Abstract

Firms react to shortages in the supply of their inputs by looking for substitutes. We investigate the impact of finding such substitutes on estimates of the size of regional and national disaster impacts. To investigate this issue, we use the German multiregional supply-use table (MRSUT) for 2007, together with data on the direct impacts of the 2013 heavy floods of the German Elbe and the Danube rivers. Our analysis starts with a non-linear programming model that allows for maximum substitution possibilities. In that case there are little to no indirect damages in the directly affected regions, whereas negative indirect impacts of a magnitude of 5–7% and of up to 34% of the direct impact occur in other German regions and abroad, respectively. Adding the increasingly less plausible fixed ratios commonly used in standard Type I and extended Type II multiregional input-output and MRSUT models, results in (1) substantial increases in the magnitude of negative indirect impacts and (2) a significant shift in the intra-regional versus interregional and international distribution of these impacts. Our conclusion is that both demand-driven and supply-driven input-output and supply-use models tend to grossly overstate the indirect damages of negative supply shocks, which are part and parcel of most disasters.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

The core economic property of most disasters is that it primarily constitutes a shock to the supply-side of the economy. Most naturally, economic actors that are subjected to a negative shock in the supply of their intermediate, land, capital or labour inputs will react by looking for substitutes. Whether they are able to find such substitutes at acceptable prices determines whether or not they will have to diminish or even stop their production and sales. Consequently, besides the negative impacts on directly affected actors, other actors delivering the substitutes will experience positive impacts, while the size of the negative impacts on actors that are faced with supply shortages mainly depends on their ability to substitute for their lacking inputs. Hence, estimates of the size of an important part of both the positive and the negative wider economic impacts of disasters will strongly depend on the assumptions made with regard to the ease with which various actors are able to find such substitutes.

Different models make different assumptions in this regard. Typically, input-output (IO) and supply-use (SU) models assume that firms, governments and households purchase their inputs in fixed proportions, whereas computable general equilibrium (CGE) models assume that substitution is possible and that some types of substitution are more easily made than others, which is reflected in using different substitution elasticities. Recently, Koks et al. (2015) compared the regional and national disaster impacts of two flooding scenarios for the Italian Po river delta, as estimated with, respectively, the adaptive regional input-output (ARIO) model developed by Hallegate (2008), a regionalized version of the CGE model developed Standardi et al. (2014), as applied in Carerra et al. (2015), and the multi-regional impact assessment (MRIA) model of Koks and Thissen (2016). Both with a convex and with a linear recovery path, the fixed ratio ARIO approach predicts national economic losses that are 1.5–3 times larger than those of the more flexible MRIA and CGE models. With a concave recovery path, the ARIO model outcomes are 4.5–7 times larger than those of the MRIA model and almost 6 times larger than those of the CGE approach. Without the mitigating positive impact of the recovery path assumptions, the differences would be even larger.

Standard demand-driven IO models, which includes the widely used Inoperability IO model (IIM, Santos and Haimes 2004; Santos 2006; Anderson et al. 2007), can be expected to generate even larger indirect impacts for basically two reasons. Firstly, when one makes an attempt to analyse supply shocks, it is necessary to transform the supply shock into a shock to final demand. Oosterhaven (2017) shows that the transformation typically used in IIM applications causes double-counting and, hence, inflated indirect impact estimates. Secondly, the assumptions of fixed ratios, especially regarding trade origins, underlying these models exclude any adaption possibilities. Nonetheless, the IIM appears to be the most widely used model for disaster impact studies. The main reason for this might be its much lower data requirements compared to the above mentioned approaches, especially compared to CGE models. In fact, the advantage of spatial CGE models (cf. Tsuchiya et al. 2007), in terms of allowing for substitution effects, requires the availability of all kinds of elasticities. Moreover, modelling impacts in the short run as opposed to the long run requires different versions of the model, as short run substitution elasticities are much closer to zero than their longer run equivalents (Rose and Guha 2004).

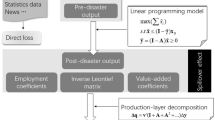

In a recent application to the Danube and Elbe flooding 2013 in Germany, Oosterhaven and Többen (2017) find that the simplicity of standard IO models comes at a price, as they show that fixed trade origin and fixed industry market shares lead to significantly inflated indirect impact estimates compared to the base non-linear programming (NLP) model proposed in Oosterhaven and Bouwmeester (2016). This base model has been developed with the goal to allow for a more realistic representation of the adaption behaviour of economic actors at research costs, in terms of data requirements, that are comparable to those of standard IO models. This is achieved by assuming that, in the event of a disaster, economic actors try to maintain their old transaction patterns as much as possible. In addition, their NLP model allows for accounting for supply shocks directly, without the need for any transformation, by setting constraints on production capacities of directly affected industries.

Interpreting the differences in outcomes between all these different models, however, is problematic as it is almost impossible to attribute the total difference to all the individual aspects that differ between each of them. In this chapter we approach this problem by working with a single model, i.e., the one proposed in Oosterhaven and Bouwmeester (2016), which allows for maximum substitution flexibility, and by sequentially adding increasingly less plausible fixed ratios to this base model. In this way, the cumulative impact of each individual fixed ratio becomes separately clear. The NLP model that is used as the base model will be discussed in Sect. 9.2, along with the multi-regional supply-use (MRSU) accounting framework to which it is applied, and the four simultaneously occurring heavy German floods of 2013 that are simulated with this model. The various fixed ratios that are most often used in the literature are discussed in Sect. 9.3, while Sect. 9.4 discusses the impact of sequentially adding these fixed ratios to the base model. Section 9.5 concludes that economies that possess maximal flexibility (resilience) will experience only little wider economic damages, whereas assuming all kind of fixed ratios substantially increases the magnitude of wider economic impact estimates, while it substantially changes its spatial distribution. In an Appendix we discuss the similar results that occur when the fixed ratios of a supply-driven MRSU model are added to our base model.

2 Accounting Scheme, Base Model and Disaster Scenarios

All eight models used here are calibrated on the use-regionalized multi-regional supply-use table (MRSUT) for Germany for 2007 (Többen 2017a, Ch. 4), with value added split-up in regional labour income and other value added, and domestic final demand split-up in consumption from regional labour income and other regional final demand. In order to keep the computational requirements at a reasonable level the MRSUT covering the 16 German states is aggregated to 12 industries and 19 products. See Table 9.1 for the set-up of this database.

The symbols in Table 9.1 and in the upcoming equations have the following meaning, with bold faces indicating vectors and matrices, and italics indicating scalars:

\( {v}_{ip}^r\in {\mathbf{V}}^{\mathbf{r}} \) = supply of product p by industry i in region r (= origin),

\( {u}_{pi}^{rs}\in {\mathbf{U}}^{\mathbf{rs}} \) = use of product p from region r by industry i in region s (= destination),

\( {y}_p^{rs}\in {\mathbf{y}}^{\mathbf{rs}} \) = use of product p from region r by households working and living in s,

\( {f}_p^{rs}\in {\mathbf{f}}^{\mathbf{rs}} \) = use of product p from region r by other final demand in region s,

\( {e}_p^r\in {\mathbf{e}}^{\mathbf{r}} \) = foreign exports of product p by region r,

\( {l}_i^r\in {\mathbf{l}}^{\mathbf{r}} \) = labour compensation by industry i in region r,

\( {w}_i^r\in {\mathbf{w}}^{\mathbf{r}} \) = other value added of industry i in region r,

\( {g}_p^r\in {\mathbf{g}}^{\mathbf{r}} \) = total supply = total demand of product p by region r,

\( {x}_i^r\in {\mathbf{x}}^{\mathbf{r}} \) = total output = total input by industry i in region r,

\( {u}_{pi}^{RoW,s}\in {\mathbf{U}}^{\mathbf{row},\mathbf{s}} \) = foreign imports of product p by industry i in region s,

\( {y}_p^{RoW,s}\in {\mathbf{y}}^{\mathbf{RoW},\mathbf{s}} \) = foreign imports of product p of households working and living in region s,

\( {f}_p^{RoW,s}\in {\mathbf{f}}^{\mathbf{RoW},\mathbf{s}} \) = foreign imports of product p for other final demand in region s,

∗ = summation over the index concerned.

The base model uses the minimal amount of assumptions possible. First, it assumes that market prices react such, to the disaster-induced shocks to the supply and demand of products, that the accounting identities of the MRSUT are maintained. Second, it assumes that all economic actors try to maintain their old pattern of economic transactions as much as possible (see Oosterhaven and Bouwmeester 2016, for an extended discussion of this approach, and Oosterhaven and Többen 2017, for a first application with a MRSUT accounting framework).

To simulate the consequences of assumption that all economic actors try to maintain their pre-disaster pattern of economic transactions, as much as possible, the objective function of our non-linear programming (NLP) model minimizes the information gain of the transaction values of the post-disaster MRSUT, compared to the corresponding values of the pre-disaster MRSUT, which are indicated by the superscripts ex:

In all scenarios this objection function is minimized subject to three accounting type constraints.

First, we assume that prices change in such a way that the economy remains in market equilibrium, i.e., we assume that supply equals demand by product by region:

This means that all variables represent quantities measured in pre-disaster (base year) prices. Implicitly, we also assume in (9.2) that the ultra-short run adaptation possibilities of depleting stocks of inputs have already taken place or are impossible, as is the case with most services. This assumption assures that total sales, i.e., the second term of (9.2), equals total output.

Second, we assume total output equals total input by regional industry:

Note that these two constraints represent the equality of the corresponding rows and columns of Table 9.1.

Third, we assume that total consumption from labour income is tied to total labour income by region:

where \( {h}^s={\sum}_p^r{y}_p^{rs, ex}/{\sum}_i{l}_i^{s, ex} \) denotes the ratio of total household consumption from labour income of people living and working in region s to total labour income of the same people in the pre-disaster MRSUT. Note that hs = (1 − ts), where ts is the labour income tax rate plus savings rate of these households. Consequently, (9.4) assumes that households living from labour incomes are not able to change their (anyhow small) savings rate and that government will not change its tax rate in face of a disaster. Moreover, (9.4) implies that the labour income accruing to commuters is part of Other value added in region s, while the consumption expenditures of commuters are part of Other final demand in other regions r ≠ s. Strictly taken, (9.4) is neither an accounting identity nor a market equilibrium condition. Instead, it models the budget constraint of regional households that only have regional labour incomes as income source, which represents the majority of all regional households (Többen 2017b).

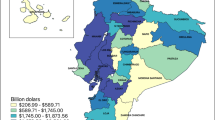

When the base model (9.1)–(9.4) is run to simulate the pre-disaster equilibrium, the 2007 MRSUT for Germany is reproduced exactly, as it should. The outcomes for regional and national total output as well as for foreign exports in this base scenario will be compared with two main disaster scenarios, namely, with the 2013 heavy flooding of the Danube and its tributaries, which directly impacted the German region of Bayern, and with the 2013 heavy flooding of the Elbe and its tributaries, which directed impacted the German regions of Sachsen, Sachsen-Anhalt and Thüringen (see Oosterhaven and Többen 2017, for details). However, for the Elbe flooding we do not treat all of the three directly affected regions simultaneously, but rather compute outcomes for the direct shocks to one of the regions separately. We do so in order to prevent that the indirect impacts triggered by each region’s direct impact offset each other. In this way, we actually defined four independent disaster scenarios.

We assume that the flooding imposes constraints on the production capacities of industries in the directly affected regions. These direct damages to production capacities are modelled by:

where d indicates the directly impacted industries and \( {\gamma}_d^d \) their capacity loss rates. The direct loss of production capacities is taken from Schulte in den Bäumen et al. (2015), where they are estimated by means of monthly data about the number of workers working “less than normally” by region and industry.

Generally, such indirect approaches to estimate the direct impact of a disaster are not ideal, as they are based on assumptions, whose impacts are difficult to assess. In our case, our estimate of the direct impact may very well include some indirect impacts too. In his critique of disaster impact analysis, Albala-Bertrand (2013) distinguishes three stages to arrive at a conclusion, namely, input data, modelling technique and interpretation of results, whereby assumptions made at each stage compound the assumptions made at former stages. This chapter examines the role of modelling assumptions typically used in standard demand- and supply-driven IO and SU models given an arbitrary direct shock to the supply-side of an economy. In the sense of this hierarchy, we, thus, only deal with those assumptions added at the second tier of the whole assumption-compound, while taking the errors made in the first tier for granted.

3 Adding Fixed Ratios to the Base Model

Next, we describe the fixed ratios that we will cumulatively add to the base scenario (9.1)–(9.5), in the order in which we consider them less and less plausible.

First, we add fixed intermediate and primary technical coefficients for each industry in each region, i.e., we assume that firms minimize their cost under a Leontief-Walras production function, which gives (Oosterhaven 1996):

where \( {a}_{pi}^{\ast s} \) denote technical intermediate input coefficients, i.e., intermediate inputs regardless of their spatial origin per unit of output, \( {b}_i^s \) denote regional labour incomes per unit of output, and \( {c}_i^s \) denote other value added per unit of output, with \( {a}_{pi}^{\ast s}, \)\( {b}_i^s \) and \( {c}_i^s \)being calculated from the 2007 MRSUT as \( {a}_{pi}^{\ast s}={\sum}^r{u}_{pi}^{rs, ex}/{x}_i^{s, ex} \), \( {b}_i^s={l}_i^{s, ex}/{x}_i^{s, ex} \) and \( {c}_i^s={w}_i^{s, ex}/{x}_i^{s, ex} \). Note that \( {\sum}_p{a}_{pi}^{\ast s}+{b}_i^s+{c}_i^s=1,\forall i,s \), by definition. Thus, (9.6) assumes that technical substitution of, e.g., metal subparts for plastic subparts, to be impossible. In the short run after a disaster this is a very reasonable assumption. However, the longer the period after a disaster, the less plausible this assumption becomes.

Second, we add fixed trade origin coefficients for intermediate inputs, which are commonly used in all demand-driven MRIO and MRSU models (cf. Oosterhaven 1984). As the data are available, we use the cell-specific, so-called interregional version of this assumption (Isard 1951), instead of the less data demanding row-specific, so-called multi-regional version (Chenery 1953; Moses 1955). Formally, the cell-specific version is written as

where \( {t}_{pi}^{rs} \) = trade origin shares, i.e., use of product p from region r per unit of total use of product p by industry i in region s. These shares are calculated from the MRSUT, with \( {\sum}^r{t}_{pi}^{rs}=1 \) by definition, as r includes RoW. The row-specific version of (9.7) assumes that the trade origin shares for all purchasing industries i in region s are equal.

The assumption of fixed trade origin ratios extends the fixed technology ratios (9.6) to the geographical origin of intermediate inputs (cf. Oosterhaven and Polenske 2009). In the context of negative demand shocks, it is more or less plausible to assume that firms proportionally purchase less inputs from all their established suppliers. In the case of a negative supply shock, however, firms will immediately search for different sources for their inputs. In an extreme case, assuming fixed trade origin ratios implies that firms have to shut down their own production completely if only one of their suppliers is not able to deliver the required inputs. Hence, this assumption definitely leads to overstating the negative impacts of disasters.

Note that, from a calculation point of view, it is not efficient to add both (9.6) and (9.7) to the base scenario (9.1)–(9.5). It more efficient to combine (9.6) and (9.7), which gives:

with \( {a}_{ij}^{rs} \) representing the fixed interregional input coefficients.

Third, the assumption of fixed industry market shares is commonly used in input-output (IO) models based on industry-by-industry transaction matrices, both in the case when such models are based on supply-use tables (SUTs) and when they are based on symmetric industry-by-industry IO tables. In the first case the assumption needs to be made explicitly in order to derive an operational IO model (Oosterhaven 1984), while, in the second case, the assumption is implicitly embodied in the symmetric IO table itself, which nowadays typically is derived from supply-use accounts (see Miller and Blair 2009). Formally, this assumption is written as:

where \( {d}_{ip}^r \) = market share of industry i in the regional supply of product p, calculated from the MRSUT, with \( {\sum}_i{d}_{ip}^r=1. \)

While this assumption is plausible, to some extent, when used in the context of a positive demand shock, it is highly implausible when the economy is faced with a negative supply shock. This can be easily shown with an example. Assume the extreme case where a certain product is produced by two industries only. Say that the first industry provides 90% of the total supply, whereas the market share of the second industry is only 10%. If this second industry is forced to shut down its production because of a disaster while the first industry is unaffected, fixed market shares would imply that the first industry will also not be able to sell that product. Therefore, the assumption of fixed industry market shares can be expected to inflate the outcomes of any model artificially.

The assumptions (9.8) and (9.9) together present the combination of fixed ratios used by the basic interregional IO model and the interregional Inoperability IO Model (IIM), which are equivalent (Dietzenbacher and Miller 2015).

Fourth, we cumulatively add the assumption for household consumption from labour incomes that corresponds with the fixed technical coefficients for intermediate demand, namely fixed technical consumption package coefficients:

where \( {p}_{py}^s \)denote technical package coefficients (i.e., household consumption of product p regardless of its spatial origin per unit of total household consumption), with the \( {p}_j^s \) being calculated from the base-year MRSUT as \( {p}_{py}^s={\sum}^r{y}_{py}^{rs, ex}/{y}_{\ast}^{\ast s, ex} \), with \( {\sum}_p{p}_{py}^s=1 \). We consider assuming fixed ratios for consumption demand much less plausible than assuming fixed ratios for intermediate demand, as their nature is more behavioural than technical, although private cars, of course, also cannot drive without gasoline. More importantly, in face of a severe drop in income, households will consciously change their consumption in the direction of consuming relatively more food and shelter.

Fifth, we add fixed consumption trade origin shares for household consumption demand:

where \( {t}_{py}^{rs} \) = trade origin shares, i.e., household consumption of product p from region r per unit of total household consumption of product p in region s. These shares are calculated from the MRSUT, with \( {\sum}^r{t}_{py}^{rs}=1 \), by definition, as r includes RoW.

Again, for calculation efficiency reasons, we do not add both (9.10) and (9.11) to the earlier set of fixed ratios, but instead add their combination, i.e., fixed interregional consumption package coefficients:

where \( {p}_{py}^{rs}={y}_p^{rs, ex}/{y}_{\ast}^{\ast s, ex} \) denotes household consumption of product j from region r per total consumption of households in region s, with \( {\sum}_j^r{p}_j^{rs}=1 \).

The assumptions (9.8)–(9.9) plus (9.12), in fact, represent the combination of fixed ratio assumptions of the extended (i.e., Type II) interregional IO and IIM models.

Sixth and seventh, we add the same two assumption, as (9.10) and (9.12), for other regional final demand, namely fixed technical package coefficients,

and fixed interregional package shares:

These two assumptions are not commonly found in the disaster impact literature. Probably because they are very implausible. Other regional final demand comprises of government consumption demand, and government and private investment demand. Each of these three types of demands will react very differently to supply shocks. In all cases, this will imply a conscious change in the composition of each type of demand, which is why assuming fixed (technical or trade) ratios is very unrealistic. Only in the case of government consumption demand, assuming fixed technical package coefficients will have some credibility, as bureaucrats will still need their bureaus, computers and papers in combination.

4 Impacts of Fixed Ratios on Modelling Outcomes

The comparison of running the cumulatively extended base model for the four flooding scenarios with the base scenario (9.1)–(9.4) is made in terms of the ratio of the regional and national indirect impacts to the direct impacts on gross output. The regional ratios are defined as:

where the numerator measures the indirect change in regional gross output in the flooded region, while the denominator measures the direct loss of gross output due to the floods in that same region. The corresponding national ratios are defined as:

where the numerator represents the indirect change in national gross output due to the flooding in region d.

The first row of Tables 9.2, 9.3, 9.4 and 9.5 shows these ratios for the flooding of, respectively, the Danube in Bayern and the Elbe in Sachsen, Sachsen-Anhalt and Thüringen, separately, under the assumption of maximal economic flexibility. Most remarkable is the very small size of all indirect impacts and especially of those occurring in the directly affected regions. While the floods cause zero (or close to zero) intra-regional indirect impacts, the effect on other German regions is in the range of about 5–7% of the size of the direct shock (i.e., loss of production capacity). Apart from Thüringen, the drop of foreign exports is much larger compared to the effects occurring in Germany itself. The very small positive indirect impacts in the not directly affected regions suggest that the loss of intermediate inputs is predominantly substituted by increasing the foreign imports and decreasing the foreign exports. This indicates that economies with a very high degree of economic flexibility, as assumed in (9.1)–(9.5), will experience negligible indirect economic damages of whatever disaster. Such economies obviously need to direct their attempts to reduce the overall cost of disasters at diminishing their direct cost, and leave the size of the indirect cost to the market.

The second to fourth row show the indirect impacts for adding the first set of fixed ratios, which, taken together, constitute the assumptions used in Type I multi-regional IO and SU models.

Surprisingly, adding fixed technical coefficients (second row) has no impact of scale of indirect impacts in the case of the Danube flooding in Bayern, neither in Bayern itself nor in the rest of Germany or abroad. In contrast, in the three, economically less diversified and much smaller eastern German states fixed technical coefficients tend to increase intraregional indirect impacts and the drops of foreign exports, but decrease negative indirect impacts occurring in the rest of Germany. At the same time, some industries in the rest of Germany increase their production, in order to compensate for the loss of inputs caused by, especially, the floods in these three eastern states.

When fixed origin-specific trade coefficients are added to the technical coefficients (third row), negative impacts occurring in the directly affected regions and in the rest of Germany as well as abroad increase significantly. However, especially in the three eastern states affected by the Elbe flooding, the intra-regional effects are still very small compared to the impacts occurring in the rest of Germany and particularly abroad. Compared to adding fixed technical coefficients only, the strongest relative increase can be observed for intra-regional indirect impacts followed by interregional impacts occurring in the rest of Germany and impacts to foreign countries due to a drop of exports.

Adding fixed industry market shares, completes the set of assumptions on which multi-regional Type I IO and SU models are build. This additional assumption leads to the strongest increases in indirect disaster impacts in the directly affected regions themselves compared to the cases discussed before. Intra-regionally, the indirect impacts increase at least by a factor of about 4–5 in Thüringen and Bayern. Nonetheless, compared to the indirect impact occurring in the Rest of Germany and compared to the drop of exports, the intraregional effects are still small. In Bayern, Sachsen-Anhalt and Thüringen the negative indirect effects in the Rest of Germany increase only slightly by less than 5%, or, in the case of Sachsen, even decrease by a small amount. Similarly, the increases in the drop of exports to foreign countries are relatively small compared to the change in the scale in the intra-regional impacts. In Bayern, Sachsen and Sachsen-Anhalt this increase is less than 10%, while only Thüringen shows a more significant drop of foreign exports of a about 50%.

The fifth and sixth rows of Tables 9.2, 9.3, and 9.4 show the outcomes of adding fixed ratios for the final consumption of households. Fixed consumption package and fixed consumption trade origin ratios taken together with the three earlier fixed ratios constitute the assumptions of the multi-regional Type II input-output and supply-use models.

Adding fixed consumption package coefficients (fifth row) results in very similar outcomes compared to the case where fixed technical coefficients have been added to the NLP base model (second row). Indeed, the intra-regional and interregional effects caused by the Danube flooding in Bayern do not change at all, whereas the impacts caused by the Elbe floods in Sachsen, Sachsen-Anhalt and Thüringen increase only slightly. In Bayern, the only difference to adding fixed technical coefficients is that the drops of foreign exports increase slightly, while it did not in the case of adding fixed technical coefficients.

Adding fixed trade origin ratios for consumption expenditures leads to significantly different outcomes in the four regions under study. In Bayern, especially the intra-regional indirect impact increases strongly by about more than 40%, whereas the changes in indirect impacts in the rest of Germany and on exports are much smaller with less than 2% each. In Sachsen, by contrast, intraregional indirect impacts only increase by about 6% and those on exports by about 7%, while the increase in the indirect impact on the rest of Germany is the dominant one with about 18%. Sachsen-Anhalt shows a similar impact as Sachsen, although the change in the interregional impacts of the former is not as dominant as that of the latter. In Thüringen, finally, the increase in the intraregional impacts changes most with about 17%. However, compared to Bayern the relative changes in interregional indirect impacts and in impacts on exports to foreign countries are much stronger with about 11% and 16.6% respectively.

The seventh and eighth rows, finally, show the outcomes, when fixed ratios on other final demand are imposed in addition to the assumptions of the Type I and Type II multiregional IO and SU models.

In the case of fixed other final demand package coefficients only relatively slight increases of indirect disaster impacts can be observed for the Danube flooding in Bayern. Compared to that the changes in the indirect impacts caused by the Elbe floods in Sachsen, Sachsen-Anhalt and Thüringen are much different. First of all, the intra-regional indirect impacts increase strongly. While this increase is relatively moderate in Sachsen-Anhalt with about 27%, they are about four to six times larger in Sachsen and Thüringen respectively. Strong increases can also be observed for the negative indirect impacts on the rest of Germany, but contrary to cases before, these negative impacts on some industries are now accompanied by significant positive impacts on the output of other industries.

Whereas the indirect impacts observed before all have been significantly smaller than what one would expect from Type I and Type II IO and SU models, adding fixed other final demand trade origin ratios eventually generates results of the expected order. In particular the indirect intra-regional impacts increase drastically by a factor of about seven in Bayern, Sachsen and Thüringen and even become about 40 times larger in the case of Sachsen-Anhalt. Another remarkable outcome is that the negative indirect interregional impacts also increase drastically due to the floods in the three eastern German states by factors of about 2.6 in Thüringen to about 3 in Sachsen-Anhalt. Compared to that, the increase in the negative interregional impacts caused by the flooding in Bayern increases only moderately by about 40%.

From these quite diverse outcomes observed for the four different regions two main patterns can be deduced. Firstly, as expected, the more fixed ratios are added to the model, the larger is the indirect impact felt in the directly affected regions themselves, in the rest of Germany and abroad. Especially in the most extreme case, fixed ratios lead to indirect impacts that are many times larger as in the case with maximal substitution possibilities (i.e., the base model). Secondly, however, our outcomes clearly show that the way in which these fixed ratios affect the intraregional, interregional and international indirect impacts seems to depend strongly on the economic structure of the region under study.

On the one hand, Bayern is by far the largest of the four economies with a strong specialization on exports and as well as strong intra-regional interrelations of its industries. As a consequence, this region shows the largest impact on exports to foreign countries throughout all cases as well as the largest intra-regional indirect effects. Compared to the other regions adding fixed ratios has the strongest impact on the intra-regional output relative to the interregional and international output. In the three eastern regions, on the other hand, the intra-regional interrelations are much weaker and as a consequence the interregional effects caused by their flooding remain dominant compared to the intra-regional impacts, except for the case of added fixed other final demand trade origins in Sachsen.

Another remarkable difference between Bayern and the three eastern regions is their reaction to fixed ratios imposed on consumption demand and other final demand. Fixed ratios for consumption only results in a relatively small increase in indirect impacts in the three eastern states, whereas the increase in indirect impacts in Bayern is much stronger. For imposing fixed ratios on other final demand, the opposite is true. The relative increase in indirect impacts is much larger in the eastern states compared to that in Bayern. This can be explained by the degree to which regional industries depend on final demand of households compared to other final demand, which in particular contains the final demand of governments. As the three eastern German regions are still economically underdeveloped, the latter makes out a much larger share of total final demand compared to Bayern.

5 Conclusion

In this chapter we examined the impacts of the fixed ratio assumptions commonly used in standard demand-driven Type I and extended Type II multiregional input-output and supply-use models on the magnitude of indirect disaster impact estimates. By adding increasingly less plausible fixed ratios to the base non-linear programming model that allows for maximal substitution possibilities, we are able to examine the relative contribution of each assumption to the magnitude of indirect impacts. Our outcomes allow us to draw three main conclusions.Footnote 1

Firstly, a supply shock to a highly resilient economy does not cause significant indirect impacts compared to the magnitude of the direct ones, as the possibility of both producers and consumers to substitute lacking inputs mitigates the negative cascading effects rippling through the interregional supply chains, and adds positive impacts elsewhere. Since the accounting framework used here, is more detailed in terms of value added and final demand, additional possibilities to adapt lead to even smaller indirect impacts compared to a previous application of this model in Oosterhaven and Többen (2017).

Secondly, we find that fixed ratio assumptions not only inflate the magnitude of indirect impact estimates substantially, but that it also has a significant impact on the spatial distribution of these impacts. While in the base model with maximum substitution possibilities intra-regional indirect impacts make out only a negligible portion of the total, adding fixed ratios shifts this portion more and more towards the disaster regions themselves. Our findings suggest that the spatial distribution of these impacts should be subject to further investigation.

Thirdly, our results also suggest that the consequences of a fixed ratio assumption are highly dependent on the characteristics of the regions under study. The four regions in our study are quite different in terms of economic size, strength of intra-regional linkages and dependency on private consumption, other final demand and regional exports. Therefore, disaster impact assessments require a realistic representation of the economy under study and of its interrelations with other economies. The disaster itself is often bound to a relatively small geographic area at the subnational level. At the same time, IO data at that level of spatial resolution is practically always scarce, which highlights the importance of plausible regional supply-use data as a prerequisite for realistic modelling outcomes.

Finally, similar to the outcomes in Oosterhaven and Többen (2017), our results show that the indirect impacts of a disaster may be only a minor concern if sufficient substitution possibilities exist. This implies that disaster impact mitigating policies targeting at the enhancement of the resilience of an economy as a whole, may not be justified, at least not in high-income countries such as Germany. Instead of focussing on indirect impacts, emphasis should rather be put on policies mitigating and preventing the negative direct impacts of disasters.

Notes

- 1.

Adding the extremely implausible fixed ratios of the newly formulated supply-driven multi-regional supply-use model to the base NLP model, in the Appendix, leads to more or less comparable conclusions.

- 2.

References

Albala-Bertrand JM (2013) Disasters and the networked economy. Routledge, Oxon

Anderson CW, Santos JR, Haimes YY (2007) A risk-based input-output methodology for measuring the effects of the August 2003 Northeast blackout. Econ Syst Res 19(2):183–204

Carerra L, Standardi G, Bosello F, Mysiak J (2015) Assessing direct and indirect economic impacts of a flood event through the integration of spatial and computable general equilibrium modelling. Environ Model Softw 63:109–122

Chenery HB (1953) Regional analysis. In: Chenery HB, Clark PG, Vera VC (eds) The structure and growth of the Italian economy. U.S. Mutual Security Agency, Rome, pp 97–129

Crowther KG, Haimes YY (2005) Application of the inoperability input-output model (IIM) for systemic risk assessment and management of interdependent infrastructures. Syst Eng 8(4):323–341

DeMesnard L (2009) Is the Ghosh model interesting? J Reg Sci 49(2):361–372

Dietzenbacher E (1997) In vindication of the Ghosh model: a reinterpretation as a price model. J Reg Sci 37(4):629–651

Dietzenbacher E, Miller RE (2015) Reflections on the inoperability input-output model. Econ Syst Res 27(4):478–486

Ghosh A (1958) Input-output approach in an allocation system. Economica 25(4):58–64

Hallegate S (2008) An adaptive regional input-output model and its application to the assessment of the economic cost of Katrina. Risk Anal 28(3):779–799

Isard W (1951) Interregional and regional input-output analysis, a model of the space economy. Rev Econ Stat 33(4):318–328

Koks EE, Thissen M (2016) A multiregional impact assessment model for disaster analysis. Econ Syst Res 28(4):429–449

Koks EE, Carrerra L, Jonkeren O, Aerts J, Husby JCJH, Thissen M, Standardi G, Mysiak J (2015) Regional disaster impact analysis: comparing input-output and computable general equilibrium models. Nat Hazard Earth Syst Sci Discuss 3(11):7053–7088

Leontief WW (1951) The structure of the American economy: 1919–1939, 2nd edn. Oxford University Press, New York

Miller RE, Blair PD (2009) Input-output analysis: foundations and extensions. Cambridge University Press, New York

Moses LN (1955) The stability of interregional trading pattern and input-output analysis. Am Econ Rev 45(5):803–832

Oosterhaven J (1984) A family of square and rectangular interregional input-output tables and models. Reg Sci Urban Econ 14(4):565–582

Oosterhaven J (1988) On the plausibility of the supply-driven input-output model. J Reg Sci 28(2):203–217

Oosterhaven J (1996) Leontief versus Ghoshian price and quantity models. South Econ J 62(3):750–759

Oosterhaven J (2012) Adding supply-driven consumption makes the Ghosh model even more implausible. Econ Syst Res 24(1):101–111

Oosterhaven J (2017) On the limited usability of the inoperability IO model. Econ Syst Res 29:452–461

Oosterhaven J, Bouwmeester MC (2016) A new approach to modelling the impact of disruptive events. J Reg Sci 56(4):583–595

Oosterhaven J, Polenske KR (2009) Modern regional input-output and impact analyses. In: Capello R, Nijkamp P (eds) Handbook of regional growth and development theories. Edward Elgar, Cheltenham, pp 423–439

Oosterhaven J, Többen J (2017) Regional economic impacts of heavy flooding in Germany: a non-linear programming approach. Spat Econ Anal 12(4):404–428

Rose A, Guha G-S (2004) Computable general equilibrium modelling of electric utility lifeline losses from earthquakes. In: Okuyama Y, Chang SE (eds) Modeling spatial and economic impacts of disasters. Springer, Berlin, pp 119–141

Santos JR (2006) Inoperability input-output modeling of disruptions to interdependent economic systems. Syst Eng 9:20–34

Santos JR, Haimes YY (2004) Modelling the demand reduction input-output (I-O) inoperability due to terrorism of connected infrastructures. Risk Anal 24:1437–1451

Schulte in den Bäumen H, Többen J, Lenzen M (2015) Labour forced impacts and production losses due to the 2013 flood in Germany. J Hydrol 527:142–150

Standardi G, Bosello F, Eboli F (2014) A sub-national version of the GTAP model for Italy. Working Papers of the Fondatione Eni Enrico Mattei

Többen J (2017a) Effects of energy and climate policy in Germany: a multiregional analysis. PhD, Faculty of Economics and Business, University of Groningen

Többen J (2017b) Regional net impacts and social distribution effects of promoting renewable energies in Germany. Ecol Econ 135:195–208

Tsuchiya S, Tatana H, Okada N (2007) Economic loss assessment due to railroad and highway disruptions. Econ Syst Res 19(2):147–162

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

1.1 A.1 Impact of Adding Supply-Driven Fixed IO and SU Ratios to the NLP Model

1.1.1 A.1.1 A Supply-Driven Multiregional Supply-Use Model

The secondary question we investigate here, is whether adding the fixed ratios assumed in the supply-driven IO model produces a different outcome compared to adding the ratios of the demand-driven IO model, as discussed in the main text. First and foremost, it needs to be reiterated that the original quantity interpretation of the supply-driven IO model (Ghosh 1958) is generally considered extremely implausible (Oosterhaven 1988, 2012; Dietzenbacher 1997; DeMesnard 2009). In sum: the single homogeneous input assumption of this model implies that cars may drive without gasoline and factories may work without labour. Nevertheless, we discuss it here because, especially, natural disasters primarily constitute a shock to the supply-side of the economy, and because the name of this model suggests that it might be suited to simulate the quantity impacts of supply shocks (see Crowther and Haimes 2005, for at least one disaster application).Footnote 2

As our base model is calibrated on a use-regionalized MRSU table (labelled as purchase only by Oosterhaven 1984, who describes a whole family of MRSUTs), we first need to formulate a supply-driven MRSU model that fits these detailed data (see Table 9.1). DeMesnard (2009) already formulated a supply-driven SU model for a closed economy when he discussed the unfitness of the commodity technology assumption while constructing a demand-driven SU model. Here, we will extend his SU model to fit to a use-regionalized MRSUT. It will be the mathematical mirror of the existing demand-driven MRSU model based on a use-regionalized MRSUT (Oosterhaven 1984). For briefness sake, we put the model directly in matrix notation.

First, any change in the supply of exogenous primary inputs w´ or endogenous intermediate inputs i´U of any regional industry leads to an equally large change in its total input x´:

where the vectors and matrices follow the layout of Table 9.1. In Eq. (9.17) all inputs are treated as perfect substitute for one another, just as the demand-driven model assumes that all outputs are perfect substitutes for one another.

Second, any change in total inputs x´ leads to an equally large change in the total supply of products by that industry Vi, while the latter are produced in a fixed product mix:

where \( {m}_{ip}^r\in \mathbf{M} \) is calculated from the base-year MRSUT as \( {v}_{ip}^{r, ex}/{x}_i^{r, ex} \). Note that Eq. (9.18) may technically be only realistic in case of some chemical industries. For other industries it must be based on the wish to service all purchasers proportionally, irrespective of their demand, which consequently is assumed to be perfectly elastic, just as the demand-driven model assumes supply to be perfectly elastic (Oosterhaven 1996, 2012).

Third, any change in the regional supply of any product i´V leads to an equally large change in the total supply g of that product:

Fourth, any change in the total regional supply of any product leads to a proportional increase (i.e., with fixed allocation coefficients) in the use of that product by all industries U and the use of that product by all final demand categories Y. Here a distinction between technical allocation coefficients B and spatial allocation coefficients Tg clarifies the multi-regional nature of the extension of the closed single-region SU model:

where ⊗ indicates a cell-by-cell multiplication. The technical allocation ratios (i.e., technical output or sales coefficients) \( {b}_{pj}^{r\ast}\in \mathbf{B} \) are calculated from the base-year MRSUT as \( {b}_{pj}^{r\ast}={u}_{pj}^{r\ast, ex}/{g}_p^{r, ex} \), with the \( {b}_{py}^{r\ast}\in {\mathbf{B}}^{\boldsymbol{y}} \)calculated analogously. The trade destination ratios\( {t}_{pj}^{r\ast}\in {\mathbf{T}}^{\boldsymbol{g}} \) are calculated as \( {t}_{pj}^{rs}={u}_{pj}^{rs, ex}/{u}_{pj}^{r\ast, ex} \), with the \( {t}_{py}^{rs}\in {\mathbf{T}}^{\boldsymbol{gy}} \)calculated analogously. Note again the importance of the assumption of a perfectly elastic demand in all markets, as opposed to the assumption of a perfectly elastic supply in the demand-driven IO model.

Appropriate sequential substitution leads to, respectively, the following base equation and subsequent solution for total industry input:

In Eq. (9.21) both coefficient matrices M and B ⊗ Tg may be rectangular, but their product M B ⊗ Tg is square and has an industry-by-industry dimension. G = (I − M B ⊗ Tg)−1 represents the multi-regional generalization of the Ghosh-inverse.

The solution for total product supply may, then, be calculated simply by means of:

1.1.2 A.1.2 The Impact of Adding Supply-Driven Fixed Ratios to the Base Model

The above supply-driven MRSU model, specifies the fixed ratio assumptions that we will sequentially add to the base model (9.1)–(9.5).

First, the fixed product mix ratios by regional industry:

where \( {m}_{ip}^r \) = share of product p in the output of regional industry i, with \( {\sum}_p{m}_{ip}^r=1. \)

Second, the fixed industry and final demand allocation ratios for regional product supply, now written out in full:

where \( {b}_{pi}^{r\ast},{h}_p^{r\ast}\ \mathrm{and}\ {d}_p^{r\ast} \)denote the technical allocation coefficients, i.e., sales regardless of their spatial destination per unit of regional supply as calculated from the rows of the MRSUT. The \( {k}_p^r \) denote foreign export allocation coefficients, which do not need to be added separately as \( {\sum}_i{b}_{pi}^{r\ast}+{h}_p^{r\ast}+{d}_p^{r\ast}+{k}_p^r=1,\forall p,r \), holds because of Eq. (9.2) in the main text.

Third, the cell-specific fixed intermediate and final output trade destination ratios, now again written out in full:

where \( {t}_{pi}^{rs},{t}_{py}^{rs}\ \mathrm{and}\ {t}_{pf}^{rs} \) represent the use of product p from region r per unit of total use of product p by i, y and f in region s. These shares are calculated from the rows of the MRSUT, with \( {\sum}^s{t}_{pi}^{rs}=1 \) by definition. The column-specific version of (9.25), which we do not use, as we have detailed cell-specific MRSUT information, would assume that the trade destination ratios for all different products p from region r are equal (cf. the FI multiregional SUT in Oosterhaven 1984).

Note that, from a calculation point of view, it is not efficient to add both (9.24) and (9.25) to the base scenario (9.1)–(9.5). It is more efficient to combine them, which gives:

and to then add (9.26), with its fixed interregional allocation coefficients, to the base scenario instead.

Tables 9.6, 9.7, 9.8, 9.9 describe the impact of this sequential adding of fixed ratios to the base model. The first rows, again, show the outcomes of the base model as defined by the Eqs. (9.1)–(9.5), while the second to fourth rows show the outcomes for the sequential adding of fixed product mix ratios by industry, fixed technical allocation ratios and, finally, fixed trade destination ratios. As opposed to Tables 9.1, 9.2, 9.3, 9.4 in the main text, which include the impacts on foreign exports, Tables 9.6, 9.7, 9.8, 9.9 include the impacts on foreign imports. The reason is that adding input ratios in the main text fixes the structure of the columns of the MRSUT, leaving exports relatively unconstrained, whereas adding output ratios in the Appendix fixes the structure of the rows of the MRSUT, leaving imports relatively unconstrained.

As to the impact of adding fixed product mix ratios per regional industry, it can be observed that the intra-regional indirect impact in all four regions increase by at least 11% (Bayern), whereas the interregional impacts change less and show a mixed behaviour. On the one hand, the interregional impacts in Bayern and Thüringen increase slightly by about 2%, while, on the other hand, a slight decrease 0.6% and 2% can be observed for Sachsen and Sachsen-Anhalt, respectively. The drop of imports from foreign countries changes uniformly across the four regions, whereby the largest drop can be observed in Bayern (1.5%) and the lowest in Sachsen (0.3%).

When fixed technical allocation coefficients are added on top of the fixed product mix ratios, the change in the indirect impacts is more uniform across the four regions. It can be observed that the intra-regional impacts increase substantially and are at least about 2.5 times (Sachsen and Sachsen-Anhalt) up to 10 times (Thüringen) larger than before. At the same time, the indirect impacts in all of Germany decrease significantly by about 49% for Bayern to about 75% for Sachsen. Separating industries that experience a positive indirect impact from those with a negative impact (second and third column), shows that this is due to an decrease in the negative indirect impacts combined with a substantial increase in the positive indirect impacts in the rest of Germany. In contrast, the drop of imports again increases uniformly, but is much larger compared to the case where only fixed product mix ratios by industry are imposed. As before, the largest changes apply to Bayern (27%) and the lowest to Sachsen (11%).

Adding fixed spatial allocation coefficients, finally, leads to a substantial increase in the indirect impacts, both, intra-regionally and interregionally. The only exception is Sachsen-Anhalt, where the intra-regional impacts decrease slightly. In the other three regions, the intra-regional impacts become about 3 (Bayern) to 7 (Sachsen) times larger compared to the case where only fixed technical allocation ratios are added. Regarding the interregional indirect impacts on the rest of Germany our outcomes show that positive indirect impacts vanish almost completely across all regions, while, at the same time, negative indirect impacts become 2.8 (Sachsen) to 3.4 (Thüringen) times larger than before. As in the cases before, adding fixed spatial allocation ratios again leads to a further increase in the drop of imports from foreign countries across all four regions and again this further increase is larger than before. However, the rank-order of regions changes, as the by far largest increase can now be observed for Thüringen (48%) followed by Bayern and Sachsen-Anhalt (both about 37%) and Sachsen (32%).

Comparing the indirect impacts across all of Germany shows that the total indirect impacts are relatively close to each other, ranging between about 13% to 18% of the direct impact. However, the extent to which these indirect impacts occur intra-regionally and interregionally is very different across the regions. The largest share of intra-regional impacts in nation-wide impacts of 20% can be observed for Bayern, whereas the lowest share of only 0.35% is observed for Sachsen-Anhalt.

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Többen, J., Oosterhaven, J. (2019). On the Sensitivity of Impact Estimates for Fixed Ratio Assumptions. In: Okuyama, Y., Rose, A. (eds) Advances in Spatial and Economic Modeling of Disaster Impacts. Advances in Spatial Science. Springer, Cham. https://doi.org/10.1007/978-3-030-16237-5_9

Download citation

DOI: https://doi.org/10.1007/978-3-030-16237-5_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-16236-8

Online ISBN: 978-3-030-16237-5

eBook Packages: Economics and FinanceEconomics and Finance (R0)