Abstract

Measuring renewable generation deployment in terms of megawatts installed over time, offers a somewhat restricted viewpoint from which to understand the interactions of technical, market, regulatory and economic factors that ultimately determine the success or failure of low carbon generation policy. This chapter examines some of the fundamental technical and economic differences between power systems comprising renewable and conventional technologies and why these necessitate economic, as well as regulatory, interventions in order to provide a viable investment environment for new capacity. Measures to mitigate the impact of capacity duplication on conventional generation, required to maintain power system reliability, are also considered in this context. The validity of this analysis is demonstrated through a review of the very different Russian and US markets, where both financial support and market reform are shown to be essential for successful deployment of renewables whereas neither, on its own, is sufficient.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

When considering a country’s progress in developing its renewable energy resources, it is easy to home into a discussion of Megawatts (MW) of renewable capacity installed each year and whether it is on course to deliver any treaty or government-mandated target. However, understanding the progress of renewable deployment involves much more than tracking installed capacity and checking for official policy support and requires an assessment of the legal, regulatory and economic framework within which new capacity is being, or will be, delivered. This is key to understanding both the degree of success that current achievements represent and the sustainability of further, planned capacity expansion.

This chapter looks at some of the challenges facing power systems as they transition to renewables. It examines the influence of regulation , competition, and generation economics on the viability of investment in the power sector generally and of renewables in particular. Successful deployment and sustainable expansion of renewable generation is much more likely in a market in which these factors are actively addressed. By way of illustration, the chapter includes case studies of two very different markets: the United States (US ) and Russian Federation (RF) . Though starting from materially different backgrounds, the relative success of renewable capacity delivery in these two markets has only been achieved following implementation of reforms that address the same economic and regulatory issues.

Whist an understanding of basic power system economics is fundamental to policy development, having a realistic appreciation of the costs involved during initial stages of the renewable transition is also important. Factors such as dispatchability of renewable technologies , capacity redundancy, infrastructure provision and services to drive system flexibility must also be actively addressed if system reliability is to be maintained and capacity substitution facilitated rather than being duplicated. Some discussion of these factors has been included, although their deployment will be more useful as qualitative measures of renewable market development, as the precise mix of these measures will vary for each market.

2 The Pre-renewables Age

The world into which renewable generation is expanding is very different from that into which the electricity system was being rolled out in the early part of the twentieth century. At that time, larger and more efficient generation units were being built close to their source of fuel, with the consequent requirement for transmission infrastructure to transport the power to where it was to be used. This expansion of capacity took place into a, literally, greenfield environment, in parallel with growing, first time demand from end users. By the mid-twentieth century, economists such as Boiteux (1949) had begun to tackle issues of power system economic efficiency in an environment in which investment costs were high, asset lives comparatively long and the risk of stranded investment as a result of future technical progress (Boiteux, 1957) was very real. Work in this area of pricing was important for understanding how the industry’s revenue adequacy could be assured without constraining the overall objective of developing and maintaining a co-ordinated system based on a plant mix that approximated to an economically optimal power system over time.

Of course a monopoly ownership model, whether public, mutual or investor-owned, was useful in ensuring that total required revenue could be collected. Importantly, Boiteux’s analysis did consider the stranding of assets , even though this was from the perspective of technological obsolescence, rather than competitive loss of market share . In transitioning to a renewable generation model , it will be seen that stranding of conventional assets remains an important issue to be addressed if an adverse impact of premature closure of incumbent, fossil-fuelled assets on system reliability is to be avoided.

In contrast to the initial power system rollout, the environment into which renewable technologies began to be introduced in the last decades of the twentieth century was one of relative stability and established reliability . Electricity demand was being met in an economically efficient manner, network infrastructure had been established and environmental issues were an area of somewhat niche interest. Where arrangements that allowed the development of renewable generation were established, the motivation appears to have been more about an ideological desire to introduce competition into a monopoly industry than to facilitate the introduction of renewable generation. For example, even though it included specific provisions addressing hydro -electric and combined heat and power generators , legislation for electricity market reform in the United Kingdom (UK) was primarily targeted at the introduction of competition. Indeed, the Energy Act of 1983 described itself as, “An Act to amend the law- relating to electricity so as to facilitate the generation and, supply of electricity by persons other than Electricity Boards” (UK Government, 1983).

This policy change was a first step towards opening the monopoly door to allow competition, but arrangements were still defined in terms of the impact of competing generators on the incumbent ‘owners’ of the market. A more significant consequence of the pricing provisions in this legislation was that it allowed money to ‘leak out’ of the monopoly system. For as long as the competitive market sector remained small, this issue could safely be ignored, if indeed it was considered at all. But with the passage of time, the issue of revenue adequacy has been found relevant to consideration of generation market contestability and economics well beyond Boiteux’s early concerns over stranded investment.

3 Catalysts and Constraints on Renewable Rollout

When evaluating delivery of environmentally-motivated renewable generation in any market, it would be a mistake just to try and map progress onto a template based on the experience of other markets that are much further along the road to implementation. While there are certainly areas of valid comparison, it must also be recognised that many renewable technologies , wind in particular, have advanced significantly since the turn of the twenty-first century. At that time, network operators were facing a steep learning curve in managing significantly more volatile generation systems, as were regulatory authorities who had to make difficult decisions balancing complex technical and market issues while pursuing environmental policy goals. However, these challenges were very much of their time and typical of the kind of issues faced when pioneering a new market or product and should not arise again, even in markets at an early-stage in their renewable development. It is nevertheless interesting to look at some important European policy developments that encouraged, sometimes indirectly, the development of renewable generation and also obstacles that emerged to constrain early adopting markets.

An early step in electricity market liberalisation in the European Community (now the European Union , or EU) was the 1996 Directive (96/92/EC), on common rules for the internal market in electricity. This Directive set out rules for Member States to establish common rules for the generation, transmission and distribution of electricity, including access to the market, as part of the EU internal market implementation process. This policy direction was driven by a desire to benefit customers through competition, rather than with the objective of promoting renewable generation, although it did allow that Member States , “[may] give priority to generating installations using renewable energy sources ” (European Community, 1996).

Following appropriate transposition by Member States , this Directive guaranteed renewable and other developers non-discriminatory access to markets. But it was only with the passing of the first renewable electricity Directive (2001/77/EC) (European Community, 2001) that explicit renewable energy targets were set for Member States in response to commitments made under the Kyoto agreement . By the transposition deadline, in October 2003, renewable developers in the EU were theoretically able to rely on supportive government policies to deliver increasing amounts of renewable capacity.

Notwithstanding this supportive EU legislative foundation, renewable developers in Ireland experienced a significant shock in December 2003, when technical concerns raised by the system operator brought the renewables development industry to a shuddering halt. In the five-year period to 2003, the Irish system had connected 159 MW of wind capacity , in addition to 30.5 MW connected in the previous five years, to 1997 (Ó Gallachóir, 2004). However, with a total of just under 230 MW of wind generation connected to the system and a further 1,295 MW either committed or progressing through the connection offer process, the system operator, Eirgrid , was becoming concerned at the potential system impact of this rapidly-increasing renewable technology.

