Abstract

This chapter explores how social capital influences the sustainability of family businesses over generations. In a volatility-uncertainty-complexity-ambiguity (VUCA) world, relationships and networks become more and more important. Although social capital is accumulated over time and not easily transmitted, its transfer to the next generation must be a top priority in every family business. A qualitative method of data analysis was used to better understand the process and the mechanisms through which social capital and the firm’s relationships are transferred in intra-family succession.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

Introduction

Family-owned businesses (FOBs) are the most frequently encountered business models in the world accounting for nearly 70% of the global GDP (Osunde, 2017). In Europe, 14 million FOBs provide over 60 million jobs. In many countries, they account for 55% to 90% of all companies (KPMG Enterprises, 2015). Given these significant figures, the importance of FOBs in European economies is preeminent.

With Europe’s aging population, more and more FOB leaders will retire in the coming years, making succession a relevant topic. In France, for instance, 20% of SMEs managers are 60 years old or older whereas they were only 13% in 2000 (Nougein & Vaspart, 2017). As a result, many FOBs will change hands in the next ten years. Because of the sustainable orientation of FOBs, the strong desire to preserve the family character of the business, to keep the control over the company within the family and to respect the legacy of previous generations, most of the incumbents intend to transmit the family business to younger members of the owning family (Deloitte, 2016).

A well-known challenge, however, is that only few FOBs succeed in their succession over time and ensure sustainable competent family leadership across generations (Le Breton-Miller, Miller, & Steier, 2004). Succession of ownership and management to the next generation is therefore one of the main concerns that FOBs face (Handler, 1992). It is a greater concern for FOBs than for nonfamily companies because the process includes more emotional elements, a higher potential for intergenerational conflicts and a smaller pool of talent on which to bet (Le Breton-Miller et al., 2004).

Although most of the family business leaders rank succession as one of the most important subjects on their minds, over 40% of them admit that they have not sufficiently prepared their succession during the past decade (Bhalla & Kachaner, 2015). However, poorly planned successions may have severe consequences for the business. It has been observed that recurring causes of business failure come from “business incompetence” because of a lack of knowledge and preparation (Chirico & Laurier, 2008). Mazzola et al. (2008) and Sharma (2004) state that the successor must have developed some fundamental characteristics when he or she takes over the company, among which business and industry knowledge is often tacit (Cabrera-Suárez, De Saa-Perez, & Garcia-Almeida, 2001; Steier, 2001). The successor must also have developed several abilities, like decision-making and interpersonal skills (Chrisman et al., 1998). Equally important are not only the legitimacy and the acquired credibility from both family and nonfamily stakeholders (Barach et al., 1988; Steier, 2001) but also the networks and social capital (Steier, 2001).

Although family business succession across generations has been discussed in the literature for a long time (Sharma, 2004), little attention has been devoted to the transfer of social capital and networks across generations (e.g. De Freyman et al., 2006; Steier, 2001). Yet, many strategic advantages lie in the social capital and relationships that the firm has nourished and is able to keep over time (Steier, 2001). In the current new economy, much of the value resides indeed in business networks (Steier, 2001). Social capital is an asset which is not easily transferred, and Malinen (2001) highlights that the transfer of the tacit knowledge and networks of contacts is a central concern of incumbents. Consequently, the purpose of the present chapter is to answer to this need and to offer insights about the way social capital and networks outside of the firm can be transferred across generations.

Theoretical Background

We define a family-owned business (FOB) as “a business governed and/or managed with the intention to shape and pursue the vision of the business held by a dominant coalition controlled by members of the same family or a small number of families in a manner that is potentially sustainable across generations of the family or families” (Chua et al., 1999). Every transition process usually includes changes on the management level and changes on the ownership level (KPMG Enterprises, 2017). Our analysis focuses only on the change on the management level. The person transmitting the leadership at the top management position is called the incumbent whereas the member of the next generation onto whom leadership is being transferred is called the successor. We refer to successors who are family members (by blood or by law). While in nonfamily businesses the management is separated from the leader’s private life, in FOBs the systems of family and business overlap, and thus create unique challenges. In addition to the leadership, the successor must juggle his or her own goals with the values and objectives of the owning-family’s aspirations (Bernhard, 2018; Bhalla & Kachaner, 2015).

Succession Process

It is important to understand succession in FOBs as a process rather than an isolated event (Handler, 1990), which needs to be planned long in advance (Lansberg, 1988; Sharma et al., 2001; Ward, 1987). Succession is indeed a complex process with four distinct phases (initiation, integration, joint reign and withdrawal) (Cadieux, 2007) during which the incumbent has to plan both equity transfer and the transfer of less tangible considerations like power, knowledge, skills, legitimacy and credibility to the successor (Le Breton-Miller et al., 2004; Mazzola et al., 2008). It is noteworthy to mention that the succession process is based on a mutual understanding between the incumbent intending to transmit leadership of the FOB and the (or more) successor(s) intending to take over (Cabrera-Suárez et al., 2001; Bernhard et al., 2017; De Freyman & Richomme-Huet, 2010). During this process, Handler (1994) outlines that the roles of the incumbent and successor evolve and adjust over time (see Fig. 9.1). The incumbent evolves indeed from the role of monarch over delegator to consultant whereas the successor evolves from helper over manager to leader.

Mutual role adjustment between predecessor and next-generation family member(s) (Source: Adapted from Handler [1994])

As emphasized by Handler (1994), the last two stages of this role transition are the most critical to effective successions. It is during these pivotal phases that a good preparation of the next generation becomes most apparent (Tatoglu, Kule, & Glaister, 2008).

An early start in the preparation of the successor to run the business is key (Bhalla & Kachaner, 2015; Nougein & Vaspart, 2017). On top of that, an early preparation enables the owning-family to protect themselves from unexpected incident hazards like illness or death of involved actors (De Massis et al., 2008). Lastly, it is important to ensure that potential successors have an early exposure to the business. Indeed, the sooner the successor gains experience with the business, the better the incumbent can help him or her to get familiarized with essential business elements and assist in a progressive transfer of tacit knowledge (Bhalla & Kachaner, 2015; Cabrera-Suárez et al., 2001; Goldberg, 1996; De Massis et al., 2008). An early exposure will indeed enable the successor to build relationships with key suppliers, lenders and customers; to build his/her credibility within the company and to understand the culture and insights of the family business (De Massis et al., 2008). Therefore, as suggested by Goldberg (1996), successors with extensive prior experiences within the FOBs tend to be more successful than late entrants.

