Abstract

This chapter discusses the effects of oil income on the economy of Kazakhstan, focusing on social development. It argues that Kazakhstan is expecting to face a significant economic slowdown if it remains dependent on the energy sector only. This chapter explores the alternative avenues of economic growth available for the country to avoid overreliance on oil, through the further development of institutions and complex socio-economic reforms. Analyzing broad reforms aimed at modernization and diversification of the economy the government has enacted recently, it suggests that redistribution of oil rents through more effective market mechanisms is critical for diversifying economies in oil-producing regions. This research concludes that more efforts are needed in activating market forces in the economy.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Introduction

As was discussed (see Baldakhov & Heim, 2020, and Heim & Romanov, 2020, this volume), in the 1990s, the oil sector quickly became the primary economic sector in Kazakhstan. During the period of the 1990s, as a result of the national privatization program, Kazakhstan transformed its economic structure from a Soviet-era planned economy to an oil-dependent one. Currently, oil sector earnings are responsible for about 35% of total export revenues and further contribute 20% of national budget finances, which translates to around 6.5% of the real GDP (Pomfret, 2005). The government’s radical reforms aimed at strengthening the economy by highlighting the effects of its Modernization 3.0 ProgramFootnote 1 in shaping the economic landscape to become one of the top 30 countries with a prosperous economy in the coming years (Borghijs, 2017). Among the actions proposed is increased exploitation of the Caspian oil reserves. Despite the challenges of transitioning from a planned to a market-based economy, Kazakhstan sought to attract the most significant share of foreign direct investments (FDI) per capita among Central Asian nations. The increased oil production strongly and positively influenced Kazakhstani economic growth, as well as the volume of its revenue collection. Since 2000, revenues from the oil sector have been responsible for nearly 20% of government expenditure. The cumulative effect of oil income on the general economy is tremendous, taking into account the amount of foreign investments in the form of FDI it has attracted to the country. This chapter discusses the effect of oil revenues (OR)Footnote 2 by examining their influence on Kazakhstan’s economic development since it declared independence in 1991 after the breakup of the Soviet Union.

Institutional Theory and Sustainable Development of Resource-driven Unbalanced Economies

Institutional theory in economics emerged from two streams of thoughts: first, the idea that state defines the legal framework, which ensures that market economy functions (new institutional economics, or NIE), and, second, transaction cost theory explaining that economic organizations manage by themselves to reduce costs associated with economic transactions which are influenced by the institutions governing the market (old institutionalism). NIE considers the question of why economic institutions emerged the way they did and not otherwise, by explaining the problem of resource allocation and utilization (Vargo & Lusch, 2016). Coase addressed the question of economic exchange based on transaction cost (Coase, 1937, 1972). Williamson aimed to explain how organizational forms are grounded in response to the ways in which economic actors minimize transaction costs by managing their exchange activities. According to Williamson, these costs are incurred because the exchange activities of organizations are embedded in the institutional environment (Williamson, 1981).

Institutions can be defined in different ways; in economics, institutions are often defined as the rules of the game in a society or, more formally, the humanly devised constraints that shape human interaction (North, 1990). Institutions matter since without a stable institutional framework, transaction costs may become so high that certain transactions are not undertaken at all (Peng & Meyer, 2016). Institutions develop over time, and institutional transition is a “fundamental and comprehensive change introduced to the formal and informal rules of the game that affect organisations as players” (Peng, 2003: 275). Different economies will have very different performance characteristics because of different informal norms and enforcement. North (1990) also concluded that successful political-economic systems have evolved flexible institutional structures that can survive the shocks and changes that are a part of successful evolution.

Institutional transition in emerging countries moving from central planning to market economy (to this group belong all transitional countries including Russia and Kazakhstan) is often linked with other economic concepts in order to explain certain phenomenon. The overview of selected contributions of the institutional theory in economics is given in Table 3.1.

This chapter will consider the differences in socio-economic development between oil and non-oil regions in Kazakhstan. It will justify the need for oil rent redistribution through the diversification from the extractive sector of the economy, based on the view of oil as a common-pool resource, and the need for sustainable management of such resources suggested by neo-institutional theory.

Economic Development in the post-Soviet Period

Kazakhstan is a country located strategically between Europe and Asia; it is often referred to as a Central Asian state. Borghijs (2017) observes that the sparsely populated nation of 18 million inhabitants sits on 2.7 million square kilometers landlocked by China in the east, Russia in the north, and Uzbekistan, Turkmenistan, and Kyrgyzstan in the south. Pomfret (2005) notes that among the nations united under the Union of Soviet Socialist Republics (USSR), Kazakhstan was the last to declare independence. He observes that the country is abundant in oil and natural gas, while also rich in substantial deposits of unmined gold, copper, aluminum, and chrome. Nowadays, Kazakhstan is the world’s leading oil producer. However, as Sakal (2015) noted, despite tremendous natural wealth, the policies governing natural resources over the years have failed to improve the living conditions of the majority of Kazakhstan’s population.

Firstly, the transition from a Soviet economy to an independent nation state has led to mistrust and conflicts between two major ethnic groups, namely Russian and Kazakh,Footnote 3 followed by a mass exodus that further weakened Kazakhstan’s economy during the first half of the 1990s. Additionally, the failure of the country to attract foreign investment (FDI) in this period hindered the development of its petroleum and mineral sectors (Pomfret, 2005). Consequently, in the first five years after Kazakhstan attained self-rule, the economy lost 30% of its real GDP value and inflation skyrocketed. The situation changed slightly for the better in the 1996–1997 period before dipping further in 1998.Footnote 4 The economic downturn ended in 1999, opening a new era of robust economic development in the country. Overall, the 1990s was a turbulent period for the economy of Kazakhstan. During the economic decline in the 1991–1995 period, the industrial contribution to the GDP dropped to 33% from 45%; the contribution of agriculture to the GDP declined from 27% to 5%; at the same time, the services industries’ contribution to the GDP rose to 63% from 29% before independence (Borghijs, 2017).

