Abstract

An Agent-Based Model (ABM) accounting for tax-morale and loss-aversion was implemented over different network systems with social interactions at the local level to study the phenomenon of tax evasion. This ABM is an innovative model which integrates endogenous characteristics of heterogeneous agents and proposes a more relaxed assumption on the information exchanged between agents as compared to previous social models. The current study gives an insight on the possibility that choosing specific network structures may yield to more realistic outcomes. Moreover, this ABM manages to replicate both individual and aggregate results from previous experimental and computational models of tax evasion. A clearcut novelty might be the non-linear channel through which the network centrality enhances a positive effect on the aggregated level of tax compliance. There is a large area of action for public policy makers to further research the presented results about how audit rates, fines and tax morale non-linearly increase income disclosure, whereas tax rates have a non-linear negative impact on tax compliance.

This project has received funding from the ITN ExSIDE European Union’s Horizon 2020 research and innovation programme under the Marie Sklodowska-Curie grant agreement No 721846.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Following the influential paper published by Allingham and Sandmo [1] exploring the rationale behind tax evasion phenomenon, a vast literature has congregated around the modeling of tax compliance. A non-negligible portion of income tax research has explored the mechanisms surrounding social interaction among the agents, particularly in agent-based modeling. Mittone and Patelli [2] delved into the psychological motives of tax compliance inherent to a society composed by three heterogeneous types of agents: full-compliers, imitators, and full-evaders (free-riders). The objective of their endeavor was bound to the analysis of aggregate tax behavior in function of the initial composition of the taxpaying population under two different audit schemes; uniform and tail auditing.

A comprehensive compilation of literature may include Davis et al. [3] who find stable equilibria both under low and high enforcement schemes, linked by a non-linear and asymmetric transition; Hokamp and Pickhardt [4] introduced an exponential utility function for agents in order to induce more realistic results; and Korobow, Johnson and Axtell [5] introduced a network structure but also considered individuals who possessed heterogeneous characteristics and intrinsic perceptions about the enforcement regime.

Stepping forward into a more contemporary literature review, Andrei et al. [6] contributed an additional aspect to be taken into account for agent-based models of income tax evasion. The authors found that the network structure underlying the societal arrangement has a significant impact in the decision process dynamics; principally, individuals tended to disclose a larger fraction of their income whenever they embodied networks with higher levels of centrality. Amongst the number of social structures tested, the Erdos-Renyi random network and the Power Law networks may incentive agents to comply the most given their larger capacity of propagating information and influence dissemination. The usage of network structures in models with ‘social pressure’ are everyday more frequent. A convenient example is the one by Billari et al. [7] in which agents must choose a partner based on the mutual proximity with respect to age and social status in a dynamic framework; this approach will be particularly handy for the model implementation in Sect. 3.

Alm, Bloomquist and McKee [8] conducted a social experiment intended to learn about the burden of peer effects and social pressure in the context of tax compliance. The conclusions reached by the authors discuss how agents have a statistically significant positive effect in the tax disclosures of their ‘neighbors’ or ‘people with whom they frequently share information’; when an agent is surrounded by honest (cheating) individuals, the agent itself starts to behave in a more honest (cheating) manner.

2 A Taxpayer’s Decision to Evade

Tax compliance decision-making is ordinarily modeled as a gamble or an investment opportunity involving one risky asset (undisclosed income) and a risk-free asset (disclosed income), the micro-founded expected utility to be optimized with respect to the fraction of income declared d may well be defined as:

where X is the net income after taxes and penalties in case an audit takes place, and Y is the net income after taxes in case no audit takes place.

Promptly substituting X and Y in terms of the gross earned income I, the penalty rate \(\theta \) applied to the undisclosed fraction of income in case an audit occurs, and the applicable tax rate \(\tau \), reformulates Eq. 1 to:

Solving for optimality conditions, the rational taxpayer will declare less than its actual income if the expected tax payment on undeclared income is less than the regular rate, that is, whenever \(p \cdot \theta < 1\); moreover, the fine rate must be larger than 1. There is a widely known substantial drawback for this model in the sense that it highly overestimates the tax evasion rate.