Knowledge Transfer

Knowledge is a key strategic resource of FOBs. Some authors even quote it as the most valuable asset that a firm possesses (Chirico & Laurier, 2008). The effective transmission of this knowledge to the successor is therefore an important aspect in sustainable FOBs’ succession (Cabrera-Suárez et al., 2001). Knowledge, which acts as an “enabler of longevity” (Chirico & Laurier, 2008), can be quickly defined as know-what, know-how, know-why and know-who (Malecki, 1997). Nevertheless, it is essential to differentiate between pure knowledge, that is, the theoretical principles acquired through education and academic courses, and skills (or tacit knowledge), which is the ability to carry out an activity by using and leveraging the accumulated pure knowledge (Chirico & Laurier, 2008). The former can be transmitted quite easily using text books, manuals and so on. The transmission of the latter to the successor is a greater challenge for FOBs because it is not tangible and highly personal, and it often needs to be experienced and practiced over time through training, face-to-face interactions, participation in activities and so on (Chirico & Laurier, 2008). Although the pure knowledge acquired outside of the company is important, it is the sharing of inside knowledge which will ensure the next generation to understand the ins and outs of the business. Therefore, the large amount of firm-related tacit knowledge that the incumbent has accumulated over time (Lee et al., 2003) is a source of competitive advantage for the family business and the successor’s ability to acquire the incumbent’s key skills and network of contacts is one of the main challenges in the preparation of the next generation to take over the company to ensure its continuity and its competitive edge (Cabrera-Suárez et al., 2001). Malinen (2001) finds that the transmission of their tacit knowledge and networks of contacts to the successor was one of the main incumbent’s concerns.

Social Capital Transfer

The literature emphasizes the importance of developing the successor’s relationships with key stakeholders, essentially with the incumbent (Cabrera-Suárez et al., 2001; Goldberg, 1996; Venter et al., 2005) but also with other family members, employees of the company (Bernhard & O’Driscoll, 2011; Sieger et al., 2011) as well as key customers and suppliers. The accumulation of an FOB’s social capital, also known as “relational wealth” (Steier, 2001), can become a valuable resource if managed properly (Adler & Kwon, 2002; Baron & Markman, 2000; Steier, 2001).

Social capital is defined as “the resources individuals obtain from knowing others, being part of a social network with them, or merely from being known to them and having a good reputation” (Baron & Markman, 2000). In a nutshell, social capital “involves the relationships between individuals and organizations that facilitate action and create value” (Adler & Kwon, 2002; Hitt & Ireland, 2002).

Adler & Kwon (2002) differentiate between two kinds of social capital, i.e. bridging and bonding. Bridging focuses on external relations, which are outside of the company, whereas bonding focuses on internal ties within the organization. Our analysis will concentrate on the bridging of social capital, that is, the creation and maintenance of external relationships of the family business. A specifically interesting aspect is the question of how these relationships can be transferred during an intra-family succession process.

Many authors acknowledge that social capital is an asset, which is accumulated over years and which cannot be easily transmitted (Adler & Kwon, 2002; Steier, 2001). Nevertheless, nowadays, much of the firm value does not lie in physical capital but rather in intangible capital such as business networks (Steier, 2001). Indeed, abundant social capital is likely to lead to a better access to information, better cooperation, trust from others and easier access to economic resources such as loans, protected markets or investment tips (Baron & Markman, 2000; Nahapiet and Ghoshal, 1998; Steier, 2001). In their study, Adler & Kwon (2002) also point out that social capital strengthens supplier relations, regional production networks and interfirm learning. Social capital can thus offer many benefits for the FOB.

As every FOB is immersed in a specific social context, the involved actors are embedded in several preexisting relationships (Steier, 2001) and the ability to handle them is a top priority for the sustainability of the family business. Nevertheless, it is important to keep in mind that networks are not one-sided and that without reciprocity, the relationships will depreciate over time (Adler & Kwon, 2002). Although social capital is an intangible asset, the literature argues that it can be transmitted to the next generation. As every company is embedded in a social context, the incumbent is included in a vast network of preexisting relationships that the company has built over years (Steier, 2001). One of the main goals of the successor is to understand these various networks and become a full player within this social context.

Steier (2001) identifies four situations differing in the transfer of social capital to the successor: (1) sudden succession, (2) rushed succession, (3) natural immersion and (4) planned succession. Sudden successions often appear because of unforeseeable events such as the death of the incumbent (De Massis et al., 2008), whereas rushed succession happens when circumstances force both the incumbent and the successor to make rapid decisions about the future of the FOB, such as the serious illness of the incumbent (Steier, 2001). Natural immersion is a smoother way to transmit the FOB’s social capital. In fact, the successor has time to gradually discover the network structure and relationships with key suppliers, key contacts and others. In this situation, the successor gradually starts expanding roles across functions over time, doing the incumbent’s job, and he or she is gradually being transferred the decision-making power. In a planned succession, the incumbent recognizes the importance of the social capital for the FOB and makes a long-term effort to transmit the asset to the successor (Steier, 2001). Steier (2001) argues that the incumbent should first include the successor within his or her social capital, and then later let him or her make their own decision about the relationship they want to keep and/or develop.

Given the importance of social capital in family businesses (Adler & Kwon, 2002; Steier, 2001) and the relatively little attention given to the subject in the literature (Sharma, 2004), we focus on the transfer of social capital and social networks outside the firm to understand the processes through which FOB’s relationships and networks are transmitted.

Empirical Study

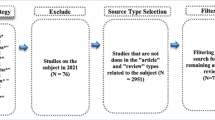

Using an exploratory qualitative approach (Eisenhardt, 1989; Yin, 2014), the interviewees in the study were all members of the next generation, to whom the family business was transmitted by the previous generation. Every interviewee experienced a smooth gradual succession or natural immersion in the sense of Steier (2001). Most of the successors entered the business after studying and getting an experience outside of the company. Their initial motivations were quite different, but they started by acquiring a low-level or medium-level management position, and they gradually reached the upper echelons, getting more and more responsibilities to run the business. All of the interviewees have worked closely with the incumbent, who was in charge of the transfer of management across generations.

The interviews were held in French or German and then translated into English. The work of translation has been meticulously realized in order to avoid bias in the interpretations of the specificity of the language and context. At the beginning of each interview, general questions were asked about the business, the history of the family business, the shareholders and the processes through which the participants were transferred the family business. Then the interviewees were specifically asked questions about the FOB’s various social networks and key relationships and the way by which these relational assets had been transferred to them.

The participants were identified through personal contacts. Four family businesses participated. During the initial contact, they were briefly explained the concept and the goal of the study. All but one agreed to schedule a slot for an interview. The one who did not accept reported a lack of time because the succession had just taken place. All the FOBs interviewed were operating in the food industry. The participants wished to remain unnamed, that’s why they are anonymized and displayed by their participant index number (P_#).

