Abstract

This chapter examines innovation activities and innovative networks in the strategic industries of three metropolitan cities of Korea, and draws policy implications for reinforcing clustering and networking. It provides the results of a survey of 180 businesses in Busan, Gwangju, and Daejeon.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Innovation and knowledge creation are recognized as the engine for national and regional growth and development in the twenty first century. However, with the progress of globalization and industrial restructuring, many regions in industrialized countries have been faced with challenges over the past several years. These challenges have been comparatively tough in large cities of the countries which have been successfully industrialized. In recent years, these regions have been experiencing various kinds of structural readjustment, there is an urgent need to restructure the industries, and develop high value added new products, and new processes in these regions.

Innovation has a crucial influence on regional growth as well as the growth of enterprises. Accordingly, not only enterprises but also regional and central governments have interest in factors that influence innovation. In creating innovation, the innovative behavior of enterprises and institutional framework of regions are important. This is because the innovative results of enterprises depend on the innovative corporate behavior, or R&D activities, and innovative environment of the region that supports them. In regions where the regional innovative system functions in a systematic way, the innovation between enterprises and knowledge suppliers can be created interactively, which is supported by policy decision-making agencies, technology transfer organizations, consulting service providers, brokers, etc.

Regional metropolitan cities of the country such as Busan, Gwangju, and Daejeon lack R&D activities of the enterprises and entrepreneurship since they developed through the mass production and export-oriented industrialization at the early stages of industrialization. Besides, since the proportion of branch plants is high in these cities, they are not regarded as highly innovative as in the innovative clusters in advanced countries. Despite that, they are trying to get over the regional crisis that is unfavorable to innovation, and strengthen innovation through the new types of strategic industries of the region.

The purpose of this chapter is to examine innovation activities and innovative networks in the strategic industries of three metropolitan cities of Korea, and to draw policy implications for reinforcing clustering and networking. To this end, the chapter provides the results of a survey of 180 businesses in Busan, Gwangju, and Daejeon. The structure of this chapter is as follows: The next section gives the concept of innovation and cluster in brief. The third section briefly explains the background of these regions and the methodology adopted for the study, and analyzes the survey results. The last section summarizes the key findings of the study and suggests policy implications for the future development of the strategic industries of the three metropolitan cities.

2 Innovation and Clusters

Innovation can be defined in various ways. Schumpeter provides five definitions of innovation as follows: (1) introduction of new products or qualitative change in existing products, (2) process innovation new to the industry, (3) opening of a new market, (4) development of new sources of supply for raw materials or other inputs, and (5) change in industrial organization.

Since the days of Schumpeter, innovation has move to the heart of economic policy-making. The European Commissions Directorate XIII, which is responsible for science and technology of Europe, defines innovation as follows: The commercially successful exploration of new technologies, ideas, or methods through the introduction of new products or processes, or through the improvement of existing ones.

Oslo Manual of the Organization for Economic Cooperation and Development (OECD 1992, 1997) provides a precise definition of technological product and process innovation which is useful for a standardized survey (Holbrook et al. 2000). The OECD definition of innovation classifies the concept of ‘new’ into three levels: new to the world, new to a nation, and new to the enterprise.

Many theoretical approaches have been suggested to explain the sources, characteristics and determinants of innovation. For example, behavioral theorists have highlighted the important influence and effect of uncertainty on decision-making of a firm. Structural theorists suggest that the structure of an entire industrial system has a key role in influencing the innovative behavior of the firm (Westhead and Batstone 1998). The institutional approach examines the relationships between national institutions of finance, education, law, science and technology, corporate activities and government policies, and their influence on the propensity for innovation (Nelson 1993). The relational approach analyzes the nature of business and social relationships in nations, manifested, for example, in the way user-supplier links encourage shared learning (Lundvall 1992).

Innovation is not an activity of a single firm; it increasingly requires an active search involving several firms to tap new sources of knowledge and technology, and apply these to products and production process (Guinet 1999). In other words, innovation is a result of an interactive learning process that involves often several actors from inside and outside the companies (EC DG XIII and XIV 1996; Simmie 2001). The current focus on knowledge has combined with the interactive theory of innovation-led to the analysis of specific factors which determine successful innovations or which influence the absorption of knowledge created outside the firm (Schibany and Schartinger 2001).