For several reasons the issues faced by Eirgrid in 2003 were unprecedented. Understandably the introduction of a significant cohort of a relatively immature, non-dispatchable and non-synchronous generation technology, to a relatively small electricity system of only 7,000 MW, with a relatively small number of conventional thermal units and limited interconnection, was perceived to represent a material risk to system security and stability. Eirgrid had three principal concerns: the lack of specific Grid Code provisions to enforce appropriate standards on windfarm operators; the lack of reliable data from wind generators preventing it from making reliable output forecasts ; and the lack of manufacturer-provided computer models to use for assessment of wind turbine behaviour on the dynamic electricity system. On the basis of these technical concerns, the system operator requested that the regulator impose a moratorium on the issue of any further connection offers and in December 2003, the regulator agreed.

However, whilst the regulator accepted the request, primarily out of concern for system security and stability , its decision also highlighted an additional concern, that:

Wider policy considerations, such as the economic impact on conventional generation of increased wind penetration have been ignored for the purpose of this direction. In the longer run this has to be a concern. (Commission for Energy Regulation, 2004: para. 17)

A final point worth noting about the regulator’s decision is that it also highlighted the importance of reaching a decision that respected Government energy policy, including the State’s international obligations such as those set out in the previously-mentioned Renewable Energy Sources Directive (2001/77/EC).

Once the Grid Code and modelling issues were resolved, the connection moratorium was lifted and Eirgrid embraced the challenge of managing a system with high penetration of variable-output generation. Indeed, it has become a world leader in this area currently allowing an instantaneous level of 65% of non-synchronous generation on the system, with the aim of raising this to 75%, over time. Within the system operator community, there is therefore plenty of technical expertise to guide any individual operator facing these kinds of technical issue for the first time.

4 Relevance of Early Renewable Experience to Current Markets

The above brief overview of experience in Ireland and Great Britain, both prior and subsequent to establishment of the broader European legal framework for renewables, shows how renewables emerged almost as a by-product of reforming traditional (i.e. mainly fossil thermal ) electricity markets . Legal and regulatory reform of the industry initially focused on facilitation of competition, rather than with the aim of promoting renewable generation. However, the concurrent development of renewable policy makes it hard to establish whether it was market reform or renewable generation obligations on governments that drove delivery.

A further complication is the remuneration arrangements for generation market entrants in the early stages of market reform. In Great Britain, payments to independent producers under the 1983 Act were based on incumbents’ avoided costs whilst, in Ireland , various support schemes in place during the market structural reforms offered renewable developers particular incentives.

Whilst these early market experiences and observations offer some clues as to factors that may support renewable generation deployment, there are too many intertwined strands of change in play to offer any useful framework for the assessment of progress and sustainability of renewable deployment in other markets almost two decades later. Clearly a supportive legal, regulatory, technical and financial environment must be in place for a sustainable renewable generation sector to emerge, but a more robust theoretical underpinning is required to direct effective policy intervention and facilitate meaningful comparisons of progress across markets in a more technologically mature era. However, this does not mean that the degree of market maturity has no relevance to understanding progress with renewable development. Rather, continuing success with renewable rollout depends on timely deployment of the type of technical solutions leading system operators are implementing to manage high penetrations of particular renewable technologies on their networks. But what are these technology issues and what preparatory steps towards mitigation should be evident in a successfully maturing renewable market?

5 Non-MW Characteristics of Renewable Generation

Renewable generation is often referred to in broad terms, as though it were a homogenous technology, such as thermal or nuclear . However, this type of thinking obscures the diversity of proven and developing renewable generation technologies, including offshore wind , hydro , solar photovoltaic (PV) , tidal and wave . The development of time-shifting energy storage technologies, such as battery , compressed air , hydrolysis and of course long-proven pumped storage , is essential for increasing system flexibility and thereby maximising renewable generation deployment. So there is a strong argument for monitoring deployment of storage capacity and the introduction of similar system services targeting increased flexibility when considering the sustainability of expansion plans for renewable generation in markets where significant renewable generation capacity has already been deployed.

Conventional, fossil-fuelled generation technologies have only limited dependence on geographical factors. Proximity to a coalfield and source of cooling water were important during the initial development of thermal-based interconnected power systems, when the transmission system was being developed to suit generation deployment. For the subsequent generation of gas-fired plants , proximity to a pipeline and existing grid connection guided location decisions. However, renewable generation depends on, for example, the conversion of utilisable tidal flows, or availability of reliable wind or high levels of rainfall. Climate , topography and geography are therefore fundamentally important to the deployment of renewables and in this respect, expansion of the sector is more complex than merely deciding to add additional production capacity to an existing system, as would have been the case with earlier, conventional generation technologies.

For this reason, a renewables-based power system expansion will generally consist of geographically-distributed generation units, often with low individual capacities compared with fossil-fuelled facilities, whereas a conventional system would normally consist of a relatively small number of high capacity units. Of course, such generalisations ignore significant exceptions, for example China ’s Three Gorges hydro-electric scheme is designed for an installed capacity of 22.5 GW (Renewables Now, 2012); large for a single generation facility of any technology. Nevertheless, this smaller distributed versus large centralised conceptualisation offers a useful perspective from which to gauge the level of actual commitment that relevant authorities have towards implementation of their renewable generation policies. In terms of access to grid connection policies and investment in network systems, those supporting renewable generation are likely to be significantly different from those required for conventional systems. So a willingness to sanction relevant infrastructure investment is often a more relevant indicator of commitment to renewable generation than a published policy.

Another feature of many renewable generation technologies is that they are often variable in output or must-run because of inability to store their input energy (e.g. run-of-river hydro , or wind generation). They may also have awkward electrical characteristics, such as being non-synchronous, that can present significant technical challenges to the system operator controlling the grid in real time. On the other hand, dispatchable renewable generation has significant advantages over thermal plant in that it can ramp output up or down extremely quickly, which is important for grid stability when there is a significant amount of non-synchronous, variable-output renewable plant on the system.

In summary, any review comparing renewable generation development across jurisdictions needs to look at more than past, present and planned ‘Megawatts in the ground’. Where substantial progress has already been made, the question must be whether there is evidence of sustainability in plans for ongoing expansion of renewable capacity . For example, is there evidence of increasing energy storage capacity ? Do current or planned market rules require greater resilience in response to rapid changes in system frequency ? Are ongoing network enhancements that facilitate further distributed generation underway and planned?

In markets where renewable deployment is at an earlier stage, it is reasonable to look for evidence of resource assessments being undertaken, proven regulatory and revenue support frameworks being implemented, along with appropriate infrastructure development policies. Without these it would be unwise to conclude that renewable development plans will actually be delivered.