FOB 1 produces Alsatian wine and markets it all over the world. The FOB was founded in 1865. Participant 1 (P_1) belongs to the fifth generation of the family business which he took over in 1999 from his father. The company has changed a lot during the last 153 years. The incumbent reported that each generation is different and has played a part in the building of the family business.

FOB 2 is a Germany-based producer of food packaging founded in 1928. Participant 2 (P_2) represents the fourth generation of the family business and she took over the company in 2018, after joining it in 2009. Her father retired in 2009 and he hired an external CEO, because his daughter was not ready to handle a CEO position yet. During these last years, the contract of the external CEO was coming to an end, and it was decided that Participant 2 will take over.

FOB 3, founded in 1938, is an Alsace-based company producing Sauerkraut. Participant 3 (P_3) represents the fourth generation of the family business. Today the capital is equally divided between the four shareholders: the Participant 3, the participant’s father, the participant’s godfather and his cousin. Since the previous year, they operate under the “Pact Dutreil,” which is a French legal plan to ease the patrimonial transmission, given that each of them engages to work in the company for the following six years. Today, the company is consequently run by these four shareholders, so the transmission is still in progress. In 2023, the family business is likely to be run by Participant 3 and his cousin.

FOB 4 is Alsace-based and specialized in the coffee roasting since 1926. Today, all the shareholders are within the family. Participant 4 (P_4) belongs to the third generation of the family business. His father was appointed Managing Director in 1977 and President in 1987. The participant entered the family business in 2003, after a career in the purchasing department of various companies, and he took the FOB’s presidency in 2009, when his father retired. Participant 4 works with his sister, who is in charge of all the legal aspects regarding the family business (Table 9.1).

The transcribed interviews were coded, following an open-coding methodology (Strauss & Corbin, 1990). Key concepts were identified by making cross-transcript comparisons and organizing the data into distinct categories. Main focus was to identify the different steps through which the social capital was transferred to the next generation. The coding analysis was led by the interview protocol, which in a systematic way asked the participants about their own experience of succession, and especially the way they had received social capital. Similarities and differences of each process were compared, and the results were organized into broader and concrete categories. Existing concepts were used to offer a framework, explaining the whole process of transfer of external social capital across generations in family businesses.

Research Findings

The findings section illustrates the importance of social capital within family businesses and identifies the key stakeholders engaged. Furthermore, the various steps through which social capital is transferred across generations, from the incumbent’s introduction of the successor to the effective management of social capital, are highlighted.

The Importance of Relationships in FOBs

Overall, the participants of the study emphasized the importance of social capital to their family business, and each participant highlighted the significance of relationships in their day-to-day activities.

P_1: “Relationships are key in the business.”

Social networks have consequently a high value in the eyes of the interviewed people because they bring a lot of benefits to the business. Social networks are relevant to get information, to get some help or advice in specific situations, to get new thoughts and new perspective on the business, and they are a way to expand the owned business.

P_4: “Beyond the quality of their products, it is the information we get through this network which matters.”

When the participants were asked about the various social networks in which the family business was inserted, various important key networks were named. The given answers to social networks could be classified in the following groups: (1) customers and suppliers, (2) other entrepreneurs/family businesses, (3) family members, (4) employees and (5) others. All interviewees named the customers and suppliers. The participants emphasized the need to maintain good relationships with them.

Most of the interviewees stated other entrepreneurs/family businesses as key relationships. Interestingly, they are said to be also important in their day-to-day activities. For example, they can give a hand in specific situations, and they bring new ideas for business, a fresh look on how to do things, or new ideas on how the company should be run.

P_1: “For example, last month I needed an additional tractor and one other wine-grower lent me one.” … “My father and I went to Australia in 1996 [to meet some wine-grower]. […] It was really interesting to observe another know-how.”

They are an important source of information, which is why other entrepreneurs within the same industry are highly appreciated. Not rarely they share business intelligence, best practices, crucial information on the market, the economic context, materials, to each other.

P_4: “There are the networks with other entrepreneurs in order to exchange the best practices, the strength of each, information on suppliers, on machines.”

In this vein, social capital is a way to bring a benchmark to the family business. As they have often built personal relationships beyond doing business together, a high level of trust is built between each other over the years. As a result, they offer benchmarking with trust to the family business.

P_4: “Benchmark, and benchmark with trust. The information coming from them are better.”

Most of the interviewees stated to take part in various business organizations such as federations. These organizations enable them to meet new people, to pool and gather information about the market.

P_3: “It is essential to keep in touch with them [other entrepreneurs] in order to get some insights on the market, on the production, on the difficulties they encountered. For instance, it enables us to get information about the promotion which will be implemented.”

Surprisingly, only few of the interviewees named the family as a key stakeholder. The ones who named it, however, highlighted the importance to have good relationships with those family members who are active in the family business. In some cases, some major decisions are taken in line with the family.

P_3: “Secondly, there are the internal relations between my father, my godfather, my cousin and me. It is essential to exchange, to share and to speak about what we are doing. If one calls a customer, it is important to tell the others what was said, what information we got and so on.”

The employees were also named as a key stakeholder (Bernhard & O’Driscoll, 2011; Sieger et al., 2011). The importance of employees was emphasized because in numerous cases they are really attached to the family business, and the business owners often know them very well. It was important to know what the employees wanted and how to deal with them.

Finally, banks, lawyers and accounting companies were named by a few of them. It can be observed from the comments that they are more than “paid” relationships. The family business acts only as a customer and they were not regarded as being part of a social network per se. Nevertheless, these trustful relationships could also be important for getting information and support.

P_1: “I was introduced to the chartered accountant by my father. […] Once I took over the family business, we maintained a very good relationship together. I think he is the person who helped me the most. […] There was a time when he was nearly a co-manager because he had such an eye on the business that he could have replaced me for one month if needed (he laughs). I managed to entrust to him my worries, my conflicts with others. We had a mutual assistance.”

Transfer of Social Capital Across Generations in FOBs

From the insights gained from the interviews, four main stages were identified in the process of transfer of social capital across generations: (1) the presentation phase, (2) the observation phase, (3) the integration phase and (4) the management phase. In the following we will provide a more detailed overview of the identified phases.

Phase 1: Presentation of the successor During this phase, the role of the incumbent is to introduce and familiarize the successor with the firm’s social capital. In every transmission of social capital, the first step is the successor’s introduction to the FOB’s stakeholders. The presentation phase marks the first time the successor is included within the firm’s social capital, in which resides a vast network of preexisting relationships. In each of our cases, the presentation of the successor to key relationships took place before the actual taking over. It is an occasion for the family’s stakeholders to put a face to a name of the successor, that is, to meet the one who they will deal with, and to note that the future of the family is insured because a successor was found. From the successor’s perspective, it is a good way to meet and understand the different FOB’s stakeholders and social networks. Most of these presentations took place gradually over time. One interviewee noticed that these presentations started at a very young age, before he even entered the family business and chose his way.

P_1: “Since I was a teenager, my father presented me to the customers, to the suppliers, to various stakeholders as the successor of the business.”

According to him, it enables the incumbent to give another dimension to the family business because it is a good signal that its tradition and heritage will be perpetuated over years.

P_1: “[This way of doing] brings some histories and anecdotes, that the customers love. If there is a successor, they see that there is a continuity in the family business.”

Nevertheless, in most cases the successor’s introduction took place once the successor actively entered the family business. In fact, the gradual succession, which was experienced by the participants, enabled the successor to be introduced step by step to the main stakeholders as the next incumbent. The way the successor was presented varies from one case to another, or from one relationship to another within the same family business. Firstly, as the successor has worked closely with the incumbent in the transition, he followed him in the meetings or in the business lunches, where he was introduced to stakeholders as the next successor. Whenever the incumbent was meeting someone for any reason, he joined him. The underlying idea was to make the successor known.

P_2: “We did a lot of company visits, customer visits. We had meetings with them, we had a lunch with them or whatever. Then there were trade shows. When customers were coming, I was introduced to them by the external CEO as the next business-manager.”

In addition to accompanying the incumbent in various physical meetings with FOB’s stakeholders, the successor was given the stakeholder’s contact details by the incumbent. Then, it was up to him to give them a call and to introduce himself as the FOB’s next leader.

P_2: “We did a list with all the contacts we have and then we decided what contact will be met personally.”

P_3: “My father gave me the contact details and I gradually started calling the different stakeholders. For example, I called the different central buying services […] in order to introduce myself as the successor.”

Nevertheless, at this stage, the successor has often no business role, except introducing himself or herself and explaining his or her aspirations, background, competencies and experiences. In fact, real sales work was needed because the successor had to prove to the stakeholders that he or she was committed to take over the business.

P_3: “The first year, I was just there physically to introduce myself, to talk about my academic studies and why I was there.”

Interestingly, some interviewees mentioned that they met some of their customers through a company visit. In fact, they were in charge of presenting the facilities, the plant and the company as a whole to the customers. It was a good way to talk with them, to answer their questions and to show them that they will be good business owners, who know what they are talking about.

P_1: “At the beginning, I was entrusted with the task of making the group visits of the wine cellar. When you manage to explain to a group of 30, 40 or 100 persons your job, to keep people interested and to answer people’s questions, you realize that you are in the right place because you manage to transmit them a message. You are aware of that, because they order some bottles and they buy your wine.”

Phase 2: Observation In the second phase, which can partly overlap with the first one, the successor was introduced to the stakeholders. Now the goal is to observe how the incumbent handles these preexisting relationships and how the successor is evolving in this vast network of preexisting relationships.

P_3: “I observed him and learnt.”

The successor still has no active role to play except to observe and learn. By observing, he or she learns how to lead a business talk or a negotiation, for instance, to know the stakeholders, and how to speak to them. Thus, the second stage can be considered as a phase of information collection.

P_3: “I also accompanied my father to the physical meetings, like the annual one with Auchan. […] I started knowing our customers. I was not leading the interview. I was observing how my father was handling the meeting, what he was saying, how he was presenting the evolution of the business and so on.”

In this phase, the incumbent has an important role to play. Concurrently with taking the successor to the meetings, he or she has to teach how to handle relationships. The incumbent must transmit the necessary knowledge, which was acquired over time and which the successor will need in the future.

As the successor gets embedded in an environment of preexisting relationships, he or she has indeed not all the information about the customers and their history with the family business. Even if he or she starts knowing the stakeholders, the incumbent has to provide relevant information about them and has to contextualize the relationships and express his or her own thoughts and feelings about them. For example, the incumbent and the successor can take time aside once a week to discuss about the various relationships and social networks of the company.

P_2: “We got used to meeting once a week to talk about business stuff and also about people. We were going through the list of contacts and he told me whatever he knows about the contacts we were dealing with. He explained to me every specific situation encountered with the contact and the history of the relationships.”

As a result, a transfer of knowledge takes place from the incumbent to the successor in this phase. The incumbent has accumulated knowledge on the stakeholders over time, and an important part is to transmit this knowledge to the next generation. The successor must learn the specificities of each stakeholder.

P_2: “We have one customer who is a huge soccer fan and who is supporting Borussia Dortmund. The external CEO told me that every time the soccer team was losing that I should not call him for a couple of days because he must be in a bad mood. But if they win, you can call him because he is in a good mood.”

Phase 3: Integration Before the integration phase, the successor has accumulated information about stakeholders and starts integrating that now. At this stage, the successor starts knowing the stakeholders because of having met them, observed them, exchanged words with them and gathered some information on them. Slowly the successor starts establishing business relationships with them. As he or she has entered the business quite long before, he or she had time to learn the product and the specificities of the family business, so that he or she starts developing self-confidence.

In phase 3, the incumbent ideally starts letting go and giving the successor more and more responsibilities. Now it is time for the successor to directly deal with the FOB’s relationships. The successor starts being in touch with the stakeholders, talking to them in the name of the company and as the next business owner. In a way, the successor becomes the representative of the family business.

P_3: “The second year, I also accompanied my father [to an annual meeting with a big customer], but this time it was my turn to lead the meeting […] I was in charge of making conversation, exhibiting and explaining the figures, exposing our forthcoming projects.”

During the integration phase, it becomes essential that the incumbent gives more and more responsibilities to the successor. Ideally, the responsibility of handling the relationships is gradually transferred. The successor starts calling the stakeholders, solving disagreements or problems, managing any business-related issue. After embedding the successor in the social networks of the family business, the necessity starts to build own relationships in addition to these preexisting ones. For example, as illustrated by one study participant, he or she goes to various events organized by federations in order to meet people. Some interviewees even noticed that during the integration phase, the incumbent urged the stakeholders to directly deal with the successor.

P_4: “Often, my father was pretending not to be there, so that people deal directly with me. He told the switchboard to pass the call onto me. And I was in charge of answering the customers.”

Nevertheless, in the integration phase, the successor is not left alone. The incumbent is still there if needed. He or she gives advice and can accompany the successor in the decision-making process. Sometimes, the successor faces difficulties with a stakeholder’s query or does not have all the abilities to handle the matter yet. Consequently, it is important that the incumbent remains available, to help the successor.

P_3: “My father was there to help me if need be.”

It is important to note that even if the incumbent helps backstage, the successor is in charge of keeping in touch with the stakeholders. The incumbent should play only the role of a consultant.

P_4: “But it was my task to tell the customer the decisions and to present it. This way of transmitting enables me to learn a lot.”

In the integration phase, however, the successor also starts taking on some initiatives. Fulfilling the responsibilities, starting to take decisions, and having his or her own experience with the relationships, these are the first steps of the successor as the next manager of the company.

In the integration phase, it may be difficult for the successor to handle relationships because of intimidation, and the fear of making mistakes. Indeed, the successor is dealing with relationships which existed long before and which are essential to the company. In such cases it is the role of the incumbent to reassure the successor.

P_3: “What was difficult was the first time I had them on the phone, notably with the big customers, because I knew that I had in front of me, a company who accounts for 10/15% of our sales. So, I wonder what I am going to say to them and I was hoping not to tell them stupid things.”

That said, in most of the FOBs interviewed, the successor had no major problem in handling the relationships. As the transmission was gradual, natural and extended over time, the successor had time to know the stakeholders, to have a good command of the FOB’s functioning, to be self-confident in their product and to have a perspective on the business. Thus, they were well integrated into the firm’s social capital.

Interestingly, all interviewees highlighted the advantage of being a family business at this stage. In fact, they were welcomed with kindness, because the stakeholders loved the idea that a successor was found within the company. It is indeed important for them because the arrival of a successor is the warranty that there is a future in the family business and that their relationships will be perpetuated in the coming years.

P_3: “They take it very positively [the successor’s arrival] because they liked the fact that a family member took over the business. It is important for them because they know that the relations won’t end with the retirement of my father or godfather. They see that there is a future in the company and the relationship will carry on.”

P_4: “The customers were very kind. If they have a good relationship with the business, they like the fact that there is a new generation taking over the business. In every family business, it is the dream of the boss that there is a successor within the family.”

Phase 4: Management In the management phase, the transfer of social capital from the incumbent to the successor is completed. After gradual inclusion into the vast networks of preexisting relationships by the incumbent, the successor is now completely embedded in the firm’s social capital and managing alone the company relationships in the new role as the manager of the family business.

P_3: “Today, the transfer has been done so I am in charge of the relation with Pomona. I am their representative.”

P_4: “The transfer was very natural, people got used to dealing with me.”

The next step is to analyze and to decode these relationships. In fact, the successor has to define the benefits brought by each relationship and choose the ones to continue, the ones to break up and the ones to create.

P_1: “I started analyzing which relationships were good for the future of the company and which were bad. […]. I classified these relationships. I looked for a way to rationalize these relationships.”

After decoding the networks in which the family business is included, one of the main tasks of a study participant was to ensure the continuity and increase of the relevant relationships, which could bring a lot of benefit to the family business and were essential to the success of the family business.

P_3: “The goal is to reinforce our link with them and to keep in touch.”

P_2: “I tried to keep them as close as possible.”

Once the incumbent is in charge of managing external social capital, the successor must reassess the firm’s external social capital to cut some relationships, which might be helpful in appearance but are poisonous in reality.

P_1: “Nevertheless, when I observed how they were working in the organization [wine-making syndicate, gathering all the wine producer of the area], I gave them an ultimatum: either the situation changed, or I left. And I left the syndicate! I didn’t need them. They didn’t bring me anything, except nuisances.”

The role of the successor is also to bring a new wind into the business; he or she brings freshness and innovation. The successor can also expand the operations of the family business by breaking into new markets for instance. For doing so, he or she has to create new relationships, new networks and, consequently, enlarge the firm’s social capital.

P_1: “I started founding a network of importers abroad.”

At this stage, we only described the different milestones of the successor to become gradually immersed into the FOB’s social capital. From the analysis of the interviews, we determined, however, three elements that the successor must build over time to pass from one step to another: trust with the incumbent, credibility and trusting relationships with preexisting relationships. All of them are illustrated in Fig. 9.2 and then discussed in more detail in the following section.

Element 1: Building Trust Between the Incumbent and the Successor

During the interviews, the importance of building a good trusting relationship between the incumbent and the successor was mentioned several times. This is a necessary condition for the success of the overall transmission process. If the incumbent does not have trust in the successor, he or she will not let go and will not delegate responsibilities, so that the successor will not gain the necessary independence and experience. Indeed, the incumbent must be convinced that the successor has all the abilities required to handle the business and manage the FOB’s social capital.

As all the interviewed successors experienced a gradual succession, they had time to understand the culture of the FOB, as well as the particularities of the business, to meet the employees and stakeholders and to get familiar with the processes (Bernhard, 2011). Every interviewee acknowledged the importance of the time dimension in the transition process over years.

P_2: “I had worked in the company for ten years, so I knew pretty much what was going on, I know the products and I know the processes.”

Thus, the successors reckoned that they had proven themselves over years and that they had shown to the incumbent that they were trustworthy. This trust on the successor reassured the incumbent on the heir’s potential to handle the business and eased the successive delegation of increasing responsibilities. It was pointed out by study participants that trust is not self-evident but was earned step by step.

P_1: “During these 11 years of transmission, I had the chance that my father delegated me a lot of responsibilities. I took over the family business quickly. He trusted me quickly.”

P_4: “My father had gradually delegated many functions to me. The process was very fluid and natural.”

Some of them highlighted, however, that the incumbent must be willing and committed to transmit his or her company to the next generation. When one participant was asked about the conclusions he would draw about his experience of transmission, he emphasized the harmony between him and his father. He compared his successful experience to the failure of an acquaintance whose father had never let go.

P_4: “I know a company, in which the father had never managed to let go. The son contented himself from doing lower-end operational task with no view. [In the end] the son left the company, although [initially] they had decided to work together and to transmit gradually the company.”

Notwithstanding the ability of the incumbent to let go, it was also stated that it is important that the incumbent remains present and plays the role of adviser if needed, offering long-term experience and expertise.

P_2: “I had the chance to have a father who stepped back and on whom I could count if needed.”

In all observed cases, the successor had worked closely with the incumbent during the transition period. Thus, a positive working relationship was gradually built between them, so that the transmission of knowledge and social capital was gradual and smooth. They learnt to work together over time. Unlike nonfamily businesses, where the changes at the management level may allow no or very short transition periods, the succession phase can be quite long in FOBs, so that a lot of information can gradually be transferred. This situation gives opportunities to both the successor and the incumbent to exchange, to discuss, to debate and to share knowledge throughout the years. Then, the successors could observe in detail how business was handled. The interviewed successors noticed that the incumbent included them quickly in the decision process.

P_3: “We take all major decisions together […] we share all information.”

P_2: “We had a really close collaboration. Our offices were next to each other for a couple of years, and most of business decisions, which were made, were discussed between us.”