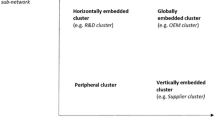

The “cluster concept” is one of these factors studied by the OECD focus group. According to the OECD report (1999), clusters are networks of interdependent firms, knowledge-producing institutions (universities, research institutes, technology-providing firms, etc.), bridging institutions (e.g., providers of technical or consultancy services), and customers, linked to a production chain which creates added value. The main idea of a cluster is that it is considered to be better equipped to succeed in the market place than an isolated company. The ‘agglomeration externalities and positive feedback,’ or that enterprises within industrial clusters have advantage in terms of growth speed or innovation over those that are isolatedly located, have been verified (Swann et al. 1998).

The enterprises within clusters are located within close proximity to each other; for this, the search cost of customers and relevant enterprises can be reduced. Further, face-to-face contacts appear to be very important as sources of technological information and in the exchange of tacit knowledge. Spatial proximity greatly enhances the possibility of such contacts. Geographical proximity is typical of clusters-although it is not absolutely necessary (Rouvinen and Ylae-Anttila 1997). Because the cooperation between actors enhances mutual trust, this industrial agglomeration of producers, customers, and competitors promotes efficiency and increases specialization.

Learning through networking and by interacting is seen as the crucial force pulling firms into clusters, and the essential ingredient for the ongoing success of an innovative cluster (Breschi and Malerba 2001). The ways enterprises learn in clusters are by embracing user-producer relationships, formal and informal collaborations, inter-firm mobility of skilled workers, and the spin-off of new firms from existing firms, universities, and public research centers (Breschi and Malerba 2001). In particular, universities and research institutes, as producers of new knowledge, may play a crucial role.

According to Asheim and Cooke (1999), there are two types of innovation networks; one is the endogenous innovative network, which is based upon a preexisting regionally or locally delineated cluster of small and medium-sized enterprises. They have a lengthy tradition of interacting and learning from one another, successfully competing on the basis of, as needed, cooperative innovation practices. Examples of such endogenous innovative networks are to be found in southern Germany (e.g., Baden Wuerttemberg) and the Third Italy (e.g., Tuscany or Emilia-Romagna).

The other is the exogenous innovative network, which takes the form of technopoles or science parks. They tend to emerge under two kinds of circumstances: (a) when large firms fragment their production structure and relocate R&D activities to functionally specialized zones where synergies are expected to arise from collocation (as in Sophia Antipolis or Lille in France), or (b) by planned innovative milieu established to promote collaboration between universities and SMEs (as in science parks in the UK and USA).

Industrial clusters are often localized, giving rise to networks and specific innovation patterns in regions. Regions differ in their preconditions for innovation such as qualification of the labor force, universities, research institutions, technology-based firms, knowledge externalities, and spillovers. Cooperation in clusters has increasingly become a requirement for success. Without cooperation, firms almost never innovate in isolation (Roelandt and den Hertog 1999). Moreover, cooperation offers a direct way to improve economic performance and reduce costs (Guinet 1999). Many of these embedded factors in regions are immobile, giving some regions advantages over others.

In many countries, clusters of innovative firms are driving growth and employment (Guinet 1999). They are more concentrated in some cities rather than others (Simmie 2001). That is why innovation is dependent on high quality professional and technical labors. High quality labors are one of the stickiest local factors of production. The primary cities in each regional economy therefore tend also to be the major national concentrations of such labor. Scale advantages in large cities, urbanization, and localization economies are seen as the main reasons for the clustering of innovative activities in metropolitan regions.

3 A Descriptive Analysis of the Survey Results

3.1 Background and Methodologies

3.1.1 Background

This chapter is focused on the innovation activities and clustering of the mechanical parts and materials industry of Busan, Information and Communication Technology (ICT) industry in Daejeon and photonics industry of Gwangju. The industrial clusters of Korea can be found in the regions which have the national or regional industrial complexes. Currently, there are 585 industrial complexes with 30 national complexes, 213 regional complexes, and 342 rural complexes (Kim et al. 2006). In particular, most of the metropolitan cities of Korea have one or more national or regional industrial complexes. The case study regions of this paper, Busan, Daejeon, and Gwangju also have national and regional industrial complexes within them.

