Abstract

In this chapter, we thoroughly analyze the relationship between capital and bank risk-taking. We collect cross section of bank holding company data from 1993 to 2008. To deal with the endogeneity between risk and capital, we employ stochastic frontier analysis to create a new type of instrumental variable. The unrestricted frontier model determines the highest possible profitability based solely on the book value of assets employed. We develop a second frontier based on the level of bank holding company capital as well as the amount of assets. The implication of using the unrestricted model is that we are measuring the unconditional inefficiency of the banking organization.

We further apply generalized method of moments (GMM) regression to avoid the problem caused by departure from normality. To control for the impact of size on a bank’s risk-taking behavior, the book value of assets is considered in the model. The relationship between the variables specifying bank behavior and the use of equity is analyzed by GMM regression. Our results support the theory that banks respond to higher capital ratios by increasing the risk in their earning asset portfolios and off-balance-sheet activity. This perverse result suggests that bank regulation should be thoroughly reexamined and alternative tools developed to ensure a stable financial system.

Access provided by Autonomous University of Puebla. Download reference work entry PDF

Similar content being viewed by others

Keywords

- Bank capital

- Generalized method of moments

- Stochastic frontier analysis

- Bank risks

- Bank holding companies

- Endogeneity of variables

13.1 Introduction

Bank capital management has become an important issue to both commercial bankers and central bankers after the recent financial crisis. As the subprime mortgage debacle spread, the balkanized regulatory system designed over half a century ago appeared totally inadequate for today’s complex financial system. In this study, we evaluate the role of capital in regulatory risk management by examining a wide-range bank holding company data. Historically, both theoretical and empirical papers on the relationship between capital and risk have produced mixed results.Footnote 1 Yet a new look at the role of bank capital in risk management is now critical if we are to protect the financial system of the twenty-first century.

This chapter fits into a long history of literature dealing in general with bank risk management and more specifically with the question of what constitutes an adequate level of bank capital. Our contribution consists of the analysis of a large cross section of bank holding companies over the years that the Basle Accords have been implemented. In addition, we introduce a unique, to our knowledge, method to exogenously model an instrumental variable for capital in a regression with risk.

One of the primary goals of bank regulators is to minimize the risk held on and off their balance sheets by financial institutions. In this way, the negative externalities of bank failures and the risk to taxpayers from losses from the federal bank safety net are avoided or reduced. A mandatory bank capital requirement is one of the most important tools historically used by regulators to stabilize the financial industry. The recent financial crisis, however, challenges the effectiveness of these mandatory capital requirements. The inherent characteristics of today’s banking industry such as rapid financial innovation, high financial leverage, information asymmetry, liquidity creation, and the federal bank safety net all distort incentives and reward risk-taking. If maintaining a certain level of capital is viewed by bank managers only as a necessary evil, then critical questions emerge: How is capital related to specific measures of risk including credit risk, liquidity risk, interest rate risk, off-balance-sheet risk, market risk, and overall bank risk? Do higher levels of capital improve or lower the efficiency of banking? Answers to these questions will help to establish the role of capital in regulatory risk management.

Empirical studies of bank capital and bank risk, however, face an inherent problem. In order to measure the effect of the level of capital on bank risk-taking, it would be useful to regress risk, as the dependent variable, on capital, as the independent variable. However, there is an obvious endogeneity problem. The amount of risk a bank can undertake is dependent on its amount of capital, and the amount of capital needed is dependent on the amount of risk that a bank wants to undertake. In other words, they are jointly determined, much like price and quantity in a basic microeconomic analysis. The solution to this problem is normally either to use a simultaneous equation model or to use instrumental variables. However, a simultaneous equation model must be properly identified, and no one has yet been able to accomplish this in regard to risk and bank capital. Likewise, no one, to our knowledge, has yet found a true instrument for capital that is independent of risk.

We present a methodology for the development of an exogenous instrument for capital in a regression with risk by using stochastic frontier analysis. First, we determine the maximum possible income that can be achieved from a given level of assets. This is referred to as fitting an upper envelope. Such a frontier is obviously exogenous to any specific bank because it is determined by the data from all banks in the sample. The distance from the frontier to any specific bank’s actual income can be considered a measure of bank inefficiency. Next, to develop the instrument for capital, we create a second frontier conditioned on bank capital as well as the amount of assets employed. The incremental inefficiency from the second frontier is a function of the bank’s capital but independent of the bank’s risk, and it is this incremental inefficiency that we propose to use as an instrument for capital.

Our analysis adds to the existing literature in several ways. First, we employ a large panel data set to consider the capital-risk relationship for a wider range of bank holding companies than typically reviewed. Previous empirical studies have commonly used market measures of risk. However, this approach necessarily limits the sample to publically owned banks or bank holding companies. In this study, we acknowledge the importance of small banks and bank holding companies, as well as the largest bank holding companies. This concern is significant since public policy related to the banking industry must consider a broad sample of banks and not only the largest organizations. As a result, we turn to the typical accounting measures of a bank’s risk and utilize a large panel data set. In a second contribution, stochastic frontier analysis is applied to exogenously generate the effect of the use of capital in banking.

Finally, the results provide evidence of bank holding companies reacting to higher mandatory capital requirements by increasing the amount of risk the bank holding company accepts. We use the generalized method of moments and look at seven different measures of risk: credit risk, liquidity risk, interest rate risk, off-balance-sheet risk, market risk, overall risk, and leverage risk. In general, many results support the proposition that increased capital requirements reduce risk in BHCs. There are, however, some results that suggest the opposite – that BHCs increase risk as their capital ratios increase. This is obviously an important finding with major public policy implications. If the primary tool used by regulators to ensure a stable financial system is creating perverse results, then alternative tools must be developed.