Element 2: Building Credibility

When the successor starts to develop business relationships with the FOB’s stakeholders, having the trust of the incumbent and bearing the family’s name is not enough. In addition to develop his or her credibility toward the incumbent, the successor must indeed appear credible in the eyes of other company stakeholders. The successor needs to prove that he or she is a valid and trustworthy person, who has all the abilities required to run the business, ensuring that their collaboration will thrive in the future.

When the interviewees were asked about the way they developed their credibility and legitimacy, the following elements were emphasized: (1) formal education, (2) experiences outside of the family business, (3) knowledge from inside and (4) company visits.

Some of the participants emphasized the importance of having an education in line with the role of the business owner. Formal education (1) is indeed a good indicator that the successor has the background required to run the business. It may be viewed as a sign of competence.

P_1: “I was legitimated because of my studies [oenology studies]. I had indeed a good command of how wine is made so I was looking credible to them.”

All participants highlighted the benefits of having got professional experience outside of the family business (2). It provides the successor with a broader perspective on managerial issues and helps in the development of adapting to other business situations. As they went out of their comfort zone, they learnt how to react to people in specific situations. They also developed their personality in another environment, which sometimes could be hostile.

Getting outside experiences helps a lot when it comes to building legitimacy. It gives the successor the credibility and respect when joining the family business, because it shows that the successor is competent, has reached some achievement and has proven worth somewhere else.

P_4: “I have also gained credibility because of my experience. I am often saying that I won my spurs elsewhere. That is totally true.”

The participants acknowledged that they built their credibility toward key stakeholders through their excellent understanding of the family business and the products they deliver (knowledge [3]). The fact that the transition process lasted several years and that they held various positions within the family business enabled them to spend time to get familiar with the company and the processes. Thus, they gained their legitimacy by showing to the stakeholders that they know what they are talking about.

P_2: “I had worked in the company for ten years, so I knew pretty much what was going on, I know the products and I know the processes.”

Some participants acknowledged that they gained their credibility in the eyes of key stakeholders, and customers notably, through the visits of their company (4). In fact, in both cases, the incumbent let the successor explain the business and the different processes of fabrication. This was a good way to show the customers the successor’s credibility by demonstrating his or her ability to talk about the business, the industry, the products.

P_4: “So, when they come to visit us, I was in charge of making the visit with all the customers. It was a good way to meet them, to test my capability of talking of the business. […] My father welcomed them in the morning, […] Then I discussed with them and I showed them around the factory. I talked with them and I answered their questions.”

Element 3: Building Trusting Relationships with Key Stakeholders

Every successor acknowledged their embedding in a vast network of preexisting relationships that they needed to handle.

P_1: “We don’t start from a blank page.”

P_2: “When you take over, you are playing in a preexisting environment.”

P_3: “Most of our customers were there before I took over, so I needed to integrate them later.”

It is important to keep in mind that some relationships are not just simple connections. There is a band of deep trust because both sides know they can count on each other. For instance, if one of them needs information, the other will share it with sincerity.

P_2: “Our collaboration is indeed built on the reliability and the trust they have on us built on the history of quality of our products and our reactivity if needed.”

P_4: “There are thousands of suppliers of green coffee in the world, but we worked only with 6 or 7 of them since 20 or 30 years. They give the right information and if we have a problem, they fix it.”

Once the successors have taken over, it is now their role to ensure that these trusting relationships remain sustainable. When one participant was asked about the way he developed and perpetuated the trustful relationships across generations, he highlighted that the sustainability lies in the mutual loyalty. There is a myriad of other relationships to build, but he emphasized the importance to favor the most reliable ones:

P_4: “We are loyal to our suppliers. We have only added two suppliers in the last 20 years because the previous ones went bankrupt. These people recognize our fidelity.”

Being family-owned proves to be an advantage, because stakeholders have trust not only in the incumbent, but also in the entire family running the business. In our cases, the successors bear the incumbents’ name, so there’s a continuity in the family business. In fact, a part of the transfer of social capital across generation relies on the family’s reputation.

P_4: “I was impressed by […] the trust they have in my father and in the name of my family.”

Nevertheless, interviewees emphasized that it is important that the successor does not take the relationships for granted. The successor must make every effort to preserve the good relationship over time.

P_3: “It is important to not take them for granted, but to carry on building the links with them, by knowing their needs, calling them, knowing the business figures.”

It is key to regularly call them or pay them a visit to ask for news and give some information about the business situation.

P_3: “We try to have them [big customers] on the phone twice or three times a year. We are also trying to see them whenever it is possible.”

A central aspect to the interviewees is to make key stakeholders feel that they are of important value to the FOB, that they are granted a special status and that their opinion counts.

Frequent contact can also be directly business-related. It is indeed also important to call them whenever there is a business problem.

P_3: “We got a problem with Auchan because together with my father we noticed that the figures had dropped. So, we took our phone and called them to enquire, we asked them questions and so on. This enabled us […] to show our customers that we are taking care of our relationships and that they are of high value in our eyes.”

In addition to maintaining strong links with key stakeholders, the interviewees also emphasized the importance of building and growing their own history with the various stakeholders:

P_1: “On the contrary, I maintained some relations because we got to know each other, or I appreciated their intervention and their way of doing things.”

P_1: “I was introduced to the chartered accountant by my father. […] I managed to entrust to him my worries, my conflicts with others. We had a mutual assistance.”

Similarly, a few interviewees highlighted that they had built strong ties with their suppliers because they had an internship there during their university studies. As the successors had worked in the company for some months, they built trusting relationships with the business owner, the members of the next generation and the employees (Bernhard, 2011).

P_4: “I met our suppliers through my internships. I spent time with them. I developed strong relationships with them. They trusted me, they gave me access to all information I needed. I got to know their margin.”

P_3: “I have also made a 3-month internship at Joker, which is one of our suppliers, who makes packaging in plastics. I have worked with the salesmen, so I went with them and met their big customers.”

The importance of building trusting relationships and strong links with key stakeholders was stressed because this ensured a smooth resolution whenever a problem arose.

P_3: “If one day, there is a problem with our products and in parallel, we don’t have a regular relationship with them, they would change their supplier and we will be out of the process. On the contrary, maintaining a sustainable relationship with them over time enables us to reinforce our link. In case of a problem, it would be easier to sweeten the pill, because they know and trust us.”

