Abstract

The recent upward trend in the direct costs of natural disasters is a reflection of both an increase in asset densities and the concentration of economic activities in hazard-prone areas. Although losses in physical infrastructure and lifelines are usually spatially concentrated in a few areas, their effects tend to spread geographically and temporally due to the more spatially disperse nature of production chains and the timing and length of disruptions. Since the 1980s, several techniques have been proposed to model higher-order economic impacts of disruptive events, most of which are based on the input-output framework. However, their contributions are fragmented in different models, and, still missing, is a more comprehensive accounting of production scheduling, seasonality in industrial linkages and demographics dynamics post-event. In this chapter, the Generalized Dynamic Input-Output (GDIO) framework is presented and its theoretical basis derived. It integrates previous contributions in terms of intertemporal dynamics, explicit intratemporal modeling of production and market clearing, inventory depletion/formation and expectation’s adjustment. Moreover, we add to the literature by introducing induced effects via a demo-economic extension to study the impact of displacement and unemployment post-disaster, the impact of disruption timing via seasonal input-output tables, and production chronology via the sequential interindustry model.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Disasters have unique features and effects that pose challenges to traditional economic modeling techniques. Most of them derive from a time compression phenomenon (Olshansky et al. 2012) in which, instead of a gradual transition phase after the steady-state is disrupted, an accelerated adjustment process (due to recovery efforts) brings the economy to a new steady-state.Footnote 1 Even though some activities compress better than others (e.g., money flows in relation to construction), it creates an intense transient economic shock (non-marginal) that is spatially heterogeneous and simultaneous depending on the intensity of damages, the local economic structure and the nature and strength of interregional linkages. As a result of the speed of disaster recovery, there is significant uncertainty, simultaneous supply constraints with specific forward and backward linkages effects due to production chronology and schedules, and behavioral changes that affect both the composition and volume of demand (Okuyama 2009). Timing is, therefore, fundamental in determining the extent of impacts since capacity constraints, inventories and production cycles vary throughout the year (see Avelino 2017).

In terms of economic modeling, the aforementioned features translate into a series of effects for which the net outcome (positive/negative) is unknown as it depends on the idiosyncrasies of the region. In the aftermath of a disaster, the previous steady-state of the economy is disrupted by changes in both supply and demand. Household displacement, income loss, structural changes in expenditure patterns, diminished government expending and reconstruction efforts imply positive and negative effects to final demand. Industrial response to the latter, in terms of output scheduling, affects intermediate demand. Conversely, supply may be locally constrained due to physical damage to capital and loss of inventory, or externally constrained by limited input availability for production (due to accessibility issues or disruptions in the production chain). Whether the net effect on the region is positive or negative will depend on the characteristics of the disaster, the resilience of local industries, the volume of reconstruction funds made available and the size of interregional linkages. Spillover effects spread through supply chains’ disruptions and resource allocations for reconstruction in different regions at different times.

Hence, modeling efforts are essential to understand the role of different constraints in the recovery path post-disaster and to better inform mitigation planning. Regional industrial linkages topologies have a key role in spreading or containing disruptions, as well as sectoral robustness in terms of inventories, excess capacity, and trade flexibility (Rose and Wei 2013). Supply chain disruptions can have significant impacts on the financial health of firms by constraining sales, diminishing operating income and increasing share price volatility (Hendricks and Singhal 2005). Nonetheless, most firms do not properly quantify these risks, with few developing backup plans for production shutdowns due to physical damage or alternative suppliers in case of disruptions (University of Tennessee 2014). Assessing the dynamics of dissemination and identifying crucial industrial nodes can lead to more resilient economic systems.

As highlighted by Oosterhaven and Bouwmeester (2016), ideally, the assessment of regional impacts should be based on an interregional computable general equilibrium (CGE) framework. However, as a set of such models is required to account for both short-run (when substitution elasticities are minimal) and long-run impacts, the cost-time effectiveness of this approach is usually problematic (Rose 2004; Richardson et al. 2015). The widely used alternative has been input-output (IO) models due to their rapid implementation, easy tractability and integration flexibility with external models that are essential in the estimation of impacts post-disaster. The tradeoff between its CGE counterpart is more rigid assumptions on substitutability of goods, price changes and functional forms, which make IO more appropriate for short-term analysis. A variety of IO models have been proposed to deal with disruptive situations, most of them built upon the traditional demand-driven Leontief model (Okuyama 2007; Okuyama and Santos 2014). Nevertheless, these contributions are fragmented in different models, many of which either fail to incorporate the aforementioned constraints or do so in an indirect way that may be inconsistent with the assumptions of the IO framework (Oosterhaven and Bouwmeester 2016; Oosterhaven 2017).

In this chapter, we offer a compromise that encompasses the virtues of intertemporal dynamic IO models with the explicit intratemporal modeling of production and market clearing, thus allowing supply and demand constraints to be simultaneously analyzed. The Generalized Dynamic Input-Output (GDIO) framework is presented and its theoretical basis derived. The GDIO synthetizes many of the early contributions in the disaster literature, especially those contained in the Inventory Adaptive Regional IO Model (Hallegatte 2014), complementing them with the Sequential Interindustry Model, a demo-economic extension and seasonality effects. We integrate in a single model inventory dynamics, expectations’ adjustment, timing of the event, impacts of displacement, unemployment and reconstruction. The GDIO provides insights into the role of pivotal production chain bottlenecks, population dynamics and interindustrial flow patterns that can guide the formulation of better recovery strategies and mitigation planning.

In the next section, a concise literature review of models focused on disruptive events using the IO framework is presented. Section 7.3 describes the intuition, mathematical formulation and solution of the GDIO model. Section 7.4 presents a simple 3-sector example to show the basic feedbacks in the model, and compares these results with the recovery paths of other models in the literature. Conclusions follow.

2 Literature Review

The input-output literature on natural disasters is vast, and although a comprehensive review is outside the scope of this chapter, it is available in Okuyama (2007), Przyluski and Hallegatte (2011) and Okuyama and Santos (2014). In this section, we briefly highlight the main contributions and some of the pitfalls from the current literature.

In explicitly considering supply, demand and trade constraints, and their sources inside the framework, optimizing rebalancing algorithms were introduced by Cochrane (1997), Oosterhaven and Bouwmeester (2016) for squared IO tables, and extended by Koks and Thissen (2016) and Oosterhaven and Többen (2017) to supply and use tables (SUT). Alternatively, Rose and Wei (2013) use both supply- and demand-driven models to capture backward and forward spillovers from shortfalls in intermediate inputs. These approaches, however, rely on an implicit assumption of perfect information to rebalance the economy and calculate total multiplier effects. A way to incorporate the increase in uncertainty in the aftermath of a disaster—arising from information asymmetries (Okuyama and Santos 2014)—is to incorporate these constraints in the IO framework by explicitly modeling the market clearing process (in a Marshallian sense). In the Adaptive Regional IO Model (ARIO) model (Hallegatte 2008), sectors produce according to an expected demand level that might differ from the actual demand resulting in over- or under-supply (a reflection of highly uncertain environments).

For ex-ante analyses, it is also essential to consider the interaction between local demand-production conditions and the evolution of these constraints instead of imposing an exogenous recovery trajectory. An alternative is provided by Lian and Haimes (2006) in the Dynamic Inoperability Input-Output Model.Footnote 2 They transform the Leontief Dynamic growth model into a recovery model that determines the speed with which the production gap post-disaster closes in each period according to supply-demand unbalances.

In terms of dynamics, a few studies have proposed formulations focused on industrial chronologies and production sequencing in order to capture intertemporal disruption leakages. The time-lagged model proposed by Cole (1988, 1989)Footnote 3 and the Sequential Interindustry Model (SIM) by Romanoff and Levine (1981) relax the assumption of production simultaneity, instead accounting for production timing. This is essential, as production delays can have ripple effects in different industrial chains, and perpetuate in the economy for several periods, influencing output intertemporally (Okuyama et al. 2002, 2004). However, still unaccounted for in the available dynamic models is the role of seasonality in the economic structure. Although some sectors have more stable production structures over the course of a year, the bias of using annual multipliers in seasonal sectors such as agriculture can be significant (Avelino 2017). Hence, fluctuations in production capacity and interindustrial linkages intra-year have a significant impact on the magnitude, spread and duration of unexpected disruptive events, which affects sectoral adaptive responses.

The important role of inventories in mitigating short-term effects of disruptions has also been incorporated in the dynamic literature: the Inventory-SIM (Romanoff and Levine 1990; Okuyama and Lim 2002), the Inventory-DIIM (Barker and Santos 2010) and the Inventory-ARIO (Hallegatte 2014). However, there is still limited consideration of different types of inventories (materials and supplies, work-in-progress, finished goods) and their formation in the same framework. Besides inventories, Rose and Wei (2013) also consider other mitigation strategies such as using goods destined for export in the local economy, input conservation and production recapture. Further, Koks and Thissen (2016)’s MRIA model allows increasing local production of by-products to reduce inoperability.

Natural disasters also tend to change expenditure patterns both in the affected region (due to layoffs, reduced production, governmental assistance programs) and outside of it (relief aid). These have been incorporated in Okuyama et al. (1999) and Li et al. (2013), but the main issue is to properly identify and quantify such behavioral changes. Another important challenge is the application of a systems approach to disaster modeling, i.e., the integration of regional macro models with physical networks (transportation, utilities, etc.) that operate at different scales and frequencies. There are temporal mismatches between low frequency economic models (monthly, quarterly, yearly basis) and high frequency physical networks (daily, hourly intervals), as well as spatial mismatches in terms of systems boundaries and granularity (economic models usually defined over administrative boundaries at macro level versus micro level larger/smaller networks). Efforts in integrating physical networks include the Southern California Planning Model (Richardson et al. 2015), the National Interstate Economic Model (Richardson et al. 2014) combining a MRIO with transportation networks, and the work of Rose and Benavides (1998) who focused on electricity supply.

In sum, several alternatives have been proposed but their contributions are fragmented in several models, without a common synthesis framework. The Inventory-ARIO model introduces many of the aforementioned contributions, such as modeling supply-demand in a dynamic context to explicitly incorporate constraints, consideration of inventory formation (materials and supplies only), and some adaptation behavior from agents, but such model is still incomplete. Missing are a more comprehensive accounting of production scheduling, seasonality in the production structure, and demographic dynamics post-event. The next section introduces a new model that departs from the Inventory-ARIO model and integrates these points in a consistent and theoretically sound way.

3 Methodology

When dynamics are introduced in the IO framework, the economic system becomes a combination of intratemporal flows and intertemporal stocks. The latter are key to exploiting these dynamics and essential to fulfill both reproducibility (conditions for production in the next period) and equilibrium conditions (market clearing) across time periods. Inventories assure irreversibility of production (i.e., inputs need to be available before output is produced) and the feasibility of free disposal in a consistent accounting sense (by absorbing unused inputs/outputs) (Debreu 1959). Therefore, as echoed by Aulin-Ahmavaara (1990), a careful definition of flows and stocks is paramount to avoid theoretical inconsistencies in the model.

Following the past literature (Leontief 1970; Romanoff and Levine 1977; ten Raa 1986), time is discretized into intervals t ∈ T, T ⊃ ℤ, of length h. The discretization of a continuous process (production), requires that any flow Zij occurring during the length h be time-compressed, as ∄Zij(t∗), ∀ t∗ ∣ t < t∗ < t + 1. Moreover, since the production process per se is not explicitly modeled, production begins and ends simultaneously and synchronously within h for all industries, and output is sold at the end of the period to final demand or inventories (stocks).Footnote 4

Flows and stocks need to be organized in a certain way in order to comply with time-relevant neoclassical assumptions on production sets. If production is to occur in period t, irreversibility mandates that all required inputs be available in advance and, therefore, input purchases occur in t − 1. Note that the discretization displaces all interindustrial flows that would occur within h to a single purchase event in the previous period, i.e., industries cannot purchase inputs during production. In addition, free disposal requires the existence of inventories, so that unused materials and finished goods can be consistently accounted for and transferred intertemporally.

Based on these assumptions, the length h can be divided into a sequence of events that starts with the formation of supply from production and ends with demand being realized, markets cleared and goods allocated, thus creating the necessary conditions for production in the next period.Footnote 5 We assume intratemporal asymmetric information between producers and consumers; hence, production schedules cannot be changed in response to demand shifts within h, but they can and will be adjusted between periods.

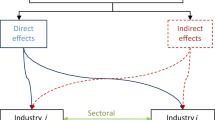

An overview of the model is presented in Fig. 7.1. The intuition behind it is straightforward: producers determine the feasibility of their production schedules for the period, given the current availability of industrial inputs, capital and labor. Assuming non-substitutability between finished goods for intermediate and final consumptions, if the total schedule is not feasible, producers use a rationing rule to set how much to offer in each market in excess of any inventories from the previous period (Sect. 7.3.1). Therefore, final demand, influenced by reconstruction efforts, displacement, labor conditions and income, might be under- or over-supplied. Industries react to this supply-demand unbalance by adjusting their expectations for the next production cycle, and by attempting to purchase the necessary level of inputs (Sect. 7.3.2). Because this interindustrial demand may also be under- or over-supplied, after markets clear, each sector determines a feasible production schedule for the upcoming period (Sect. 7.3.3). The stock losses of a disaster occur between periods, diminishing inputs, capital and displacing population, thus affecting production feasibility and demand level/composition for the next period.

The generic formulation of the GDIO model is detailed in Fig. 7.2,Footnote 6 so no specific functional forms are presented where there is flexibility (although examples are provided). Assume an economy with n industries and T production periods of length h. An industry μ ∈ 1, … , n and time period t ∈ 1, … , T are taken as reference points for expositional purposes.

3.1 Supply Side

It is imperative to distinguish between a local direct input requirement matrix (\( \overset{\sim}{\mathbf{A}} \)) and a proper technical coefficient matrix (A), as the terminology has often been indiscriminately used in the literature. The former is derived from locally purchased inputs only, while the latter arises from all inputs required for production, both local and imported, thus reflecting the structure of a Leontief production function. Local direct input requirement matrices change when regional purchase coefficients (RPC) vary since \( \overset{\sim}{\mathbf{A}}\kern-0.25em (t)=\mathbf{RPC}(t)\bigotimes \mathbf{A} \), i.e., when there is a change in the share of domestic/external suppliers. This is quite frequently the case in disaster situations as local supply plunges. Conversely, technical coefficient tables are stable and may only change due to seasonality—if intra-year tables are used (Avelino 2017)—or due to the adoption of alternative production technologies, the choice of which might depend on the availability of local supply.Footnote 7

In contrast to traditional IO specifications, the Leontief production function is extended to include primary inputs (l) and assets/capital (k), besides industrial inputs (Z). This modification introduces supply constraints due to limited input availability, physical damage to capital or displacement of the workforce. Hence, production capacity in industry μ is given by available industrial inputs, and by the coefficients \( {\mathbf{a}}_{\mu}^{\mathrm{L}}(t) \) and \( {\mathbf{a}}_{\mu}^{\mathrm{K}}(t) \), which reflect primary inputs and assets requirements per unit of output respectively.Footnote 8

Total available industrial inputs from industry i for production of industry μ at time t is the sum of locally purchased inputs (ZA), imports (MI) and materials and supplies inventories (IM) from the previous periodFootnote 9:

Total labor supply lT(t) is determined endogenously as a fixed share τ of the current resident population p(t), which in itself depends on total net migration (\( \overline{n}(t) \)) for the period, plus any external commuting labor \( {\overline{l}}^{\mathrm{E}}(t) \).Footnote 10

The labor supply can have different degrees of substitutability between industries, depending on available information on skills, age, and/or education (Kim et al. 2014; Kim and Hewings 2019). In the simplest case, it can be assumed perfectly substitutable so that l(t) = lT(t) × l(0) × (ι × l(0))−1.

Given available industrial inputs (ZT(t)), primary inputs (l(t)) and capital (k(t)), industries produce in the current period following a Leontief production function, up to a total potential output \( {\overset{\sim}{\mathbf{x}}}_{\mu}^{\mathrm{A}}(t) \):

As aforementioned, the only reason for Aij(t − 1) ≠ Aij(t) is a change in production technology as noted earlier. If regional purchase coefficients change from t − 1 to t, they may not affect Aij(t).

The actual total output \( {\mathbf{x}}_{\mu}^{\mathrm{A}}(t) \) depends on the scheduled total output for the period \( {\mathbf{x}}_{\mu}^{\mathrm{S}}(t) \) (to be discussed in Sect. 7.3.3) and any available inventory of finished goods for intermediate demand\( {\mathbf{I}}_{\mu}^{\mathrm{FI}} \) from the last period (inventories of finished goods for final demand \( {\mathbf{I}}_{\mu}^{\mathrm{FF}} \) were already embedded in \( {\mathbf{x}}_{\mu}^{\mathrm{S}}(t) \)):

After production is completed, unused inputs enter the stock of materials and supplies inventories (IM) at period t. We assume that imported inputs are used first in the production process and then local inputs are consumed.Footnote 11 In addition, note that \( {\mathbf{I}}_{i\mu}^{\mathrm{M}}(t)\ge 0 \), although \( {\Delta \mathbf{I}}_{i\mu}^{\mathrm{M}}(t) \) can be either positive or negative:

3.2 Demand Side

On the demand side, a semi-exogenous final demand vector (fμ(t)) and endogenous intermediate demands (\( {\mathbf{Z}}_{\mu j}^{\mathrm{R}}(t) \)) are locally supplied by \( {\mathbf{x}}_{\mu}^{\mathrm{A}}(t) \) and any available finished goods inventory. It is assumed that there is non-substitutability between finished goods for final demand and finished goods for intermediate demand (analogous to the use of the Armington assumption for local versus imported goods in most CGE models), although there is perfect substitution of the latter among industries.Footnote 12 The amount of \( {\mathbf{x}}_{\mu}^{\mathrm{A}}(t) \) destined for each type of demand is determined by the scheduled total output \( {\mathbf{x}}_{\mu}^{\mathrm{S}}(t) \) and scheduled demands \( {\mathbf{Z}}_{\mu i}^{\mathrm{S}}(t)\forall i \), \( {\mathbf{f}}_{\mu}^{\mathrm{S}}(t) \) that were set when purchasing inputs in t − 1. In the case when \( {\mathbf{x}}_{\mu}^{\mathrm{S}}(t)\ne {\mathbf{x}}_{\mu}^{\mathrm{A}}(t) \), a rationing scheme r(t) ∣ ∑iri(t) = 1 must be applied (Bénassy 2002). It can reflect a uniform or proportional rationing, or an industrial prioritization, for example considering the production chronology in the sequential interindustry model and prioritizing supply to those flows closer to final demand (Li et al. 2013; Hallegatte 2014). Notice that it is still possible to model such imbalance between supply and demand in an IO framework as long as t is not too large, since prices may not be able to adjust rapidly. The rationing rule is constrained by:

The composition and mix of final demand (fμ(t)) are usually affected during the recovery period due to displacement of households, changes in income distribution, financial aid, government reconstruction expenditures and investment in capital formation. Most studies model final demand change exogenously with a recovery function that gradually returns it to the pre-disaster conditions (Okuyama et al. 1999; Li et al. 2013), and a few attempt to endogenize it in the core modeling framework by closing the system regarding households (Bočkarjova 2007).

However, the simple endogenization of households to estimate induced effects implies strong assumptions. It assumes a linear homogeneous consumption function, i.e., there is a constant proportional transmission of changes in income to/from changes in consumption, that all employed individuals have the same wage and consumption pattern (consumption of unemployed individuals is exogenous) and it ignores the source of new workers (Batey and Weeks 1989; Batey et al. 2001). Of particular interest for disaster analysis is the fact that Type II multipliers artificially inflate induced effects by excluding the expenditure of workers who are unemployed in the region. As highlighted in Batey (2018), when the consumption of unemployed individuals is ignored, any change in labor requirements results in a significant change in the level of final demand as new hires suddenly “enter” the local economy. Thus, in negative growth scenarios this technique overstates the impact of the regional decline. Further, there is the additional problem, noted by Okuyama et al. (1999) that households may delay purchases of durable goods in the aftermath of an unexpected event, confining expenditures to immediate needs (necessity goods).

A way to mitigate these issues is to build upon the demo-economic framework that has been developed in the last 30 years. These integrated (demographic) models attempt to relax some of the previous assumptions by explicitly considering indigenous and in-migrant wages and consumption responses, as well as unemployment, social security benefits and contractual heterogeneity (van Dijk and Oosterhaven 1986; Madden 1993).

The demo-economic framework will be used to capture part of the change in level/mix post-disaster and its implication in terms of induced effects. We focus on the impact of displacement, unemployment and shifts in income distribution and expenditure patterns between households within the final demand. The other components of final demand are still considered to be exogenous (\( {\overline{\mathbf{f}}}^{\mathrm{O}} \)) and reconstruction demand is treated as an external shock (\( \overline{\mathbf{v}} \)).Footnote 13 We build upon a simplified version of Model IV proposed in Batey and Weeks (1989), by aggregating the intensive and extensive margins (see Appendix 7.1).Footnote 14

Therefore, once the actual total output of industry (xA) is determined, total employment for the period (lA(t)) is estimated by Eq. (7.8), and total final demand from employed residents (fHE(t)) by Eq. (7.9). Total unemployment determines the amount of final demand for these households (fHU(t)) according to Eq. (7.10).

Total final demand for the period (f(t)) is estimated by combining resident households’ expenditures, other final demand components (exogenous) and reconstruction stimulus (exogenous).

Given this semi-exogenous final demand, the actual demand supplied locally (\( {\mathbf{f}}_{\mu}^{\mathrm{A}}(t) \)) depends on finished goods produced in the period and any inventory from the previous period:

In the case where local supply is insufficient for final demand, imports (mFD) are required. The amount of available imports can be exogenously imposed in a single region setting, or it can be endogenized in a multiregional setting, where firms produce to satisfy both local and external final demand. In the latter case, spatio-temporal disruption spillover effects can be assessed. Availability can also be linked to accessibility through an additional transportation model (Sohn et al. 2004).Footnote 15 In our single region exposition, we assume an external import constraint \( {\mathbf{T}}_{\mu}^{\mathrm{FD}}(t) \) that determines how much trade flexibility there is in terms of finished goods for final demand consumption in the external industry μ.Footnote 16

Sectors that can hold finished goods’ inventoriesFootnote 17 update their stocks:

Next, industries form expectations regarding final demand in the following period in order to purchase the required inputs at t. Industries do so by means of an expectation function E[fμ(t + 1)| info], whose form is to be defined by the modeler, and may include an inventory strategy that varies according to the uncertainty in the system.Footnote 18 At this point, the GDIO intersects with the SIM, allowing sectors to behave as anticipatory, responsive or just-in-time (JIT). Anticipatory industries forecast final demand and, thus, their expectation function may or may not match the actual final demand in the next period. Just-in-time industries are a particular case in which E[fμ(t + 1) | info, JIT] = fμ(t + 1), because they produce according to actual demand next period. Finally, responsive industries react to orders placed in previous periods (for a discussion on this terminology see Romanoff and Levine 1981).Footnote 19

The required output for t + 1 (xR(t + 1)) is determined by its expected final demand via the Leontief model [Eq. (7.15)]. After accounting for any labor or capital constraints [Eq. (7.16)], and any available materials and supplies inventory, industries determine the total intermediate input requirements in the period \( {\mathbf{Z}}_{i\mu}^{\mathrm{R}}(t) \) (that includes both local and imported goods) [Eq. (7.17)].Footnote 20

Each industry then attempts to purchase its required inputs from other industries in the economy. Input supply of industry i to industry μ depends on the scheduled production, on any imposed rationing scheme, and on inventory of finished goods for intermediate demand of i. Since there is perfect substitutability of finished goods for intermediate demand among sectors, an inventory distribution scheme d(t) is required to allocate any available inventories between industries that are undersupplied. In its simplest form, it can distribute equally within those demands that exceed current supply, or it can prioritize certain industries. The actual amount of inputs purchased locally is given by:

In case local supply is insufficient for intermediate demand, imports are required. Besides possible trade constraints, for consistency the production modes of external industries need to be accommodated. In this single region exposition, the lag in production for anticipatory industries and foreign inventories is embedded in the constraint \( {\mathbf{T}}_{i\mu}^{\mathrm{I}}(t) \) that provides import flexibility.Footnote 21 In a multiregional framework, external adjustments are explicitly modeled in the other region.

Inventories of finished goods for intermediate demand are updated, allowing free disposal for industries that cannot hold inventories:

3.3 Production Scheduling for the Next Period

Finally, given the amount of inputs effectively purchased, industries determine the production schedule for the next periodFootnote 22:

These create the necessary conditions for production in the next period. Note that the disaster significantly impacts anticipatory industries, since they base decisions about the level of future production on previous final demands. Inventories, thus, have an essential role in smoothing production mismatches due to asymmetric information.

Regional purchase coefficients for the period are, therefore, implicitly determined as a function of local supply capacity (see Sect. 7.3.5). The assumption of price stability is adequate in disruptions arising from unexpected events, as prices are slower to adjust. Also, if the analysis is performed in a small region, the assumption of price taking can be effective.

3.4 Solution Procedure

Recall that the SIM assumes that, in any period, JIT and responsive industries have perfect information on current and future final demands. If we assumed complete exogeneity of the latter, this requirement is easily satisfied and the model could be solved sequentially. With the demo-economic extension, however, households’ final demand is endogenous and an iterative correcting approach is necessary. The SIM assumption is satisfied by reiterating periods in which the expected final demand and the actual final demand differ for responsive and JIT industries. For instance, at the first iteration of period t, expected final demand for these industries is set to a prior (the pre-disaster household’s final demand) in Eq. (7.15) and the model is solved until f(t + 1) is calculated via Eq. (7.11). If there is a mismatch between E[fμ(t + 1) | info, JIT or Responsive] and fμ(t + 1) for ∀μ ∣ JIT or Responsive, the prior is updated according to the convex adjustment function:

where Δ(t + 1) = (f(t + 1)/E[fμ(t + 1) | info, J or R]) − 1 and ε = 0.9 is the adjustment elasticity.Footnote 23 The current process halts and period t is reiterated with the adjusted prior. Period t + 1 is finally allowed to proceed when E[fμ(t + 1) | info, JIT or Resposive] = fμ(t + 1) .Footnote 24

3.5 Recovering the Input-Output Table for the Period

An IO table reflecting actual flows can be extracted for each period according to Fig. 7.3. Most of the vectors are determined directly from the previous equations. Interindustrial flows are determined by \( \mathbf{Z}(t)=\left(\mathbf{A}(t)\times {\hat{\mathbf{x}}}^{\mathrm{A}}(t)\right)-{\mathbf{M}}^{\mathrm{I}}(t) \), as imported inputs are consumed first. Hence, total change in inventories is derived as:

3.6 A Note on Inventories

First, recall that we assumed that besides relative prices, nominal prices do not change intertemporally. If they did, it would be necessary to account for holding gains/losses in inventories from period to period. Second, service sectors are assumed not to hold any finished goods inventory. It could be argued that they hold work-in-progress inventories (in case of consulting, entertainment, etc.), but it is assumed that these can be compartmentalized and produced in each time period. Unless h is very short (say, a day), one would expect finished services to be delivered in each time period.

Finally, the concept of partitioning transactions adopted in the System of National Accounts, which directly translates to the definition of distribution sectors (retail, wholesale and transportation) in the IO framework, needs to be accounted for when defining inventories. Transactions of retailers, wholesalers and transportation are recorded as their respective margins and, thus, represent services provided and not goods sold per se (United Nations 2009). They do not hold any finished goods inventory, and material and supplies inventories consist only of operating expenses (rent, electricity, packaging, etc.) without purchases for resale.

4 Application Example

We illustrate the GDIO with a 3-sector example for a small economy. The pre-disaster IO table for the region is presented in Fig. 7.4 and its parametrization in Tables 7.1 and 7.2. The model runs for 36 periods and we assume an unexpected event in period 13 when 15% of manufacturing becomes inoperable. There is no population displacement. Recovery happens during the subsequent 5 periods (Table 7.2). In this example, we compare the effects of trade restrictions to losses in the region, simulating a fully flexible scenario and a restricted one. These import constraints are implemented using the amount of foreign inventories/external available capacity at each period as proxies (θ = 100 and θ = 1.5 respectively).Footnote 25

Figures 7.5, 7.6 and 7.7 compare the results of both scenarios. Overall, under full trade flexibility, production losses are lower and recovery occurs faster than in the second scenario, since imports mitigate part of the supply restrictions in the economy. The model illustrates the major role that inventories and uncertainty have on losses and, especially, on their duration.

The initial periods post-disaster follow a similar pattern in both scenarios: first, manufacturing production declines due to capacity constraints causing a reduction in local income (due to layoffs) and a subsequent small impact on Services. Agriculture maintains the same level of production since it is anticipatory, thus overproducing and building up inventories. In the next period, a substantial decline is observed in all sectors due to supply constraints from manufacturing (indirect effects), available inventories in Agriculture, and lower final demand. Lower outputs also translate into increasing unemployment in the region, shifting the final demand mix towards less services and more agricultural goods.

Capacity restoration, expectation adjustments and enough inventories of intermediate goods allow a reduction in losses in periods 15–16 during which most of the inventory created in the previous two periods is consumed. The depletion of inventories, however, leads to insufficient intermediate local supply to support production from the service sector in the next period (when capacity is almost fully restored in the manufacturing sector). The negative impact in Services is exacerbated by the increase in unemployed residents who spend a significantly smaller share of their income in this sector than employed residents. As the most labor intensive sector in the economy, this leads to a negative inertial effect that exacerbates output losses until period 17. The two scenarios diverge from this point forward. The flexibility in trade in the first scenario, combined with the recovery experienced by Agriculture and Manufacturing, allows the Service sector to overcome local input supply restrictions and break its inertial effect, rebounding in the next periods. Conversely, trade restrictions in the second scenario slow such adjustment, especially for anticipatory industries in which supply-demand unbalances increase the uncertainty in the economy, compromising their expectations’ correction. This longer realignment process permeates the system for several periods, feeding the negative inertial effect in Services, expanding unemployment and reducing final demand. In time, inventory and final demand heteroscedasticity decline, allowing the economy to rebound.

Services is the most sensitive sector in this example due to 2/3 of its output being consumed by the local final demand. Hence, changes in the composition and volume of household’s demand have a crucial role in the dynamics of this sector.

By embedding intertemporal expectation adjustments via the SIM, and the demo-economic framework, this model reflects a non-smooth recovery process in contrast to other models currently available. We compare our estimates in the “flexible trade” scenario with four commonly used single-region models in the literature: the traditional Leontief model, a simplified version of Cochrane’s rebalancing model, the Inventory DIIM, and the Inventory ARIO model (see Appendix 7.2 for details on their specifications, induced effects not considered).

Overall, the recovery curve is monotonic increasing and similarly smooth across all models (Fig. 7.8). Since there is no change in demand composition nor heterogeneous production chronology, the recovery path is very homogeneous between sectors, which is in clear contrast with Fig. 7.5, in which the SIM framework, combined with the explicit consideration of labor market changes, influences the amount and timing of impacts. Moreover, by not considering labor market conditions and their effect on final demand, Services is the least impacted sector in these models. The simulations shown in Fig. 7.8 do not consider induced effects, however, which may partially explain the smaller total losses in relation to our model.

Because of their static formulations, both the Leontief and rebalancing models have no disruption spillovers beyond the 5-period recovery time for Manufacturing. Since each period’s inoperability is contained within itself, the resulting recovery path is completely dependent on the exogenous recovery timing imposed, and therefore linear. The rebalancing model shows larger losses than the Leontief model, as it captures part of the forward effects besides backward impacts.

Conversely, both dynamic models portrayed in the bottom of Fig. 7.8 account for intertemporal inoperability, resulting in longer recovery paths. In the Inventory-DIIM, the restoration pace is endogenously determined by the size of unbalance between supply-demand in each period, as well as the resilience and repair coefficient of the sectors. The Inventory-ARIO model operates in a somewhat similar fashion as the GDIO, however, without considering final demand mix changes nor different types of production modes. It is the model that generates the closest amount of total losses to our estimates (94.9%)Footnote 26 although the shape of the recovery curve differs substantially from our model due to the aforementioned differences.

5 Conclusions

Disaster events present unique challenges to economic assessment due to its time-compression characteristic that creates a structural break followed by simultaneous and intense recovery efforts in the affected areas. Due to modern “lean” production systems with high specialization, little spare capacity (to exploit scale economies), and longer production chains, disruptions and subsequent production delays in one node of a network can quickly spread to other chains and create lingering disruptive effects. Thus, there is a need to assess these transient phenomena in an industrial network perspective, accounting for the spatio-temporal spillovers within and between affected and unaffected regions.

Modeling these interdependent industrial linkages has been the main advantage of the IO framework, especially due to its relatively low data requirements, tractability and connectivity to external models. Given the simplicity and inadequacy of some of the assumptions in the traditional Leontief demand-driven model, several extensions have been proposed to address issues of supply constraints, dynamics and spatio-temporal limitations, but these contributions are still fragmentation in different models.

In a step towards a more complete methodology, the GDIO model is proposed in this chapter. It combines insights from the past literature, building upon the Inventory ARIO model, while also accounting for production scheduling, seasonality and demographic changes in a single framework. The GDIO, thus, encompasses the virtues of intertemporal dynamic models with the explicit intratemporal modeling of production and market clearing, thus allowing supply and demand constraints to be simultaneously analyzed. The key roles of inventories, expectation adjustments, timing of the event, displacement, primary inputs and physical assets are addressed. Seasonality can be included by using intra-year IO tables that can be derived via the T-EURO method (Avelino 2017). Through a demo-economic extension, we include induced effects post-disaster, accounting for level and mix changes in labor force and household income/expenditure patterns. The GDIO is “general” in the sense that simpler models as the Leontief formulation, SIM and demo-economic models can be easily derived by using simplifying assumptions. The model also allows for the extraction of balanced IO tables at each time step; this option might be advantageous in optimizing recovery efforts.

Despite these advances in modeling disaster events, the current version of the GDIO has several limitations. We are still restricted to assessing short-term effects, as in the long term the underlying socio-economic structure might exhibit significant changes [e.g., New Orleans after Hurricane Katrina (The Data Center 2015)]. The model also does not consider the impact of business cycles, when excess capacity might be extremely reduced (Hallegatte and Ghil 2008), nor does it endogenize the recovery process according to local conditions in each period (the recovery schedule is exogenously imposed). Related to the latter, although we account for the impact of labor force availability in the region, this constraint needs to be modeled exogenously accounting for accessibility and housing stock. Moreover, additional mitigation strategies beyond inventories need to be implemented in future developments of the GDIO, as those suggested by Rose and Wei (2013).

A simple application showed the advantage of the GDIO in capturing the impact of uncertainty in the recovery process, through intertemporal expectation adjustments that are affected by heteroscedasticity in inventory levels and final demand (endogenous in our model). The new system offers a more natural recovery curve in which breaks in the recovery process are common. Further research will be needed, especially for an application of the model in a real natural disaster situation in a multi-region context with seasonal IO tables, and where comparison of the results with existing methodologies can be made.

Notes

- 1.

E.g., a large amount of damaged assets is intensely replaced during recovery, moving the dynamics of capital depreciation and replacement to a new steady-state in the region or across regions.

- 2.

The DIIM is the dynamic version of the Inoperability Input-Output Model (IIM) (Santos 2003; Santos and Haimes 2004). Despite IIM’s wide application in the literature, it offers no methodological advances in relation to the traditional IO model. In fact, as shown in Dietzenbacher and Miller (2015) and Oosterhaven (2017), it is just a normalization of the Leontief model.

- 3.

- 4.

This includes both finished and work-in-progress goods.

- 5.

It follows from ten Raa (1986): all outputs for the period are assumed to form together at the end of h.

- 6.

The standard IO notation is used in this chapter. Moreover, matrices are named in bold capital letters, vectors in bold lower case letters (except inventories denoted by I) and scalars in italic lower case letters. The Greek letter ι (iota) denotes a unitary row vector of appropriate dimension. Finally, a hat sign over a vector indicates diagonalization, a prime sign transposition, × standard multiplication, and ⊗, ⊘ indicate element-wise multiplication and division respectively.

- 7.

Technology choice with constraints could be modeled using Duchin and Levine’s (2011) framework.

- 8.

E.g., suppose an industry μ relies on a 10,000 sqft factory to produce $ten million of output. Given the traditional linearity assumption, \( {\mathbf{a}}_{\mu}^{\mathrm{K}}(t)={10}^3 \) sqft/million $. These coefficients change with the economic structure, i.e., due to seasonality, labor and capital requirements might change to accommodate different production functions.

- 9.

The inventory strategy in the GDIO is quite different from the Inv-ARIO model. The latter is based on the premise that all industries seek to maintain a target level of M&S inventories similar to “order-point systems” used in managing inventories prior to the 1970s (Ptak and Smith 2011). The issue with such approach is that modern inventory management relies on “material requirement planning” systems that consider the full supply chain conditions when a firm re-orders inputs, not only its own inventory position (Ptak and Smith 2011). In the GDIO, priority is given to attend demand in the post-disaster period, instead of rebuilding inventories.

- 10.

In a multiregional specification, external labor availability would be bounded by unemployed individuals in other regions. Also, if housing data is available, net migration can be endogenous: the amount of in- (out-)migration as a proportion φ of added (lost) residential squared footage in the previous period (n(t) = φ ∗ ΔsqftRES(t − 1)).

- 11.

In this way, there is no change in inventory for external industries.

- 12.

Thus the existence of two types of finished goods inventories: \( {\mathbf{I}}_{\mu}^{\mathrm{FF}}(t) \) and \( {\mathbf{I}}_{\mu}^{\mathrm{FI}}(t) \) respectively.

- 13.

In many Regional Econometric IO models, state and local government expenditures are assumed to be endogenous with the revenues coming from a variety of direct and indirect taxes. After an unexpected event, this relationship might be uncoupled as disaster relief, funded by the federal government, pours into the region. Further, the allocation of these funds is likely to be different from the “average” portfolio of state and local government expenditures.

- 14.

We use this simplified version for expositional purposes only. Empirical applications should include a further demographic disaggregation, considering the number of individuals displaced and the expenditure pattern change of those rebuilding.

- 15.

Such extension is not included in the model’s exposition. Moreover, accessibility could also consider commuting to/from the region, constraining available labor force.

- 16.

In case there is an upper bound to imports, final demand not supplied in some sectors can be accumulated to next period (e.g., construction demand), reflecting a backlog in orders: \( {\overline{\mathbf{f}}}^{\mathrm{O}}\left(t+1\right)={\overline{\mathbf{f}}}^{\mathrm{O}}\left(t+1\right)+\left[{\mathbf{f}}_{\mu}(t)-{\mathbf{f}}_{\mu}^{\mathrm{A}}(t)-{\mathbf{m}}_{\mu}^{\mathrm{FD}}(t)\right] \).

- 17.

See Sect. 7.3.6 for notes on inventories.

- 18.

Such strategy could be included either as a deterministic (see Hallegatte 2014) or a stochastic component.

- 19.

An example of a SIM formulation with a simple inventory formation mechanism sensitive to the uncertainty in the system is:

$$ \mathrm{E}\left[{\mathbf{f}}_{\mu}\left(t+1\right)|\ \mathrm{info},\mathrm{mode}\right]=\left\{\begin{array}{c}{\mathbf{f}}_{\mu}(t)+\sigma \times \left[{\mathbf{f}}_{\mu}(t)-{\mathbf{f}}_{\mu}^{\mathrm{A}}(t)\right],\mathrm{if}\ \mathrm{anticipatory}\\ {}{\mathbf{f}}_{\mu}\left(t+1\right)+\sigma \times \left[{\mathbf{f}}_{\mu}(t)-{\mathbf{f}}_{\mu}^{\mathrm{A}}(t)\right],\mathrm{if}\ \mathrm{just}\ \mathrm{in}\ \mathrm{time}\\ {}{\mathbf{f}}_{\mu}\left(t-1\right)+\sigma \times \left[{\mathbf{f}}_{\mu}(t)-{\mathbf{f}}_{\mu}^{\mathrm{A}}(t)\right],\mathrm{if}\ \mathrm{responsive}\end{array}\right. $$where the adjustment parameter σ reflects the reaction of the sectors to such uncertainty. Therefore, we relax the assumption of perfect knowledge for production scheduling, a critique raised by Mules (1983) on the original SIM.

- 20.

- 21.

This constraint can be endogenized. A simple example would be a logistic function \( {\mathbf{T}}_{i\mu}^{\mathrm{I}}(t)=f\left(\alpha, k\right)=\left({\alpha}_i\times {\mathbf{M}}_{i\mu}^{\mathrm{I}}(0)\right)/\left(1+{e}_i^{-{k}_it}\right) \), where αi indicates the amount of underutilized external capacity and ki an industry specific speed of production increase. \( {\mathbf{T}}_{i\mu}^{\mathrm{I}}(t) \) can also be a constant number that represents external inventories.

- 22.

See footnote 20 regarding the time indexes for JIT industries.

- 23.

By letting ε < 1, the adjustment portrayed in Eq. (7.24) becomes non-linear, implying a smoother convergence correction so that each iteration allows some error room for adjustment in the next round.

- 24.

In case of responsive industries with forward lags >1, the algorithm requires reiterating previous periods when the forward lag is reached.

- 25.

The code and data for this example are available upon request.

- 26.

Total losses from the other models amount to 11.9% (Leontief), 22.0% (rebalancing) and 12.5% (Inv-DIIM) of the total estimates for the GDIO.

References

Aulin-Ahmavaara P (1990) Dynamic input-output and time. Econ Syst Res 2(4):329–344

Avelino A (2017) Disaggregating input-output tables in time: the temporal input-output framework. Econ Syst Res 29(3):313–334

Barker K, Santos J (2010) Measuring the efficacy of inventory with a dynamic input-output model. Int J Prod Econ 126:130–143

Batey P (2018) What can demographic–economic modeling tell us about the consequences of regional decline? Int Reg Sci Rev 41:256–281

Batey P, Weeks M (1989) The effects of household disaggregation in extended input-output models. In: Miller R, Polenske K, Rose A (eds) Frontiers of input-output analysis. Oxford University Press, New York, pp 119–133

Batey P, Bazzazan F, Madden M (2001) Dynamic extended input-output models: some initial thoughts. In: Felsentein D, Mcquaid R, McCann P, Shefer D (eds) Public investment and regional development. Edward Elgar, Northampton, pp 26–39

Bénassy J (2002) The macroeconomics of imperfect competition and nonclearing markets. MIT Press, Cambridge

Bočkarjova M (2007) Major disasters in modern economies: an input-output based approach at modelling imbalances and disproportions. Doctoral Thesis – University of Twente, The Netherlands

Cochrane H (1997) Forecasting the economic impact of a Midwest earthquake. In: Jones B (ed) Economic consequences of earthquakes: preparing for the unexpected. NCEER, Buffalo, pp 223–247

Cole S (1988) The delayed impacts of plant closures in a reformulated Leontief model. Pap Reg Sci Assoc 65:135–149

Cole S (1989) Expenditure lags in impact analysis. Reg Stud 23(2):105–116

Debreu G (1959) Theory of value. Yale University Press, New Haven

Dietzenbacher E, Miller R (2015) Reflections on the inoperability input-output model. Econ Syst Res 27(4):1–9

Duchin F, Levine S (2011) Sectors may use multiple technologies simultaneously: the rectangular choice-of-technology model with binding factor constraints. Econ Syst Res 23(3):281–302

Hallegatte S (2008) An adaptive regional input-output model and its application to the assessment of the economic cost of Katrina. Risk Anal 28(3):779–799

Hallegatte S (2014) Modeling the role of inventories and heterogeneity in the assessment of the economic costs of natural disasters. Risk Anal 34(1):152–167

Hallegatte S, Ghil M (2008) Natural disasters impacting a macroeconomic model with endogenous dynamics. Ecol Econ 68:582–592

Hendricks K, Singhal V (2005) An empirical analysis of the effect of supply chain disruptions on long-run stock price performance and equity risk of the firm. Prod Oper Manag 14(1):35–52

Jackson R, Madden M (1999) Closing the case on closure in Cole’s model. Pap Reg Sci 78(4):423–427

Jackson R, Madden M, Bowman H (1997) Closure in Cole’s reformulated Leontief model. Pap Reg Sci 76(1):21–28

Kim K, Hewings G (2019) Bayesian estimation of labor demand by age: theoretical consistency and an application to an input-output model. Econ Syst Res 31:44–69

Kim K, Kratena K, Hewings G (2014) The extended econometric input-output model with heterogeneous household demand system. Econ Syst Res 27(2):257–285

Koks E, Thissen M (2016) A multiregional impact assessment model for disaster analysis. Econ Syst Res 29(4):429–449

Leontief W (1970) The dynamic inverse. In: Carter A, Bródy A (eds) Contributions to input-output analysis I. North-Holland, London, pp 17–46

Li J, Crawford-Brown D, Syddall M, Guan D (2013) Modeling imbalanced economic recovery following a natural disaster using input-output analysis. Risk Anal 33(10):1908–1923

Lian C, Haimes Y (2006) Managing the risk of terrorism to interdependent infrastructure systems through the dynamic inoperability input-output model. Syst Eng 9(3):241–258

Madden M (1993) Welfare payments and migration in a nonlinear, extended input-output model with an application to Scotland. Pap Reg Sci 72(2):177–199

Mules T (1983) Some simulations with a sequential input-output model. Pap Reg Sci Assoc 51:197–204

Okuyama Y (2007) Economic modeling for disaster impact analysis: past, present, and future. Econ Syst Res 19(2):115–124

Okuyama Y (2009) Critical review of methodologies on disaster impact estimation. https://www.gfdrr.org/sites/gfdrr/files/Okuyama_Critical_Review.pdf

Okuyama Y, Lim H (2002) Linking economic model and engineering model: application of sequential interindustry model (SIM). Research Paper 2002–12, REAL

Okuyama Y, Santos J (2014) Disaster impact and input-output analysis. Econ Syst Res 26(1):1–12

Okuyama Y, Hewings G, Kim T, Boyce D, Ham H, Sohn J (1999) Economic impacts of an earthquake in the New Madrid seismic zone: a multiregional analysis. In: Elliot W, McDonough P (eds) Optimizing post-earthquake lifeline system reliability: Proceedings of the 5th U.S. conference on lifeline earthquake engineering, August 12–14, 1999. American Society of Civil Engineers, Reston, pp 592–601

Okuyama Y, Hewings G, Sonis M (2002) Economic impacts of unscheduled events: sequential interindustry model (SIM) approach. Research Paper 2002–11, REAL

Okuyama Y, Hewings G, Sonis M (2004) Measuring economic impacts of disasters: interregional input-output analysis using sequential interindustry model. In: Okuyama Y, Chang S (eds) Modeling spatial and economic impacts of disasters. Springer, Berlin, pp 77–102

Olshansky R, Hopkins L, Johnson L (2012) Disaster and recovery: processes compressed in time. Nat Hazard Rev 13:173–178

Oosterhaven J (2000) Lessons from the debate on Cole’s model closure. Pap Reg Sci 79(2):233–242

Oosterhaven J (2017) On the limited usability of the inoperability IO model. Econ Syst Res 29(3):452–461

Oosterhaven J, Bouwmeester M (2016) A new approach to modelling the impacts of disruptive events. J Reg Sci 56(4):583–595

Oosterhaven J, Többen J (2017) Wider economic impacts of heavy flooding in Germany: a non-linear programming approach. Spat Econ Anal 12(4):404–428

Przyluski V, Hallegatte S (2011) Indirect costs of natural hazards. CONHAZ Consortium, Paris

Ptak C, Smith C (2011) Orlicky’s material requirements planning, 3rd edn. McGraw-Hill, New York

Richardson H, Park J, Moore J II, Pan Q (2014) National economic impact analysis of terrorist attacks and natural disasters. Edward Elgar, Cheltenham

Richardson H, Pan Q, Park J, Moore J II (2015) Regional economic impacts of terrorist attacks, natural disasters and metropolitan policies. Springer, New York

Romanoff E, Levine S (1977) Interregional sequential interindustry model: a preliminary analysis of regional growth and decline in a two region case. Northeast Reg Sci Rev 7:87–101

Romanoff E, Levine S (1981) Anticipatory and responsive sequential interindustry models. IEE Trans Syst Man Cybern 11(3):181–186

Romanoff E, Levine S (1990) Technical change in production processes of the sequential interindustry model. Metroeconomica 41(1):1–18

Rose A (2004) Economic principles, issues, and research priorities in hazard loss estimation. In: Okuyama Y, Chang S (eds) Modeling spatial and economic impacts of disasters. Springer, Berlin, pp 13–36

Rose A, Benavides J (1998) Regional economic impacts. In: Shinozuka M, Rose A, Eguchi R (eds) Engineering and socioeconomic impacts of earthquakes: an analysis of electricity lifeline disruptions in the New Madrid area. MCEER, Buffalo, pp 95–124

Rose A, Wei D (2013) Estimating the economic consequences of a port shutdown: the special role of resilience. Econ Syst Res 25(2):212–232

Santos J (2003) Interdependency analysis: extensions to demand reduction inoperability input-output modeling and portfolio selection (Unpublished doctoral dissertation). University of Virginia, Charlottesville, VA

Santos J, Haimes Y (2004) Modeling the demand reduction input-output (I-O) inoperability due to terrorism of interconnected infrastructures. Risk Anal 24(6):1437–1451

Sohn J, Hewings G, Kim T, Lee J, Jang S (2004) Analysis of economic impacts of an earthquake on transportation network. In: Okuyama Y, Chang S (eds) Modeling spatial and economic impacts of disasters. Springer, Berlin, pp 233–256

ten Raa T (1986) Dynamic input-output analysis with distributed activities. Rev Econ Stat 68(2):300–310

The Data Center (2015) Facts for features: Katrina recovery. Retrieved from https://www.datacenterresearch.org/data-resources/katrina/facts-for-features-katrina-recovery/

United Nations (2009) System of national accounts 2008. United Nations, New York

University of Tennessee (2014) Managing risk in the global supply chain. Global Supply Chain Institute, Knoxville

van Dijk J, Oosterhaven J (1986) Regional impacts of migrants’ expenditures: an input-output/vacancy-chain approach. In: Batey P, Madden M (eds) Integrated analysis of regional systems. Pion, London, pp 122–147

Acknowledgments

The authors would like to thank Yasuhide Okuyama, Adam Rose and the two anonymous reviewers for providing substantial feedback and suggestions to improve this work. Any remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Ethics declarations

This research was supported in part by an appointment to the U.S. Army Corps of Engineers (USACE) Research Participation Program administered by the Oak Ridge Institute for Science and Education (ORISE) through an interagency agreement between the U.S. Department of Energy (DOE) and the U.S. Army Corps of Engineers (USACE). ORISE is managed by ORAU under DOE contract number DE-SC0014664. All opinions expressed in this chapter are the author’s and do not necessarily reflect the policies and views of USACE, DOE or ORAU/ORISE.

Appendices

Appendix 7.1: Simplified Model IV (Batey and Weeks 1989)

where:

-

\( \overset{\sim}{\mathbf{A}} \): is a matrix (n × n) of local direct input requirements

-

xA: is a column vector (n × 1) of total output by industry

-

fA: is a column vector (n × 1) of total final demand by industry

-

\( {\mathbf{h}}_{\mathrm{c}}^{\mathrm{E}} \): is a column vector (n × 1) of employed households’ expenditure pattern

-

\( {\mathbf{h}}_{\mathrm{c}}^{\mathrm{U}} \): is a column vector (n × 1) of unemployed households’ expenditure pattern

-

\( {\mathbf{h}}_{\mathrm{r}}^{\mathrm{E}} \): is a row vector (1 × n) of wage income from employment coefficients

-

aL: is a row vector (1 × n) of employment/output ratios

-

ρ: is a column vector (n × 1) of probabilities indicating the likelihood of previously unemployed indigenous workers filling opened vacancies

-

s: unemployment benefits

-

\( {x}_H^E \): total employed household income

-

fH: income from exogenous sources to employed households

-

u: unemployment level

-

lT: total labor supply

Appendix 7.2: Additional Models’ Specification

Model | Assumptions |

|---|---|

Static Leontief demand-driven model | Supply constraints converted into demand constraints via: fA(t) = (I − Γ(t)) ∗ fA(0) Where I − Γ(t) represents the amount of inoperability by sector at time t. |

Cochrane’s model | No trade restrictions. Rebalance estimated using: \( {\mathbf{x}}^{\mathrm{A}}(t)={\left(\mathbf{I}-\left(\mathbf{I}-\boldsymbol{\Gamma} (t)\right)\overset{\sim}{\mathbf{A}}\right)}^{-1}\ast {\mathbf{f}}^{\mathrm{A}} \) |

Inventory DIIM | Resilience coefficients (l) assumed 0.55 (agriculture) and 0.16 (services).a Manufacture’s resilience coefficient estimated following Barker and Santos (2010) at 0.54.a Repair coefficients (k) estimated following Barker and Santos (2010).a No initial inventories. |

Inventory ARIO (version 4.1) | Same parametrization from Hallegatte (2014), except: • Maximum overproducing capacityb: αmax = 1 • Number of days of stock: \( {n}_j^i=60 \) • Size of direct losses: 1 • Reconstruction timescale: 5 years • Production reduction parameterb: ψ = 1 |

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Avelino, A.F.T., Hewings, G.J.D. (2019). The Challenge of Estimating the Impact of Disasters: Many Approaches, Many Limitations and a Compromise. In: Okuyama, Y., Rose, A. (eds) Advances in Spatial and Economic Modeling of Disaster Impacts. Advances in Spatial Science. Springer, Cham. https://doi.org/10.1007/978-3-030-16237-5_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-16237-5_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-16236-8

Online ISBN: 978-3-030-16237-5

eBook Packages: Economics and FinanceEconomics and Finance (R0)