Akin to the adjustment outlined by Hokamp and Pickhardt [4], a power utility function is imputed into the model outlined in Eq. 2. Discarding for simplicity the subindex, yet considering for each agent i and each time t, the utility function of every single agent is characterized in Eq. 3.

where the variables are denoted as: period-wealth \(W = \{X,Y\} \), the fraction of declared income \(d \in [0,1]\), loss-aversion \(\rho \in (0,1)\), and tax-morale \(\kappa \in [0,1]\). In this sense, a higher the tax morale yields a larger utility of complying; while a higher loss-aversion would yield a lower utility on wealth.

Tax morale has been a recurring matter in the models of tax compliance ever since Myles and Naylor [9] asserted a social conformity framework in which agents attained an additional utility from conforming to the established social norms. Despite the complications to accurately define tax morale, hereafter tax morale will be understood as an umbrella term, in the sense of Luttmer and Singhal [10], enclosing intrinsic motivation, reciprocity, culture, biases and social influences. Next in order, loss aversion will be understood as the well-known wealth effect described by Tversky and Kahneman [11].

A remark for the current tax decision model is the non-matchable income assumption, meaning that an auditor from the Tax Agency does not know beforehand the individuals’ incomes. If a society would happen to account for a non-negligible matching system for its labor market, the assumption may be relaxed to take into consideration only the non-matchable portion of the agents’ stipends without sacrificing any of the models’ intuitions and results.

2.1 Subjective Audit Rate

The individuals’ subjective probability of being audited is updated based on their past experience. Moreover, their audit beliefs are likewise updated by the behaviors of their ‘neighbors’, defined as the agents with whom they frequently exchange information, as in Alm, Bloomquist and McKee [8]. Hereafter, the subjective audit probability perceived by agent i at time t can be defined as a weighted average of the agent’s prior experience (temporal updating) and the signals from its neighboring individuals (geographical updating) last period.

The universe of agents coexists in a predefined network structure with (local) social interactions and each period agents exchange information with their neighbors, however they never get to know the entire situation nor the composition of the society in which they inhabit. Afterwards, agents update their own perceived audit probability by means of a weighted average of three possible channels: their subjective audit rate in the previous period (prior), their own recalling of past audits (memory), and the signals they received from their neighbors (social influence).

where \(\lambda _1\) and \(\lambda _2\) are convex averaging weights, \(A_{i,t-s}\) is valued one if the agent i was audited in the period \((t-s)\) and zero otherwise, \(S_j\) is the memory or number of audit periods that agent j can recall in the past, and \(N_{i,t-1}\) is the number of neighbors of agent i at time t.

3 Implementation of the Agent-Based Model

There are key distinctions that difference ABM’s from mathematical models. Arguably one the most germane attributes of any Agent-Based Model is its intrinsic capability of embodying plentiful heterogeneous agents, all possessing unique aspects and personalities. Accordingly, each agent is heterogeneous by acquiring specific built-in characteristics. Secondly, individuals base their decision process in their own subjective probabilities of being audited and not in the true audit rates. Lastly, agents coexist in neighborhoods inside a larger societal structure which allows for information exchange at a local level.

Similarly to Korobow et al. [5], this model includes the three listed attributes, however there is a key difference in the assumptions about shared information. Korobow et al., for example, implemented their model under the hypothesis that individuals shared their own, personal ‘payoffs’ for tax evasion among their neighborhoods, however, they acknowledged the unlikelihood of such delicate information becoming public in real-life scenarios. In order to outplay this limitation, now agents communicate solely their memory about previous audits and update their subjective probability of being audited in conjunction with the frequency of audits perceived by themselves and their immediate neighbors.

Stepping into the realm of the current work, agents are constituted as individuals embroidered by personal traits: tax-morale, loss-aversion, income, age and an initial subjective probability of being caught evading taxes. Moreover, the tax-morale and loss-aversion parameters are dynamic, increasing stochastically with respect to age. On any occasion in which an agent would happen to grow into an age above 65, it would be removed from the network analogous to a retired individual would exit the labor market; to replace the empty node left inside the network, a new individual, aged 18 and with its own particularities, would replace the available position.