This chapter looks at the deployment of renewable energy in the US and Russia , using non-Megawatt parameters of this type to assess the extent to which past performance may serve as a guide to the future.

6 Economics, Contestability, Reliability and Regulation —Key Parameters for Renewables Generation System Economics

6.1 Economics

A detailed exposition of the economics of electricity generation is beyond the scope of this chapter. However, an appreciation of some basic issues of generation economics is important when trying to understand why some states are more successful than others in delivering their renewable goals. In this context, it is instructive to step back and look first at how economics were a relatively minor consideration for the historic, monopoly-owned, thermal plant systems from which, to a greater or lesser extent current, competitive arrangements have evolved. This simple starting point permits greater clarity for exposition of the underlying economic principles of power generation than a more complex model, involving diversity of ownership and competitively-driven stranded investment . This approach is also helpful as it highlights four intrinsic characteristics of electricity generation , that:

-

it is capital intensive;

-

assets are long-lasting;

-

production must continuously match demand that varies significantly, both diurnally and seasonally; and

-

real-world production plant is prone to sudden breakdown.

As with any investment, generation investment must be paid for even if it is not always in use and production technology may evolve faster than the life of generation assets. Thus, even if a power system is optimally structured in terms of technologies, capital investment and fuel costs at some moment in time, within an asset lifetime of 30–40 years, it is reasonable to expect some disruption to emerge that invalidates, or at least affects, one or more of these parameters.

However, when the electricity production system is monopoly-owned, whether by the state or by investors, the economic objective has been to develop a system that minimises overall production costs, and hence the cost to customers, by optimising investment in capacity by plant type, operating hours for each generation unit and outturn marginal cost of production for the system as a whole. This type of traditional approach to decisions on generation investment was described by Turvey (1968) in his essay on the application of welfare economics to pricing and investment in electricity supply. For the monopolist, there is no economic regret when technology cost or fuel cost outturns diverge from forecast, because prices can always be adjusted to recoup outturn input costs and un-amortised, stranded investment costs can also be recovered through retail tariffs. A monopoly market is therefore always revenue-adequate.

Perhaps the two most significant factors leading to the demise of such ‘economically optimal’ monopoly generation systems were the development of efficient combined-cycle gas turbines, that were around 50% more fuel-efficient than existing coal and oil plant, and political shifts that allowed, and even encouraged, independent generators to compete with the monopoly incumbents. The gas technology innovation could have co-existed with a centrally-planned system in which the obsolescence of older coal plants could have been managed without compromising revenue adequacy of the overall system. Tariff increases would have been used to cover stranded costs. But, in combination with market liberalisation allowing equality of access to the grid and, at least in theory, uncontrolled expansion of capacity , the link between system capacity requirement, electricity prices and overall system funding was lost.

The new, competitive environment also removed any incentive for co-ordination of capacity provision between baseload , mid-merit and peaking plant. Experience of the early competitive market in Great Britain showed that developers appeared to discount any material impact of their new capacity on market price and generally planned for maximum power output of their new plants for the maximum duration consistent with a proper maintenance regime. Essentially, revenue maximisation was the goal, with revenue depending on the unit operating, thereby providing a natural hedge for its offtake contract, and a market price below the plant’s marginal cost of production during outages; planned or otherwise.

In a competitive market therefore, there is no natural way of recovering even legitimate stranded costs, without recourse to out-of-market mechanisms. Stranding is seen as a normal business risk to be borne by the investor, even for relatively new plant. For example, an investor building an oil-fired generator in the 1970s and completing it just as oil prices increased permanently, by an order of magnitude, would have found operation of the facility to be wholly uneconomic and the facility fit only to be mothballed. If such a scenario had occurred in a competitive market, the owner of the new generation plant would have suffered a total loss, without any means of recompense for such an unforeseeable event. Competitive markets involving large upfront investment costs are therefore more exposed to disruptive change, creating a disincentive to investment in new capacity without some form of price guarantee.

Investment in renewable generation faces a similar type of technology risk . Not so much from a disruptive technology type, but rather from increased scale and declining capital cost of similar technology. For example, the capital cost of a wind generation plant has decreased significantly over the last decade or two, encouraging sufficient market entry to affect the market price of energy for earlier developers. Successful implementation of a renewable generation policy must recognise the need for investors to have some level of revenue certainty over a significant proportion of their assets’ useful lives, to minimise their asset financing costs. Without some form of revenue support to mitigate revenue risk within the finance repayment timescale, it is unlikely that renewable developers will be willing to invest.

6.2 Contestability

Bearing in mind that generation plant is long-lived and expensive and that, over time, plant efficiency and reliability decline, there is a natural incentive on investors to seek to maximise their revenue in the early years following commissioning , before unhedgeable assumptions in their investment model cease to hold true and the introduction of newer plant displaces their plant down the merit order. In a competitive market, all generators will therefore bid their output in a manner that optimises their revenue . To understand what that means in practice, the most useful approach is to adopt the principles set out by Baumol et al. (1982) in their groundbreaking work on contestability.

In terms of electricity generation , Baumol, Panzar and Willig’s key findings for a contestable market were that:

-

A market is contestable if it “is accessible to potential entrants and … the potential entrant can, without restriction, serve the same market demands and use the same productive techniques as those available to the incumbent firms” and “potential entrants evaluate the profitability of entry at the incumbent firms’ pre-entry prices. That is, although the potential entrants recognise that an expansion of industry outputs leads to lower prices … the entrants nevertheless assume that if they undercut incumbents’ prices they can sell as much of the corresponding good as the quantity demanded by the market at their own prices” (Page 5).

-

‘the quantities demanded by the market at the prices in question must equal the sum of the outputs of all the firms in the configuration … the prices must yield to each active firm revenues that are no less than the cost of producing its outputs. And, … there must be no opportunities for entry that appear profitable to potential entrants who regard the prices of the incumbent firms as fixed’ (Page 5).

-

Sunk costs have a significant role in determining whether or not a market is contestable. Where the cost of market entry is reversible without cost, unsustainable prices will provide incentives for rational entrepreneurs to enter the market, as the ability for costless reversal of entry allows temporary profits to be taken at the initial prices of incumbents.

-

‘… a sharp increase in the degree of approximation to competitive behaviour can be expected in a contestable market once the number of firms producing a good equals or exceeds two. For then, under perfect contestability, each such good must be priced at its marginal cost, which will be the same for all of its producers’ (Page 468).

At first glance it would appear that the sheer scale of sunk cost associated with entering the generation market and the lack of any comparable recoverable value on exit, must mean that the market does not allow costless exit and is therefore not contestable in any meaningful way. In turn this would suggest that generators should be able to obtain sufficient market revenue to earn an appropriate return on their investment . However, further consideration of generation market characteristics leads to a different conclusion, with consequences for both conventional and renewable generators.

