market monopolization. We find that allowing firms to coordinate their R&D investment leads to a significantly lower market differentiation (which transfers into a higher level of spillover) and much higher investment in R&D. This allows firms to increase their profits due to significant cost reduction but also allows them to increase production which implies a lower market price for consumers and thus increase in consumer surplus.

What is an especially significant finding is that the full monopolistic outcome outlasts in terms of consumer surplus and total welfare the fully competitive scenario. While the firms can coordinate the production process to obtain more monopoly power, the coordination in R&D surpasses that effect. Moreover, the welfare results from full monopolization are very close to the ones from cooperation in only R&D investment. Hence, as the results show, the restrictions on R&D cooperation that can be made by the antitrust agencies for fear of market cartelization are not justified by the theoretical model as the lack of coordinated R&D investment does the consumers more harm than market monopolization.

Although the presented model gives theoretical insight into the welfare implications of coordinated activity with endogenous differentiation and R&D investment, the presented research is just a first step into an examination of this relationship. A more general investigation of possible cost functions and their parametrizations is necessary to determine the paper conclusions in a more throughout manner. Moreover, the decision of spillover ratio (which translates into differentiation level) can be examined as an outcome of competitive decision-making. The increase of heterogeneity between firms and the increase in the number of competitors might also serve as an inspiring generalization. Thus, we think that by the paper, we allow much more extensive research concerning the implications of R&D cooperation on market differentiation.

Notes

- 1.

For modeling reasons (mainly having a similar cost function that in original works), we assume that firms decide on the level of spillover and that level is transformed into substitution ratio by function h. However, as the economic context and real possibility seems more plausible in assuming that firms decide on the scope of differentiation, we will refer to that decision process in that manner.

- 2.

In that case, it is a situation of a monopolist operating on two horizontally differentiated markets with two separate (but not entirely due for spillover) production facilities.

- 3.

We can, without a loss in generality, reverse this logic and state that firms choose how distinct their products are and given that they will try to obtain as much spillover as possible. Both principles would lead to the same conclusions.

- 4.

It shall be noted, that while there is no general proof to that statement, the following results are robust to the changes in the listed parameters’ values.

- 5.

Note that since the marginal cost of R&D investment is increasing, it is optimal to allocate the total R&D investment between the firms equally.

References

Becker, W., & Dietz, J. (2004). R&D cooperation and innovation activities of firmsevidence for the german manufacturing industry. Research policy, 33(2), 209–223.

Belderbos, R., Carree, M., & Lokshin, B. (2004). Cooperative R&D and firm performance. Research policy, 33(10), 1477–1492.

Camagni, R. (1993). Inter-firm industrial networks: the costs and benefits of cooperative behaviour. Journal of Industry Studies, 1(1), 1–15.

Cefis, E., Rosenkranz, S., & Weitzel, U. (2009). Effects of coordinated strategies on product and process r&d. Journal of Economics, 96(3), 193–222.

d’Aspremont, C., & Jacquemin, A. (1988). Cooperative and noncooperative R&D in duopoly with spillovers. The American Economic Review, 78(5), 1133–1137.

Davidson, C., & Deneckere, R. (1984). Horizontal mergers and collusive behavior. International Journal of Industrial Organization, 2(2), 117–132.

De Bondt, R., & Veugelers, R. (1991). Strategic investment with spillovers. European Journal of Political Economy, 7(3), 345–366.

Dixit, A. (1979). A model of duopoly suggesting a theory of entry barriers. J. Reprints Antitrust L. & Econ., 10, 399.

Harter, J. F. (1993), ‘Differentiated products with R&D’, The Journal of Industrial Economics pp. 19–28.

Horváth, R. (2002), Cooperation in research and development, Universitat Autònoma de Barcelona,.

Hotelling, H. (1990). Stability in competition, in ‘The Collected Economics Articles of Harold Hotelling’. Springer, 50–63.

Kaiser, U. (2002). An empirical test of models explaining research expenditures and research cooperation: evidence for the german service sector. International Journal of Industrial Organization, 20(6), 747–774.

Kamien, M. I., Muller, E. & Zang, I. (1992), ‘Research joint ventures and R&D cartels’, The American Economic Review pp. 1293–1306.

Lin, P., & Saggi, K. (2002). Product differentiation, process r&d, and the nature of market competition. European Economic Review, 46(1), 201–211.

Park, J.-H. (2001), ‘Strategic R&D policy under vertically differentiated oligopoly’, Canadian Journal of Economics pp. 967–987.

Piga, C., & Poyago-Theotoky, J. (2005). Endogenous R&D spillovers and locational choice. Regional science and urban economics, 35(2), 127–139.

Prokop, J., & Karbowski, A. (2018). R&D spillovers and cartelization of industries with differentiated products, ZBW.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly.

Symeonidis, G. (2003). Comparing cournot and bertrand equilibria in a differentiated duopoly with product r&d. International Journal of Industrial Organization, 21(1), 39–55.

van Wegberg, M. (1995), ‘Can R&D alliances facilitate the formation of a cartel? the example of the european it industry’.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

Proof of Proposition 1

The profit of the firm i, given the optimal reactions of production and R&D investment, is:

while, if \(\beta = 0\), the profit function is then

Assuming \(0<c<a\) and \(\alpha \le 1\), the profit from the formula 13.10 is always lower than if \(\beta = 0\).

For \(\alpha > 1\), the profit for \(\beta > 0\) is always higher than the one for \(\beta = 0\).

Proof of Proposition 2

To proof Proposition 2 we need to state that the optimal level of firm’s investment \(x^*_i\) from formula 13.5 is higher than \(x^{CX}_i\) from the formula 13.7. It can be shown, after some calculations, that it is the case for \(\alpha > 1\).

Proof of Proposition 3

The profit of firm i in the R&D investment cooperation scenario, for the given optimal level of R&D investment function and best response in terms of production, is

If \(\beta = 0\), the above formula is then the same as in formula 13.4. It can be seen that if \(\alpha \le 1\), the profit is highest when \(\beta = 0\), while if \(\alpha > 1\) the profit for \(\beta > 0\) will be always higher than if \(\beta = 0\).

Proof of Proposition 4

The profit of the firm i in the fully cooperative scenario, for the given optimal level of R&D investment function and production, is

As in Propositions 1 and 3, for \(\alpha \le 1\), the firm’s profit is highest if \(\beta = 0\), while for \(\alpha > 1\), it is always higher for \(\beta > 0\).

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Wisnicki, B. (2020). Impact of R&D Cartelization with Endogenous Product Differentiation. In: Tsounis, N., Vlachvei, A. (eds) Advances in Cross-Section Data Methods in Applied Economic Research. ICOAE 2019. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-38253-7_13

Download citation

DOI: https://doi.org/10.1007/978-3-030-38253-7_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-38252-0

Online ISBN: 978-3-030-38253-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)