Discussion

In this study we addressed the question of how external social capital is transferred to the next generation in FOBs. Our goal was to better understand the mechanisms and the evolving role of both the incumbent and the successor in the succession process. A series of interviews led to the emergence of a theoretical framework (Fig. 9.2), illustrating the dynamics and mechanisms of the transfer of social capital within FOBs via a four-step process. This process is in line with the framework illustrated by Handler (1994) on the succession process as a whole. In addition to the four-stage life cycle, a mutual role adjustment between the incumbent and the successor was observed. The incumbent’s gradual withdrawal is accompanied by the gradual taking on of power by the successor. Indeed, one of the interviewees compared this transfer process with a pair of scissors. As included in the concept of “natural immersion” (Steier, 2001), the successor usually enters the family business by getting into a lower- or medium-level management position and gradually reaches the top echelons after getting the approval by the incumbent.

The study offers meaningful conceptual and empirical evidence about how external social capital is transferred to the next generation in family businesses, by clarifying the different steps of the transmission process. The study also offers support to the concept of “natural immersion” built by Steier (2001), according to which the successor gradually assimilates the nuances of network structure and relationships.

Nevertheless, we found that some preconditions are essential to ensure a smooth process. A good relationship between the incumbent and the successor is essential (Cabrera-Suárez et al., 2001, Goldberg, 1996, Venter et al., 2005) to ensure a successful transfer of social capital across generations. The incumbent must be willing and devoted to share the information on the firm’s social networks with the successor, that’s why a trustful relationship between them must be fortified over time (Element 1) (De Massis et al., 2008). Our study also suggests that successors need to prove to the incumbent that they are valid and trustworthy, and that they have all the required abilities to run the business (Element 2). To reach this goal, our study reveals that successors can leverage the skills they acquired through education (Barbera et al., 2015; Dyer, 1986) or job experiences outside of the FOB (Tatoglu et al., 2008; Venter et al., 2005). Successors can also attain legitimacy by the quality of their performed work. Moreover, the study suggests another way for successors to build credibility, namely, through demonstrating superior knowledge and a good command of the family business they had acquired. It is important to keep in mind that the credibility of the successor is instrumental in enabling a successful integration of the successor within the social capital of the FOB (Barach et al., 1988; Venter et al., 2005). Lastly, successors have to build their own “history” with the stakeholders. They must move beyond the status of being “the son/daughter of” to being “the father/mother of.” Consequently, they must build trustful relationships with stakeholders over time (Element 3). Another interesting finding is that being a family business helps a great deal in the transmission process because the stakeholders regularly regard it as a positive sign when a successor is found within the family. Notably, the family reputation is another part of the transfer of social capital across generations, which, however, happens automatically.

For business owners and their families directly concerned with the topic of succession, this chapter emphasizes the importance of social capital within FOBs and provides frameworks explaining the requirements and major steps by which key relationships can be transferred. Malinen (2001) shows that one of the main concerns of incumbents is how to transfer their tacit knowledge and networks of contacts to the successor. From this perspective, our study can offer some answers to such concern.

Limitations and Future Research

Although relevant outcomes were observed in the case studies, the findings are of only limited generalizability because of the small size of our sample. Second, in addition to translation bias, a bias from the sample may arise, because of our choice of successors willing to share their views and experiences with us. Notwithstanding these limitations on successors’ feedback, our goal was not to test any theory or hypothesis, but to understand the wider process through which social capital is transferred from one generation to the next.

Another limitation of the study is that our emergent framework (see Fig. 9.2) was not tested or backed by a sufficient sample of interviewees but evolved from a combination of analyzed narratives and existing findings from the family business. A second round of interviews, ideally with a representative sample of successors, would be useful to test the emerging processes. Such a sample would ideally consist of successful, but also of failing successions.

In our study, we based our analysis on the experiences of the participant and viewed it from the successor’s perspective. Future research may also study the phenomenon of transfer of social capital from the incumbent’s perspective.

Furthermore, our study can give only a glimpse on the social skills that the successor needs to develop over time. In fact, talking about external social capital implies managing and creating links with human beings. Consequently, social skills must be built to efficiently handle these relationships. Reflecting on these social skills is difficult for the interviewed successors, and more objective data from outsiders would be necessary. Lastly, in our study, we mainly focused our analysis on the transfer of external social capital. Further research on the topic of the transmission of internal social capital is needed to better understand how the transfer of relationships with the employees or the family takes place (Bernhard, 2011).

Conclusion

Succession is one of the prevalent topics in the family business literature (Sharma, 2004) and the role of the incumbent is to ensure the survival of the firm by preparing the next generation to take over an FOB. The transfer of social capital, in which resides key resources, is one of the major aspects of this preparation. Relational assets play a critical role in a family firm’s survival and success (Steier, 2001). In fact, FOBs are embedded in a specific social context, composed of various relationships and networks with external stakeholders. When the successor enters the family business, he or she is immersed in a vast network of preexisting relationships (Steier, 2001). The role of the incumbent is to bring the successor into these networks of external relationships and accompany him or her over time. The capacity of the successor to handle, maintain and nourish these networks and external relationships is a key determinant for a successful succession and the sustainability of the family firm (De Massis et al., 2008; Steier, 2001). In our study, we identified four stages through which the incumbent gradually transmits the firm’s external social capital to the successor: presentation, observation, integration and management. Based on our case data, we also found key elements that a successor needs to develop during the process to ensure a smooth transfer of social capital: the trust with the incumbent, credibility as well as trusting relationships with the stakeholders. The presented research enables the reader to get a better understanding of the process through which social capital is transferred from one generation to the next.

References

Adler, P., & Kwon, S. (2002). Social capital: Prospects for a new concept. The Academy of Management Review, 27(1), 17–40.

Barach, J. A., Gantisky, J., Carson, J. A., & Doochin, B. A. (1988). Entry of the next generation: Strategic challenge for family business. Journal of Small Business Management, 26(2), 49–57.

Barbera, F., Bernhard, F., Nacht, J., & McCann, G. (2015). The relevance of a whole-person learning approach to family business education: Concepts, evidence, and implications. Academy of Management Learning & Education, 14(3), 322–346.

Baron, R. A., & Markman, G. D. (2000). Beyond social capital: How social skills can enhance entrepreneurs’ success. The Academy of Management Executive, 14(1), 106–116.

Bernhard, F. (2011). Psychological ownership in family businesses: Three essays on antecedents and consequences. Lohmar, Germany: Eul Verlag.

Bernhard, F. (2018). Holding on to family values or adapting to a changing world – The case of Barilla global business value innovations (pp. 117–127). Springer.

Bernhard, F., & O’Driscoll, M. P. (2011). Psychological ownership in small family-owned businesses: Leadership style and nonfamily-employees’ work attitudes and behaviors. Group & Organization Management, 36(3), 345–384.

Bernhard, F., Pundt, A., & Martins, E. (2017). The role of leadership and related mediators in the development of psychological ownership in organizations. In C. Olckers, L. van Zyl, & L. van der Vaart (Eds.), Theoretical orientations and practical applications of psychological ownership (pp. 181–202). Springer.