Whilst the issue of significant sunk costs for both entering and exiting the market would generally be considered fatally to undermine any assertion that the generation market can be considered contestable, market entry also involves a lengthy and costly period to complete the processes of permitting, design, procurement and construction. In a contestable market, incumbent(s) would be aware of the new entry underway and act to lower the financial return available to the new participant however, for reasons described below, they will not do this. Together these issues would also deny contestability, as they preclude any possibility of temporary market participation and profitability, based on arbitraging an incumbent’s unsustainable pricing model. However, the intrinsic requirement for oversupply of generation capacity on any system, as a result of the diurnal and seasonal variation in demand and reserve to cover planned or unplanned outages , means that there will always be non-running capacity available to run, whether required to meet market demand or not. The sunk cost objection to generation being a contestable market therefore falls away.

Turning to the applied requirement for contestability, that all generators are able to serve the same market demands and use the same productive techniques, it is clear that all generator units using the same technology are essentially substitutable for each other; differentiated only by age-related issues of efficiency , reliability and fuel hedging strategy. In making their original investment decision, each unit’s investors will have concluded that they have advantages in these areas that will allow them to make a profit, even if the market price falls in response to their entry. Their investment analysis will also have assumed that if their perceived cost advantages are real, they will be able to undercut incumbents’ prices and sell as much of their output as the quantity demanded by the market, at their own price; that is, the plant will operate at full load for as long as its costs retain some advantage and demand is not a constraint. On this test, the generation market would likely be contestable.

The final test for contestability is the price that a generator can obtain for its output. One possibility is that the generator commits to sell power at a defined price to a retail supplier for a period of time. This is a useful approach where project financing is used to fund a new generation plant and renders a new facility largely indifferent to the spot market price for energy. It will procure energy from the market if the price falls below its own production cost and generate whenever price is higher. The generator’s objective is to negotiate an offtake price that fully remunerates its fixed costs of finance, operation and return on investment and also covers its variable operation and fuel costs. In a mature competitive market, both power purchasers and producers recognise their own duration-specific risks and will aim for these to be reflected in their contracts. Power purchasers will have concerns about customer loyalty and may not wish to enter into contracts lasting the full duration of a generator’s financing commitment. The generator is therefore under pressure to offer shorter-term offtake contracts that better meet its customers’ risk profiles and these shorter-term contracts inevitably face pressure to align with current market prices at the time of re-negotiation.

One unusual factor that must be considered in relation to the pricing of generation offers into the market is one that is probably unique to the electricity market . This is that electricity market pricing operates on the basis that increasing demand is met by dispatching generators in order of increasing short-run marginal cost. When the market operates on the basis of a clearing price, the last plant on will generally only recover its fuel cost, but other, cheaper plant delivering at the same time will access the same price. Depending on the relative fuel costs of different generation technologies, baseload generation plant may in practice achieve revenue equivalent to its long-run marginal cost, but there is no guarantee of inherent revenue adequacy in a market; particularly for long-lived assets that may well be superseded by newer technologies within their lifetimes.

For generators whose financing costs have been amortised, their fixed costs of operation will be materially lower than those of newer plant, with the consequence that an acceptable financial return can be had at a price that is materially lower than that of a newer plant, even if the latter is more efficient in terms of its variable cost of production. The incentive for fully-depreciated plant is therefore initially to maximise its inframarginal revenue by maximising its running hours and offering power into the market at a price that is just below the long-run marginal cost of the newer plant. In turn, the newer plant will be incentivised to respond by bidding its lower production cost to maximise its running hours and therefore its inframarginal revenue, even though this may turn out to be some way below its target to recover its long-run marginal cost. This can be justified on the basis that the concept of long-run cost is somewhat nebulous, depending on ill-defined factors around expected plant life and finance rate and duration, that may change over time. However, the important point to note is that over-supply of generation (an intrinsic aspect of the market) will incentivise generators to bid their output into the market at a price close to their short-run marginal cost, in the hope of earning additional, inframarginal rent.

Any relief that hedging contracts might offer from this competitive pressure is likely to be relatively short lived, at least in comparison with the asset life, as power purchasers note the impact of competitive generator offers in the spot market and calibrate their expectations of contract price duration accordingly. Generators therefore face commercial pressures to maximise revenue by pricing their output at a level close to their short-run marginal cost and seek a contribution to their fixed costs from inframarginal revenue. In summary, it is reasonable to conclude that a competitive electricity generation market, even where production capacity is optimised with respect to demand, is much more contestable than might initially be thought. When combined with a competitive market structure, such a system is unlikely to be sustainably revenue-adequate for all plant capacity required to ensure supply reliability, unless some form of capacity support mechanism is provided. This has significant implications for markets seeking to maximise renewable participation.

With the exception of technologies having input energy storage capability, new renewable capacity is not dispatchable in the same way as conventional plant. When output is available, its production cost is essentially zero, exerting a downward pressure on market prices. As the proportion of renewable generation in a competitive market increases, running hours for conventional generators will decrease, although reliability requirements may remain little changed. With the loss of ability to earn inframarginal revenue, conventional generators will increasingly depend on capacity support payments , but there will also be pressure to close capacity.

In conclusion, contestability of the generation market indicates that even conventional generators will depend on some form of capacity support mechanism in a competitive market, although such payments may be made opaquely, e.g. through bundling with the overall market price. However, as the level of renewable generation in a market increases, the ability of conventional generators to access such bundled support will be reduced, which will have the effect of forcing the support to become explicit. A perverse outcome of successful deployment of renewables in a market is therefore that a support mechanism will likely be required for conventional generators to maintain system reliability , unless the renewable capacity mix includes sufficient a sufficient component of dispatchable generation.

In a largely renewable market with capacity payments being made to conventional generators, the question arises as to whether these will act to inhibit or promote further renewable rollout. The answer depends on the nature of these payments. To support ongoing renewable development, capacity payments should obligate technical characteristics that complement the attributes of renewable generation, such as support for system reliability and output flexibility . They should also be of fixed duration.

6.3 Reliability

Consumers expect, with greater or lesser degrees of confidence, that their lights will come on whenever they turn the switch, which means that the power system must be in balance at every moment in time and with sufficient reserve to meet the increased demand. From the System Operator (SO) perspective, this means that there must be a high level of confidence that any plant scheduled to operate will deliver the expected amount of energy. Dispatchability means that system operation can be planned weeks or months in advance, with the final running order being refined closer to real time, as new information on availability or performance becomes available. Even in competitive generation markets the SO will require generators to provide availability information and will co-ordinate maintenance outages.

Another basic issue from the SOs point of view is that the overall power system must be stable and resilient to any network outage , loss of generator output or change in consumer demand. Operational failures like these are expressed as sudden falls in system frequency that require other plants on the system to adjust their output to compensate and thereby to bring the system back into balance.

