Abstract

Building a successful start-up is rewarding, and there are many challenges to be faced as the start-up moves towards becoming profitable.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Patent Application

- Federal Trade Commission

- Venture Capital Investor

- Business Incubator

- Private Equity Firm

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

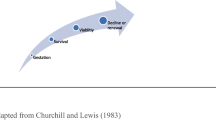

1 Start-ups

Building a successful start-up is rewarding, and there are many challenges to be faced as the start-up moves towards becoming profitable. A start-up will transform and morph as it escalates through the different stages of growth, each having unique financial needs and financing options. The stages of development include seed, start-up, early-stage development, growth and maturity. Securing funding early on is one of the most challenging endeavors a start-up undertakes. It is understandable that a start-up with limited capital may view obtaining IP rights as waste of precious funds. This perception often leads start-up companies to the presumption that it is more affordable and a better business strategy for the start-up to utilize first-mover advantage to monetize newly developed technology, rather than bother with obtaining IP protection. While first-mover advantage has the benefit of turning the company’s newest technological development into cash quickly, the risk associated with utilizing first-mover advantage as a business strategy is high and can doom an up-and-coming company once its competitors get a hold of its unprotected technology. If the start-up has developed something that triggers the development of a whole new field of hot technology, or serves as a base platform for the development of that new technology, the implications of being the owner of that base-level IP could be immensely profitable if the IP rights are properly protected.

Rather than viewing the cost of IP protection as a fund-draining burden on the start-up’s limited capital, obtaining IP rights should be viewed as an investment in the start-up. If a start-up wants to become an established, successful business, the start-up needs to behave in the same way as an established, successful business—focusing meticulously on maximizing the return on every dollar spent.

The thought of pursuing a patent, for example, can be daunting for a small start-up. The cost of a typical provisional patent application ranges from $3,000 to $7,000. The cost of a typical non-provisional patent application ranges from $8,000 and $12,000. Then, if the patent issues, there is the cost of issuance, and the cost of maintaining the patent; i.e., maintenance fees to be paid to the USPTO at 3.5, 7.5, and 11.5 years after issuance of the patent. There may also be the cost of litigation, if any is required, to enforce the patent. While these are all necessary costs incurred during the patenting process and during enforcement of the patent, a determined and savvy start-up company would be looking for a way to make the cost associated with procuring patent prosecution services more manageable.

In an effort to allay a start-up client’s concerns regarding legal fees, some law firms offer start-up company clients special fixed-fee rates that are available exclusively for start-up clients. For example, when filing for a patent, the start-up client would pay a reasonable set amount for the patent filing and prosecution, regardless of how many hours the IP attorney actually spends on prosecuting the patent. This pricing model generates value for the start-up company client as patent prosecution can potentially require many back-and-forth communications between the patent prosecutor and the Examiner assigned to the patent application at the USPTO.

Additionally, some law firms will negotiate a payment structure with start-up company clients. A busy start-up, with limited funds now, needs a law firm that understands the company’s financial situation. For instance, while there is an initial up-front cost for filing a patent (the cost of preparing the application for submission to the USPTO and payment of the filing fee), other costs associated with the patent can be paid at a later date as those costs arise, i.e., the issuance fee can be paid at the time the patent is allowed or maintenance fees, which are due at 3.5, 7.5, and 11.5 years after issuance of the patent, can be paid once they are due.

1.1 IP Portfolio Development and Investors

IP rights can serve as valuable company assets and can be monetized in several ways. For example, the addition of a patent, or simply a patent application, to a start-up’s IP portfolio makes the start-up an eye-catching investment opportunity to equity financiers—venture capitalists (VCs) and angel investors who view a start-up’s attempts to obtain patent protection as a demonstration of the company’s dedication and commitment to striving for success. Pending patent applications can also be used by investors to assess whether the start-up will effectively be able to deter potential competition.

