Abstract

This chapter describes a business model in a contingent claim modeling framework. The model defines a “primitive firm” as the underlying risky asset of a firm. The firm’s revenue is generated from a fixed capital asset and the firm incurs both fixed operating costs and variable costs. In this context, the shareholders hold a retention option (paying the fixed operating costs) on the core capital asset with a series of growth options on capital investments. In this framework of two interacting options, we derive the firm value.

The chapter then provides three applications of the business model. Firstly, the chapter determines the optimal capital budgeting decision in the presence of fixed operating costs and shows how the fixed operating cost should be accounted by in an NPV calculation. Secondly, the chapter determines the values of equity value, the growth option, and the retention option as the building blocks of primitive firm value. Using a sample of firms, the chapter illustrates a method in comparing the equity values of firms in the same business sector. Thirdly, the chapter relates the change in revenue to the change in equity value, showing how the combined operating leverage and financial leverage may affect the firm valuation and risks.

Access provided by Autonomous University of Puebla. Download reference work entry PDF

Similar content being viewed by others

Keywords

- Bottom-up capital budgeting

- Business model

- Capital budgeting

- Contingent claim model

- Equity value

- Financial leverage

- Fixed operating cost

- Gross return on investment (GRI)

- Growth option

- Market performance measure

- NPV

- Operating leverage

- Relative value of equity

- Retention option

- Return attribution

- Top-down capital budgeting

- Wealth transfer

75.1 Introduction

A “business model” often simply describes “ways that a firm makes money.” It is a general description of the business environment, forecasts of earnings, and the proposed business strategies, and it often lacks the rigorous specification of a financial model. Despite the ambiguity, business models are important to corporate finance, investments, portfolio management, and many aspects of financial businesses.

They provide a framework to determine a firm’s value, to evaluate corporate strategies, and to distinguish one firm from another firm or one business sector to another. The prevalent use of business models cannot be understated. Yet, despite the tremendous growth in applications of financial modeling in capital markets, the use of financial principles in developing business models is largely unexplored.

An early example of financial modeling of a business is pioneered by Stoll (1976). He presents a business model of a market maker. Demsetz (1968) suggests that market makers are in the business of providing liquidity to a market and they are compensated by the market via their bid-ask spreads. Stoll then develops the optimal dealer’s bid-ask prices within Demsetz’s business environment and shows precisely how a trader should set their bid-ask quotes, their trading strategies relating to their inventory positions, and finally the profits to the traders under competition. In short, Stoll provides the business model of a trading firm, leading to the subsequent growth of the microstructure theory. The successful use of the “dealer’s business model” in microstructure theory demonstrates the importance of insights gained in modeling a business. For example, Ho and Marcis (1984) extend the business model to incorporate the fixed operating costs of a market making firm to determine the equilibrium number of market makers in the AMEX market.

However, to date, few rigorous business models have been proposed in the corporate finance literature. There are some examples. Trigeorgis (1993) values projects as multiple real options on the underlying asset value. Botteron et al. (2003) use barrier options to model the flexibility in production and sales of multinational enterprises under exchange rate uncertainties. Brennan and Schwartz (1985) determine the growth model of a mining firm. Cortazar et al. (2001) develop a real option model for valuing natural resource exploration investments such as oil and copper when there is joint price and geological-technical uncertainty. Gilroy and Lukas (2006) formalize the choice of market entry strategy for an individual multinational enterprise from a real option perspective. Fontes (2008) addresses investment decisions in production systems by using real options. Sodal et al. (2008) value the option to switch between the dry bulk market and wet bulk market for a combination carrier. Villani (2008) combines the real option approach with the game theory to examine an interaction between two firms that invest in R&D. Wirl (2008) investigates optimal maintenance of equipment under uncertainty and the options of scrapping versus keeping the equipment as a backup while paying the keeping cost. These models explore the use of contingent claim models in various corporate financial decisions ranging from abandoning or increasing the mining capabilities to scrapping versus maintenance of equipment. In reality, real option approach is in three different corporate uses. There are a strategic way of thinking, an analytical valuation tool, and an organization-wide process for evaluation, monitoring, and managing capital investment according to Triantis and Borison (2001).

This chapter extends the real option literature to describe the business models in a more general context. The purpose of the chapter is twofold: firstly we propose the use of real option approach to describe a business and secondly we show how such a business model can be used in some applications.

Our model is a discrete time, multi-period, contingent claim model. We assume that a firm is subjected to a business risk. The revenues are generated from a capital asset. It has to incur a fixed operating cost, making a fixed payment continually (a perpetual payment) to stay in business, and has the options to invest in future projects. That is, the firm must pay an exercise price continually to retain the option in business and at the same time maintains the growth options of Myers (1984). Such retention options and the growth options cannot be separated.

The model is applicable to many business sectors, including the retail chain companies, airlines, software companies, and other businesses whose revenues are generated from a core capital investment and whose expense structure consists of both fixed operating costs and variable costs. The inputs to the business model can be drawn from the published financial statements and market data, and therefore, the model is empirically testable.

We then show how the business model can be used in three important areas in corporate finance: (1) to determine the optimal capital budgeting decision given a fixed operating cost, (2) to relative value firms in the same business sector with different business models, and (3) to relate the change of the firm’s revenue to the change of the equity value.