In the Busan region, which has a strong agglomeration of footwear, apparel, and mechanical parts and materials industries, for example, the mechanical parts and materials industry is one of the main industries of the local industrial complexes. While the enterprises in the industry are located within the industrial complexes of the city, many of them are concentrated in Sasang-gu and Saha-gu. While Daejeon has the National Science and Technology Complex for Research Institutions, Gwangju has the National High-tech Industrial Complex for Photonics-related industry. The ICT enterprises of Daejeon are mostly clustered in Yuseung-gu and Daeduck-gu. The photonics enterprises of Gwangju are mostly located in Buk-gu and Gwangsan-gu. The case studies of the paper, the mechanical parts and materials industry of Busan, photonics industry of Gwangju, and ICT industry of Daejeon have been selected from the strategic industries that have formed clusters centering around the principal industrial complexes of each of the three cities.

Busan, which is located at the hub of the marine transportation of Korea, has the population of some 3.67 million, which accounts for 7.4 % of the entire population of the nation. The mechanical parts and materials industry includes part of the new materials, mechatronics, shipbuilding, mechanical equipment, and steel and iron industry. In Busan, there are more than one thousand enterprises in these industries, with some 25 thousand workers employed in the companies. The sales per worker of the companies surveyed are some ₩ 490 million, which is comparatively high; however, the exports per worker are only ₩ 30 million, revealing that they are simply a domestic consumer-oriented industry. The mechanical parts and materials industry of Busan lacks key leading enterprises, which results from the nature of the industry, and is composed mostly of small and medium-sized enterprises. In addition, supporting institutions such as public research institutions or agencies for technical support, which may lead the technical innovation, are insufficient considering the scale of the cluster.

Daejeon city, located in the central part of the nation, is the fifth largest city in the country among Korea’s top seven large cities including Seoul, Busan, Incheon, Daegu, Gwangju, and Ulsan. The population is some 1.45 million, and accounts for 3.1 % of the nation’s population. Daejeon is the transportation hub of the country, connecting the whole country from east to west, and from north to south, and easily accessible from anywhere of the country. The Daejeon city is the center of knowledge and information, and situated at the second administrative capital of the country. Besides, Daejeon is home to the Daedeok Valley, the cradle of the high-tech industry of the country, where the Daedeok Science Town—the country’s R&D park, is located. This is where the country’s leading science and technology think-tank and research institutes are situated with top class human resources concentrated in it—16,000 personnel here hold master’s or doctorate degrees with 43 % doctorate degree holders. They work for the government or private enterprises as researcher or higher education researchers, or work for venture businesses or supporting institutions. The ICT industry of Daejeon involves the information and telecommunications components, equipment, software and contents, and services. As of 2004, some 12,000 workers are employed in some 580 enterprises. The sales per worker of the companies surveyed are not high, or ₩ 350 million,Footnote 1 with the exports per worker amounting to only 30 million, and they have a profit model that is domestic consumer-oriented.

Gwangju, in the southwest part of the country, is one of the seven major cities of the country coming in sixth in size. It has some 1.41 million populations, taking 3 % of the whole population. The National High-tech Industrial Complex of Gwangju is characterized as a cluster of small firms which have been relocated recently from other parts of the nation, the Seoul Metropolitan Area (SMA), in particular, and spun-off firms, R&D institutes and universities such as Advanced Photonics Research Institute, Gwangju Institute of Science and Technology, private enterprises such as LG Innotech, etc. Since the duration of the clustering is shorter than that of Busan or Daejeon, as of 2004, some 5,000 workers are employed in some 230 enterprises. The sales per worker of the companies surveyed are not high, or ₩ 340 million; however, the exports per worker are ₩ 160 million. This makes the city the most export-oriented of the three case study clusters. The Busan and Gwangju regions do not have enough number of public research institutes that can support the R&D activities of the enterprises compared to the research institute-clustered Daejeon.

3.1.2 Methodology

The surveys on the companies were conducted between July and August of 2005. The total number of the surveyed companies is 180 from Busan, Daejeon, and Gwangju, and the surveys provided the base for the following analysis. For the purpose of the innovation survey in three regional strategic industries, innovative firms are defined as those which have introduced a technologically new product or process during the previous 3 years. The survey covers not only the production network but also innovation characteristics and network. However, this paper restricts the scope of the current analysis to the innovation characteristics and network in the three regions’ strategic industries (Fig. 1).

Major strategic industries in three large cities. source (Kwon et al. 2005)

3.1.3 Company Attributes

Table 1 shows the characteristics of the companies surveyed. Overall, 42 % of the samples were established before the 1997 financial crisis, with 37 % between 1998 and 2000, and 21 % after 2001. Among the companies surveyed in Busan, those that were established before the financial crisis took the most part while in Gwangju, companies that were set up after 2001 were surveyed the most. This is reflected on the size of the companies. In Gwangju and Daejeon, the proportion of small-sized enterprises is higher than the average while in Busan those of small and medium-sized, and large enterprises are high.

Despite that, in the mechanical parts and materials industry of Busan, most of the companies are small and medium-sized with large ones taking only 8 %. These companies were established before 1997. The oldest company of those surveyed was founded in 1960. The majority of the small and medium-sized businesses in the mechanical parts and materials of Busan have long history, while companies in the photonics industry of Gwangju and ICT industry of Daejeon are newly founded.

3.2 Innovation Characteristics and Innovation Types

Innovation plays a crucial role in the performance of the enterprise. How innovative are the companies in the surveyed regional strategic industries? In accordance with the survey purpose, the innovative enterprise is defined as that which has introduced technologically new products or processes over the past 3 years.

In the study on the 180 companies located in the three metropolitan cities in Korea, the proportion of the innovative enterprises is very high in Gwangju and Daejeon while in Busan, that of innovative firms is only 40 %. Table 2 shows that there are significant differences in the proportion of innovative firms by regional strategic industries.

The innovation types introduced in early 2000s were either product innovations (88 %) or process innovations (12 %). The proportion of product innovation turned out to be high in Gwangju and Daejeon while in Busan that of process innovation appeared high. The mechanical parts and materials industry of Busan is stressing process innovation with some 40 % of the companies introducing innovation. In the mechanical parts and materials industry of Busan, process innovation is considered relatively more important in regions where mature industries are common. In the ICT industry of Daejeon and photonics industry of Gwangju, product innovation is more frequent than process innovation while in the mechanical parts and materials industry of Busan, product innovation is comparatively less frequent.

The OECD definition of innovation has three levels in terms of “new”: new to the world, new to a nation, and new to the firm. “New” is necessary but not sufficient for innovation. For a product or process to be innovative, it must have a sense of uniqueness to it. This does not mean every innovation must be a world first (Holbrook and Hughes 2000).

In the strategic industry of the three metropolitan cities, only 21 % of the new products were new to the world. At present, in the metropolitan regions, the level of innovation of these enterprises is low and this can be explained by the fact that they are at the early stage of strengthening their strategic industry base. In the Busan mechanical parts and materials industry, 20 % of the enterprises have developed products that are new to the world over the past 3 years. In the Daejeon ICT industry, the proportion decreases to 14 and goes up to 30 % in the Gwangju photonics industry. These innovations are quite interesting since they show the innovation system that produces innovation and the characteristics and competence of the enterprises. This also means that even the novelty of innovation can be differentiated by regional industry.

3.3 Innovation Networks

3.3.1 Source of Innovation

In the process of innovation, enterprises utilize various kinds of information sources. In most cases, knowledge cannot be obtained from explicit information alone; therefore, the most efficient means to link diverse activities in the process of innovation is the direct long-term contact among individuals who have the capacity to transfer knowledge. In particular, the long-term personal contact such as cooperative projects or researches is a crucial element for the acquisition and dissemination of tacit knowledge.

As seen in Table 3, the source of innovation originates mostly from cooperative projects or researches. A 45.6 % of the corporations in the Daejeon ICT industry, 54.7 % in the Gwangju photonics industry, and 64 % in the Busan mechanical parts and materials industry consider the experiences from the process of the cooperative projects or researches to be the most important source of innovation. The result that cooperative projects or researches are the most important source of innovation is not surprising.

The second most important source of information for the Gwangju photonics industry and Daejeon ICT industry, when it comes to innovation, is the patent information, technology information, paper, Internet, and others. A 21.1 % of the surveyed ICT-related enterprises in Daejeon regarded explicit knowledge to be the second most important source. The Gwangju photonics-related enterprises cited explicit knowledge and formal contact as the second most important source. In Busan, formal consulting was cited as the second most important source for innovation. As is the case in the experience of innovation, the Busan mechanical parts and materials industry shows different tendency from the other two industries in Daejeon and Gwangju regarding the source of innovation. Table 3 also shows that informal contacts with ex-colleagues and friends seldom play a crucial role.

3.3.2 Innovation Partner

This part deals with the key actors among innovation partners in the strategic industry cluster in the three regions. Enterprises were asked to indicate if they are associated with the following categories of innovation partners: suppliers, clients, supporting agencies, universities, and research institutes. The respondents had to consider only those partners who actually made a contribution to their innovation creation. In general, customers are more important than suppliers who often initiate modifications of products or development of new products (Kaufmann and Tödtling 2000). Sometimes they are even involved in the development process itself (Kaufmann and Tödtling 2000). Besides buyers and suppliers, knowledge providers and service providing firms such as universities, research organizations, and consultants are important innovation partners.

In the strategic industries of the three metropolitan cities, customers are the most important innovation partners. Though the principal value chain of the strategic industry of the three cities are the user-supplier relationship, the significance of universities as innovation partner is very low. In substance, no matter what type of R&D is carried out, in the innovation projects, the public research labs are also more important than universities as innovation partner.

In the Daejeon ICT industry, the contact with research institutes is very strong due to the strong ICT knowledge base such as the ETRI. In the Daejeon region, 28.3 % of the enterprises performed innovation activities in collaboration with public research institutes. In the Busan mechanical parts and materials industry, suppliers are as important, as cooperative partner, as the Gwangju and Daejeon research institutes in the process of innovation. Research institutes are less favored as innovation partner by Busan enterprises than those in Gwangju or Daejeon (Table 4).

A possible explanation for this is the difference in the institutional environment and industrial characteristics. The reason the Busan enterprises less utilize universities and public research institutes as innovation partner than product-innovating companies in other clusters, can be that the research institutes are not sufficient in the region; that companies here are not capable enough to utilize them; or that they do not recognize the need to cooperate. The relevance between universities and public research institutes as key actors in the innovation network is also determined by the institutionalization of the R&D within the region.

In Daejeon and Gwangju, public policies are dominant which are targeted at the fostering, subsidizing, or supporting the collaboration between public institutions and business organizations. Under the circumstances, it is natural to find that public research institutes are the most frequently used collaboration partners in the innovation process in the Daejeon ICT industry and Gwangju photonics industry.

3.3.3 Relationship Between Innovation and Cooperation

Enterprises with a high propensity to collaborate with other partners are more likely to experience innovation. Therefore, it is not surprising to have the result that R&D cooperation plays a crucial role in creating innovation for businesses. This corresponds to the study results that, in Busan, companies with experiences in cooperation successfully created innovation while those with no experiences hardly did (Tables 5, 6).

In the process of innovation of the Busan mechanical parts and materials industry, the R&D cooperation between customers and universities are highly important, in particular. However, with the Daejeon ICT industry and Gwangju photonics industry, the R&D cooperation occurs in a very natural way, and is not a sufficient condition for innovation.

3.3.4 Spatial Levels of the R&D Cooperation

What are the relevant spatial levels of the R&D cooperation networks? It can be classified into five types: Local, regional, SMA, national, and worldwide level. For the Daejeon ICT firms, while the R&D cooperation with universities or research institutes is concentrated in the local level, the customers are located in the SMA. For the Gwangju photonics firms, the R&D cooperation of universities and research institutes is focused on the regional level while the customers are situated in the SMA. In the Busan region, all partners for the R&D cooperation are within the region. As a result, while the Busan mechanical parts and materials industry succeeded in achieving the critical mass at the region level, with the Daejeon ICT industry and Gwangju photonics industry, inducing the customers into the region can be a major strategy for the development of the cluster since the customers to cooperate R&D are mostly located in the SMA (Table 7).

3.3.5 Source of Tacit Knowledge

Innovation activities involve a great deal of interactions with external sources of knowledge and experiences. Innovation depends on knowledge and assimilation of information through learning and cooperation. Know-how transfer requires personal interactions trough exchanges, training, seminar, cooperative projects, and cooperative work performance. By its very nature, tacit knowledge cannot be written down; therefore it must be acquired by learning and experience, and after that it becomes embodied in a person or organization. This type of knowledge can be achieved by human mobility and personal exchanges through cooperation. These are important instruments for knowledge dissemination.

Table 8 shows 40 % of the companies responded that relevant know-how is transferable to other possible cooperation partners through exchanges among firms. In the Busan mechanical parts and materials industry, the most important source of information when exchanging tacit knowledge is the customers. A 27.3 % of the surveyed companies regarded customers as the most important actor. Only a few responded seminars, discussions, and informal exchanges among researchers are the most important source of tacit knowledge in the innovation process.

When exchanging tacit knowledge, the most important source of knowledge is the joint R&D among universities and research institutes for the Daejeon ICT firms. A 23.8 % of the surveyed firms considered the exchanges among universities and research institutes as the most important source. While the exchanges with the customers were cited as the most important relationship for the Busan mechanical parts and materials businesses, they were regarded as the second most important for the Daejeon ICT industry. Table 8 also shows that while the seminars and informal exchanges among researchers are crucial for the Gwangju photonics industry, they do not play any significant role for the Busan mechanical parts and materials industry.

4 Summaries and Conclusions

4.1 Summaries

The purpose of this chapter is to compare and analyze the innovation capacity, innovation network, and source of innovation of the regional strategic industries in the three metropolitan cities, and to suggest policy implications for strengthening clustering and networking. In order to examine the status of innovation and networks of enterprises, a firm level survey was conducted among the strategic industries of the three metropolitan cities.

Most of the firms in the Busan mechanical parts and materials industry have a longer history than those in Gwangju and Daejeon with the sales of their primary products two to three times higher. However, the innovation capacity of most of the firms is low compared to those in other regions, and the innovation activities are also highly concentrated in the enhancement of the manufacturing process rather than in the new product introduction.

In contrast, companies in Gwangju and Daejeon were newly founded after the financial crisis with a high proportion of R&D investment. They are more experienced in innovation, and most of the innovation activities are related to the development of new products. For the Busan enterprises, differentiated support should be considered according to each individual company’s characteristics since their innovation activities are different—this results from the difference in the companies’ employment size and characteristics.

On the other hand, in Gwangju and Daejeon, small and medium-sized firms are common, and the level of cooperation and interactions among them is higher than in Busan. Research institutes play a more crucial role for innovation in Daejeon than in Gwangju. The proportion of new products in the total sales is comparatively high, and a number of firms experience innovation in Daejeon. It can be assumed that this is why the cooperation and knowledge spillover between research bodies such as universities and research institutes, and local businesses play a decisive role in the regional innovation system.

In summary, the strategic industry cluster of the three metropolitan cities has the following in common: First, the premier industry was selected that is the largest in scale and most competitive out of the four strategic industries chosen by region; second, most of the firms are located in the industrial complex or business-agglomerated location; third, the proportion of product innovation is higher than that of process innovation; fourth, the source of innovation in the process of the corporate innovation is the experiences achieved from the joint projects or researches, and informal contacts hardly constitute the innovation source; and lastly, customers as innovation partner play a decisive role in creating innovation for each strategic industry.

On the other hand, the mechanical parts and materials industral cluster of Busan is different from the Daejeon ICT and Gwangju photonics industrial cluster. Firstly, while the businesses of Busan were founded before the financial crisis in 1997, those of Daejeon and Gwangju were set up after the crisis. Secondly, while the proportion of innovation experience of the businesses in Busan was 40 %, that of those in Daejeon and Gwangju was high, or 90 %. Thirdly, for the Busan businesses, open sources such as patent information, technology information, paper and Internet was not important as innovation source; however, it was the second most important factor for the Daejeon and Gwangju businesses. Fourth, for the Busan enterprises, suppliers were the second most important innovation partner while for those in Daejeon and Gwangju, it is the research institutes that are the second most important innovation partner.

Fifth, while cooperation has significant influence on innovation for the Busan businesses, it hardly affects innovation for the companies in Gwangju and Daejeon. Sixth, for the Busan firms, most of the R&D collaboration is carried out within the region no matter who the partner is. For the Gwangju and Daejeon enterprises, R&D collaboration with universities and research institutes is carried out within the region, with customers is conducted in the SMA. This means that the major customers of the Gwangju and Daejeon industries can be found in the SMA; therefore, it is hard to say the clusters have achieved the critical mass. Seventh, while the Busan companies exchange the tacit knowledge with the customers in the process of innovation, those in Gwangju and Daejeon do it in the course of the joint research with universities and research institutes.

Based on these results, it can be said that, the Busan mechanical parts and materials industrial cluster has achieved the critical mass, but that it lacks the leading enterprise which can play a key role for the regional economy, with the venture companies being sluggish in the region. Since the interactions and collaboration are weak among firms, it is proper to say that it is at the early stage of the cluster development at which the base for innovation is provided.

As for Gwangju photonics industrial cluster, the customers exist in the SMA, and the level of critical mass is not satisfactory. Therefore, despite diverse promising bases for innovation, it remains at the early stage of the cluster formation. In terms of the R&D cooperation network, while the research and innovation activities among universities and research institutes occur within Gwangju, it depends on the SMA for the research and innovation activities with the customers.

Compared to the above regions, in Daejeon ICT industrial cluster, there exist abundant resources for innovation such as research institutes, venture companies, universities and supporting institutions. However, since Daejeon does not reach the critical mass which can realize self-reliance, the role of leading enterprises which can provide the backward and forward linkages to local firms, would be critical for future strategies. Concerning practical strategies, Daejeon need to utilize the R&D special zone project.

4.2 Policy Conclusions

The efficiency of the innovation system is the key determinant of national and regional competitiveness in the Knowledge-based Economy. Innovation and knowledge generation take place as result of a variety of activities and networks such as user-producer relationships, academy-industry links and spin-offs.

In particular, cooperation is an essential part of the innovation process for most of the innovative firms. Due to the fact that innovation is by far more than a stand-alone activity, policies should be directed toward the systemic aspect of innovation rather than be targeted toward isolated actors. The analysis shows that the presence and quality of the public research infrastructure (universities and public research institutes) and its links to industry are one of the most important assets for supporting innovation.

What can be drawn as policy conclusions from this analysis? It is clear that the basic considerations are also valid for innovation systems in other metropolitan regions. But due to the fact that the structures of innovation-related interactions and institutional environments are different by region and industry, the actual measures should be specific in each region and industry. For the three metropolitan strategic industries, the following measures seem to be necessary to improve the innovative performance of firms.

Firstly, it is necessary to induce clients and key firms into the region and strengthen the network with clients. As for Gwangju and Daejeon, it is necessary to induce customers in the SMA and overseas customers into the region, and expand the size of the cluster, in order to obtain the scale as well. As for Busan, it seems that the critical mass has been already achieved; therefore, the required strategies are to induce public research institutes that are mechanical parts and materials industry-related, and strengthen the network with them.

Secondly, policies concerned with innovation should consider the cooperative aspects of innovation in the Busan mechanical parts and materials industry. For this, it is necessary to add new functions to existing institutions or establish new agencies. It is also required that research institutes and supporting institutions assist the cooperation among small and medium-sized enterprises rather than that among large companies. In order to promote innovation, they need to lead local firms rather than follow them.

Another possible route to encourage academy-industry links is to further develop technopark which is designed to accommodate and support the technology-based firms. Technopark creates the channel by which academic science may be linked to commerce. The technopark model is just one approach to bridging the gap between academic research and commercialization. One of the basic objectives of technopark is to promote cooperation among businesses, and between businesses and universities or research institutes.

Another purpose is to facilitate technology transfer and cooperation for innovation among enterprises. In order to reduce uncertainty and encourage a sense of synergy among enterprises, universities and research institutes, technoparks needs to provide information and organize R&D cooperation as well as formal meeting such as conventions, seminars and conferences.

The third policy conclusions refer to the new roles of innovation supporting institutions such as broker institutions, universities and research institutes. Universities and industrial firms exist for different purposes, and many barriers impede research cooperation among researchers. If there are problem in bridging them, agents are required to mediate between knowledge producers and users. In this respect, public and semi-public technological service institutions are important such as technological innovation centers, regional research centers and technoparks. With the intermediary organizations, communication and cooperation can be further facilitated.

Government-sponsored research institutes and universities are the main performers of generic research and produce a body of basic knowledge for the use and further development by industry. They have many brilliant people making new discoveries but they lack the means or the will to reach out to the market. From the enterprise point of view, firms agree that they could benefit from universities or research institutes. Nevertheless, they may get weary of the cooperation with universities or research institutes, and lack the information concerning the services to be offered. It may be, therefore, necessary for academic institutions to take the lead in establishing linkages through the provision for local businesses of information on the types of linkages available.

Notes

- 1.

KRW for USD exchange rate in March 2013 (approx. ₩ 1,000: $0.88).

References

Asheim, B., & Cooke, P. (1999). Local learning and interactive innovation networks in a global economy. Making connections: Technological learning and regional economic change. Aldershot: Ashgate.

Breschi, S., & Malerba, F. (2001). The geography of innovation and economic clustering: Some introductory notes. Industrial Corporate Change, 10(4), 817−833.

European Commission Dgs VIII and XVI. RITTS and RIS Guidebook (1996). Regional actions for innovation. Brussels: EC.

Guinet, J. (1999). Introduction. Boosting innovation: The cluster approach. Paris: OECD.

Holbrook, A., & Hughes, L. (2000). Operationalizing definitions of innovation at the level of the firm, ISRN Working Paper 2.

Holbrook, A., Padmore, T., & Hughes, L. (2000). Innovation in enterprises in a non-metropolitan area: Quantitative and qualitative perspectives. In H. A. Holbrook & D. A. Wolfe (Eds.), Innovation, institutions and territory. Montreal & Kingston: School of Policy Studies.

Kaufman, A., & Tödtling, F. (2000). Systems of innovation in traditional industrial regions. Regional Studies, 34(1), 29−40.

Kim, D. J., & Kwon, Y. S., et al. (2001). Industrial agglomerations and regional clusters in Korea. Korea Research Institute for Human Settlements.

Kim, W. B., et al. (2006). Sustainable development on the urban fringe: Korean case study, East Asia and the pacific region. Anyang: Korea Research Institute for Human Settlements.

Kwon, Y. S., et al. (2005). A study on the innovation cluster strategy for regional specialization. Anyang: Korea Research Institute for Human Settlements.

Lundvall, B.-Å. (ed.) (1992). National Innovation Systems: Towards a Theory of Innovation and Interactive Learning. London: Pinter

Nelson, R. (ed.) (1993). National innovation systems. Oxford: Oxford University Press.

OECD (1992). Technology and the economy: The key relationships. Paris: OECD.

OECD (1997). Proposed guidelines for collecting and interpreting technological innovation data: The oslo manual (2nd ed.). Paris: OECD.

OECD (1999). Managing national innovation systems. Paris: OECD.

Roelandt, T. J. A., & den Hertog, P. (1999). Cluster analysis and cluster-based policy making in OECD countries: An introduction to the theme. Boosting innovation: The cluster approach. Paris: OECD.

Rouvinen, P., & Ylae-Anttila, P. (1997). A few notes on finnish cluster studies. Competitive advantage of Finland.

Schibany, A., & Schartinger, D. (2001). Interactions between universities and enterprises in Austria. Innovative networks. Paris: OECD.

Simmie, J. (ed.) (2001). Innovative cities. London: Spon Press.

Swann, G. M. P., Prevezer, M., & Stout, D. (eds) (1998). The dynamics of industrial clustering: Oxford university press.

Westhead, P., & Batstone, S. (1998). Independent technology-based firms. Urban Studies, 35(12), 2197−2219.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag London

About this chapter

Cite this chapter

Kwon, Y.S. (2014). Innovation and Networks in Industrial Clusters: Empirical Results from Three Large Cities. In: Oh, DS., Phillips, F. (eds) Technopolis. Springer, London. https://doi.org/10.1007/978-1-4471-5508-9_14

Download citation

DOI: https://doi.org/10.1007/978-1-4471-5508-9_14

Published:

Publisher Name: Springer, London

Print ISBN: 978-1-4471-5507-2

Online ISBN: 978-1-4471-5508-9

eBook Packages: EngineeringEngineering (R0)