The rest of the chapter is organized as follows. Section 13.2 summarizes the literature that deals with bank capital regulation. Section 13.3 presents our methodology, and Sect. 13.4 reports the data along with its univariate analysis. In Sect. 13.5, we present our empirical results. Section 13.6 concludes.

13.2 Literature Review

It has been argued that excessively high capital requirements can produce social costs through lower levels of intermediation. In addition, there can be unintended consequences of high capital requirements such as risk arbitrage (increasing risk to offset the increase in capital and thereby maintain the same return on capital), increased securitization, and increased off-balance-sheet activity, all of which could mitigate the benefits of increased capital standards. See Berger et al. (1995) and Santos (2001). The extent to which these unintended consequences played a role in our recent crisis is yet to be determined.

Moral hazard is high on the list of problems receiving attention in this post-financial crisis environment. The presence of a federal safety net creates moral hazard because bank management does not have to worry about monitoring by depositors (see Merton 1977; Buser et al. 1981; Laeven and Levine 2009). Absent depositor monitoring, banks are free to increase risk. If, however, deposit insurance and other elements of a federal safety net are reasons for increases in bank risk, why do they continue to exist? The answer lies in the contemporary theory of financial intermediation. It has been well established in the literature that there is need for both demand deposit contracts and the possibility of bank runs (Diamond and Dybvig 1983; Calomiris and Kahn 1991; Diamond and Rajan 2000; and Santos 2001). If the possibility of bank runs is needed, and bank runs are harmful, then government deposit insurance is an optimal solution. There is a related issue. Banks have a unique ability to resolve information asymmetries associated with risky loans. As a result, bank failures can produce a serious contraction in credit availability, especially among borrowers without access to public capital markets. The federal safety net is needed to avoid this credit contraction. Likewise, if a bank is considered “too big to fail,” then the government will always bail the bank out, and there is no reason for bank management to limit risk.

It needs to be noted that not everyone is in agreement that the use of capital requirements is the best way to reduce risk in banking. Marcus (1984) and Keeley (1990) argue that a bank’s charter value mitigates against increased risk. Banks operate in a regulated environment, and therefore, a charter to operate contains market power. Excessive risk increases the cost of financial distress, and this can cause a loss of charter value. Kim and Santomero (1988) argue that a simple capital ratio cannot be effective, and any ratio would need to have exactly correct risk weights in a risk-based system. Gorton and Pennacchi (1992) discuss “narrow banking” and propose splitting the deposit services of banks from the credit services. In other words, the financial system would include money market accounts and finance companies. The money market accounts would only invest in short-term high-quality assets and leave the lending to the finance companies that would not take in any deposits.

In Prescott (1997), he reviews the precommitment approach to risk management. Briefly, banks commit to a level of capital, and if that level proves to be insufficient, the bank is fined. This is used currently in the area of capital in support of a trading portfolio but cannot be used for overall capital ratios since a fine against a failed bank is not effective. Esty (1998) studies the impact of contingent liability of stockholders on risk. In the late nineteenth and early twentieth century, bank stockholders were subject to a call or an assessment for more money if needed to meet the claims on a bank. There was a negative relation between increases in risk and the possible call on bank stockholders. Calomiris (1999) makes a strong case for requiring the use of subordinated debt in bank capital structures. The need to issue unguaranteed debt and the associated market discipline would act as an effective limit to the amount of risk a bank would be able to assume. John et al. (2000) argue that a regulatory emphasis on capital ratios may not be effective in controlling risk. Since all banks will have a different investment opportunity set, an efficient allocation of funds must incorporate different risk-taking for different investment schedules. These authors go on to argue that senior bank management compensation contracts may be a more promising avenue to control risk using incentive-compatible contracts to achieve the optimal level of risk.

Marcus and Shaked (1984) show how Merton’s (1977) put option pricing formula can be made operational and then used the results to estimate appropriate deposit insurance premium rates. The results of their empirical analysis indicated that the then current FDIC premiums were higher than was warranted by the ex ante default risk of the sample banks. This implies that banks are not transferring excessive risk to the deposit insurance safety net and capital regulation is effectively working.

Duan et al. (1992) address the question of the impact of fixed-rate versus risk-based deposit insurance premiums directly. The authors tested for specific risk-shifting behavior by banks. If banks were able to increase the risk-adjusted value of the deposit insurance premiums, then they had appropriated wealth from the FDIC. This is because the FDIC, at the time, could not increase the insurance premium even though risk had increased. Their empirical findings were that only 20 % of their sample banks were successful in risk-shifting behavior and therefore the problem was not widespread. This also implies that capital management has been effective.

Keeley (1992) empirically studied the impact of the establishment of objective capital-to-assets ratio requirements in the early 1980s. His evidence documents an increase in the book value capital-to-assets ratio of previously undercapitalized banks, and this, of course, was the goal of the new capital regulations. His study, however, is unable to confirm the same result when looking at the market value capital ratios. While the market value capital-to-assets ratios also increased, there was no significant difference between the undercapitalized banks and the adequately capitalized banks. Nevertheless, this was more evidence that capital regulation was working.