Pomfret (2005) claims that the poor economic conditions arose because, after declaration of independence, the country’s leadership focused on secession politics and internal conflict resolution at the expense of the economic development of the nation. He suggests that the cause of this was former President Nursultan Nazarbayev’sFootnote 5 economic policy for 1992–1994 period, which was aimed at maintaining close commercial bonds with Russia. He argues that to maintain ties with the largest economy of the breakaway states, Kazakhstan followed Russia’s footsteps, which included the radical reforms of price liberation and privatization of state corporations in 1992. In this endeavor, Kazakhstan’s leadership failed to set an agenda for the country’s macroeconomic development (Pomfret, 2005). While the country evolved in the shadow of Russia, pluralism flourished in 1994 before leadership bolstered its political authoritarianism, making Kazakhstan less democratic than Russia (Sakal, 2015). He stated that Kazakhstan suspended its economic reforms for close to a decade and that then privatization spiraled during this period. Between 1995 and 1997, Kazakhstan sold all of its treasured state corporations through a process similar to Russia’s “voucher scheme.” After the depletion of national wealth held in public enterprises, Kazakhstan’s leadership turned its attention in the development of its oil sector (Pomfret, 2005). He notes that, against this backdrop, the economy suffered severe adverse external shocks at the end of 1990s, both because of the financial crisis in Russia in August 1998Footnote 6 and because of falling oil prices in this period, resulting in Kazakhstan devaluing its currency by a substantial margin. Kazakhstan’s economy became predominantly dependent on the energy sector. From independence to the present date, Kazakhstan’s oil production tripled, making it among the top oil-producing nations in the world.

O&G Industry Overview

Among resource-rich countries, Kazakhstan occupies a top position, possessing 30 billion barrels of proven crude oil reserves (see Table 3.2) and 4.8 billion cubic meters of natural gas, which altogether account for 2.22% of the world’s petroleum reserves, contributing 7% of oil reserves in Eurasia. Kazakhstan also holds the top position among the largest petroleum producers, with an annual oil production of 1.4 million barrels a day and a gas production of 220,000 m3/d. Estimations show that, at these rates, Kazakhstan will contribute to petroleum production for the next several decades. Major oil and gas fields, also referred as unique fields or megaprojects, and their recoverable oil reserves, according to national statistical data, are Tengiz with 7 billion barrels (1.1 km3), Karachaganak with 8 billion barrels (1.3 km3) and 1350 km3 of natural gas, and Kashagan with 7–9 billion barrels (1.1–1.4 km3). In 2018, Kazakhstan reached production up to 1.5 million barrels of oil a day (OPEC, 2018), most of which are exported. This development lifted Kazakhstan into the ranks of the world’s top oil-producing nations.

Figure 3.1 shows the distribution of hydrocarbon reserves in Kazakhstan by region. There is a curious correlation between the volume of reserves and the regional household income indicators (see Fig. 3.5, this chapter)—the higher the hydrocarbon reserves in the region, the higher the welfare of the people living in the area.

The distribution of hydrocarbon reserves by regions, %. (Source: Authors’ own processed data based on KazMunayGas annual report 2016, Available at http://www.kmg.kz/uploads/AnnualReport2016Rus2.pdf)

Substantial natural resources deposits fuelled the economic growth. Later, strategic initiatives facilitated the movement of foreign capital into the country through “multi-vector” policies to govern the energy sector. Notable among these efforts is the oil transport network which the state agreed on with its neighbors, Russia and China (Hardin, 2012). Kazakhstan’s energy potential became apparent during the Soviet era, precisely five decades ago, although nobody knew with certainty the magnitude of the country’s fossil fuel potential (O&G Journal, 1991). The Mangyshlak Peninsula in the western part of the country demonstrated great potential for petroleum production; however, the lack of capital and technical expertise in the Soviet era dimmed hopes of developing these fields until the country’s independence, when the American oil giant Chevron moved in to develop the Tengiz and Korolev oil fields. In the Soviet period, oil and gas explored in Kazakhstan flowed through the Orenburg pipeline system into Russia for processing. Processing its petroleum in Russia illustrates a significant challenge that Kazakhstan faced at independence because the country’s petroleum infrastructure consisted of old Soviet-era development, which advanced the industry as a one single whole. After becoming self-governing, Kazakhstan needed to develop its expertise and capital to be genuinely sovereign, even as it remained connected to Russia (Sakal, 2015).

Kazakhstan’s oil dominance through its petroleum exploration in the Caspian Sea basin was yet to come. After its declaration of independence, Kazakhstan abandoned the rouble as its currency and focused on attracting FDI and international expertise to spur its economic growth, particularly in the energy sector, including both the petroleum and electricity sub-sectors (Pomfret, 2005). The deal between Chevron and the local corporation TengizNeftegaz Production Association in 1993 gave birth to TengizChevroil (TCO). Additionally, to develop the Karachaganak oil field, in 1992 the government engaged both the Italian energy company ENI and British Gas. Later, they approached Gazprom, the owner of the Orenburg oil network. Then, Gazprom transferred its stakes to Lukoil in 1997. At this time, China, through the Chinese National Petroleum Corporation (CNPC), also tapped into the Kazakhstani energy sector by acquiring a 60% stake in a local natural gas producer—AktobeMunayGas. Some European enterprises also entered Kazakhstan to develop its electricity grid, but national leadership later reversed private ownership in the power sub-sector to state control in the name of national security. In 1994, the Kazakhstani government formed an international consortium, in which the state-owned KazakhstanCaspiyShelf collaborated with six major international oil companies, including Total, Mobil, BP/Statoil, Shell, Agip (acquired by ENI in 2003), and BG. In 1997, Kazakhstan signed production-sharing agreements (PSA), with each company receiving equal stake.