Bhalla, V., & Kachaner, N. (2015). Succeeding with succession planning in family businesses. The Boston Consulting Group.

Cabrera-Suárez, K., De Saa-Perez, P., & Garcia-Almeida, D. (2001). The succession process from a resource-and knowledge-based view of the family firm. Family Business Review, 14(1), 37–46.

Cadieux, L. (2007). Succession in small and medium-sized family businesses: Toward a typology of predecessor roles during and after instatement of the successor. Family Business Review, 10, 95–109.

Chirico, F., & Laurier, W. (2008). The creation, sharing and transfer of knowledge in family business. Journal of Small Business and Entrepreneurship, 21(4), 413–433.

Chrisman, J. J., Chua, J. H., & Sharma, P. (1998). Important attributes of successors in family business: An exploratory study. Family Business Review, 11(1), 19–34.

Chua, J. H., Chrisman, J. J., & Sharma, P. (1999). Defining the family business by behavior. Entrepreneurship Theory and Practice, 23(4), 19–39.

Deloitte. (2016). Next-generation family businesses: Evolution, keeping family value alive.

De Freyman, J., & Richomme-Huet, K. (2010). Entreprises familiales et phénomène successoral. Pour une approche intégrée des modes de transmission. Revue française de gestion, 200, 161–179.

De Freyman, J., Richomme-Huet, K., Paturel, R., & Toulon, I. (2006). Condition model for transferring social capital in family business succession. Proceedings of the International Research Entrepreneurship Exchange.

De Massis, A., Chua, J. H., & Chrisman, J. J. (2008). Factors preventing intra-family succession. Family Business Review, 21(2), 183–199.

Dyer, W. G., Jr. (1986). Cultural change in family firms: Anticipating and managing business and family transitions. San Francisco: Jossey-Bass.

Eisenhardt, K. M. (1989). Building theories from case study research. Academy of Management Review, 14, 532–550.

Goldberg, S. D. (1996). Effective successors in family-owned business. Family Business Review, 9(2), 185–197.

KPMG Enterprises. (2015). European family business trends – Modern times?

KPMG Entreprises. (2017). Baromètre des entreprises familiales européennes (6th ed.).

Handler, W. C. (1990). Succession in family firms: A mutual role adjustment between entrepreneur and next-generation family members. Entrepreneurship Theory and Practice, 15(1), 37–51.

Handler, W. C. (1992). The succession experience of the next generation. Family Business Review, 5(3), 283–307.

Handler, W. C. (1994). Succession in family business. Family Business Review, 7(2), 133–157.

Hitt, M. A., & Ireland, R. (2002). The essence of strategic leadership: Managing human and social capital. Journal of Leadership & Organizational Studies, 9(1), 3–14.

Lansberg, I. (1988). The succession conspiracy. Family Business Review, 1(2), 119–143.

Le Breton-Miller, I., Miller, D., & Steier, L. P. (2004). Toward an integrative model of effective FOBs succession. Entrepreneurship Theory and Practice, 28(4), 305–328.

Lee, D. S., Lim, G. H., & Lim, W. S. (2003). Family business succession: Appropriation risk and choice of successor. Academy of Management Review, 28(4), 657–666.

Malecki, E. (1997). Technology and economic development: The dynamics of local, regional, and national competitiveness. Amsterdam: Addison-Wesley.

Malinen, P. (2001). Like father like son? Small family business succession problems in Finland. Enterprise and Innovation Management Studies, 2(3), 195–204.

Mazzola, P., Marchisio, G., & Astrachan, J. (2008). Strategic planning in family business: A powerful developmental tool for the next generation. Family Business Review, 21(3), 239–258.

Morris, M. H., Williams, R. O., Allen, J. A., & Avila, R. A. (1997). Correlates of success in family business transitions. Journal of Business Venturing, 12(5), 385–401.

Nahapiet, J., & Ghoshal, S. (1998). Social capital, intellectual capital and the organizational advantage. Academy of Management Review, 23, 242–266.

Nougein, C., & Vaspart, M. (2017). Rapport d’information fait au nom de la délégation aux entreprises relatif aux moyens de favoriser la transmission d’entreprise au bénéfice de l’emploi dans les territoires. Sénat français, session ordinaire de 2016/2017.

Osunde, C. (2017). Family businesses and its impact on the economy. Journal of Business & Financial Affairs, 6(1), 1–3.

PwC. (2017). Croissance, innovation, transmission, quels enjeux pour les entreprises familiales?

Sharma, P. (2004). An overview of the field of family business studies: Current status and directions for the future. Family Business Review, 17(1), 1–36.

Sharma, P., Chrisman, J. J., Pablo, A. L., & Chua, J. H. (2001). Determinants of initial satisfaction with the succession process in family firms: A conceptual model. Entrepreneurship Theory and Practice, 25(3), 17–35.

Sieger, P., Bernhard, F., & Frey, U. (2011). Affective commitment and job satisfaction among non-family employees: Investigating the roles of justice perceptions and psychological ownership. Journal of Family Business Strategy, 2(2), 78–89.

Steier, L. (2001). Next-generation entrepreneurs and succession: An exploratory study of modes and means of managing social capital. Family Business Review, 14(3), 259–276.

Strauss, A. L., & Corbin, J. M. (1990). Basics of qualitative research: Grounded theory procedures and techniques. Newbury Park, CA: Sage Publications.

Tatoglu, E., Kule, V., & Glaister, K. (2008). Succession planning in family-owned businesses. International Small Business Journal, 26(2), 155–180.

Venter, E., Bochoff, C., & Maas, G. (2005). The influence of successor-related factors on the succession process in small and medium-sized family businesses. Family Business Review, 18(4), 283–303.

Ward, J. L. (1987). Keeping the family business healthy: How to plan for continuing growth, profitability, and family leadership. San Francisco: Jossey-Bass.

Yin, R. K. (2014). Case study research design and methods (5th ed.). Thousand Oaks, CA: Sage.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter

Bernhard, F., Hiepler, M., Engel, FX. (2020). Family Business Sustainability: The Intergenerational Transfer of Social Capital and Network Contacts. In: Saxena Arora, A., Bacouel-Jentjens, S., Sepehri, M., Arora, A. (eds) Sustainable Innovation. International Marketing and Management Research. Palgrave Pivot, Cham. https://doi.org/10.1007/978-3-030-30421-8_9

Download citation

DOI: https://doi.org/10.1007/978-3-030-30421-8_9

Published:

Publisher Name: Palgrave Pivot, Cham

Print ISBN: 978-3-030-30420-1

Online ISBN: 978-3-030-30421-8

eBook Packages: Business and ManagementBusiness and Management (R0)