Hovakimian and Kane (2000) use the same empirical design as Duan et al. (1992) but for a more recent time period, and they obtain opposite results. They also start with the argument of Merton (1977) that the value of deposit insurance increases in asset return variance and leverage. They regress the change in leverage on the change in risk and find a positive rather than a negative coefficient. The coefficient must be negative if capital regulation forces banks to decrease leverage with increases in risk. In a second test, they regress the change in the value of the deposit insurance premium on the change in the asset return variance. Here again the coefficient must be negative (or zero) if there is any restraint. In this equation, the coefficient measures how much the bank can benefit from increasing the volatility of its asset returns. The option-model evidence presented shows that capital regulation has not prevented risk-shifting by banks and that it was possible for banks to extract a deposit insurance subsidy.

In Hughes et al. (2001), the authors study the joint impact of two functions of bank capital. First is the capital’s influence on market value conditioned on risk, and second is its impact on production decisions incorporating endogenous risk. Efficient BHCs are determined according to frontier analysis, and then these BHCs are assumed to be value-maximizing firms. The conclusion is that these value-maximizing firms do achieve economies of scale, but the analysis of production must include capital structure and risk-taking.

Berger et al. (2008) note that US banks hold significantly more equity capital than the minimum amount required by regulators. Their evidence documents the active management of capital levels by BHCs including setting target levels of capital above regulatory minimums and moving quickly to achieve their targets. Over the 15-year period of their study, BHCs regularly used new issues of shares and share repurchase programs to actively manage their capital levels. Several reasons for differing capital ratios among BHCs are given by the authors. Banks with high earnings volatility would likely hold more capital. Banks whose customers are more sensitive to default risk via counterparty exposure may be forced to hold more capital. Firms with high charter values will want to minimize their costs of financial distress by maintaining high capital ratios. On the other hand, larger banks by asset size tend to be more diversified, enjoy scale economies in risk management, have ready access to capital markets, and are possibly viewed as “too big to fail” with attendant implicit government guarantees.

Flannery and Rangan (2008) also document a large increase in bank capital during the 1990s. The authors note the timing correlation with deregulation of the banking industry and the related increase in risk exposure. They suggest that increased diversification may have been offset by the increased risk of the newly permissible activities. As a result, it was counterparty risk that was the driving force for higher capital ratios.

13.3 Methodology

13.3.1 Instrumental Variable for Capital

We differ from previous studies that deal with the endogeneity between risk and capital using traditional methods such as a simultaneous equation approach or two- or three-stage regression analysis.Footnote 2 In this study, we follow the method and concept of Hughes et al. (2001, 2003); and others and use stochastic frontier analysis to estimate the inefficiency of our sample of bank holding companies. See Jondrow et al. (1982) for a discussion of fitting production frontier models. We then create a unique instrumental variable for bank capital to be used in regressions of capital and risk. The question we ask is: “How efficient is a bank holding company in converting the resources with which it has to work into profit?” The frontier developed is exogenous to any specific bank since it is based on the results of all banks in the sample. From this frontier, we measure the inefficiency of each bank as the distance between the frontier and that specific bank’s pretax income. This measure, however, must be adjusted for those elements that are beyond the control of the bank.

Our unrestricted frontier model determines the highest possible profitability based solely on the book value of assets employed. The unrestricted model is specified as

where PTI is pretax income, BVA is of book value of assets, ξ is statistical noise, ς is systematic shortfall (under management control), and ς ≥ 0. A quadratic specification is used to allow for a nonlinear relation between the pretax income and the book value of assets.

Our next step is to develop a second frontier based on the level of bank holding company capital as well as the amount of assets. The implication of using the unrestricted model is that we are measuring the unconditional inefficiency of the banking organization. By also conditioning the model on capital, we can develop a measure of the incremental efficiency or inefficiency of an organization due to its capital level. It is this incremental inefficiency due to a bank’s capital level that we propose to use as an instrument for capital in a regression of risk on capital. Specifically, our restricted model, again in a quadratic form, is as follows:

where BVC is the book value of capital, v is statistical noise, and u denotes the inefficiency of a bank considering its use of both assets and capital.

The two assessments of inefficiency allow us to measure the difference in profitability due to the use of capital by calculating the difference in the inefficiency between the restricted and unrestricted model. Specifically,

This becomes our instrumental variable for capital. While any measure of profitability endogenously includes risk, our instrument, the difference between two measures of profitability conditioned only on capital, is related to capital but not to risk which is included in both models.

13.3.2 Generalized Method of Moments

We first apply a generalized method of moments (GMM) regression in this study.Footnote 3 There are several reasons why we need to consider the infeasibility of the OLS regression. First, the departure from normality of the variable δ due to the combined error terms should be taken into account in the analysis. There is no theory to support a Gaussian distribution of these variables. Furthermore, in practice, the ranges of the independent and dependent variables are bounded within certain intervals. Unlike other estimators, GMM is robust and does not require information on the exact distribution of the disturbances. We follow Hamilton (1994) to construct our GMM estimation. To control for the impact of size on a bank’s risk-taking behavior, the book value of assets is considered in the model (Gatev et al. 2009). The relationship between the variables specifying bank behavior and the use of equity is analyzed by GMM regression. Specifically,

where y k,t is one of the measures of risk or behavior (e.g., total equity/total asset) for bank i in year t; c is a constant; b k,t is the coefficient of instrumental variable of capital, δ i,k , for k’s regression in year t; γ k,t is the coefficient of natural logarithm of bank’s book value; and η k,t is the error term.

