Abstract

In this chapter we discuss generation expansion planning in systems with variable resources. The variability and uncertainty in renewable resources like wind and solar power pose new challenges from a long-term planning perspective. There is clearly a need to introduce cleaner sources of electricity generation for environmental reasons. However, at the same time, system reliability must be maintained while trying to minimize the total cost of meeting the electricity demand. We use a stochastic dynamic optimization model to analyze optimal expansion decisions considering uncertainty in wind power generation as well as future load. In a case study, we focus on the São Miguel Island and investigate how the uncertainty and variability in wind power and load impact optimal expansion decisions in the long run. We show that wind power is a cost-efficient expansion alternative on São Miguel, but that some dispatchable generation is also needed to compensate for the variability and uncertainty in wind power. We also analyze how demand response contributes to change the optimal portfolio of supply resources.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

In this chapter we discuss generation expansion planning in systems with variable resources. The variability and uncertainty in renewable resources like wind and solar power pose new challenges from a long-term planning perspective. There is clearly a need to introduce cleaner sources of electricity generation for environmental reasons. However, at the same time, system reliability must be maintained while trying to minimize the total cost of meeting the electricity demand. We use a stochastic dynamic optimization model to analyze optimal expansion decisions considering uncertainty in wind power generation as well as future load. In a case study, we focus on the São Miguel Island and investigate how the uncertainty and variability in wind power and load impact optimal expansion decisions in the long run. We show that wind power is a cost-efficient expansion alternative on São Miguel, but that some dispatchable generation is also needed to compensate for the variability and uncertainty in wind power. We also analyze how demand response contributes to change the optimal portfolio of supply resources.

2 Modeling Framework

We build on the optimization model for generation expansion in electricity markets first proposed in [1, 2] and later expanded in [3]. The original model was inspired from real options theory for investments under uncertainty [4] and also from the theory of peak-load pricing [5]. We extend the model to consider wind power as an expansion candidate, and we represent the wind power variability in the system dispatch. Whereas the model developed in [1–3] was originally intended to analyze generation expansion decisions in restructured electricity markets, we now assume that the expansion decisions are made through centralized planning with the objective of maximizing social surplus in the system.

The generation expansion planning problem is formulated as a stochastic dynamic programming (SDP) problem. SDP has been used for generation expansion planning within the regulated industry in the past [6, 7], but typically for thermal or hydrothermal systems without consideration of variable renewable resources such as wind and solar energy. We differentiate between short- and long-term uncertainties in the generation expansion framework, as outlined below. We focus on generation expansion planning in this chapter. Detailed operational constraints and the impact of the transmission network are therefore not considered.

2.1 SDP Formulation with Short- and Long-Term Uncertainties

The overall problem for a centralized planner considering investing in new power generation can be stated as an optimization problem over a planning horizon of T years, as shown in (20.1)–(20.5). The objective is to maximize the sum of discounted social surplus over the planning horizon, considering supply costs and consumer benefits. We use a 1-year time resolution and assume that investments can only take place at the beginning of each year. In order to handle the value of a plant beyond the planning horizon, we adjust the investment costs according to its lifetime and the length of the planning period assuming a constant annuity. Hence, the termination payoff, g T in (20.4), is simply the expected social surplus in the last period under the condition that no new investment is made:

where

The short- and long-term uncertainties differ in respect to how they influence the optimal investment decision. The long-term uncertainties are correlated from year to year, and according to real options theory, there may be a value for the planner in waiting to see how these uncertainties unfold. This is because the future looks different depending on which state you move to from one year to the next. We represent the average annual load as a long-term uncertainty, since this will have an important impact on future generation costs. The average load is modeled as a binary Markov tree (Fig. 20.1). The model could be extended to also include other long-term uncertainties (e.g., fuel prices) with a similar representation, although this would increase the state space of the model.

In contrast to the long-term uncertainties, the short-term uncertainties in the model are not correlated from year to year. Hence, the planner has no incentive to wait for these uncertainties to be revealed. Availability of renewable resources, inflow to hydropower stations, unit outages, and weather-driven fluctuations in load will typically be the most important short-term uncertainties influencing the system operation. We consider short-term uncertainties in wind power and load in this chapter. The short-term uncertainties will still influence the investment strategy, since they influence the dispatch and generation costs. Furthermore, different technologies are exposed to different levels of short-term risks. In our model we maximize the sum of expected social surplus over the planning horizon. The short-term uncertainties (ω s ) only have an effect on the net expected payoff function within the periods (g k ), while the long-term uncertainties (ω l ) influence the state transitions. The short- and long-term uncertainties are assumed to be uncorrelated.

Since the long-term uncertainty in load is represented as a discrete Markov tree and the annual expected payoffs are additive, we can solve the investment problem using SDP. We use a backward SDP algorithm with discrete time and states, as described in [8], to find the solution to the problem, based on the standard iterative Bellman equation in (20.6).

The net expected payoff function in time step k, g k , represents the annual social surplus from electricity generation. g k depends on the installed capacity of different generation technologies, the load, and the expansion decisions at time step k. g k is also a function of the short-term uncertainties in wind power and load, which influence the system dispatch as explained below.

2.2 Supply, Demand, and Dispatch Algorithm

Electricity supply is represented with an aggregate supply curve consisting of new and existing (old) generation technologies, as is illustrated in Fig. 20.2. The first step on the supply curve represents wind power, which has a low variable cost and uncertain availability. Hence, the length of the first step of the supply curve, \(\mathbf{\mathit{x}}_{1,\mathrm{new}}^{{\prime}}\), is a stochastic variable, which depends on the short-term uncertainty for wind power, as shown in (20.7). The short-term uncertainty in wind power consists of a set of discrete realizations of availability factors for wind power, \({\mathbf{\mathit{rw}}}^{{\prime}}\), for each of three demand subperiods within the year. The wind power availability for one realization, m, is given by

The second step on the supply curve, \(X_{1,\mathrm{old}}\), represents baseload generation with low operating cost and a fixed capacity. The third and fourth steps of the supply curve consist of new and old capacity of dispatchable peaking generators, x 2, new and X 2, old. Note that the old peaking capacity is assumed to have higher operating cost than the new technology, represented by the increasing marginal cost curve for X 2, old.

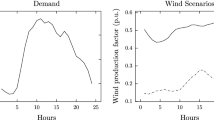

The annual demand is divided into three subperiods: base (1), medium (2), and peak demand (3), as illustrated in Fig. 20.3. A part of the demand within each sub period, L i, flex, is assumed price responsive up to a certain price level, P flex,max. We assume a constant proportion between the maximum subperiod demands in the model, as described in (20.8). Furthermore, the price responsive parts of demand are fixed fractions of the maximum demands, i.e., L flex, k = \(c_{L,\mathrm{flex}} \times L_{\max,k}\), where c L, flex is a constant which applies to all three subperiods. Consequently, the demand curves for all three subperiods can be described by the state variable for load, l k , in addition to the constant parameters for prices and loads. In the case study, we analyze the impact of varying the fraction of price flexible demand, c L, flex:

where

Short-term uncertainty in demand is represented in an equivalent manner to the short-term uncertainty in wind power. The state variable for demand, l k , is multiplied with a relative demand factor, \({\mathbf{\mathit{rd}}}^{{\prime}}\), as shown in (20.9). The relative demand factors follow a discrete probability distribution, which represents the deviations from the average demand in each subperiod. Hence, the relative demand factor represents both variability and uncertainty for demands within the subperiods. The subperiod demand constants, \(c_{L,\max }\), combined with the discrete distributions for relative demand factors, rd ′, give a representative probabilistic representation of the fluctuations in load over the course of the year:

We assume a merit order dispatch for the system, as illustrated in Fig. 20.4. This ensures that the system is dispatched to minimize the operating cost. Quantities and prices, which are equivalent to marginal costs, are calculated for each subperiod. Note that if there is insufficient generation capacity available to supply the fixed part of demand, load curtailment will take place. In contrast, in situations with surplus supply, wind curtailment may be necessary if the wind power generation is higher than the demand. The dispatch heuristic consists of a looping structure, which is repeated for each realization of the short-term uncertainties for wind and demand. The uncertainties in wind power and demand will cause horizontal shifts in the supply and demand curves, respectively. For each year, expected prices, quantities, costs, and the resulting social surplus are calculated over all combinations of the discrete realizations of the short-term uncertainties in wind power and demand. The total expected social surplus over the year is used as the payoff, g k , in the SDP expansion algorithm to find the optimal expansion strategy in the initial year, as explained above.

3 Case Study

We use the model to analyze generation expansion on São Miguel. The optimization model is used to find the optimal expansion decision at the beginning of each year with a 10-year planning horizon. We simulate the optimal expansion plan over a period of 20 years, assuming that the realized load growth equals the expected growth in the binomial tree for load (Fig. 20.1). The case study assumptions and results are presented below.

3.1 Assumptions

Parameters for supply and demand are summarized in Table 20.1. For supply, the existing generation fleet on São Miguel consists of geothermal power (40 %), hydropower (4. 5%), a small amount of power from biomass, and the remainder being met by heavy fuel oil generators, as explained in Chap. 4. There is no wind power installed on the island. In this chapter, we use the same assumption as in previous chapters that geothermal, hydropower, and biomass are negative loads. Hence, the only existing technology modeled in the supply curve is fuel oil generators, assumed to have an operating cost of between 185 and 215 $/MWh, in line with assumptions in previous chapters. The two expansion alternatives are wind power and additional combustion turbines with fuel oil. We assume that the planner has the options to investment in 9 MW of wind power and/or 5 MW of fuel oil generation in each year. Of course, not investing at all is an additional option. Note that wind power, x 1, new, has a relatively high investment cost but zero operating cost. In contrast, fuel oil-fired generation, x 2, new, has a low investment cost, but very high operating cost. A simple levelized cost analysis of the two technologies is shown in Table 20.2. Wind power is assumed to have a capacity factor of 0.46, in line with the wind power data from Chap. 4. This is a very high capacity factor, indicating that the wind conditions are very good on São Miguel. The levelized cost calculation is done for different capacity factors for the fuel oil plant. This is a dispatchable plant, and its utilization is not known at the time the expansion decisions are made. Table 20.2 shows that for all capacity factors, the levelized cost for the fuel oil plant per kWh is much higher than for wind power. This is because of the high cost of fuel oil on the island. However, the availability of wind power is stochastic, whereas the combustion turbine is assumed to have a constant availability. The generation expansion model considers the differences in availability between the two technologies and factors this into the analysis to find the optimal expansion decisions.

The net load duration curve is shown in Fig. 20.5. The original load duration curve, before the non-dispatchable resources are subtracted, is also shown for comparison. With the exception of the peaking hours, the difference between the two curves is relatively constant. This indicates that the generation from geothermal, hydro, and biomass mainly serves as baseload in the system. We use the net load duration curve to estimate parameters for the demand curve representation in the expansion model. The lengths of the base, medium, and peak demand sub periods are set to 4,784, 3,000, and 1,000 h accordingly. The subperiod demand constants, \(c_{L,\max }\), in Table 20.1 are derived by taking the average of the loads in the three sub periods. The expected value and standard deviation of the annual load growth is estimated based on historical data from 2000 to 2008 [9]. In this period, the mean load grew on average 2.7 MW/year with a standard deviation of 1.5 MW/year. Hence, the parameters l growth and l sdv are set to 2.7 and 1.5, respectively (Table 20.1). The value of lost load is assumed to be 3,500 $/MWh, and the highest price on the flexible part of the demand curve is set to 350 $/MWh. In the case study, we use two different assumptions for the amount of flexible demand, i.e., that either 1 or 20% of the load is price responsive.

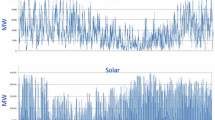

The short-term uncertainties in wind power and demand influence the expected dispatch and payoffs within each year. The probability distribution for the relative wind availability factors (Fig. 20.6) shows that the wind power resources are best in the medium demand subperiod, followed by the peak and base subperiods. For demand (Fig. 20.7), the base period has the widest range, which is expected since this is the longest subperiod and therefore covers a wider distribution of demands. The distributions for the medium and peak periods are relatively similar, although the steep upper part of the net load duration curve (Fig. 20.5) is also reflected in the peak distribution. We assume that the demand and wind power uncertainties are independent. With 10 realizations of each uncertainty, the dispatch routine is run 100 times for each year, i.e., for each combination of load and wind power realizations. Note that both distributions remain constant in the expansion planning model. This is clearly a simplification, since load behavior is likely to change over time. Furthermore, the best wind resources are likely to be built first, and this would impact the wind availability for consecutive expansions. Geographical dispersion of wind power plants would also influence the distributions for the total wind resources on the island.

3.2 Results

We run the optimal expansion model for the time period 2008–2028. Expansion decisions are made at the beginning of each year based on a 10-year planning horizon. The simulated average load growth is assumed to follow the expected value of 2.7 MW/year. Below, we present results for optimal capacity expansion, the resulting dispatch of the different technologies, the amount of load and wind curtailment in the system, and the marginal costs in each of the demand subperiods, which in turn could be used for pricing purposes. We run two sets of simulations, i.e., with either 1% or 20% price responsive demand. Finally, we also conduct a sensitivity analysis of how the optimal generation expansion and curtailment levels change with the expected load growth.

3.2 Generation Expansion and Dispatch

The optimal expansion plan (Fig. 20.8) shows that the majority of the new capacity is wind power. The wind power expansion is driven by the low cost of wind power compared to fuel oil-fired power plants (Table 20.2). Most of the new fuel oil capacity is added in the last 10 years of the simulation period. At this point, additional thermal capacity is needed to compensate for the uncertainty and variability in wind power. In fact, with low demand response (DR1), the fuel oil capacity grows at about the same rate as the wind power capacity in the last 10 years. Increasing the amount of demand response (DR20) leads to lower capacity expansion overall, particularly for the fuel oil technology. Furthermore, the increase in thermal capacity occurs about 5 years later compared to DR1. This is because the price responsive demand acts a flexible and dispatchable resource, which reduces the need for dispatchable generation.

The resulting annual dispatch for all the generation technologies in the system is shown in Fig. 20.9. Geothermal and hydro generation is subtracted from the load, as explained above, and therefore has constant generation throughout the simulation period. Wind generation increases rapidly to meet between 35 and 40% of the total load in the system. The new fuel oil generation increases towards the end of the planning horizon. The main effect of increasing the demand response is that the total load decreases and also that less fuel oil generation is being dispatched. The higher demand response also allows for a slightly higher fraction of load being met by wind power.

3.2 Curtailment of Load and Wind Power

The short-term uncertainty in wind power must be compensated by flexible supply and demand resources in the system. The likelihood of being able to meet the fixed part of the demand increases by investing in more thermal capacity with constant availability. However, the more expansion of such resources, the less they are used. Hence, there is a trade-off between the investment cost of new capacity and the cost of curtailment in the system. The social surplus objective in the expansion model considers this trade-off in finding the optimal expansion plan. Figure 20.10 shows that load curtailment starts occurring a few years into the simulation period and eventually reaches a level of more than 5 GWh in the case with low demand response. This is close to 1% of the total fixed demand in the system. More demand response reduces the amount of load curtailment to about half, as the flexible part of the demand curve responds to high prices before load curtailment becomes necessary.

Wind power is attractive from a cost perspective, given its low levelized cost. However, as the amount of installed wind capacity increases, there is a chance that wind power exceeds the load so that wind power curtailment becomes necessary.Footnote 1 In this case, there is a trade-off between meeting the load with cheap wind energy and the need for curtailing the wind power in surplus situations. Figure 20.10 shows that wind power curtailment increases rapidly during the first 7–8 years of the simulation period. At this point the wind curtailment reaches approximately 16–17% of total dispatched wind generation, which appears to be an equilibrium level, as it stays at this level throughout the rest of the period. Demand response leads to slightly less wind power curtailment, since the pace of wind power expansion is a bit slower in this case (Fig. 20.8). Note that with the representation of demand response in the model, the dispatched load can only be reduced.Footnote 2

The generation model considers the trade-offs discussed above and maximizes the sum of consumer and producer surpluses (i.e., the social surplus) over the short- and long-term uncertainties. An important finding from the analysis is that some curtailment of both load and wind power is optimal under the current assumptions. However, the optimal level of wind power curtailment is clearly much higher than the desired load curtailment, as shown in Fig. 20.10.

3.2 Marginal Costs of Generation (Prices)

We also analyze the impact of the optimal expansion plan on the marginal cost of generation. The marginal costs of generation in the subperiods can be interpreted as system prices and could possibly be used to determine dynamic rates or even for real-time pricing. Figure 20.11 shows that the prices are the same in all three demand subperiods at the outset of the simulation period. This is because the original fuel oil generation (X 2, old) is always the marginal technology in the original system. The expansion of wind power leads to a significant reduction in the prices during the base period. At the same time, the peak price increases dramatically. This is because load curtailment starts occurring in the peak period during some realizations of the short-term uncertainty. The expected price is therefore influenced by the value of lost load (VOLL), assumed to be $3,500/MWh. The average price during all subperiods remain at or below $200/MWh. The main effects of more demand response are that the peak price increase occurs later and that the average price is lower towards the end of the simulation period.

3.2 Sensitivity Analysis: Load Growth

Finally, we investigate the impact of the annual load growth in the system, varying l growth between 0 and 3.375 MW/year. Figure 20.12 shows that even with no load growth, it is optimal to invest in substantial amounts of wind power to reduce the overall cost of the electricity supply. The wind power capacity increases more or less as a linear function of load growth. In contrast, substantial expansion of fuel oil generation only takes place at the higher load growth levels. Demand response reduces the need for new capacity, particularly thermal generation. Figure 20.13 shows that wind curtailment takes place for all simulated load growths, whereas load curtailment only occurs for higher load growths as there is no load curtailment in the original system. Higher demand response leads to reductions in the curtailments of both wind power and load.

4 Conclusion

In this chapter we have used a stochastic dynamic optimization model to analyze generation expansion with variable resources. The case study of the São Miguel Island shows that wind power is an attractive investment alternative on this island, due to the low cost in comparison with thermal generation from fuel oil. However, some dispatchable thermal generation is still needed to compensate for the variability and uncertainty in wind power. The dispatch results show a significant curtailment of wind power during surplus conditions as the amount of wind power capacity increases. A small amount of load curtailment during scarcity situations is also optimal from a social surplus perspective. Furthermore, the change in the capacity mix leads to much higher differences between the marginal system costs during periods of high and low demand. Wind power brings down the marginal cost during low load periods, whereas scarcity situations with load curtailment lead to much higher expected marginal costs during peak-load periods. The average annual marginal costs remain relatively stable. The utility company and regulator would have to decide on how much of the increased price variability to pass on to end users. Our results show that an increase in the amount of price responsive demand from 1 to 20% of total demand has several advantages. A more flexible demand side leads to a large reduction in the need for new thermal generation capacity, as demand helps accommodate variability and uncertainty in wind power through its response to prices. More demand response also leads to less curtailment of wind power and load and to a slightly higher share of wind power in the overall system dispatch.

The generation expansion model used in this chapter focuses on the impact of long- and short-term uncertainties on the optimal investment decisions. The detailed operational constraints analyzed in previous chapters are not included in the expansion analysis. In future work, we are planning to improve the uncertainty representation by incorporating the decomposition methods for load and wind uncertainty from Chap. 6 into the SDP framework. We will also consider the impact of diversity in wind resources on the aggregate probability distribution for wind power. Furthermore, we will consider adding more operational constraints (e.g., unit commitment and operating reserves) into the dispatch algorithm, to better represent the operational impacts of variable generation on planning decisions for generation expansion.

Notes

- 1.

In this expansion study, we assume that wind power alone can meet the demand when sufficient wind power is available. In reality, some thermal units may be required to stay online to provide certain ancillary services to the system. If so, wind curtailment would happen more frequently than under the assumptions used in this case study. The impact of more detailed operational constraints (e.g., unit commitment) on generation expansion with renewable resources is studied in more detail in [10, 11].

- 2.

An alternative demand representation, which allows for demand increase during low load periods through price response and/or load shifting, would contribute to reduce the level of wind power curtailment. Introduction of energy storage would have a similar effect by storing surplus wind energy for use during high loads.

References

A. Botterud, Long-term planning in restructured power systems: dynamic modelling of investments in new power generation under uncertainty. Ph.D. Thesis 2003:106, Norwegian University of Science and Technology, Trondheim, Norway, Dec 2003. http://www.diva-portal.org/ntnu/theses/abstract.xsql?dbid=48

A. Botterud, M.D. Ilić, I. Wangensteen, Optimal investments in power generation under centralized and decentralized decision making. IEEE Trans. Power Syst. 20(1), 254–263 (2005)

G. Doorman, A. Botterud, Analysis of generation investments under different market designs. IEEE Trans. Power Syst. 23(3), 859–867 (2008)

A.K. Dixit, R.S. Pindyck, Investment Under Uncertainty (Princeton University Press, Princeton, 1994)

M.A. Crew, C.S. Fernando, P.R. Kleindorfer, The theory of peak-load pricing: a survey. J. Regul. Econ. 8, 215–248 (1995)

B.F. Hobbs, Optimization methods for electric utility resource planning. Eur. J. Oper. Res. 83, 1–20 (1995)

B. Mo, J. Hegge, I. Wangensteen, Stochastic generation expansion planning by means of stochastic dynamic programming. IEEE Trans. Power Syst. 6(2), 662–668 (1991)

D.P. Bertsekas, Dynamic Programming and Optimal Control, 2nd edn. (Athena Scientific, Nashua, NH, USA 2000)

F. Amorin, B. Palmintier, A. Pina, “Azores Green Islands: Looking at Demand,” Alliance for Global Sustainability, Annual Meeting, 2009.

B. Palmintier, M. Webster, Impact of unit commitment constraints on generation expansion planning with renewables, in Proceedings of IEEE PES General Meeting, Detroit, MI, Jul 2011

D.S. Kirschen, J. Ma, V. Silva, R. Bellhomme, Optimizing the flexibility of a portfolio of generating plants to deal with wind generation, in Proceedings of IEEE PES General Meeting, Detroit, MI, Jul 2011

Acknowledgments

The generation expansion model used in this chapter was developed with funding in part from Industry’s Innovation Fund at the Norwegian University of Science and Technology (NTNU).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer Science+Business Media New York

About this chapter

Cite this chapter

Botterud, A., Abdel-Karim, N., Ilić, M. (2013). Generation Planning Under Uncertainty with Variable Resources. In: Ilic, M., Xie, L., Liu, Q. (eds) Engineering IT-Enabled Sustainable Electricity Services. Power Electronics and Power Systems, vol 30. Springer, Boston, MA. https://doi.org/10.1007/978-0-387-09736-7_20

Download citation

DOI: https://doi.org/10.1007/978-0-387-09736-7_20

Published:

Publisher Name: Springer, Boston, MA

Print ISBN: 978-0-387-09735-0

Online ISBN: 978-0-387-09736-7

eBook Packages: EngineeringEngineering (R0)