The physical mass of traditional, heavy rotating generation plant means that the mechanical inertia of the machine’s rotating elements will store a considerable amount of kinetic energy during operation. The electro-magnetic coupling between alternator rotor and stator, allows this mechanical inertia plus additional energy stored in its boiler or reservoir, to maintain the machine’s electrical output in the initial stage following a fault and supports the wider system until the output of remaining plant can be increased to rebalance the system. By its nature the amount of inertia available to a power system will vary over the day and year as the operational plant mix changes but maintaining it at an appropriate level is essential for management of fluctuations in system frequency .

As discussed earlier, one of the characteristics of many renewable generation technologies is that they are non-synchronous, with the result that the SO may curtail the amount of such plant allowed on the system at any one time. However, this is unlikely to be a concern until the instantaneous penetration of non-synchronous generation on the system reaches a level of 50% or so, as Eirgrid has shown. Few other countries have reached this level of such renewable capacity, but the Irish experience is that measures to increase non-synchronous generation beyond this level will take a number of years. While other system operators will benefit from Eirgrid ’s experience, markets in which renewable deployment is regarded as having been successful should have plans in place to address the issue of inertia, if their success is to be maintained.

6.4 Regulation

As previously described, generation assets are expensive, long-lived and immovable; presenting a challenge to any investor seeking a quick exit from such an investment. This means that renewable investment is only likely to take place in an environment where there are clear market rules that are enforced by a powerful and independent body with relevant expertise. These rules must guarantee equality of treatment for all participants and be underpinned by a transparent legal framework.

When considering the sustainability of any country’s renewable investment strategy, or indeed in seeking to understand the failure of an apparently sound renewable policy, an early consideration must be whether or not such a robust regulatory framework is in place. As discussed later, in relation to the US experience, it is not necessary for actual anti-competitive behaviour to exist in a market in order for investment by potential market entrants to be discouraged. The perceived risk on its own is sufficient to act as a deterrent. For a regulatory framework to be successful in promoting renewables, or indeed any form of competitive generation, it must separate ownership and operation of the grid from ownership of generation assets. This approach has been adopted by the European Union , as well as the US and Russian regulators, whose progress in delivering renewable deployments in their respective markets is discussed in the next section.

7 Relevance to Renewable Investment

If the above economic and regulatory issues actually influence investor behaviour in the real world, then we should expect to see any successful programme for expansion of renewable generation capacity being preceded by legal reforms that deliver an orderly dismantling of prior monopoly arrangements and create a supportive commercial environment for independent producers entering the market.

Financial underpinning of renewables can take many forms, but the most important issue is that rapid expansion of renewable generation in any market can only be expected if there is widespread investor confidence in the new, more open economic environment. If there is limited or no competition in the retail market, then revenue adequacy for all generation can be assured by retail price regulation that delivers sufficient income to provide the target level of support. But, where competition is a significant market feature, then levies will be necessary to fund mechanisms such as renewable production credits or price guarantees that can complement any capacity payment arrangements that supplement inframarginal rent earned through market operation. For renewable developers, revenue support arrangements are almost certainly needed to mitigate lenders’ risks and thereby allow access to the lowest-cost development capital. Support ensures that lenders face only normal project quality risks (e.g. engineering quality, operational skill and resource reliability). Its absence adds in market price risk. In practice therefore, significant renewable development is unlikely in the absence of such support.

In markets where good progress has been made in the deployment of renewables, the sustainability of progress should be evidenced by the deployment of renewables-supporting technologies, such as storage and system operator programmes facilitating further increases in renewable production. At some point, when renewable output is having a material impact on the running hours of conventional plant, some form of capacity revenue support arrangements can be expected for the non-renewable generation that is still required to provide ongoing system reliability . However, this support is separate from arrangements aimed at supporting renewable investment and should be structured to provide capacity of a type that is compatible with the characteristics of renewable generation technologies present on the system.

Having established the importance of competitive issues in generation economics and the role of government and regulation in providing frameworks that support investor confidence, it is reasonable to expect that actual delivery of renewable policy is only likely once effective market access reforms and appropriate revenue support arrangements have been implemented. While each country’s decisions on how best to deliver its renewable generation policy ambitions will depend on its own history and cultural environment, any dependency on successfully harnessing non-governmental investment for delivery must address these access reform and financial framework issues before real progress can be made. If policy choices or global economic circumstances constrain these reforms , then delivery outcomes will reflect the compromises that have been made.

8 Testing the Hypothesis—Two Case Studies

A comparison of two contrasting markets will be helpful in examining how effective their respective approaches to access reform and financial framework development have been in practice. For this exercise, the United States (US) and the Russian Federation have been chosen. Both markets have set targets for renewable generation capacity and both markets started from a position of monopoly market structures; municipal or investor-owned in the US and state owned in the case of Russia . Data for the US is available in great detail from the US Energy Information Administration (EIA), that compiles what is generally regarded as the most comprehensive dataset on the US market, while information on the Russian market has been obtained from the market supervisory organisation (NP Market Council) and the market operator (ATS Energo). A final point about the Russian market is that there are significant areas where population density or lack of network interconnection means that competitive market structures have not been implemented. However, there are two ‘price zone’ areas, where market prices are calculated and renewable support mechanisms are in place to support investment.

To begin with, some appreciation of the physical differences between these two countries and their electricity industries is required to provide a context within which progress in delivery of their renewable goals can be assessed. In terms of physical size, the Russian Federation is almost double the area of the US: at almost 17.1 million km2, compared with 9.8 million km2 for the US, it is physically the largest country in the world (World Bank , 2017a: 1, b: 2). In contrast, with a population of 146.9 million (Rosstat, 2018), it is much less populous than the US with 328.2 million (United States Census Bureau, 2018). The US and Russia are also significantly different in terms of geography, climate and stage of economic development , although both have similar levels of technological expertise.

8.1 US Experience

Information from the EIA (Fig. 16.1) shows just how electrically interconnected the US is, with over 580 thousand km of transmission lines transporting 4,015 TWh of bulk power in 2017 (EIA, 2018).

US Electricity system transmission lines. (Source: Energy Information Administration, 2018)

Originally, vertically-integrated, municipal, co-operative or investor-owned monopolies made access by independent power producers more difficult because of real or perceived lack of a level playing field for connections and access to market.

First moves towards encouraging greater equality of treatment for non-incumbent generators were made by the Federal Energy Regulatory Commission (FERC) in Order No. 888 (Federal Energy Regulatory Commission, 1996). This became effective on 9 July 1996 and required,

“all public utilities that own, control or operate facilities used for transmitting electric energy in interstate commerce to have on file open access non-discriminatory transmission tariffs that contain minimum terms and conditions of non-discriminatory service.”

Order No. 888 was interrelated with Order No. 889 in putting in place rules that were designed “to remove impediments to competition in the wholesale bulk power marketplace and to bring more efficient, lower cost power to the Nation’s electricity consumers”, by ensuring non-discriminatory pricing for access to transmission systems. In other words, market entrants would enjoy the same access to markets and transmission information as was available to the incumbent utility. It also allowed cost recovery for certain utility stranded costs associated with the provision of open access.