Owning IP, or even simply pending patent applications, can set your start-up apart from other, less confident start-up ventures. Some VCs and angel investors will not even consider investing in a start-up that lacks an IP portfolio, or at least basic IP for the company’s core technology. Both large investment banks and boutique private equity firms are interested in raising and investing funds that are specifically targeted at those small entities in possession of IP rights and other intangible assets. While the initial cost of prosecuting a patent may seem expensive to a start-up, the return on investment for obtaining a patent, or other IP rights, could secure the start-up the investment capital it needs to launch into a profitable and successful enterprise.

1.2 Positioning a Startup to be an Attractive Acquisition Target

Some start-ups’ primary business strategy is to utilize the contents of their IP portfolio as part of an exit strategy, with the goal of making the company an attractive acquisition target for larger corporations or competitors. Often times, it is more cost effective and a good business investment for a large corporation or competitor to buy-up a small start-up that holds desirable IP, rather than to license the IP from the start-up or risk infringement litigation. This can often result in a high rate of return for the start-up since the buyer is paying for the patent, as well as the potential future benefit of the patent. If the start-up is not looking to be acquired, but is seeking to monetize the patent, the start-up could utilize a sale and lease back acquisition model whereby the start-up sells the patent to a competitor, but requires in the terms of sale a covenant not to sue, which is essentially a license allowing the start-up to continue using the patented invention without the consequence of infringement. Effectively, the start-up would capitalize on the patent without losing the right to use it.

Factors that make a company an attractive acquisition target include:

-

IP portfolio breadth and scope

-

IP insurance

-

Complete ownership of the IP in the portfolio

-

The quantity of patent applications verses the number of issued patents

-

The overall quality of the IP

-

Comprehensive protection afforded by the IP in the portfolio.

1.3 Case Study: Facebook’s Acquisition of Instagram, Face.com and Snaptu

Facebook has become a ubiquitous social networking service. Its popularity has grown immensely since its debut on the Internet in February of 2004. Having more than one billion active users as of September 2012, it is the fastest growing social networking site in terms of popularity. Facebook, as a company, has grown immeasurably and makes headlines every time it acquires a new business. Facebook has made a series of acquisitions over the years to supplement the technology behind many of the user functions available on Facebook’s social media site. IP related to such supplemental technologies have added value for Facebook since the technology is related to the core of Facebook’s social media business. Several examples of Facebook’s strategic acquisitions include acquiring Instagram, Snaptu and Face.com.

The Acquisition of Instagram

Instagram, an instantly popular photo sharing service application launched in 2010, amassed approximately 30 million users by the time of its Android mobile platform release in April of 2012. Within the first day that the Instagram application was available for download on the Android platform, more than 1 million individual users downloaded the app. Facebook noticed Instagram’s success and expressed an interest in acquiring Instagram shortly thereafter. A deal was negotiated in late April of 2012, consisting of an acqui-hire arrangement (the employees from the acquired company are part of the deal), $300 million in cash, plus 23 million shares of Facebook common stock in exchange for Instagram. The deal was not finalized until September 2012 when the Federal Trade Commission approved the deal. At the time of the negotiations in April, Facebook stock was valued at nearly $38 per share, but by the time the Federal Trade Commission had approved the deal, Facebook’s stock price had dropped to around $19 per share; what started as a billion dollar deal for Instagram ended up being worth $715 million upon closing. During negotiations, Instagram was probably disinclined to negotiate for a floating share exchange ratio since Facebook’s share prices were experiencing growth. But after Facebook’s IPO in May 2012, Facebook’s stock value dropped, and Instagram ultimately did not get the $1billion it initially set out to earn on the deal.

Facebook had consistently experienced difficulty with photo uploading on mobile platforms. A user would have to take a picture with the phone’s camera functionality, and then upload the picture to Facebook by accessing the photo stored in the phone’s photo library. Acquiring and implementing the technology behind Instagram would allow users to access an application which allows them to take photos and instantly upload those images to Facebook. In theory, the technology transfer from Instagram would enable Facebook to streamline the mobile photo uploading process that Facebook users are so fond of. The strategic value of the technology acquired by Facebook is readily apparent; however, by 2013 Facebook still had not effectively implemented the Instagram technology it acquired. Instagram was an acqui-hire acquisition and as such the Instagram team of software developers and engineers was absorbed by Facebook. The Instagram department has grown in number of employees since the acquisition, which has contributed to idea generation and the development of new products that Facebook is not using. Facebook has been criticized for its “acquire now, and figure out what to do with the acquisition later” approach to the Instagram acquisition.

Then in December of 2012, Instagram announced proposed changes in its terms of use, due to take effect in early 2013. The changes would give Instagram the right to share photos uploaded with the Instagram app to its parent company’s site, Facebook. Similarly, language in the revised terms of service would also grant Instagram the right to sell users’ photos to “business or other entity … without compensation to [the user].” Users cried out in outrage and expressed concerns about copyright ownership in the photos that were posted.

The Acquisition of Face.com

In June of 2012 Facebook acquired the small start-up company Face.com, primarily to access Face.com’s facial recognition software IP rights. Face.com focused on the development of facial recognition software for use on mobile platforms. The software allows a user to “teach” the application the name of the person, or subject, in the picture. After learning the photo subject’s name, the application can search through photos and automatically tag any other pictures of that same person with their name. Such technology would fit nicely with Facebook’s social media site capabilities, as Facebook users tag photos of their friends and themselves constantly. Facebook’s planned course of action involves coupling the Face.com technology to the technology obtained from the Instagram acquisition, making it easy for Facebook users to upload pictures and automatically tag those photos.

The Acquisition of Snaptu

Snaptu is a social media mobile application created by Mobilica (the company later changed its name to Snaptu), which is a small start-up company that creates java-based applications for mobile phones which replicate many of the features of smartphone applications, thereby making those same applications accessible on mobile devices that are not smartphones. The Snaptu technology is compatible with over 2,500 different mobile devices. Facebook acquired Snaptu in March of 2011 for an estimated $70 million. The deal was an acqui-hire situation; Facebook gained the Snaptu employees in addition to the technology and the related IP. Facebook’s strategy was to acquire technology that would enable Facebook use on ordinary mobile phones so that the social media site could enter emerging markets that do not yet have access to smartphone technology.

1.4 Liquidating IP Assets to Recoup Losses

In the event that the start-up fails, patents can be monetized in a way to help recoup losses incurred by the failure of the business. There is a logical strategy in the start-up industry that if the start-up is going to fail, it should fail in the quickest, most efficient and cost-effective way possible. This strategy makes good business sense because the less cost incurred during failure translates to less net loss as a result of the failure. Patents can be bought and sold like assets. In the event that the start-up goes under, the start-up can sell its patents, or patent applications, as a means to recover some of the losses sustained by the company. The start-up can sell or auction off its IP portfolio, or portions of its portfolio.

2 Incubators

Business incubators are designed to nurture small, fledgling businesses during the start-up phase by providing business development support and encouraging the business to flourish and grow at its own pace. A cluster of quasi-related burgeoning businesses make up a business incubator. These businesses share a workspace where they can all operate harmoniously. Incubators provide the businesses with services and access to office equipment, telecommunication/Internet services and reception services. Incubators also provide participants with an extensive network of well-connected professionals, experienced mentors and an array of specialized experts in the relevant technology field.

In order to participate in an incubator, the small business must apply and be selected for participation in the incubator. Although incubators can vary greatly according to their specific goals or “mission”, some application criteria may include:

-

The breadth and depth of the start-up company’s business plan

-

The composition and quality of the members of the business’s management team

-

The likely capitalization capacity of the company’s idea, and

-

The estimated time to commercialization.

Typically applicants are selected based on whether the applicant business is compatible with the other businesses in the incubator and the space that is available for use. Other considerations are also taken into account, such as whether special permits are required for the applicant business to operate, whether specialized equipment and or laboratory space is needed, etc. Once admitted to the incubator, participant companies typically stay for a period of 1–3 years although this duration may be significantly more or less depending upon the incubators.

There are a variety of benefits available to the participants of a business incubator. For example, the incubator environment is highly conducive to networking and professional development. Participant businesses are provided with numerous opportunities to connect with other professionals, entrepreneurs and mentors. Inexperienced entrepreneurs can gain exposure to new ideas, garner tried-and-true business advice from successful serial entrepreneurs, and are encouraged to make connections and business contacts that they otherwise could never possibly establish.

Business incubators also offer educational programming for those businesses that are participating in the incubator. Entrepreneurship educational programming often includes seminars, workshops, lecture series and panel discussions on various topics including strategies for approaching funding sources, pitching ideas to investors, managing intellectual property portfolio, media relations, the importance of marketing, and how to manage growth of the company.

The reduced costs associated with participating in an incubator are substantial as well. The work space is offered to the business at a reduced rental rate. Furthermore, the incubator participants share overhead expenditures for the facility and split the cost of basic business operation essentials (electricity, Internet, utilities, etc.). Incubator participants also benefit from any volunteer initiatives instituted by the incubator. Many incubators have volunteer initiatives where professionals in the business community offer their time and expertise to incubator participants free of charge. Businesses within the incubator can receive targeted advice and professional services (such as legal, accounting or IT services) and the opportunity to make connections with these professionals as they work with the incubator participants to build a successful business.

2.1 Case Study: The University of Pennsylvania’s UPSTART Company Formation Program

The UPStart program at the University of Pennsylvania in Philadelphia, offers support and guidance to start-ups that are trying to commercialize new technology. The program began in 2010 to address the need for commercialization support for technology developed by University research efforts conducted at the University of Pennsylvania. Implementing a business incubator within an educational institution helps to vertically channel new technology developed by the University through the commercialization process. The UPStart program puts these newly developed technology ventures into contact with other valuable resources, such as renowned faculty members and research entities, service providers, experienced entrepreneurs, potential investors and marketing opportunities. The Program has also established collaborative relationships with several local research and business entities, including the University Science Center and the Wharton Small Business Development Center to help get new small businesses up and running successfully.

Protocol at the University requires that faculty members who invent new technology disclose the invention to the University’s Center for Technology Transfer. If the technology seems like a worthy investment, intellectual property rights are sought for the invention, and the technology is introduced into the UPStart program. A company is formed, and the company signs an agreement with the UPStart program, forging a partnership and obliging the company to adhere to UPStart’s rules. The company must form an LLC, incorporating in Delaware, and must file all the requisite forms associated with doing business with the government. Once the company is established, the company and the UPStart program work together to develop a business plan and marketing strategy to attract funding from prospective investors. The program will also assist the company in writing grant proposals. Also, in an effort to educate the fledgling company and to help move the business along, the company will be assigned an experienced entrepreneur by the program. The company will work with outside legal counsel to create an IP management strategy specifically tailored to the unique technology and will explore licensing options. Once funding is secured, the IP rights accrued thus far are transferred to the company.

Additional perks available to UPStart participants include benefiting from the variety of services provided by the program. Participants also benefit from discounted rates offered on vendor provided services due to UPStart’s business relationships with a variety of preferred venders. Furthermore, companies can lease laboratory and/or office space at a rate of $1/sq. ft./month.

3 Business Accelerators

Incubators and accelerators share similar characteristics, such as offering business development services and professional advice and guidance to start-up participants. Also, businesses that participate in an accelerator, like an incubator, have a myriad of opportunities to network with others in the field. The major difference between incubators and accelerators is time and the amount of pressure that the start-up is put under. Business accelerators are intense, time-compressed programs designed to assist start-ups in getting up and running in a matter of months.

A business accelerator is intended for start-ups that are focused on reducing their time to market. Application to an accelerator is often open to anyone. Once selected as a participant in an accelerator, the process moves very rapidly and is focused on team success, rather than individual development or mentoring. Accelerators are particular when choosing prospective participant companies. The primary focus of an accelerator is to provide participant companies with exposure to potential investors, and by the same token, provide investors with what can be considered quality, promising new start-ups worth investing in.

3.1 Case Study: The Y Combinator Business Accelerator

Y Combinator is an information technology start-up accelerator that was founded in 2005 by Paul Graham, Trevor Blackwell, Robert Morris, and Jessica Livingston. It provides start-ups with seed funding and invests approximately $18,000 per investment cycle into the participating start-ups of that cycle. In exchange for the seed funding provided by Y Combinator, Y Combinator will retain stock in the successful start-up; approximately 2–10 % but typically falling in the 6–7 % range.

After completing an application, selected applicants travel to the San Francisco Bay Area to attend the program during one of two three-month funding cycles: January-March or June–August. The accelerator operates in a similar fashion to a business incubator. Y Combinator offers participants all the necessary services and forms to turn the start-up into a fully operational business entity.

Y Combinator is designed to encourage collaboration between participants; participants demonstrate a prototype of their project within two weeks of starting the program and are regularly encouraged to openly talk about their projects with each other during the program in hopes that participants will help each other arrive at solutions and improve their ideas. During the session, participants attend numerous workshops and events designed to educate the participants and address problems that they are having with the commercialization, vision, and strategy or product development. Some of these sessions are geared toward developing a good pitch for the product, while others are intended to be counseling sessions with an investment firm so that participants can determine the best strategy for procuring funding based on the particular technology being commercialized. Participants can also schedule time to discuss these issues with any of the 9 members of the Y Combinator staff who have demonstrated experience and success in digital start-ups as they are either the founders of Y Combinator or they are the older alumni of the program. Participants also attend weekly dinners where they have the opportunity to share and demonstrate completed projects or progress while having the opportunity to listen to notable guest speakers during the meal. Notable guest speakers are generally prominent figures in the digital start-up space and have included successful individuals such as Al Gore, Alexis Ohanian (co-founder of social news website Reddit), Mark Zuckerberg (Facebook founder), Marissa Mayer (Yahoo president and CEO) and Rich Miner (co-founder of Android Inc.).

The session concludes with a Demonstration Day after 11 weeks of highly productive time spent developing the start-up. Participants demo a final product to investors and interested spectators. This is an opportunity to attract funding and also an opportunity to practice all the skills learned during participation in the Y Combinator accelerator program. Some investors are so captivated by what they see that they indicate their commitment to funding the idea at Demo Day, while others require additional convincing in subsequent meetings.

Y Combinator has funded more than 460 start-ups since its inception in 2005. Some of the most well known companies to develop as a result of Y Combinator funding include Dropbox (cloud storage space where users can store files) and Scribd (social reading and publishing website). When the company has become sufficiently successful, it exits Y Combinator either through acquisition or IPO. A few famous exits from Y Combinator include Reddit (social news aggregator website), Couldkicker (centralized web-based control hub for cloud servers), and OMGPOP (game developer/publisher of multiplayer, social and mobile games). Despite having exited, alumni companies can continue to access the network of alumni after the program has ended.

4 Typical Services Offered by Business Incubators and Accelerators

Incubators and accelerators offer participant businesses a collection of services to promote the development and growth of the business participants. They may provide educational programming, business plan development workshops, customer service training, mentoring, and networking opportunities. Business incubator managers act as liaisons and facilitators, putting the entrepreneurs in connection with firms, specialists and experts to render unique services, consultation and advice. Incubators and accelerators also make an effort to assist participants in gaining access to seed capital and federal grants. They offer services to help businesses prepare financial proposals and grant applications, assist participants in obtaining loans and introduce participants to Angel and venture capital investor networks.

Some incubators and accelerators limit the type of businesses which may participate so that the participants can share research equipment. For example, the businesses may be restricted to a certain industrial field such as biotechnology or life sciences. These particular businesses require the use of wet laboratory space, specialized lab equipment, permits for dangerous chemicals or other hazardous materials and sophisticated scientific instruments. To cut down on costs, the businesses within the incubator or accelerator share a communal lab space, with designated time slots when the businesses may use the lab area.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Copyright information

© 2014 Springer Science+Business Media New York

About this chapter

Cite this chapter

Halt, G.B., Fesnak, R., Donch, J.C., Stiles, A.R. (2014). Monetization Strategies for Startups, Incubators and Accelerators. In: Intellectual Property in Consumer Electronics, Software and Technology Startups. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-7912-3_18

Download citation

DOI: https://doi.org/10.1007/978-1-4614-7912-3_18

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-7911-6

Online ISBN: 978-1-4614-7912-3

eBook Packages: EngineeringEngineering (R0)