13.4 Data

We obtain our data on bank holding companies from Federal Reserve reports FR Y-9C for the years 1993–2008. Data on risk-weighted assets, tier 1 capital, and tier 2 capital were not included with the FR Y-9C reports from 1993 to 1996. We were graciously provided this missing information by the authors of Berger et al. (2008).

Table 13.1 displays the descriptive statistics of the sample BHCs in our analysis. The total of 24,973 bank-year observations ranges from 2,256 in 2005 to 678 in 2008. From 2005 to 2006, there is an especially large drop in the number of BHCs included in our data. This is primarily due to a change in the reporting criteria for the FR Y-9C report. Starting in 2006, the threshold for required reporting by a BHC was increased from BHCs with $150 million in total assets to BHCs with $500 million in total assets. Note that in spite of the 57 % drop in the number of BHCs reporting in 2006 compared with 2005, the total assets represented in the sample for these 2 years decreased by only 14 %.

Our data start in 1993 because 1992 was the final year in which capital ratios were still adjusting in order to conform to the Basle I Capital Accord. As a result, 1993 represents the first year that does not include any mandated changes in the capital ratios. The entire period of 1993–2008 contains a number of significant events affecting the banking industry. For instance, the Riegle-Neal Interstate Banking and Branching Act was passed in 1994 eliminating geographic restrictions on bank expansion. In 1999 the Gramm-Leach-Bliley Financial Services Modernization Act was passed effectively repealing the Glass-Steagall Act. Together these two acts overturned 65 years of legislation and regulation intended to keep banks financially sound.

From an economic point of view, the early portion of our time period represented a time of recovery from recession. The economy then moved from recovery to growth, and the decade ended in a tech-stock boom followed by a bursting of the tech-stock price bubble and an attendant recession. The new decade brought traditional financial policies intended to stimulate the economy which, in hindsight, probably helped to lay the foundation for the housing price bubble which precipitated the 2007–2009 financial crisis. The time period from 1993 to 2008 seems to be a very appropriate period in which to analyze bank capital ratios.

Previous empirical studies have used market measures of risk and various risk measures derived from a market model based on return data. However, this approach necessarily limits the sample to publically owned banks or bank holding companies. In this study, we wish to determine the impact of capital on various measures of risk and acknowledge the importance of small banks and bank holding companies, as well as the largest bank holding companies. This concern is significant since public policy related to the banking industry must consider the broadest sample and not only the largest organizations. As a result, we utilize a large panel data set and turn to the typical accounting measures of a bank’s risk.

13.4.1 Overall Observations of BHC Data

We see the significant events and the economic activity listed above in the statistics in Table 13.1. First, the size of BHCs measured by either their asset values or equity has increased, while the number of banks has decreased. This trend is still evident after adjusting for changes in the reporting criteria for the FR Y-9C report. The government deregulation noted above has resulted in increased concentration in the banking industry. We note also the significant cross-sectional variation in scale of BHCs that suggests the utilization and operation of their resources vary considerably.

When we look in Table 13.1 at the basic leverage ratio of equity to assets (E/A), we see a generally rising ratio. In 1993, the ratio was 8.5 %, while in 2008 it was 9.2 %. These ratios appear to be in line with mandatory capital requirements. We also see variation in this trend consistent with prevailing economic activity. For example, the decline from 9.4 % in 1998 to 8.9 % in 1999 reflects the tech-stock problems of that time period. In Table 13.1, we also see a rising trend in RA, the ratio of risk-based assets to total assets. Here, however, the trend is far more pronounced, rising from 43.80 % in 1993 to 76.00 % in 2008. Confirmation of these two trends comes from the trend in CAP, the ratio of tier 1 plus tier 2 capital to risk-based assets. This ratio declines from 16.10 % in 1993 to 14.50 % in 2008. While these ratios are substantially above the Basle Capital Accord standards, the trend is clearly down.

Another dramatic trend over this time period is the increase in off-balance-sheet activity. In Table 13.1, the off-balance-sheet activities-to-total assets ratio (OBS) has increased from 12.00 % in 1993 to 31.50 % in 2008. While this trend is not a surprise, we need to ask if there is capital to support this expansion and consider the makeup of the components of off-balance-sheet activities. It is unclear whether BHCs use off-balance-sheet activities to decrease or increase risk.

The time-varying overall performance measures of our sample of BHCs such as pretax income (PTI), return on equity (ROE), nonperforming assets ratio (NPA), and the interest-sensitive gap (Gap) are shaped by major economic occurrences and policies. Return on equity has varied in a relatively narrow band over this time period. With the exception of 2007 and 2008, the return on equity ranged from 12.20 % to 13.50 %. In line with the financial crisis that started in 2007, ROE declined to 11.00 % in 2007 and to 8.40 % in 2008. It is also noteworthy that the highest return on equity was in the first year of our sample period, 1993. Nonperforming assets appear to move in concert with economic activity. The recovery and expansion period of 1993–1998 is marked by a steady decrease in the ratio of nonperforming assets to equity. This is followed by an increase in this ratio during the tech-stock bubble and recession after which we see another decline until the crisis of 2007 and 2008.

Since the industrial structure of financial services changes intertemporally, we analyze the risk and use of capital by BHCs year by year. The analysis suggests banks progressively depend more on aggressive funding sources and new product lines over our sample period. Given that financial leverage (e.g., equity/asset ratio) must remain approximately stable due to regulatory requirements, bankers may try to improve their ROE by (1) enhancing overhead efficiency (OHE), (2) engaging in more off-balance-sheet activities (OBS), and (3) using interest-sensitive gap management in an attempt to decrease their total risk-based capital ratio (Cap) while maintaining an attractive ROE. The above developments in the banking industry generate potential improvement in performance but also intensify uncertainties and complexities of bank management. Therefore, a study to investigate the impact of the use of capital on the riskiness of banks is an indispensible element in bank management.