The top export destination for Kazakhstan is China. Kazakhstan’s oil exports to China reached 10 billion metric meters in 2015. China’s economic growth, however, is currently on a downward turn and with this its demand for oil, affecting Kazakhstan’s economy. The publication by Guardian (2017) stated that China, as the leading importer of motor vehicles, plans to ban production of petrol and diesel cars in the near future. British Petroleum Energy Outlook 2019 predicts that China may switch to “low-carbon transport” including bans on sales of all internal-combustion engine cars, increase the share of biofuels, and increase the share of renewables in their energy mix (BP, 2019). Such news is bad for Kazakhstan in terms of having a market for its large output of petroleum. It is likely to affect the flow of oil in the country’s pipeline in the southern region. Additionally, Hardin (2012) notes that China’s unexploited oil reserves could prove substantial in the future and end up competing with Kazakhstan’s oil sector. This chapter, therefore, also explores the alternative avenues of economic growth available for the country, such as the service sector, in order to deter overreliance on ORs to support government expenditure.

Consequently, Hardin (2012) suggests that Kazakhstan ought to continue to pro-actively diversify its economy for stability, as dependence on petroleum alone would be detrimental. There was evidence of this in 2009, when oil prices dropped suddenly. She notes that, currently, ORs account for 35–40% of the state budget and contribute 20% to the country’s GDP.Footnote 7 She further suggests that the expansion of the energy sector is instrumental in driving growth in the wider economy, particularly in the construction sector. Hardin (2012) argues that Kazakhstan can apply its collaboration in the energy sphere to propagate regional cooperation, which it can extend to enforce peace in the area.

Pomfret (2005) discusses some of the reasons for the dismal performance of the Kazakhstani economy during the first decade of independence. First, although Kazakhstan is rich in fossil fuel reserves and mineral deposits, the government under former President Nazarbayev poorly utilized national resources during the first decade of independence. Kalyuzhnova and Patterson (2016) argue that corruption, government ineffectiveness, weak regulatory frameworks, and anarchy reigned supreme during this period. They note that the country scored poorly on the Index of Economic Freedom (IEF) scale, whose ten components rated government performance in terms of regulatory efficiency, rule of law, open markets, and limited government. Second, the social imbalance between major ethnic groups created a politically unstable nation with an uncertain economy. Third, Kazakhstan embraced democracy in an attempt to open up its political and economic space. According to Pomfret (2005), however, the country’s leadership reversed this gain and adopted regressive political tenets, making it less tolerant to divergent political views, even more than the government officials in Russia. Kazakhstan’s fortunes changed in 1996, however, when the country turned its attention to developing its oil fields, which amassed riches for its elite. The economic boom came in the new millennium, as oil prices surged, and the country discovered new oil fields with significant oil and gas deposits. This has attracted the attention of scholars of various disciplines to study development in the Caspian state. To this end, there is a significant volume of literature touching on the country’s natural resource policies (see next sections), but limited literature discussing the influence of natural resource wealth on the socio-economic dynamics in the region.

The Effects of Oil Rents on the Economic Development

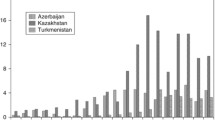

Natural gas and oil have been the primary drivers of rapid economic growth in Kazakhstan during the past two decades. Figure 3.2 shows that the country’s oil rentsFootnote 8 more than quadrupled between 1991 and 2011; however, they have recently dropped to 10% of GDP. As a result, during the period of high oil rents, the nation’s share in the international oil arena rose from only 0.7% to 1.8%, pushing Kazakhstan into position 18 among the world’s oil producers in that year. In some periods, oil and gas accounted for up to 25% of the Kazakhstani GDP and up to two-thirds of the country’s exports, making fossil fuels the single most important export commodity.

Since the Kazakhstani economy relies heavily on oil, with 60% of the government’s revenue from that sector, periods of high oil prices translate into substantial economic performance for the country. On the other hand, price drops result in a slowdown of economic growth. Figure 3.2 illustrates this relationship between oil price fluctuations and the GDP growth of oil-dependent countries such as Kazakhstan, where there was an economic dip in 1998. Similar trends occurred in between 2008 and 2009, and most recently in 2014, when oil prices fell (see Fig. 1.1, Baldakhov & Heim, 2020, this volume). The recent trends also illustrate the inability of an emerging resource-rich country to move out of the middle-income trap.Footnote 9

Recent Economic Development

Research has explored why economic growth in Kazakhstan has slowed significantly. Rahmanov (2016) attributes this decline to the mid-2014 collapse in the price of oil. Additionally, he notes that Kazakhstan’s main trading partners, such as Russia and China, are similarly experiencing a slowdown in their economic performance. Accordingly, growth deceleration started in China in 2011, heralding the era of single-digit GDP growth rates. According to Rahmanov (2016), the slowdown in China is the result of the changes in Chinese economic policy from an export-led and investment-driven approach to the more recent domestic consumption-driven framework. This change in economic policy resulted in a sharp drop in the demand for the raw materials and energy that Kazakhstan supplied to China. After that, the double effects of the United Nations’ sanctions on Russia and the drop in oil prices took a toll on the country’s economic pillars, producing a similar impact in its neighboring country, Kazakhstan. This resulted in a loss of 30% of its export revenues from its two main trading partners, China, and Russia.

The WB (2017), while giving an overview of the country’s economic update, suggests that the Kazakhstani economy continued to suffer from depressed oil prices and weak regional demand for its exports, resulting in a low 1% GDP growth rate in 2016. Consequently, the report notes that the country’s budget deficit widened in the wake of reduced oil production, from US $5.5 billion (3% of the real GDP) in 2015 to US $8.2 billion, equivalent to 6.1% of the GDP in 2016. The report, however, suggests that increased FDI inflows, mainly to expand the energy sector, prevented further negative growth. Borghijs (2017) argues that this latest upturn in economic performance allowed the central bank of Kazakhstan, NBK, to restock its foreign exchange reserves, which it had channeled into stabilizing the local currency, the tenge, for the previous two years. Regarding the latter, the IMF (2015) executive board report notes that the fiscal stimulus which the NBK intended to spur economic growth worsened the country’s budgetary accounts—the country’s fiscal surplus fell from 5% of the GDP in 2013 to just 1.5% in 2014. According to the WB (2017) report, domestic consumption declined considerably in 2016 because of the devaluation of the tenge, resulting in up to 14.6% inflation and denting the purchasing power of local households.

Consequently, the WB suggests that poverty levels, measured by the international rate of US $5 per day, rose to around 20% that year. In phases of lower economic activity, monetary conditions are tight, sharply suppressing lending activity. The report notes, however, that the latest economic trend in Kazakhstan forced the NBK to institute ambitious fiscal reforms aimed at improving the country’s monetary policy model and bank operations. The success of the NBK’s reforms is evident in the reduced number of non-performing loans in Kazakhstani banks (WB, 2017).

These reforms may lead to future economic growth in Kazakhstan; that growth will likely pick up slowly, but remain below pre-2014 levels, when oil prices were robust. The World Bank projects a GDP growth rate of 3% between 2017 and 2019 as the price of oil recovers gradually to US $55–60 per barrel, and oil output from the Kashagan wells begins to increase to offset any lost production from the mainland oil fields. The WB (2017) report notes that, while Kazakhstani export revenues will rise to support the country’s fiscal balance payments and budget deficit, the two balance payments will soon reach a shortfall.

The IMF (2015) report suggests that because of lower oil prices and the dismal economic performance that resulted, Kazakhstan’s external position is presently weak. While assessing the value of the tenge based on the Assessing Reserve Adequacy (ARA) framework, the report finds the NBK financial reserves to be below the acceptable adequacy range of 100–150% of the country’s composite ARA measurement. The report found that the value of the tenge, hinged on two foreign currencies, the rouble and the US dollar, was overvalued by 4–14%. It also notes, however, that the accumulated value of the oil fund (not considered in the ARA assessment)—standing strong at US $75 billion, 35% of the country’s real GDP—cushions the economy in general.

According to Borghijs (2017), the Kazakhstani government instituted a twofold plan to counter the nation’s economic downturn. He notes that, first, to counteract the falling domestic consumer demand, the NBK introduced a stimulus package aimed at developing small and medium enterprises (SMEs) and the banking sector, as well as to improve infrastructure. Second, to bridge its budget deficit, the NBK withdrew money from the National Fund for the Republic of Kazakhstan (NFRK), established in 2001 to stabilize the economy. Additionally, the government borrowed US $2 billion from the World Bank and the Asian Development Bank (ADB) to finance its balance payment shortfalls. The IMF (2015) report suggests that in order not to deplete the NFRK too soon, the government had pursued gradual fiscal consolidation over the succeeding few years.

Third, the government embarked on a radical change in its monetary policy. Because of devaluation pressure on the tenge, in the middle of 2005, the NBK opted to unpeg the value of the tenge to foreign currencies. As a result, the tenge depreciated against the US dollar from an exchange rate of 185 tenge to the dollar in 2015 to as much as 390 tenge in 2016, later appreciating slightly to exchange at around 330 tenge to the dollarFootnote 10 (see Fig. 3.3). Borghijs (2017) observes that interestingly, the tenge mostly trailed behind the rouble exchange rate against the dollar during this floatation, as shown in Fig. 3.3. The effect of the depreciation of the tenge was a high inflation rate and even higher prices of imported goods in the wake of diminished demand.

The Effects of OR on Socio-economic Development

Gilpin and Gilpin (2001)argue that under the influence of the order of global markets, statehood appears to lose its distinction. After the end of the Cold War era, international economic scholarship shifted its focus from nations to markets. Consequently, Sakal (2015) observes that Kazakhstan, which liberalized its market to international players after independence, falls in the same category. He suggests that agendas of liberalization and privatization dominated the Kazakhstani political landscape in the 1990s. In this regard, Ostrowski (2010) notes that the country privatized some mining enterprises, transport systems, and oil refineries to foreign corporations throughout this period. Sakal (2015) further suggests that, even currently, the state continues its quest to integrate into the international market by attracting considerable amounts of FDI for the development of its fossil fuel sector, which is a pillar of the country’s economic growth and requires massive capital injection.