The first application deals with what Myers (1984) describes as two approaches in capital budgeting, the discounted cash flow and strategic planning approaches, as “two cultures and one problem” in the valuation of a firm. The bottom-up method (the discounted cash flow approach) determines the net present value of a project, and the manager accepts the project if the net present value is positive and rejects it otherwise. The top-down method (the strategic planning approach) considers all future state-dependent investments simultaneously and determines the optimal investment strategies that maximize the firm value.

While the two approaches are related by the valuation of a firm, corporate finance literature has not described how they are related to each other explicitly. Specifically, in the presence of fixed operating costs, how should the “expenses” of a project, at the margin, be incorporated in the NPV calculation? We show that the standard one period model cannot describe the relationships between the cost of the project to the future inflow of the project and the outflows of the project cost as well as the firm’s fixed operating costs. In this chapter, we show how the NPV method is related to the top-down method via the implied fixed-cost measure. Relating to this issue, McDonald (2006) argues that the discounted cash flow and the real option valuation should provide the same answer when the methods are used correctly. However, he further argues that to the extent that the managers who use the real option valuation have effectively adopted a different business model, there is a real and important difference between the discounted cash flow and the real option valuation.

The second application of a business model deals with measuring the impact of the growth option, the debt, and the fixed operating cost on the observed equity value. These results are illustrated by applying the model to a sample of retail chain companies.

The third application focuses on the relationship between the firm’s revenues and the stock valuation. We show how the operating leverage and the financial leverage together affect the change in the equity value with a change in the revenue. The model provides a return attribution of the equity returns based on the firm’s business model. This approach enables corporate managers to evaluate the impact of the firm’s operating leverage and the financial leverage on the risk of the firm’s earnings.

The chapter proceeds as follows. Section 75.2 provides the business model of a firm. Section 75.3 provides the numerical simulations of the capital budgeting problem, comparing the optimal capital budgeting decisions based on the bottom-up and top-down decisions. Section 75.4 provides the application of the business model to the equity value decomposition. Section 75.5 describes return attribution results using the business model. Finally, Sect. 75.6 contains the conclusions.

75.2 The Model Assumptions

Many retail chain stores must incur significant fixed operating costs in setting up the distribution system, producing or buying the products, managing the core business processes. At the same time, the retail chain store invests in new distribution centers, and each investment is a capital budgeting decision. Each product development is a capital budgeting decision, which should increase the firm value at the margin. These are some of many examples where capital budgeting decision on each project is part of the business model of the firm, which must include the management of a significant fixed operating cost.

The model uses the standard basic assumptions in real option literature. We assume a multi-period discrete time model where all agents make their decisions at specific regular intervals; the one period interest rate is R F , a constant; the firm seeks to maximize the shareholders’ wealth; and the market is efficient. We assume a frictionless market with no corporate taxes and personal taxes, and therefore, the capital structure is irrelevant to the maximization of shareholders value. The following assumptions describe the model of the firm of this chapter.

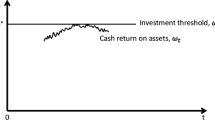

Assumption 1. The Business Risk of the Firm (GRI)

In this model, unlike many standard real option models, we use the sales (or revenue) of the firm as the risk driver and not the operating profits, as commonly used. The sales represent the business risk of the firm, while the operating profits are affected by the business model of the firm. We assume that the firm is endowed with a capital asset (CA). For example, the capital asset can be a factory that produces goods and services resulting in sales. The sales generated by one unit of the capital asset are called the gross return on investment (GRI). GRI is the risk driver of the model, and the risk represents the uncertain demand for the products. Therefore, the sales are stochastic, given by the following equation.

When the GRI increases, the firm would increase its sales for the same capital asset. When there is a down turn in GRI, the sales would fall. Extending the model to multiple risk sources should provide a more realistic model but may obscure the basic insights that the model provides.

We assume that GRI follows a binomial lattice process that is lognormal with no drift. The upstate and downstate are given by a proportional increase of exp(−σ) with probability q and a proportional decrease of exp(−σ) with probability (1 – q). σ is the volatility assumed to be constant. The market probability q is chosen so that the expected value of GRI over one period is the observed GRI at the beginning of each step. That is, the risk follows a martingale process.

While GRI follows a recombining binomial process, we will use a non-recombining tree notation. Specifically, we let n = 0, 1, 2,…, and for each time n, we let the index i denote the state variable i = 0, 1, 2,…,2n − 1. Then at any node of the tree (n, i), the binomial upstate and downstate nodes of the following step are denoted by (n, 2i + 1) and (n, 2i), respectively. Then the martingale process is specified by the following equation:

for n = 0, 1, 2,… and i = 0, 1, 2,…, 2n − 1

Let ρ be the cost of capital for the business risk, which is the required rate of return for that business risk, GRI. Note that the standard cost of capital of a firm reflects the risk of the firm’s free cash flows taking the operating leverage into account, not the firm’s sales risk as we do here. Since the firm risk is the same at each node, the cost of capital ρ is constant in all states and time periods on the lattice.

Assumption 2. The Primitive Firm (V p )

To apply the contingent claim valuation approach to value the firm, we begin with the definition of the primitive firm as the “underlying security.” The primitive firm is a simple corporate entity which has no debt or claims other than the common shares, which are publicly traded.

