Abstract

Palm oil production has had an extraordinary evolution since 2000, especially in Southeast Asian countries. Its profitability is related to lower market prices due to it having the cheapest production costs , compared to the other EU oils. Market forces have stimulated its production and trade, with a shift in the use of land in tropical countries (particularly in Southeast Asia). Palm oil has a high smoke point for its saturated fatty acid content, which is much healthier than the performance of conventional oils produced and used in Europe (corn, sunflower and peanut oil). The controversy of which palm oil has been the subject is linked to the environmental sustainability aspects of the production process. According to the European Commission, palm oil cultivation over the past 20 years has been the cause of 20% of global deforestation. However, our results highlighted that the price trends of selected vegetable oils are related to their variations. This allows the advancing of some hypotheses. On the supply side, the production costs (decisively in favour of palm oil) and the environmental constraints are affecting the vegetable oil market. On the demand side, the number and price, on the one hand of substitute products, and on the other hand of the complementary good as well as consumer taste and preference, all influence consumer behaviour. Consumer income and its distribution and, in both cases, public policies affect the various choices to be made. Public action should therefore consider these variables. A single policy may not be sufficient to steer the market in the right direction, especially in the logic of market globalisation.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Palm oil (botanical classification Eleaeis guineensis) comes from the fruit of the oil palm tree, a tropical species that originated in West Africa, but now grows as a hybrid in many parts of the world, including Southeast Asia and Central America. Palm oil cultivation has a very different structure compared to the other main vegetable oils due to investments in plantations. The productive life of a plant is about 20–30 years and it starts to produce fruit only after 30 months. The plant, to grow and be productive, needs a tropical climate .

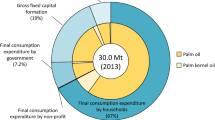

Palm fruit contains two types of oil : palm oil , which comes from the mesocarp or the fleshy part of the fruit, and palm kernel oil, which comes from the seed in the fruit. Finally, the shells that remain after the kernel oil has been extracted are called palm kernel shells. Palm oil is the highest oil yield crop , producing on average about 4–5 tonnes of oil /ha annually; this is 10 times more than soybean and 5 times more than rapeseed (Koh and Wilcove 2007; Fitzherbert et al. 2008; Sumathi et al. 2008; Corley 2009; McCarthy and Cramb 2009; Wilcove and Koh 2010; Castiblanco et al. 2013; Pirker et al. 2016). As raw material, it is used both for the food and non-food industry. Processed palm oil is important for the preparation of cosmetics, food, lubricants and fuels. According to the USDA (2017), about half of the packaged products in supermarkets contain this oil . Direct palm oil competitors are soybean and rapeseed . Among edible oils, palm oil accounts for about 40% of all vegetable oils.

Given the substitutability of palm oil and its low cost , compared to other vegetable oils, the EU over the years has increased the use of this oil . Consequently, Europe is now a leading importer of palm oil .

In the existing literature, several studies have analysed vegetable oil price relationships (Yu et al. 2006; Campiche et al. 2007; Zhang and Reed 2008; Harri et al. 2009; Peri and Baldi 2010; Zhang et al. 2010; Esmaeili and Shokoohi 2011; Natanelov et al. 2011; Sanders et al. 2014; Rezitis 2015; Bentivoglio et al. 2018).

Starting from these premises, the paper aims to present and analyse the European vegetable oil market focusing on the role played by palm oil , a strategic commodity for some Southeast Asian countries. Moreover, this study seeks to explore the presence of cointegration linkages between palm oil and other selected vegetable oil prices. Because vegetable oil prices tend to move closely with one another, price differentiations (even if small) are sufficient to move preferences in international markets.

To achieve these aims, the paper is structured as follows. Section 2 presents an overview of the palm oil sector at world level (production, consumption and trade). Section 3 shows the EU vegetable oil market and trends. After a brief review on palm oil sustainability included in Sect. 4, details of the data used, the methodology and the results on price relationships are discussed in Sect. 5. The conclusions drawn from the study are presented in the final section.

2 Palm Oil Production, Consumption and Trade

According to USDA FAS data (2017), the global production of palm oil accounted for 34% of all vegetable oil in 2016, followed by soybean (29%), rapeseed (15%) and sunflower oils (9%). Global palm oil production has grown from 18 million tonnes in 1996 to 67 million tonnes in 2017, an increase of 273%.

Currently, Indonesia (54%) and Malaysia (31%), together, account for around 85% of global palm oil production. However, there has also been a remarkable increase in palm oil production in other parts of the world, namely, Thailand (about 2.2 million tonnes), Columbia (about 1.3 million tonnes) and Nigeria (about 1 million tonnes) (Table 1).

A significant change in the palm oil market took place during the past decade, when, in 2005 Indonesia surpassed Malaysia in the production of palm oil , becoming in 2006–2008 the world’s leading producer (Fig. 1).

(Source Authors’ elaboration on Index Mundi data 2017a)

Malaysian and Indonesian palm oil production (1964–2017)

Indonesian production has more than doubled from 2006 to 2017 (+117%) while in Malaysia palm oil production grew more than 37% over the same period.

From the supply side, the availability of land in Indonesia has allowed this country to become the top producer (USDA 2007). The harvested area of palm oil in Indonesia increased from 5.2 million hectares in 2006 to 9.3 million hectares in 2017 (+78%). In Malaysia , the harvested area of palm oil increased from 3.7 million hectares to 5.2 million hectares over the same period (+40%).

The growth of production and the expansion of the palm oil area coincides with the increase in palm oil trade. In 2017, palm oil made up 33% of global total vegetable oil consumption, ahead of soybean (30%), rapeseed (16%) and sunflower oil (9%); global consumption rose from 17 million tonnes in 1996 to 63 million tonnes in 2017, making it the most consumed oil in the world (Fig. 2).

(Source Authors’ elaboration on USDA FAS data 2017)

Word consumption of vegetable oil (1996–2017)

Global insecurity, high oil prices from non-renewable sources, political instability of the main suppliers and exporters of oil , and concerns about climate change , have increased the demand for renewable energy worldwide and, more markedly, in emerging Asian countries. However, India and China have also increased their use of non-renewable energy. China, in particular, as a strategic goal, aims to improve the energy efficiency of motor vehicles. Moreover, according to FAO forecasts (2012), by 2020 the global demand for palm oil will double and triple by 2050.

Palm oil is also the most traded vegetable oil in the world. As shown in Table 2, Indonesia and Malaysia are the largest palm oil exporters by far, and imports involve many different countries. More specifically, India, the EU and China are the biggest purchasers of Malaysian and Indonesian palm oil (55% of global imports).

3 European Vegetable Oil Production, Consumption and Trade

Over 2000–2016, European countries increased their production of vegetable oils by 86%, from 9.1 to 16.9 million tonnes (Fig. 3).

(Source Authors’ elaboration on FEDIOL data 2017)

Production of vegetable oil in the EU (2000–2016)

The EU is the world’s largest producer of rapeseed oil . According to FEDIOL data, in 2016, European production of rapeseed oil accounted for 62% of all vegetable oils , followed by sunflower (18%) and soybean oil (16%). Specifically, since 2000 rapeseed oil production has increased substantially compared to other vegetable oils . Germany and France are the two largest producers of rapeseed in the EU , followed by Spain and Poland. The main driver of the demand for rapeseed oil is the biodiesel industry but food and industrial use of rapeseed oil also influence demand (USDA 2016a, b).

Rapeseed oil is also the main vegetable oil consumed in the EU (Fig. 4). In 2016, the consumption of rapeseed oil accounted for 41% of all vegetable oils , followed by palm oil (26%) and sunflower oil (17%). The consumption of rapeseed oil between 2000 and 2016 had a constant positive trend.

(Source Authors’ elaboration on FEDIOL data 2017)

Consumption of vegetable oil in the EU (2000–2016)

In the EU , palm oil plays an important role as a feedstock for energy (61%), especially for biodiesel, as edible oil for food (34%) and for non-food products, as animal feed and for industrial use (5%). From 2010 to 2014 palm oil used for non-energy purposes (for example, food, animal feed, etc.) declined, while palm oil consumption for energy (transport, electricity generation and heating) increased. The European vegetable oil demand is only partially satisfied by domestic rapeseed production and thus the EU largely depends on palm oil imports. Palm oil makes up the majority of the vegetable oils imported into Europe (70%). Europe’s demand for palm oil increased from 2.5 million tonnes in 2000 to 6.7 million tonnes in 2015 (+168%).

4 Palm Oil Sustainability: An Overview

Palm oil production is a divisive issue. The arguments against range from protection of the environment and biodiversity (mainly due to deforestation), and food security and safety. The most visible change , caused by intensive oil palms plantations, is the huge loss of natural forests (FAO 2010). The main concerns are deforestation methods blamed for decreased biodiversity; changes to the consumption patterns and local population employment opportunities; greenhouse gas emissions and the destruction of endangered species (orangutans, Sumatra tiger, elephants, etc.). The cheapest way to clear land is to slash and burn and burning produces pollution. In response to consumer pressure, an increasing number of food industries have adopted prohibitions on the use in food of palm oil derived from plantations that occupy former forests. The growth in production, however, continues although at less high growth rates.

The Indonesian and Malaysian lands are rich in carbon. When forestlands are drained and burned, they release coal and methane gases into the atmosphere causing an increase in emissions and endangering the health of local populations . Deforestation also hampers human rights as plantation owners use forced labour and subcontract land under onerous conditions to local populations . The Indonesian Government has adopted some limitations on crop production and expansion and has promoted the reclamation of some over-exploited areas. The Malaysian government is considering the same measures.

At international level, the Roundtable on Sustainable Palm Oil (RSPO), a multi-stakeholder and not-for-profit initiative of the palm oil industry was set up in 2004. Producers, non-governmental organisations and other stakeholders , aiming at minimising the negative impact of oil palm cultivation on the environment , on local communities and on consumer choices, are part of the RSPO.Footnote 1 More specifically, consumer goods companies make up 46% of the members, producers and processers 33%, growers 11%, retailers 4%, NGOs and banks 4% (RSPO 2016). Some well-known global companies are members of the RSPO, such as, Unilever, IKEA, Ferrero and Nestlé while processors, such as, Wilmar, Sinarmas and Golden Agri Resources are also members.

Producers obtain sustainable palm oil certification if the following principles are applied (RSPO 2016):

-

1.

Commitment to Transparency: growers and processors have to provide information and documentation on environmental, social and legal issues to stakeholders .

-

2.

Compliance with Applicable Laws and Regulations: the member companies must comply with all local, national and international laws and/or regulations; prove their right to use the land where the plantation is located as well as compliance with local people user rights.

-

3.

Commitment to Long-term Economic and Financial Viability: the member companies must furnish a management plan clearly explaining how the goal of long-term economic and financial viability is to be achieved.

-

4.

Use of Appropriate Best Practices by Growers and Processors: operating procedures must be documented, implemented and monitored. The practices have to maintain soil fertility, minimise the degradation of soils and maintain water quality and availability. Companies must adopt appropriate integrated pest management approaches and have workers, smallholders and contract workers appropriately trained.

-

5.

Environmental Responsibility and Conservation of Natural Resources and Biodiversity: the companies have to mitigate the negative and boost the positive impacts of the palm oil industry while demonstrating continuous improvements in their operations. Endangered species living in the plantations must be identified and their survival ensured, waste reduced, recycled, or reused and fossil fuel usage reduced and renewable energy usage optimised. The use of burning must be avoided for preparing land or replanting.

-

6.

Responsible Consideration of Employees and of Individuals and Communities Affected by Growers and Processors: companies must adopt open and transparent methods of communication between growers, processors and local communities. Customary or user rights must be respected. Salaries and conditions for employees and for contract workers have to meet, at a minimum, legal or industry standards and must be sufficient to provide decent living wages. The employer must respect the rights of personnel to form and join trade unions , and to prohibit the use of child labour. Growers and processors must deal fairly and transparently with smallholders and their labour forces.

-

7.

Responsible Development of New Plantings: before establishing new plantations or expanding existing ones, a social and environmental impact assessment must be provided.

-

8.

Commitment to Continual Improvement in Key Areas of Activity: growers and processors should implement action plans that allow demonstrable continuous improvement in key operations.

Despite RSPO’s worthy goals, in 2016, only 21% of the total global production was estimated to be RSPO compliant: in Indonesia , the RSPO certified area is only 1.8 million hectares in a planted area of more than 11 million hectares (RSPO 2016).

5 Vegetable Oil Prices Relationship

Within the existent economic literature, the approachess used to study price relationships follow different conceptual frameworks (Bakhat and Würzburg 2013). In this study, we applied time series models to estimate the dynamic relationships between vegetable oil prices (Myers 1992; Balbás et al. 2005; Taylor 2008; Anderson 2011; Asari et al. 2011; Bentivoglio et al. 2014, 2016; Chatfield 2016).

Different characteristics are relevant to implement a time series model: the presence of stochastic trend (unit roots) and cointegration. Firstly, unit root tests are tools for discriminating between non-stationary (presence of stochastic trend) and stationary (presence of deterministic trend) time series . Secondly, cointegration tests are useful to test if time series tend to move together over time (cointegration). In this study, we applied the standard augmented Dickey–Fuller test (1979) (ADF) to determine whether vegetable oil price series are stationary or not. The ADF test is one of the best-known and most widely used unit root tests (Im et al. 2003; Saghaian 2010; Fedorová 2016). This tests considers as null hypothesis H0 that the series is not stationary (or contains a unit root) against the stationary alternative corresponding to the alternative hypotheses H1 (or does not contains a unit root). Furthermore, the Johansen test (1988) for cointegration was then used to determinate whether the series are cointegrated. The Johansen procedure is based on two steps. In the first, the optimal lag length for the model is determined by investigating the performance of Akaike (AIC) (1973), Hannan and Quinn (HQ) (1979) and Schwarz (SC) (1978) information criteria (IC). In the second step, given the optimal lag length, the cointegration rank is obtained through the trace test and the Maximum-Eigenvalue test. For both test statistics, the initial Johansen test is a test of the null hypothesis of no cointegration against the alternative of cointegration.

All the analyses were carried out using the statistical software Rats32s (Regression Analysis of Time Series ).

Data is based on monthly prices from November 1998 to February 2017. This amounts to a total of 220 observations. In detail the study has utilised the monthly prices (€/tonnes) of oil from rapeseed , palm, sunflower and soybean which were collected from the Index Mundi database. The indexed price series used in the analysis are presented in Fig. 5, with the base period price consisting of the year 1998.

(Source Authors’ elaboration on Index Mundi data 2017d)

Vegetable oils indexed prices (1998 = 100)

The volatility of vegetable oil s price (Fig. 5) is significantly high in recent years.

Generally, sunflower oil has the highest price in the market.

To investigate the time series properties of the variables, we started with presenting the four price series for stationarity. In order to examine the stationarity status for each series, the ADF test has been conducted. As shown in Table 3, the ADF test failed to reject the null hypothesis of unit root, suggesting that all the variables are non-stationarity at the 1% significance level.

Based on the unit root test results, we examined whether there are cointegration vectors among the four prices series. In general, the price series are cointegrated if they move together in the long-run. According to the Engle and Granger approach (1987), a linear combination of two or more non-stationarity series, which share the same order of integration, may be stationarity. If a stationarity linear combination exist, the series are said to be cointegrated and a long-run equilibrium relationship exists.

As a test for the presence of cointegration among the prices series, the Johansen cointegration test is performed. Moreover, in order to apply Johansen’s method, it is useful to know the optimal lag length. We determined the optimum lag length using the Hannan Quinn information criterion (HQ) and Schwarz criterion (SC). Given the optimal lag length, the cointegration rank is obtained through the trace test and the Maximum-Eigenvalue test.

Both information criteria suggested an optimal lag order of 2. Table 4 shows the results of the Johansen cointegration test .

The value of trace is smaller than 5% critical value when r (cointegration rank) is 1. This implies that a single cointegration relationship exists between the prices.

6 Concluding Remarks

Palm oil production has had an extraordinary evolution since 2000, especially in Southeast Asian countries. EU imports have recorded a positive trend from 2000 tonnes in 2000 to 6000 tonnes in 2016, thereby tripling the quantity placed on the market.

Palm oil can be used in the production of biofuels and food (bakery sweets in general and fried foods). This is because palm oil, from a technological point of view , has a high smoke point for its saturated fatty acid content, which is much more salutary than the performance of conventional oils produced and used in Europe (corn , sunflower and peanut oil ).

As is well known, the profitability of palm oil is related to its lower market price due to it having the cheapest production costs , compared to the other EU oils .

The controversy which palm oil has been the subject of in recent media campaigns is linked not so much to its technical, health and nutritional characteristics but to the environmental sustainability aspects of the production process. Market forces have stimulated its production and trade, with a shift in the use of land in tropical countries, and particularly in Southeast Asia, causing the so-called direct and indirect land use changeover—land use change (LUC) and indirect land use change (ILUC) (Rasetti et al. 2014).

According to the European Commission, biofuels produced from European raw materials do not seem to have negative consequences on the environment . European Commission documents (COM 2017/57) reveal the risks of indirect change in land use, highlighting that palm oil cultivation over the past 20 years has been the cause of 20% of global deforestation and that in 2014, 46% of the entire imported product in Europe was used for transport. This was an increase of more than 34% in comparison to 2010 and which today requires about one million hectares of tropical soils to sustain (European Parliament 2016).

For this reason, with the adoption of the ILUC Directive (EU Directive 2015/1513), the EU has limited the contribution of these biofuels to 10% of the renewable energy target in the transport sector, with stringent constraints on the production of biodiesel from foreign biomass. The document calls on the European Commission to phase out the use of this raw material as a component of biodiesel “no later” than 2020.

From the standpoint of the environment , the issue of land use change and deforestation, on the other hand, leads to concerns about environmental protection strategies that need to be actively pursued to safeguard against the exploitation and monopolisation of land at the expense of biodiversity and soil protection, food security and the protection of local populations . It is clear that a strategy such as a world-class sustainability certification requirement (Finco et al. 2012), if shared between the business world and governments, could be the first simple strategy to be implemented.

To conclude in macroeconomic terms, our results highlighted that the price trends of selected vegetable oils , are related to their variations. This allows the advancing of some hypotheses. On the supply side, the production costs (decisively in favour of palm oil ) and the environmental constraints are affecting the vegetable oil market. On the demand side, the number and price, on the one hand of substitute products, and on the other hand, the complementary good and consumer taste and preference, influence consumer behaviour. Consumer income and its distribution and, in both cases, public policies (in favour of consumers and/or producers) affect the various choices to be made. Public action should, therefore consider these variables. A single policy may not be sufficient to steer the market in the right direction, especially in the logic of market globalisation .

Notes

- 1.

The RSPO is composed of 2941 members from 85 countries whose membership covers the entire supply chain : oil palm producers, processors or traders, consumer goods manufacturers, retailers, banks/investors, environmental, and social non-governmental organisations.

References

Anderson, T. W. (2011). The Statistical Analysis of Time Series (Vol. 19). New York: Wiley.

Asari, F. F. A. H., Rahman, N. H. A., Razak, E. A. A., Ahmad, B. A. S., Harun, N. F. A., & Jusoff, K. (2011). A Time Series Analysis of the Relationship Between Total Area Planted, Palm Oil Price and Production of Malaysian Palm Oil. World Applied Sciences Journal, 12(BES), 34–40.

Bakhat, M., & Würzburg, K. (2013). Price Relationships of Crude Oil and Food Commodities. Economics for Energy. (Working Paper WP FA06/2013). Available on http://www.eforenergy.org/docpublicaciones/documentos-de-trabajo/WPFA06-2013.pdf.

Balbás, A., Romera, R., & Ruiz, E. (2005). An Overview of Probabilistic and Time Series Models in Finance. In Recent Advances in Applied Probability (pp. 27–63). Boston, MA: Springer.

Bentivoglio, D., Bucci, G., & Finco, A. (2018). Revisiting the Palm Oil Boom in Europe as a Source of Renewable Energy: Evidence from Time Series Analysis. Quality—Access to Success, 19, 59–66.

Bentivoglio, D., Finco, A., & Bacchi, M. R. P. (2014). European Biodiesel Market and Rapeseed Oil: Which Impact on Agricultural Food Prices. International Journal of Global Energy Issues. Special Issue on Bio-Energy, Economics and Policy, 37(5/6). https://doi.org/10.1504/ijgei.2014.067667.

Bentivoglio, D., Finco, A., & Bacchi, M. R. P. (2016). Interdependencies Between Biofuel, Fuel and Food Prices: The Case of the Brazilian Ethanol Market. Energies, 9(6), 464.

Campiche, J. L., Bryant, H. L., Richardson, J. W., & Outlaw, J. L. (2007, July). Examining the Evolving Correspondence Between Petroleum Prices and Agricultural Commodity Prices. In The American Agricultural Economics Association Annual Meeting. Portland, OR.

Castiblanco, C., Etter, A., & Aide, T. M. (2013). Oil Palm Plantations in Colombia: A Model of Future Expansion. Environmental Science & Policy, 27, 172–183.

Chatfield, C. (2016). The Analysis of Time Series: An Introduction. Boca Raton: CRC Press.

Corley, R. H. V. (2009). How Much Palm Oil Do We Need? Environmental Science & Policy, 12(2), 134–139.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association, 74(366a), 427–431. https://doi.org/10.1080/01621459.1979.10482531.

Engle, R., & Granger, C. (1987). Co-integration and Error Correction: Representation, Estimation, and Testing. Econometrica, 55(2), 251–276. https://doi.org/10.2307/1913236.

Esmaeili, A., & Shokoohi, Z. (2011). Assessing the Effect of Oil Price on World Food Prices: Application of Principal Component Analysis. Energy Policy, 39(2), 1022–1025.

European Parliament 2014–2019 Report on Palm Oil and Deforestation of Rainforests. (2016/2222(INI)). Committee on the Environment, Public Health and Food Safety 17.3.2017, Bruxelles.

FAO. (2010). Global Forest Resources Assessment. Rome: FAO.

FAO. (2012). World Agriculture Towards 2030/2050: The 2012 Revision. Rome: FAO.

FEDIOL. (2015). Vegetable Oils—EU Production, Imports, Exports and Consumption. Available on http://www.fediol.be/web/evolution%201980%20_%202015/1011306087/list1187970161/f1.html.

FEDIOL. (2017). Vegetable Oils Production, Imports, Export and Consumption, 2016 Annual Statistics. Available on http://www.fediol.be/data/1503559968Stat%20oils%202016%20total%20only.pdf.

Fedorová, D. (2016). Selection of Unit Root Test on the Basis of Length of the Time Series and Value of AR (1) Parameter. STATISTIKA, 96(3), 3.

Finco, A., Padella, M., Bentivoglio, D., & Rasetti M. (2012). Sostenibilità dei biocarburanti e sistemi di certificazione. Economia & Diritto Agroalimentare (EDA), XVII, 247–269, Firenze.

Fitzherbert, E. B., Struebig, M. J., Morel, A., Danielsen, F., Brühl, C. A., Donald, P. F., et al. (2008). How Will Oil Palm Expansion Affect Biodiversity? Trends in Ecology & Evolution, 23(10), 538–545.

Harri, A., Nalley, L., & Hudson, D. (2009). The Relationship Between Oil, Exchange Rates, and Commodity Prices. Journal of Agricultural and Applied Economics, 41(2), 501–510.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for Unit Roots in Heterogeneous Panels. Journal of Econometrics, 115(1), 53–74.

Index Mundi. (2017a). Palm Oil by Country in 1000 MT. Available on https://www.indexmundi.com/agriculture/?commodity=palm-oil.

Index Mundi. (2017b). Palm Oil Exports by Country in 1000 MT. Available on https://www.indexmundi.com/agriculture/?commodity=palm-oil&graph=exports.

Index Mundi. (2017c). Palm Oil Imports by Country in 1000 MT. Available on https://www.indexmundi.com/agriculture/?commodity=palm-oil&graph=imports.

Index Mundi. (2017d). Vegetable Oils Commodity Prices. Available on https://www.indexmundi.com/commodities/.

Johansen, S. (1988). Statistical Analysis of Cointegration Vectors. Journal of Economic Dynamics and Control, 12(2–3), 231–254.

Koh, L. P., & Wilcove, D. S. (2007). Cashing in Palm Oil for Conservation. Nature, 448(7157), 993–994.

McCarthy, J. F., & Cramb, R. A. (2009). Policy Narratives, Landholder Engagement, and Oil Palm Expansion on the Malaysian and Indonesian Frontiers. The Geographical Journal, 175(2), 112–123.

Myers, R. J. (1992). Time Series Econometrics and Commodity Price Analysis. Department of Economics, The University of Queensland.

Natanelov, V., Alam, M. J., McKenzie, A. M., & Van Huylenbroeck, G. (2011). Is There Co-movement of Agricultural Commodities Futures Prices and Crude Oil? Energy Policy, 39(9), 4971–4984.

Peri, M., & Baldi, L. (2010). Vegetable Oil Market and Biofuel Policy: An Asymmetric Cointegration Approach. Energy Economics, 32(3), 687–693.

Pirker, J., Mosnier, A., Kraxner, F., Havlík, P., & Obersteiner, M. (2016). What Are the Limits to Oil Palm Expansion? Global Environmental Change, 40, 73–81.

Poku, K. (2002). Small-Scale Palm Oil Processing in Africa (Vol. 148). Food & Agriculture Org.

Rasetti, M., Finco, A., & Bentivoglio D. (2014). GHG Balance of Biodiesel Production and Consumption in EU. International Journal of Global Energy Issues. Special Issue on Bio-Energy, Economics and Policy, 37(5/6). https://doi.org/10.1504/ijgei.2014.067665.

Rezitis, A. N. (2015). The Relationship Between Agricultural Commodity Prices, Crude Oil Prices and US Dollar Exchange Rates: A Panel VAR Approach and Causality Analysis. International Review of Applied Economics, 29(3), 403–434.

RSPO. (2016). Certification. http://www.rspo.org/certification.

Saghaian, S. H. (2010). The Impact of the Oil Sector on Commodity Prices: Correlation or Causation? Journal of Agricultural and Applied Economics, 42(03), 477–485.

Sanders, D. J., Balagtas, J. V., & Gruère, G. (2014). Revisiting the Palm Oil Boom in South-East Asia: Fuel Versus Food Demand Drivers. Applied Economics, 46(2), 127–138.

Sumathi, S., Chai, S. P., & Mohamed, A. R. (2008). Utilization of Oil Palm as a Source of Renewable Energy in Malaysia. Renewable and Sustainable Energy Reviews, 12(9), 2404–2421.

Taylor, S. J. (2008). Modeling Financial Time Series. Singapore: World Scientific.

United States Department of Agriculture (USDA). (2007, December 31). Indonesia: Palm Oil Production Prospects Continue to Grow (Commodity Intelligence Report).

United States Department of Agriculture (USDA). (2016a, January 4). EU-28 Oilseed and Products Annual 2016 (GAIN Report Number: AU1603).

United States Department of Agriculture (USDA). (2016b). EU-28 Biofuels Annual. EU Biofuels Annual 2016 (GAIN Report Number: NL6021).

United States Department of Agriculture (USDA). (2017, May). Oilseeds: World Markets and Trade. USDA FAS.

Wilcove, D. S., & Koh, L. P. (2010). Addressing the Threats to Biodiversity from Oil-Palm Agriculture. Biodiversity and Conservation, 19(4), 999–1007.

Yu, T. H., Bessler, D. A., & Fuller, S. (2006, July). Cointegration and Causality Analysis of World Vegetable Oil and Crude Oil Prices. In The American Agricultural Economics Association Annual Meeting (pp. 23–26). Long Beach, CA.

Zhang, Q., & Reed, M. (2008, February 2). Examining the Impact of the World Crude Oil Price on China’s Agricultural Commodity Prices: The Case of Corn, Soybean, and Pork. In The Southern Agricultural Economics Association Annual Meetings (Vol. 5, p. 2008). Dallas, TX.

Zhang, Z., Lohr, L., Escalante, C., & Wetzstein, M. (2010). Food Versus Fuel: What Do Prices Tell Us? Energy Policy, 38(1), 445–451.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Bentivoglio, D., Finco, A., Bucci, G., Zolin, M.B. (2018). Asian Palm Oil Production and European Vegetable Oil Market: What Can We Learn in Terms of Sustainability?. In: Andreosso-O’Callaghan, B., Jaussaud, J., Zolin, M. (eds) Asian Nations and Multinationals. Palgrave Pivot, Cham. https://doi.org/10.1007/978-3-030-00913-7_6

Download citation

DOI: https://doi.org/10.1007/978-3-030-00913-7_6

Published:

Publisher Name: Palgrave Pivot, Cham

Print ISBN: 978-3-030-00912-0

Online ISBN: 978-3-030-00913-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)