A number of authors noted that developing and emerging resource-rich economies perform more poorly in terms of economic growth and socio-economic development than those counterparts who lack comparable volumes of natural resourcesFootnote 11 (Sachs & Warner, 1995; Stiglitz, 2007; William, 2011; Crivelli & Gupta, 2014). Scholars have emphasized that Kazakhstan also bears significant risk because of the nation’s overreliance on ORs to support its socio-economic development, and suffers from the effects of the Dutch disease (Howie & Atakhanova, 2014). Prior research also established a connection between the country’s currency exchange rate and volatility in oil prices. For example, Kutan and Wyzan (2005) argued that price volatility of raw materials makes management of natural resource revenues difficult and thereby restricts economic growth. Kalyuzhnova and Patterson (2016) explain that the Dutch Disease is a direct product of an appreciation of a national currency because of a boom accruing from exports of natural resources; in turn, the result is the shrinking of production and the manufacturing sectors in an economy. They assert that the findings from the Jahan-Parvar and Mohammadi (2011) study, as well as the Sachs and Warner (2001) research, demonstrate this principle. The Gylfason (2001) study explains the mechanisms that link natural resource revenues to low economic growth rates, such as low levels of human capital, rent seeking, the Dutch disease, and government mismanagement (Kalyuzhnova & Patterson, 2016).

Some authors consider natural resources to be the engine that propelled economic growth (i.e., Stevens, 2003). They note those additional subsequent studies by scholars such as Lederman and Maloney (2007), Stijns (2005), and earlier research by Maloney (2002), which measured reserves per capita or net resource export by every worker, established the positive effect of natural resources on real GDP growth. Nevertheless, among the oil-rich emerging and developing nations examined, only Malaysia, Botswana, Thailand, and Indonesia managed a GDP growth rate of at least 4% along a long-term horizon (Gylfason, 2001). According to Ploeg (2011), the difference between the four oil producers and their underperforming counterparts rested in the economic policies instituted by their governments, particularly in industrialization and economic diversification. Fasano (2000) notes that the United Arab Emirates exemplify an explicit example of an economic diversification policy by using their fossil fuel revenues to improve the living standards of their citizens, especially in social sectors like education, health, and infrastructure improvement.

According to Gylfason (2001), the natural resources sector employs less human capital compared to an industry such as production or manufacturing. He argues that an economy that relies on natural resources for economic growth ought to institute significant diversification policies because the natural wealth becomes increasingly depleted over time. A Director of the Asia and Pacific Department of the IMF suggests (Singh, 2013):

for inclusive growth in addition to the wise use of the resources it is imperative that backward and forward linkages are developed between the natural resource sector and the wider economy. Achieving this objective involves financial sector deepening, building infrastructure , enhancing human capital, and promoting the agricultural sector.

Kalyuzhnova and Patterson (2016) propose that Kazakhstan’s government uses its Ministry of Gas and Oil, which manages the fossil fuel sector, to operate the country’s energy policy. They note that the basis of the state’s energy policy is sustainable economic development, sound environmental practices, promotion of accountability, and adoption of modern technologies to attract maximum FDI.

Successful stories of resource-led economies, such as Finland, Sweden, Norway, Canada, and the UK, can be attributed to strong public institutions and a lower level of corruption. Well-managed government institutions enact sound policies, which help manage natural resource revenues for overall economic development. As a rule, strong institutions are necessary for robust socio-economic performance, but weak public institutions exert an adverse effect on economic growth (Kalyuzhnova & Patterson, 2016).

ORs drained to a centralized institution increase the efficiency of reallocation through economies of scale and stabilize the economy against external shocks (Kendall-Taylor, 2011). Najman et al. (2005) suggested that the distribution system in resource-rich countries can be organized in three ways. First, “official public redistribution” comprises of revenues and taxes that stem from oil exports that the government shares locally, including financial transfers to the NFRK. Second, “company redistribution” includes direct, indirect, and induced incomes, which the oil companies spend or invest locally. This type of revenue is critical in diversifying regional economies. For the OR to benefit more people in the oil-producing regions,Footnote 12 it must generate large indirect employment and social programs, since oil companies directly employ only a small number of workers. The third type of OR redistribution, the “unofficial redistribution,” reflects two factors at play: informal individual household undertakings created from small businesses and self-employment (usually not declared) and corrupt applications (transacted in secrecy).

Although the inflow of oil incomes accelerated the economic development of the most peripheral regions of Kazakhstan, some regions still experienced little sustainable economic growth (see Fig. 3.4).

Kalyuzhnova and Patterson (2016) noted that the fact that oil-producing western areas remain mainly in poverty is particularly surprising, despite several cycles of oil boom.

The Most Recent Socio-economic Reforms

According to the WB (2017) economic update on Kazakhstan, former President Nazarbayev enacted broad political reforms aimed at creating a balanced political system in the country in the first quarter of 2017. The report notes that through a constitutional amendment, the office of the president retained most of the critical functions of influencing policymaking decisions, while the office shared part of that power with both parliament and the executive arm of the government. The WB (2017) report notes that the presidency retained its strategic roles, such as commanding security and defense functions, but transferred socio-economic policy management to the other two arms of the government. The report observes that the constitutional amendment also moved the role of creating or dissolving government agencies and approving state programs from the President to the Cabinet. The new changes similarly empowered the lower house of parliament to exercise its powers in the hiring or firing of the cabinet (WB, 2017). The report further suggests that the former president also pledged more authority to local governments.

Termed Modernization 3.0, these reforms intended to trigger an economic revolution of Kazakhstan (WB, 2017). According to Borghijs (2017), the sweeping changes were targeted at making the state competitive internationally and place it in the ranks of the top 30 leading economies of the world by 2050. He suggests that economic agenda prioritized five critical areas in its push for economic transformation of the country. First, the plan aimed to modernize the Kazakhstani economy by accelerating technology adoption. Second, these changes are expected to improve the ease of doing business in the nation. Third, the reforms were targeted at increasing the country’s macroeconomic stability. Fourth, restructuring meant a higher quality of Kazakhstan’s human resources. Finally, these transformations sought to strengthen the state’s national security, domestic institutions, and anti-corruption efforts.