Tax morale is initialized from a society-level parameter for the entire network, whereas loss-aversion is entirely endogenous for each individual. For a society level tax-morale of \(\kappa _S \le 0.5\), individual morale is modeled as \(\kappa \sim U(0,2\kappa _S)\). Endorsing the notion of loss-aversion as the preference of avoiding a loss over attaining a win, coupled by the endowment effect in which an individual would rather pay a higher rate to retain something it owns (net income) than to receive another thing it does not own (taxes), it follows that a local and endogenous loss-aversion parameter (\(\rho \)) may well be defined as the relative income position held by the individual with respect to its neighbors divided by the neighborhood size \(|N_i|\) (including the agent) plus one, where the highest loss-aversion measures pertain the most affluent agents.

This definition allows the global distribution of individual loss-aversion of \(\rho \) to be symmetric around 0.50. The distribution of (\(\rho \)) resembles a bell-shape tendency, at least when contrasted against the original Uniform\(\sim U(0,1)\).

Enhancing audits to shift from random to endogenous and regarding the income effect on tax compliance, a modification was made on the Tax Agency’s audit strategy. It would not be a surprise that a Tax Agency would be more inclined into targeting individuals whose eye-catching income stands out from the sample. Ergo, proceeding for each agent, the endogenous probability of being audited is set in accordance to its income level, where individuals with higher salaries have larger probabilities of being audited. Following, the endogenous audit rate q for agent i is the true audit rate p multiplied by the ratio of the agent’s income over the average income of the population, shown in Eq. 6.

Notwithstanding the adjustment implemented for the endogenous audit rates, the mean value of q remains equal to the true audit rate p; allowing for consistent testing of parameters. To see this it suffices to sum over all agents i and divide by N in both sides of Eq. 6.

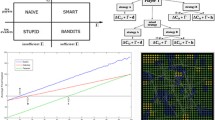

Figure 1 depicts the decision process mechanism in a rather simplified manner. An artificial society is structured as a network, where each agent is initialized with exogenous parameters \(\{\kappa _0, \rho _0, q_0, \hat{p_0}, I_0, age_0\}\) and chooses an optimal fraction of income to declare \(d^*\). Afterwards, audits take place and agents communicate ‘signals’ or information regarding the audit process. Next, agents update and endogenize parameters \(\{\kappa _t, \rho _t, q_t, \hat{p_t}, I_t, age_t\}\) and repeat the decision process. Every agent repeats the cycle until it is retired from the labor market.

3.1 Network Structure

Immediately upon the parameter booting, whether endogenous or not, lies the second cornerstone of the ongoing Agent-Based model with social pressure: the network formation process. Embracing the methodology followed by Andrei et al. [6], a selection of nine different underlying network structures where tested ensuing comparisons and contrasts among one another: two types of random graphs, small words, large world, Watts-Strogatz, ring, wheel and two types of scale-free networks.

Figures 2 and 3 display an Erdos-Renyi random graph and a random geometric graph, respectively, in a toroidal world which ‘wraps up’ both vertically and horizontally. Albeit both graphs having the exact number of agents, links and degree distribution, its interesting how the physical arrangement appears to be strikingly different. The ABM simulations where implemented in the Netlogo software, where the default ordering of agents follows the random geometric structure of Fig. 3. All network structures, except for the fitness function model, where implemented using the ‘nw’ extension of Netlogo.

Figure 4 presents a fitness function network in a Cartesian environment without ‘wrapping’. This is a specific type of scale-free networks, following a mathematical specification to determine or not an association between any two given individuals. Inspired on the social interaction Agent-Based model with spatial components devised by Billari et al. [7], individuals are constrained to link only with ‘relevant others’ within their reach in terms of age and social position. Attending to this notion, an artificial society was emulated on a Cartesian plane where the x-axis features the agents’ age whilst the y-axis represents the individuals’ income. First, a newly created set of agents is randomly assigned individual age and salaries and positioned in their corresponding coordinates inside the plane. Then, each time-step, agents advance one unit horizontally, and, stochastically increase their income, shifting north in the plane on the long-run. The procedure continues for each agent until they reach a sufficiently advanced age, in which case they ‘retire’ from the labor market and are replaced by an offspring endowed with a fraction (two-thirds) of the exiting agent’s wealth and being positioned at the left edge, starting their own working life.

Figure 4 depicts a pyramidal society after 60 timestamps where the top-right corner positions are occupied by old, wealthy individuals, the top-left corner is void (juvenile millionaires) and a dense bottom-left edge reveals a large amount of young agents with low or middle incomes. Evidently, it would be plausible to speculate that in the real world a person would discuss his or her fiscal matters rather exclusively with people of their own age and income level (social status).

4 Results

The main objective of the following section is understanding the effects of different regressors on the fraction of income declared at the society level. The Behavior Space tool incorporated in the Netlogo software allowed for a simulation of 21,890 simulations ran over 729 different possible parameter combinations: \(\tau = \{25\%, 35\%,45\%\}\), \(p = \{2\%, 6\%,10\%\}\), \(\kappa = \{10\%, 25\%,40\%\}\), \(\theta = \{2, 4, 10\}\), and nine different network structures; each simulation accounted for 350 agents and fixing the probability updating weights to \(\lambda _1 = \lambda _2 = \lambda _3 = 1/3\).

The analysis of the parameters is specified in Table 1 along with their respective significance codes. Keeping in mind the nature of the outcome variable d to be bounded between zero and one, a specific statistical model must be applied for data analysis. The results produced by the simulation were tested under a Tobit model censored for minimum and maximum values of zero and one, respectively, boundaries included. Moreover, quadratic coefficients where added to study the non-linear interactions of each parameter.

Table 1 delineates the different linear and non-linear effects that each parameter imposes in the fraction of income disclosed. Column (1) and Column (2) both deal with the effects of tax rates, audit rates, fines and tax-morale. The last regressors in Column (1) take into consideration the average closeness-centrality of all individuals in the underlying network where agents coexist; the closeness-centrality is interpreted as ‘how easily a node may be reached from all other nodes’. Hereby and after closeness will be understood as the inverse of the average distance of a node to all other nodes; where the distance between two nodes is the shortest path in which one node may reach the other. Consequently, a node who requires few steps to reach other nodes will have a lower average distance, implying a larger closeness within the network. On the other hand, Column (2) controls for each network structure by adding one dummy variable for each type while keeping the Erdos-Renyi random-graph as the baseline case, allowing for comparisons with the results by Andrei et al. [6].

Opening the analysis of the Tobit model, tax rates seem to impose a negative effect on tax compliance, yet such impact seems to marginally increase for very large levels of tax duties. This effect, which can be interpreted from a positive estimated coefficient for \(\tau \) and a negative estimated coefficient for \(\tau ^2\), as seen in Table 1, is represented in Fig. 5 where tax compliance decreases non-linearly with respect to the tax rate. A basal development of any taxation model is the understanding of how tax rates behavior reflect an impact on the collected revenues from the Tax Agency’s point of view. The Laffer Curve is the representation of tax revenues as a function of the tax rate. Governments cannot over-raise the tax rate as it would incentive agents to evade taxes, reducing the governmental revenue. Figure 6 details the corresponding Laffer Curve for the simulated society.

An outcome from Table 1 that falls in line with common sense is the positive coefficient for audit rates; as the true probability of being audited increases, a larger proportion of agents experience audits, which in turn communicate the event to their neighbors and the information about a harsher enforcement environment becomes public knowledge, ensuing higher tax compliance among individuals. The quadratic term of the audit rate suggests that, despite the notion of larger audit rates implying higher tax compliance, this policy tool will tend to lose effect as the audit probabilities start turning ‘too high’. Fines (or penalties), represented by the parameter \(\theta \) in this model, retain a somewhat secondary role at inhibiting tax evasion. Analogous to findings in the tax policy literature, see for example Alm, Jackson and McKee [12], fine rates have statistically significant effects to deter evasion even though their estimated coefficients are rather low. Fines help deter evasion only up to some degree given that in the model specification they only appear interactively with the true audit rate p forming the enforcement criterion \(\theta p\). Ergo, for relatively high values of p, parameter \(\theta \) loses its strength. The resulting non-linear effects of audit rates on tax evasion have relevance for public policy, shedding light on a possibility that raising audit rates and strengthening enforcement schemes may have marginally decreasing effects. Side by side with these results, Kirchler et al. [13] point out that policy makers should concentrate less in penalties and enforcement, and instead, focus on policies aiming to heighten voluntary compliance.

It may be wise to commence the discernment of tax morale by acknowledging how fundamentally difficult it is to measure a society’s morale. However, miscellaneous interpretations could typify a government’s control over a society’s tax morale through a larger participation and political inclusion of citizens or even by generating a feeling over how well the budget is being spent. Relying on citizen’s perception of their trust on institutional authorities may be, as well, a proxy conjecture about societal morale. Adopting the assumption, however, that tax-morale is not only measurable but mutable, it has a positive, non-linear, and statistically significant effect on tax compliance, that is, individuals endowed with a higher tax-morale would be more inclined to disclose their true incomes and thus diminish their fiscal evasion. Consequently, societies whose citizen’s tax-morale is low should be more concerned in establishing an agenda which would encourage taxpayers’ involvement within the society and policies targeting the promotion of how resources are being ‘well spent’.

The concluding parameter in Column (1), the closeness centrality of the network, previously defined, yielded a statistically significant positive effect in the aggregate tax compliance and a negative coefficient on its squared transformation. There exists, therefore, a non-linear channel through which closeness in a network may stimulate tax compliance at the aggregate level. Perhaps these peer-effects gain their impetus from the spread of information and the availability of knowledge regarding the audit frequency.

Column (2) provides a deeper look into the dynamics of closeness centrality by recurring to dummy variables in the Tobit model. Even more, the closeness centrality for each structure may be seen in Table 2 to serve as reference.

Reminiscent of the Erdos-Renyi graph as the baseline case, the random geometric and the preferential attachment networks do not have a statistically significant different repercussion regarding tax behavior. Lattice, ring, small worlds and wheel structures impose a curtailed effect on tax evasion, statistically significant lower than the benchmark; these effects may be seen in the statistically significant negative coefficients that these dummies attained in Table 1. Watts-Strogatz worlds seem to retain a statistically significant reduced effect with respect to the benchmark, nonetheless the estimated coefficient is relatively modest in comparison to the alternative networks. Ultimately, the fitness function model conveys a small increase in the aggregate tax levels, nevertheless limited to a minor statistical significance. As a final word, the closeness of wheel networks, as seen in Table 2 is markedly high, however it is not efficient in the sense of enhancing tax compliance; consequently, a large centrality is no guarantee for discouraging tax evasion. A possible explanation may be that, for each network, the loss-aversion distribution changes. The fitness model, based on income proximity, accounts for the fastest speed of bell-shape convergence of \(\rho \), making it close to reality, whereas other structures have large fractions of agents with very low, or very high, loss-aversion levels.

A robustness check took into account the aggregate convergence results provided by previous ABM’s of tax compliance. Figures 7 and 8 illustrate the emergence of a bottom-up compliance behavior, both in the fraction of aggregate declared income and for the average perceived audit probability. In Fig. 7, even if the agents act independently and do not know the exact declared income of others, they converge to an aggregate level of tax compliance; the oscillating convergence at three different steady states is presented with respect to their respective levels of societal tax morale, for \(\kappa = \{10\%, 25\%, 40\%\}\) and \(p=5\%\), \(\theta =2\), and \(\tau = 30\%\). In Fig. 8, in spite of the seemingly accurate mean perceived probability, a t-test proved that agents overestimated the true audit rate for \(p = 2\%\) and \(p =6\%\) yet they underestimated it at the \(p = 10\%\) level; where \(\kappa =25\%\), \(\theta = 2\), and \(\tau = 30\%\). Accordingly, agents consistently fail to discover the true audit rate both individually and collectively.

Alm et al. [14] studied individual tax evasion by means of economics and discovered that over two thirds of individuals either fully-evade or fully-comply, generating a dichotomous distribution of the share of income disclosed; a behavior which is not supported by the standard expected utility theory. Figure 9 depicts the last idea that the power utility model has to offer by reproducing the dichotomous behavior of individual taxpayers found in economic experiments for different levels of tax morale. Intriguingly, a power utility model with social interactions may be able to replicate not only the aggregate, but also the individual level results found in the literature of experimental economics.

5 Conclusions

An expected utility theory tax evasion model was presented under a power-utility function specification and implemented through an Agent-Based model with heterogeneous agents and local social interactions, simulated over different underlying network structures. Agents have limited knowledge about their surroundings yet may acquire endogenous parameters of loss-aversion and audit rates, depending not only on their income levels but also in the corresponding ones from their neighbors. An exploratory setup shed light in the possibility of choosing specific network structures which may yield a more realistic result, particularly for the calibration of endogenous parameters as loss-aversion. Following, a fitness-function model that accounts for age and social status (income) was questioned and deemed to be appropriate for modeling taxpayers’ behavior. In top of that, the assumption on the information exchanged is relaxed from communicating evasion rates and payoffs to simply sharing their past memories about the occurrence or not of former audits.

There is a large area of action for public policy makers in the further study of how audit rates and fines non-linearly increase tax compliance, yet both tools tend to lose effect whenever over-enforced. Whilst tax rates have a non-linear negative impact on income disclosure, tax morale offers an opportunity for governments with an unreceptive image among their citizens to call for a larger voluntary tax contribution by attending for a better public image of government spending or by strengthening their political inclusion. Moreover, an interesting property of the model specification is its capability of reproducing both individual behavioral patters and aggregate convergence levels of tax compliance as the encountered in experimental economics literature. Lastly, a novel parameter for the closeness centrality of the networks was tested and found to be a non-linear channel through which societies may converge to higher tax compliance rates for more closely connected social structures.

References

Allingham, M.G., Sandmo, A.: Income tax evasion: a theoretical analysis. J. Public Econ. 1(3–4), 323–338 (1972)

Mittone, L., Patelli, P.: Imitative behaviour in tax evasion. In: Luna, F., Stefansson, B. (eds) Economic Simulations in Swarm: Agent-Based Modelling and Object Oriented Programming, vol. 14. Springer, Boston (2000). https://doi.org/10.1007/978-1-4615-4641-2_5

Davis, J., Hecht, G., Perkins, J.: Social behaviors, enforcement, and tax compliance dynamics. Acc. Rev. 78, 39–69 (2003)

Hokamp, S., Pickhardt, M.: Income tax evasion in a society of heterogeneous agents: evidence from an agent-based model. Int. Econ. J. 24(4), 541–553 (2010)

Korobow, A., Johnson, C., Axtell, R.: An agent-based model of tax compliance with social networks. Nat. Tax J. 30(3), 589–610 (2007)

Andrei, A.L., Comer, K., Koehler, M.: An agent-based model of network effects on tax compliance and evasion. J. Econ. Psychol. 40(C), 119–133 (2014)

Billari, F., Diaz, B.A., Fent, T., Prskawetz, A.: The wedding-ring. Demographic Res. 17(3), 59–82 (2007)

Alm, J., Bloomquist, K.M., McKee, M.: When you know your neighbour pays taxes: information, peer effects, and tax compliance. In: Working Paper Series No. 6775. Victoria University of Wellington (2017)

Myles, G., Naylor, R.: A model of tax evasion with group conformity and social customs. Eur. J. Polit. Econ. 12(1), 49–66 (1996)

Luttmer, E.F.P., Singhal, M.: Tax morale. J. Econ. Perspect. 28(4), 149–168 (2014)

Tversky, A., Kahneman, D.: Availability: a heuristic for judging frequency and probability. Cogn. Psychol. 5, 207–232 (1973)

Alm, J., Jackson, B., McKee, M.: Estimating the determinants of taxpayer compliance with experimental data. Nat. Tax J. 45(1), 107–114 (1992)

Kirchler, E., Hoelzl, E., Wahl, I.: Enforced versus voluntary tax compliance: the “slippery slope” framework. J. Econ. Psychol. 29(2), 210–225 (2008)

Alm, J., McClelland, G.H., Schulze, W.D.: Why do people pay taxes? J. Public Econ. 48(1), 21–38 (1992)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Garcia Alvarado, F. (2019). Network Effects in an Agent-Based Model of Tax Evasion with Social Influence. In: Demazeau, Y., Matson, E., Corchado, J., De la Prieta, F. (eds) Advances in Practical Applications of Survivable Agents and Multi-Agent Systems: The PAAMS Collection. PAAMS 2019. Lecture Notes in Computer Science(), vol 11523. Springer, Cham. https://doi.org/10.1007/978-3-030-24209-1_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-24209-1_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-24208-4

Online ISBN: 978-3-030-24209-1

eBook Packages: Computer ScienceComputer Science (R0)