The firm has one unit capital asset. The capital asset does not depreciate, and the value does not change. We can think of the capital assets as the distribution centers of a retail chain store. Let m be the gross profit margin. For simplicity, in this section, we assume that there are no costs associated in generating the sales, and that m equals unity. And therefore, the firm’s sales are the profits, which are distributed to all the shareholders. Equation 75.2 presents the sales risk, and the GRI(n,i) and ρ are the sales and cost of capital of the primitive firm at each node (n,i) on the lattice.

Note that the sales (and hence the profits) are always positive, because GRI follows a multiplicative process. By the definition of the cost of capital, the primitive firm value at each node point on the binomial lattice is

for n = 0, 1, 2, … and i = 0, 1, 2,…, 2n − 1.

Given the binomial process of the primitive firm, which we will use as the “underlying security,” we can derive the risk-neutral probabilities, p(n, i), at time n and state i. The derivation is given in Appendix 1.

When the cost of capital equals the risk-free rate and when the volatility σ is sufficiently small, the risk-neutral probability is approximately 0.5. That is, when σ is small, the upward movement is approximately the same as the downward movement, and therefore, the expected value with the binomial probability of 0.5 shows that the GRI must follow a martingale process. When the cost of capital is high relative to the risk-free rate, the risk-neutral probability would assign a lower weight to the upward movement, according to Eq. 75.4, to balance the use of the risk-free rate, a lower rate than the cost of capital, for discounting the future value. The use of the risk-neutral probability ensures the valuation method is consistent with that of the market valuation of Eq. 75.3.

Note that as long as the volatility and the cost of capital are independent of the time n and state i, the risk-neutral probability is also independent of the state and time and is the same at each node point on the binomial lattice. We will value our firm relative to the primitive firm. Therefore, using the standard relative valuation argument, we may assume that the primitive firm follows a drift at the risk-free rate. The market probability q is relevant only to the extent of determining the cost of capital ρ, but q is not used explicitly in the model.

The use of the risk-neutral probabilities enables us to discount all cash flows of our firm by the risk-free rate in all states of the world. The primitive firm value V p specifies the stochastic process of the “underlying security,” and Eq. 75.4 is the standard assumption made in the contingent claim valuation model.

Assumption 3. The Firm’s Cash Flows (CF) and Value (V)

V is the value of a firm that has fixed operating costs, fixed expenditures for operating purposes. The fixed operating cost (FC) is independent of the units of the goods sold and is paid at the end of each period. Payments to the vendors and suppliers and the employees’ salaries and benefits are some examples of the fixed operating costs, and they may constitute a significant part of the firm’s cash outflow.

The net profit of the firm, using Eq. 75.1, is given by

for n = 0, 1, 2, … and i = 0, 1, 2,…, 2n − 1

Note that GRI is the only source of risk to the firm’s net income. The firm pays all the net income as dividends. In the case of negative income, the firm issues equity to finance the short fall of cash for simplicity. Therefore, the firm’s net income is the free cash flows, and the present value of which is the firm value V.

Assumption 4. The Planning Horizon (T) and the Terminal Conditions

We assume that there is a strategic planning time horizon T. We will value the firm at each node at planning horizon T. Conditional on the firm not defaulted before reaching the horizon T, we can determine the firm value at time T.

Without the loss of generality, we make some simplifying assumptions at the terminal date. In this model, we assume that all future fixed operating cost is capitalized at time T to be a constant FC(T). After the horizon date T, the firm may default on the fixed operating cost. And therefore, the capitalized value of the fixed operating cost should depend on the primitive firm value at time T. The value of this capitalized value is also a contingent claim. The value, based on Merton (1973), is provided in Appendix 2 and result will be used later. For clarity of the presentation at this point, we keep the model simple without affecting the main results. Therefore, at the terminal date T, the firm value is given by

where \( {V}_p=\frac{ GRI\left(T,i\right)\cdot CA\left(T,i\right)}{\rho } \) for i = 0, 1, 2,…, 2n − 1.

That is, the firm value at time T is the primitive firm value with the capital asset CA, plus the cash flow of the firm over the final period, net of the capitalized fixed costs. The limited liability of a corporation is assumed in this model, and therefore, the firm value is bounded from being negative.

Assumption 5. Investment Decisions

The firm has an option to make $I capital investment at each node, (n, i) every year over the planning horizon. For simplicity, we assume that the decisions are not reversible in that the firm cannot undo the investments in any future state of the world.

The increase of the capital investment leads to a direct increase in the firm’s capital assets. And, we have

The GRI of the business is not affected by the increase in the firm size, and hence, the business risk is independent of the capital investment. However, the sales are affected by the capital budgeting decisions. The marginal increase in sales to the firm with the investment at the node (n,i) is given by

Finally, the investment decisions are made at all the nodes such that the firm value is maximized. It is important to note that since the firm can decide on the investment at each state of the world, CA(n,i) at each node depends on the path to that node. Therefore, the model is a path-dependent model.

These assumptions complete the description of the model. Assumption (1) describes the risk class of the business. Assumption (2) introduces the primitive firm enabling us to relate the cost of capital ρ to the risk-neutral valuation framework. Assumption (3) specifies the business model of the firm, identifying the firm’s free cash flows as the residual of all the claims, like the fixed costs, on the firm’s sales. We use the simplest business model in this chapter, but this assumption can be generalized to study different business models, which can be specified by different cost and sales structure. Assumption (4) specifies the terminal condition, following the standard assumptions made on the horizon in strategic planning. Assumption (5) specifies the marginal investment I(n,i) that increases the capital asset CA(n,i) The marginal returns of the investments can be generalized, even though, we choose the simplest relationship here. Given the above assumptions, we can now determine the maximum value of the firm based on the optimal capital investment decisions.