At the time these rules were being devised, FERC had recognised the difficulty of ensuring true equality of access to transmission networks when these were owned by entities that also owned generation. Order No. 888 therefore included provisions to ensure functional unbundling of generation from networks, thereby encouraging the formation of Independent System Operators (ISOs) and Regional Transmission Operators (RTOs), as network owning companies restructured to ensure compliance with the new regulatory obligations.

Some three years after Order No. 888 became effective, in December 1999, FERC issued Order No. 2000 (Federal Energy regulatory Commission, 2000), that became effective on 6 March 2000. The aim of this Order, entitled “Regional Transmission Organizations”, was “to advance the formation of Regional Transmission Organizations (RTOs).” Regulations in this Order required each public utility that owned, operated, or controlled facilities for the transmission of electric energy in interstate commerce to make certain filings with respect to forming and participating in an RTO. This Order was a substantial document, of over 700 pages, including discussion of issues raised in the consultation period following the FERC’s Notice of Proposed Rulemaking (NOPR). It addressed issues such as specification of minimum characteristics and functions of an RTO, the requirement for RTOs organisational arrangements to be adaptable to meet future market needs and transmission ratemaking (tariffing) policies to be followed.

In summary therefore, between 1996 and 2000 the US electricity sector was transformed by regulatory action. A relatively small number of ISOs and RTOs began to emerge from a much larger collection of vertically-integrated and competitively obstructive utility monopolies, to provide non-discriminatory access to the transmission system for all generators and elimination of charging arrangements that acted as barriers to competition.

The other important incentive for renewable generation development in the US has been the renewable generation Production Tax Credit (PTC) (United States Energy Department, 1992). This is “an inflation-adjusted per-kilowatt-hour (kWh) tax credit for electricity generated by qualified energy resources and sold by the taxpayer to an unrelated person during the taxable year”, that lasts for 10 years from the date the plant is put into service. Originally set at £0.015/kWh when introduced in 1992, at the time of writing in 2018, the tax credit is now $0.023/kWh. However, for wind facilities commencing construction in 2017, 2018 and 2019, the PTC is being stepped down by 20%, 40% and 60%.

In combination, equal access to the grid, the PTC and resources mobilised by the many developers keen to enter the market following implementation of FERC Order 2000, lead to explosive growth in the installed capacity of renewable generation, as shown in Fig. 16.2.

Growth in US renewable generation since 1995. (Source: Raw data sourced from EIA, 2018)

While the EIA is the most authoritative source of energy data for the US, there have historically been data missing from its published information as new technologies have come into use, for example, as householders have become generators through the installation of rooftop solar PV . In this regard the IEA has only recently started to estimate the amount of embedded small solar capacity, although it now estimates that this may have added a further 12 GW, and growing, level of capacity to figures published in recent years.

Another factor pointing to the maturity of the US renewable market is the emergence of non-hydraulic energy storage capacity being deployed in the market. EIA figures for 2017 include 0.7 GW of battery, 0.11 GW of gas with compressed air and 0.04 GW of flywheel storage in service, with a further 0.7 GW planned by 2023. Development of these storage facilities, including use of batteries for system frequency control, suggests that the system operators ’ market for system services is preparing for significant further expansion of renewable generation capacity, even though the capacity of further projects noted in the national database tails off beyond 2021.

Information available for the US therefore appears to support the hypothesis that regulatory action in the year 2000 to level the commercial playing field, together with a federal government guaranteed scheme to provide a form of revenue support, has lead to the emergence of a large number of private developers entering the market and delivering substantial new renewable generation capacity. However it is also clear that the maturity of technology is also a factor. The EIA data shows that wind was able to take advantage of regulatory reform almost immediately, whereas solar PV took nearly a decade to emerge as a material contributor to renewable capacity.

Further research might identify whether this coincidence of market reform and rapid capacity expansion was a result of maturing wind technology, or a mismatch between the level of PTC and technology cost. However, the data does suggest that PTC support was not enough, on its own, to initiate the deployment of renewable generation to any significant extent and is consistent with the hypothesis that both regulatory reform and revenue support measures are required for effective development of renewable generation. Russian experience, where market reform came before introduction of effective revenue measures, suggests the US experience was not particularly technology-driven.

8.2 Russian Federation

The Federal Grid Company of Russia owns more than 142.4 thousand km of the Unified National Electric Grid transmission system, with an operational area of 15.1 million km,2 the system transmitted 1,040 TWh of bulk power in 2017 (Public Joint Stock Company Federal Grid Company of the unified energy system, 2017: 7).

Given the physical scale of Russia ’s territory, the relatively small scale of its electricity transmission system compared with that of the US might be surprising. However, the former’s grid reflects the country’s climate, development history and pattern of settlement. In the case of Russia , the relative lack of interconnection poses a challenge for economic exploitation of the country’s renewable energy resources. The fact that some areas are not physically connected to the Unified Electricity System and have been excluded from market entry arrangements for independent producers adds to the complexity of any attempt to offer a concise description of how the sector has evolved from the Soviet monopoly structure to the present day. However, available data are sufficient to gain some understanding of how restructuring of the electricity industry and establishment of a price support regime have affected development of renewable generation projects.

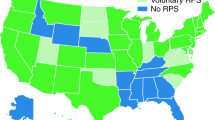

Association NP Market Council is the market supervisory organisation for the Russian electricity market to which all wholesale market participants must legally belong. It also controls ATS Energo; the market operator for price zones 1 and 2, in which wholesale prices are unregulated and set by market rules. Figure 16.3 shows the division of the country into zones where organisational unbundling of monopoly and competitive activities is mandatory and where wholesale market pricing applies, along with the non-price and isolated zones in which special, regulated prices apply (Association NP Market Council, 2019).

Price and non-price zones for electricity in the Russian Federation. (Source: Association NP Market Council, 2019)

A more thorough exploration of the interaction between geographic, political and industrial power structures and the central government’s reforming objectives in relation to the Russian electricity sector was undertaken by Wengle (2011) and is a useful starting point for understanding the context in which the Russian electricity market has evolved.

Changes to the Russian electricity sector began seriously in 2001 and are outlined in the grid company’s 2002 annual report (Public Joint Stock Company Federal Grid Company of the unified energy system, 2002: 1). In summary, the decision was made to reform the power industry and restructure it along the lines of naturally monopolistic and competitive types of activity, on the basis of Government order (No. 526). Soon after, implementation of stage 1 of the plan was approved by Decree 1040-p, that initiated structural reforms as a preliminary step towards implementing a competitive electric power market. A significant step was to establish the “Federal Grid Company of the Unified Energy System ” as the main grid owning company for the Russian Federation . Among other objectives, this company is required “to guarantee equal access of sellers and buyers to the wholesale market of the electric power”. Federal Laws Nos. 35-FZ and 36-FZ (2003) set out the basic framework of the industry transition to a market-based system, with subsequent legislation, Government Resolution No. 1172 (2010), establishing rules for the wholesale market.

From the perspective of renewable generation, the most significant legislative event has been Government Resolution No. 449 ‘On the mechanism of promoting the use of renewable energies at the Wholesale Electricity and Capacity Market’ (28 May 2013). From this brief overview, it is clear that there has been a steady evolution of the legal framework underpinning changes to the electricity industry structure during the first decade or so of this century, to deliver equality of system and market access rights. These changes have followed a consistent policy path that is transparent and supportive of investors; a situation confirmed by the entry of non-Russian companies into the energy market .

In looking at development of the renewable generation market in Russia , key dates would therefore be: 2003 when arrangements for transition to a market model were defined; 2004 when non-discriminatory access to the grid was guaranteed for all participants; 2010 when wholesale market rules were defined; and 2013 when Resolution No. 449 set out the mechanism for promoting renewable energy in the wholesale market.

An unusual feature of the Russian renewable support mechanism is that it is a contract for the provision of capacity rather than exported energy, although the achievement of reasonably attainable capacity factors for each technology is essential to ensure projects receive their full payments and avoid financial penalties. Projects must also be controllable (downwards) in response to System Operator instructions, if financial penalties are to be avoided. In terms of effectiveness, it matters little whether renewable support is based on capacity, or output-based as in US, the effect is similar in terms of mitigating lender risk. However the cost of capacity-based schemes can obviously be more easily predicted.

There are three other factors designed to integrate Russian capacity support arrangements into the country’s wider policy for economic development :

-

cost of the support programme is controlled by annual limits on the total capacity of renewable contracts awarded in each annual round;

-

targets are set for local content that must be included in each project, for each technology type; and

-

A maximum price per kW is set for each technology type, although contracts are awarded on the basis of the actual prices bid by applicants.

Although some commentators suggested that the above parameters, defined by Resolution No. 449, would be unduly onerous and risky for investors, this has not turned out to be the case. Indeed the Market Operator’s (MO) report for that first OPVFootnote 1 selection process resulted in the award of contracts for 1,081 MW of renewable capacity, across 76 projects, for delivery by 2015. Subsequent project selection rounds have been equally successful, with projects totalling over 5.3 GW of renewable capacity being awarded contracts since 2013, although these have often been awarded to consortia featuring established foreign industry players, rather than to numerous small-scale developers. For example, one consortium involving Fortum Energy of Finland was awarded 1 GW of wind capacity contracts in 2017, while ENEL of Italy secured 291 MW.

Effectiveness of the Russian electricity market reforms in terms of delivering renewable generation capacity can also be gauged from MO data on the time taken to deliver projects following completion of the permitting process. Figure 16.4 shows data for 65 operational renewable projects that have been permitted since 2001. This shows the time elapsed between obtaining permits and the projects becoming operational in the market (i.e. shown as operational in the MO register). The correlation between length of delivery process and progress with industry structural and market reforms is too striking to be merely coincidental and, although a significant proportion of these pre-dated the OPV process, projects developed under this scheme are now (2018) being commissioned. Available evidence therefore supports the hypothesis that renewable energy projects are held back by uncertainties over the stability of market access and commercial arrangements. This is consistent with the intuitive perception that, rules ensuring long-term equality of market access and contractual financial support, increase both the number of projects coming forward and speed up delivery through reducing complexity of the process.

Overall there appears to have been lively private interest in competing for renewable capacity contracts, with successful developers being sufficiently confident to offer prices within the price limit. However, a comparison between delivery dates promised by successful bidders in the OPV auctions and renewable capacity actually registered as operational in the market (see Fig. 16.5), suggests that the 5.3 GW of operational renewable capacity that successful bidders promised by 2023, may be somewhat optimistic.

A detailed analysis of this discrepancy is beyond the scope of this chapter, but reasons could range from specific Russian issues, such as challenges in meeting local content requirement, the more generic issue of “paid-as-bid” auctions where projects turn out to be undeliverable for the offered price, or any of the myriad holdups common to developers in any jurisdiction. In spite of delays, it is clear that renewable delivery is gathering momentum and that wind energy is becoming the dominant technology, with capacity contracts awarded in the 2018 OPV process being almost six times the total for solar photovoltaic . By way of comparison, solar PV was awarded just under four times the capacity of wind in the initial competition, in 2013.

A final and important point to note is that the OPV process does not tell the whole story about renewables in the Russian Federation . Outside of the price zones, RusHydro (2018a), the 60% government-owned power company, is currently building approximately 2.1 GW of large hydro projects ranging in capacity from 320 to 840 MW, to add to its existing 30 GW of renewable generation (RusHydro, 2018b).Footnote 2 The scale of these major hydro developments contrasts sharply with the 160 MW of small hydro project awarded capacity contracts over the 6 years of the OPV (Resolution 449) process that is designed to support solar PV , wind and small hydro (under 25 MW).

9 Conclusion

The deployment of renewable generation has faced a different set of challenges from those faced by conventional, fossil generation as economies electrified in the early twentieth century. With the exception of hydro -electric generation, renewables have comprised a collection of emerging and developing technologies trying to enter established and technically more or less optimal markets already occupied by well-understood and reliable conventional technologies. In addition to capacity duplication, the large-scale addition of zero marginal cost renewables disrupted the economics of conventional plant that operated in markets designed on the assumption that marginal production cost increases with increasing demand. In this respect, new renewable generation only increased visibility of the already-existing issue of revenue adequacy in competitive electricity markets .

The central argument of this chapter is that there are certain basic characteristics of competitive electricity market economics that must be addressed before investors will risk long-term investment in new generation assets, irrespective of whether their investment is in conventional or renewable capacity. The challenge for governments and regulators has been to create legal and regulatory frameworks that maintain investment in clean generation capacity, at an acceptable public cost, without precipitating uncontrolled market exit by the conventional generation plant that has ensured stable and reliable operation of the overall electricity system. The challenge for power system operators has been one of learning to manage the technical transition from large, dispatchable, transmission-connected fossil generation plants to an environment of more distributed generation facilities, with less predictable output and significantly different capability to provide essential system services.

In summary, this chapter has argued that significant private investment in renewable generation capacity is unlikely in any competitive market, unless the two fundamental issues, of equal market access and revenue support are addressed. The assessment of US and Russian electricity markets contained in this chapter suggests that this argument is well-supported by the evidence. Investment must be underpinned by a legal and regulatory framework that ensures equal system and market access for new assets over their economic life and the system overcapacity issue addressed through some form of price support or revenue guarantee arrangement. In the medium term, sustainability of renewable deployment programmes is dependent on the introduction of new system services and technical measures that address specific reliability characteristics of individual markets.

