Abstract

Purpose The purpose of this chapter is to explore the effect of subsidiary autonomy on intra-MNC knowledge transfers during captive R&D offshoring to emerging markets. Design/methodology/approach: A framework to this end is outlined and illustrated in relation to four cases of captive R&D offshoring to emerging markets. Findings Subsidiary autonomy has a mainly negative effect on primary knowledge transfer and a mainly positive effect on reverse knowledge transfer. Newly established R&D subsidiaries in emerging markets need primary knowledge transfer in order to build up their competence before they can add to the knowledge level of the MNC. Gradual increase in R&D subsidiary autonomy is thereby beneficial for subsidiary innovation performance.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

As well as there is a need for further research concerning the whole process of outsourcing, rather than just the preparation and planning stages of the phenomenon (Hätönen and Eriksson 2009), the whole process of offshoring is worthy of further exploration. By means of longitudinal case studies, this chapter can be seen as a reply to the calls for further research concerning subsidiary evolution (Birkinshaw and Hood 1998) including the long-term indirect effects in relation to subsidiary evolution (Dellestrand 2010, p 78); however, in particular, the premises of this chapter is to better understand drivers of captive offshoring performance for R&D activities established in emerging markets with a particular focus on the role of subsidiary autonomy. Recently, a surge of foreign R&D investments have taken place in emerging markets such as China (Harryson and Søberg 2009) and India (Pillania 2005), and many companies are considering to make similar investments.

Different types of R&D offshoring are important to investigate. Although companies today are likely to offshore core activities, they are unlikely to outsource them (Dossani and Kenney 2007). There is some support to the thesis that offshores R&D outsourcing, as well as captive R&D offshoring is beneficial for innovation performance. However, we also find some support for the thesis that captive R&D offshoring is more beneficial for innovation performance than offshore R&D outsourcing (Nieto and Rodriguez 2011). Hence, it may be particularly interesting to look at captive R&D offshoring. These results are, however, still based on rather weak signals, and there is a clear need for further research. This need is particularly clear when we start to look at the drivers for innovation performance. Successful innovation is not secured simply by deciding to carry out captive R&D offshoring, but must be found in the process of establishing innovation capabilities in a global context. In particular offshoring of knowledge-intensive business activities, such as R&D, brings about the necessity to better understand the dynamics of knowledge transfer back and forth between R&D headquarters and R&D subsidiaries.

The level of national development influences the benefit of reverse knowledge flows from subsidiary to headquarter (Ambos et al. 2006). Although this notion may be reasonable, it seems clear that not only the county’s level of development is influencing the preconditions for knowledge transfer. For example, subsidiary autonomy is also likely to have important implications for intra-MNC knowledge flows such as primary—and reverse knowledge transfer. Few studies have investigated the implications of subsidiary autonomy on intra-MNC knowledge flows. This topic is important because the innovation performance of MNCs increasingly depends on offshored R&D subsidiaries, and thereby implicitly on efficient knowledge transfer between headquarters and offshored subsidiaries. This chapter therefore sets out to investigate the following research question: what is the role of R&D subsidiary autonomy in relation to intra-MNC R&D knowledge flows during captive offshoring ?

A knowledge transfer perspective is applied, since this is particularly relevant in order to understand the role of subsidiary autonomy, and how it relates to knowledge flows within MNCs. The outline of the chapter is to present a framework relevant to this end, followed by brief description of the methodology. The empirical part illustrates the theoretical framework, which is subsequently utilized in the analysis, before relevant conclusions are presented.

2 Theoretical Framework

2.1 Knowledge Transfer

Knowledge transfer can be defined as “a process in which an organization recreates and maintains a complex, causally ambiguous set of routines in a new setting” (Szulanski 2000, p 10). Argote et al. (2003) argue that knowledge transfer can be organized according to three properties of the knowledge management context: properties of units (e.g., an individual, a group or an organization), properties of the relationships between units and properties of the knowledge itself. Within each of these dimensions, the literature is ripe with discussions of key elements known to facilitate and/or disrupt the performance of the knowledge transfer processes (Grant and Gregory 1997; Easterby-Smith et al. 2008).

In this article, we extend this perspective by discussing knowledge transfer in the context of R&D networks and thus extend the focus from knowledge transfer as discrete occurrences to repeated cycles of knowledge flow. Knowledge flows to and from a subsidiary can be categorized as primary, secondary and reverse knowledge transfer. Primary knowledge transfer is the transfer of knowledge from headquarter to the subsidiary, secondary knowledge transfer is the transfer of knowledge between subsidiaries, and reverse knowledge transfer is the transfer of knowledge from subsidiary back to the headquarter (Buckley et al. 2003). In simple terms, primary knowledge transfer is related to replication, it is about exploiting existing knowledge and it is successful when broadly equivalent outcomes are realized by similar means (Baden-Fuller and Winter 2005). Secondary knowledge transfer takes place between the subsidiaries and between the subsidiary and its partners, for example, in relation to local sourcing or the sharing of best practices. This chapter, however, extends this by also including reverse knowledge transfer and continuously expanding the available knowledge base to the scope of a successful knowledge flow in the MNE. The reverse knowledge transfer process is the key to sustaining the position of the headquarter as the orchestrator of knowledge in the MNE.

Not all reverse knowledge transfer is beneficial. In particular with newly established R&D in emerging markets, this may often be the case. Benefit may be defined as the overall value of the knowledge transfer as perceived by headquarters (Ambos et al. 2006, p 297). This has a dimension of perception to it; that is, change requests are rarely received with great enthusiasm at headquarters as they often demand changes in documentation, procedures and routines and maybe more importantly because they may point to deficiencies originating at headquarters. Similarly, not all primary knowledge transfer is beneficial. Beneficial primary knowledge transfer thereby concerns the overall value of the knowledge transfer as it is perceived by the subsidiary; here, we often find factors such as the not-invented-here syndrome, lack of absorptive capacity leading to knowledge spill over or lack of appropriateness of knowledge due to particular contextual factors. Although it is relevant to distinguish between primary knowledge transfer and reverse knowledge transfer, it is also relevant to pay attention to the interrelationships between the two. For instance, the success of and characteristics of primary knowledge transfer is likely to determine the success of reverse knowledge transfer (Buckley et al. 2003).

2.2 Subsidiary Autonomy

The relationship between corporate headquarters and offshore subsidiaries in multinational firms is well established (e.g., Prahalad and Doz 1987; Bartlett and Ghoshal 1989; Nohria and Ghoshal 1994) as is the relationship between corporate headquarters and the strategic business units in diversified firms (Gupta and Govindarajan 1986, 1991). One of the key sentiments of these perspectives is the importance of “fit” between the context of the subsidiary or the business unit and the governance structures and managerial systems used to manage them. This means that different strategic roles of the subsidiaries or business units require different governance structures and management systems. A similar logic can be applied to the relationship between a business unit headquarters and individual plants in a multiplant network (Bartlett and Ghoshal 1993).

From this follows that specialization is a key driver of network performance, but with specialization comes a certain coordination demand, which may be described through different types of interdependencies. Van de Ven et al. (1976) define interdependence as the extent to which units of an organization are dependent upon one another to accomplish their tasks. From this perspective, interdependence depends on the inherent nature of work flow and can be split into: (1) pooled; (2) sequential; (3) reciprocal (Thompson 1967). Van de Ven et al. (1976) extend the classification by adding the team interdependence type, which refers to the case of interdependence when the work is acted jointly and simultaneously without measurable breaks in the flow of work between responsible parties. The four types can be ranked according to increasing levels of interdependence, the pooled type having the lowest level of interdependence, followed by sequential, reciprocal and the team types. Different types of interdependence require different means for achieving coordination (Thompson 1967; King 1999). According to Van de Ven et al. (1976) pooled interdependence, characterized by lower relationship intensity, can be coordinated by standardization, while the sequential type calls for planning, and in the intensive interdependence types, that is, reciprocal and team, coordination is achieved by constant transmission of information, feedback and mutual adjustment.

Taking the outset in these task interdependencies, Kuemmerle (1997) distinguishes between two types of foreign R&D sites each satisfying a different need. On the one hand, the “home-base-augmenting laboratory site,” with the objective to absorb knowledge from the local scientific community, creates new knowledge and transfers it to the homebase, thus augmenting the initial competencies of the central R&D site. The other type is referred to as the “home-base-exploiting site,” which commercializes knowledge that is transferred from the central R&D site at home, to the laboratory site abroad, to local manufacturing and marketing, basically exploiting the central R&D site competencies. The type of R&D site will determine its location decision close to local competence centers or manufacturing and marketing locations. In both configurations, the homebase tends to remain the center of activity as it sets the standards and remains the central node in the network leaving little local autonomy to offshore subsidiaries.

Maturity is an important aspect of establishing offshore subsidiaries. Eppinger and Chitkara (2006) note that companies tend to deploy a global development strategy in stages, allowing them to gain experience gradually by moving more and more development responsibilities to new foreign units. In the process of upgrading, the strategic role of subsidiaries international coordination and process management follows as a means for increasing efficiency and effectiveness in the emerging global network.

2.3 Autonomy and Knowledge Transfer

It is clear that interdependence and autonomy are interlinked and that they are important in relation to the effectiveness of knowledge transfer within multinational companies. However, previous studies have largely neglected the dynamic interrelationships between the concepts. Various studies have investigated how subsidiaries can increase their autonomy. These studies have, for example, established that there is an inverted-U-shaped relationship between subsidiary size and subsidiary autonomy (Johnston and Menguc 2007). This means that size and autonomy is only correlated to a certain point, above which increases in subsidiary size result in decreases in autonomy.

Using data from seven developed countries in Europe, Foss and Pedersen (2002) found that interdependence between units is important for the transfer of internally produced subsidiary knowledge, whereas subsidiary autonomy is particularly important for the transfer of knowledge originating from local clusters a subsidiary has tapped into (Foss and Pedersen 2002). However, interdependence and autonomy are interrelated concepts in the sense that it is difficult to imagine a subsidiary which is interdependent with headquarters without having some autonomy of its own. When establishing a new R&D subsidiary in emerging markets, the goal may often be that the subsidiary becomes an interdependent unit; however, for this goal to be attainable, the subsidiary is likely, sooner or later, to need some autonomy in order to become interdependent with headquarters. But the questions of how to develop subsidiary autonomy, how much autonomy to grant and when, in the offshoring process, are not entirely trivial.

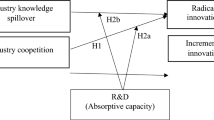

The findings of Foss and Pedersen (2002) are likely to be relevant for establishments of R&D subsidiaries in emerging markets in the sense that the autonomy a subsidiary is granted should enable the subsidiary to reap the benefits of its location. In particular, it should enable the subsidiary to tap into local clusters of knowledge, as these may be unfamiliar and difficult to reach for the R&D homebase. It is, thereby, important that the subsidiary has the autonomy to identify and to carry out collaboration with such knowledge clusters, which may result in beneficial reverse knowledge transfer, as illustrated in Fig. 9.1. In this sense, R&D subsidiary autonomy may have positive effects for reverse knowledge transfer. However, before reverse knowledge transfer can take place, primary knowledge transfer is most often needed, in particular in relation to newly established R&D subsidiaries in emerging markets (Søberg 2010). If too much autonomy is granted to the newly established R&D subsidiary early on, it may instigate too much redundant knowledge creation, rather than building on existing knowledge within the company. In other words, it may hamper primary knowledge transfer and the upgrading of skills, knowledge levels and capabilities, which the R&D subsidiary needs in order to contribute to innovation performance, as outlined in Fig. 9.1.

Figure 9.1 above summarizes the theoretical framework and proposes that R&D subsidiary autonomy has a negative effect on primary knowledge transfer, and a positive effect on reverse knowledge transfer, as illustrated in Fig. 9.1. Newly established R&D subsidiaries in emerging markets need primary knowledge transfer in order to build up their competence before they can add to the knowledge level of the MNC in terms of beneficial knowledge transfer. Gradual increase in R&D subsidiary autonomy is thereby beneficial for subsidiary innovation performance.

In line with the literature presented above the framework outlined here advocates a gradual increase in autonomy for newly established R&D subsidies in emerging markets. The reader may, therefore, assume that the underlying message is to focus exclusively on the knowledge level and maturity level of the subsidiary as a determinant of how much autonomy a subsidiary should have. However, this simple determinism is not likely to be beneficial as none of the determinants are fixed and because of the repeated nature of knowledge flows within the R&D network. As we have leant from the literature above, the role and the type of activities in the subsidiary remain important aspects to consider in this context as well. R&D subsidiaries with largely local mandates such as “local for local” (Bartlett and Ghoshal 1990) R&D subsidiaries focusing on adapting products to the local market, or developing new products and services specifically to the local market, may be in need of more autonomy, and interdependence with the R&D homebase may be less important compared with other types of R&D subsidiaries. For example, “locally-leveraged” and “locally-linked” (Bartlett and Ghoshal 1990) R&D subsidiaries in emerging markets that are mainly preoccupied with assisting a R&D homebase in carrying out R&D for the global market could be a contrasting example. If a newly established R&D subsidiary in emerging markets serves as sort of low-cost R&D subsidiary for the world, it may be more important than in the former example to integrate and create interdependencies with the R&D homebase. In other words, an implicit part of defining the autonomy of an R&D subsidiary relates to the characteristics and the clarity of its particular role.

3 Methodology

Extensive qualitative empirical material have been collected from four Scandinavian high-tech companies and are reported in four exploratory case studies (Yin 2003) of captive R&D offshoring in China and India. In the case selection, it was emphasized that it was possible to get good access to the cases, that the companies are leading high-tech companies, who have recently established R&D subsidiaries in China or India. It was also emphasized that the case companies come from different industries that are of importance in Scandinavia.

It is believed that rich contextual information is pertinent to facilitating a rich understanding of the phenomenon as we have quite extensive knowledge of drivers of global R&D, but do not fully understand the process related to how it is operationalized. The abductive approach (Alvesson and Sköldberg 1994; Dubois and Gadde 2002) is the methodological strategy for this inquiry where more than 50 in-depth interviews have been made, since 2007. The interviews generally lasted between 45 min and 1.5 h. Empirical data have been collected in both headquarters and subsidiary as recommended by Ambos et al. (2010) as well as Dellestrand (2010) in order to be better able to investigate the interactions between headquarters and subsidiaries and how this evolves over time during the captive R&D offshoring process. Empirical findings triggered a search for theory and theory development through continuous interchange and pattern matching (Yin 2003) between empirical data and theory. This took place in order to secure good empirical support for the theoretical framework. The interviewees are mainly employees within the R&D organizations of the case companies. Interviews have been carried out in person and by telephone, both in Scandinavia and Asia. Employees on different management levels as well as employees without management responsibility have also been interviewed. This has been done in order to get as close as possible to the important problems, as well as in order to enable triangulation of data across managerial levels.

4 Empirical Findings

4.1 Med Tech

The company started the R&D subsidiary in China in 2001. It was the first R&D subsidiary set up by the company abroad. Subsequently, two other R&D subsidiaries were established in the US. One of these is still running, and seemingly doing very well. However, the other one has been shut down again. In China, the main focus of the R&D subsidiary is to carry out biopharmaceutical research activities together with the R&D homebase. The activities span many different types of diseases; however, they mainly center around treatments where the company can leverage its expertise concerning proteins. Important reasons behind the establishment of the R&D subsidiary in China was to comply with informal request from Chinese authorities to not only sell products, but also develop products in China, as well as Med Tech wishes to be better able to recruit talents from China. This especially concerns Chinese returnees with experience from overseas, who prefer to live in China.

4.1.1 Subsidiary Autonomy

As mentioned above, the company established an R&D center in the US, which was subsequently closed down again. A key learning from this experience within the company was that the R&D center was not proper aligned with the rest of the company. The R&D center in the US had become excessively self-organized. The activities were not sufficiently aligned with the activities of the rest of the company.

A vice president located in Scandinavia had the overall responsibility for the establishment of the R&D subsidiary in China. He ensured that, from the very beginning, a local Chinese management team was in place in the R&D subsidiary in China. He also ensured that scientists in the R&D homebase, who were skeptic toward the R&D internationalization, became directly involved in the efforts to integrate the new R&D subsidiary. Initially, employees in the R&D subsidiary found their role a bit unclear. It was difficult to know whether to go ahead in a self-organized manner or whether it would be best to only collaborate closely with the R&D homebase in Scandinavia. For instance, the R&D subsidiary independently took charge in relation to setting up the local quality processes and procedures, only to discover later on, that it would have been better and easier to utilize the already established processes in the R&D homebase. Such experiences clarified the benefit of close collaboration with the R&D homebase. The role of the R&D subsidiary is to contribute to R&D projects in terms of protein expression and purification. This takes place primarily in earlier stages of drug development.

In 2001, the activities in the Chinese R&D subsidiary pertained only to one of the two divisions of the company. In 2008, a group, which is part of the other division of the company, was established in China, as part of the R&D subsidiary. Currently this group contains 25 % of the employees of the R&D subsidiary.

Gradually, the R&D subsidiary is taking a more and more independent role concerning different technologies. The R&D homebase no longer needs to be involved in the decision when research associates in the R&D subsidiary are promoted to scientists.

Still, the R&D homebase has much influence on the activities of the R&D subsidiary. Usually, employees in the R&D subsidiary take part in projects, which are managed in Scandinavia. Currently, employees in the Chinese R&D subsidiary participate in two-thirds of ongoing R&D projects within the biggest division of the company. During the last two years, the R&D center has had the mandate to initiate projects independently. This has so far happened once, which means that one R&D project is now run out of China with a Chinese project manager. Also, the R&D center has now been given the mandate to run a “mini pallet,” which maybe will enable the R&D center independently to prepare projects to be taken over by downstream people. The R&D subsidiary is thereby included in a broader spectrum of activities than previously. So far, R&D personnel in the R&D homebase have always been involved to evaluate whether processes developed in the R&D center were mature enough to be handed over to personnel dealing with downstream maturation of manufacturing processes in the R&D homebase. This may change in the future, so that this step may become redundant.

4.2 Wind Tech

The company develops and manufactures components for wind turbines. It is particularly blades the company is focusing on. Five years ago, the R&D subsidiary was established in India covering a broad range of activities. Employees in the R&D subsidiary are among other things preoccupied with finite element analysis, construction, structural design, aerodynamics, quality control processes and (six sigma) reliability. The most advanced R&D and testing of concepts takes place in Scandinavia. Most of the resources in the R&D subsidiary are allocated to global projects, which are not specifically targeted at local needs.

4.2.1 Subsidiary Autonomy

The role of the R&D subsidiary is to a large extent to support R&D activities ongoing in other locations within the company, especially in Scandinavia. Initially, the often calculation heavy tasks, which were carried out in the subsidiary, were somewhat loosely specified from the Scandinavian side. The resulting calculations carried out by the R&D employees in the Indian R&D subsidiary were initially often not of a good enough quality, according to the Scandinavian R&D employees. The Scandinavian R&D employees felt that often these calculations somewhat disregarded the context in which these calculations should be used. Hence, among engineers in the Scandinavian part of the R&D organization of the company, it is the experience that the Indian colleagues need clear specifications and subsequent control of their work. The engineers in India, however, find it necessary to educate the Scandinavian engineers concerning how to read out, for example, reliability reports carried out in the Indian R&D subsidiary. As a consequence of these initial problems, the tasks carried out in the Indian R&D subsidiary are now pretty clearly specified, and specialized. The clear specification of tasks complies with the apparent Indian preference “for being told what to do”; however, in the R&D homebase, this is also seen as an inhibiting factor. It leaves fewer opportunities for the Indian R&D subsidiary to train the ability to take on more challenging projects.

The R&D activities in the subsidiary are still tightly controlled from Scandinavia. For instance, all chief engineers are located in Scandinavia. Local engineers in the R&D subsidiary in India interpret this as if it is the goal to keep all the authority in Scandinavia even though the number of employees in the Indian R&D subsidiary is growing rapidly.

Concerning minor projects, the R&D subsidiary in India is starting to have a leading role. Already in 2010, the propensity of the Indian engineers to file patents, was just as high as the Scandinavian engineers, when it is taken into consideration that there are still fewer engineers in the Indian R&D subsidiary, than in the R&D homebase in Scandinavia. Quite a few of these inventions relate to areas beyond the specified tasks of the inventors in India. Some of the employees in the R&D subsidiary work extra hours in order to be able to work with more creative challenges beyond their specified tasks. In 2010, engineers in the Indian R&D subsidiary came up with a new and better way to carry out warranty calculations in relation to the products of the company. In the same year, the responsibility for improvement and validation of repair solutions was appointed to the Indian R&D subsidiary.

Local universities have not been leveraged much yet, even though good opportunities exist for local industry–university collaboration, according to personnel in the R&D subsidiary. It is a goal for the local Indian management group to increase such efforts when possible.

4.3 Pack Tech

The company is active within the packaging industry in relation to packaging material as well as packaging equipment. The activities of the R&D subsidiary, which was set up in China five years ago, relate to both of these areas.

4.3.1 Subsidiary Autonomy

Within the first year of the R&D subsidiary’s existence, it was up to the subsidiary to take initiative and participate in different projects. This had implications for the development of the local engineers and the benefit of the training they received, as illustrated by the following quote:

I would say in the first year the company did not really know what we were lacking (Interview 09.09.2011, Mechanical designer).

The responsibility for the Chinese R&D subsidiary was initially shared between the whole R&D homebase management. The R&D subsidiary manager proposed to change this to a situation where only four people in the R&D homebase management group would have the responsibility for the R&D subsidiary in China. This proposal was not approved; however, instead, the responsibility was divided between five different areas in the management group, whereby the R&D subsidiary manager obtained the management focus he was missing.

As the role of the R&D subsidiary was clarified, and the R&D employees started to carry out tasks they had been assigned, they started to benefit more from the training they received.

Most of the work carried out by the R&D subsidiary so far has gone into one particular project, which initially was targeted at the local market. However, the design, which was created and decided in the R&D homebase, seems somewhat unfit for the high-cost sensitivity of the local market, and the project has been redirected to target other markets, even though this was not initially the plan.

Gradually, more and more decisions are made in the Chinese R&D subsidiary. Within packaging validation, the engineers in the R&D subsidiary are free to take their own decisions. When they validate a package, they no longer need to get their validation validated by the R&D homebase. However, concerning mechanical engineering in relation to mechanical design, the R&D homebase is still largely in power.

Smaller projects have been more successful in the R&D subsidiary so far. One such project was carried out with a local university and resulted in a quality validation rig. The developed type of rig is now to be utilized worldwide in the company, thereby reducing costs related to these quality validations.

In 2011, the R&D subsidiary was appointed the responsibility for an old product system. It is thereby the responsibility of the R&D subsidiary to improve and update this product system. Increasingly, project management will be carried out more and more within the Chinese R&D subsidiary itself, rather than from Scandinavia. However, all projects are still initiated in Scandinavia.

4.4 Mechanic Tech

The company is active within the automation equipment industry and has established an R&D subsidiary in China seven years ago. The establishment of the R&D subsidiary is part of the company’s initiatives to increase its global footprint, thereby improving sourcing opportunities globally; however, the ability to adapt products locally and respond fast to local demands in the rapidly growing local market are also important reasons behind the R&D subsidiary establishment. To a lesser extent, access to local competence was a motivating factor behind the R&D subsidiary establishment.

4.4.1 Subsidiary Autonomy

Core technology in the company is developed in the Scandinavian part of the R&D organization.

The role of the R&D subsidiary was not clear from the beginning. Initially, the engineers of the R&D subsidiary were very eager to develop ideas, and they were given the autonomy to do so. However, most of these ideas were not very useful and were discontinued. The main problems with these ideas were typically that the ideas were nothing new, it had already been tried out before, or it would not really make a difference in the marketplace. In the beginning, the contribution of the Chinese R&D subsidiary constituted primarily support of local production and local sourcing.

A few years ago, the development of a small robot for electronics industries was initiated in the R&D subsidiary. It is a global product, although it is expected to sell primarily in Asia, since that is where the majority of electronic manufacturing takes place. Later, hardware development was also initiated in the R&D subsidiary in China in order to respond to primarily Asian needs and the local sourcing opportunities. The product may be sold elsewhere, but the focus is on Asia.

Gradually, the R&D employees in the Chinese R&D subsidiary become more knowledgeable concerning automation equipment as well as the internal processes of the company. Compared with earlier, they now develop fewer, but better ideas. The Chinese R&D subsidiary is expected to increasingly take part in more and more advanced R&D activities. However, in the near future, this is likely to be still within different types of application of the technology of the company rather than dealing with new core technology.

5 Analysis

A common theme between the cases was the difficulty of the newly established R&D subsidiaries to define roles and tasks vis-à-vis the rest of the R&D network. Setting the strategic mandate and specifying task interdependencies was a key trigger for progress with knowledge transfer both for primary, but especially for reverse knowledge transfer. Within Med Tech, Wind Tech and Pack Tech, the newly established R&D subsidiaries initially found their role to be rather unclear. Employees within the newly established R&D subsidiary of Wind Tech in India also found their tasks not to be sufficiently specified. Their Scandinavian engineering colleagues initially felt the Indian engineers carried out calculations somewhat disregarding the context in which the calculation should be utilized. This may relate to a lower level of industry-specific knowledge, that is, wind turbines within the R&D subsidiary in India. For the engineers in the Indian subsidiary, it proved to be more difficult to contextualize the calculations they do, because they lack industry-specific knowledge. The necessary primary knowledge transfer needed in order to mitigate such problems can be inhibited by a lack of clarity in relation to the role of newly established R&D subsidiaries in emerging markets. Not knowing your role makes it difficult to focus the absorption of knowledge and activities undertaken in a newly established R&D subsidiary. For example, within Pack Tech, the employees in the newly established R&D subsidiary did not know how to make use of all the training they received, before they knew their mandate, and which projects they should participate in. In this sense, the clarification of the role of the R&D subsidiary improves primary knowledge transfer.

Mechanic Tech experienced that the Chinese engineers came up with ideas, which had already been developed previously in the company, but although this at first was perceived as wasted efforts by the HQ, it met local market demands calling for cheaper and simpler technology. Med Tech experienced that employees in the Chinese R&D subsidiary reinvented, for no reason other than what seemed to be ignorance of the existing well-established knowledge and processes within the company. However, it clearly drove local knowledge of the underlying principles of operations aspired in the company, which facilitated a search ability allowing future identification and absorption of corporate best practice. The employees in the Chinese R&D subsidiary have learned to look and ask more carefully in the R&D homebase whether something is in place, before they go ahead and redo it themselves.

5.1 Subsidiary Autonomy

A key enabler of knowledge transfer within the case companies was a clear specification of tasks and roles in the newly established R&D subsidiaries, leaving little autonomy for them initially. If a newly established R&D subsidiary has little autonomy, it is likely to depend on the R&D homebase when it carries out its activities. This may create a propensity to build on the existing knowledge base within the company, rather than developing something entirely new. The more autonomy a R&D subsidiary gets, the more likely it will develop knowledge, which is new to the company, for example, by utilizing the resources differently from how they are used in the R&D homebase and/or by taking advantage of its location, which evidently is different from the location of the R&D homebase. At the same time, the risk may increase that the R&D subsidiary “reinvents the wheel” and develops knowledge which has already been developed in the company, as seen within, for example, Med Tech and Mechanic Tech. This risk is likely to be higher if autonomy is granted, to newly established R&D subsidiaries in emerging markets, before much primary knowledge transfer has successfully taken place. However, if a R&D subsidiary never increases its level of autonomy, it may hamper its development at later stages. For example, Wind Tech experiences how clear specifications of the tasks in the R&D subsidiary produce few opportunities in the R&D subsidiary to train the ability to take on more challenging projects. This may indicate that more autonomy is needed at R&D subsidiary level, if a subsidiary is to make more advanced contributions in terms of reverse knowledge transfer.

5.1.1 Local Adaptation

One can speculate whether it would have been beneficial for Pack Tech to give more autonomy to the Chinese R&D subsidiary in relation to the big project, which the R&D subsidiary plays a big part in. The local Chinese target market for the project initially would suggest this to be relevant. In any case, the designers in Scandinavia do not seem to learn as much from the project as they could. A reason behind this is that the local Chinese engineers, lacking knowledge about why the design is as it is, find it difficult to report back to the headquarters concerning the results they get when validating the concepts developed in Scandinavia. This can be seen as an example of poor primary knowledge transfer breeding causal ambiguity (Szulanski 1996) as well as poor reverse knowledge transfer (Buckley et al. 2003). However, we may also imply that local autonomy is relevant for the development of local products. Possibly local engineers would have been better able to grasp the local demands (for low-cost solutions). Hence, when local product development is needed for the local market, newly established R&D subsidiaries may need to obtain more autonomy sooner than otherwise. In this case, the subsidiary was probably not ready to lead the project from the beginning. Smaller projects are easier for newly established R&D subsidiaries to run successfully. One example of this is Pack Tech, which runs projects with local universities. One of these projects results in cost reductions in package quality validation processes in the company across the globe. However, future successes of this kind may be hampered a bit by the fact that the R&D subsidiary always has to apply for budget, for these types of collaborations, in the R&D homebase. This may be a better example of situations where R&D subsidiary autonomy should not be granted too sparingly.

Increases in roles and responsibilities may not correspond with higher autonomy. The need for coordination and alignment with other sites and stakeholders may increase as a function of the role sometimes faster than the level of autonomy. As resources increasingly have to be spent on coordination and alignment with other sites, the level of autonomy may decrease. For example, for R&D subsidiaries that, as they grow increasingly take on projects, focus above and beyond local market needs, this is likely to be the case.

If an R&D subsidiary is unable to translate its autonomy into knowledge creation that is aligned with the rest of the company, it may turn out to be ultimately devastating for the R&D subsidiary. This is illustrated in the case of Med Tech, which shut down a newly established R&D subsidiary in the US, for such reasons. Local R&D subsidiary managers may over time try to negotiate and act in order to increase the autonomy of the R&D subsidiaries they manage. However, early on, they may be better off without too much autonomy too soon.

Apart from the implications of role and mandate of an R&D subsidiary, specification practices may also be worth mentioning in this context. In practical terms, the way in which a R&D homebase specifies the work of a newly established R&D subsidiary has implications for the autonomy level of the subsidiary. However, specifications alone do not determine how much autonomy is in place. It is possible to imagine a situation where the specification level is high; however, autonomy, that is, the liberty to solve the tasks as one wishes to do so could also at the same time be high. This situation is probably rare. Of course, sometimes certain kinds of specification may limit the options for solving the task in different ways and thereby also limit autonomy. This may make it necessary to change the way in which specifications are done when a change in autonomy levels is intended.

6 Managerial Implications

This study to some extend confirms the notion that successful primary knowledge transfer facilitates successful reverse knowledge transfer. However, the study supports an extended understanding of primary knowledge transfer where success is determined not just by the ability to replicate homebase knowledge, but rather that efforts should be made into building an understanding of the underlying principles of operations. With this extension, the primary transfer process facilitates a subsequent uptake of knowledge-augmenting activities, which may benefit the corporate stock of knowledge. To a manager, it may not be so helpful in itself to know that primary knowledge transfer success will determine the benefit of reverse knowledge transfer. It may be more valuable for a manager to know how to influence this equation. In line with previous research, it remains clear that causal ambiguity, that is, an inadequate understanding of the reasons for success or failure of a practice, is a key barrier to transfer across locations (Szulanski 1996). Addressing this, it is important to know that the level of autonomy granted to a subsidiary will influence the knowledge flows back and forth between R&D homebase and R&D subsidiary. In order not to jeopardize successful primary knowledge transfer, a gradual increase of subsidiary autonomy is important; however, if a subsidiary does not develop sufficient autonomy over time, it is likely that the potential for beneficial reverse knowledge transfer is not fully reaped. Likewise, granting a high level of autonomy to a subsidiary from the outset will not facilitate an appropriate infrastructure for knowledge flows between subsidiaries. These considerations are particularly important to pay attention to as R&D activities become increasingly internationalized.

7 Conclusion

The framework and empirical research suggest that subsidiary autonomy has a negative effect on primary knowledge transfer, and a positive effect on reverse knowledge transfer, as previously illustrated in Fig. 9.1. Newly established R&D subsidiaries in emerging markets need primary knowledge transfer in order to build up local competence and capabilities, but also a deep understanding of the corporate principles of operations, before they can start to challenge and add to the knowledge stock of the MNC. Gradual increase in R&D subsidiary autonomy is, thereby, beneficial for subsidiary innovation performance during a knowledge build-up phase. Meanwhile, the autonomy of the subsidiary, in the longer term, is more likely to be determined by the strategic mandate of the subsidiary and the type of interdependency between the subsidiary and the remaining R&D network. Furthermore, the need for local adaptation of products is important to pay attention to when deciding levels of R&D subsidiary autonomy, as such local needs may trigger a higher need for R&D subsidiary autonomy than otherwise. In other words, we find the well-described trade-off between local responsiveness and global efficiency, but also find that this trade-off may be mediated by carefully designing and orchestrating knowledge transfer infrastructures and aligning it with structural autonomy.

References

Alvesson M, Sköldberg K (1994) Tolkning och Reflektion. Studentlitteratur, Lund

Ambos T, Ambos B, Schlegelmilch B (2006) Learning from foreign subsidiaries: an empirical investigation of headquarters’ benefits from reverse knowledge transfers. Int Bus Rev 15(3):294–312

Ambos TC, Andersson U, Birkinshaw J (2010) What are the consequences of initiative-taking in multinational subsidiaries? J Int Bus Stud 41(7):1099–1118

Argote L, Mcevily B, Reagans R (2003) Managing knowledge in organizations: an integrative framework and review of emerging themes. Manag Sci 49(4):571–582

Baden-Fuller C, Winter SG (2005) Replicating organizational knowledge: principles or templates? Max-Planck-Institute of Economics, Evolutionary Economics Group

Bartlett CA, Ghoshal S (1989) Managing across borders: the transnational solution. Harvard Business School Press, Boston

Bartlett CA, Ghoshal S (1990) Managing innovation in the transnational corporation. In: Bartlett CA, Doz Y, Hedlund G (eds) Managing the global firm. Routledge, London, pp 215–255

Bartlett CA, Ghoshal S (1993) Beyond the M-form: toward a managerial theory of the firm. Strategic Manag J 14(S2):23–46

Birkinshaw J, Hood N (1998) Multinational subsidiary evolution: capability and charter change in foreign-owned subsidiary companies. Acad Manag Rev 23(4):773–795

Buckley P, Clegg J, Tan H (2003) the art of knowledge transfer: secondary and reverse transfer in China’s telecommunications manufacturing industry. Manag Int Rev 43(2):67–93

Dellestrand H (2010) Orchestrating innovation in the multinational enterprise: headquarters involvement in innovation transfer projects. Ph.d doctoral, Uppsala University

Dossani R, Kenney M (2007) The next wave of globalization: relocating service provision to India. World Dev 35(5):772–791

Dubois A, Gadde L-E (2002) Systematic combining: an abductive approach to case research. J Bus Res 55(7):553–560

Easterby-Smith M, Prieto I, Esgueva A, Spain V (2008) Dynamic capabilities and knowledge management: an integrative role for learning? Br J Manag 19(3):235–249

Eppinger SD, Chitkara AR (2006) The new practice of global product development. MIT Sloan Manag Rev 47(4):22–30

Foss NJ, Pedersen T (2002) Transferring knowledge in MNCs: The role of sources of subsidiary knowledge and organizational context. J Int Manag 8(1):49–67

Grant E, Gregory M (1997) Adapting manufacturing processes for international transfer. Int J Oper Prod Manag 17(10):994–1005

Gupta AK, Govindarajan V (1986) Resource sharing among SBUs: strategic antecedents and administrative implications. Acad Manag J 29(4):695–714

Gupta A, Govindarajan V (1991) Knowledge flows and the structure of control within multinational corporations. Acad Manag Rev 16(4):768–792

Harryson SJ, Søberg PV (2009) How transfer of R&D to emerging markets nurtures global innovation performance. Int J Technol Globalisation 4(4):367–391

Hätönen J, Eriksson T (2009) 30 + years of research and practice of outsourcing—exploring the past and anticipating the future. J Int Manag 15(2):142–155

Johnston S, Menguc B (2007) Subsidiary size and the level of subsidiary autonomy in multinational corporations: a quadratic model investigation of Australian subsidiaries. J Int Bus Stud 38(5):787–801

King A (1999) Retrieving and transferring embodied data: implications for the management of interdependence within organizations. Manag Sci 45(7):918–935

Kuemmerle W (1997) Building effective R&D capabilities abroad. Harvard Bus Rev 75(2):61–72

Nieto MJ, Rodriguez A (2011) Offshoring of R&D: looking abroad to improve innovation performance. J Int Bus Stud 42(3):345–361

Nohria N, Ghoshal S (1994) Differentiated fit and shared values: alternatives for managing headquarters-subsidiary relations. Strateg Manag J 15(6):491–502

Pillania RK (2005) New knowledge creation scenario in Indian industry. Global J Flexible Syst Manag 6(3):49–57

Prahalad CK, Doz YL (1987) The multinational mission: balancing local demands and global vision. Free Press, New York

Szulanski G (1996) Exploring internal stickiness: impediments to the transfer of best practice within the firm. Strategic Manag J 17:27–43 (Special issue, Winter 1996)

Szulanski G (2000) The process of knowledge transfer: a diachronic analysis of stickiness. Organ Behav Hum Decis Process 82(1):9–27

Søberg PV (2010) Industrial influences on R&D transfer to China. Chinese Manag Stud 4(4):322–338

Thompson JD (1967) Organizations in action: social science bases of administration. McGraw-Hill, New York

Van De Ven AH, Delbecq AL, Koenig R Jr (1976) Determinants of coordination modes within organizations. Am Sociol Rev 41(2):322–338

Yin RK (2003) Case study research: design and methods. Sage Publications, Thousand Oaks

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag London

About this chapter

Cite this chapter

Søberg, P.V., Wæhrens, B.V. (2013). The Dual Role of Subsidiary Autonomy in Intra-MNC Knowledge Transfer. In: Pedersen, T., Bals, L., Ørberg Jensen, P., Larsen, M. (eds) The Offshoring Challenge. Springer, London. https://doi.org/10.1007/978-1-4471-4908-8_9

Download citation

DOI: https://doi.org/10.1007/978-1-4471-4908-8_9

Published:

Publisher Name: Springer, London

Print ISBN: 978-1-4471-4907-1

Online ISBN: 978-1-4471-4908-8

eBook Packages: EngineeringEngineering (R0)