Let us use the following numerical example to illustrate the model in Table 75.1. Consider a particular scenario over two periods, where n = 0, 1, 2.

The stochastic variable is GRI. Given the investment schedule on line 3, the capital asset over time is given by line 4. Sales are determined by GRI and CA. The fixed cost is constant over time. The free cash flow is then determined following the standard income statements.

75.3 Simulation Results of the Capital Budgeting Decisions

The firm seeks to maximize the firm value by using the control variables, which are the capital investments, at all the node points along the scenario paths in the binomial lattice to the horizon date. There are \( {\displaystyle \sum_{n=1}^T{2}^n} \) capital investment decisions.

We use the backward substitution method based on the non-recombining tree. We first assume a set of investment decisions, I(n, i), at each node along all paths. Note that I(n, i) can equal to 0 in some of the nodes. At the horizon date, we can determine the firm value at each node. Then we use the risk-neutral probability and determine the firm value at time T − 1, such that the firm value at that node point has a risk-free return based on the risk-neutral probability, V*. Specifically,

for i = 0, 1, …2T − 1 – 1.

Note that we are rolling back a non-recombining tree and not a recombining lattice. Therefore, the state i here denotes a state along a scenario path of a tree, and the states (2i + 1) and 2i refer to the binary states of the subsequent period.

If the firm value is less than the value FC + I, which is the cash outflow, the firm declares bankrupt and has value zero; otherwise, the firm value is V * − FC − I. That is,

Note that we have assumed that the firm has decided on all the investment decisions at the beginning of the period. Therefore, at each node, the firm is obligated to invest I(n,i), a nonnegative value. We continue with this process recursively, rolling back one period at a time. We then determine the firm value. That is, we recursively apply the following Eq. 75.11 till n = 0.

for n = 0, 1, …T − 1 and i = 0, 1, …, 2n − 1.

We now seek a set of investment decisions I(n, i) along all the paths to determine the highest value of the firm. This search can be accomplished by a nonlinear optimization procedure.

For clarity of the exposition, we have chosen to use a non-recombining tree and a nonlinear optimization to determine the firm value. However, the model can be specified using a recombining binomial lattice, and the firm value can be determined using the standard roll back method, without the use of any numerical nonlinear optimization method. The model is presented in Appendix 3. We have shown that the two approaches are equivalent.

We simulate the model with the following inputs: the risk-free rate of 10 %; the cost of capital ρ of 10 % with volatility σ of 30 %; a risk-neutral probability p of 0.425557; an initial capital asset CA of $30 million; and the capitalized fixed cost of FC/0.1, where the capitalized fixed cost is assumed to present value of the perpetual fixed-cost payment discounted at the risk-free rate. We consider the problem over 5 years where the firm can invest $1 million on a new distribution center at each node on the binomial lattice. The optimal investment decisions (top-down capital budgeting decisions) are determined by a nonlinear optimal search algorithmFootnote 1, where the investment decisions are the choice variables with the objective function being the firm value.

The optimal decision can be related to the capital budgeting decisions. When the capital investment is made, the free cash flow (CF) is given by

Investment decisions should be made at the margin, and therefore, one may argue that the fixed operating cost is not needed to be considered. Given that the cost of capital is ρ, then the net present value of the project is

The capital investment is made when NPV > 0.Footnote 2 This capital budgeting decision can be called a bottom-up approach. In this approach, line managers deal with the capital budgeting decisions, maximizing the net present value of each project which they manage. The capital budgeting decisions are made from the line manager’s point of view rather than the headquarters’ overall view, in the sense that the line manager accepts or rejects a project by focusing on the project’s cash flows. If we assume that there is no fixed operating cost, the bottom-up approach can be shown to be the same as the top-down approach. In sum, the net present value maximization at the local level should lead to the global optimization for the firm that has no fixed operating costs.

Figure 75.1 shows the capital budgeting decisions using the bottom-up approach, where 1 and 0 denote the acceptance and rejection decision, respectively. For example, 0 at the top node represents that the firm rejects the project at time 0 and state 0. Since we assume the non-recombining tree, we have 2n states at period n.

However, if we optimize the capital budgeting decisions using the top-down method, we have different optimal decisions shown in Fig. 75.2, where the shaded nodes represent the states where the capital budgeting decisions differ between the bottom-up and top-down methods.

When we compare Figs. 75.1 and 75.2, the results show that the firm accepts projects using the bottom-up approach that are rejected by the top-down approach. That means many NPV positive projects may have negative impact to firm value.

Note that our model is consistent to that of Myers (1977). By viewing the fixed operating cost as claims to the value of the primitive firms, positive net present value project may not be accepted by the global optimization to maximize the firm value. Our model interprets the result to suggest that portion of the fixed operating costs should be incorporated in the calculation of the net present value of the project. Therefore, our valuation framework provides a model to adjust for the presence of fixed operating costs in capital budgeting in a multi-period context, something that the Myers model does not cover.

Specifically, we define the marginal present value MPV(n, i) at any node point (n, i) to be the marginal increase in the firm value in accepting a project at node (n, i) based on the top-down optimized solution. It is computed

where FV *(n, i) and FV(n, i) are the firm values at the node (n, i) with the investment and without the investment, respectively, while holding all the investment decisions in other nodes constant. This definition of the marginal change in the firm value isolates the effect of the investment at a specific node from the growth options at the other nodes.

Let NPV(n, i) be the net present value of the project at node (n, i) such that

and let the present value of the fixed cost as a function of the primitive firm value at node (n, i) be

Then the “wealth transfer,” WT, the loss of the shareholders value in taking the project in the presence of the fixed cost, is given by

It follows that the marginal change in the firm value is the NPV net of the wealth transfer effect.

Rearranging Eqs. 75.15, 75.17, and 75.18, we have

Note that D as a function of the firm value is determined by the fixed-cost structure. Since we assume that the fixed cost is a fixed cash flow at any time and state, the function is the same at any node. Equation 75.19 can be interpreted intuitively. In the presence of a fixed cost, the capital budgeting decision depends on the fixed-cost factor. Portion of the present value of the incoming cash flow should first be adjusted by the fixed-cost factor and the project is taken (rejected) if MPV > (<) 0.

D can be derived in our model, as the fixed cost can be valued. The plot of the fixed-cost factor as a function of the percentage change in the firm value is provided in Fig. 75.3 below.

As expected, the fall in the firm value would lead to a lower discount factor, resulting in more positive NPV projects being rejected. When the firm value is significantly high, the fixed-cost factor is one, and then the NPV and the top-down approach are the same. In general, given a firm’s business model, the fixed-cost factor function can be derived. And this function provides the link between the bottom-up and top-down capital budgeting problem.

The model assumes that all the projects are independent of each other in the sense that the capital budgeting decision of one project is independent of the other projects. Using the bottom-up method, the independence of projects would lead to independence in the capital budgeting decisions across the projects. Yet in the presence of the fixed operating cost, it is straightforward to show that optimal decisions of the projects are related. For example, referring to Fig. 75.2 in the top-down capital budgeting decision, we would optimally invest in the upstate for period 1 and would again optimally invest in period 2 in both the upstate and downstate. However, if we do not invest in period 1, then the top-down optimal solution would lead to no investment in the subsequent downstate in the second period. Therefore, the model shows that these projects are not independent in the capital budgeting decision, contrary to the bottom-up capital budgeting decision rule.

75.4 Relative Valuation of Equity

In this section, we decompose the value of the primitive firm into its components. We recognize that the firm’s capitalization is a compound option on the underlying business risk. These embedded options are options on the financial leverage, operating leverage and the strategic value. We estimate these option values using a sample of retail chain stores, and we show that such decomposition can provide us useful insights into the valuation the firms’ equities.

In deriving the value of the firm, we assume that the firm pays out all the free cash flows and we construct a recombining lattice from the tree described in the previous section, such that the firm value is derived by the rolling back procedure. The recombining lattice is described in Appendix 3.

We consider the following retail chain stores: Wal-Mart, Target, Lowe’s and Darden. We will describe these firms in brief. Wal-Mart (WMT) is now the largest retailer in North America. The company is operating approximately 4,000 stores worldwide. WMT is also a leader in developing and implementing retail information technology. Target (TGT) is the fourth largest US general merchandise retailer. It has approximately 1,000 stores, with much of their revenue derived from its discount stores. Lowe’s Companies (LOW) is the second largest US home improvement retailer, selling retail building materials and supplies through more than 600 stores. Darden Restaurants, Inc (DRI) has over 600 restaurants and is a leader in the casual dining sector. The details of implementing the model using the observed data are provided in Appendix 4.

In this sample of firms, they all share the basic business model of retail chain business. They focus on their core production of their products and they sell the products through their distribution networks. The turnover, which is the sales to the total asset, depends on consumer spending. In times of recession, consumers may lower their spending on merchandizing, dining, and expenditures. As such, we may consider these firms as belonging to the similar risk class with similar cost of capital for the business.

We have shown that the inputs to the business model are profit margin m, fixed operating costs FC, turnover x, capital investment rate I, and leverage l. All these inputs can be derived or observed from the financial statements. The business model then derives the market value of equity, which is also observed in the market. We can calibrate the cost of capital of the business and the business volatility such that the equity value and the model inputs best fit the observed values.

Specifically, we use the data below, based on January 31, 2002 financial statements, as input to the business model in Table 75.2.

We then determine the implied volatility of the business risk driver (volatility) and the implied cost of capital of the business by minimizing the sum of squares of the observed market performance measures and the corresponding model value. The results are presented in Table 75.3.

The results show that the cost of capital implied from the firm’s equity value for Wal-Mart is particularly low when compared with the other retail chain stores. Darden has the highest cost of capital, which is 12.42 %. Target and Lowe’s has similar cost of capital of about 9 %.

We can now decompose the primitive firm value of each firm into it building blocks of value. We have shown that the market equity value is a compound option of three options. Equity is an option on the firm value, which has an embedded real option net of the “perpetual risky coupon debt” of the fixed costs. Or the market equity value can be built from the underlying firm value. Starting from the underlying firm value, we can add the real option and net of the perpetual debt. Then all equity firms with a real option (which is an all equity growth firm) are the underlying risky assets, whose European call option is the market value of equity.

Let V p be the value of the firm without debt, growth, or fixed costs, which we called the primitive firm. It can be calculated by using the valuation model assuming that the fixed cost and capital investment rate are zero. Let V fc be the value of the firm without debt and growth, but has the fixed costs, which we call the fixed-cost firm. F is the market value of the fixed costs, which is defined as

Let V be the value of the firm without debt, but with optimal capital investment strategy and fixed cost. Then G is the value of the growth option, which can be calculated as the difference between the firm value V and the firm without growth, V fc .

D is the market value of the debt, relatively valued to the firm value V. Then the market capitalization of the firm (market value of the equity) is the underlying firm with the growth option net of the fixed costs and the debt.

Or the equity value can be reexpressed as

The decomposition of the value is summarized in Table 75.4.

To compare the results across the firms, we can normalize the equity value by the firm’s book equity value, by considering the market-to-book multiples (S/E), as reported in the last row of Table 75.4. The results show that Wal-Mart has the highest multiple of 7.8420.

Now, Table 75.5 provides insights into the determinants of the market multiples of the firms. We can use the above results and derive the values in proportions as reported below.

Note that the multiple (S/E) is the product of all the ratios presented in the rows above. And therefore, the table provides a decomposition of the equity multiples. The result shows that the firms have significant fixed operating costs. For example, Target’s fixed operating cost is 80.44 % of the primitive firm value. However, the market assigns a significant growth value to Target. In fact, the firm with growth option is a multiple of 1.5602 to the firm without growth option. The results also show that Wal-Mart attains the high multiple because of its high value of the primitive firm value to its total asset. As we have shown above, the high multiple value is mainly the result of a market low cost of capital to the firm business.

The business model provides a systematic approach to determine the building blocks of value to the market observed equity value. And therefore, this approach provides us insight into the determinants of the market value of equity.

75.5 Equity Return Attribution

The business model can also provide insights into the relationship between the equity value and the firm’s revenue. In this section, we use the business model to determine the impact of a 1 % increase in the gross investment return on the stock returns. And in the process, we determine impact of the operating leverage, financial leverage, and the growth option on the equity returns.

First note that the stock price multiple to the book value can be expressed as follows.

It follows that

Given in proportional increase of GRI by 1 %, the change of the equity to book multiple is given by

This equation provides an attribution of the proportional change in the stock multiple. The changes of the components are simulated and are provided in Table 75.6.

Note that the sum of the rows equal to the stock price change (the last row). For example, consider Wal-Mart; 1 % increase in the gross return on investment, and hence 1 % increase in sales, would lead to 1.97 % increase in the equity value. The return attribution shows that a significant portion of this return comes from the increase in the primitive firm value (1 %) and the effect of the operating leverage (1.07 %). The % increase of the primitive firm value is directly proportional to the % increase in revenue, by definition. The increase in the growth option value is impacted less by the revenue change, resulting in a negative contribution of the equity returns (–0.22 %). The financial leverage has an insignificant impact (0.13 %) because of the relatively low financial leverage of Wal-Mart measured in market value. The capital asset and book equity value are not affected by the change in revenues. This result seems to apply approximately to other stores in this sample of retail chain stores, showing that these stores are quite similar in the sense that they are industry leaders in their specific businesses. However, for retail chain stores with higher operating leverage relative to the firm’s value, then the relationships are more complex.

The analysis shows that the business model enables us to identify how the operating leverage and financial leverage affect the equity returns and thus provides useful insights into the relationship between the market valuation and the profitability of the business. The use of the contingent claim approach to formulate the business risk enables us to incorporate the risk of the business (the volatility of the gross return on investment) to the debt structure and the operating leverage of the firm, something that the traditional financial ratio approach cannot capture.

75.6 Conclusions

This chapter provides a parsimonious model of a firm. The model enables us to value the firm as a contingent claim on the business risks. Using a contingent claim valuation framework, we can then relate the firm maximization to the capital budgeting rule, the fixed operating costs, and the cost of capital of the project as well as that of the firm. The model enables us to determine the impact of the fixed costs on the NPV valuation of a project. The business model also enables us to gain insight into the building blocks of value for the firm’s equity and the relationship of the equity returns to its revenues.

Specifically, we have shown that the top-down and bottom-up decisions are related by the fixed-cost factor, which is a function of the firm value. This function can be specified given the business model of the firm. The lower the firm value is, the deeper the discount on the present value of the project is. Therefore, this may lead to a rejection of a positive NPV project. This result has several implications in corporate finance. For some firms with high operating leverage, for example, communication companies, seeking to acquire other firms, the model suggests that the acquisition analysis should focus not only on the synergic effect in the capital budgeting decision but the fixed-cost factor opposing effect. For a start-up company, the extensive use of the operating cost substituting the variable costs would adversely affect its capital budgeting decisions.

While we use retail chain stores to describe the business model, other businesses also share a similar model. Also, the model can be generalized to incorporate multiple risk sources or perpetual fixed operating costs with more complex fixed-cost schedules. These and other extensions of the model are not expected to change the key insights provided in the chapter.

Furthermore, the model assumptions can be relaxed to further investigate other corporate finance issues. For example, the model can analyze the impact of the fixed operating costs on the debt structure. Debts can be viewed as junior debt to the “perpetual debt,” the fixed operating cost. The underlying security in this contingent claim valuation is the primitive firm. The impact of the fixed operating costs on the firm’s debt may explain the bond behavior observed in the market, as the bond would behave like a junior debt (Ho and Lee 2004b).

Notes

- 1.

We use an optimization subroutine, GlobalSearch, written in Mathematica. The description of the procedure is provided at www.loehleenterprises.com.

- 2.

For clarity of the exposition, let the NPV be defined by Eq. 75.13. To be precise, the expected cash flow may not be perpetual in the presence of default. We will explain the implication of default on the free cash flow later in this section.

References

Botteron, P., Chesney, M., & Gibson-Anser, R. (2003). Analyzing firms strategic investment decisions in a real options framework. International Financial Markets, Institutions and Money, 13, 451–479.

Brennan, M. J., & Schwartz, E. S. (1985). Evaluating natural resource investments. Journal of Business, 58, 135–157.

Cortazar, G., Schwartz, E. S., & Casassus, J. (2001). Optimal exploration investments under price and geological-technical uncertainty: A real options model. R&D Management, 31, 181–190.

Demsetz, H. (1968). The cost of transacting. Quarterly Journal of Economics, 82, 33–53.

Fontes, D. B. M. M. (2008). Fixed versus flexible production systems: A real option analysis. European Journal of Operational Research, 188, 169–184.

Gilroy, B. M., & Lukas, E. (2006). The choice between greenfield investment and cross-border acquisition: A real option approach. The Quarterly Review of Economics and Finance, 46, 447–465.

Ho, T. S. Y., & Lee, S. B. (2004a). The Oxford guide to financial modeling. New York: Oxford University Press.

Ho, T. S. Y., & Lee, S. B. (2004b). Valuing high yield bonds: A business modeling approach. Journal of Investment Management, 2, 1–12.

Ho, T. S. Y., & Marcis, R. (1984). Dealer bid-ask quotes and transaction prices: An empirical study of some AMAX options. Journal of Finance, 39, 23–45.

McDonald, R. L. (2006). The role of real options in capital budgeting: Theory and practice. Journal of Applied Corporate Finance, 18, 28–39.

Merton, R. (1973). On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance, 29, 449–470.

Myers, S. C. (1977). Determinants of corporate borrowing. Journal of Financial Economics, 5, 147–175.

Myers, S. C. (1984). Finance theory and financial strategy. Interface, 14, 126–137, reprinted in 1987, Midland Corporate Finance Journal 5, 6–13.

Sodal, S., Koekebakker, S., & Aadland, R. (2008). Market switching in shipping: A real option model applied to the valuation of combination carriers. Review of Financial Economics, 17, 183–203.

Stoll, H. R. (1976). Dealer inventory behavior: An empirical investigation of NASDAQ stocks. Journal of Financial and Quantitative Analysis, 11, 356–380.

Triantis, A., & Borison, A. (2001). Real options: State of the practice. Journal of Applied Corporate Finance, 14, 8–24.

Trigeorgis, L. (1993). The nature of option interactions and the valuation of investments with multiple real options. Journal of Financial and Quantitative Analysis, 28, 1–20.

Villani, G. (2008). An R&D investment game under uncertainty in real option analysis. Computational Economics, 32, 199–219.

Wirl, F. (2008). Optimal maintenance and scrapping versus the value of back ups. Computational Management Science, 5, 379–392.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1: Derivation of the Risk-Neutral Probability

The risk-neutral probabilities p(n,i) can be calculated from the binomial tree of V p . Let V p (n,i) be the firm value at node (n,i). In the upstate, the firm value is

By the definition of the binomial process of the gross return on investment,

Further, the firm pays a cash dividend of C u = V p (n,i) × ρ × e σ. Therefore, the total value of the firm V u p , an instant before the dividend payment in the upstate, is

Similarly, the total value of the firm V d p , an instant before the dividend payment in the downstate, is

Then the risk-neutral probability p is defined as the probability that ensures the expected total return is the risk-free return.

Substituting V p , V u p , V d p into equation above and solve for p, we have

Where \( A=\frac{1+{R}_F}{1+\rho } \).

Appendix 2: The Model for the Fixed Operating Cost at Time T

When the firm may default the fixed operating cost, the fixed operating cost can be viewed as a perpetual debt of a risk bond. The valuation formula of the perpetual debt is given by Merton (1973).

Where

-

V = the primitive firm value

-

FC = fixed cost per year

-

r f = risk free rate

-

Γ = the gamma function (defined in the footnote)

-

σ = the standard deviation of \( \tilde{ GRI} \)

-

M (•) = the confluent hypergeometric function (defined in the footnote)

where

Appendix 3: The Valuation Model Using the Recombining Lattice

In this model specification, we assume that the GRI stochastic process follows a recombining binomial lattice:

where n = 0, 1,… T and j = 0, …, n.

At time T, the horizon date, consider the node (T, j); j is the state on a recombining lattice. Suppose that the firm has made k investments in the period T, where 0 ≤ k ≤ T − 1. The firm value is given by Eq. 75.32:

and CA is the initial capital asset.

Now we roll back one period. We then compare the firm value with or without making an investment I. Given that the firm at the end of the period T − 1 has already invested k times and would not invest at time T − 1, the firm value is

If the firm at that time invests in the capital asset, then the firm value is

Optimal decision is to maximize the values of the firm under three possible scenarios: taking the investment, not taking the investment, or defaulting. Therefore, the value of the firm at the node (T − 1, j) with k investments is

Now we can determine the firm value recursively for each n, n = T − 1, T − 2,…1.

At the initial period,

The firm value at the initial time can then be derived by recursively rolling back the firm value to the initial point, where n = 0. We follow the method of the fiber bundle modeling approach in Ho and Lee (2004a).

To illustrate, we use a simple numerical example. Following the previous numerical example, we assume that the GRI is 0.1, the capital asset CA is 30, the risk-free rate and the cost of capital are both 10 %, the risk-neutral probability is 0.425557, the volatility 30 %, the fixed cost FC is 3, and finally the investment is 1.

Given the above assumption, the binomial process is presented below.

The binomial lattice of GRI

Time | 0 | 1 | 2 | 3 |

|---|---|---|---|---|

j | GRI | |||

3 | 0.245960311 | |||

2 | 0.18221188 | 0.134985881 | ||

1 | 0.134985881 | 0.1 | 0.074081822 | |

0 | 0.1 | 0.074081822 | 0.054881164 | 0.040656966 |

Given the GRI binomial lattice, we can now derive the firm value lattices. The values are derived by backward substitution. The firm value depends on the capital asset level CA, the state j, and the time n.

Firm value | V(n,j,CA) | ||||

|---|---|---|---|---|---|

State j | CA | ||||

3 | 55.2836 | 32 | |||

2 | 14.9999 | 32 | |||

1 | 0.0000 | 32 | |||

0 | 0.0000 | 32 | |||

j | |||||

3 | 52.5780 | 31 | |||

2 | 31.0516 | 13.5150 | 31 | ||

1 | 5.3286 | 0.0000 | 31 | ||

0 | 0.0000 | 0.0000 | 31 | ||

j | |||||

3 | 49.8725 | 30 | |||

2 | 29.0473 | 12.0302 | 30 | ||

1 | 14.9802 | 4.6541 | 0.0000 | 30 | |

0 | 6.329610 | 1.0230 | 0.0000 | 0.0000 | 30 |

Time n | 0 | 1 | 2 | 3 |

At time 3, the firm values are derived by Eq. 75.32 for each level of outstanding capital asset level at time 3, an instant before the investment decision. Then the firm values for time 2 are derived by Eq. 75.34. Once again, the firm value depends on the outstanding CA level. The firm value at time 0 does not involve any investment decision, and therefore, it is derived by rolling back from the firm values where the CA level is 30.

Appendix 4: Input Data of the Model

The input data of the model are derived from the balance sheets and income statements of the firms.

IS | Target | Lowe’s | Wal-Mart | Darden |

|---|---|---|---|---|

Revenue | 39,888 | 22,111.1 | 217,799 | 4,021.2 |

Costs of sales | 27,246 | 15,744.2 | 168,272 | 3,127.7 |

Gross profit | 12,642 | 6,366.9 | 49,527 | 893.5 |

Gross profit margin (m)a | 0.3169 | 0.2880 | 0.2274 | 0.2222 |

Fixed cost | 8,883 | 4,053.2 | 36,173 | 407.7 |

Depreciation | 1,079 | 534.1 | 3,290 | 153.9 |

Interest cost | 464 | 180 | 1,326 | 31.5 |

Other incomes | 0 | 24.7 | 2,013 | 0.9 |

Pretax incomes | 2,216 | 1,624.3 | 10,751 | 301.3 |

Tax | 842 | 601 | 3,897 | 104.2 |

Effective tax ratio (τ)b | 0.3800 | 0.3700 | 0.3625 | 0.3458 |

Balance sheet | Target | Lowe’s | Wal-Mart | Darden |

|---|---|---|---|---|

Capital assets | 13,533 | 8,653.4 | 45,750 | 1,779.5 |

Gross return on invest (GRI)a | 2.9475 | 2.5552 | 4.7606 | 2.2597 |

LTDb | 8,088 | 3,734 | 18,732 | 517.9 |

Book equity | 7,860 | 6,674.4 | 35,102 | 1,035.2 |

Market information | Target | Lowe’s | Wal-Mart | Darden |

|---|---|---|---|---|

Sharesa | 902.8 | 775.7 | 4,500 | 176 |

Stock pricea | 44.41 | 46.07 | 59.98 | 18.6 |

Market capitalization (equity)a | 40,093 | 35,736 | 269,910 | 3,274 |

Risk free rate (Rf)b | 0.06 | 0.06 | 0.06 | 0.06 |

Coupon rateb | 0.06 | 0.06 | 0.06 | 0.06 |

Max investc | 2,115 | 2,060.5 | 7,000 | 201 |

Rights and permissions

Copyright information

© 2015 Springer Science+Business Media New York

About this entry

Cite this entry

Ho, T.S.Y., Lee, S.B. (2015). Business Models: Applications to Capital Budgeting, Equity Value, and Return Attribution. In: Lee, CF., Lee, J. (eds) Handbook of Financial Econometrics and Statistics. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-7750-1_75

Download citation

DOI: https://doi.org/10.1007/978-1-4614-7750-1_75

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-7749-5

Online ISBN: 978-1-4614-7750-1

eBook Packages: Business and EconomicsReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences