Abstract

The purpose of this chapter is to provide an overview of supply chain complexity and suggests appropriate supply chain strategies based on material flow and contractual relationships, to align product and process complexities. The material flow strategies considered for product and process alignment are lean, agile, leagile and risk hedging. The strategies considered for the contractual relationship are types of relationship, integration and preferred channel of operation. We substantiate the link between strategies and types of complexities using a case study. The discussion of this chapter is useful to supply chain managers for leveraging product and process complexities into competitive advantage.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Complexity science is the study of the phenomena that emerge from a collection of interacting objects. To a certain extent, complexity could be defined as the situation in which a collection of objects are competing for some kind of limited resource. In some instances, it is difficult to exactly define complexity, in such scenarios it could be viewed in terms of its characteristics, such as when a system contains a collection of many interacting objects or “agents”, the behaviour of these objects is affected by memory or “feedback”. The objects can then adapt their strategies according to their history: whether the system is typically “open”, appears to be “alive”, or exhibits emergent phenomena which are generally surprising (and may be extreme). Emergent phenomena typically arise in the absence of any sort of “invisible hand” or central controller (Johnson 2007).

The objective of this chapter is to provide an overview about complexities and explain complexity types and measures. The focus is to understand product and process complexities in supply chain. The major contribution of this chapter is to propose an alignment model to mitigate complexities using material flow and contractual relationship strategies.

The rest of the chapter is organised as follows: Section 2 defines complexity and space of complexity. Section 3 discusses product and process complexities. Measurement of complexity at different level is discussed in Sect. 4. Different types of supply chain strategies for product flow and contractual relationship are discussed in Sect. 5. Complexity strategy alignment model is proposed in Sect. 6. Illustration of the model is done through a case study in Sect. 7. Outcome of the findings are discussed based on the two aspects viz. complexities and strategies in Sect. 8. Managerial insights of the study are outlined in Sect. 9. Finally, Sect. 10 summarises the chapter and outlines the potential scope of future work.

2 Definition of Complexity and Space of Complexity

There is no agreed definition of complexity. However, researchers have attempted to explain complexity in various different ways based on numbers of structural components, its differentiation, degree of heterogeneity (relational), level of analytical sophistication (cognitive) and multiple part interactions (linear and non-linear) (Blau and Schoenher 1971; Price 1972; Price and Mueller 1986; Wang and Tunzelmann 2000; Choi and Krause 2006; Chapman 2009). For the purpose of this chapter we adopt the definition of complexity suggested by Johnson’s (2007)

Complexity is a study of the phenomenon which emerge from a collection of interacting objects competing for limited resource.

The space of complexity is that state which the system occupies and which lies between order and chaos. It is a state which embraces paradox; a state where both order and chaos exist simultaneously. It is also the state in which maximum creativity and possibility exist for realisation and exploration. In consideration of the space of complexity, chaos is defined as the deterministic behaviour of a dynamic system in which no system state is ever repeated (Chapman 2009; Wilding 1998).

One way to understand the different states of a given situation, from ‘order’ to ‘chaotic’, is through understanding various linkages between available resources ( ) and competing objects (

) and competing objects ( ) as shown in Table 1.

) as shown in Table 1.

3 Complexity Types

Supply chain complexities can be classified with respect to product and process. These are discussed below:

3.1 Product Complexity

Product complexity refers to number of components, materials, process stages, technologies, performance criteria, technological difficulty in design, manufacture and assembly of a product. Heavy electrical equipment, nuclear power plants, military systems and flight simulators are considered as complex products (Walker et al. 1988; Hobday 1998; Wang and Tunzelmann 2000). We make an attempt, through a literature review, to classify the factors based on the tangible and intangible nature of both product and process. We classify tangible product complexities into the categories of numerousness and differentiations, as well as number of interacting pairs and level of inter-relationship (see Table 2). Intangible product complexities are classified based on the appearance style and comfort, safety and ease of handling (see Table 3).

3.2 Process Complexity

Process complexity refers to the supply base, which is made up of a number of suppliers, methods of supply, methods of cost calculation, difference in capabilities, several operational practices and different modes of connectivity. We classify tangible process complexities into the categories of numerousness and differentiations, as well as number of interacting pairs and level of inter-relationship, as shown in Table 4. (Choi and Krause 2006; Kaluza et al. 2006). Based on the sourcing characteristics suggested by Fredriksson and Jonsson (2009), intangible process complexities have been categorised as human capital, culture, infrastructure and policies and regulations. The intangible factors are shown in Table 5.

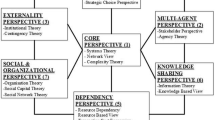

Supply chain complexity is driven by internal drivers, such as managerial decisions and external drivers, such as uncertainty and dynamics in the marketplace (Kaluza et al. 2006). It has been suggested that the competitive advantage of firms operating in global networks will increasingly be derived from their ability to manage the complex web of relationships and flows that characterise their supply chains (Christopher 2005). Aligning proper material flow and contractual relationship strategy with respect to complexity, as shown in Fig. 1, is a challenging managerial decision to be taken by top level organisations.

The aggregate representation of factors would constitute the complexity of product and process. Since the factors discussed earlier in this section include both qualitative and quantitative elements and it requires a framework to measure overall level of product and process complexities. Few attempts made by researchers to measure different types of complexity are discussed in the next section.

4 Complexity Measures

4.1 Firm-Level Complexity Measure

Mariotti (2008) proposed measure referred as complexity factor (CF) for individual firms based on products, markets, facilities, employees and customers. This measure is somewhat collectively represents the complexity of the organisation rather than isolated measures such as calculating sales and margin per stock keeping unit, sales per customer or market, sales per employee available to measure them separately. The proposed measure is a self-benchmarking measure available to relate complexity with the organisational profitability. Mariotti’s (2008) measure to firm CF is given below.

Mariotti (2008) categorised CF into three levels based on CF value. : If the CF value is less than 1, then firms are considered to be profitable; if it is more than 50, the firms are highly complex; and, if it is between 1 and 50, then a deeper understanding of the causes of complexity is required.

4.2 Product Complexity Measure

Few attempts were made by researchers to measure product complexity. Zhuo and Qunhui (2007) proposed an indicator-based system using the grey technique to measure product complexity. The suggested indicators include the influence of technology (number and maturity of technology), physical characteristics (number of components, volume and density), organisation (people, departments, information transfer and resources allocation) and environment (number of suppliers and customers, regulations and standards and market competition). Motorola views product complexity purely based on products’ physical characteristics, organisational aspects. Motorola’s complexity index (CI) consists of variables such as average part per time, test time, assembly time, mechanical postponement, software postponement, use of industry standard parts and component reuse. For Motorola CI served as a gatekeeper tool for screening new product designs to prevent unnecessary and costly complexity.

4.3 Process Complexity Measure

This section describes attempts to measure and manage logistics and supply chain complexity.

4.3.1 Logistics Complexity

Specific measures of logistics complexity are not provided in the literature. Logistics complexity is expressed qualitatively using exploratory studies (e.g., Nilsson 2006) or case studies (Rao and Young 1994). Using case studies from the fashion retail industry, Masson et al. (2007) explained logistics complexity in terms of demand and supplier network complexity. He took into consideration quantity, intermediaries and geographical dispersion as constituents of supplier network complexity.

4.3.2 Supply Chain Complexity Measure

Milgate (2001) measured supply chain complexity using proxies such as the number of raw material parts, breadth of supplier base and percent of sales from exported product available in manufacturing database. However, data are firm specific and thus it is difficult to generalise. Recently, Isik (2010) attempted to measure supply chain complexity associated with uncertainty and variety. He used entropy-based statistical measures for the supply chain, which had been previously used for manufacturing. Isik (2010) argued that complexity is not only the function of the probabilities of different states, but also that each state has different complexities on its own. He defined expected value for each state and measured the deviation. His work updates that the earlier work of Frizelle and Woodcock (1995), Reiss (1993) opined that primarily there are four determinants those drive complexity. These are size, diversity, variety and uncertainty.

Quantification and suitability of factors for measuring supply chain complexity depend on the applicable sectors and there is no unique way to represent it. Appropriate factors could be chosen for a particular sector from the factor-list provided in Tables 2, 3, 4 and 5. If a standard measure is available to capture the product and process complexities, then it would be appropriate for supply chain managers to choose the right strategies to mitigate the supply chain complexity. Supply chain strategies that would be most helpful to overcome product and process complexities are discussed in the next section.

5 Supply Chain Strategies

The fundamental objective of a typical supply chain strategy is to ensure smooth flow at minimum cost (Christopher et al. 2006). However, it is not easy to identify an appropriate strategy, based on product and process complexities. Christopher et al. (2006) argued that sourcing strategy, operations strategy and route to market need to be appropriate to specific product market conditions. Chopra and Meindl (2007) stated that supply chain strategies determine the nature of material procurement, transportation of materials, manufacture of product or creation of service and distribution of product. Fisher (1997) explained the need of different supply chain strategies for functional and innovative products with examples from a diverse range of consumer products including food, fashion apparel and automobiles. The taxonomy, suggested by Christopher et al. (2006), for selecting an appropriate supply chain strategy for material flow, is based on product uncertainty and lead time. The success of Japanese firms in the early 19980s and 1990s prompted practitioners and academics to examine their firm–supplier relationships. Firms started concentrating on methods to develop long term, close knit and cooperative relationships with suppliers (Liker and Choi 2004; Jean et al. 2010). The next section describes a few supply chain strategies based on material/service flow and contractual relationships between supplier and manufacturer.

5.1 Material Flow Strategies in Supply Chain

Material flow in a supply chain depends on the product nature (based on demand) and process (based on supply). There are four material/service flow strategies in supply chains: agility, lean thinking, leagile and risk hedging. These strategies are considered as generic strategies based on supply and demand characteristics (Christopher et al. 2006). Each is outlined briefly below and summarised in Table 6.

5.1.1 Agility

Agility is primarily concerned with responsiveness—the ability to match supply and demand in turbulent and unpredictable markets. The key characteristic of agility is flexibility. Lockstrom (2007) predicted that many smaller, more agile firms would gain market share at the expense of the industry titans that find it more difficult to change with product and process requirements. Agility is a strategy most suitable for highly innovative products, with more uncertain demand and supply as it is a strategy which adapts inventory pooling, or dual sourcing, to absorb uncertainty. A good example of agility is the case of Zara, the Spanish fashion garment manufacturer and retailer (Christopher 2006).

5.1.2 Lean

The idea of lean thinking was developed by Womack and Jones (1996), among others. The focus of lean thinking has been on the elimination of waste. Christopher (2000) has suggested that the lean concept works well when demand is relatively stable, predictable and variety is very low. This minimises the cost of making and delivering the product to the customer. This strategy is most applicable to functional products with a lower uncertainty of demand and supply. A lean strategy is followed by Procter and Gamble to manage its supply chain for volume products to Wal-Mart in the USA.

5.1.3 Leagile

Leagile is a hybrid strategy that combines lean and agile principles. Lean principles are used for predicable, standard products and agile principles for unpredictable or special products. Leagile principles are used for unpredictable demand and long lead times. Leagile is used as a classic postponement strategy by Hewlett Packard for its range of desktop printers (Christopher et al. 2006).

5.1.4 Risk Hedging

Risk hedging is applicable for less demand uncertain product (functional) and high supply uncertain supply processes (evolving processes). An example given by Christopher et al. (2006) is a million plastic Christmas trees ordered each year by the UK retailer Woolworths from its numerous suppliers in China. Risk hedging is a trade-off strategy meant to gain without predominant loss and it is almost similar to lean strategy with more emphasis given towards supply uncertainty.

5.2 Contractual Relationship Strategies

To understand contractual relationship strategies one needs to be cognisant with the components: what are the relationships involved, what is supply chain integration and how do these impact type of channel preferences.

5.2.1 Relationship

A supplier’s relationship varies from a transactional to a strategic one. Nordin (2008) suggested this, based on transaction cost theory claiming that a translational relationship is applicable for products with low uncertainty and large volume, and an integration or partnership type supplier relationship is when the uncertainty is higher and volumes lower. Rycroft and Kash (1999) postulated that complex technologies are innovated by equally complex innovation networks (strategic alliances, research consortia) involving firms, universities, government agencies and other organisations. Recently, Jean et al. (2010) hypothesised that there is a positive relationship between technological uncertainty and a transactional relationship. The summary of type of relationship and their applicability is shown in Table 7.

5.2.2 Supplier Integration

Supplier integration embodies various communication channels and linkages within a supply network. Integration refers to both internal (within firm) and external (outside firm) integration and this chapter refers to external integration. Supplier integration deals with the factors such as technology and knowledge integration, information sharing, trust and joint sense making (Myers and Cheung, 2008) with their first and second tier suppliers. Table 8 summaries the use of different modes of integrating a supplier and its applicability, as suggested by Myers and Cheung (2008), Selnes and Sallis (2003) and Frazier et al. (2009).

5.2.3 Type of Channel Preferred

Decision on type of channel preferred depends on the mode of purchase, which can be direct purchasing from low cost country (LCC) supplier (DPS), purchasing from LCC supplier through foreign subsidiary (PFS), purchasing from LCC through a supplier’s subsidiary in home country (SSH), purchasing through a third-party intermediary (P3P) or purchasing through International Procurement Office (IPO). According to Hall (1976), people in a high-context culture, such as Japan or China, rely on the communication context more than those in a low-context culture, such as the United States or Germany. People from high-context cultures mainly try to obtain information from their personal information network. In contrast, people from low-context cultures seek information from a research base or use information sources such as reports, databases and the Internet. A high-context culture that emphasises human elements and personal relationships in communication will have better trust-building processes (Rosenbloom and Larsen 2003). Summary of different types of channel preferred and its applicability is shown in Table 9.

This section discussed the major constituents of material flow and contractual relationship strategies. The major aim of next chapter is to explore the possible alignment between supply strategies and product and process complexities.

6 Complexity Strategy Alignment

This section discusses, through literature, the nature of alignment required to minimise complexity in the supply chain. High value-added competition is based on the innovation of technologies that are knowledge intensive (supported by large investment in R and D) and complex. Examples include automobiles, aircraft and telecommunication equipment. These are the technologies that underpin the major knowledge-based economies, and provide the most prized competitive advantages and support a host of non-economic capabilities as well such as health care, national security and environmental protection (Rycroft 2007). In the literature, we found some evidence that increased relationship integration enables firms to examine, and re-examine, their own product strategies, creating more opportunities to develop new products (Chen et al. 2008). With greater technological uncertainty in the global supply chain, suppliers need more critical information from their customers (OEMs) to keep ahead of the competition. Moreover, demand–driven supply networks have forced dominant customers to outsource part of their high-level value-adding activities, including new product development, to small suppliers. In a more unpredictable technological environment, customers are willing to share knowledge with their small suppliers, to maintain their product quality and develop better new product strategies. Branded OEMs such as Apple and IBM collaborate with many original development manufacturers to develop next-generation products, mobile phones and laptops for example. These companies share much critical information about end-user preferences and market trends with their innovative original development manufacturers (Jean et al. 2010). Other examples include Boeing, which has outsourced the design of wing parts to Russia and Texas Instruments and Intel which have each outsourced the development of devices to Indian firms (Engardio et al. 2003). Nordin (2008) stated that cost could be reduced if suppliers were kept at arms length in transactional relationships and contracts awarded through competitive bidding. He also suggested transactional purchasing for simpler services bought in bulk as they have low asset specificity and uncertainty and do not directly impact on core business processes.

To explain our proposed alignments we use by way of example two products with varied product and process complexities, an aircraft and a car instrument panel. This is summarised in Fig. 2.

Aircraft could be placed under the product category of medium to high product complexity spectrum and have various sub-systems which have varied categories of process complexity, such as the engine sub-system for low to medium process complexity and fastening sub-systems (such as inserts and locknuts) could be treated as belonging to the high process product complexity category. It is assumed that an engine sub-system would sit in the low to medium process complexity category as an aircraft manufacturer (e.g. Boeing, airbus) is most likely to have only limited suppliers (e.g. Rolls Royce, Honeywell), so the number of managed interfaces would be minimal and of limited variety as there is not much difference in technical capability among suppliers and limited modes of connectivity. However, in the case of fastening sub-systems the aircraft manufacturer could procure from different suppliers (e.g. Aircraft Fasteners Ltd) with different capabilities and product systems, hence this component is assumed to be in the medium to high process complexity category.

If product complexity is from medium to high then, based on process complexity, it can be aligned using a leagile supply chain strategy (Fig. 3). If process complexity is from low to medium it can be aligned with an agile strategy. In the aircraft example, agile strategy for the engine sub-assembly is used to align low to medium process complexity. The aircraft manufacturer would be dealing with one or two suppliers and, in turn, suppliers should be responsive enough to take care of changes in demand, variety, lead time and innovation. With respect to integration, they should have full integration with suppliers (Fig. 4). This would include processes such as regular monitoring and face-to-face communication. A strategic peer-to-peer relationship is necessary for them to succeed (Fig. 5), as well as having an IPO at the supplier’s location (Fig. 6). Jean et al. (2010) emphasised that in a high-context culture, firms rely more on person-to-person relationships to communicate with supply partners. They have indicated that, to augment integration, close relational bonding and ties can facilitate information sharing, and thus aid the development of innovative behaviours. Nordin (2008) emphasises the importance of close collaboration and a strategic relationship when there is greater complexity, and lower standardisation, of the products and services offered.

If the process complexity is from medium to high, then a leagile strategy would be used to align with the medium to high product complexities. In the case of fastener sub-assembly there could be many suppliers with many variations. To avoid disruptions, the manufacturer has to pool inventory to meet the uncertainties. In terms of alliance, a partial integration would be appropriate as would a consultant client relationship. When it comes to preferred channel, the most appropriate would be to purchase from LCC through a SSH or purchase through a P3P. Similarly, the sourcing of car instrument panel can be explained using Figs. 3, 4, 5 and 6.

In this section, we explained the possible strategy and complexity alignment through examples. In the following section, we examine a case study to explain proposed models.

7 Case Study

In order to confirm the above alignment and arguments, a pilot study was carried out using a company that exports automotive and engineering components to leading OEM manufacturers based in the US, Europe and Asia. Contrary to Eisenhardt’s (1998) recommendation of four to ten as the number of cases that a researcher should select, other scholars showed that a smaller number of cases provide greater opportunities for depth of observations (Narasimhan and Jayaram 1998; Dyer and Wilkins 1991; Voss et al. 2002). In fact, Dyer and Wilkins (1991) argued that single case studies enable the capturing of much greater detail of the context within which the phenomena under study occur. Hence, we used a single company to capture the details in detail. The company produces fasteners, radiator caps, powder metal parts, cold extruded parts, hot forged parts, pumps and assemblies. Their Chinese facility is located in Zhejiang province and can produce thousands of varieties of fasteners, including standard and customised ones. Their present capacity is 6,000 metric tonnes of standard and specialised fasteners. If demand is higher, they can outsource from their other plants located in India, Germany, the UK and Malaysia. This product is valuable for our study because it has both product and process complexities. Product and process complexities could be analysed as per the tangible and intangible factors listed in Tables 2, 4 and 5. The data and information were gathered through interviews and observations of the research team members during field visits to the company. Data and information were collected at the company site using a semi-structured interview questionnaire during August–September, 2011. The interview questionnaire had five sections that included respondent and organisational characteristics, product complexity factors (both tangible and intangible factors), process complexity factors (both tangible and intangible factors), material flow strategies and contractual relationship strategies. For tangible factors objective data were collected and for intangible factors, a 5-point Likert scale was used. Respondent and organisational characteristics are shown in Table 10.

The details of complexities and strategies are discussed in the following section.

7.1 Product Complexity

The case company produces different products such as fasteners, radiator caps, powder metal parts, cold extruded parts, hot forged parts, pumps and assemblies. Based on the list of factors and elements given in Tables 2 and 3, the responses with respect to product complexity are shown in Table 11. Since the factors listed in Tables 2 and 3 are general and applicable to all industry. The company representative felt that they have complexity elements related to numerousness and differentiation factors in tangible complexity and safety factor with respect to intangible product complexity factors. In numerousness factors, it is clear that the company has to deal with number of raw materials and performance criteria. They have high technological difficulty in design and manufacture.

7.2 Process Complexity

The case company representative felt substantial level of complexity with their supplier base. The response to individual complexity element with respect to our tangible process complexity factor classification such as numerousness, differentiations and number of interrelationship is given in Table 12. Their major concerns in terms of numerousness are related with number of suppliers, lead time variations and variety of products. On differentiation aspects, variety of production method adopted by their suppliers and difference in their technical capability matters most. Since the case company is operating in a high cultural context country they prefer to have different mode of connectivity with their suppliers. It is also interesting to note that case company suppliers have inter-relationship which adds complexity to the supply base.

Case company visualised adequate level of intangible process complexity with respect to all aspects of complexity classification factors given in Table 5. The case company’s response for applicable individual complexity element is shown in Table 13. The case company is concern about policies and regulations, cultural and human capital aspects.

7.3 Supply Chain Strategies

The case company follows lean supply chain strategy for material flow. In terms of contractual relationship, they adapt peer-to-peer type of relationship even though their products are functional. They prefer to use two types of channels such as direct purchasing from low cost country (DPS) and purchasing from low cost country through foreign subsidiary (PFS). They share knowledge and information with trustworthy suppliers through quite frequent personal meetings. The major characteristics of material flow and contractual relationship strategy is shown in Table 14.

8 Case Company Complexity Strategy Alignment

Interpretation of pilot study based on complexity strategy alignment can be made in two ways. Using proposed alignment shown in Figs. 3, 4, 5 and 6 and the material flow and contractual relationship strategy, it is easy to identify the product and process complexity of the case company. Since we do not have standard framework to capture the composite measures of product and process complexities, our interpretation is based on Figs. 3, 4, 5 and 6 and the case company’s strategies. Later, we cross examine our interpretation made earlier through Figs. 3, 4, 5 and 6 and strategies approximately with the responses obtained for various product and process complexities.

8.1 Interpretations Based on Case Company’s Strategies and Proposed Alignment

The supply chain strategies adopted in the case company are “lean strategy” for material flow, “peer-to-peer” relationship for relationship, “partial integration” for type of integration and “DPS and PFS” for the type of sourcing channel. Using their material flow and contractual relationship strategies and the proposed complexity strategy alignment discussed in Sect. 5, Figs. 7, 8, 9 and 10 represent the case company’s complexities strategy alignment.

Restructuring of Case Company’s Complexity Strategy Alignment

Based on our proposed alignment discussed in Sect. 5, if the case company is using lean material strategy, then they should have a “consultant-client” type of relationship and procure through “P3P” channel instead of “DPS and PFS” channel. It is evident that they are currently practicing lean strategy, which is applicable for low process and low product complexity product. Based on their responses, we found that they have low product complexity and a somewhat higher process complexity. We would suggest that, if the firm is interested in continuing this strategy, they have to reduce their process complexity. Specifically, they need to reduce their tangible and intangible process complexities which are discussed in the managerial implication section.

8.2 Cross Examination of the Case Company’s Complexity Strategy Alignment

Product and process complexities based on the response from case company are shown in Tables 10, 11 and 12. It is obvious that company’s product complexity is approximately low to medium, because their tangible factors are low and intangible factor is quite high. Similarly, the company’s process complexity varies from medium to high because tangible and intangible factors are from medium to high. Using the proposed alignment discussed in Sect. 5 and their known complexity level, it is satisfactory if they adapt the following material flow and contractual relationship strategies.

Material flow strategy | : | Risk hedging material flow strategy |

Type of relationship | : | Master–Slave type of relationship (Translational) |

Type of integration | : | No integration is required |

Type of channel preferred | : | DPS and PFS are preferred |

From the above cross examination, it is obvious that there is a perfect match between the types of channel they are sourcing and there are slight deviation in material flow strategy, type of relationship and type of integration. They follow lean material strategy even though they have high process complexity. It is interesting to note the deviation, because they have standard rationalised supplier base. They have partial integration to be proactive and mitigate if there is a surge in complexity level. With respect to the type of channel they are sourcing they are very well aware about high process complexity and doing it rightly.

9 Managerial Implications

In the previous section, we examined the proposed strategy complexity alignment on two aspects i.e. For a known strategy what should be the product and process complexity of the case company, whereas on the other side we examined the suitability of chosen strategy of the company based on their response to the complexity factors. From the pilot study it is obvious that companies have to focus more on reducing tangible and intangible process complexity factors rather than product complexity factors. In this section, we discuss below the general suggestions how a firm can reduce process complexity factors with the example of case company.

Suggestions to reduce tangible process complexities in terms of numerousness, differentiation, and number of interacting pairs are given below.

Numerousness

-

Companies can reduce the number of suppliers and lead time variations through proper supply base rationalisation. They could also consider real landed cost factors such as cost of delay, inventory cost, reliability cost and procurement and operations cost.

-

Companies should think about reducing their varieties of products if they are interested in practicing lean strategy.

Differentiation

-

Companies should come up with policies to increase the technical capability among suppliers.

-

Firms should insist that suppliers to adopt quality policy and to have a suitable inventory control policy along the lines of their buyers.

-

Companies must consider logistics constraints during the planning phase.

Number of Interacting Pair and Level of Inter Relationship

-

Optimal number of connectivity would be appropriate for the companies and reduce different modes and numbers of connectivity, even though it is a high context cultural country. A company with low product complexity and high process complexity should maintain a consultant-client type of relationship.

-

Companies should formalise their interactions with their suppliers. Most of the companies want to be proactive and trying to aim for higher level of integration. Aiming for higher level of integration is advisable at the same time they need to leverage their strategies adopted for material flow and contractual relationship.

Suggestions to reduce intangible process complexity factors in terms of human, culture, infrastructure and policies and regulation are discussed below.

Human

-

In order to improve supplier skills and knowledge, companies should organise training and evaluation sessions before engaging in long-term collaborative contractual relationships.

-

The suppliers’ should regularly update about developments elsewhere, to improve the cognition of best practices.

Culture

-

Before sharing critical information, companies should establish a formal relationship, which may include heavy penalties for deviation.

-

Even though the companies adopt collaborative relationship, they must understand trust building for high context culture country.

Infrastructure

-

Focal companies must educate their suppliers about the value of supply chain efficiency and its advantages.

-

Focal companies should be aware of hidden costs in warehousing and transportation that could be eradicated if there was a proper network arrangement.

Policies and Regulations

-

Focal companies and their suppliers should agree to share profit/loss if there is deviation due to currency risk.

-

To protect intellectual property risk, firms should only engage with trustworthy suppliers with agreed penalties if something goes wrong.

10 Concluding Remarks and Future Work

This chapter analyses the complexity issues and appropriate strategies for the supply chain. The research classifies product and process complexities. A major outcome of this work is the examination of the complexities from a joint supplier and firm perspective where both product and supply process complexities have been considered. The study takes into account tangible and intangible complexity factors. We suggested alignments for the product and process complexities with material flow and contractual relationship strategies. The strategy alignment has been illustrated with simple examples. The study validated the alignment using a pilot study company based in China. The major limitation of this study is the confinement of validation to one case, and there are also challenges in evolving a quantifiable composite measure for supply chain complexity. This will be addressed in further work, where detailed case study analyses for various sectors will be carried out. Standard techniques such as Analytic Hierarchy Process or multi-attribute utility theory will be used to capture the mix of tangible and intangible complexity factors in determining weightage and ranking. A common composite score that considers tangible and intangible factors could be evolved once the weightage is known. Further, a longer term objective of this research is to analyse the impact of complexities and strategies on supply chain resilience.

References

Blau, P. M., Schoenherr, R. A. (1971). The structure of organizations. Basic books, New York.

Chopra, S., and Meindl, P. (2007). Supply chain management: Strategy, planning and. operation. Prentice Hall, 3rd eds.

Chapman, G. (2009). Chaos and complexity, Elsevier Ltd.

Christopher, M. (2005). Logistics and supply chain management. London: Financial Times/Prentice-Hall.

Christopher, M., Peck, H., & Towill, D. (2006). A taxonomy for selecting global supply chain strategies. The international Journal of Logistics Management, 17(2), 277–287.

Christopher, M. (2000). The agile supply chain: Competing in volatile markets. Industrial Marketing Management, 29(1), 37–44.

Choi, T. Y., & Krause, D. R. (2006). The supply base and its complexity: Implications for transaction costs, risks, responsiveness, and innovation. Journal of Operations Management, 24, 637–652.

Dyer, W. G., & Wilkins, A. L. (1991). Better stories, not better constructs, to generate better theory: A rejoinder to eisenhardt. Academy of Management Review, 16(3), 613–619.

Engardio, P., Bernstein, A. Kripalani, M., Balfour, F., Grow, B. and Greene, J. (2003). The new global job shift. Business week online 50.

Frazier, G. L., Elliot, M., Kersi, D. A., & Rindfleisch, A. (2009). Distributor sharing of strategic information with suppliers. Journal of Marketing, 73(July), 31–43.

Fredriksson, A., & Jonsson, P. (2009). Assessing consequences of low-cost sourcing in china. International Journal of Physical Distribution and Logistics Management, 39(3), 227–249.

Frizelle, G., & Woodcock, E. (1995). Measuring complexity as an aid to developing operational strategy. International Journal of Operations and Production Management, 15(5), 26–39.

Hall, E. T. (1976). Beyond culture. Garden City: Anchor Press.

Hobday, M. G. (1998). Product complexity, innovation and industrial organisation. Research Policy, 26, 689–710.

Isik, F. (2010). An entropy-based approach for measuring complexity in supply chains. International Journal of Production Research, 48(12), 3681–3696.

Jean, R. B., Sinkovics, R. R., & Kim, D. (2010). Drivers and performance outcomes of relationship learning for suppliers in cross-border customer–supplier relationships: The role of communication culture. Journal of International Marketing, 18(1), 63–85.

Johnson, N. F. (2007). Two’s company, three is complexity. Oxford: Oneworld publications.

Kaluza, B., Bliem, H. and Winkler, H. (2006). Strategies and metrics for complexity management in supply chains, Complexity management in supply chains, edited by blecker/Kersten, Ercih Schmidt verlag GmbH@co, Berlin.

Liker, J. K. and Choi, T. Y. (2004). Building deep supplier relationship. Harvard business review, 104–113.

Lockstrom, M. (2007). Low-cost country sourcing: Trends and implication, wiesbaden: Deutscher universitst{uml}ats-Verlag: GWV fachverlage, springer.

Mariotti, J. L. (2008). The complexity crisis. Massachusetts: Platinum Press.

Masson, R., Iosif, L., MacKerron, G., & Fernie, J. (2007). Managing complexity in agile global fashion industry supply chains. International Journal of Logistics Management, 18(2), 238–254.

Milgate, M. (2001). Supply chain complexity and delivery performance: an international exploratory study. Supply Chain Management: An International Journal, 6(3), 106–118.

Myers, M. B., & Cheung, M.-S. (2008). Sharing global supply chain knowledge. MIT Sloan Management Review, 49(4), 67–73.

Nilsson, F. (2006). Logistics management in practice–towards theories of complex logistics. International Journal of Logistics Management, 17(1), 38–54.

Narasimhan, R., & Jayaram, J. (1998). Reengineering service operations: a longitudinal case study. Journal of Operations Management, 17(1), 7–22.

Nordin, F. (2008). Linkages between service sourcing decisions and competitive advantage: A review, propositions, and illustrating cases. International Journal of Production Economics, 114, 40–55.

Price, J. L. (1972). Complexity. In: Price, J. L. (Ed.), Handbook of organizational measurement (pp. 70–77). Lexington, MA:D.C. Health and Company

Price, J. L., Mueller, C.W. (1986). Complexity. In: Price, J. L., Mueller, C.W. (Ed.), Handbook of organizational measurement (pp. 100–105). Marshfield, MA:Pitman Publishing.

Rao, K., & Young, R. R. (1994). Global supply chains: factors influencing outsourcing of logistics functions. International Journal of Physical Distribution & Logistics Management, 24(6), 11–20.

Reiss, M. (1993). Komplexita¨tsmanagement (I), working paper. Stuttgart, 54–59.

Rosenbloom, B., & Larsen, T. (2003). Communication in international business-to-business marketing channels: does culture matter? Industrial Marketing Management, 32(4), 309–315.

Rycroft, R. W., & Kash, D. E. (1999). The complexity challenge: Technological innovation for the 21st century. London: Printer Publishers.

Rycroft, R. W. (2007). Does cooperation absorb complexity? Innovation networks and the speed and spread of complex technological innovation. Technological Forecasting and Social Change, 74, 565–578.

Selnes, F., & Sallis, J. (2003). Promoting relationship learning. Journal of Marketing, 67, 80–95.

Voss, C. A., Tsikriktsis, N., & Frohlich, M. (2002). Case research in operations management. International Journal of Operations and Production Management, 22(2), 195–219.

Wilding, R. (1998). The supply chain complexity triangle: Uncertainty generation in the supply chain. International Journal of Physical Distribution and Logistics Management, 28(8), 599–616.

Walker, W., Graham, M., & Harbor, B. (1988). From components to integrated systems: technological diversity and integration between the military and civilian sectors. In P. Gummett & J. Reppy (Eds.), The relations between defence and civil technologies (pp. 17–37). Academic publishing, London: Kluwer.

Wang, Q., & Tunzelmann, Nv. (2000). Complexity and the functions of the firm: breadth and depth. Research Policy, 29, 805–818.

Womack, J., & Jones, D. (1996). Lean thinking: Banish waste and create wealth in your corporation. NewYork: Simon and Schuster.

Zhuo, Z., & Qunhui, L. (2007). A grey measurement of product complexity. Systems, man and cybernetics, 2007. ISIC. IEEE International Conference on, 2176–2180.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag London

About this chapter

Cite this chapter

Subramanian, N., Rahman, S. (2014). Supply Chain Complexity and Strategy. In: Ramanathan, U., Ramanathan, R. (eds) Supply Chain Strategies, Issues and Models. Springer, London. https://doi.org/10.1007/978-1-4471-5352-8_1

Download citation

DOI: https://doi.org/10.1007/978-1-4471-5352-8_1

Published:

Publisher Name: Springer, London

Print ISBN: 978-1-4471-5351-1

Online ISBN: 978-1-4471-5352-8

eBook Packages: EngineeringEngineering (R0)