Russia and the US could not be more different in terms of their power industry origins, path of market development and current stage of renewable deployment. In terms of revenue support and market access, tax breaks came before structural reform in the US, whereas structural reform came first in Russia . But it is significant that neither jurisdiction was able to make material progress with renewable deployment until both regulatory and revenue support measures were implemented within the competitive market arrangements. It might be argued that wind and solar PV generation technologies were too immature for large-scale deployment when production tax credits were first introduced in the US but, as Fig. 16.3 shows, delivery of Russian renewable projects permitted in the first years of the millennium was subject to considerable delays. The balance of probability is therefore that the stage of renewable technological maturity is less important to delivery than the regulatory and financial environment into which it is to be deployed.

At the time of writing, the US has had almost 20-years of experience delivering renewables, so there is sufficient data to detect a trend of success. On the other hand, it has only been 5 years since Russia ’s arrangements were implemented in mid-2013 and it is too early to tell if promised capacity will be delivered; Figure 16.5 certainly suggests that delivery dates promised by a number of successful applicants for OPV renewable capacity contracts may have been somewhat optimistic. On the other hand, the scale of renewable deployment in the US has now reached the stage where there is a net retirement of conventional plant capacity and system operators are implementing technical solutions to enhance grid stability in a high-renewable environment.

In conclusion this chapter has demonstrated that any assessment of renewable deployment in a jurisdiction should start with an assessment of whether the regulatory environment ensures long-term equality of market access for renewables and whether mechanisms are available to support revenue adequacy. In this regard, the outlook for renewable deployment in both Russia and the US is positive, as both these requirements are in place. However, future progress assessments should consider the impact of falling levels of production tax credits in the US and the effectiveness of system operator measures that aim to reduce curtailment of renewable output. For Russia , the focus should be on actual delivery of projects promised through the OPV competitive process, in addition to market operator data on renewable output.

Notes

- 1.

OPV is the English language acronym used by ATS Energo (Administrator of the Trading System of the Wholesale Electricity Market) for the ‘Selection of RES projects’ (Отбор проектов ВИЭ); This is the process for “competitive selection of investment projects for the construction of generating facilities operating on the basis of using renewable energy sources.”

- 2.

A more comprehensive overview of current and potential renewable generation capacity in the Russian Federation can be found in International Renewable Energy Agency (IRENA, 2018).

References

Association NP Market Council. 2019. About the Electricity Industry—General Information. http://www.en.np-sr.ru/en/srnen/abouttheelectricityindustry/generalinformation/index.htm.

ATS Energo. 2019. News Feed. https://www.atsenergo.ru/.

Baumol, W.J., Panzar, J.C. and Willig, R.D. 1982. Contestable Markets and the Theory of Industry Structure. Harcourt Brace Jovanovich Inc.

Boiteux, M. 1949. La tarification des demandes en pointe: Application de la théorie de la vente au coût marginal. Revue Générale de l’Électricité.

Boiteux, M. 1957. The Role of Amortization in Investment Planning. International Economic Papers 10: 161–162 (translated from Revue de Recherche Opérationelle).

Commission for Energy Regulation. 2004. Wind Generator Connection Policy, Direction by the Commission for Energy Regulation. CER/04/245.

Energy Information Administration (EIA). 2018. US Energy Mapping System—Electric Transmission System Layer. https://www.eia.gov/state/maps.php.

European Community. 1996. Directive 96/92/EC of the European Parliament and of the Council of 19 December 1996 Concerning Common Rules for the Internal Market in Electricity, Article 8(3).

European Community. 2001. Directive 2001/77/EC of the European Parliament and of the Council of 27 September 2001 on the Promotion of Electricity Produced from Renewable Energy Sources in the Internal Electricity Market. Annex.

Federal Energy Regulatory Commission. 1996. Promoting Wholesale Competition Through Open Access Non-discriminatory Transmission Services by Public Utilities; Recovery of Stranded Costs by Public Utilities and Transmitting Utilities, Order No. 888. Federal Register Vol. 61, no. 92, May 10, 1996.

Federal Energy Regulatory Commission. 2000. Regional Transmission Organizations, Order No. 2000 Federal Register Vol. 65, no. 4, January 6, 2000, p. 810.

International Renewable Energy Agency (IRENA). 2018. Renewable Energy Prospects for the Russian Federation (REmap Working Paper): April 2018. https://www.irena.org/publications/2017/Apr/Renewable-Energy-Prospects-for-the-Russian-Federation-REmap-working-paper.

Ó Gallachóir, G. 2004. The Grid Connection Moratorium in Ireland. Proceedings of the European Wind Energy Conference 2004, Figure 1, November 22–25, London.

Public Joint Stock Company Federal Grid Company of the Unified Energy System. 2002. Reforming of Electric Power Industry in the Russian Federation, Annual Report for 2002.

Public Joint Stock Company Federal Grid Company of the Unified Energy System. 2017. Market Review: Annual Financial Report for the Year 2017.

Renewables Now. 2012. China’s 22.5-GW Three Gorges Dam Reaches Full Capacity, July 5, 2012. https://renewablesnow.com/news/chinas-22-5-gw-three-gorges-dam-reaches-full-capacity-287247/.

Rosstat. 2018. Population. Russian Statistical Yearbook, http://www.gks.ru/bgd/regl/b18_13/Main.htm.

RusHydro. 2018a. Hydrogeneration. http://www.rushydro.ru/activity/1B3ADB8F7A/.

RusHydro. 2018b. Investor Presentation: Renaissance Capital 22nd Annual Russia Investor Conference, April 10–11, 2018. http://www.eng.rushydro.ru/upload/iblock/6ce/RusHydro_Apr_2018_MOEX.pdf.

Turvey, R. 1968. Optimal Pricing and Investment in Electricity Supply; An Essay in Applied Welfare Economics. George Allen and Unwin Ltd.

United Kingdom Government. 1983. Energy Act 1983.

United States Census Bureau. 2018. US and World Population Clock. https://www.census.gov/popclock/.

United States Energy Department. 1992. Renewable Electricity Production Tax Credit (PTC). https://www.energy.gov/savings/renewable-electricity-production-tax-credit-ptc.

Wengle, S.A. 2011. Post-Soviet Developmentalism and the Political Economy of Russia’s Electricity Sector Liberalization. http://cis.uchicago.edu/oldsite/outreach/summerinstitute/2014/documents/wengle/sti2014_wengle2012_postsovietdevelopmentalism.pdf.

World Bank. 2017a. World Development Indicators. https://databank.worldbank.org/data/reports.aspx?source=2&country=RUS.

World Bank. 2017b. World Development Indicators. https://databank.worldbank.org/data/reports.aspx?source=2&country=USA.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter

Wright, I. (2020). Regulation and Market Reform: The Essential Foundations for a Renewable Future. In: Wood, G., Baker, K. (eds) The Palgrave Handbook of Managing Fossil Fuels and Energy Transitions. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-28076-5_16

Download citation

DOI: https://doi.org/10.1007/978-3-030-28076-5_16

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-28075-8

Online ISBN: 978-3-030-28076-5

eBook Packages: EnergyEnergy (R0)