Strategy 2050

The WB (2017) report indicates that Kazakhstan is overcoming its economic challenges in the short term. The report, however, also suggests that the state faces a daunting task in the long run in diversifying its economy beyond dependency on fossil fuel revenues. To achieve the goal of becoming one of the top 30 most advanced economies of the world, diversification of the economy is necessary. From this perspective, recent key initiatives in Kazakhstan, namely Strategy 2050, as well as the country’s Nurly Zhol and the One Hundred Concrete Steps , aimed at modernizing Kazakhstan, are of particular interest.

Borghijs (2017) argues that Kazakhstani leadership knows of the ominous challenge the country faces in its quest for radical economic growth. He suggests that this understanding drove the country to develop its Strategy 2050 Program in 2012. The implementation of this plan is a crucial measure of success in the wake of the economic downturn in the state. He suggests that some of the areas of focus in this strategy could include the expansion of sectors driven by high local demand, such as building and construction, machinery assembling, development of pharmaceutical industries, production of construction materials, and promoting industries that bring foreign exchange, including tourism, light industries, and agribusiness. Additionally, the strategy aims to encourage innovation in such vital industries as information technology, communication, clean energy technologies, and biotechnology (Borghijs, 2017).

Nurly Zhol

According to the WB (2017) report, this modernization program, which is intended to compliment the country’s long-term strategy, consists of an infrastructure improvement undertaking at the cost of the US $15 billion between 2015 and 2020 periods. The report suggests the infrastructure investments aimed at improving connectivity in this landlocked state are not only in the transport sector but further cover other areas, such as logistics, energy, industry, and utilities (i.e., heating and water systems). Additionally, the report observes that investments also include those oriented toward the growth of the SME sub-sector.

Chin (2016) argues that the ADB study on meeting the infrastructural development needs of the Asian continent forms the basis of the Nurly Zhol initiative. He notes that the ADB study estimated infrastructure requirements for central Asian countries in the 2016–2030 period is 7% of the real national GDP, which translates to about US $500 billion. Borghijs (2017) observes that for Central Asia to meet this goal, individual states must make substantial investments in their infrastructure improvement. Consequently, he suggests that Kazakhstan needs to collaborate with various international financial institutions, including the ADB, to raise necessary capital to finance its long-term goals. In this regard, from 1994 to date, Kazakhstan’s borrowed amount from the ADB stands at US $4.4 billion. Chin (2016) notes that the nation uses the ADB loans to finance various infrastructure developments, such as transport route networks, boosting national energy security, supporting the growth of the private sector, and supplementing social security.

The One Hundred Concrete Steps Concept

Launched in 2015, the One Hundred Concrete Steps concept encompasses a wide-ranging set of institutional reforms that includes promoting a professional civil service, strengthening the country’s regulatory structure, promoting accountability, transparent government financial management, and improving the administration of public enterprises. The Kazakhstani government is now expected to play a regulatory role in setting targets for the privatization of state-owned businesses between 2016 and 2020. The aim is to promote private sector participation in the economy, enhance efficiency, and reduce state contributions to just 15% of the GDP by transferring its stake into 65 large public enterprises that encompass the postal service, railway network, airports, and Air Astana. The state also took bold steps to promote a business-friendly environment in the nation by making it easier to get electricity, start a business, trade across borders, acquire construction permits, resolve insolvency, and increase protection for small and medium investors. These steps have led to Kazakhstan’s ranking increasing to 35 in 2017 from 51 in 2016, as per the Ease of Doing Business Report by the WB.

Conclusion

Since the 1990s, oil production in Kazakhstan has increased tremendously, turning oil into the most critical commodity to support the growth of the country’s economy. However, this study finds that Kazakhstan’s quest to be among the top 10 oil-exporting countries has yet to bear fruit, as the state currently occupies the 12th position among the leading oil exporters in the world (OPEC, 2018). After its declaration of independence and starting the process of privatization of public enterprises, Kazakhstan redesigned its economic structure from a Soviet-era industrial style. In this process, it became a booming economy in terms of oil. Currently, the oil sector contributes about 35% of Kazakhstan’s export income and up to 20% of the country’s budget expenses. These numbers translate into almost 6.5% of the real national GDP. To this extent, Kazakhstan’s government seeks to strengthen the oil sector’s role in the economy in the next few decades, as established through its radical reforms. As a result, the government tripled the nation’s oil production within a span of twenty years, from 475 thousand barrels a day in 1998 to more than 1.5 million barrels a day in 2018. The country is further increasing its oil output by developing the Caspian wells.

FDI inflows into Kazakhstan rose significantly in the new millennium to support the growth of the oil and energy sectors; however, though the oil sector generates substantial revenues, it contributes less to employment opportunities. This brings us to the role of the policies concerning the redistribution of ORs and how the energy sector in Kazakhstan is governed. The government’s Modernization 3.0 policy strategy intends to initiate an economic insurgency by aiming to turn Kazakhstan into an internationally competitive economy. Through this initiative, Kazakhstani leadership hopes that by 2050, their state will be among the top 30 economies of the world. The current transformative economic agenda targets five strategic areas. The first strategy aims to modernize the national economy through fast-tracking technological acceptance. The second policy expects to create a business-friendly environment to promote the growth of the private sector. The third plan targets increasing the stability of the macroeconomic environment to attract more FDI inflows into Kazakhstan. The fourth strategy, on the other hand, aims to restructure the quality of Kazakhstan’s human resources by promoting education for all. Finally, the recent policy change has the aim to transform the state’s institutions to encourage accountability, good governance, national security, and anti-corruption measures. To this end, Kazakhstan still needs to put more effort into diversifying its economy and bringing market forces into play.

Notes

- 1.

The third stage of modernization in Kazakhstan. Announced on January 31, 2017, by the former President Nazarbayev. More details about this strategic initiative in the paragraphs below.

- 2.

The income that a government accrues from taxation and duties (both customs and excise duties) collected for servicing the public expenditure.

- 3.

Uzbeks, Ukrainians, and Germans are minority groups.

- 4.

Resulting in default of the Russian State in August 1998.

- 5.

Former President Nazarbayev served as President of Kazakhstan since the office was established in 1990 (28 years ago). The institution of the presidency plays an important role in the political system of Kazakhstan; that is why the president initially announces all significant initiatives.

- 6.

Russian financial crisis (Russian Default) hit Russia on 17 August 1998. It resulted in the Russian government devaluing the rouble from about US $6 up to US $24 during several months. The reasons for it were internal, such as declining productivity, high fixed exchange rate, and chronic fiscal deficit in combination with two external chocks—1997 Asian financial crisis and declining oil prices.

- 7.

GDP is the value of the total goods produced and services delivered in a particular nation for one year.

- 8.

Oil rents refers to the profit before tax or royalties of oil exploration. Taxes and royalties are paid by oil companies to the state where the oil exploration takes place.

- 9.

Middle-income trap is a term describing the failure of the country to sustain growth and transit from resource-driven growth, based on low-cost labor and capital, to productivity-driven growth (Khakas & Kohli, 2011).

- 10.

Current exchange rate is 390 tenge to US $1 (1 December 2019).

- 11.

The O&G industry dominating economy suppresses economic growth and often resource-rich countries are unable to use wealth to develop their economies and have therefore lower economic growth than expected, even lower than natural resource-scarce economies (Sachs & Warner, 1995). This phenomenon has been called a “paradox of plenty” or “resource curse.”

- 12.

Aktobe, Kyzylorda, and the Caspian Sea, later including WKO, Atyrau, and Mangystau.

Bibliography

Baldakhov, U., & Heim, I. (2020). Institutional reform in Kazakhstan. In I. Heim (Ed.), Kazakhstan’s diversification from the natural resources sector: Strategic and economic opportunities. London, UK: Palgrave Macmillan.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Borghijs, A. (2017). Kazakhstan aiming for the top 30. Retrieved from: https://www.jbic.go.jp/wp-content/uploads/reference_en/2017/03/54472/20170323_seriesMacroKAZ.pdf

British Petroleum (BP). (2019). Energy outlook. Retrieved from BP web-site: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2019.pdf

Chin, G. T. (2016). Asian Infrastructure Investment Bank: governance innovation and prospects. Global Governance: A Review of Multilateralism and International Organizations, 22(1), 11–25.

Coase, R. H. (1937). The nature of the firm. Economica, 4(16), 386–405.

Coase, R. H. (1972). The firm, the market and the law. Chicago, IL: University of Chicago Press.

Crivelli, E. & Gupta, S. (2014). Resource blessing, revenue curse? Domestic revenue effort in resource-rich countries. IMF Working Paper. Retrieved from IMF web-site http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.434.7256&rep=rep1&type=pdf

Fasano, U. (2000). Review of the experience with oil stabilization and saving funds in selected countries. IMF working paper. Washington: International Monetary Fund, pp. 3–19. Retrieved from https://www.imf.org/external/pubs/ft/wp/2000/wp00112.pdf

Gilpin, R., & Gilpin, J. (2001). Global political economy – Understanding the international economic order. Princeton, NJ: Princeton University Press.

Gylfason, T. (2001). Natural resources and economic growth: What is the connection? CESifo working paper. Retrieved from: http://hdl.handle.net/10419/75741

Hardin, K. (2012). Kazakhstan’s energy sector since independence: Two decades of growth and challenges ahead? Retrieved from: https://www.files.ethz.ch/isn/136798/012712_ACUS_Eurasia_Hardin.pdf

Heim, I., & Romanov, M. (2020). The oil and gas industry in Kazakhstan’s investment regimes. In I. Heim (Ed.), Kazakhstan’s diversification from the natural resources sector: Strategic and economic opportunities. London, UK: Palgrave Macmillan.

Howie, P., & Atakhanova, Z. (2014). Resource boom and inequality: Kazakhstan as a case study. Resources Policy, 39, 71–79.

IMF. (2015). Republic of Kazakhstan – 2015 Article IV consultation – Press release; staff report for the republic of Kazakhstan. Retrieved from IMF web-site: https://www.imf.org/external/pubs/ft/scr/2015/cr15241.pdf

Jahan-Parvar, M., & Mohammadi, H. (2011). Oil prices and real exchange rates in oil-exporting countries: A bounds testing approach. The Journal of Developing Areas, 45(1), 309–318.

Kalyuzhnova, Y., & Patterson, K. (2016). Kazakhstan: Long-term economic growth and the role of the oil sector. Comparative Economic Studies, 58(1), 93–118.

Kendall-Taylor, A. (2011). Instability and oil: How political time horizons affect oil revenue management. Studies in Comparative International Development, 46(3), 321–348.

Khakas, H., & Kohli, H. (2011). What is the middle-income trap, why do countries fall into it, and how can it be avoided? Global Journal of Emerging Market Economies, 3(3), 281–289.

Kutan, A., & Wyzan, M. (2005). Explaining the real exchange rate in Kazakhstan, 1996–2003: Is Kazakhstan vulnerable to the Dutch disease? Economic Systems, 29(2), 242–255.

Lederman, D., & Maloney, W. (2007). Natural resources, neither curse nor destiny. Palo Alto, CA: Stanford University Press.

Maloney, W. (2002). Missed opportunities: innovation and resource-based growth in Latin America. Economia, 3(1), 111–167.

Moe, T. M. (1984). The new economics of organization. American Journal of Political Science, 28(4), 739–777.

Najman, B., Pomfret, R., Raballand, G., & Sourdin, P. (2005). How are oil revenues redistributed in an oil economy? The case of Kazakhstan. Adelaide, SA: University of Adelaide, School of Economics. Retrieved from http://www.economics.adelaide.edu.au/research/papers/doc/wp2005-18.pdf

Nelson, R. R., & Winter, S. G. (1982). The Schumpeterian trade-off revisited. American Economic Review, 72(1), 114–132.

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge, UK: Cambridge University Press.

North, D. C. (1994). Economic performance through time. American Economic Review, 84(3), 359–368.

O&G Journal. (1991). First Tengiz oil well placed on production. June 03, 1991. Retrieved from https://www.ogj.com/articles/print/volume-89/issue-22/in-this-issue/general-interest/first-tengiz-oil-well-placed-on-production.html

OPEC (2018). OPEC Bulletin 2018. Retrieved from https://www.opec.org/opec_web/en/publications/202.htm

Ostrom, E. (1990). Governing the commons. New York, UK: Cambridge University Press.

Ostrom, E. (2005). Understanding institutional diversity. Princeton, NJ: Princeton University Press.

Ostrowski, W. (2010). Politics and oil in Kazakhstan. London, UK: Routledge.

Peng, M. M. (2003). Institutional transitions and strategic choices. Academy of Management Review, 28(2), 275–296.

Peng, M. M., & Meyer, K. E. (2016). International business. London, UK: Sengage Learning.

Penrose, E. T. (1959). The theory of the growth of the firm. Oxford, UK: Basil Blackwell.

Ploeg, F. (2011). Natural resources: Curse or blessing? Journal of Economic Literature, 49(2), 366–420.

Pomfret, R. (2005). Kazakhstan’s economy since independence: Does the oil boom offer a second chance for sustainable development? Europe-Asia Studies, 57(6), 859–876.

Rahmanov, R. (2016). Permanent and temporary oil price shocks, macroeconomic policy, and tradable non-oil sector: Case of Azerbaijan, Kazakhstan, and Russia. In Proceedings of annual conference of the Bilateral Assistance and Capacity Building for Central Banks (BCC) (pp. 1–21). Central Bank of the Republic of Azerbaijan. Retrieved from: https://www.cbar.az/assets/4321/WP-series-09_2016.pdf

Sachs, J., & Warner, A. (2001). Natural resources and economic development – The curse of natural resources. European Economic Review, 45(1), 827–838.

Sachs, J., & Warner, A. M. (1995a). Natural resource abundance and economic growth. NBER working paper series. Working paper 5398. Cambridge, UK: National Bureau of Economic Research.

Sakal, H. B. (2015). Natural resource policies and standard of living in Kazakhstan. Central Asian Survey, 34(2), 237–254.

Scott, W. R. (2014). Institutions and organizations. Thousand Oaks, CA: Sage.

Singh, A. (2013). Harnessing natural resource wealth for inclusive growth and economic development. In Conference on harnessing natural resource wealth for inclusive growth and economic development. International Monetary Fund.

Stevens, P. (2003). Resource impact-curse or blessing? Investment Policy, 22, 5–6.

Stiglitz, J. E. (2007). In M. Humphreys, J. Sachs, & J. E. Stiglitz (Eds.), Escaping the resource curse (pp. 23–52). New York, NY: Columbia University Press.

Stijns, J.-P. C. (2005). Natural resource abundance and economic growth revisited. Resources Policy, 30(2), 107–130.

The Guardian. (2017). China to ban production of petrol and diesel cars in the near future. Retrieved from: https://www.theguardian.com/world/2017/sep/11/china-to-ban-production-of-petrol-and-diesel-cars-in-the-near-future

Vargo, S. L., & Lusch, R. F. (2016). Institutions and axioms: an extension and update of service-dominant logic. Journal of the Academy of Marketing Science, 44(1), 5–23.

WB. (2005). Republic of Kazakhstan – Getting competitive, staying competitive: The challenge of managing Kazakhstan’s oil boom. Retrieved from the WB web-site http://siteresources.worldbank.org/INTKAZAKHSTAN/Resources/CEMengApril27.pdf

WB. (2017). Kazakhstan – The economy has bottomed out: What is next? Country economic update. Retrieved from WB web-site: http://documents.worldbank.org/curated/en/585891494402103086/pdf/114856-9-5-2017-20-39-19-KAZCEUclearedforpublication.pdf

William, A. (2011). Shining a light on the resource curse: an empirical analysis of the relationship between natural resources, transparency, and economic growth. World Development, 39(4), 490–505.

Williamson, O. E. (1981). The Economics of Organization: the transaction cost approach. The American Journal of Sociology, 87(3), 548–577.

Williamson, O. E. (2000). The new institutional economics: taking stock, looking ahead. Journal of Economic Literature, 38(3), 595–613.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter

Heim, I., Salimov, K. (2020). The Effects of Oil Revenues on Kazakhstan’s Economy. In: Heim, I. (eds) Kazakhstan's Diversification from the Natural Resources Sector. Euro-Asian Studies. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-37389-4_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-37389-4_3

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-37388-7

Online ISBN: 978-3-030-37389-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)