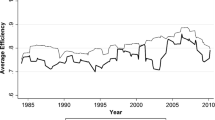

13.4.2 Instrumental Variable

The statistical summary of our instrumental variable, δ, for each year is shown in Table 13.2. Consistent with the findings documented by Hughes et al. (2001), John et al. (2000), Keeley (1990), and Kim and Santomero (1988), the use of equity capital by banks, on average, triggers a loss in efficiency. The dispersion of δ is substantial both cross-sectionally and intertemporally. For our sample, the distribution of δ in the same year tends to be skewed to the left-hand side and leptokurtic (i.e., has positive excess kurtosis). Therefore, we look at nonparametric statistics and use a normality-free regression model in our analysis to avoid the possible errors in estimation.

13.4.3 Measures of Bank Risk

We investigate the risks faced by banks from various aspects. Table 13.3 displays the measures of risk used in this study: credit risk, liquidity risk, interest rate risk, off-balance-sheet (OBS) risk, market risk, and finally leverage risk. Credit risk is concerned with the quality of a bank’s assets. Historically this has focused on a bank’s loan portfolio, but recent events have shown the importance of looking at all bank assets in light of potential default risk. Liquidity risk measures the ability of a bank to meet all cash needs at a reasonable cost whenever they arise. Interest rate risk is the extent to which banks have protected themselves from market-driven changes in the level of interest rates. Banks have the opportunity to use asset/liability management tools to mitigate the impact of changes in interest rates on both bank earnings and bank equity. We also collect data on off-balance-sheet activities and investigate their relationship with bank capital. Market risk is the risk of changes in asset prices that are beyond the control of bank management. Finally, leverage risk is the risk arising from the capital structure decisions of the BHC. The first five measures of risk relate to the various elements of business risk confronting bank management. Leverage risk, on the other hand, relates directly to the financial decisions taken in terms of the amount of capital employed. From another perspective, it can be said that minimum capital requirements (i.e., maximum leverage standards) are mandated by regulators to mitigate the various elements of business risk that the BHC accepts.

Table 13.4 displays the Spearman correlation coefficients between bank size and our instrumental variable over the sample period. We look at this nonparametric test due to the non-normal distribution of the instrument and variables. We believe that the generally insignificant correlation between our instrument and the book value of assets in combination with the generally significant correlation of our instrument and the book value of equity justifies the use of delta as an instrument for capital. In addition, Table 13.4 shows that, measured by book value of equity and pretax income, large BHCs tend to suffer a greater loss in efficiency than their smaller counterparts at a statistically significant level. On the other hand, the value of assets does not necessarily demonstrate a negative relation with bank efficiency. These findings suggest that the inefficiency of BHCs comes from the use of equity capital but is not directly led by the expansion of business scale and/or scope. Therefore, a careful investigation of the impact of capital on banking risks is appropriate.

13.5 Empirical Results

We look at seven different measures of risk: credit risk, liquidity risk, interest rate risk, off-balance-sheet risk, market risk, composite risk, and leverage risk. While many of the results support the proposition that increased capital requirements reduce risk in BHCs, there are some very significant results that suggest the opposite – that BHCs increase risk as their capital ratios increase.

Our results are displayed in Tables 13.5, 13.6, 13.7, 13.8, 13.9, and 13.10 and provide a number of interesting insights. To enhance robustness, we present both Spearman’s rank correlation coefficient between the tested variable and the instrumental variable for capital, δ, and the coefficient of δ in GMM regressions. To control for the size of the bank holding companies, each coefficient of δ is generated by GMM regression with a constant and the natural logarithm of the book value of assets. While the coefficient of the control variable and the constant term are omitted from the tables, they are available upon request. In Table 13.5, we find a positive relationship between ratio of total equity to total assets and our instrument for capital (see Eq/A). The coefficient on our instrument is strictly positive and statistically significant. This is clearly what we would expect. As leverage decreases, so does risk; therefore, higher capital should be associated with higher levels of this risk measure. In other words, it should be a positive relationship, and it is. However, for the ratio of risky assets to total assets, risk increases as the ratio increases. Therefore, higher capital should be associated with lower levels of this risk measure (a negative relationship), and again that is what we find. When we look at just tier 1 capital to total risky assets, we find the expected positive relationship, and when we look at the ratio of tier 2 to tier 1 capital, we find the expected negative relationship.

In Table 13.6, we look at some traditional measures of credit risk. As the ratio of nonperforming loans to total loans increases, so does risk. Therefore, the coefficient on capital should be negative, and they are with several exceptions over the years. Our second measure of credit risk is the ratio of nonperforming loans to total equity. Here again higher levels of the ratio imply higher risk, so we expect to find a negative relationship and we do, and this time without exception and at high levels of significance. When we look at the ratio of loan charge-offs to loans outstanding, we have more exceptions, but in general we find an expected negative relationship.

The ratio of the provision for loan loss to total loans is an ambiguous measure. A high provision could indicate bank management is expecting high loan losses. On the other hand, a high ratio could indicate conservative bank management that is taking no chances on an underfunded allowance for loan loss. When we look at the provision as a percentage of total equity, we again have the same ambiguous results possible. In general, we find that both of these risk measures produce a negative coefficient on our measure of capital. The ambiguity seems to be resolved in that as the provision for loan losses increases, so does risk. The alternative explanation is that risk should decrease with this ratio, but higher capital levels produce counterintuitive results. The ratio of the allowance for loan loss to total loans moves inversely with capital while the ratio of allowance for loan loss to total equity moves in the opposite direction.

We turn now to the allowance for loan losses. Like the provision for loan loss ratios, we have the same ambiguous expectations, but now we find conflicting results. There is no clear expectation for the impact of this ratio on risk. In other words, both the ratio of the allowance for loan losses to total loans and the ratio of the allowance for loan losses to total equity can be reflecting either high risk or low risk. What we find is that the allowance for loan loss as a percentage of loans produces a positive sign for the coefficient on capital, while the allowance for loan loss as a percentage of equity produces a negative sign on the coefficient.

We find even more consistent counterintuitive results when we look at the relationship between capital and liquidity risk in Table 13.7. Lower capital ratios are generally related to higher levels of short-term purchased liabilities (see STPF/A and FFP/A). Since short-term purchased money is more volatile than core deposits, for example, we would expect high levels of purchased money to be associated with high levels of capital, yet this is not what we find. On the other hand, we do find that higher capital ratios are related to more liquid assets (HLA/A) and better coverage of short-term liabilities (FFS/A). Since both of these ratios imply higher levels of liquidity, we expected them to be related to lower levels of capital. Apparently liquidity risk is not reflected in a BHC’s capital level.

When we look at a BHC’s exposure to interest rate risk, we again find counterintuitive results. As noted above, Table 13.7 shows that low capital ratios are related to high levels of short-term purchased funds. This can result in a fundamental liquidity problem if some markets for short-term borrowing completely dry up as we have observed in the recent financial crisis. Our more direct measure of interest rate risk is the interest-sensitive gap (gap) which we define as interest-sensitive assets minus interest-sensitive liabilities divided by total assets. Here we find ambiguous results. It is obvious that wider gaps expose banks to more risk if interest rates move against the bank. However, wide gaps can be held in both a positive and negative direction. A high positive gap indicates a BHC has a large amount of interest-sensitive assets in relation to interest-sensitive liabilities and will be hurt by falling interest rates. A high negative gap indicates a BHC has a large amount of interest-sensitive liabilities in relation to interest-sensitive assets and will be hurt if interest rates rise. Our results in Table 13.7 indicate that wider gaps are associated with lower levels of capital, but this is only a true measure if BHCs typically held a positive gap.

In Table 13.8, we turn our attention to BHCs’ off-balance-sheet activity. Rather surprisingly, off-balance-sheet exposures seem to be inversely related to capital levels in spite of the Basle Capital Accords. Recall that the Basle Accords require the maintenance of capital in support of off-balance-sheet activity. Yet all of our measures of off-balance-sheet risk are associated with low capital levels with one exception. The notional amount of commodity derivatives held for trading compared with the notional amount of commodity derivatives held for other purposes is associated with a higher level of capital. Our interpretation of the ratios that measure the amount of derivatives held for trading compared with the derivatives held for other purposes is that the derivatives not held for trading are held to hedge an existing position on the books of the BHC. As a result, a high ratio implies more trading activity in relation to hedging activity, and therefore, more capital should be required. However, we again find high OBS ratios associated with low levels of capital.

In Table 13.9, we look at two measures of market risk: the size of the BHCs’ trading account and the amount of unrealized gains or losses on the BHCs’ investment portfolio. We again find what we believe are counterintuitive results. First, larger trading portfolios inherently contain a larger amount of market risk. On the other hand, a large amount of unrealized gains in the investment portfolio mitigates market risk, at least to some extent. We find, however, low levels of capital associated with higher trading portfolios, while high levels of capital are associated with higher unrealized gains in the investment portfolio.

Our results concerning performance measures are shown in Table 13.10. Here we find evidence of higher capital ratios being associated with higher return on assets ratios and with higher net interest spreads. Since higher returns on earning assets are logically associated with higher risk, it is appropriate that higher capital is used in support of the additional risk. However, while the direction of the causality is not clear, this could be interpreted as more evidence that BHCs increase risk to maintain a target return on equity in the face of higher capital requirements.

13.6 Conclusions

In this study, we thoroughly analyze a large cross section of bank holding company data from 1993 to 2008 to determine the relationship between capital and bank risk-taking. Our sample includes a minimum of almost 700 BHCs in 2008 and a maximum of about 1,500 BHCs in 1993. This produces nearly 25,000 company-year observations of BHCs starting with the year that risk-based capital requirements were first in place. Our data cover a period containing significant changes in the banking industry and varying levels of economic activity. The Riegle-Neal and Gramm-Leach-Bliley acts were passed during this time period, and the tech-stock and housing bubbles both burst with attendant recessions. By including a larger size range of BHCs in our analysis over a long sample period, our results are applicable to relatively small BHCs as well as to the largest 200 or so BHCs traditionally included in empirical studies.

We employ stochastic frontier analysis to create a new type of instrumental variable for capital to be used in regressions of risk and capital, thereby mitigating the obvious endogeneity problem. The instruments are validated to confirm their high correlation with capital and limited correlation with risk. We conclude that they are suitable for use in our models and employ a GMM estimator to acknowledge the non-normal distribution of the instruments.

Our results are consistent with the theory that BHCs respond to higher capital ratios by increasing the risk in the earning asset portfolios. We find an inverse relationship between the proportion of risky assets held by a bank holding company and the amount of capital they hold. We also find lower levels of capital associated with measures of credit risk that indicate a riskier loan portfolio. For example, the amount of nonperforming assets held by the bank holding company is inversely related to the bank holding company’s capital.

Our findings also demonstrate a counterintuitive relationship between bank capital and liquidity risk. Less liquid banks tend to have low capital ratios, while more liquid banks tend to have high capital ratios. These same results suggest that a higher level of interest rate risk is also related to lower levels of capital. Our direct measure of the mismatch between interest-sensitive assets and liabilities provides additional evidence, although somewhat ambiguously, of higher interest rate risk being associated with lower capital. High levels of off-balance-sheet activity and of market risk exposure are likewise surprisingly related to low capital levels. Finally, we note the association of high levels of capital with high return on asset ratios. This association at least suggests that bank holding companies do increase the risk of their earning assets in order to provide an adequate return on their capital.

Our analysis adds to the existing literature with three contributions. First, we employ a large panel data set to consider the capital-risk relationship for a wider range of bank holding companies than previously reviewed. Second, stochastic frontier analysis is applied to exogenously generate the effect of the use of capital in banking. Finally, our results provide what we believe are important findings with potentially major public policy implications. If the primary tool used by bank regulators to ensure a stable financial system is, instead, creating perverse results, then alternative tools must be developed. Further exploring the relationship between the efficiency of capital and the risk strategy adopted by a bank would be a contribution to this literature.

Notes

References

Berger, A. N., Herring, R. J., & Szego, G. P. (1995). The role of capital in financial institutions. Journal of Banking and Finance, 24, 1383–1398.

Berger, A. N., DeYoung, R., Flannery, M. J., Lee, D., & Oztekin, O. (2008). How do large banking organizations manage their capital ratios? Journal of Financial Services Research, 343, 123–149.

Buser, S. A., Chen, A. H., & Kane, E. J. (1981). Federal deposit insurance, regulatory policy, and optimal bank capital. Journal of Finance, 36, 51–60.

Calomiris, C. W. (1999). Building an incentive-compatible safety net. Journal of Banking and Finance, 23, 1499–1519.

Calomiris, C. W., & Kahn, C. M. (1991). The role of demandable debt in structuring optimal banking arrangements. American Economic Review, 81, 497–513.

Campbell, J., Lo, A., & MacKinlay, A. C. (1997). The econometrics of financial markets. Princeton: Princeton University Press.

Diamond, D. W., & Dybvig, P. H. (1983). Bank runs, deposit insurance, and liquidity. Journal of Political Economy, 91, 401–419.

Diamond, D. W., & Rajan, R. (2000). A theory of bank capital. Journal of Finance, 55, 2431–2465.

Duan, J., Moreau, A. F., & Sealey, C. W. (1992). Fixed rate deposit insurance and risk-shifting behavior at commercial banks. Journal of Banking and Finance, 16, 715–742.

Esty, B. C. (1998). The impact of contingent liability on commercial bank risk taking. Journal of Financial Economics, 47, 189–218.

Flannery, M. J., & Rangan, K. P. (2008). What caused the bank capital build-up of the 1990s? Review of Finance, 12, 391–430.

Gatev, E., Schuermann, T., & Strahan, P. E. (2009). Managing bank liquidity risk: How deposit-loan synergies vary with market conditions. Review of Financial Studies, 22, 995–1020.

Gorton, G., & Pennacchi, G. (1992). Financial innovation and the provision of liquidity services. In J. R. Barth & R. Dan Brumbaugh (Eds.), Reform of federal deposit insurance. New York: Harper Collins.

Hamilton, J. D. (1994). Time series analysis. Princeton: Princeton University Press.

Hansen, L. P. (1982). Large sample properties of Generalized Method of Moments estimators, Econometrica, 50, 1029–1054.

Hovakimian, A., & Kane, E. J. (2000). Effectiveness of capital regulation at U.S. commercial banks: 1985 to 1994. Journal of Finance, 55, 451–468.

Hughes, J. P., Mester, L. J., & Moon, C. (2001). Are scale economies in banking elusive or illusive? Incorporating capital structure and risk into models of bank production. Journal of Banking and Finance, 25, 2169–2208.

Hughes, J. P., Lang, W. W., Mester, L. J., Moon, C., & Pagano, M. (2003). Do bankers sacrifice value to build empires? Managerial incentives, industry consolidation, and financial performance. Journal of Banking and Finance, 27, 417–447.

John, K., Saunders, A., & Senbet, L. (2000). A theory of bank regulation and management compensation. Review of Financial Studies, 13, 95–125.

Jondrow, J., Lovell, C. A., Materov, I. S., & Schmidt, P. (1982). On the estimation of technical inefficiency in the stochastic frontier production function model. Journal of Econometrics, 19, 233–238.

Keeley, M. C. (1990). Deposit insurance, risk, and market power in banking. American Economic Review, 80, 1183–1200.

Keeley, M. C. (1992). Bank capital regulation in the 1980s: Effective or ineffective? In S. Anthony, G. F. Udell, & L. J. White (Eds.), Bank management and regulation: A book of readings. Mountain View: Mayfield Publishing Company.

Kim, D., & Santomero, A. M. (1988). Risk in banking and capital regulation. Journal of Finance, 42, 1219–1233.

Laeven, L. A., & Levine, R. (2009). Bank governance, regulation and risk taking. Journal of Financial Economics, 93, 259–275.

Marcus, A. J. (1984). Deregulation and bank financial policy. Journal of Banking and Finance, 8, 557–565.

Marcus, A. J., & Shaked, I. (1984). The valuation of FDIC deposit insurance using option-pricing estimates. Journal of Money, Credit and Banking, 16, 446–460.

Merton, R. C. (1977). An analytic derivation of the cost of deposit insurance and loan guarantees. Journal of Banking and Finance, 1, 3–11.

Prescott, E. S. (1997). The pre-commitment approach in a model of regulatory banking capital. FRB of Richmond Economic Quarterly, 83, 23–50.

Santos, J. A. (2001). Bank capital regulation in contemporary banking theory: A review of the literature. Financial Markets, Institutions and Instruments, 10, 41–84.

Shrieves, E., & Dahl, D. (1992). The relationship between risk and capital in commercial banks. Journal of Banking and Finance, 16, 439–457.

VanHoose, D. (2007). Theories of bank behavior under capital regulation. Journal of Banking and Finance, 31, 3680–3697.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1: Stochastic Frontier Analysis

Stochastic frontier analysis (SFA) is an economic modeling method that is introduced by Jondrow et al. (1982). The frontier without random component can be written as the following general form:

where PTI i is the pretax income of the bank i, i = 1,..N, TE i denotes the technical efficiency defined as the ratio of observed output to maximum feasible output, x i is a vector of J inputs used by the bank i, f(x i , b) is the frontier, and b is a vector of technology parameters to be estimated. Since the frontier provides an estimate of the maximum feasible output, we then can measure the shortfall of the observed output from the maximum feasible output. Considering a stochastic component that describes random shocks affecting the production process in this model, the stochastic frontier becomes

The shock, \( {{e}}^{v_i} \), is not directly attributable to the bank or the technology but may come from random white noises in the economy, which is considered as a two-sided Gaussian distributed variable.

We further describe TE i as a stochastic variable with a specific distribution function. Specifically,

where u i is the nonnegative technical inefficiency component, since it is required that TE i ≤ 1. Thus, we obtain the following equation:

We then can describe the frontier according to a specific production model. In our case, we assume that bank’s profitability can be specified as the log-linear Cobb-Douglas function:

Because both v i and u i constitute a compound error term with a specific distribution to be determined, hence the SFA is often referred as composed error model.

In our study, we use the above stochastic frontier with different inputs to generate the net effect of bank capital without mixing the impact of risk. The unrestricted model (without including bank equity) is

where BVA is the natural logarithm of book value of assets, ξ is statistical noise, ς is systematic shortfall (under management control), and ς ≥ 0. Our restricted model is as follows:

where BVC is the natural logarithm of book value of capital, v is statistical noise, and u denotes the inefficiency of a bank considering its use of both assets and capital. The difference in the inefficiency between the restricted and unrestricted model,

is our instrumental variable. The instrumental variable for capital can be used in regressions of various measures of risk, as the dependent variable, on our instrument for capital, as the independent variable, while controlling for BHC size.

Appendix 2: Generalized Method of Moments

Hansen (1982) develops generalized method of moments (GMM) to estimate parameters that its full shape of the distribution function is not known. The method requires that a certain number of moment conditions were specified for the model. These moment conditions are functions of the model parameters and the data, such that their expectation is zero at the true values of the parameters. The GMM method then minimizes a certain norm of the sample averages of the moment conditions.

Suppose the error term ε t = ε(x t , θ) is a (T × 1) vector that contains T observations of the error term ε t , where x t includes the data relevant for the model and θ is a vector of N β coefficients. Assume there are N H instrumental variables in an (N H × 1) column vector, h t and T observations of this vector form a (T × N H ) matrix H. We define

The notation ⊗ denotes the Kronecker product of the two vectors. Therefore, f t (θ) is a vector containing the cross product of each instrument in h with each element of ε. The expected value of this cross product is a vector with N ε N Η elements of zeros at the parameter vector:

Since we do not observe the true expected values of f, thus we must work instead with the sample mean of f,

We can minimize the quadratic form

where W T is an (N H × N H ) symmetric, positive definite weighting matrix. We then find the first-order condition is

where D T (θ T ) is a matrix of partial derivatives defined by

Note the above problem is nonlinear; thus, the optimization must be solved numerically.

Applying the asymptotic distribution theory, the coefficient estimate \( {\widehat{\theta}}_T \) is

where Ω = (D 0′WD 0)−1 D 0′WSWD 0 (D 0′WD 0)−1. D 0 is a generalization of M HX in those equations and is defined by D 0 ≡ E[∂f(x t , θ 0)/∂θ 0]. S is defined as

The GMM estimators are known to be consistent, asymptotically normal, and efficient in the class of all estimators that do not use any extra information aside from that contained in the moment conditions. For more discussion of the execution of the GMM, please refer to Campbell et al. (1997) and Hamilton (1994).

Rights and permissions

Copyright information

© 2015 Springer Science+Business Media New York

About this entry

Cite this entry

Chiou, WJ.P., Porter, R.L. (2015). Does Banking Capital Reduce Risk? An Application of Stochastic Frontier Analysis and GMM Approach. In: Lee, CF., Lee, J. (eds) Handbook of Financial Econometrics and Statistics. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-7750-1_13

Download citation

DOI: https://doi.org/10.1007/978-1-4614-7750-1_13

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-7749-5

Online ISBN: 978-1-4614-7750-1

eBook Packages: Business and EconomicsReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences