Abstract

Taking into account the time-varying, jump and leverage effect characteristics of asset price fluctuations, we first obtain the asset return rate model through the GJR-GARCH model (Glosten, Jagannathan and Rundle-generalized autoregressive conditional heteroskedasticity model) and introduce the infinite pure-jump Levy process into the asset return rate model to improve the model’s accuracy. Then, to be more consistent with reality and include more uncertainty factors, we integrate the more generalized parabolic fuzzy variable (which can cover the triangle and trapezoid fuzzy variable) to represent asset price volatility. Next, considering more general situations with fuzzy variables with mixed distributions, we apply fuzzy simulation technology to the least squares Monte Carlo algorithm to create fuzzy pricing numerical algorithms, that is the fuzzy least squares Monte Carlo algorithm. Finally, by using American options data from the Standard & Poor’s 100 index, we empirically test our fuzzy pricing model with different widely used infinite pure-jump Levy processes (the VG (variance gamma process), NIG (normal inverse Gaussian process) and CGMY (Carr-Geman-Madan-Yor process) under fuzzy and crisp environments. The results indicate that the fuzzy option pricing model is more reasonable; the fuzzy interval can cover the market prices of options and the prices that obtained by the crisp option pricing model, the fuzzy option pricing model is feasible one.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- American option

- Fuzzy set theory

- Fuzzy simulation technology

- Levy process

- GJR-GARCH model

- Least squares Monte Carlo approach

1 Introduction

The pricing problem of American options is usually solved with either analytical or numerical methods. Earlier studies mainly used analytical methods to determine the price of American options: Johnson [1] used approximate analysis to determine the value of an American option under the assumption of no dividend; Geske et al. [2] constructed a model to analyse an American option with a dividend pay-out, but no closed-form solution was obtained. Therefore, numerical methods began discussed to solve American option pricing; these include commonly used binomial tree, finite difference, and least square Monte Carlo methods, among others. Cox et al. [3] proposed the binomial tree method, which offers simple and effective solutions, and it provides an accurate numerical solution by continuously shrinking the time step; therefore, it is often used as a reference to evaluate the accuracy of other numerical approaches. However, when the model includes multiple random influencing factors, the number of values increases exponentially to calculate in the binomial tree method, which often leads to the curse of dimensionality. The finite difference method mainly converts the asset pricing differential equation into a difference equation, and by obtaining solutions through an iterative method, it mitigates the difficulty in directly solving the differential equation. In 1978, Brennan et al. [4] applied this calculation method in the pricing of American options, but the curse of dimensionality persists when this method is used to solve high-dimensional problems. The Monte Carlo method has the characteristic of forward simulation, so it cannot be applied directly for the pricing of American options, which have a backward iterative search characteristic. Longstaff et al. [5] modified the Monte Carlo method by using the least squares approach and proposed the least squares Monte Carlo algorithm, which solves the application difficulty of the said method in the pricing of American options; they also provided empirical evidence of the method effectiveness. This method uses the least squares approach to estimate the expected value of continuous holding for each path. By comparing the values to the value associated with immediate exercise, the exercise point of each path is determined. Finally, the value of the American option is obtained by computing the discounted average value of each path’s exercise point.

The above calculation methods are effective in pricing American options; however, these studies use the Black-Scholes (B-S) model as their theoretical basis, in which the asset price random process is treated as a geometric Brownian motion, which is unfit for real-life financial markets. Empirical studies have demonstrated that fluctuations in asset price and rate of return are often characterized by non-continuity, clustering and leverage effects; consequently, we need to construct a more flexible asset pricing model to accurately reflect how asset prices change in reality. Asset price usually jumps in movements, and by adding a Levy process in the pricing model, we can construct a jump model with random jumps of different strengths. Moreover, generalized autoregressive conditional heteroskedasticity (GARCH) models are most frequently used to express the volatility in asset price fluctuations and leverage effects, and such models are highly expandable and more capable of providing accurate descriptions of volatility; therefore, by combining the two models to form the Levy-GARCH model, we can better capture the characteristics of the volatility of the underlying asset. The Levy-GARCH model is widely used in the pricing of European options, but due to the complexity of American options, the model is less frequently applied as a theoretical model for American options. Based on the background described above, jump measure, time-varying volatility and leverage effects are incorporated in this study to construct the Levy-GARCH pricing model for American options proposed by Glosten, Jagannathan and Rundle (Levy-GJR-GARCH) on the basis of an infinite pure jump Levy process and an asymmetric GARCH model. In addition, in real-life financial markets, many subjective and objective uncertainty factors lead to randomness and fuzziness in the price of the option. Therefore, it is necessary to incorporate fuzzy set theory in the pricing model to improve the classic pricing theory. Hence, this study analysed the American option pricing model under a fuzzy environment, incorporated fuzzy simulation technology, and used the least squares Monte Carlo algorithm to analyse the model. Lastly, through empirical analysis, we compared the option pricing simulation results of the three infinite pure jump Levy processes (variance gamma (VG), normal inverse Gaussian (NIG), Carr-Geman-Madan-Yor (CGMY)) combined with the GJR-GARCH model.

Through the review of the existing literature, we found abundant studies regarding European option, but studies about American option pricing are still limited. Furthermore, the existing studies mainly focus on numerical algorithm improvements, and insufficient research was pursued to improve the theoretical model. Therefore, we constructed the fuzzy Levy-GJR-GARCH American option pricing model, which is more consistent with reality, and verify the model’s efficiency by using empirical analysis. The rest of this chapter is structured as follows: Sect. 2 introduces the parabolic fuzzy variable; Sect. 3 deduces the Levy-GJR-GARCH American option pricing model under a fuzzy environment; Sect. 4 provides a brief introduction of fuzzy simulation technology, then based on it design the algorithms for fuzzy American option pricing model, that is fuzzy least squares Monte Carlo algorithm. Section 5 combines the Standard & Poor’s 100 index (S&P 100 Index) American put option prices to perform empirical testing. Section 6 summaries the findings of this study.

2 Parabolic Fuzzy Variable

The concept of fuzzy sets was first proposed by Zadeh in 1965 [6]. It gradually developed into a more complete fuzzy theory, which revealed a new direction for asset pricing theories.

Let \(\tilde{A} \) be a mapping of the domain X to [0, 1], that is, \(\tilde{A}:X \rightarrow [0,1]\), \(x \rightarrow \tilde{A} (x)\) is called a fuzzy set on X. \(\tilde{A} (x)\) is called the membership function of the fuzzy set \(\tilde{A} \), and the set of all fuzzy sets on X is denoted as \(\tilde{F} (X)\). If \(\alpha \in [0,1]\), \({\tilde{A} _\alpha } = \{{x \in X\mid \tilde{A}(x) \ge \alpha }\}\), then \({\tilde{A} _\alpha }\) is called the \(\alpha \)-level set of fuzzy set \(\tilde{A} \). If \(\tilde{a} \) is a regular convex fuzzy set with a upper semi-continuous membership function \(\tilde{a} (x)\) and the level set \({\tilde{a} _\alpha }\) is bounded, i.e., \(\alpha \in [0,1]\), then \({\tilde{a}}\) is called a fuzzy number.

If the membership function form of fuzzy number \(\tilde{A}\) is:

where \(\tilde{A} \) is a parabolic fuzzy number called \(\tilde{A} = {({a_1},{a_2},{a_3},{a_4})_n}\). If \(n=1\), the above is a trapezoidal fuzzy number; if \(n=1\) and \({a_2} = {a_3}\), the above is a triangular fuzzy number. Therefore, triangular fuzzy numbers and trapezoidal fuzzy numbers are special cases of parabolic fuzzy numbers (See Fig. 1). At this point, the \(\alpha \) level set of \(\tilde{A} \) can be expressed as \(\mathop {A_{\alpha }}\limits ^{\sim }=[{\mathop {A_{\alpha }}\limits ^{\sim }}^{L},{\mathop {A _{\alpha }}\limits ^{\sim }}^{U}]=[{a_1}+\root n \of {\alpha } ({a_2}-{a_1}),{a_4}-\root n \of {\alpha } ({a_4}-{a_3})]\), where \({\mathop {A_{\alpha }}\limits ^{\sim }}^{L} \) is the \(\alpha \) pessimistic value of fuzzy variable \(\mathop {A}\limits ^{\sim } \) and \({\mathop {A_{\alpha }}\limits ^{\sim }}^{U} \) is the \(\alpha \) optimistic value of \(\mathop {A}\limits ^{\sim } \).

3 Fuzzy Levy-GJR-GARCH American Option Pricing Model

As the notations used in the remainder of this paper are listed as follows:

Variable | Description |

|---|---|

\(S_{0}\) | The underlying asset price at initial time |

\(S_{t}\) | The underlying asset price at time t |

T | Time to expiration |

K | Exercise price |

r | Risk-free interest rate |

\(V(S_{t},t)\) | Option price at time t |

\(\sigma _{t}\) | Volatility at time t |

\({X_{t}}\) | Levy process |

\(\theta \) | Drift rate |

v | Jump rate |

g | Gamma function |

3.1 The Process of the Underlying Asset Price

We assumed the fluctuation of the underlying asset price has the characteristics of time-varying, jump and leverage effect, thus the sequence of the rate of return of the underlying asset is described using an asymmetric conditional heteroskedasticity model. GJR-GARCH model can express the conditional heteroskedasticity “leverage effect”. Therefore, we chose to use GJR-GARCH model proposed by Glosen et al. [7] as the specific form of the asset return rate model, specifically as follows:

In the asset return rate model (2), \(R_{t}\) is asset’s logarithmic return rate, \(u_{t}\) is the expected rate of return under the condition of information set \(F_{t-1} \), \(\gamma _{t} \) is the mean correction factor, and \(\sigma _{t}^{2} \) is the time-varying variance sequence, \(I_{t}\) represents the indicator function. w represents intercept, \(\alpha \) is the influence coefficient of the variance of previous period to the variance of current period, \(\beta \) is the influence coefficient of the residual of previous period to the residual of current period, \(\delta \) represents asymmetric effect coefficient. \(z_{t} \) represents the innovation of the mean equation, and it follows distribution \(D(\bullet )\) with mean value of 0, variance of 1, and parameter \(\theta _{D}\), for which this study will establish several different infinite pure jump Levy processes, such as VG, NIG and CGMY process.

-

(1)

VG process:

$$\begin{aligned} E(e^{iuX_{t}})&=\varphi (u;\sigma ,v,\theta )\nonumber \\&=(1-iuv\theta +\frac{1}{2} \sigma ^{2} vu^{2})^{-\frac{1}{v}} \end{aligned}$$(3)of which,

$$\begin{aligned} C&=\frac{1}{v}>0 \\ \nonumber M&=(\sqrt{\frac{1}{4} \theta ^{2} v^{2} +\frac{1}{2}\sigma ^{2} v} +\frac{1}{2} v\theta )^{-1}>0\\\nonumber G&=(\sqrt{\frac{1}{4} \theta ^{2} v^{2} +\frac{1}{2} \sigma ^{2} v} -\frac{1}{2} v\theta )^{-1} >0 \nonumber \end{aligned}$$ -

(2)

NIG process:

$$\begin{aligned} E(e^{iuX_{t}})&=\varphi (u;\lambda , \eta , \kappa ) \nonumber \\&=\mathrm{exp(}\eta \sqrt{\lambda ^{2} -\eta ^{2}} \mathrm{-}\kappa \sqrt{\lambda ^{2} -(\eta +iu)^{2}} \mathrm{)} \end{aligned}$$(4)of which, \(\lambda >0\), \(\kappa >0\), \(-\lambda<\eta <\lambda \).

-

(3)

CGMY process:

$$\begin{aligned} E(e^{iuX_{t}})&=\varphi (u;C,G,M,Y) \nonumber \\&=\mathrm{exp(C}g\mathrm{(-Y)}(M-iu)^{Y} \nonumber \\ {}&+(G+iu)^{Y} \mathrm{-M}^{Y} \mathrm{-G}^{Y} \mathrm{)} \end{aligned}$$(5)of which, \(C>0\), \(G>0\), \(M>0\), \(Y<2\), g represents gamma function.

3.2 The Risk-Neutral Conversion of the Underlying Asset Pricing

In theory, there should be no arbitrage in the option value; therefore, the asset return rate model (see Eq. (2)) requires risk-neutral conversion to ensure the validity of the no-arbitrage assumption. Under risk-neutral measure Q, \(\mathrm{E}^{Q} (S_{t} |S_{t-1})=S_{t-1} e^{r_{t}} \), where \(r_{t} \) represents the risk-free rate of return. Here, the risk-neutral model is,

Above, \(\varphi ^{Q} (\sigma _{t})=\mathrm{E}^{Q} (e^{\sigma _{t} \varsigma _{t}^{Q}})\) is the mean correction factor, where \(\varsigma _{t}^{Q} \) is white noise with mean of 0 and variance of 1. Using the Christofersen et al. [8] method to construct the pricing kernel \(\{\varsigma _{t}\} \), we establish a Radon-Nikodym derivative sequence that can materialise real measurement of risk-neutral measure conversion:

Under a non-normal environment, the kernel sequence \(\{\varsigma _{t}\}\) is not the only one that fulfils the following formula:

Here, \(\psi (\bullet )\) represents the exponential part of the moment-generating function. Based on the characteristics of the moment-generating function \(\psi _{t}^{\prime } (0)=E_{t-1} [\sigma _{t} z_{t}]\), \(\psi _{t}^{\prime \prime } (0)=Var_{t-1} [\sigma _{t} z_{t}]=\sigma _{t}^{2} \), we obtain the following analytical expression for the kernel sequence \(\{\varsigma _{t}\}\):

After obtaining the kernel sequence \(\{\varsigma _{t}\}\), we can perform risk-neutral adjustment on the stochastic item \(\varepsilon _{t} =\sigma _{t} z_{t} \) and obtain the following formula:

Therefore, under the risk-neutral measure, the mean equation can be expressed as follows:

The conditional variance formula for the risk-neutral asset return rate model can be expressed as

At this point, we can see that there is some discrepancy between the risk-neutral measure and the real measure of sequence \(\varepsilon _{t}^{Q} \) and \((\sigma _{t}^{2})^{Q}\); therefore, it is necessary to perform parameter adjustment using kernel sequence \(\{\varsigma _{t}\} \).

4 The Algorithm Design for Fuzzy American Option Pricing Model

4.1 Fuzzy Simulation Technology

Fuzzy simulation technology only provides a statistical estimate of the model, not the precise result, but it is the effective method for complex problems for which analytical results are unattainable.

If \(\xi \) is a fuzzy variable with probability space \((\Theta ,P(\Theta ),Pos)\), the function \(f(\xi )\) is also a fuzzy variable; at the same time, the membership function of \(f(\xi )\) can be obtained using the following simulation method:

Step 1. Randomly and evenly extract a number \(\xi _{k}\) (\(k=1, 2{\dots }\)N) from the level set of fuzzy variable \(\xi \), calculate \(\xi _{k} \) membership from the membership function of \(\xi \), and denote it as \(v_{k} \).

Step 2. Based on the formula for function \(f(\xi _{k})\), calculate the function value \(f(\xi _{k})\).

Step 3. Repeat Steps 1 through 2 N times.

Step 4. Calculate the expected value \(E(f(\xi ))=\frac{1}{N} f(\xi _{k})\) of function \(f(\xi )\) and draw the membership function of \(f(\xi )\) based on (\(f(\xi _{k})\), \(v_{k} \)).

4.2 Fuzzy Least Squares Monte Carlo Algorithm

Presuming that the number of Monte Carlo algorithm-simulated paths is N and that the time to expiration T is divided into M periods, at time \(\mathrm{t}_{i} \), the exercise value of path-j is \(I_{i,j} (S_{i,j})=\max (K-S_{i,j},0)\), where K is the exercise price and \(S_{i,j}\) is the asset price on path j during \(\mathrm{t}_{i}\). The conditional expected value of continuous option holding can only obtained using backward inference \(E_{i,j}(S_{i,j} )=E[\exp (-r\Delta t)V_{i+1,j} (S_{i+1,j})|S_{i,j} ]\). Therefore, the conventional Monte Carlo method is not suitable for numerical simulation of the American option pricing model. The least squares Monte Carlo approach regards the discounted value of the option value at time \(\mathrm{t}_{i+1} \), \(\exp (-r\Delta t)V_{i+1,j} (S_{i+1,j})\), as the Y variable and \(S_{i,j} \) and \(S_{i,j}^{2}\) as X variable, constructing a least squares regression model for Y as a function of X and obtaining regression coefficients \(a_{1}\), \(a_{2}\) and \(a_{3} \). The following formula can yield an approximation for \(E_{i,j} (S_{i,j})\):

Based on the above method, compare the value of continuation holding and the value of exercise at each node of N paths, thereby obtaining the optimal exercise strategy for each path. Discount the option value of each path to the present period and obtain the average of each path’s discounted option value; this said average value is the acquired option price.

If the asset price volatility \(\sigma \) is a fuzzy number, the asset price \(S_{i,j}\) is also a fuzzy number, whereas the exercise value \(I_{i,j} (S_{i,j})\) and value of continuous holding \(E_{i,j} (S_{i,j})\) are both functions of \(S_{i,j} \); therefore, \(I_{i,j} (S_{i,j})\) and \(E_{i,j} (S_{i,j})\) are also fuzzy numbers. Their \(\alpha \) level set can be expressed as follows:

Because the asset price and option value are fuzzy variables, when comparing and solving the least squares regression equation, the expected value of fuzzy variable is used in the calculation. The calculation of the option price using the least squares Monte Carlo algorithm is as follows:

Step 1. Randomly and evenly extract a number \(\sigma _{k}(k=1,2{\dots }N)\) from the \(\alpha \) level set of the fuzzy variable \(\mathop {\sigma }\limits ^{\sim }\), calculate the membership degree of \(\sigma _{k}\) from the membership function of \(\mathop {\sigma }\limits ^{\sim }\), and denote it as \(v_{k} \).

Step 2. Based on the asset price formula, calculate the asset price \(S_{k,j} (j=1,2{\dots }M)\) at each node of path j.

Step 3. Find the option exercise value \(I_{k,j} (S_{k,j})\) at each node of path j, and calculate the value of continuous option holding \( E_{k,j} (S_{k,j})\) at each node using the least squares method.

Step 4. Repeat Steps 1 through 3 N times.

Step 5. Calculate the expected option value \(E(V_{0})=V_{k,0} /N\), and based on (\(V_{k,0} \), \(v_{k} \)), draw the fuzzy option value membership function diagram.

5 Empirical Analysis

5.1 Source of Data

This study used the S&P 100 Index and American put options acquired from S&P 100 Index as the data for empirical analysis. The S&P 100 Index prices were selected from the closing prices of data of 1526 days dating from March 22, 2011 to March 23, 2017 (data source: Yahoo!Finance), and the American S&P 100 Index put option prices were selected to be the average prices of the final transacted prices for different expiry dates and different exercise prices for put options on March 23, 2017 (data source: Chicago Board of Options Exchange). The data used in this research excluded options with same month expiry. We only took into account American options with exercise prices within the range of 95%–105% of the index prices and eliminated contracts with option values close to 0. Consequently, we obtained 70 data points, of which 22 expire in April, 22 expire in May, 11 expire in June, 5 expire in July, 5 expire in September and 5 expire in December.

5.2 Parameter Estimation

To reduce the complexity of parameter estimation, this study used a two-step method to estimate the parameters of GJR-GARCH model and Levy process: in step 1, set innovations as Gaussian distribution and use maximum likelihood estimation to estimate the parameters of the GJR-GARCH model; in step 2, based on the innovations data obtained in step 1, use the generalised method of moments to estimate the parameters of the VG, NIG and CGMY models. The results of the parameters estimation are presented in Table 1, from which we can see that the “leverage effect” parameter \(\delta \) of GJR-GARCH model is greater than 0. At the 1% significance level, the significance is not 0, indicating that the changes in volatility are clearly asymmetric, with downward fluctuations stronger than upward fluctuations.

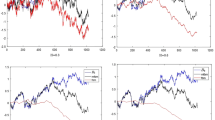

Figures 2 and 3 show the time-varying volatility sequence and the innovations sequence, and Table 2 presents the descriptive statistics of innovations. From the characteristics of the innovation data, we can see that volatility in innovations is not white noise; the skewness and kurtosis are \(-0.4951<{0}\) and \(4.9872>3\), respectively, indicating a leptokurtic, fat-tailed distribution. Therefore, a Levy process can provide higher accuracy than a Gaussian distribution.

5.3 Empirical Result Analysis

The multiplier of S&P 100 Index options is 100 USD (i.e. each point represents 100 USD). The closing price of S&P 100 Index on March 23, 2017 was 1,040, i.e. \(S_{0}=1,040\). We used the 10-year T-bond yield as of March 23, 2017 as the risk-free interest rate, \(r=2.4\%\) (data source: official website of US Treasury Department). To examine the pricing effect of the Levy-GJR-GARCH model under a fuzzy environment, we compared the pricing result with that of the Levy-GJR-GARCH model under a crisp environment. Under fuzzy theory, the volatility \(\sigma \) of an asset price is set as a fuzzy variable, whereas in the GARCH model, the volatility \(\sigma \) is set as a time-varying variable. To reduce the complexity of the fuzzy calculation, the membership function of the time-varying volatility \(\{\mathop {\sigma _{\mathrm{t}}}\limits ^{\mathrm{\sim }}\}\) was set as an equal form of parabolic membership function. Because estimation of four parameter values was required for parameter interval of parabolic fuzzy numbers, the historical rates of return of 1525, 1200, 800 and 400 trading days before March 23, 2017 were selected as observation samples based on different market information reflected by different sampling intervals.

The expected values under a fuzzy environment were obtained from the upper and lower weights of the \(\alpha =0.95\) level set of fuzzy number \(\mathop {\mathrm{V}_{t}}\limits ^{\sim }\), and the exact formula is as follows:

Furthermore, we selected 22 short-term option pricing results with expiry in April 2017 to further analyse the differences in option pricing under fuzzy and crisp environments. The result is shown in Fig. 4. From the simulation result, we can see that all market prices fall within the fuzzy interval of the VG, NIG and CGMY models under a fuzzy environment, which shows that the market prices of options are better covered when a fuzzy price interval is used. In contrast with the smaller fuzzy interval of the VG model and the greater fuzzy interval of the NIG model, the fuzzy interval of the CGMY model offers better simulation results. Simultaneously, we observe that under a crisp environment, the simulation results of the VG and CGMY models are greater than the market price when the exercise price is lower and less than the market price when the exercise price is higher, whereas the simulation result of the NIG model is less than the market price when the exercise price is lower and greater than the market price when the exercise price is higher.

6 Conclusions

The decision of the optimal stopping time makes American option pricing problems more complicated than the European option pricing problem, and the traditional BS (Black Schloes) model is not capable of deciding American option pricing. Taking into account the time-varying, jump and leverage effect characteristics of the asset price fluctuation, this study built a Levy-GJR-GARCH American option pricing model based on an infinite pure jump process. Meanwhile we incorporated fuzzy set theory and set the underlying asset price volatility as the more generalized parabolic fuzzy variable and considering more general situations with the fuzzy variables with mixed distributions, based on fuzzy simulation technology established fuzzy least squares Monte Carlo numerical algorithms for the proposed model. Lastly, using the S&P 100 Index and data for the corresponding American put options, we empirically tested our fuzzy pricing model with different widely used infinite pure-jump Levy processes (the VG, NIG and CGMY processes) under fuzzy and crisp environments. The results indicate that the fuzzy option pricing model is more reasonable; the fuzzy interval can cover the market prices of options and the prices that obtained by the crisp option pricing model, the fuzzy option pricing model is feasible one.

References

Johnson, H.E.: An analytic approximation for the American put price. J. Financ. Quant. Anal. 18(01), 141–148 (1983)

Geske, R., Johnson, H.E.: The American put option valued analytically. J. Finance 39(5), 1511–1524 (1984)

Cox, J.C., Ross, S.A., Rubinstein, M.: Option pricing: a simplified approach. J. Financ. Econ. 7(3), 229–263 (1979)

Brennan, M.J., Schwartz, E.S.: Finite difference methods and jump processes arising in the pricing of contingent claims: a synthesis. J. Financ. Quant. Anal. 13(03), 461–474 (1978)

Longstaff, F.A., Schwartz, E.S.: Valuing American options by simulation: a simple least-squares approach. Rev. Financ. stud. 14(1), 113–147 (2001)

Zadeh, L.A.: The concept of a linguistic variable and its application to approximate reasoning-I. Inf. Sci. 8(3), 199–249 (1975)

Glosten, L.R., Jagannathan, R., Runkle, D.E.: On the relation between the expected value and the volatility of the nominal excess return on stocks. J. Finance 48(5), 1779–1801 (1993)

Christoffersen, P., Elkamhi, R., Feunou, B., Jacobs, K.: Option valuation with conditional heteroskedasticity and nonnormality. Rev. Financ. Stud. 23(5), 2139–2183 (2009)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Zhang, H., Watada, J. (2019). Building Fuzzy Levy-GJR-GARCH American Option Pricing Model. In: Seki, H., Nguyen, C., Huynh, VN., Inuiguchi, M. (eds) Integrated Uncertainty in Knowledge Modelling and Decision Making. IUKM 2019. Lecture Notes in Computer Science(), vol 11471. Springer, Cham. https://doi.org/10.1007/978-3-030-14815-7_17

Download citation

DOI: https://doi.org/10.1007/978-3-030-14815-7_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-14814-0

Online ISBN: 978-3-030-14815-7

eBook Packages: Computer ScienceComputer Science (R0)